Sidus Space (NASDAQ: SIDU) (the “Company” or “Sidus”), a

provider of end-to-end precision Space Infrastructure solutions

that include satellite Data-as-a-Service on its proprietary

on-orbit platform, announced its financial results for the second

quarter ended June 30, 2024 and provided a business update. The

Company is scheduled to host a conference call and webcast today,

Monday, August 19th, at 5:00 p.m. ET.

“During the second quarter of 2024, we achieved a major

milestone with the successful commissioning of our first LizzieSat™

(LS-1) which was launched on the SpaceX Transporter-10 Rideshare

Mission in March. Following this critical phase, we began

activating payloads and accomplished the primary objectives of

several LS-1 missions. As the first commercial satellite designed,

manufactured and operated entirely by Sidus, LS-1 has demonstrated

our vertical integration capabilities and our experience in

deploying and operating our satellite equipped with multiple

technologies that serve a diverse range of applications and

customers,” said Carol Craig, Founder and CEO of Sidus Space. “This

accomplishment marks a significant step forward in our strategy to

establish Sidus as a leader in the Space ecosystem. Our Space-based

Data-as-a-Service business model, enabled by the LizzieSat™

constellation, is primed to scale rapidly, driving high-margin

revenue as we prepare for the launches of LizzieSat™ 2 and 3 with

SpaceX,” Ms. Craig concluded.

Operational Highlights for the Quarter Ending June 30,

2024:

- Constellation Development: LizzieSat™ 2 and 3 are in the

advanced stages of production and manifested for launch

- New Service Offering: Spacecraft Mission Control Center for

commercial customers

- HEO Agreement: Secured a second agreement with HEO for

Non-Earth Imaging Payload and Data services

- Partnership Expansion: Partnered with Orbital Transports to

expand market reach

- Bechtel Delivery: Completed purchase order and delivers

cabinets for Bechtel’s NASA Mobile Launcher 2 (ML2) project,

continuing production for additional cabinets

- NASA moon RACER team: Awarded a subcontract on the $30M

Intuitive Machines-led Moon RACER team for the NASA Lunar Terrain

Vehicle Services (LTVS) contract in support the Agency’s Artemis

Campaign

- LizzieSat™ –1 Payloads: Began activating payloads upon

successful completion of the Commissioning Phase of

LizzieSat-1

- DoD Mentor-Protégé Program Extension: The Department of Defense

extended the Sidus Space and L3Harris’ Mentor-Protégé program for a

second year

- Quality Certification: Achieved recertification of ISO

9001:2015 and AS9100D quality designation

- AI and Data Success: LizzieSat-1 successfully transmitted data

from Orbit through FeatherEdge, Sidus’ Artificial Intelligence (AI)

Rapid Delivery Platform, and supported the flight heritage of

Arkisys’ Applique Technology.

- AI-Enhanced Solutions: Sidus successfully demonstrated an AI

Enhanced, thermal sensing, firefighting software solution on

LizzieSat™

- International Expansion: Sidus Space and NamaSys Bahrain signed

an MOU with plans to establish “Sidus Arabia” a Joint Venture

headquartered in Saudi Arabia to develop a Satellite Manufacturing

Facility and pursue joint initiatives

Subsequent Operational Highlights:

- Successfully completed the primary objectives of the Autonomous

Satellite Technology for Resilient Application (ASTRA) historic

In-Space payload mission with NASA Stennis Space Center

Corporate Governance and Capital Formation

Highlights:

Board Appointments:

- Jeffrey (Jeff) Shuman appointed to Board of Directors

- Carol Craig, Founder and CEO was appointed as Chairman

following Leonard Riera’s resignation as Chairman

Financial Highlights for the Second Quarter Ending June 30,

2024:

Selling, general and administrative expenses totaled

approximately $3.1 million, a $500,000 decrease from $3.6 million

in Q2 2023, largely due to a reduction in payroll related expenses

directly related to building our satellites which were reclassed to

fixed asset as well as a reduction in professional fees and

insurance expense.

Total revenue for the three months ended June 30, 2024, totaled

approximately $930,000, a decrease of $440,000 compared to total

revenue for the three months ended June 30, 2023. This decrease was

primarily driven by the timing of fixed price manufacturing

milestones and delays in satellite contract payments, which are

expected to recover in the second half of the year.

Cost of revenue increased 105% to approximately $1.8 million, up

from $860,000 in Q2 2023. The percent change in the cost of revenue

was higher than the percent decrease in revenue due to a mix of

contracts with higher material expenses vice labor, shifts in

milestone payments for our higher margin satellite related business

and higher depreciation costs associated with the monthly

depreciation of our first satellite asset deployed March 2024.

The gross profit margin decreased to negative (91%), compared to

37% in Q2 2023, mainly due to lower satellite related revenue

versus prior year due in large part by the timing of satellite

related payments and fixed price milestone contracts in the first

half of 2024 and higher costs related to the depreciation of our

first satellite asset.

Adjusted EBITDA loss, a non-GAAP measure for the three months

ended June 30, 2024 was $3.2 million, compared to $2.8 million for

the same period the prior year. Total non-GAAP adjustments for

interest expense, depreciation and amortization, acquisition deal

costs, severance costs, capital markets and advisory fees,

equity-based compensation, and warrant costs are provided in the

reconciliation table listed below.

Net Loss for the three months ended June 30, 2024 was $4.1

million, compared to a net loss of $3.5 million in the same quarter

of 2023.

Conference Call and Webcast

Event:

Sidus Space Second Quarter 2024 Financial

Results Conference Call

Date:

Monday, August 19, 2024

Time:

5:00 p.m. Eastern Time

Live Call:

+ 1-877-269-7751 (U.S. Toll-Free) or

+1-201-389-0908 (International)

Webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1684792&tp_key=a1891a0338

For interested individuals unable to join the conference call, a

dial-in replay of the call will be available until Monday,

September 2, 2024, at 11:59 P.M. ET and can be accessed by dialing

+1-844-512-2921 (U.S. Toll Free) or +1-412-317-6671 (International)

and entering replay pin number: 13748500. An online archive of the

webcast will be available for three months following the event at

investors.sidusspace.com.

About Sidus Space

Sidus Space (NASDAQ: SIDU) is a multi-faceted Space

Infrastructure-as-a-Service satellite company focused on

mission-critical hardware manufacturing; multi-disciplinary

engineering services; satellite design, production, launch

planning, mission operations; and in-orbit support. The Company is

in Cape Canaveral, Florida, where it operates from a

35,000-square-foot manufacturing, assembly, integration, and

testing facility focused on vertically integrated

Space-as-a-Service solutions including end-to-end satellite

support.

Sidus Space has a mission of Bringing Space Down to Earth™ and a

vision of enabling space flight heritage status for new

technologies while delivering data and predictive analytics to

domestic and global customers. More than just a

“Satellite-as-a-Service” provider, Sidus Space products and

services are offered through its several business units:

Space-as-a-Service, Space-Based Data Solutions, AI/ML Products and

Services, Mission Planning and Management Operations, 3D Printing

and Products and Services, Satellite Manufacturing and Payload

Integration, and Space and Defense Hardware Manufacturing. Sidus

Space is ISO 9001:2015, AS9100 Rev. D certified, and ITAR

registered.

Forward-Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

‘forward-looking statements’ within the meaning of The Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements relating to the expected trading

commencement and closing dates. The words ‘anticipate,’ ‘believe,’

‘continue,’ ‘could,’ ‘estimate,’ ‘expect,’ ‘intend,’ ‘may,’ ‘plan,’

‘potential,’ ‘predict,’ ‘project,’ ‘should,’ ‘target,’ ‘will,’

‘would’ and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Actual results may

differ materially from those indicated by such forward-looking

statements as a result of various important factors, including: the

uncertainties related to market conditions and other factors

described more fully in the section entitled ‘Risk Factors’ in

Sidus Space’s Annual Report on Form 10-K for the year ended

December 31, 2023, and other periodic reports filed with the

Securities and Exchange Commission. Any forward-looking statements

contained in this press release speak only as of the date hereof,

and Sidus Space, Inc. specifically disclaims any obligation to

update any forward-looking statement, whether as a result of new

information, future events or otherwise.

NON-GAAP MEASURES

To provide investors with additional information in connection

with our results as determined in accordance with GAAP, we use

non-GAAP measures of adjusted EBITDA. We use adjusted EBITDA in

order to evaluate our operating performance and make strategic

decisions regarding future direction of the company since it

provides a meaningful comparison to our peers using similar

measures. We define adjusted EBITDA as net income (as determined by

U.S. GAAP) adjusted for interest expense, depreciation and

amortization expense, acquisition deal costs, severance costs,

capital market and advisory fees, equity-based compensation and

warrant costs. These non-GAAP measures may be different from

non-GAAP measures made by other companies since not all companies

will use the same measures. Therefore, these non-GAAP measures

should not be considered in isolation or as a substitute for

relevant U.S. GAAP measures and should be read in conjunction with

information presented on a U.S. GAAP basis.

The following table reconciles adjusted EBITDA to net loss (the

most comparable GAAP measure) for the three months ended June 30,

2024 and 2023:

Three Months Ended

June 30,

2024

2023

Change

%

Net Income / (Loss)

$

(4,136,084

)

$

(3,501,581

)

$

(634,503

)

18

%

Interest Expense (i)

249,174

228,244

20,930

9

%

Depreciation and Amortization (ii)

605,003

76,025

528,978

696

%

Fundraising expense (iii)

-

139,000

(139,000

)

-100

%

Warrant costs underwriter (iv)

-

240,525

(240,525

)

-100

%

Severance Costs

17,231

-

17,231

-

Equity based compensation

80,829

-

80,829

-

Total Non-GAAP Adjustments

952,237

683,794

268,443

39

%

Adjusted EBITDA

(3,183,847

)

(2,817,788

)

(366,059

)

13

%

(i) Sidus Space incurred increased

interest expense due to short-term note payable due in Q4 2024 and

interest expense related to an asset based loan.

(ii) Sidus Space incurred increased

depreciation expense 2024 with launch and deployment of satellite

fixed asset and related satellite software, as well as new ERP

software capitalization.

(iii) Sidus Space incurred decreased

Fundraising expense due to no fundraising activities in Q2

2024.

(iv) Sidus Space incurred one-time costs

related to underwriter warrants during 2023

SIDUS SPACE, INC

CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

June 30,

December 31,

2024

2023

Assets

Current assets

Cash

$

1,444,369

$

1,216,107

Accounts receivable

621,313

1,175,077

Accounts receivable - related parties

264,802

67,447

Inventory

1,400,686

1,217,929

Contract asset

77,124

77,124

Contract asset - related party

46,000

43,173

Prepaid and other current assets

4,449,118

5,405,453

Total current assets

8,303,412

9,202,310

Property and equipment, net

12,800,850

9,570,214

Operating lease right-of-use assets

262,007

115,573

Intangible asset

398,135

398,135

Other assets

74,969

64,880

Total Assets

$

21,839,373

$

19,351,112

Liabilities and Stockholders'

Equity

Current liabilities

Accounts payable and other current

liabilities

$

4,552,652

$

6,697,562

Accounts payable and accrued interest -

related party

887,402

677,039

Contract liability

77,124

77,124

Contract liability - related party

46,000

43,173

Asset-based loan liability

861,660

2,587,900

Notes payable

2,048,451

2,017,286

Operating lease liability

262,007

119,272

Total current liabilities

8,735,296

12,219,356

Operating lease liability -

non-current

-

-

Total Liabilities

8,735,296

12,219,356

Commitments and contingencies

Stockholders' Equity

Preferred Stock: 5,000,000 shares

authorized; $0.0001 par value; no shares issued and outstanding

Series A convertible preferred stock:

2,000 shares authorized; 0 and 372 shares issued and outstanding,

respectively

-

-

Common stock: 210,000,000 authorized;

$0.0001 par value

Class A common stock: 200,000,000 shares

authorized; 4,081,344 and 983,173 shares issued and outstanding,

respectively

409

98

Class B common stock: 10,000,000 shares

authorized; 100,000 shares issued and outstanding

10

10

Additional paid-in capital

63,879,410

49,918,441

Accumulated deficit

(50,775,752

)

(42,786,793

)

Total Stockholders' Equity

13,104,077

7,131,756

Total Liabilities and Stockholders'

Equity

$

21,839,373

$

19,351,112

SIDUS SPACE, INC

CONSOLIDATED STATEMENT OF

OPERATIONS

(UNAUDITED)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenue

$

834,798

$

1,175,616

$

1,679,909

$

3,090,340

Revenue - related parties

92,772

194,793

297,816

543,696

Total - revenue

927,570

1,370,409

1,977,725

3,634,036

Cost of revenue

1,768,671

862,632

2,734,762

2,230,460

Gross profit (loss)

(841,101

)

507,777

(757,037

)

1,403,576

Operating expenses

Selling, general and administrative

expenses

3,056,814

3,560,482

6,702,397

7,102,651

Total operating expenses

3,056,814

3,560,482

6,702,397

7,102,651

Net loss from operations

(3,897,915

)

(3,052,705

)

(7,459,434

)

(5,699,075

)

Other income (expense)

Other income

1,613

17,950

1,613

17,950

Other expense

-

-

-

-

Interest expense

(186,175

)

(187,667

)

(339,701

)

(375,194

)

Interest income

12,313

-

12,313

-

Asset-based loan expense

(65,920

)

(38,634

)

(161,375

)

(79,567

)

Finance expense

-

(240,525

)

-

(806,754

)

Total other income (expense)

(238,169

)

(448,876

)

(487,150

)

(1,243,565

)

Loss before income taxes

(4,136,084

)

(3,501,581

)

(7,946,584

)

(6,942,640

)

Provision for income taxes

-

-

-

-

Net loss

$

(4,136,084

)

$

(3,501,581

)

$

(7,946,584

)

$

(6,942,640

)

Dividend on Series A preferred Stock

-

-

(42,375

)

-

Net loss attributed to stockholders

(4,136,084

)

(3,501,581

)

(7,988,959

)

(6,942,640

)

Basic and diluted loss per common

share

$

(0.99

)

$

(6.85

)

$

(2.30

)

$

(17.15

)

Basic and diluted weighted average number

of common shares outstanding

4,181,344

511,315

3,450,577

404,821

SIDUS SPACE, INC

CONSOLIDATED STATEMENT OF CASH

FLOWS

(UNAUDITED)

Six Months Ended

June 30,

2024

2023

Cash Flows From Operating

Activities:

Net loss

$

(7,946,584

)

$

(6,942,640

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Stock based compensation

160,028

806,754

Finance Expense

-

-

Depreciation and amortization

858,033

79,385

Bad debt

-

-

Changes in operating assets and

liabilities:

Accounts receivable

553,764

156,130

Accounts receivable - related party

(197,355

)

54,696

Inventory

(182,757

)

(537,523

)

Contract asset

-

-

Contract asset - related party

(2,827

)

(15,956

)

Prepaid expenses and other assets

946,246

(1,483,918

)

Accounts payable and accrued

liabilities

(1,968,107

)

1,732,714

Accounts payable and accrued liabilities -

related party

210,363

(465

)

Contract liability

-

-

Contract liability - related party

2,827

15,956

Changes in operating lease assets and

liabilities

(3,699

)

(4,394

)

Net Cash provided by (used in) Operating

Activities

(7,570,068

)

(6,139,261

)

Cash Flows From Investing

Activities:

Purchase of property and equipment

(4,067,741

)

(2,614,169

)

Cash paid for asset acquisition

-

-

Net Cash used in Investing Activities

(4,067,741

)

(2,614,169

)

Cash Flows From Financing

Activities:

Proceeds from issuance of common stock

units

13,742,311

14,787,511

Proceeds from issuance of Series A

preferred stock units

-

-

Proceeds from asset-based loan

agreement

46,133

2,881,228

Repayment of asset-based loan

agreement

(1,772,373

)

(3,167,195

)

Proceeds from notes payable

-

-

Repayment of notes payable

(150,000

)

(179,524

)

Payment of lease liabilities

-

-

Repayment of notes payable - related

party

-

-

Dividend paid

-

-

Net Cash provided by (used in) Financing

Activities

11,866,071

14,322,020

Net change in cash

228,262

5,568,590

Cash, beginning of period

1,216,107

2,295,259

Cash, end of period

$

1,444,369

$

7,863,849

Supplemental cash flow information

Cash paid for interest

$

338,116

$

155,365

Cash paid for taxes

$

-

$

-

Non-cash Investing and Financing

transactions:

Debt forgiveness

$

-

$

-

Class A common stock issued for conversion

of Series A convertible preferred stock

$

16,566

$

-

Common stock issue for reverse split

adjustment

$

-

$

-

Recognition of right-of-use asset and

lease liability

$

284,861

$

135,235

Class A common stock issued for exercised

cashless warrant

$

-

$

-

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819963303/en/

Investor Relations investorrelations@sidusspace.com

Media Inquiries press@sidusspace.com

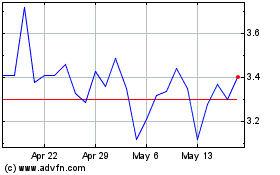

Sidus Space (NASDAQ:SIDU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sidus Space (NASDAQ:SIDU)

Historical Stock Chart

From Jan 2024 to Jan 2025