SigmaTron International, Inc.(Nasdaq:SGMA), an electronic

manufacturing services company, today reported revenues and

earnings for the third quarter ended January 31, 2010.

Revenues increased to $30.6 million for the third quarter of

fiscal year 2010 from $27.0 million for the same quarter in the

prior year. Net income increased to a profit of $415,468 in the

third quarter of fiscal year 2010 compared to a loss of ($265,458)

for the same period in the prior year. Basic and diluted

earnings per share for the quarter ended January 31, 2010, were

$0.11 compared to a loss of ($0.07) for both the same quarter in

fiscal 2009.

For the nine months ended January 31, 2010, revenues decreased

to $87.5 million compared to $106.6 million for the same period

ended January 31, 2009. Net income for the 2010 period was

$530,291 compared to $1,819,182 for the same period in the prior

year. Basic and diluted earnings per share for the nine months

ended January 31, 2010 were $0.14 and $0.13, respectively, compared

to $0.48 and $0.47, respectively, for the nine months ending

January 31, 2009.

Commenting on SigmaTron's third quarter and nine month results,

Gary R. Fairhead, President and Chief Executive Officer, said, "I

am pleased to report a solid profit for our third quarter of fiscal

2010, which is one year after we saw our revenue drop precipitously

in response to the global economic downturn. Our quarterly

results were negatively impacted by expenses related to our

changing banks during the quarter but otherwise operationally

consistent with our second quarter results. Just like the

second quarter, each month during the third quarter was

profitable. Historically, our second and third quarters have

been nominally stronger than our first and fourth quarters.

"Heading into our fourth quarter, we see many customers

adjusting inventory levels short term. My current expectation

is that revenue during the fourth quarter will be lower than that

of the third quarter. However, I also believe that the second

half of calendar 2010 will be stronger than the same period of

2009.

"The basis for my optimism for later this calendar year is that

several new programs from both existing and new customers are

scheduled to launch mid-year. Barring a short term economic

downturn, I have every reason to believe most of these programs

will go to market.

"As previously announced in our press release on January 11,

2010, we successfully changed our bank to Wells Fargo / HSBC Trade

Bank during the quarter. We believe our new banking

arrangement will provide greater financial support and flexibility

as the economy recovers. Clearly this transition was an

important milestone for SigmaTron, and we look forward to a long

term relationship with our new bank.

"While all of this news is positive, uncertainty and volatility

in the global economy clearly remains. Our cost reductions

remain in place and we continue to monitor both our cost structure

as well as our revenue levels. There is reason to be

optimistic compared to twelve months ago, but we will remain

cautious."

Headquartered in Elk Grove Village, IL, SigmaTron International,

Inc. is an electronic manufacturing services company that provides

printed circuit board assemblies and completely assembled

electronic products. SigmaTron International, Inc. operates

manufacturing facilities in Elk Grove Village, Illinois, Acuna and

Tijuana, Mexico, Hayward, California and Suzhou-Wujiang,

China. SigmaTron International, Inc. maintains engineering and

materials sourcing offices in Taipei, Taiwan.

Note: This press release contains forward-looking

statements. Words such as "continue," "anticipate," "will,"

"expect," "believe," "plan," and similar expressions identify

forward-looking statements. These forward-looking statements

are based on the current expectations of the Company. Because

these forward-looking statements involve risks and uncertainties,

the Company's plans, actions and actual results could differ

materially. Such statements should be evaluated in the context

of the risks and uncertainties inherent in the Company's business

including the Company's continued dependence on certain significant

customers; the continued market acceptance of products and services

offered by the Company and its customers; pricing pressures from

our customers, suppliers and the market; the activities of

competitors, some of which may have greater financial or other

resources than the Company; the variability of our operating

results; the results of long-lived assets impairment testing; the

variability of our customers' requirements; the availability and

cost of necessary components and materials; the ability of the

Company and our customers to keep current with technological

changes within our industries; regulatory compliance; the continued

availability and sufficiency of our credit arrangements; changes in

U.S., Mexican, Chinese or Taiwanese regulations affecting the

Company's business; the current turmoil in the global economy and

financial markets; the stability of the U.S., Mexican, Chinese and

Taiwanese economic systems, labor and political conditions;

currency exchange fluctuations; and the ability of the Company to

manage its growth. These and other factors which may affect

the Company's future business and results of operations are

identified throughout the Company's Annual Report on Form 10-K and

as risk factors and may be detailed from time to time in the

Company's filings with the Securities and Exchange

Commission. These statements speak as of the date of such

filings, and the Company undertakes no obligation to update such

statements in light of future events or otherwise unless otherwise

required by law.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Three Months

Three Months

Nine Months

Nine Months

Ended

Ended

Ended

Ended

January 31, 2010

January 31, 2009

January 31, 2010

January 31, 2009

Net sales

$30,599,499

$26,970,927

$87,493,820

$106,581,773

Cost of products sold

27,219,708

24,218,696

78,570,880

93,268,965

Gross profit

3,379,791

2,752,231

8,922,940

13,312,808

Selling and administrative expenses

2,503,571

2,666,375

7,448,821

9,328,834

Operating income

876,220

85,856

1,474,119

3,983,974

Other expense

211,860

246,441

627,519

1,096,267

Income (loss) from operations before income tax

664,360

(160,585)

846,600

2,887,707

Income tax expense

248,892

104,873

316,309

1,068,525

Net income (loss)

$415,468

($265,458)

$530,291

$1,819,182

Net income (loss) per common share -- basic

$0.11

($0.07)

$0.14

$0.48

Net income (loss) per common share -- assuming dilution

$0.11

($0.07)

$0.13

$0.47

Weighted average number of common equivalent

shares outstanding - assuming dilution

3,873,531

3,822,556

3,853,902

3,869,394

CONDENSED CONSOLIDATED BALANCE SHEETS

January 31, 2010

April 30, 2009

Assets:

Current assets

$61,561,244

$59,622,532

Machinery and equipment-net

25,298,583

26,200,578

Intangible assets

420,965

608,887

Other assets

618,613

699,379

Total assets

$87,899,405

$87,131,376

Liabilities and shareholders' equity:

Current liabilities

$20,568,227

$16,055,185

Long-term obligations

21,384,637

25,674,306

Stockholders' equity

45,946,541

45,401,885

Total liabilities and stockholders' equity

$87,899,405

$87,131,376

CONTACT: SigmaTron International, Inc.

Linda K. Frauendorfer

1-800-700-9095

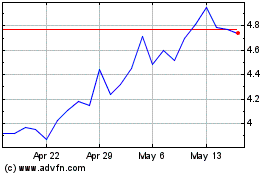

Sigmatron (NASDAQ:SGMA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sigmatron (NASDAQ:SGMA)

Historical Stock Chart

From Jul 2023 to Jul 2024