0000737468FALSE00007374682024-12-122024-12-12

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 12, 2024

| | |

| WASHINGTON TRUST BANCORP, INC. |

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Rhode Island | | 001-32991 | | 05-0404671 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| | | | | | | | | | | |

| 23 Broad Street | | |

| Westerly, | Rhode Island | | 02891 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | |

| (401) | 348-1200 |

| (Registrant's telephone number, including area code) |

| | |

| N/A |

| (Former name or address, if changed from last report) |

| | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

COMMON STOCK, $.0625 PAR VALUE PER SHARE | WASH | The NASDAQ Stock Market LLC |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | |

| Emerging growth company | ☐ |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition |

| period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the |

| Exchange Act. | ☐ |

Item 7.01. Regulation FD Disclosure.

On December 12, 2024, Washington Trust Bancorp, Inc. (the “Corporation”) issued a press release announcing that it has commenced an underwritten public offering of the shares of its common stock (the “Offering”). The offer and sale of the shares of common stock in the Offering was registered under the Securities Act of 1933, as amended (the “Act”), pursuant to the Corporation’s shelf registration statement on Form S-3 (File No. 333-274430), which was declared effective by the Securities and Exchange Commission (the “SEC”) on September 29, 2023, including the base prospectus contained therein, as supplemented by a preliminary prospectus supplement dated December 12, 2024, filed by the Corporation with the SEC pursuant to Rule 424(b) under the Act, with a final prospectus supplement to be filed with the SEC prior to the closing of the Offering. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The Corporation is hereby making available a presentation titled “Washington Trust Bancorp, Inc. Follow-On Offering Investor Presentation,” which is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this item and the attached Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Act, as amended, except as shall be expressly set forth by specific reference in any such filing. The information contained in this report does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | | | | | | | |

| (d) | Exhibits. | | |

| | | | |

| | Exhibit No. | | Exhibit |

| | | | |

| | | | |

| | | | |

| | 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | WASHINGTON TRUST BANCORP, INC. |

| Date: | December 12, 2024 | | By: | /s/ Ronald S. Ohsberg |

| | | | Ronald S. Ohsberg |

| | | | Senior Executive Vice President, Chief Financial Officer and Treasurer |

NASDAQ: WASH

Media Contact: Sharon M. Walsh

SVP, Director of Marketing Strategy and Planning

Telephone: (401) 348-1286

E-mail: smwalsh@washtrust.com

Date: December 12, 2024

FOR IMMEDIATE RELEASE

Washington Trust Announces Stock Offering

WESTERLY, R.I., December 12, 2024 (PR NEWSWIRE)…Washington Trust Bancorp, Inc. (Nasdaq: WASH) (the “Corporation”), parent company of The Washington Trust Company, of Westerly (the “Bank”), today announced it has commenced an underwritten public offering of $55,000,000 of the Corporation’s common stock. The Corporation also expects to grant the underwriter a 30-day option to purchase up to an additional 15% of the shares of its common stock sold in the offering. BofA Securities is serving as the sole book-running manager for the offering.

The Corporation intends to use the net proceeds of this offering for general corporate purposes to support continued organic growth and capital generation, which are expected to include investments in the Bank and Bank balance sheet optimization strategies involving the sale of lower-yielding loans and available for sale debt securities, the repayment of wholesale funding balances and the purchase of debt securities with current market yields.

ADDITIONAL INFORMATION REGARDING THE OFFERING

The common stock offering is being made pursuant to a shelf registration statement on Form S-3 (File No. 333-274430), which was filed with the Securities and Exchange Commission (the “SEC”) on September 8, 2023, and declared effective by the SEC on September 29, 2023. A preliminary prospectus supplement to which this communication relates has been filed with the SEC, and a prospectus supplement will be filed with the SEC prior to the closing of the common stock offering. Before you invest in any securities, you should read the preliminary prospectus supplement and accompanying prospectus, including the risk factors set forth therein, the registration statement and the documents incorporated by reference therein, and the other documents that the Corporation has filed with the SEC for more complete information about the Corporation and the offering. Copies of these documents are available at no charge by visiting EDGAR on the SEC’s website at www.sec.gov. When available, copies of the preliminary prospectus supplement, the prospectus supplement and accompanying prospectus related to the offering may also be obtained from BofA Securities, NC1-022-02-25, 201, North Tryon Street, Charlotte, NC 28255-0001, Attention: Prospectus Department or by email at dg.prospectus_requests@bofa.com.

NO OFFER OR SOLICITATION

This press release does not constitute an offer to sell, a solicitation of an offer to sell, or the solicitation of an offer to buy any securities. There will be no sale of securities in any jurisdiction in which such an offering, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

SPECIAL NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains statements that are “forward-looking statements.” Forward looking-statements include all statements that are not historical facts and include any statements regarding the proposed offering and the intended use of net proceeds from the offering. We may also make forward-looking statements in other documents we file with the SEC, in our annual reports to shareholders, in press releases and other written materials, and in oral statements made by our officers, directors, or employees. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “outlook,” “will,” “should,” and other expressions that predict or indicate future events and trends and which do not relate to historical matters. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. A detailed discussion of factors that could affect our results is included in the Corporation’s SEC filings, including Item 1A. “Risk Factors” of its Annual Report on Form 10-K for the year ended December 31, 2023. You should not rely on forward-looking statements, because they involve known and unknown risks, uncertainties, and other factors, some of which are beyond our control. These risks, uncertainties, and other factors may cause our actual results, performance, or achievements to be materially different from the anticipated future results, performance, or achievements expressed or implied by the forward-looking statements. The Corporation undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in our expectations, except as required by law.

ABOUT WASHINGTON TRUST BANCORP, INC.

Washington Trust Bancorp, Inc., NASDAQ: WASH, is the publicly-owned holding company of The Washington Trust Company (“Washington Trust”, “the Bank”), with $7.1 billion in assets as of September 30, 2024. Founded in 1800, Washington Trust is recognized as the oldest community bank in the nation, the largest state-chartered bank headquartered in Rhode Island and one of the Northeast’s premier financial services companies. Washington Trust values its role as a community bank and is committed to helping the people, businesses, and organizations of New England improve their financial lives. The Bank offers a wide range of commercial banking, mortgage banking, personal banking and wealth management services through its offices in Rhode Island, Connecticut and

Massachusetts and a full suite of convenient digital tools. Washington Trust is a member of the FDIC and an equal housing lender.

December 2024 Follow-On Offering Investor Presentation NASDAQ: WASH

Disclaimers 2 Forward-Looking Statements In this presentation, “we,” “our,” “us,” “Washington Trust” or the “Company” refers to Washington Trust Bancorp, Inc., and our consolidated subsidiaries, including The Washington Trust Company, of Westerly, unless the context indicates that we refer only to the parent company, Washington Trust Bancorp, Inc. This presentation contains certain statements that may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on various assumptions (some of which are beyond our control), may be identified by reference to a future period or periods, or by the use of forward-looking terminology such as “believe,” “expect,” “estimate,” “anticipate,” “continue,” “plan,” “approximately,” “intend,” “objective,” “goal,” “project” or other similar terms or variations on those terms, or the future or conditional verbs such as “will,” “may,” “should,” “could” and “would.” These forward-looking statements were based on information, plans and estimates at the date of this presentation, and Washington Trust assumes no obligation to update forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. Actual results, performance or achievements of Washington Trust may differ materially from those discussed in these forward-looking statements, as a result of, among other factors, the factors described under the caption “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) and updated by our Quarterly Reports on Form 10-Q and other reports filed with the SEC. You should carefully review all of these factors. You should be aware that there may be other factors that could cause these differences and many of which are beyond our control, including, but not limited, to: changes in general business and economic conditions on a national basis and in the local markets in which we operate; changes in customer behavior due to political, business and economic conditions, including inflation and concerns about liquidity; interest rate changes or volatility, as well as changes in the balance and mix of loans and deposits; changes in loan demand and collectability; the possibility that future credit losses are higher than currently expected due to changes in economic assumptions or adverse economic developments; ongoing volatility in national and international financial markets; reductions in the market value or outflows of wealth management assets under administration; decreases in the value of securities and other assets; increases in defaults and charge-off rates; changes in the size and nature of our competition; changes in legislation or regulation and accounting principles, policies and guidelines; operational risks including, but not limited to, changes in information technology, cybersecurity incidents, fraud, natural disasters, war, terrorism, civil unrest and future pandemics; regulatory, litigation and reputational risks; and changes in the assumptions used in making such forward-looking statements. No Offer or Solicitation This presentation is nether an offer to sell nor a solicitation of an offer to purchase any securities of Washington Trust. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities of any such jurisdiction. Any offer to sell or solicitation of an offer to purchase securities of Washington Trust will be made only pursuant to a prospectus supplement and prospectus filed with the SEC. Washington Trust has filed a registration statement (including a prospectus) (File No. 333-274430) and a preliminary prospectus supplement with the SEC for the offering to which this presentation relates. Before making an investment decision, you should read the prospectus and preliminary prospectus supplement and the other documents that Washington Trust has filed with the SEC for additional information about Washington Trust and the offering. You may obtain these documents for free by visiting the SEC’s website at www.sec.gov. Alternatively, Washington Trust or any underwriter or dealer participating in the offering can arrange to send you copies of the prospectus and preliminary prospectus supplement if you request by contacting BofA Securities, Inc. at dg.prospectus_requests@bofa.com. These securities are not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency or public or private insurer. Neither the SEC nor any other regulator has approved or disproved of the securities of Washington Trust of passed on the adequacy or accuracy of this presentation. Any representation to the contrary is a criminal offense.

Disclaimers 3 Industry Information This presentation includes statistical and other industry and market data that Washington Trust obtained from government reports and other third-party sources. Our internal data, estimates, and forecasts are based on information obtained from government reports, trade, and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and third-party research, surveys, and studies) is accurate and reliable, we have not independently verified such information and no representations or warranties are made by us or our affiliates as to the accuracy of any such statements or projections. In addition, estimates, forecasts, and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this presentation. These and other factors could cause our results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, Return on Tangible Common Equity ("ROTCE"), and Tangible Book Value Per Share. ROTCE is calculated as net income available to common shareholders divided by tangible common equity, where tangible common equity excludes intangible assets and preferred equity. Tangible Book Value Per Share is calculated as tangible common equity divided by outstanding common shares. Washington Trust's management uses these non-GAAP measures to evaluate Washington Trust's performance, profitability and financial strength, as they provide additional insight into operational results, facilitate comparability across reporting periods, and offer useful perspectives for assessing business trends and peer performance. Such non-GAAP measures are supplemental and not substitutes for GAAP financial measures, and reconciliations to the most comparable GAAP measures are provided in the Appendix to this Presentation.

4 Offering Summary Issuer Washington Trust Bancorp, Inc. Ticker / Listing WASH / NASDAQ Base Offering Size $55mm (100% Primary) Over-Allotment Option 15% (100% Primary) Expected Pricing Date December 11, 2024 Use of Proceeds We intend to use the net proceeds of this offering for general corporate purposes to support continued organic growth and capital generation, which are expected to include investments in the Bank and Bank balance sheet optimization strategies involving the sale of lower-yielding loans and available for sale debt securities, the repayment of wholesale funding balances and the purchase of debt securities with current market yields. The precise amounts and timing of our use of the net proceeds will depend on our, and our subsidiaries’, funding requirements and the availability of other funds. Lock-Up 90-Days for directors and executive officers Sole Bookrunner BofA Securities

1. A unique opportunity to invest in the Oldest Community Bank in the United States 2. Full suite of Commercial, Retail, and Wealth Management and Estate planning capabilities comparable to much larger banks 3. Strong diversification of revenue, with 34% from fees through 09/30/24 4. Sophisticated commercial presence focused on local markets 5. Strong credit performance 6. Potential Balance Sheet Repositioning to enhance profitability profile of the franchise The Washington Trust Investment Story L E V E R A G I N G O U R S T R O N G M A R K E T P O S I T I O N A N D B U S I N E S S M O D E L T O D E L I V E R S U S TA I N A B L E VA L U E F O R O U R S H A R E H O L D E R S 5 1 2 3 4 5 6

6 W A S H I N G T O N T R U S T A T - A - G L A N C E $7B Regional Financial Services Provider Net Interest Income Wealth Mgmt. Mortgage Banking Other Diverse Revenue Streams Market Area: RI, MA, CT o 28 bank branches o 5 wealth management offices o 7 mortgage loan offices o 4 commercial lending centers Founded in 1800 Oldest Community bank in the US $7.1B Assets under administration Largest State-Chartered Bank In Rhode Island $629M Market Capitalization (3) $7.1B Assets $5.5B Loans $5.2B Deposits Premier Regional Wealth Management Firm Shareholder Returns o ROA: 0.60%(1) o ROTCE: 10.79% (2) o Dividend yield: 6.07% (3) At or for the nine months ended September 30, 2024, unless otherwise noted (1) Return on Average Assets (“ROA”). Consists of net income divided by average total assets.. (2) See “Non-GAAP Financial Measures” on page 3 of this presentation for additional information. (3) At December 2, 2024. Consists of Q3 2024 dividend of 56 cents annualized divided by closing stock price as of December 2, 2024. Fees = 34% of total revenue

7 F I N A N C I A L G O A L S A N D S T R A T E G I E S Strong, Diversified Franchise Core Bank o Commercial Banking o C&I focus expanding beyond RI borders o High quality CRE franchise (developer relationships) o Leading credit quality o Retail Banking o Strong branch franchise o Successful de novo expansion ongoing o Opportunities for increased deposit penetration through enhanced sales orientation and tech investments Fee Businesses o Wealth Management o Full-service asset management, trust and estate capabilities o Enhanced financial planning o Mortgage Banking o Re-oriented to saleable originations 1 2

8 L O A N S Strong Growth in Quality Loan Portfolio Total Loan Portfolio 2020 2021 2022 2023 9/30/2024 CRE C&I Residential Consumer $4.3 $5.6 $5.1 $5.5 $4.2 ($ in billions) CRE (38%) C&I (10%) Residential (46%) Consumer (6%) 64% Variable rate loans(1) 99% Residential lending in RI, MA, & CT(1) At December 31st unless otherwise noted (1) At September 30, 2024. o Southern New England focus o Customer-centric approach with emphasis on superior service and appropriate solutions o Prudent underwriting with solid credit quality metrics

9 A S S E T Q U A L I T Y Historical Differentiator for Washington Trust -0.2% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 YT D 09 /2 02 4 Net Loan Charge-Offs / Average Loans Cumulative losses 2006 – 9/30/2024 (bps) WASH 162 Average peer 617 Median peer 382 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 9/ 30 /2 02 4 Non-Accrual Loans / Total Loans 162 bps Most recent complete peer data as of 09/30/2024 Percentile ranking for the year ended December 31st unless otherwise noted among public banks & thrifts with $3 billion to $10 billion in total assets excluding Puerto Rico; Source: S&P Global Market Intelligence Leading credit quality: o Prudent and consistent underwriting standards o Sponsor/relationship orientation o Markets/sectors we know o No unsecured consumer credit

10 L A R G E S T Community Bank in Rhode Island (1) FDIC deposits as of June 30, 2024; most recent data available (1) At September 30, 2024. *East Greenwich branch opened in May 2021, **Cumberland branch opened in August 2022, ***Barrington branch opened in April 2023, ****Smithfield branch opened in February 2024, *****Olneyville branch opened in August 2024 11.5% Market Share in Rhode Island (1) $171M Avg. in-market deposits per branch (2) De Novo Branch Growth Rank Institution (ST) Branch Count Total Deposits in Market ($B) Total Market Share 1 Citizens (RI) 54 $15.6 36.7% 2 Bank of America (NC) 24 8.7 20.4% 3 Washington Trust (RI) 26 4.9 11.5% 4 Santander 20 2.9 6.8% 5 Bank Rhode Island (MA) 22 2.5 5.9% 6 BankNewport (RI) 19 2.2 5.2% 7 TD Bank 11 1.6 3.7% 8 Centreville Bank (RI) 9 1.1 2.7% 9 HarborOne (MA) 9 0.7 1.6% 10 Webster Bank (CT) 7 0.5 1.3% Total For Institutions In Market 235 $42.6 Rhode Island Market Share (1)

11 D E P O S I T S Steady, Balanced Mix of Deposits Total In-Market Deposit Portfolio 2020 2021 2022 2023 9/30/2024 Demand & NOW Money market & savings Time deposits $3.8 $4.7$4.5 $4.7 $4.8 ($ in billions) Time deposits (25%) MM & Savings (34%) Demand & Now (41%) At December 31st unless otherwise noted (1) As of 9/30/24. (2) YTD through 9/30/24. (3) Determined in accordance with regulatory requirements excluding affiliate deposits and fully-collateralized preferred deposits as of 9/30/24. 20% Uninsured deposits after exclusions (3) 2.57% Cost of in-market deposits (2) o Give customers the options of banking where, when and how they choose o Local decision making – ability to provide rate exceptions, solve customer issues and communicate decisions quickly o Successfully compete against the larger banks by offering solid needs-based solutions

12 R E V E N U E Generating Diverse Income Sources Revenue Contributions From All Major Business Lines 2020 2021 2022 2023 YTD 09/2024 Net interest income Wealth Management Mortgage Banking All Other $226.9 66% 20% 6% 8% $218.6$228.8 $193.2 $145.6 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 YT D 09 /2 02 4 Non-Interest Income / Operating Income WASH Average peer Median peer Fee Revenue Outpaces Peer Group Better than 95% of peer group (1) ($ in millions) At December 31st unless otherwise noted (1) Peers are public banks & thrifts with $3 billion to $10 billion in total assets excluding Puerto Rico; Most recent complete peer data as of 09/30/2024. Source: S&P Global Market Intelligence.

o Full range of personalized financial services aimed at building customized solutions for clients o Key differentiators: o breadth of our holistic advisory services, which go beyond what many of our competitors can offer o credentials of our professionals o broad investment offerings not available in other registered investment adviser (“RIA”) and boutique firms o Offer personalized client service integrating comprehensive financial planning, investment management, and an omnichannel client experience Cash 9% Equity 65% Fixed Income 23% Other 3% Asset Mix at September 30, 2024 13 W E A L T H M A N A G E M E N T Sizeable Wealth Management Operation $38.7 $35.5 $29.0 2022 2023 YTD 9/30/2024 Revenues ($ millions) 91% MANAGED ASSETS At or for the year ended December, unless otherwise noted $6.0 $6.6 $7.1 $6.9 $6.2 $6.8 2022 2023 YTD 9/30/2024 Assets Under Administration (AUA) ($ billions) Spot AUA Average AUA o Key contributor to pre-tax income o Average client size: $3.9 million o 84% high net worth individuals

14 M O R T G A G E B A N K I N G Shifting Origination Mix $1,191 $720 $381 2022 2023 YTD 9/30/2024 Mortgage Originations (2) ($ millions) Originated for Sale Originated for Portfolio o Mortgage banking is historically a substantial source of noninterest income in the form of sale gains o Team strategically located in various geographic areas within Rhode Island, Massachusetts and Connecticut to effectively meet market opportunities o Our operations team is focused on speed to execution At December 31st unless otherwise noted (1) Net gains on loan sales and commissions on loans originated for others, fair value changes on mortgage loans held for sale and forward loan commitments, and net loan servicing fee income. (2) Includes loans originated for portfolio or sale and as broker for other parties. 80% 45 % 74% 64% 20% 36%26% 55 % $8.7 $6.7 $8.1 2022 2023 YTD 9/30/2024 Mortgage Banking Revenues (1) ($ millions)

15 P R O F I T A B I L I T Y Performance Momentum o Net interest income & Net Interest Margin (1) - declining rates benefit liability- sensitive balance sheet o Wealth management - benefiting from improved equity markets and client fee restructure o Mortgage banking fees - return to saleable originations has lifted sales revenue through YTD 2024; more originators expected to be hired in 2025 (commission- based) o Potential balance sheet restructure expected to result in improved earnings potential and unlock capital for reinvestment in higher yielding assets o Expiration of amortizing swap termination expense in April 2026 o $13.6mm unamortized at 9/30/24 o Pre-tax expense of $715k per month, $8.6mm per year o Estimated annualized pro forma EPS impact = $0.37 (at 9/30/24) (2) o Estimated annualized pro forma NIM impact = 12bp (at 9/30/24) (3) (1) Consists of net interest income divided by average interest-earning assets. (2) Assumes pre-tax amortization expense of $8.581 million, tax rate of 25.5%, and diluted shares for the quarter ended September 30, 2024 of 17.140 million (3) Assumes pre-tax amortization expense of $8.581 million, and interest earning assets for the quarter ended September 30, 2024 of $7.0001 billion

Potential Balance Sheet Optimization Would Further Improve Profitability Profile • We are evaluating a potential repositioning of low-yielding available- for-sale securities and loans • The goal of a potential loan and securities repositioning is to further improve profitability, decrease leverage, reduce asset duration, and improve the interest rate risk profile of the pro forma company • Any securities or loan repositioning would NOT be undertaken until WASH has received the proceeds from the planned common equity offering 1 2 3 Strategic Considerations Potential Transaction Assumptions(1) ____________________ (1) Based on Washington Trust management estimates. (2) Represents short term FHLB funding that is no longer necessary. 16 Potential Assets Sold: (Proceeds) Weighted Average Yield: Funding to be Paid Down: (Deleveraging(2)) Securities Reinvested: ~$200mm ~$390mm WA Duration: Securities ~$390mm ~2.6% ~3.9 years Loans ~$200mm ~2.9% ~6.6 years

17 P R O F I T A B I L I T Y M E T R I C S Historical Outperformance Has Been Challenged by Interest Rate Environment 0.00% 0.50% 1.00% 1.50% 2.00% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 YT D 09 /2 02 4 ROA $0 $15,000 $30,000 $45,000 $60,000 $75,000 $90,000 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 YT D 09 /2 02 4 Net Income 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 YT D 09 /2 02 4 ROATCE (1) 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 YT D 09 /2 02 4 Net Interest Margin At December 31st unless otherwise noted Peers are public banks & thrifts with $3 billion to $10 billion in total assets excluding Puerto Rico; Most recent complete peer data as of 09/30/2024. Source: S&P Global Market Intelligence (1) See “Non-GAAP Financial Measures” on page 3 of this presentation for additional information.

18 C A P I T A L P O S I T I O N / B A L A N C E S H E E T Capital Supports Dividend 0.00% 4.00% 8.00% 12.00% 16.00% 20.00% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 9/ 30 /2 02 4 Total Risk-based Capital 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 9/ 30 /2 02 4 Tangible Equity / Tangible Assets o Solid balance sheet, fee-intensive business model o Temporary decline in Tangible Equity / Tangible Assets ratio due to available- for-sale (“AFS”) securities unrealized losses $26.40 $27.75 $29.44 12/31/2022 12/31/2023 9/30/2024 Book Value per Share (1) Book value per share $22.42 $23.78 $25.51 12/31/2022 12/31/2023 9/30/2024 Tangible Book Value per Share (2) Tangible Book value per share At December 31st unless otherwise noted (1) Consists of total equity available to holders of common stock divided by the number of outstanding shares. (2) See “Non-GAAP Financial Measures” on page 3 of this presentation for additional information. Peers are public banks & thrifts with $3 billion to $10 billion in total assets excluding Puerto Rico; Most recent complete peer data as of 09/30/2024. Source: S&P Global Market Intelligence

19 Appendix

L O A N S Commercial Lending Portfolio 20 $540,792 $428,217 $337,950 $296,545 $203,972 $202,854 $29,231 $62,530 Multi-Family (26%) Retail (20%) Industrial & Warehouse (16%) Office (14%) Hospitality (10%) Healthcare facility (10%) Mixed Use (1%) Other (3%) % of CRE Portfolio by Segment as of 9/30/24 Commercial Real Estate (CRE): $2.1 billion Commercial & Industrial (C&I): $566.3 million $131,120 $69,069 $56,620 $48,239 $42,860 $41,232 $25,362 $22,168 $20,557 $11,693 $10,729 $2,570 $84,060 Healthcare & social assistance (23%) Real estate rental and leasing (12%) Transportation & warehousing (10%) Manufacturing (9%) Educational services (8%) Retail trade (7%) Finance and insurance (4%) Information (4%) Arts, entertainment, and recreation (4%) Accommodation and food services (2%) Professional, scientific, and technical services (2%) Public administration (0%) Other (15%) % of C&I Portfolio by Segment as of 9/30/24 Multi-Family: generally low-rise suburban with high amenities, have benefited from the COVID exodus from the cities. None subject to rent control, only small % of units are designated as "affordable." Portfolio occupancy is in the 90s; overall LTV under 50%; rents >= market in virtually all cases. No delinquencies. Office: generally low-rise suburban, w/o market or tenant concentrations. Most are performing well, especially the medical office segment, and we have stress-tested all maturities within the next two years. The few properties that are in workout are managed intensively to get them to the earliest possible resolution. Healthcare & Social Assistance: geographically diversified. Includes multiple medical practices, several community health facilities, and a few skilled-nursing facilities. Practices are performing and have benefited from consolidation. Community health centers are well-established and service a large segment of the RI population - recent state increases to Medicaid reimbursement rates will ease operating pressures. Skilled nursing facilities manage their private/public mix effectively and have largely moved past the staffing challenges that led to excessive costs using agency labor.

$ thousands; at September 30, 2024 (1) Approximately 68% of the total commercial real estate office balance of $297 million is secured by income producing properties located in suburban areas. Additionally, approximately 40% of the total commercial real estate office balance is expected to mature before September 30, 2026. (2) The balance of commercial real estate office consists of 49 loans. (3) Does not include $26.1 million of unfunded commitments. (4) Total commitment (outstanding loan balance plus unfunded commitments) divided by number of loans. Weighted Average Asset Quality Balance (2)(3) Avg Loan Size (4) Loan to Value Debt Service Coverage Pass Special Mention Classified Non-Accrual (included in Classified) Non-Owner Occupied Commercial Real Estate Office (inclusive of Construction): Class A $112,875 $9,477 59% 1.72X $106,584 $6,291 $- $- Class B 86,421 4,350 67% 1.32X 64,735 - 21,686 18,259 Class C 14,790 2,113 56% 1.39X 14,790 - - - Medical Office 56,124 7,525 70% 1.33X 56,124 - - - Lab Space 26,335 23,460 91% 1.20X 5,817 - 20,518 - Total Office (1) $296,545 $6,584 68% 1.45X $248,050 $6,291 $42,204 $18,259 21 o Office portfolio consists of 49 loans with a carry value of $297 million o Approximately 40% of the total commercial real estate office balance will mature before September 30, 2026 L O A N S Office Portfolio

22 Non-GAAP Financial Measures Washington Trusts' management uses these non-GAAP measures to evaluate Washington Trust's performance, profitability and financial strength, as they provide additional insight into operational results, facilitate comparability across reporting periods, and offer useful perspectives for assessing business trends and peer performance. Such non-GAAP measures are supplemental and not substitutes for GAAP financial measures.

v3.24.3

Cover Page Document

|

Dec. 12, 2024 |

| Cover Page [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 12, 2024

|

| Entity Registrant Name |

WASHINGTON TRUST BANCORP, INC.

|

| Entity Incorporation, State or Country Code |

RI

|

| Entity File Number |

001-32991

|

| Entity Tax Identification Number |

05-0404671

|

| Entity Address, Address Line One |

23 Broad Street

|

| Entity Address, City or Town |

Westerly,

|

| Entity Address, State or Province |

RI

|

| Entity Address, Postal Zip Code |

02891

|

| City Area Code |

(401)

|

| Local Phone Number |

348-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

COMMON STOCK, $.0625 PAR VALUE PER SHARE

|

| Trading Symbol |

WASH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000737468

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

wash_CoverPageAbstract |

| Namespace Prefix: |

wash_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

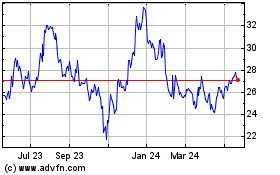

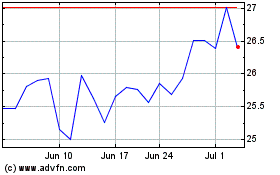

Washington Trust Bancorp (NASDAQ:WASH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Washington Trust Bancorp (NASDAQ:WASH)

Historical Stock Chart

From Feb 2024 to Feb 2025