TrustCo Bank Corp NY: A Standout No Matter the Economic Environment

December 10 2024 - 9:05AM

TrustCo Bank Corp NY (TrustCo, Nasdaq: TRST) on December 9, 2024,

issued an analysis comparing its performance for the first three

quarters of 2024 to that of the Company’s peers on the following

metrics: Efficiency Ratio, Cost of Funds, Tier 1 Capital, and

Diluted EPS. The referenced charts are attached.

Efficiency

Ratio2

Efficiency ratio is a numerical representation

of what it costs us to make a dollar. As the chart below shows,

TrustCo ranks in the bottom 21st percentile (lower being better)

year-to-date, and over the latest quarter ending September 30,

2024.

|

Efficiency RatioTRST Outranks 79% of

Peers |

|

|

|

Year to Date |

Latest Quarter |

|

|

TrustCo Bank Corp NY |

60.80% |

59.65% |

|

|

Peer Average |

69.06% |

67.62% |

Common Equity Tier 1 Capital

Ratio

Tier 1 common capital ratio (“CET 1”) is a

measurement of a bank’s core equity capital, compared with its

total risk-weighted assets, and signifies a bank’s financial

strength. It shows how well a bank can withstand financial stress

and remain solvent. Maintaining an extremely healthy CET 1 capital

ratio is a bedrock strategic principle of TrustCo, and illustrates

the strength and soundness of Trustco Bank for over a century.

TrustCo continues to lead its peers in this metric, and is at the

top, or 100th percentile of its peer group, for the nine months

ending September 30, 2024 and September 30, 2023, respectively.

|

CET Tier 1 Capital RatioTRST Outranks 100% of

Peers |

|

|

|

|

|

|

|

|

|

Year to Date 9/30/2024 |

Year to Date 9/30/2023 |

|

|

|

TrustCo Bank Corp NY |

19.27% |

19.27% |

|

|

|

Peer Average |

12.46% |

12.53% |

|

Cost of Funds

Cost of funds is a profitability metric,

measured by the interest rate banks pay on deposit accounts in

order to obtain the funds they use to lend to customers. The

spread, or difference between the interest paid on deposits and the

interest earned on loans, is net interest margin. The lower the

cost of funds, the more profitable the bank can be. TrustCo ranks

in the bottom 5th percentile (lower being better) of its peers for

deposit costs year-to-date, and over the latest quarter ending

September 30, 2024. Trustco has retained and grown its deposit

portfolio without sacrificing returns to shareholders.

|

Cost of FundsTRST Outranks 95% of

Peers |

|

|

|

Year to Date |

Latest Quarter |

|

|

TrustCo Bank Corp NY |

1.70% |

1.67% |

|

|

Peer Average |

2.56% |

2.63% |

Earnings per Share

Earnings per share (EPS) is a measure of a

company's profitability that indicates how much profit each

outstanding share of common stock has earned. It's calculated by

dividing the company's net income by the total number of

outstanding shares. The higher a company's EPS, the

more profitable it is considered to be. A higher EPS indicates a

greater value because investors will pay more for a company’s

shares if they think the company has higher profits relative to its

share price. From an investor standpoint, EPS is often measured

against companies of the same industry or across a period of time.

As the chart below shows, TrustCo ranks in the top 74th percentile

of peer companies for EPS year-to-date, and over the latest

quarter, ending September 30, 2024.

|

Diluted EPSTRST Outranks 74% of

Peers |

|

|

|

|

|

|

|

|

|

Year to Date |

Latest Quarter |

|

|

|

TrustCo Bank Corp NY |

$1.97 |

$0.68 |

|

|

|

Peer Average |

$1.36 |

$0.47 |

|

About TrustCo Bank Corp

NYTrustCo Bank Corp NY is a $6.1 billion savings and loan

holding company. Through its subsidiary, Trustco Bank, Trustco

operates 138 offices in New York, New Jersey, Vermont,

Massachusetts and Florida. Trustco has a more than 100-year

tradition of providing high-quality services, including a wide

variety of deposit and loan products. In addition, Trustco Bank’s

Wealth Management Department offers a full range of investment

services, retirement planning and trust and estate administration

services. Trustco Bank is rated as one of the best performing

savings banks in the country. The common shares of TrustCo are

traded on the NASDAQ Global Select Market under the symbol

TRST. For more information, visit

www.trustcobank.com.

Contact Robert M. Leonard, EVP and COO (518)-381-3693

1Data provided in charts above is

derived from S&P Capital IQ

2Non-GAAP Financial Measure

Reconciliation

The Securities and Exchange Commission (“SEC”)

has adopted certain rules with respect to the use of “non-GAAP

financial measures” by companies with a class of securities

registered under the Securities Exchange Act of 1934, as amended,

such as TrustCo Bank Corp NY (the “Company”). Under the SEC’s

rules, companies making disclosures containing non-GAAP financial

measures must also disclose, along with each non-GAAP financial

measure, certain additional information, including a reconciliation

of the non-GAAP financial measure to the closest comparable GAAP

financial measure and a statement of the company’s reasons for

utilizing the non-GAAP financial measure as part of its financial

disclosures. The Company’s presentation of efficiency ratio in this

slide is determined by a method other than in accordance with

GAAP.

Adjusted Efficiency Ratio: Financial

institutions often use an “efficiency ratio” as a measure of

expense control relative to revenue from net interest income and

non-interest fee income. The efficiency ratio typically is defined

as noninterest expense divided by the sum of taxable equivalent net

interest income and noninterest income. As in the case of net

interest income, generally, net interest income as utilized in

calculating the efficiency ratio is typically expressed on a

taxable equivalent basis. Moreover, many financial institutions, in

calculating the efficiency ratio, also adjust both noninterest

expense and noninterest income to exclude from these items (as

calculated under GAAP) certain component elements, such as other

real estate expense (deducted from noninterest expense) and

securities transactions (excluded from noninterest income). We

calculate the efficiency ratio by dividing total noninterest

expenses as determined under GAAP, excluding other real estate

expense, net, by net interest income (fully taxable equivalent) and

total noninterest income as determined under GAAP, excluding

unrealized gains recognized on equity securities. We believe that

this provides a reasonable measure of primary banking expenses

relative to primary banking revenue. Additionally, we believe this

measure is important to investors looking for a measure of

efficiency in our productivity measured by the amount of revenue

generated for each dollar spent.

We believe that the Company’s adjusted

efficiency ratio provides information that is important to

investors and that is useful in understanding the Company’s

financial position and results. Management internally assesses our

performance based, in part, on this measure. However, this non-GAAP

financial measure is supplemental and is not a substitute for an

analysis based on the GAAP equivalent measure. As other companies

may use different calculations for efficiency ratio, this

presentation may not be comparable to other similarly titled

measures reported by other companies. A reconciliation of the

non-GAAP measure of adjusted efficiency ratio to GAAP efficiency

ratio is set forth below.

| |

|

|

|

|

| |

|

|

|

|

| Adjusted

Efficiency Ratio |

Three Months

Ended |

|

Nine Months

Ended |

|

| |

9/30/2024 |

|

9/30/2024 |

|

|

Net interest income (GAAP) |

$38,671 |

|

|

$113,037 |

|

|

| Taxable

equivalent adjustment |

- |

|

|

- |

|

|

| Net interest

income (fully taxable equivalent) (Non-GAAP0 |

38,671 |

|

|

113,037 |

|

|

| Noninterest

income (GAAP) |

4,931 |

|

|

15,425 |

|

|

| Less: Net

gains on equity securities |

23 |

|

|

1,383 |

|

|

| Revenue used

for adjusted efficiency ratio (Non-GAAP) |

$43,579 |

|

|

$127,079 |

|

|

| Total

noninterest expense (GAAP) |

$26,200 |

|

|

$77,562 |

|

|

| Less: Other

real estate expense, net |

204 |

|

|

294 |

|

|

| Expense used

for adjusted efficiency ratio (Non-GAAP) |

$25,996 |

|

|

$77,268 |

|

|

| |

|

|

|

|

| Efficiency

Ratio (GAAP) |

60.08 |

% |

|

60.85 |

% |

|

| Efficiency

Ratio (Non-GAAP) |

59.65 |

% |

|

60.80 |

% |

|

| |

|

|

|

|

Peer Group

|

Arrow Financial Corp. |

AROW |

Glens Falls |

NY |

|

BCB Bancorp Inc. |

BCBP |

Bayonne |

NJ |

|

Capital City Bank Group Inc. |

CCBG |

Tallahassee |

FL |

|

CNB Financial |

CCNE |

Clearfield |

PA |

|

Columbia Financial |

CLBK |

Fair Lawn |

NJ |

|

ConnectOne Bancorp Inc. |

CNOB |

Englewood Cliffs |

NJ |

|

Financial Institutions Inc. |

FISI |

Warsaw |

NY |

|

FineMark Holdings, Inc. |

FNBT |

Fort Myers |

FL |

|

First Commonwealth Financial |

FCF |

Indiana |

PA |

|

Flushing Financial Corp. |

FFIC |

Uniondale |

NY |

|

HarborOne Bancorp Inc |

HONE |

Brockton |

MA |

|

Kearny Financial Corp. |

KRNY |

Fairfield |

NJ |

|

Mid Penn Bancorp |

MPB |

Millersburg |

PA |

|

NBT Bancorp Inc. |

NBTB |

Norwich |

NY |

|

Northfield Bancorp |

NFBK |

Woodbridge |

NJ |

|

S&T Bancorp |

STBA |

Indiana |

PA |

|

The First Long Island Corp. |

FLIC |

Glen Head |

NY |

|

Tompkins Financial Corporation |

TMP |

Ithaca |

NY |

|

Univest Financial Corp. |

UVSP |

Souderton |

PA |

Subsidiary: Trustco Bank

|

Contact: |

Robert M. Leonard |

|

|

Executive Vice President |

|

|

(518) 381-3693 |

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Nov 2024 to Dec 2024

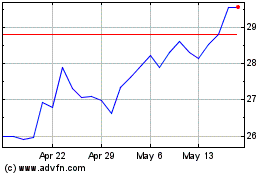

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Dec 2023 to Dec 2024