United Therapeutics Corporation (Nasdaq: UTHR), a public

benefit corporation, today announced its financial results for the

quarter ended June 30, 2024. Total revenues in the second quarter

of 2024 grew 20 percent year-over-year to $714.9 million, compared

to $596.5 million in the second quarter of 2023.

“This quarter we drove record revenue from our foundational

commercial business. Next year we expect data from our innovative

clinical pipeline. All this while we march forward with our

revolutionary organ manufacturing programs,” said Martine

Rothblatt, Ph.D., Chairperson and Chief Executive Officer of

United Therapeutics. “We believe there is no other biotech with our

combination of relentless focus, near-term commercial growth, and

clinical potential.”

Michael Benkowitz, President and Chief Operating Officer

of United Therapeutics, added, “Our fifth straight quarter of

record revenue was driven by continued traction for Tyvaso in

pulmonary hypertension associated with interstitial lung disease,

along with strong fundamentals for our other products in pulmonary

arterial hypertension and neuroblastoma.”

Second Quarter 2024 Financial Results

Key financial highlights include (dollars in millions, except

per share data):

Three Months Ended June

30,

Dollar Change

Percentage Change

2024

2023

Total revenues

$

714.9

$

596.5

$

118.4

20

%

Net income

$

278.1

$

259.2

$

18.9

7

%

Net income, per basic share

$

6.26

$

5.53

$

0.73

13

%

Net income, per diluted share

$

5.85

$

5.24

$

0.61

12

%

Revenues

The table below presents the components of total revenues

(dollars in millions):

Three Months Ended June

30,

Dollar Change

Percentage

Change

2024

2023

Net product sales:

Tyvaso DPI®(1)

$

258.3

$

193.6

$

64.7

33

%

Nebulized Tyvaso®(1)

139.9

125.3

14.6

12

%

Total Tyvaso

398.2

318.9

79.3

25

%

Remodulin®(2)

147.3

127.2

20.1

16

%

Orenitram®

107.1

95.1

12.0

13

%

Unituxin®

51.7

44.3

7.4

17

%

Adcirca®

5.7

7.5

(1.8

)

(24

)%

Other

4.9

3.5

1.4

40

%

Total revenues

$

714.9

$

596.5

$

118.4

20

%

(1)

Net product sales include both

the drug product and the respective inhalation device.

(2)

Net product sales include sales

of infusion devices, including the Remunity® Pump.

Total Tyvaso revenues grew by 25 percent to $398.2 million in

the second quarter of 2024, compared to $318.9 million in the

second quarter of 2023. This growth was primarily due to an

increase in quantities sold, driven by the commercial launch of

Tyvaso DPI in June 2022 and continued growth in commercial

utilization by patients with pulmonary hypertension associated with

interstitial lung disease and, to a lesser extent, price

increases.

The growth in Tyvaso DPI revenues resulted primarily from an

increase in quantities sold and, to a lesser extent, price

increases. The increase in Tyvaso DPI quantities sold was due to

continued growth in the number of patients following the product’s

launch and, to a lesser extent, increased commercial utilization

following the implementation of the Part D redesign under the

Inflation Reduction Act (IRA).

The growth in Remodulin revenues resulted primarily from an

increase in U.S. Remodulin revenues, driven by an increase in

quantities sold and, to a lesser extent, lower Medicaid

rebates.

The growth in Orenitram revenues resulted primarily from an

increase in quantities sold and, to a lesser extent, a price

increase. The increase in quantities sold was driven, at least in

part, by increased commercial utilization following the

implementation of the Part D redesign under the IRA.

The growth in Unituxin revenues resulted from a price increase

and an increase in quantities sold.

The table below presents the breakdown of total revenues between

the United States and rest-of-world (ROW) (in millions):

Three Months Ended June

30,

2024

2023

U.S.

ROW

Total

U.S.

ROW

Total

Net product sales:

Tyvaso DPI(1)

$

258.3

$

—

$

258.3

$

193.6

$

—

$

193.6

Nebulized Tyvaso(1)

130.2

9.7

139.9

119.6

5.7

125.3

Total Tyvaso

388.5

9.7

398.2

313.2

5.7

318.9

Remodulin(2)

122.5

24.8

147.3

103.5

23.7

127.2

Orenitram

107.1

—

107.1

95.1

—

95.1

Unituxin

46.8

4.9

51.7

39.5

4.8

44.3

Adcirca

5.7

—

5.7

7.5

—

7.5

Other

4.6

0.3

4.9

3.2

0.3

3.5

Total revenues

$

675.2

$

39.7

$

714.9

$

562.0

$

34.5

$

596.5

(1)

Net product sales include both the drug

product and the respective inhalation device.

(2)

Net product sales include sales of

infusion devices, including the Remunity Pump.

Expenses

Cost of sales. The table below summarizes cost of sales

by major category (dollars in millions):

Three Months Ended June

30,

Dollar Change

Percentage Change

2024

2023

Category:

Cost of sales

$

75.9

$

63.2

$

12.7

20

%

Share-based compensation expense(1)

1.9

0.9

1.0

111

%

Total cost of sales

$

77.8

$

64.1

$

13.7

21

%

(1)

See Share-based compensation

below.

Cost of sales, excluding share-based compensation. Cost of sales

for the three months ended June 30, 2024 increased as compared to

the same period in 2023, primarily due to an increase in Tyvaso DPI

royalty expense.

Research and development. The table below summarizes the

nature of research and development expense by major expense

category (dollars in millions):

Three Months Ended June

30,

Dollar Change

Percentage Change

2024

2023

Category:

External research and development(1)

$

49.4

$

49.3

$

0.1

—

%

Internal research and development(2)

44.5

34.7

9.8

28

%

Share-based compensation expense(3)

8.6

5.0

3.6

72

%

Impairments(4)

—

—

—

—

%

Other(5)

37.1

—

37.1

NM

(6)

Total research and development expense

$

139.6

$

89.0

$

50.6

57

%

(1)

External research and development

primarily includes fees paid to third parties (such as clinical

trial sites, contract research organizations, and contract

laboratories) for preclinical and clinical studies and payments to

third-party contract manufacturers before FDA approval of the

relevant product.

(2)

Internal research and development

primarily includes salary-related expenses for research and

development functions, internal costs to manufacture product

candidates before FDA approval, and internal facilities-related

expenses, including depreciation, related to research and

development activities.

(3)

See Share-based compensation

below.

(4)

Impairments primarily includes

impairment charges to write down the carrying value of in-process

research and development and of certain property, plant, and

equipment as a result of research and development activities. There

were no impairment charges during the three months ended June 30,

2024 and June 30, 2023.

(5)

Other primarily includes upfront

fees and milestone payments to third parties under license

agreements related to development-stage products and adjustments to

the fair value of our contingent consideration obligations.

(6)

Calculation is not

meaningful.

Research and development, excluding share-based compensation.

Research and development expense for the three months ended June

30, 2024 increased as compared to the same period in 2023,

primarily due to increased expenditures related to upfront

non-refundable licensing payments for drug delivery devices and

increased expenditures related to organ manufacturing projects.

Selling, general, and administrative. The table below

summarizes selling, general, and administrative expense by major

category (dollars in millions):

Three Months Ended June

30,

Dollar Change

Percentage Change

2024

2023

Category:

General and administrative

$

113.0

$

102.0

$

11.0

11

%

Sales and marketing

25.4

20.1

5.3

26

%

Share-based compensation expense(1)

39.2

7.9

31.3

396

%

Total selling, general, and administrative

expense

$

177.6

$

130.0

$

47.6

37

%

(1)

See Share-based compensation below.

General and administrative, excluding share-based compensation.

General and administrative expense for the three months ended June

30, 2024 increased as compared to the same period in 2023,

primarily due to an increase in legal expenses related to

litigation matters and an increase in personnel expense due to

growth in headcount.

Share-based compensation. The table below summarizes

share-based compensation expense by major category (dollars in

millions):

Three Months Ended

June 30,

Dollar Change

Percentage Change

2024

2023

Category:

Stock options

$

8.1

$

1.6

$

6.5

406

%

Restricted stock units

19.2

13.6

5.6

41

%

Share tracking awards plan

(STAP)

21.9

(1.9

)

23.8

NM

(1)

Employee stock purchase plan

0.5

0.5

—

—

%

Total share-based compensation expense

$

49.7

$

13.8

$

35.9

260

%

(1)

Calculation is not meaningful.

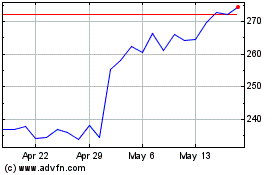

The increase in share-based compensation expense for the three

months ended June 30, 2024, as compared to the same period in 2023,

was primarily due to an increase in STAP expense driven by a 39

percent increase in our stock price for the three months ended June

30, 2024, as compared to a one percent decrease in our stock price

for the same period in 2023.

Income tax expense. Income tax expense for the three

months ended June 30, 2024 and 2023 was $77.2 million and $76.0

million, respectively. Our effective income tax rate (ETR)

for the three months ended June 30, 2024 and 2023 was 22 percent

and 23 percent, respectively. Our ETR for the three months ended

June 30, 2024 decreased compared to our ETR for the three months

ended June 30, 2023 primarily due to a lower amount of uncertain

tax positions recorded.

Share repurchase. In March 2024, we entered into an

accelerated share repurchase agreement (the ASR agreement)

with Citibank, N.A. (Citi). Under the ASR agreement, we made

an aggregate upfront payment of $1.0 billion to Citi and received

an aggregate initial delivery of 3,275,199 shares of our common

stock on March 27, 2024, representing approximately 80 percent of

the total shares that would be repurchased under the ASR agreement

measured based on the closing price of our common stock on March

25, 2024.

The share purchase under the ASR agreement was divided into two

tranches, resulting in upfront payments of $300 million and $700

million, respectively. The final settlement of the $300 million

tranche occurred in June 2024, and we received an additional

181,772 shares of our common stock upon settlement. At the final

settlement of the $700 million second tranche, which we expect to

occur in the third quarter of 2024, we may be entitled to receive

additional shares of common stock, or, under certain limited

circumstances, be required to make a cash payment to Citi or, if we

so elect, deliver shares of common stock to Citi.

The final number of shares that we will ultimately repurchase

pursuant to the ASR agreement will be based on the average of the

daily volume-weighted average price per share of our common stock

during the repurchase period, less a discount and subject to

adjustments pursuant to the terms and conditions of the ASR

agreement.

Webcast

We will host a webcast to discuss our second quarter 2024

financial results on Wednesday, July 31, 2024, at 9:00 a.m. Eastern

Time. The webcast can be accessed live via our website at

https://ir.unither.com/events-and-presentations. A replay of the

webcast will also be available at the same location on our

website.

United Therapeutics: Enabling Inspiration

At United Therapeutics, our vision and mission are one. We use

our enthusiasm, creativity, and persistence to innovate for the

unmet medical needs of our patients and to benefit our other

stakeholders. We are bold and unconventional. We have fun; we do

good. We are the first publicly-traded biotech or pharmaceutical

company to take the form of a public benefit corporation

(PBC). Our public benefit purpose is to provide a brighter

future for patients through (a) the development of novel

pharmaceutical therapies; and (b) technologies that expand the

availability of transplantable organs.

You can learn more about what it means to be a PBC here:

unither.com/pbc.

Forward-Looking Statements

Statements included in this press release that are not

historical in nature are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, among others, statements

related to our anticipated near-term commercial growth; the

anticipated progress of our organ manufacturing programs; our

clinical potential, including anticipated clinical trial data next

year; our unique position in the biotech industry; and our goals of

innovating for the unmet medical needs of our patients and to

benefit our other stakeholders, furthering our public benefit

purpose of developing novel pharmaceutical therapies and

technologies that expand the availability of transplantable organs.

These forward-looking statements are subject to certain risks and

uncertainties, such as those described in our periodic reports

filed with the Securities and Exchange Commission, that could cause

actual results to differ materially from anticipated results.

Consequently, such forward-looking statements are qualified by the

cautionary statements, cautionary language and risk factors set

forth in our periodic reports and documents filed with the

Securities and Exchange Commission, including our most recent

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and

Current Reports on Form 8-K. We claim the protection of the safe

harbor contained in the Private Securities Litigation Reform Act of

1995 for forward-looking statements. We are providing this

information as of July 31, 2024, and assume no obligation to update

or revise the information contained in this press release whether

as a result of new information, future events, or any other

reason.

ORENITRAM, REMODULIN, REMUNITY, TYVASO, TYVASO DPI, and UNITUXIN

are registered trademarks of United Therapeutics Corporation and/or

its subsidiaries.

ADCIRCA is a registered trademark of Eli Lilly and Company.

UNITED THERAPEUTICS

CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except per share

data)

Three Months Ended

June 30,

2024

2023

(Unaudited)

Total revenues

$

714.9

$

596.5

Operating expenses:

Cost of sales

77.8

64.1

Research and development

139.6

89.0

Selling, general, and administrative

177.6

130.0

Total operating expenses

395.0

283.1

Operating income

319.9

313.4

Interest income

46.2

37.2

Interest expense

(11.6

)

(14.8

)

Other income (expense), net

0.8

(0.6

)

Total other income, net

35.4

21.8

Income before income taxes

355.3

335.2

Income tax expense

(77.2

)

(76.0

)

Net income

$

278.1

$

259.2

Net income per common share:

Basic

$

6.26

$

5.53

Diluted

$

5.85

$

5.24

Weighted average number of common shares

outstanding:

Basic

44.4

46.9

Diluted

47.5

49.5

SELECTED CONSOLIDATED BALANCE

SHEET DATA

(Unaudited, in

millions)

June 30, 2024

Cash, cash equivalents, and marketable

investments

$

4,301.9

Total assets

6,723.2

Total liabilities

1,026.0

Total stockholders’ equity

5,697.2

Category: Earnings

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731653485/en/

Dewey Steadman at (202) 919-4097

https://ir.unither.com/contact-ir

United Therapeutics (NASDAQ:UTHR)

Historical Stock Chart

From Oct 2024 to Nov 2024

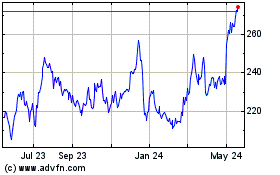

United Therapeutics (NASDAQ:UTHR)

Historical Stock Chart

From Nov 2023 to Nov 2024