Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 21 2023 - 3:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

Form 6-K

____________________________________________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2023

Commission File Number: 001-41066

____________________________________________________________

Sono Group N.V.

(Registrant’s name)

____________________________________________________________

Waldmeisterstraße 76

80935 Munich

Germany

(Address of principal executive offices)

____________________________________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

Resignation of Members of Sono Group N.V.’s Supervisory Board

On April 21, 2023, four members of the supervisory board of Sono Group N.V. (the “Company”) resigned as members of the Company’s supervisory board and as members of the Company’s supervisory board committees, as applicable, with immediate effect. The members of the Company’s supervisory board were:

| | · | Martina Buchhauser, chairperson of the supervisory board, independent member of the audit committee and chairperson of the nomination and corporate governance committee; |

| | · | Sebastian Böttger, independent member of the audit committee, and chairperson of the compensation committee; |

| | · | Robert A. Jeffe, vice chairperson of the supervisory board, chairperson, independent member and financial expert of the audit committee, and member of the compensation committee; and |

| | · | Arnd Schwierholz, member of the supervisory board, member of the audit committee and member of the nomination and corporate governance committee. |

Johannes Tischler, who was nominated by Laurin Hahn, will continue to serve on the Company’s supervisory board and the supervisory board can thus continue to perform its duties.

The Company has commenced the process of finding suitable candidates to fill the vacancies on its supervisory board as promptly as reasonably practicable, taking into account the Company’s nomination arrangement pursuant to which the Company’s Co-Chief Executive Officers and Co-Founders, Laurin Hahn and Jona Christians, acting individually, are each permitted to make a binding nomination for one supervisory board member. Once suitable candidates have been identified, the Company shall convene a general meeting of shareholders to appoint them.

Non-Compliance with Nasdaq Audit Committee Requirements

As a consequence of the resignation of all members of the Company’s supervisory board except Johannes Trischler described above, the Company will not have any supervisory board committees until new candidates for the Company’s supervisory board have been identified and appointed. As a result, the Company is no longer in compliance with Nasdaq Listing Rule 5605(c)(2)(A), which requires a listed company to have an audit committee composed of at least three members, who each meet the criteria for independence set forth in Rule 10A-4(b)(1) under the Securities Exchange Act of 1934.

On April 21, 2023, the Company notified The Nasdaq Stock Market, Inc. that it was not in compliance with Nasdaq Listing Rule 5605(c)(2)(A) as a result of the resignation of four members of its supervisory board, including those who served on the audit committee.

Under Nasdaq Rule 5810(c)(2)(ii), as a result of having more than one vacancy on the audit committee, the Company believes it will be granted 45 days from the date of notice of non-compliance it expects to receive by Nasdaq to submit a plan of compliance to Nasdaq. After reviewing the Company’s plan, Nasdaq may accept it and grant the Company an extension of up to 180 calendar days from the date of notice of non-compliance by Nasdaq to regain compliance. If Nasdaq does not accept the plan of compliance, the Company may appeal Nasdaq’s decision before a Nasdaq Hearing Panel.

The Company intends to take all necessary steps to regain compliance with the Nasdaq Listing Rules by filling the audit committee vacancies on a timely basis with new members of its supervisory board, who fulfill the requirements of the Nasdaq listing rules applicable to audit committee members.

About This Document

The information included in this Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Exhibit 99.1 attached hereto includes a press release issued by the Company on April 21, 2023.

Forward-Looking Statements

This document includes forward-looking statements. The words "expect", "anticipate", "intend", "plan", "estimate", "aim", "forecast", "project", "target", “will” and similar expressions (or their negative) identify certain of these forward-looking statements. These forward-looking statements are statements regarding the Company's intentions, beliefs, or current expectations. Forward-looking statements involve inherent known and unknown risks, uncertainties, and contingencies because they relate to events and depend on circumstances that may or may not occur in the future and may cause the actual results, performance, or achievements of the Company to be materially different from those expressed or implied by such forward looking statements. These risks, uncertainties and assumptions include, but are not limited to the risks, uncertainties and assumptions set forth in the Company’s filings with the U.S. Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov and on the Company’s website at ir.sonomotors.com. Many of these risks and uncertainties relate to factors that are beyond the Company's ability to control or estimate precisely, such as the actions of regulators and other factors. Readers should therefore not place undue reliance on these statements, particularly not in connection with any contract or investment decision. Except as required by law, the Company assumes no obligation to update any such forward-looking statements.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Sono Group N.V. |

| | | (Registrant) |

| | | |

| | | |

| Date: April 21, 2023 | | /s/ Jona Christians |

| | | Jona Christians |

| | | Chief Executive Officer and Member of the Management Board |

| | | |

| Date: April 21, 2023 | | /s/ Torsten Kiedel |

| | | Torsten Kiedel |

| | | Chief Financial Officer and Member of the Management Board |

| | | |

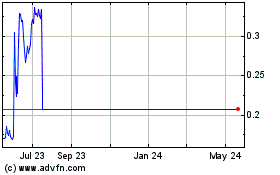

Sono Group NV (NASDAQ:SEV)

Historical Stock Chart

From Oct 2024 to Nov 2024

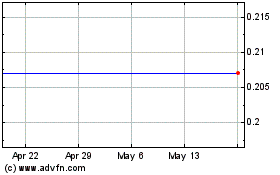

Sono Group NV (NASDAQ:SEV)

Historical Stock Chart

From Nov 2023 to Nov 2024