false

0000906465

0000906465

2025-01-03

2025-01-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported)

January 3, 2025

QCR HOLDINGS, INC.

(Exact name of registrant as specified in charter)

Commission File Number: 0-22208

| Delaware |

|

42-1397595 |

| (State or other jurisdiction of incorporation) |

|

(I.R.S. Employer Identification Number) |

3551 Seventh Street

Moline, Illinois 61265

(Address of principal executive offices, including zip code)

(309) 736-3584

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act.

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $1.00 Par Value |

|

QCRH |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment

of Certain Officers; Compensatory Arrangements of Certain Officers.

John H. Anderson Consulting Services Agreement

QCR Holdings, Inc. (the “Company”) previously announced on

May 20, 2024, that John H. Anderson would retire from his roles as Chief Deposit Officer for the Company and as Chief Executive Officer

for the Company’s wholly-owned bank subsidiary, Quad City Bank and Trust Company (“QCBT”), effective January 3, 2025

(the “Retirement”). In connection with the Retirement, on May 20, 2024, the Company, QCBT, and Mr. Anderson entered into

an Addendum to Mr. Anderson’s Employment Agreement with QCBT and the Company dated January 9, 2019 (together, the “Employment

Agreement”).

On January 3, 2025, QCBT and Mr. Anderson further entered into a Consulting

Services Agreement (the “Agreement”), pursuant to which Mr. Anderson will provide certain consulting services to QCBT

until December 31, 2025. Services to be provided under the Agreement include advice and consultation on business development, employee

coaching and mentoring and other similar matters as necessary to aid in the transition required by the Retirement. Pursuant to the terms

of the Agreement, in addition to and separately from any benefits Mr. Anderson is entitled to under the Employment Agreement, he will

receive a monthly consulting retainer throughout the duration of the Agreement, as well as reimbursement for certain expenses.

The foregoing description of the Agreement does not purport to be complete

and is qualified in its entirety by the terms and conditions of such document, which is filed as Exhibit 10.1 to this Current Report on

Form 8-K and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SignatureS

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: January 8, 2025 |

QCR HOLDINGS, Inc. |

| |

|

|

|

By: |

/s/ Todd A. Gipple |

|

Name: |

Todd A. Gipple |

|

Title: |

President and Chief Financial Officer |

Exhibit 10.1

CONSULTING

SERVICES AGREEMENT

This Consulting Services Agreement (this

"Agreement"), dated as of January 3, 2025 (the “Effective Date”), is by and between Quad City

Bank and Trust Company, an Iowa banking corporation, (the “Bank”) and John Anderson, an independent contractor (“Consultant”)

(Consultant and Bank may be referred to collectively as the “Parties”).

WHEREAS, Consultant previously served as Chief Executive Officer

for the Bank until his retirement effective January 3, 2025; and

WHEREAS, Consultant has agreed to provide certain consulting services

to the Bank to aid in the transition required by his retirement.

NOW, THEREFORE, the parties hereby agree as

follows:

1. SERVICES.

1.1 The Bank hereby engages

Consultant, and Consultant hereby accept such engagement, as an independent contractor to provide certain consulting services to the Bank

on the terms and conditions set forth in this Agreement.

1.2 The services to be

provided by Consultant under this Agreement shall include advice and consultation on business development, employee coaching and mentoring,

and other similar matters as necessary to aid in the transition required by Consultant’s retirement from the Bank and as may be

requested from time to time by the Bank’s President and Chief Executive Officer (the “Services”). It is anticipated

that such Services shall not exceed 20 hours per month.

1.3 Consultant shall perform

the services under the general direction of the Bank’s President and Chief Executive Officer but shall have the general ability

to determine the time, place, and manner in which the Services are performed. The Bank shall not control or direct the manner or means

by which Consultant performs the Services.

1.4 The Bank shall provide

Consultant with access to its premises, materials, information, and systems to the extent necessary for the performance of the Services.

Consultant shall furnish, at Consultant’s own expense, the materials, equipment and other resources necessary to perform the Services;

provided, however, that the Bank will provide one standard issue Bank laptop and related equipment to facilitate Consultant’s access

to the Bank’s systems, which Consultant shall return to the Bank upon the termination or expiration of the Agreement.

1.5 Consultant shall comply

with all third-party access rules and procedures communicated to Consultant in writing by the Bank, including those related to safety,

security, and confidentiality.

2. TERM.

The term of this Agreement shall commence on January 3, 2025, and shall continue until December 31, 2025, unless terminated earlier in

accordance with Section 9 (the “Term”). Any extension of the Term will be subject to mutual written agreement of the

Parties.

3. FEES

AND EXPENSES.

3.1 In consideration for

the Services to be performed by Consultant under this Agreement, the Bank will pay Consultant a monthly consulting retainer of Two Thousand

Dollars and No Cents ($2,000.00). Such payments shall be made on the first Friday of the month beginning February 7, 2025, with the last

payment on January 2, 2026, unless the Agreement is terminated earlier in accordance with Section 9.

3.2 Consultant acknowledges

that Consultant will receive an IRS Form 1099-NEC from the Bank, and that Consultant shall be solely responsible for all federal, state,

and local taxes.

3.3 The

Bank shall reimburse Consultant for actual, documented and reasonable travel expenses incurred

by Consultant in connection with the performance of the Services that have been approved in advance in writing by Bank.

4. RELATIONSHIP

OF THE PARTIES. Consultant is an independent contractor of the Bank, and this Agreement shall not be construed to create

any association, partnership, joint venture, employment, or agency relationship between Consultant and the Bank for any purpose. Consultant

has no authority and shall not hold himself out as having authority to bind the Bank, and Consultant shall not make any agreements or

representations on the Bank's behalf without the Bank's prior written consent.

5. INTELLECTUAL

PROPERTY RIGHTS.

5.1 All documents, work

product, and other materials that are delivered under this Agreement (collectively, the “Deliverables”), and all other

writings, technology, inventions, discoveries, processes, techniques, methods, ideas, concepts, research, proposals, and materials, and

all other work product of any nature whatsoever, that are created, prepared, produced, authored, edited, modified, conceived, or reduced

to practice in the course of performing the Services (collectively, and including the Deliverables, “Work Product”),

and all patents, copyrights, trademarks (together with the goodwill symbolized thereby), trade secrets, know-how, and other confidential

or proprietary information, and other intellectual property rights (collectively “Intellectual Property Rights”) therein,

shall be owned exclusively by the Bank. Consultant acknowledges and agrees that any and all Work Product that may qualify as “work

made for hire” as defined in the Copyright Act of 1976 (17 U.S.C. § 101) is hereby deemed “work made for hire”

for the Bank and all copyrights therein shall automatically and immediately vest in the Bank. To the extent that any Work Product does

not constitute “work made for hire,” Consultant hereby irrevocably assigns to the Bank and its successors and assigns, for

no additional consideration, Consultant’s entire right, title, and interest in and to such Work Product and all Intellectual Property

Rights therein, including the right to sue, counterclaim, and recover for all past, present, and future infringement, misappropriation,

or dilution thereof.

5.2 To the extent any copyrights

are assigned under this Section 5, Consultant hereby irrevocably waives in favor of the Bank, to the extent permitted by applicable law,

any and all claims Consultant may now or hereafter have in any jurisdiction to all rights of paternity or attribution, integrity, disclosure,

and withdrawal and any other rights that may be known as “moral rights” in relation to all Work Product to which the assigned

copyrights apply.

5.3 As between Consultant

and the Bank, the Bank is, and will remain, the sole and exclusive owner of all right, title, and interest in and to any documents, specifications,

data, know-how, methodologies, software, and other materials provided to Consultant by the Bank (“Bank Materials”),

and all Intellectual Property Rights therein. Consultant has no right or license to reproduce or use any Bank Materials except solely

during the Term to the extent necessary to perform Consultant’s obligations under this Agreement. All other rights in and to the

Bank Materials are expressly reserved by the Bank. Consultant has no right or license to use the Bank's trademarks, service marks, trade

names, logos, symbols, or brand names.

6. CONFIDENTIALITY.

6.1 Consultant acknowledges

that Consultant will have access to information that is treated as confidential and proprietary by the Bank including without limitation

information pertaining to the Bank’s business operations and strategies, customers, suppliers, technology, finances, sourcing, personnel,

or operations of the Bank, its affiliates, or their suppliers or customers, in each case whether spoken, written, printed, electronic,

or in any other form or medium (collectively, the “Confidential Information”). Any Confidential Information that Consultant

accesses or develops in connection with the Services, including but not limited to any Work Product, shall be subject to the terms and

conditions of this clause. Consultant agrees to treat all Confidential Information as strictly confidential, not to disclose Confidential

Information or permit it to be disclosed, in whole or part, to any third party without the prior written consent of the Bank in each instance,

and not to use any Confidential Information for any purpose except as required in the performance of the Services. Consultant shall notify

the Bank immediately in the event Consultant becomes aware of any loss or disclosure of any Confidential Information.

6.2 Confidential Information

shall not include information that:

| (a) | is or becomes generally available to the public other than through Consultant’s breach of this Agreement; or |

| (b) | is communicated to Consultant by a third party that had no confidentiality obligations with respect to such information. |

6.3 Nothing herein shall:

| (a) | be construed to prevent disclosure of Confidential Information as may be required by applicable law or regulation, or pursuant to

the valid order of a court of competent jurisdiction or an authorized government agency, provided that the disclosure does not exceed

the extent of disclosure required by such law, regulation, or order; or |

| (b) | prohibit or restrict Consultant (or Consultant’s attorney) from initiating communications directly with, responding to an inquiry

from, providing testimony before, or otherwise participating in any investigation or proceeding conducted by the Securities and Exchange

Commission (SEC), the Financial Industry Regulatory Authority (FINRA), any other self-regulatory organization, or any other federal or

state regulatory authority regarding possible securities law violations. |

7. REPRESENTATIONS

AND WARRANTIES. Consultant represents and warrants to the Bank that:

7.1 He shall perform

the Services in a professional and workmanlike manner in accordance with generally recognized industry standards for similar services

and shall devote adequate resources to meet his obligations under this Agreement;

7.2 He is in compliance

with, and shall perform the Services in compliance with, all applicable federal, state, and local laws and regulations, including

by maintaining all licenses, permits, and registrations required to perform the Services;

7.3 The Bank will

receive good and valid title to all Deliverables, free and clear of all encumbrances and liens of any kind; and

7.4 The Services will

be in conformity in all material respects with all requirements or specifications stated in this Agreement.

8. INDEMNIFICATION.

8.1 Consultant shall defend,

indemnify, and hold harmless the Bank and its affiliates and their officers, directors, employees, agents, successors, and assigns from

and against all losses, damages, liabilities, deficiencies, actions, judgments, interest, awards, penalties, fines, costs, or expenses

of whatever kind (including reasonable attorneys' fees) arising out of or resulting from:

| (a) | bodily injury, death of any person, or damage to real or tangible personal property resulting from Consultant’s acts or omissions;

or |

| (b) | Consultant’s breach of any representation, warranty, or obligation under this Agreement. |

8.2 The Bank may satisfy

such indemnity (in whole or in part) by way of deduction from any payment due to Consultant.

9. TERMINATION.

9.1 Consultant or the Bank

may terminate this Agreement, effective immediately upon written notice to the other party to this Agreement, if the other party breaches

this Agreement and such breach is incapable of cure, or with respect to a breach capable of cure, the other party does not cure such breach

within 10 calendar days after receipt of written notice of such breach.

9.2 Upon expiration or

termination of this Agreement for any reason, or at any other time upon the Bank's written request, Consultant shall promptly:

| (a) | deliver to the Bank all Deliverables (whether complete or incomplete) and all materials, equipment, and other property provided for

Consultant’s use by the Bank; |

| (b) | deliver to the Bank all tangible documents and other media, including any copies, containing, reflecting, incorporating, or based

on the Confidential Information; |

| (c) | permanently erase all of the Confidential Information from Consultant’s computer systems; and |

| (d) | certify in writing to the Bank that Consultant has complied with the requirements of this clause. |

9.3 The terms and conditions

of this Section 9 and Sections 5, 6, 7, and 8 shall survive the expiration or termination of this Agreement.

10. OTHER

BUSINESS ACTIVITIES. Consultant agrees that he is not, and during the Term of this Agreement shall not be, engaged or employed

in any business, trade, profession, or other activity that would create a conflict of interest with the Bank. If any such actual or potential

conflict arises during the Term of this Agreement, Consultant shall immediately notify the Bank in writing. If the Bank determines, in

its sole discretion, that the conflict is material, the Bank may terminate the Agreement immediately upon written notice.

11. ASSIGNMENT.

Consultant shall not assign any rights or delegate or subcontract any obligations under this Agreement. Any assignment in violation of

the foregoing shall be deemed null and void. The Bank may freely assign its rights and obligations under this Agreement at any time.

Subject to the limits on assignment stated above, this Agreement will inure to the benefit of, be binding on, and be enforceable against

each of the Parties hereto and their respective successors and assigns.

12. REMEDIES.

In the event Consultant breaches or threatens to breach Section 6 of this Agreement, Consultant hereby acknowledges and agrees that money

damages would not afford an adequate remedy and that the Bank shall be entitled to seek a temporary or permanent injunction or other

equitable relief restraining such breach or threatened breach from any court of competent jurisdiction without the necessity of showing

any actual damages and without the necessity of posting any bond or other security. Any equitable relief shall be in addition to, not

in lieu of, legal remedies, monetary damages, or other available forms of relief.

13. GOVERNING

LAW, JURISDICTION, AND VENUE. This Agreement and all related documents and all matters arising out of or relating to this

Agreement and the Services provided hereunder, whether sounding in contract, tort, or statute, for all purposes shall be governed by

and construed in accordance with the laws of the State of Iowa, without giving effect to any conflict of laws principles that would cause

the laws of any other jurisdiction to apply. Any action or proceeding by either of the Parties to enforce this Agreement shall be brought

only in any state or federal court located in the State of Iowa, County of Linn. The Parties hereby irrevocably submit to the exclusive

jurisdiction of these courts and waive the defense of inconvenient forum to the maintenance of any action or proceeding in such venue.

14. MISCELLANEOUS.

14.1 Consultant shall not

export, directly or indirectly, any technical data acquired from the Bank, or any products utilizing any such data, to any country in

violation of any applicable export laws or regulations.

14.2 All notices, requests,

consents, claims, demands, waivers, and other communications hereunder shall be in writing and addressed to the Parties at the following

addresses:

If to Bank: Laura Ekizian, President and CEO

5405 Utica Ridge Road

Davenport, Iowa 52807

lekizian@qcbt.com

If to Consultant: John H. Anderson

To the last address on file with the Bank’s Human Resources

Department

14.3 This Agreement, and

related exhibits and schedules, constitutes the sole and entire agreement of the Parties with respect to the subject matter contained

herein, and supersedes all prior and contemporaneous understandings, agreements, representations, and warranties, both written and oral,

with respect to such subject matter.

14.4 This Agreement may

be amended, modified, or supplemented only by an agreement in writing signed by each party hereto, and any of the terms thereof may be

waived, only by a written document signed by each party to this Agreement or, in the case of waiver, by the party or parties waiving compliance.

14.5 If any term or provision

of this Agreement is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not

affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

14.6 This Agreement may

be executed in multiple counterparts and by signature, each of which shall be deemed an original and all of which together shall constitute

one instrument.

IN WITNESS WHEREOF, the Parties hereto have executed this

Agreement as of the date first above written.

QUAD CITY BANK AND TRUST COMPANY

By: /s/ Laura Ekizian__________________

Laura Ekizian

President and Chief Executive Officer

CONSULTANT

By: /s/ John H. Anderson_______________

John H. Anderson

7

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

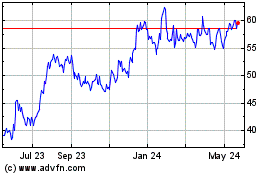

QCR (NASDAQ:QCRH)

Historical Stock Chart

From Dec 2024 to Jan 2025

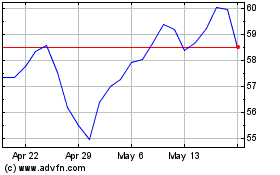

QCR (NASDAQ:QCRH)

Historical Stock Chart

From Jan 2024 to Jan 2025