CHICAGO, IL , received awards for most innovative new ETF, and

contribution to the ETF sector, at the 7th Annual Forum on

Closed-End Funds & Global ETFs. The event was held April 16 in

New York City.

The PowerShares S&P 500 BuyWrite Portfolio (NYSE: PBP), was

recognized with The Award for Most Innovative New ETF in 2007. The

PBP portfolio is based on the CBOE S&P 500 BuyWrite Index which

measures the total rate of return of an S&P 500� covered call

strategy. This strategy consists of holding a portfolio indexed to

the S&P 500� and selling a succession of written options, each

with an exercise price at or above the prevailing price level of

the S&P 500�.

The Award for Contribution to the ETF Sector In 2007 was

presented to Edward McRedmond, senior vice president of portfolio

strategies at Invesco PowerShares.

"On behalf of Invesco PowerShares, I am honored to receive this

award. We have been fortunate to interact with so many talented

people in the ETF business, many of whom are equally deserving of

this recognition," said McRedmond. "I'd like to thank my industry

colleagues for their efforts to educate investors about the

benefits of ETFs."

"We are honored to receive recognition from our peers for the

passionate work we are doing here at Invesco PowerShares," said

Bruce Bond, president and CEO of Invesco PowerShares. "We believe

our innovative and diverse suite of ETFs is at the forefront of the

ETF industry delivering value and market-leading ideas to

investors."

The Annual Closed End Fund & ETF Awards, an initiative of

Capital Link, seek to identify and recognize annually those fund

sponsors and executives who consistently apply high standards of

financial disclosure, as well as investor and shareholder

relations. The Closed End Fund (CEF) & ETF Awards are based on

nominations by a committee of analysts and industry specialists who

actively follow CEFs and ETFs.

Invesco PowerShares is a part of Invesco Ltd., a leading

independent global investment management company.

Invesco PowerShares is leading the intelligent ETF revolution

through its family of more than 100 domestic, international and

active exchange-traded funds. With assets under management of

$12.75 billion, PowerShares ETFs trade on all of the major U.S.

stock exchanges that trade ETFs. For more information, please visit

us at www.invescopowershares.com.

Invesco PowerShares is a part of Invesco Ltd., a leading

independent global investment management company dedicated to

helping people worldwide build their financial security. By

delivering the combined power of its distinctive worldwide

investment management capabilities, including AIM, Atlantic Trust,

Invesco, Perpetual, PowerShares, Trimark, and WL Ross, Invesco

provides a comprehensive array of enduring investment solutions for

retail, institutional and high-net-worth clients around the world.

Operating in 20 countries, the company is currently listed on the

New York Stock Exchange under the symbol IVZ. Additional

information is available at www.invesco.com.

There are risks involved with investing in ETFs including

possible loss of money. Shares are not actively managed and are

subject to risk similar to stocks and covered call options, as well

as those risks related to short selling and margin maintenance.

Shares are not FDIC insured, may lose value and have no bank

guarantee.

There are additional risks involved in writing (selling) covered

call options on the stocks of the S&P 500 Index (Index). The

Fund, by writing covered call options on this Index, will give up

the opportunity to benefit from potential increases in the value of

the index stocks above the exercise prices of the options, but will

continue to bear the risk of declines in the value of the Index.

The premiums received from the options may not be sufficient to

offset any losses sustained from the volatility of the Index over

time. In addition, exchanges may suspend trading of options in

volatile markets. If trading is suspended, the Fund may be unable

to write (sell) options at times that may be desirable or

advantageous for the Fund to do so. Trading suspensions may limit

the Fund's ability to achieve its investment objectives. The Fund

may be required to sell investments from its portfolio to make cash

settlement on (or transfer ownership of an Index stock to

physically settle) any options that are exercised. Such sales (or

transfers) may occur at inopportune times, and the Fund may incur

transaction costs that increase its expenses.

The Chicago Board Options Exchange is the index provider for the

PowerShares S&P 500 BuyWrite Portfolio. CBOE is not affiliated

with the Trust, the Adviser or the Distributor. The Adviser has

entered into a license agreement with the Index Provider to use the

Underlying Index. The PowerShares S&P 500 BuyWrite Portfolio is

entitled to use its respective Underlying Index pursuant to a

sublicensing arrangement with the Adviser.

"S&P," "S&P 500" and "S&P 500(TM) Index," are

registered trademarks of Standard & Poor's Ratings Group, a

division of The McGraw-Hill Companies, Inc. (S&P). S&P has

granted Invesco PowerShares Capital Management LLC ("Licensee") a

license to use the CBOE S&P 500 BuyWrite Index for purposes of

Licensee's PowerShares S&P 500 BuyWrite Portfolio.

The CBOE S&P 500 BuyWrite Index(TM) is a trademark of CBOE

and has been licensed for use for certain purposes by the

Adviser.

Shares are not individually redeemable and owners of the shares

may acquire those shares from the Funds and tender those shares for

redemption to the Funds in Creation Unit aggregations only,

typically consisting of 100,000 shares.

Invesco Aim Distributors, Inc. is the distributor of the

PowerShares Exchange-Traded Fund Trust I, the PowerShares

Exchange-Traded Fund Trust II, the PowerShares Actively Managed

Exchange-Traded Fund Trust and the PowerShares India

Exchange-Traded Fund Trust.

Invesco PowerShares Capital Management LLC., Invesco Aim

Distributors, Inc. and Invesco Institutional (N.A.), Inc. are

indirect, wholly owned subsidiaries of Invesco Ltd.

An investor should consider each Fund's investment objective,

risks, charges and expenses carefully before investing. The

prospectus contains this and other information about the Funds. For

more complete information about the Funds or to obtain a

prospectus, call 800.983.0903. Please read the prospectus carefully

before investing.

Media Contacts: Kristin Sadlon Porter Novelli 212-601-8192 Email

Contact Bill Conboy BC Capital Partners 303-415-2290 Email

Contact

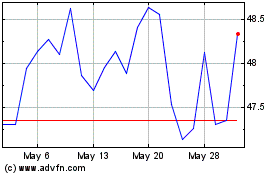

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Dec 2023 to Dec 2024