Rush Enterprises, Inc. (NASDAQ: RUSHA & RUSHB), which operates

the largest network of commercial vehicle dealerships in North

America, today announced that for the quarter ended September 30,

2024, the Company achieved revenues of $1.896 billion and net

income of $79.1 million, or $0.97 per diluted share, compared with

revenues of $1.981 billion and net income of $80.3 million, or

$0.96 per diluted share, in the quarter ended September 30, 2023.

In the third quarter of 2024, the Company recognized a one-time,

pre-tax charge of approximately $3.3 million, or $0.03 per share,

related to property damage caused by Hurricane Helene. In the third

quarter of 2023, the Company recognized a one-time, pre-tax charge

of approximately $2.5 million, or $0.02 per share, related to a

fire loss at our San Antonio, Texas facility. Additionally, the

Company’s Board of Directors declared a cash dividend of $0.18 per

share of Class A and Class B Common Stock, to be paid on December

12, 2024, to all shareholders of record as of November 12, 2024.

“As we have experienced for the last several quarters, the

industry continues to struggle with low freight rates and high

interest rates, resulting in continued weak demand for Class 8

trucks. Considering these ongoing challenges, we are pleased with

our overall financial performance in the third quarter,” said W.M.

“Rusty” Rush, Chairman, Chief Executive Officer, and President of

Rush Enterprises. “Although sluggish industry conditions continue

to negatively impact over-the-road-carriers, we saw positive

results in the quarter with respect to our Class 8 vocational and

public sector customers. In addition, demand from our medium-duty

customers remained healthy throughout the quarter, enabling us to

outperform the market. While the used truck market remains

difficult, our used truck operations are executing well, managing

inventory levels to market conditions while also making strong

contributions to our earnings,” he continued. “In the aftermarket,

we saw a slight improvement in our revenue compared to our second

quarter results, particularly with respect to our service sales,

which outperformed the market,” Rush said.

“Looking toward the remainder of the year and the beginning of

2025, although we believe freight rates have found their bottom, we

do not anticipate any significant recovery in new Class 8 truck

sales until sometime later in 2025. We will continue to rely on the

talents of our professional sales force to uncover opportunities to

leverage our “One Team” sales approach and fight for market share

growth. Despite the tough industry conditions, we expect that our

Class 8 and Class 4-7 new commercial vehicle sales will improve in

the fourth quarter compared to the third quarter,” explained Rush.

“Although we expect a typical seasonal decline in our fourth

quarter aftermarket results, we believe market conditions will

begin to slowly improve during the first quarter of 2025,” he

continued.

“It is important that I express my gratitude to our employees

for their hard work this quarter. I am especially grateful for

their ability to remain focused on our long-term goals despite

challenging market conditions, while also continuing to provide

best-in-class service to our customers. Additionally, I would be

remiss if I did not say a special word of thanks to Michael

McRoberts, who as previously announced, is stepping down from his

role as Chief Operating Officer, effective October 31. Mike has

added immeasurable value to this organization over his many years

of service, and I am sure he will continue to do so in his role as

Senior Advisor to the Company and as an active member of our Board

of Directors. Effective November 1, Jason Wilder will become the

Company’s Chief Operating Officer, as previously announced. I am

confident that this leadership transition will be seamless and that

Jason will effectively lead the Company in his new role going

forward,” said Rush.

Operations

Aftermarket Products and

Services

Aftermarket products and services accounted for approximately

61.5% of the Company’s total gross profit in the third quarter of

2024, with parts, service and collision center revenues totaling

$633.0 million, down 1.6% compared to the third quarter of 2023.

The Company achieved a quarterly absorption ratio of 132.6% in the

third quarter of 2024, compared to 132.8% in the third quarter of

2023.

“Our aftermarket revenue was down slightly year-over-year, but

as I previously noted, was up compared to our second quarter

results,” said Rush. “Although the freight recession continues, we

saw sequential growth in the third quarter with respect to our

over-the-road and wholesale customers for the first time since

2023. In addition, the refuse and public sector market segments

continue to be bright spots with respect to Class 8 aftermarket

sales, while medium-duty aftermarket sales continue to be strong

across all market segments,” he continued.

“We are hopeful that declines in aftermarket sales revenues are

behind us and that demand will begin to increase in 2025. Although

we expect a typical seasonal decline in our fourth quarter

aftermarket results, we believe we will begin a slow climb back to

more normal market conditions starting in the first quarter of

2025,“ Rush explained. “We believe that our continued focus on

strategic initiatives, such as planned maintenance packages and

Xpress Services, will allow us to continue to outperform the

market,” he added.

Commercial Vehicle Sales

New U.S. and Canadian Class 8 retail truck sales totaled 73,037

units in the third quarter of 2024, down 3.5% over the same period

last year, according to ACT Research. The Company sold 3,604 new

Class 8 trucks in the third quarter, a decrease of 16.7% compared

to the third quarter of 2023, which accounted for 5.3% of the new

U.S. Class 8 truck market and 1.6% of the new Canada Class 8 truck

market. ACT Research forecasts U.S. and Canadian retail sales of

new Class 8 trucks to total 264,000 units in 2024, a 12.5% decrease

compared to 2023.

“Economic uncertainty and continued low freight rates continue

to plague Class 8 carriers. However, considering these ongoing

challenges, we were pleased with our sales results in the third

quarter,” Rush said. “Although Class 8 demand remains weak in the

over-the-road segment, our unique focus on specialty markets,

including vocational and public sector, allowed us to achieve

strong sales results to those customer segments, which we expect to

continue in the fourth quarter,” he added.

“Our order intake improved slightly late in the third quarter.

Consequently, we expect our new Class 8 truck sales to increase

slightly in the fourth quarter compared to our third quarter

results,” Rush said. “While we are pleased to see a slight uptick

in demand, market conditions remain challenging and commercial

vehicle inventory levels are near an all-time high industry-wide.

Because of these factors, we believe that truck pricing will

continue to be competitive and that new Class 8 truck sales will

remain challenging through the first half of 2025,” he added.

New U.S. and Canadian Class 4 through 7 retail commercial

vehicle sales totaled 68,923 units in the third quarter of 2024,

down 1.1% over the same period last year, according to ACT

Research. The Company sold 3,379 Class 4 through 7 medium-duty

commercial vehicles in the third quarter, an increase of 4.2%

compared to the third quarter of 2023, which accounted for 5.0% of

the total new U.S. Class 4 through 7 commercial vehicle market and

2.9% of the new Canada Class 5 through 7 commercial vehicle market.

ACT Research forecasts U.S. and Canadian retail sales for new Class

4 through 7 commercial vehicles to be approximately 273,200 units

in 2024, a 2.5% increase compared to 2023.

“We continued to experience healthy demand from medium-duty

customers across all of our customer segments in the third quarter.

Production has stabilized, delivery lead times continue to improve,

and we are, once again, proud to have outperformed the market in

medium-duty commercial vehicle sales,” Rush said. Our strategic

focus on achieving a diversified customer base has served us well

in the medium-duty market, and we are pleased that our Class 4-7

commercial vehicle sales were wide-ranging across a variety of

industry segments,” he stated.

“Looking ahead, we continue to monitor potential delays from

body manufacturers that could impact deliveries of new Class 4

through 7 commercial vehicles. However, we believe that demand for

medium duty commercial vehicles will remain solid in the fourth

quarter, and we believe we are well-positioned to increase our

market share,” Rush said.

The company sold 1,829 used commercial vehicles in the third

quarter of 2024, a 1.8% increase compared to the third quarter of

2023. “Although the market is still experiencing weak used truck

demand due to the aforementioned freight recession, tight credit

and excess supply, we continue to successfully execute on our used

truck sales strategies, which led to positive results in the third

quarter. Used truck depreciation rates have largely returned to

normal ranges, and we continue to manage our inventory levels,

which we believe are appropriate given the anticipated increase in

trade activity from our new truck customers,” Rush stated.

Leasing and Rental

Rush Truck Leasing operates 56 PacLease and Idealease franchises

across the United States and Canada, with more than 10,000 trucks

in its lease and rental fleet and more than 2,200 trucks under

contract maintenance agreements. Lease and rental revenue decreased

0.4% in the third quarter of 2024 compared to the third quarter of

2023, primarily due to a slight decrease in rental utilization.

“Our leasing and rental revenues were basically flat

year-over-year. However, we continue to add new vehicles to our

fleet, which will translate to lower operating costs going forward.

We anticipate that rental utilization rates will improve in the

fourth quarter, and we expect to see moderate growth in our leasing

and rental revenues as we move into 2025”, Rush said.

Financial Highlights

In the third quarter of 2024, the Company’s gross revenues

totaled $1.896 billion, a 4.3% decrease from $1.981 billion in the

third quarter of 2023. Net income for the quarter was $79.1

million, or $0.97 per diluted share, compared to net income of

$80.3 million, or $0.96 per diluted share, in the quarter ended

September 30, 2023. In the third quarter of 2024, the Company

recognized a one-time, pre-tax charge of approximately $3.3

million, or $0.03 per share, related to property damage caused by

Hurricane Helene. In the third quarter of 2023, the Company

recognized a one-time, pre-tax charge of approximately $2.5

million, or $0.02 per share, related to a fire loss at our San

Antonio, Texas facility.

Aftermarket products and services revenues were $633.0 million

in the third quarter of 2024, compared to $643.6 million in the

third quarter of 2023. The Company delivered 3,604 new heavy-duty

trucks, 3,379 new medium-duty commercial vehicles, 574 new

light-duty commercial vehicles and 1,829 used commercial vehicles

during the third quarter of 2024, compared to 4,326 new heavy-duty

trucks, 3,244 new medium-duty commercial vehicles, 425 new

light-duty commercial vehicles and 1,797 used commercial vehicles

during the third quarter of 2023.

During the third quarter of 2024, the Company repurchased $0.2

million of its common stock pursuant to its stock repurchase plan

and has repurchased a total of $77.4 million of the $150.0 million

that is currently authorized by its Board of Directors. In

addition, the Company paid a cash dividend of $14.2 million during

the third quarter.

“There is no doubt that 2024 has been a challenging year for the

commercial vehicle industry. However, I am extremely proud that our

team has rallied behind our expense management and sales

initiatives, which have allowed us to navigate this challenging

operating environment while continuing to deliver value to our

shareholders. We are committed to our long-term strategic

initiatives, and I have confidence we will end this difficult year

in a strong financial position,” said Rush.

Conference Call Information

Rush Enterprises will host its quarterly

conference call to discuss earnings for the third quarter of 2024

on Wednesday, October 30, 2024, at 10 a.m. Eastern/9 a.m.

Central. The call can be heard live via the Internet

athttp://investor.rushenterprises.com/events.cfm.

Participants may register for

the call

at:https://register.vevent.com/register/BId3cc30bd8c9c4a0b997370aa063270c3While

not required, it is recommended that you join the event 10 minutes

prior to the start.

For those who cannot listen to the live

broadcast, the webcast replay will be available

athttp://investor.rushenterprises.com/events.cfm.

Rush Enterprises, Inc. is the premier solutions

provider to the commercial vehicle industry. The Company owns and

operates Rush Truck Centers, the largest network of commercial

vehicle dealerships in North America, with more than 150 locations

in 23 states and Ontario, Canada, including 124 franchised

dealership locations. These vehicle centers, strategically located

in high traffic areas on or near major highways throughout the

United States and Ontario, Canada, represent truck and bus

manufacturers, including Peterbilt, International, Hino, Isuzu,

Ford, Dennis Eagle, IC Bus and Blue Bird. They offer an integrated

approach to meeting customer needs – from sales of new and used

vehicles to aftermarket parts, service and body shop operations

plus financing, insurance, leasing and rental. Rush Enterprises'

operations also provide CNG fuel systems (through its investment in

Cummins Clean Fuel Technologies, Inc.), telematics products and

other vehicle technologies, as well as vehicle up-fitting, chrome

accessories and tires. For more information, please visit us at

www.rushtruckcenters.com www.rushenterprises.com and

www.rushtruckcentersracing.com, on Twitter @rushtruckcenter and

Facebook.com/rushtruckcenters.

Certain statements contained in this release,

including those concerning current and projected market conditions,

sales forecasts, market share forecasts s and anticipated demand

for the Company’s services, are “forward-looking” statements (as

such term is defined in the Private Securities Litigation Reform

Act of 1995). Such forward-looking statements only speak as of the

date of this release and the Company assumes no obligation to

update the information included in this release. Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Important factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements include, but are not limited to,

competitive factors, general U.S. economic conditions, economic

conditions in the new and used commercial vehicle markets, customer

relations, relationships with vendors, inflation and the interest

rate environment, governmental regulation and supervision, product

introductions and acceptance, changes in industry practices,

one-time events and other factors described herein and in filings

made by the Company with the Securities and Exchange Commission,

including in our annual report on Form 10-K for the fiscal year

ended December 31, 2023. In addition, the declaration and payment

of cash dividends and authorization of future share repurchase

programs remains at the sole discretion of the Company’s Board of

Directors and the issuance of future dividends and authorization of

future share repurchase programs will depend upon the Company’s

financial results, cash requirements, future prospects, applicable

law and other factors that may be deemed relevant by the Company’s

Board of Directors. Although we believe that these forward-looking

statements are based on reasonable assumptions, there are many

factors that could affect our actual business and financial results

and could cause actual results to differ materially from those in

the forward-looking statements. All future written and oral

forward-looking statements by us or persons acting on our behalf

are expressly qualified in their entirety by the cautionary

statements contained or referred to above. Except for our ongoing

obligations to disclose material information as required by the

federal securities laws, we do not have any obligations or

intention to release publicly any revisions to any forward-looking

statements to reflect events or circumstances in the future or to

reflect the occurrence of unanticipated events.

-Tables and Additional Information to Follow-

|

RUSH ENTERPRISES, INC. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(In Thousands, Except Shares and Per Share Amounts) |

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

| |

|

(unaudited) |

|

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

185,073 |

|

$ |

183,725 |

|

|

Accounts receivable, net |

|

282,553 |

|

|

259,353 |

|

|

Note receivable, affiliate |

|

6,905 |

|

|

|

|

Inventories, net |

|

1,964,835 |

|

|

1,801,447 |

|

|

Prepaid expenses and other |

|

21,027 |

|

|

15,779 |

|

| Total current assets |

|

2,460,393 |

|

|

2,260,304 |

|

| Property and equipment,

net |

|

1,568,056 |

|

|

1,488,086 |

|

| Operating lease right-of-use

assets, net |

|

116,085 |

|

|

120,162 |

|

| Goodwill, net |

|

430,004 |

|

|

420,708 |

|

| Other assets, net |

|

73,933 |

|

|

74,981 |

|

| Total

assets |

$ |

4,648,471 |

|

$ |

4,364,241 |

|

| |

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Floor plan notes payable |

$ |

1,285,033 |

|

$ |

1,139,744 |

|

|

Current maturities of finance lease obligations |

|

38,693 |

|

|

36,119 |

|

|

Current maturities of operating lease obligations |

|

16,855 |

|

|

17,438 |

|

|

Trade accounts payable |

|

173,777 |

|

|

162,134 |

|

|

Customer deposits |

|

87,114 |

|

|

145,326 |

|

|

Accrued expenses |

|

150,560 |

|

|

172,549 |

|

| Total current liabilities |

|

1,752,032 |

|

|

1,673,310 |

|

| Long-term debt, net of current

maturities |

|

399,674 |

|

|

414,002 |

|

| Finance lease obligations, net

of current maturities |

|

92,061 |

|

|

97,617 |

|

| Operating lease obligations,

net of current maturities |

|

101,464 |

|

|

104,514 |

|

| Other long-term

liabilities |

|

29,712 |

|

|

24,811 |

|

| Deferred income taxes,

net |

|

170,571 |

|

|

159,571 |

|

| Shareholders’ equity: |

|

|

|

|

|

Preferred stock, par value $.01 per share; 1,000,000 shares

authorized; 0 shares outstanding in 2024 and 2023 |

|

– |

|

|

– |

|

|

Common stock, par value $.01 per share; 105,000,000 Class A

shares and 35,000,000 Class B shares authorized; 62,307,564 Class A

shares and 16,695,873 Class B shares outstanding in 2024; and

61,461,281 Class A shares and 16,364,158 Class B shares outstanding

in 2023 |

|

820 |

|

|

806 |

|

|

Additional paid-in capital |

|

577,665 |

|

|

542,046 |

|

|

Treasury stock, at cost: 1,299,589 Class A shares and 1,750,566

Class B shares in 2024; and 1,092,142 Class A shares and 1,731,157

Class B shares in 2023 |

|

(129,644 |

) |

|

(119,835 |

) |

|

Retained earnings |

|

1,638,257 |

|

|

1,450,025 |

|

|

Accumulated other comprehensive income (loss) |

|

(3,953 |

) |

|

(2,163 |

) |

|

Total Rush Enterprises, Inc. shareholders’ equity |

|

2,083,145 |

|

|

1,870,879 |

|

|

Noncontrolling interest |

|

19,812 |

|

|

19,537 |

|

| Total shareholders’

equity |

|

2,102,957 |

|

|

1,890,416 |

|

|

Total liabilities and shareholders’ equity |

$ |

4,648,471 |

|

$ |

4,364,241 |

|

| |

|

|

|

|

|

|

| RUSH

ENTERPRISES, INC. AND SUBSIDIARIES |

| CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (In Thousands,

Except Per Share Amounts) |

| (Unaudited) |

| |

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

New and used commercial vehicle sales |

$ |

1,163,255 |

$ |

1,235,767 |

$ |

3,586,882 |

$ |

3,648,286 |

|

Parts and service sales |

|

633,045 |

|

643,623 |

|

1,909,672 |

|

1,942,979 |

|

Lease and rental |

|

89,129 |

|

89,466 |

|

264,696 |

|

264,681 |

|

Finance and insurance |

|

5,780 |

|

6,317 |

|

17,111 |

|

19,077 |

|

Other |

|

4,924 |

|

5,567 |

|

16,799 |

|

20,536 |

|

Total revenue |

|

1,896,133 |

|

1,980,740 |

|

5,795,160 |

|

5,895,559 |

| Cost of products

sold |

|

|

|

|

|

|

|

|

|

New and used commercial vehicle sales |

|

1,053,512 |

|

1,113,294 |

|

3,239,431 |

|

3,287,998 |

|

Parts and service sales |

|

399,973 |

|

410,935 |

|

1,204,360 |

|

1,216,441 |

|

Lease and rental |

|

63,607 |

|

62,106 |

|

190,064 |

|

184,098 |

|

Total cost of products sold |

|

1,517,092 |

|

1,586,335 |

|

4,633,855 |

|

4,688,537 |

| Gross

profit |

|

379,041 |

|

394,405 |

|

1,161,305 |

|

1,207,022 |

| Selling, general and

administrative expense |

|

239,741 |

|

257,132 |

|

754,774 |

|

770,631 |

| Depreciation and amortization

expense |

|

19,134 |

|

15,872 |

|

51,376 |

|

44,731 |

| Gain on disposition of

assets |

|

588 |

|

220 |

|

690 |

|

596 |

| Operating

income |

|

120,754 |

|

121,621 |

|

355,845 |

|

392,256 |

| Other income (expense) |

|

149 |

|

133 |

|

370 |

|

2,384 |

| Interest expense (income),

net |

|

17,664 |

|

14,194 |

|

55,101 |

|

37,415 |

| Income before

taxes |

|

103,329 |

|

107,560 |

|

301,114 |

|

357,225 |

| Provision for income

taxes |

|

23,819 |

|

26,926 |

|

71,422 |

|

87,277 |

| Net

income |

|

79,420 |

|

80,634 |

|

229,692 |

|

269,948 |

| Less: Net income attributable

to noncontrolling Interests |

|

288 |

|

356 |

|

291 |

|

940 |

| Net income attributable to

Rush Enterprises, Inc. |

$ |

79,132 |

$ |

80,278 |

$ |

229,401 |

$ |

269,008 |

| |

|

|

|

|

|

|

|

|

| Net income

attributable to Rush Enterprises, Inc. per

share of common stock: |

|

|

|

|

|

|

|

|

| Basic |

$ |

1.00 |

$ |

0.99 |

$ |

2.91 |

$ |

3.30 |

| Diluted |

$ |

0.97 |

$ |

0.96 |

$ |

2.81 |

$ |

3.19 |

| |

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

79,216 |

|

81,229 |

|

78,878 |

|

81,629 |

| Diluted |

|

81,884 |

|

83,987 |

|

81,607 |

|

84,251 |

| |

|

|

|

|

|

|

|

|

| Dividends declared per common

share |

$ |

0.18 |

$ |

0.17 |

$ |

0.52 |

$ |

0.45 |

| |

|

|

|

|

|

|

|

|

This press release and the attached financial

tables contain certain non-GAAP financial measures as defined under

SEC rules, such as Adjusted Net Income, Adjusted Total Debt,

Adjusted Net (cash) Debt, EBITDA, Adjusted EBITDA, Free Cash Flow,

Adjusted Free Cash Flow and Adjusted Invested Capital, which

exclude certain items disclosed in the attached financial tables.

The Company provides reconciliations of these measures to the most

directly comparable GAAP measures.

Management believes the presentation of these

non-GAAP financial measures provides useful information about the

results of operations of the Company for the current and past

periods. Management believes that investors should have the same

information available to them that management uses to assess the

Company’s operating performance and capital structure. These

non-GAAP financial measures should not be considered in isolation

or as a substitute for the most comparable GAAP financial measures.

Investors are cautioned that non-GAAP financial measures utilized

by the Company may not be comparable to similarly titled non-GAAP

financial measures used by other companies.

| |

|

Three Months Ended |

|

Commercial Vehicle Sales Revenue (in

thousands) |

|

September 30, 2024 |

|

September 30, 2023 |

|

New heavy-duty vehicles |

$ |

677,882 |

|

$ |

756,071 |

|

|

New medium-duty vehicles (including bus sales revenue) |

|

361,813 |

|

|

332,860 |

|

|

New light-duty vehicles |

|

33,510 |

|

|

25,684 |

|

|

Used vehicles |

|

81,285 |

|

|

109,114 |

|

|

Other vehicles |

|

8,765 |

|

|

12,038 |

|

|

|

|

|

|

|

|

Absorption Ratio |

|

132.6 |

% |

|

132.8 |

% |

|

|

|

|

|

|

|

|

Absorption RatioManagement uses

several performance metrics to evaluate the performance of its

commercial vehicle dealerships and considers Rush Truck Centers’

“absorption ratio” to be of critical importance. Absorption ratio

is calculated by dividing the gross profit from the parts, service

and collision center departments by the overhead expenses of all of

a dealership’s departments, except for the selling expenses of the

new and used commercial vehicle departments and carrying costs of

new and used commercial vehicle inventory. When 100% absorption is

achieved, then gross profit from the sale of a commercial vehicle,

after sales commissions and inventory carrying costs, directly

impacts operating profit.

|

Debt Analysis (in thousands) |

|

September 30, 2024 |

|

September 30, 2023 |

|

Floor plan notes payable |

$ |

1,285,033 |

|

$ |

1,121,490 |

|

|

Current maturities of long-term debt |

|

─ |

|

|

104,778 |

|

|

Current maturities of finance lease obligations |

|

38,693 |

|

|

36,128 |

|

|

Long-term debt, net of current maturities |

|

399,674 |

|

|

202,824 |

|

|

Finance lease obligations, net of current maturities |

|

92,061 |

|

|

103,513 |

|

|

Total Debt (GAAP) |

|

1,815,461 |

|

|

1,568,733 |

|

|

Adjustments: |

|

|

|

|

|

Debt related to lease & rental fleet |

|

(526,443 |

) |

|

(443,095 |

) |

|

Floor plan notes payable |

|

(1,285,033 |

) |

|

(1,121,490 |

) |

|

Adjusted Total Debt (Non-GAAP) |

|

3,985 |

|

|

4,148 |

|

|

Adjustment: |

|

|

|

|

|

Cash and cash equivalents |

|

(185,073 |

) |

|

(191,988 |

) |

|

Adjusted Net Debt (Cash) (Non-GAAP) |

$ |

(181,088 |

) |

$ |

(187,840 |

) |

| |

|

|

|

|

|

|

Management uses “Adjusted Total Debt” to reflect

the Company’s estimated financial obligations less debt related to

lease and rental fleet (L&RFD) and floor plan notes payable

(FPNP), and “Adjusted Net (Cash) Debt” to present the amount of

Adjusted Total Debt net of cash and cash equivalents on the

Company’s balance sheet. The FPNP is used to finance the Company’s

new and used inventory, with its principal balance changing daily

as vehicles are purchased and sold and the sale proceeds are used

to repay the notes. Consequently, in managing the business,

management views the FPNP as interest bearing accounts payable,

representing the cost of acquiring the vehicle that is then repaid

when the vehicle is sold, as the Company’s floor plan credit

agreements require it to repay loans used to purchase vehicles when

such vehicles are sold. The Company has the capacity to finance all

of its lease and rental fleet under its lines of credit established

for this purpose, but may choose to only partially finance the

lease and rental fleet depending on business conditions and its

management of cash and interest expense. The Company’s lease and

rental fleet inventory are either: (i) leased to customers under

long-term lease arrangements; or (ii) to a lesser extent, dedicated

to the Company’s rental business. In both cases, the lease and

rental payments received fully cover the capital costs of the lease

and rental fleet (i.e., the interest expense on the borrowings used

to acquire the vehicles and the depreciation expense associated

with the vehicles), plus a profit margin for the Company. The

Company believes excluding the FPNP and L&RFD from the

Company’s total debt for this purpose provides management with

supplemental information regarding the Company’s capital structure

and leverage profile and assists investors in performing analysis

that is consistent with financial models developed by Company

management and research analysts. “Adjusted Total Debt” and

“Adjusted Net (Cash) Debt” are both non-GAAP financial measures and

should be considered in addition to, and not as a substitute for,

the Company’s debt obligations, as reported in the Company’s

consolidated balance sheet in accordance with U.S. GAAP.

Additionally, these non-GAAP measures may vary among companies and

may not be comparable to similarly titled non-GAAP measures used by

other companies.

| |

|

Twelve Months Ended |

|

EBITDA (in thousands) |

|

September 30, 2024 |

|

September 30, 2023 |

|

Net Income attributable to Rush Enterprises, Inc.

(GAAP) |

$ |

307,448 |

|

$ |

367,334 |

|

|

Provision for income taxes |

|

98,145 |

|

|

117,229 |

|

|

Interest expense |

|

70,603 |

|

|

45,877 |

|

|

Depreciation and amortization |

|

66,475 |

|

|

58,851 |

|

|

(Gain) on sale of assets |

|

937 |

|

|

(618 |

) |

|

EBITDA (Non-GAAP) |

|

543,608 |

|

|

588,673 |

|

|

Adjustments: |

|

|

|

|

|

Interest expense associated with FPNP and L&RFD |

|

(71,439 |

) |

|

(46,806 |

) |

|

Adjusted EBITDA (Non-GAAP) |

$ |

472,169 |

|

$ |

541,867 |

|

| |

|

|

|

|

|

|

The Company presents EBITDA and Adjusted EBITDA,

for the twelve months ended each period presented, as additional

information about its operating results. The presentation of

Adjusted EBITDA that excludes the addition of interest expense

associated with FPNP and the L&RFD to EBITDA is consistent with

management’s presentation of Adjusted Total Debt, in each case

reflecting management’s view of interest expense associated with

the FPNP and L&RFD as an operating expense of the Company, and

to provide management with supplemental information regarding

operating results and to assist investors in performing analysis

that is consistent with financial models developed by management

and research analyst. “EBITDA” and “Adjusted EBITDA” are both

non-GAAP financial measures and should be considered in addition

to, and not as a substitute for, net income of the Company, as

reported in the Company’s consolidated statements of income in

accordance with U.S. GAAP. Additionally, these non-GAAP measures

may vary among companies and may not be comparable to similarly

titled non-GAAP measures used by other companies.

| |

|

Twelve Months Ended |

|

Free Cash Flow (in thousands) |

|

September 30, 2024 |

|

September 30, 2023 |

|

Net cash provided by operations (GAAP) |

$ |

311,922 |

|

$ |

322,469 |

|

|

Acquisition of property and equipment |

|

(384,033 |

) |

|

(356,896 |

) |

|

Free cash flow (Non-GAAP) |

|

(72,111 |

) |

|

(34,427 |

) |

|

Adjustments: |

|

|

|

|

|

Draws on floor plan financing, net |

|

163,109 |

|

|

185,065 |

|

|

Acquisitions of L&RF assets |

|

285,404 |

|

|

261,685 |

|

|

Non-maintenance capital expenditures |

|

21,753 |

|

|

29,815 |

|

|

Adjusted Free Cash Flow (Non-GAAP) |

$ |

398,156 |

|

$ |

442,138 |

|

| |

|

|

|

|

|

|

“Free Cash Flow” and “Adjusted Free Cash Flow”

are key financial measures of the Company’s ability to generate

cash from operating its business. Free Cash Flow is calculated by

subtracting the acquisition of property and equipment included in

the Cash flows from investing activities from Net cash provided by

(used in) operating activities. For purposes of deriving Adjusted

Free Cash Flow from the Company’s operating cash flow, Company

management makes the following adjustments: (i) adds back draws (or

subtracts payments) on the floor plan financing that are included

in Cash flows from financing activities, as their purpose is to

finance the vehicle inventory that is included in Cash flows from

operating activities; (ii) adds back lease and rental fleet

purchases that are included in acquisition of property and

equipment (iii) adds back non-maintenance capital expenditures that

are for growth and expansion (i.e. building of new dealership

facilities) that are not considered necessary to maintain the

current level of cash generated by the business. “Free Cash Flow”

and “Adjusted Free Cash Flow” are both presented so that investors

have the same financial data that management uses in evaluating the

Company’s cash flows from operating activities. “Free Cash Flow”

and “Adjusted Free Cash Flow” are both non-GAAP financial measures

and should be considered in addition to, and not as a substitute

for, net cash provided by (used in) operations of the Company, as

reported in the Company’s consolidated statement of cash flows in

accordance with U.S. GAAP. Additionally, these non-GAAP measures

may vary among companies and may not be comparable to similarly

titled non-GAAP measures used by other companies.

|

Invested Capital (in thousands) |

|

September 30, 2024 |

|

September 30, 2023 |

|

Total Rush Enterprises, Inc. Shareholders' equity

(GAAP) |

$ |

2,083,145 |

|

$ |

1,899,612 |

|

|

Adjusted net debt (cash) (Non-GAAP) |

|

(181,088 |

) |

|

(187,840 |

) |

|

Adjusted Invested Capital (Non-GAAP) |

$ |

1,902,057 |

|

$ |

1,711,772 |

|

| |

|

|

|

|

|

|

“Adjusted Invested Capital” is a key financial

measure used by the Company to calculate its return on invested

capital. For purposes of this analysis, management excludes

L&RFD, FPNP, and cash and cash equivalents, for the reasons

provided in the debt analysis above and uses Adjusted Net Debt in

the calculation. The Company believes this approach provides

management a more accurate picture of the Company’s leverage

profile and capital structure and assists investors in performing

analysis that is consistent with financial models developed by

Company management and research analysts. “Adjusted Net (Cash)

Debt” and “Adjusted Invested Capital” are both non-GAAP financial

measures. Additionally, these non-GAAP measures may vary among

companies and may not be comparable to similarly titled non-GAAP

measures used by other companies.

Contact: Rush Enterprises,

Inc., San AntonioSteven L. Keller, 830-302-5226

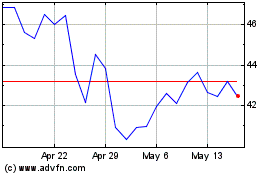

Rush Enterprises (NASDAQ:RUSHB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rush Enterprises (NASDAQ:RUSHB)

Historical Stock Chart

From Dec 2023 to Dec 2024