Venus Concept Inc. (“Venus Concept” or the “Company”) (NASDAQ:

VERO), a global medical aesthetic technology leader, announced

financial results for the three and six months ended June 30, 2024.

Second Quarter 2024 Summary & Recent

Progress:

- Company continues to execute

against Transformational Plan

- Cash used in operations of $1.3

million, down 37% year-over-year and down 54%

quarter-over-quarter

- Total revenue of $16.6 million,

down 17% year-over-year, but in-line with second quarter estimate

of at “least $16.5 million”.

- Gross margin up 62 basis points

year-over-year to 71.5%, combined with a 13% decrease in operating

expenses year-over-year, drives 3% reduction in GAAP operating loss

year-over-year

- Adjusted EBITDA loss of $4.1

million, up 4% year-over-year, despite 17% revenue decline

- On May 28, 2024, the Company

announced a $35 million debt-to-equity exchange transaction,

significantly reducing the Company’s debt balance and bringing the

Company back into compliance with the Nasdaq Minimum Equity

Requirement.

- On June 3, 2024, the Company

announced that it received a medical device license issued by

Health Canada to market the Venus Versa Pro system in Canada.

- On June 17, 2024, the Company

announced that that it has entered a new strategic skin resurfacing

and skin tightening device supply arrangement with Skin Laundry

Holdings, Inc.

- On June 27, 2024, the Company

announced the successful completion of its NEXThetics events held

across several major cities in North America. NEXThetics events

bring together Venus Concept’s network of aesthetic leaders and

practitioners and have seen a significant increase in popularity

and attendance.

Management Commentary:

“Second quarter revenue results met the

expectations we outlined on our first quarter report,” said Rajiv

De Silva, Chief Executive Officer of Venus Concept. “Aesthetic

capital equipment sales continue to be challenged by macroeconomic

headwinds and as expected, our revenue results outside the U.S.

continue to be impacted by the strategic initiatives to exit

certain unprofitable direct market. However, we importantly

continue to see evidence that our efforts to reposition the

business over the last eighteen months have been proving

successful. We are enhancing our cash flow profile – as evidenced

by the 47% reduction year-over-year in cash used in operations over

the first six months of 2024 - and remain focused on enhancing our

balance sheet condition and enhancing the Company’s foundation to

support long-term, sustainable, profitability and growth in the

future.”

Second Quarter 2024 Financial Results:

| |

|

Three Months Ended June 30, |

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

|

| |

|

(dollars in thousands) |

|

|

|

|

Revenues by region: |

|

|

|

|

|

|

|

|

|

|

| United States |

|

$ |

9,280 |

|

|

$ |

9,757 |

|

|

|

| International |

|

|

7,302 |

|

|

|

10,318 |

|

|

|

|

Total revenue |

|

$ |

16,582 |

|

|

$ |

20,075 |

|

|

|

| |

|

Three Months Ended June 30, |

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

Change |

|

| (in thousands, except

percentages) |

|

$ |

|

|

% of Total |

|

|

$ |

|

|

% of Total |

|

|

$ |

|

|

% |

|

|

Revenues by product: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Venus Prime /

Subscription—Systems |

|

$ |

4,517 |

|

|

27.2 |

|

|

$ |

4,311 |

|

|

|

21.5 |

|

|

$ |

206 |

|

|

|

4.8 |

|

| Products—Systems |

|

|

8,588 |

|

|

51.8 |

|

|

|

12,313 |

|

|

|

61.3 |

|

|

|

(3,725 |

) |

|

|

(30.3 |

) |

| Products—Other |

|

|

2,647 |

|

|

16.0 |

|

|

|

2,586 |

|

|

|

12.9 |

|

|

|

61 |

|

|

|

2.4 |

|

| Services |

|

|

830 |

|

|

5.0 |

|

|

|

865 |

|

|

|

4.3 |

|

|

|

(35 |

) |

|

|

(4.0 |

) |

|

Total |

|

$ |

16,582 |

|

|

100.0 |

|

|

$ |

20,075 |

|

|

|

100.0 |

|

|

$ |

(3,493 |

) |

|

|

(17.4 |

) |

Total revenue for the second quarter of 2024

decreased $3.5 million, or 17%, to $16.6 million, compared to the

second quarter of 2023. The decrease in total revenue, by region,

was driven by a 29% decrease year-over-year in international

revenue and a 5% decrease year-over-year in United States revenue.

The decrease in total revenue, by product category, was driven by a

30% decrease in products – systems revenue and a 4% decrease in

services revenue, offset partially by a 5% increase in lease

revenue and a 2% increase in products - other revenue. The

percentage of total systems revenue derived from the Company’s

internal lease programs (Venus Prime and our legacy subscription

model) was approximately 34% in the second quarter of 2024,

compared to 26% in the prior year period.

Gross profit for the second quarter of 2024

decreased $2.4 million, or 17%, to $11.8 million compared to the

second quarter of 2023. The change in gross profit was primarily

due to a decrease in revenue in our international markets driven by

the accelerated exit from unprofitable direct markets and the

effects of tighter third-party lending practices which negatively

impacted capital equipment sales in both the U.S. and international

markets. Gross margin was 71.5% of revenue, compared to 70.8% of

revenue for the second quarter of 2023.

Operating expenses for the second quarter of

2024 decreased $2.5 million, or 13%, to $17.4 million, compared to

the second quarter of 2023. The change in total operating expenses

was driven by a decrease of $1.3 million, or 16%, in selling and

marketing expenses, a decrease of $1.0 million, or 10%, in general

and administrative expenses and a decrease of $0.2 million, or 12%,

in research and development expenses. Second quarter of 2024

general and administrative expenses included approximately $0.2

million of costs related to restructuring activities designed to

improve the Company's operations and cost structure.

Operating loss for the second quarter of 2024

was $5.6 million, compared to operating loss of $5.8 million for

the second quarter of 2023.

Net loss attributable to stockholders for the

second quarter of 2024 was $20.0 million, or $3.05 per share,

compared to net loss of $7.4 million, or $1.35 per share for the

second quarter of 2023. Second quarter net loss attributable to

stockholders includes a pre-tax loss on debt extinguishment of

$10.9 million related to the debt-to-equity exchange transaction.

Adjusted EBITDA loss for the second quarter of 2024 was $4.1

million, compared to adjusted EBITDA loss of $4.0 million for the

second quarter of 2023.

As of June 30, 2024, the Company had cash and

cash equivalents of $5.7 million and total debt obligations of

approximately $46.0 million, compared to $5.4 million and $74.9

million, respectively, as of December 31, 2023.

Fiscal Year 2024 Financial Outlook:

Given the Company’s active dialogue with

existing lenders and investors and the ongoing evaluation of

strategic alternatives with various interested parties to maximize

shareholder value, the Company is not providing full year 2024

financial guidance at this time. The Company expects total revenue

for the three months ending September 30, 2024 of at least $17.0

million, representing a 3% decline year-over-year and a 3% increase

quarter-over-quarter.

Conference Call Details:

Management will host a conference call at 8:00

a.m. Eastern Time on August 13, 2024 to discuss the results of the

quarter with a question-and-answer session. Those who would like to

participate may dial 877-407-2991 (201-389-0925 for international

callers) and provide access code 13747737. A live webcast of the

call will also be provided on the investor relations section of the

Company's website at ir.venusconcept.com.

For those unable to participate, a replay of the

call will be available for two weeks at: 877-660-6853 (201-612-7415

for international callers); access code 13747737. The webcast will

be archived at ir.venusconcept.com.

About Venus Concept

Venus Concept is an innovative global medical

aesthetic technology leader with a broad product portfolio of

minimally invasive and non-invasive medical aesthetic and hair

restoration technologies and reach in over 60 countries and 10

direct markets. Venus Concept's product portfolio consists of

aesthetic device platforms, including Venus Versa, Venus Versa Pro,

Venus Legacy, Venus Velocity, Venus Viva, Venus Glow, Venus Bliss,

Venus Bliss MAX, Venus Epileve, Venus Viva MD and AI.ME. Venus

Concept's hair restoration systems include NeoGraft® and the ARTAS

iX® Robotic Hair Restoration system. Venus Concept has been backed

by leading healthcare industry growth equity investors, including

EW Healthcare Partners (formerly Essex Woodlands), HealthQuest

Capital, Longitude Capital Management, Aperture Venture Partners,

and Masters Special Situations.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. Any statements contained herein that are not of historical

facts may be deemed to be forward-looking statements. In some

cases, you can identify these statements by words such as such as

“anticipates,” “believes,” “plans,” “expects,” “projects,”

“future,” “intends,” “may,” “should,” “could,” “estimates,”

“predicts,” “potential,” “continue,” “guidance,” and other similar

expressions that are predictions of or indicate future events and

future trends. These forward-looking statements include, but are

not limited to, but are not limited to, statements about our

financial performance and metrics; the growth in demand for our

systems and other products; the efficacy of the restructuring plan;

the identification and efficacy of strategic alternatives to

maximize shareholder value; the reduction in our cash burn; and the

continued implementation of turnaround plans, including debt

restructurings and financings. These forward-looking statements are

based on current expectations, estimates, forecasts, and

projections about our business and the industry in which the

Company operates and management's beliefs and assumptions and are

not guarantees of future performance or developments and involve

known and unknown risks, uncertainties, and other factors that are

in some cases beyond our control. As a result, any or all of our

forward-looking statements in this communication may turn out to be

inaccurate. Factors that could materially affect our business

operations and financial performance and condition include, but are

not limited to, those risks and uncertainties described under Part

II Item 1A—“Risk Factors” in our Quarterly Reports on Form 10-Q and

Part I Item 1A—“Risk Factors” in our Annual Report on Form 10-K for

the fiscal year ended December 31, 2023. You are urged to consider

these factors carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on the

forward-looking statements. The forward-looking statements are

based on information available to us as of the date of this

communication. Unless required by law, the Company does not intend

to publicly update or revise any forward-looking statements to

reflect new information or future events or otherwise.

|

|

|

|

Venus Concept Inc.Condensed Consolidated

Balance Sheets(In thousands of U.S. dollars,

except share and per share data) |

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,732 |

|

|

$ |

5,396 |

|

|

Accounts receivable, net of allowance of $4,161 and $7,415 as of

June 30, 2024, and December 31, 2023, respectively |

|

|

24,584 |

|

|

|

29,151 |

|

|

Inventories |

|

|

19,782 |

|

|

|

23,072 |

|

|

Prepaid expenses |

|

|

1,009 |

|

|

|

1,298 |

|

|

Advances to suppliers |

|

|

4,540 |

|

|

|

5,604 |

|

|

Other current assets |

|

|

1,256 |

|

|

|

1,925 |

|

|

Total current assets |

|

|

56,903 |

|

|

|

66,446 |

|

| LONG-TERM ASSETS: |

|

|

|

|

|

|

|

|

|

Long-term receivables, net |

|

|

9,479 |

|

|

|

11,318 |

|

|

Deferred tax assets |

|

|

1,195 |

|

|

|

1,032 |

|

|

Severance pay funds |

|

|

421 |

|

|

|

573 |

|

|

Property and equipment, net |

|

|

1,126 |

|

|

|

1,322 |

|

|

Operating right-of-use assets, net |

|

|

3,907 |

|

|

|

4,517 |

|

|

Intangible assets |

|

|

6,719 |

|

|

|

8,446 |

|

|

Total long-term assets |

|

|

22,847 |

|

|

|

27,208 |

|

| TOTAL ASSETS |

|

$ |

79,750 |

|

|

$ |

93,654 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Trade payables |

|

$ |

7,189 |

|

|

|

9,038 |

|

|

Accrued expenses and other current liabilities |

|

|

12,474 |

|

|

|

12,437 |

|

|

Note payable |

|

|

2,289 |

|

|

|

— |

|

|

Current portion of long-term debt |

|

|

1,297 |

|

|

|

4,155 |

|

|

Income taxes payable |

|

|

626 |

|

|

|

366 |

|

|

Unearned interest income |

|

|

1,198 |

|

|

|

1,468 |

|

|

Warranty accrual |

|

|

1,139 |

|

|

|

1,029 |

|

|

Deferred revenues |

|

|

894 |

|

|

|

1,076 |

|

|

Operating lease liabilities |

|

|

1,432 |

|

|

|

1,590 |

|

|

Total current liabilities |

|

|

28,538 |

|

|

|

31,159 |

|

| LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

|

42,402 |

|

|

|

70,790 |

|

|

Accrued severance pay |

|

|

458 |

|

|

|

634 |

|

|

Deferred tax liabilities |

|

|

2 |

|

|

|

15 |

|

|

Unearned interest revenue |

|

|

438 |

|

|

|

671 |

|

|

Warranty accrual |

|

|

271 |

|

|

|

334 |

|

|

Operating lease liabilities |

|

|

2,613 |

|

|

|

3,162 |

|

|

Other long-term liabilities |

|

|

664 |

|

|

|

338 |

|

|

Total long-term liabilities |

|

|

46,848 |

|

|

|

75,944 |

|

| TOTAL LIABILITIES |

|

|

75,386 |

|

|

|

107,103 |

|

| Commitments and Contingencies

(Note 9) |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY (DEFICIT)

(Note 15): |

|

|

|

|

|

|

|

|

| Common Stock, $0.0001 par

value: 300,000,000 shares authorized as of June 30, 2024 and

December 31, 2023; 7,255,277 and 5,529,149 issued and outstanding

as of June 30, 2024, and December 31, 2023, respectively |

|

|

30 |

|

|

|

30 |

|

| Additional paid-in

capital |

|

|

295,320 |

|

|

|

247,854 |

|

| Accumulated deficit |

|

|

(291,648 |

) |

|

|

(261,903 |

) |

| TOTAL STOCKHOLDERS’ EQUITY

(DEFICIT) |

|

|

3,702 |

|

|

|

(14,019 |

) |

| Non-controlling interests |

|

|

662 |

|

|

|

570 |

|

| |

|

|

4,364 |

|

|

|

(13,449 |

) |

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY (DEFICIT) |

|

$ |

79,750 |

|

|

$ |

93,654 |

|

|

|

|

|

Venus Concept Inc.Condensed Consolidated

Statements of Operations(In thousands of U.S.

dollars, except per share data) |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Leases |

|

$ |

4,455 |

|

|

$ |

4,311 |

|

|

$ |

8,048 |

|

|

$ |

10,072 |

|

| Products and services |

|

|

12,127 |

|

|

|

15,764 |

|

|

|

26,013 |

|

|

|

30,534 |

|

| |

|

|

16,582 |

|

|

|

20,075 |

|

|

|

34,061 |

|

|

|

40,606 |

|

| Cost of goods sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Leases |

|

|

410 |

|

|

|

721 |

|

|

|

1,887 |

|

|

|

2,450 |

|

| Products and services |

|

|

4,323 |

|

|

|

5,134 |

|

|

|

8,678 |

|

|

|

10,237 |

|

| |

|

|

4,733 |

|

|

|

5,855 |

|

|

|

10,565 |

|

|

|

12,687 |

|

| Gross profit |

|

|

11,849 |

|

|

|

14,220 |

|

|

|

23,496 |

|

|

|

27,919 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling and marketing |

|

|

7,048 |

|

|

|

8,380 |

|

|

|

14,422 |

|

|

|

16,412 |

|

| General and

administrative |

|

|

8,660 |

|

|

|

9,633 |

|

|

|

18,908 |

|

|

|

20,818 |

|

| Research and development |

|

|

1,737 |

|

|

|

1,965 |

|

|

|

3,522 |

|

|

|

4,602 |

|

| Total operating expenses |

|

|

17,445 |

|

|

|

19,978 |

|

|

|

36,852 |

|

|

|

41,832 |

|

| Loss from operations |

|

|

(5,596 |

) |

|

|

(5,758 |

) |

|

|

(13,356 |

) |

|

|

(13,913 |

) |

| Other expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange (gain)

loss |

|

|

774 |

|

|

|

(178 |

) |

|

|

1,098 |

|

|

|

(530 |

) |

| Finance expenses |

|

|

2,452 |

|

|

|

1,553 |

|

|

|

4,120 |

|

|

|

3,061 |

|

| (Gain) loss on disposal of

subsidiaries |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

76 |

|

| Loss on debt

extinguishment |

|

|

10,901 |

|

|

|

— |

|

|

|

10,901 |

|

|

|

— |

|

| Loss before income taxes |

|

|

(19,723 |

) |

|

|

(7,132 |

) |

|

|

(29,475 |

) |

|

|

(16,520 |

) |

| Income tax expense |

|

|

141 |

|

|

|

189 |

|

|

|

178 |

|

|

|

424 |

|

| Net loss |

|

$ |

(19,864 |

) |

|

$ |

(7,321 |

) |

|

$ |

(29,653 |

) |

|

$ |

(16,944 |

) |

| Net loss attributable to

stockholders of the Company |

|

$ |

(19,951 |

) |

|

$ |

(7,409 |

) |

|

$ |

(29,745 |

) |

|

$ |

(17,066 |

) |

| Net income attributable to

non-controlling interest |

|

$ |

87 |

|

|

$ |

88 |

|

|

$ |

92 |

|

|

$ |

122 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(3.05 |

) |

|

$ |

(1.35 |

) |

|

$ |

(4.81 |

) |

|

$ |

(3.19 |

) |

| Diluted |

|

$ |

(3.05 |

) |

|

$ |

(1.35 |

) |

|

$ |

(4.81 |

) |

|

$ |

(3.19 |

) |

| Weighted-average number of

shares used in per share calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

6,550 |

|

|

|

5,471 |

|

|

|

6,189 |

|

|

|

5,355 |

|

| Diluted |

|

|

6,550 |

|

|

|

5,471 |

|

|

|

6,189 |

|

|

|

5,355 |

|

|

|

|

|

Venus Concept Inc.Condensed Consolidated

Statements of Cash Flows(in

thousands) |

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(29,653 |

) |

|

$ |

(16,944 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,952 |

|

|

|

2,032 |

|

|

Stock-based compensation |

|

|

578 |

|

|

|

850 |

|

|

Provision for expected credit losses |

|

|

444 |

|

|

|

977 |

|

|

Provision for inventory obsolescence |

|

|

723 |

|

|

|

674 |

|

|

Finance expenses and accretion |

|

|

2,526 |

|

|

|

680 |

|

|

Deferred tax expense (recovery) |

|

|

(176 |

) |

|

|

78 |

|

|

Loss on sale of subsidiary |

|

|

— |

|

|

|

76 |

|

|

Loss on extinguishment of debt |

|

|

10,901 |

|

|

|

— |

|

|

Loss on disposal of property and equipment |

|

|

19 |

|

|

|

— |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable short-term and long-term |

|

|

5,962 |

|

|

|

6,153 |

|

|

Inventories |

|

|

2,567 |

|

|

|

297 |

|

|

Prepaid expenses |

|

|

289 |

|

|

|

207 |

|

|

Advances to suppliers |

|

|

1,064 |

|

|

|

132 |

|

|

Other current assets |

|

|

669 |

|

|

|

1,642 |

|

|

Operating right-of-use assets, net |

|

|

610 |

|

|

|

879 |

|

|

Other long-term assets |

|

|

(2 |

) |

|

|

(268 |

) |

|

Trade payables |

|

|

(1,611 |

) |

|

|

259 |

|

|

Accrued expenses and other current liabilities |

|

|

225 |

|

|

|

(4,185 |

) |

|

Current operating lease liabilities |

|

|

(158 |

) |

|

|

(236 |

) |

|

Severance pay funds |

|

|

152 |

|

|

|

154 |

|

|

Unearned interest income |

|

|

(503 |

) |

|

|

(887 |

) |

|

Long-term operating lease liabilities |

|

|

(549 |

) |

|

|

(555 |

) |

|

Other long-term liabilities |

|

|

(239 |

) |

|

|

(25 |

) |

|

Net cash used in operating activities |

|

|

(4,210 |

) |

|

|

(8,010 |

) |

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(47 |

) |

|

|

(92 |

) |

|

Net cash used in investing activities |

|

|

(47 |

) |

|

|

(92 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

10 |

|

|

|

1,109 |

|

|

2023 Multi-Tranche Private Placement, net of costs of $367 |

|

|

— |

|

|

|

1,633 |

|

|

2024 Registered Direct Offering shares and warrants, net of costs

of $222 |

|

|

976 |

|

|

|

— |

|

|

Dividends from subsidiaries paid to non-controlling interest |

|

|

— |

|

|

|

(87 |

) |

|

Proceeds from Short-Term Bridge Financing By Madryn, net of costs

$238 |

|

|

2,000 |

|

|

|

— |

|

|

2024 Convertible Notes issued to EW, net of costs of $393 |

|

|

1,607 |

|

|

|

— |

|

|

Net cash provided by financing activities |

|

|

4,593 |

|

|

|

2,655 |

|

| NET INCREASE (DECREASE) IN

CASH AND CASH EQUIVALENTS AND RESTRICTED CASH |

|

|

336 |

|

|

|

(5,447 |

) |

| CASH AND CASH EQUIVALENTS AND

RESTRICTED CASH — Beginning of period |

|

|

5,396 |

|

|

|

11,569 |

|

| CASH AND CASH EQUIVALENTS AND

RESTRICTED CASH — End of period |

|

$ |

5,732 |

|

|

$ |

6,122 |

|

| SUPPLEMENTAL

DISCLOSURES OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

69 |

|

|

$ |

18 |

|

|

Cash paid for interest |

|

$ |

1,594 |

|

|

$ |

2,381 |

|

Use of Non-GAAP Financial Measures

Adjusted EBITDA is a non-GAAP measure defined as

net income (loss) before foreign exchange (gain) loss, financial

expenses, income tax expense (benefit), depreciation and

amortization, stock-based compensation and non-recurring items for

a given period. Adjusted EBITDA is not a measure of our financial

performance under U.S. GAAP and should not be considered an

alternative to net income or any other performance measures derived

in accordance with U.S. GAAP. Accordingly, you should consider

Adjusted EBITDA along with other financial performance measures,

including net income, and our financial results presented in

accordance with U.S. GAAP. Other companies, including companies in

our industry, may calculate Adjusted EBITDA differently or not at

all, which reduces its usefulness as a comparative measure. We

understand that although Adjusted EBITDA is frequently used by

securities analysts, lenders and others in their evaluation of

companies, Adjusted EBITDA has limitations as an analytical tool,

and you should not consider it in isolation, or as a substitute for

analysis of our results as reported under U.S. GAAP. Some of these

limitations are: Adjusted EBITDA does not reflect our cash

expenditures or future requirements for capital expenditures or

contractual commitments; Adjusted EBITDA does not reflect changes

in, or cash requirements for, our working capital needs; and

although depreciation and amortization are non-cash charges, the

assets being depreciated will often have to be replaced in the

future, and Adjusted EBITDA does not reflect any cash requirements

for such replacements.

We believe that Adjusted EBITDA is a useful

measure for analyzing the performance of our core business because

it facilitates operating performance comparisons from period to

period and company to company by backing out potential differences

caused by changes in foreign exchange rates that impact financial

assets and liabilities denominated in currencies other than the

U.S. dollar, tax positions (such as the impact on periods or

companies of changes in effective tax rates), the age and book

depreciation of fixed assets (affecting relative depreciation

expense), amortization of intangible assets, stock-based

compensation expense (because it is a non-cash expense) and

non-recurring items as explained below.

The following is a reconciliation of net loss to Adjusted EBITDA

for the periods presented:

|

Venus Concept Inc.Reconciliation of Net

loss to Non-GAAP Adjusted EBITDA |

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Reconciliation of net

loss to adjusted EBITDA |

|

(in thousands) |

|

|

(in thousands) |

|

Net loss |

|

$ |

(19,864 |

) |

|

$ |

(7,321 |

) |

|

$ |

(29,653 |

) |

|

$ |

(16,944 |

) |

| Foreign exchange (gain)

loss |

|

|

774 |

|

|

|

(178 |

) |

|

|

1,098 |

|

|

|

(530 |

) |

| (Gain) loss on disposal of

subsidiaries |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

76 |

|

| Loss on debt

extinguishment |

|

|

10,901 |

|

|

|

— |

|

|

|

10,901 |

|

|

|

— |

|

| Finance expenses |

|

|

2,452 |

|

|

|

1,553 |

|

|

|

4,120 |

|

|

|

3,061 |

|

| Income tax expense |

|

|

141 |

|

|

|

189 |

|

|

|

178 |

|

|

|

424 |

|

| Depreciation and

amortization |

|

|

977 |

|

|

|

1,010 |

|

|

|

1,952 |

|

|

|

2,032 |

|

| Stock-based compensation

expense |

|

|

239 |

|

|

|

369 |

|

|

|

578 |

|

|

|

850 |

|

| CEWS (1) |

|

|

— |

|

|

|

— |

|

|

|

418 |

|

|

|

— |

|

| Other adjustments (2) |

|

|

238 |

|

|

|

412 |

|

|

|

1,148 |

|

|

|

1,330 |

|

| Adjusted

EBITDA |

|

$ |

(4,142 |

) |

|

$ |

(3,967 |

) |

|

$ |

(9,260 |

) |

|

$ |

(9,701 |

) |

(1) In April 2022, the Canada Revenue Agency (“CRA”) initiated

an audit of the Canada Emergency Wage Subsidy Claim (“CEWS”) that

the Company filed between 2020-2021. The CRA has currently assessed

a denial of CEWS claims made by the Company in 2020 and requesting

repayment of $418. The Company disputes the CRA assessment and

intends to challenge this matter through the Tax Court or Judicial

Review.

(2) For the three and six months ended June 30, 2024 and June

30, 2023 the other adjustments are represented by restructuring

activities designed to improve the Company's operations and cost

structure.

Investor Relations Contact:

ICR Westwicke on behalf of Venus Concept:

Mike Piccinino, CFA

VenusConceptIR@westwicke.com

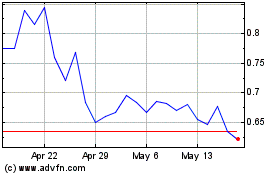

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Nov 2023 to Nov 2024