Filed Pursuant to Rule 424(b)(3)

Registration No. 333-267328

Prospectus Supplement No. 2

(to Prospectus dated August 7, 2023)

555,555 Common Shares Issuable Upon

Exercise of Warrants

XORTX THERAPEUTICS INC.

This Prospectus Supplement No. 2 (this “Prospectus Supplement”)

amends and supplements the Prospectus dated August 7, 2023 (the “Prospectus”) of XORTX Therapeutics Inc. (the

“Company”), which forms a part of our Registration Statement on Form F-1 (Registration No. 333-267328). This

Prospectus Supplement is being filed to amend and supplement the information included or incorporated by reference in the Prospectus with

the information contained in this Prospectus Supplement. The Prospectus and this Prospectus Supplement relate to the offer by us of 555,555

common shares issuable upon exercise of 555,555 common share purchase warrants (the “Warrants”). The Warrants have

an exercise price of $5.00 and expire five years from the original date of issuance (October 7, 2027).

This Prospectus Supplement should be read in conjunction with the Prospectus,

as it has been further supplemented, which is to be delivered with this Prospectus Supplement. This Prospectus Supplement updates and

supplements the information in the Prospectus. If there is any inconsistency between the information in the Prospectus and this Prospectus

Supplement, you should rely on the information in this Prospectus Supplement.

Our common shares are currently traded under the symbol “XRTX”

on the TSX Venture Exchange (the “TSXV”) and on the Nasdaq Capital Market (“Nasdaq”). On June 12,

2024, the last reported sale price of our common shares on the TSXV was CAD$2.99 per common share and on the Nasdaq was $2.12 per common

share.

Investing in our securities involves a high degree of risk. You

should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 10 of

the Prospectus and under similar headings in any further amendments or supplements to the Prospectus before you decide whether to invest

in our securities.

Neither the Securities and Exchange Commission, Canadian securities

commission nor any domestic or international securities body has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is June 13,

2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-40858

XORTX Therapeutics Inc.

3710 – 33rd Street NW, Calgary, Alberta, T2L 2M1

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission

in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and

make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as

long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing

on EDGAR.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

XORTX THERAPEUTICS INC. |

|

| |

|

(Registrant) |

|

| |

|

|

|

|

| Date: |

October 3, 2023 |

By: |

/s/ Allen Davidoff |

|

| |

|

Name: |

Allen Davidoff |

|

| |

|

Title: |

Chief Executive Officer

|

|

EXHIBIT INDEX

Exhibit 99.1

3710 – 33rd Street NW, Calgary, Alberta, Canada T2L 2M1

T + 1 403 455 7727 | xortx.com | TSXV / NASDAQ : XRTX

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that a special meeting (the "Meeting") of

the shareholders (the "Shareholders") of XORTX Therapeutics Inc. (the "Company") will be held at 3710 – 33rd Street NW,

Calgary, Alberta, Canada T2L 2M1 at 10:00 a.m. (Calgary time), on Wednesday, October 25, 2023.

The Meeting is being called for the following purposes:

| |

1. |

To consider and vote on an ordinary resolution to amend the articles of the Company to provide for a consolidation of the Company's common shares on an up to nine (9) to one (1) basis, with such ratio to be determined at the discretion of the directors as more particularly described in the Management Information Circular of the Company dated September 20, 2023; and |

| |

2. |

to transact such other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

Particulars of the foregoing matters are set forth in the accompanying management information

circular.

Only Shareholders of record at the close of business on September 12, 2023

(the “Record Date”) are entitled to notice of and to attend the Meeting or any adjournment or adjournments thereof

and to vote thereat, unless, after the Record Date, a holder of record transfers his or her common shares in the capital of the Company

("Common Shares") and the transferee, upon producing properly endorsed share certificates or otherwise establishing that he or she owns

such Common Shares, requests, not later than 10 days before the Meeting, that the transferee’s name be included in the list of shareholders

entitled to vote such Common Shares, in which case such transferee shall be entitled to vote such Common Shares, as the case may be, at

the Meeting.

DATED at Calgary, Alberta this 20th day of September, 2023.

| |

BY ORDER OF THE BOARD OF DIRECTORS

|

| |

“Anthony Giovinazzo”

|

| |

Anthony Giovinazzo

Chairman |

A Shareholder may attend the Meeting in person or may be represented

by proxy. Shareholders are requested to complete, date, sign and return the accompanying form of proxy for use at the Meeting or any adjournments

or postponements thereof. To be effective, the enclosed form of proxy must be mailed, hand delivered, faxed or voted online or by telephone

so as to reach or be deposited with TSX Trust Company at 100 Adelaide Street West, Suite 301, Toronto, Ontario, Canada, M5H 4H1, not later

than forty-eight (48) hours (excluding Saturdays, Sundays and statutory holidays in the City of Toronto, Ontario) prior to the time set

for the Meeting or any adjournments or postponements thereof.

Exhibit 99.2

SPECIAL MEETING OF THE HOLDERS OF COMMON SHARES

OF XORTX THERAPEUTICS INC.

TO BE HELD ON OCTOBER 25, 2023

Dated September 20, 2023

These materials are important and require your immediate attention. If you

have questions or

require assistance with voting your shares you may contact XORTX Therapeutics proxy solicitation agent:

Laurel Hill Advisory Group

North American Toll-Free Number: 1-877-452-7184

Outside North America: 416-304-0211

Email: assistance@laurelhill.com

3710 – 33rd Street NW, Calgary, Alberta, Canada T2L 2M1

T + 1 403 455 7727 | xortx.com | TSXV / NASDAQ : XRTX

MANAGEMENT INFORMATION CIRCULAR

FOR THE SPECIAL MEETING OF THE HOLDERS OF COMMON SHARES

OF XORTX THERAPEUTICS INC. TO BE HELD ON OCTOBER 25, 2023

Dated September 20, 2023

GENERAL PROXY

INFORMATION

Solicitation of Proxies

This management information circular (“Management Information

Circular”) is furnished in connection with the solicitation of proxies by the management and the directors of XORTX THERAPEUTICS

INC. (“XORTX” or the “Company”) for use at the special meeting of the shareholders (the “Shareholders”)

of the Company (the “Meeting”) to be held at 3710 – 33rd Street NW, Calgary, Alberta at 10:00 a.m.

(Calgary time) on Wednesday, October 25, 2023, and at all adjournments thereof for the purposes set forth in the accompanying notice of

the Meeting (the “Notice of Meeting”). The solicitation of proxies will be made primarily by mail and may be supplemented

by telephone or other personal contact by the directors, officers and employees of the Company. Directors, officers and employees of the

Company will not receive any extra compensation for such activities. The Company may also retain, and pay a fee to, one or more professional

proxy solicitation firms to solicit proxies from the Shareholders in favour of the matters set forth in the Notice of Meeting. The Company

may pay brokers or other persons holding common shares of the Company (“Common Shares”) in their own names, or in the

names of nominees, for their reasonable expenses for sending proxies and this Management Information Circular to beneficial owners of

Common Shares and obtaining proxies therefrom. The cost of the solicitation will be borne directly by the Company.

Laurel Hill Advisory Group is acting as the Company’s proxy solicitation

agent. If you have any questions or require assistance in voting your proxy, please contact Laurel Hill Advisory Group at 1-877-452-7184

toll free in North America, or 416-304-0211 (outside North America) or by email at assistance@laurelhill.com. The Company will be paying

Laurel Hill Advisory Group a fee of $35,000, plus reasonable out-of-pocket expenses.

No person is authorized to give any information or to make any representation

other than those contained in this Management Information Circular and, if given or made, such information or representation should not

be relied upon as having been authorized by the Company. The delivery of this Management Information Circular shall not, under any circumstances,

create an implication that there has not been any change in the information set forth herein since the date hereof.

This Management Information Circular is being sent to both registered and

non-registered owners of the Common Shares.

Non-Registered Shareholders

Only registered Shareholders, or the persons they appoint as their proxies,

are entitled to attend and vote at the Meeting. However, in many cases, Common Shares beneficially owned by a person (a “Non-Registered

Shareholder”) are registered either:

| |

(a) |

in the name of an intermediary (an “Intermediary”) with whom the Non-Registered Shareholder deals in respect of the Common Shares (Intermediaries include, among others: banks, trust companies, securities dealers or brokers, trustees or administrators of a self-administered registered retirement savings plan, registered retirement income fund, registered education savings plan and similar plans); or |

| |

(b) |

in the name of a clearing agency (such as The Canadian Depository for Securities Limited in Canada, and the Depository Trust Company in the United States) of which the Intermediary is a participant. |

In accordance with the requirements of National Instrument 54-101 Communication

With Beneficial Owners of Securities of a Reporting Issuer of the Canadian Securities Administrators, the Company has distributed

copies of the Notice of Meeting, this Management Information Circular and its form of proxy (collectively the “Meeting Materials”)

to the Intermediaries and clearing agencies for onward distribution to Non-Registered Shareholders. Intermediaries are required to forward

the Meeting Materials to Non-Registered Shareholders unless the Non-Registered Shareholders have waived the right to receive them. Intermediaries

often use service companies to forward the Meeting Materials to Non-Registered Shareholders. Generally, Non-Registered Shareholders who

have not waived the right to receive Meeting Materials will either:

| |

(a) |

be given a voting instruction form which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “voting instruction form”) which the Intermediary must follow.; Most brokers delegate responsibility for obtaining instructions from clients to Broadridge Financial Services (“Broadridge”). Broadridge mails a voting instruction form (“VIF”) in lieu of a proxy provided by the Company. The completed VIF must be returned by mail (using the return envelope provided) or by facsimile. Alternatively, Non-Registered Shareholders may call a toll-free number or go online to www.proxyvote.com to vote; or |

| |

(b) |

be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the form of proxy and deposit it with TSX Trust Company, 100 Adelaide Street West, Suite 301, Toronto, Ontario, Canada, M5H 4H1. |

The purpose of these procedures is to permit Non-Registered Shareholders

to direct the voting of the Common Shares they beneficially own.

Should a Non-Registered Shareholder who receives either a voting instruction

form or a form of proxy wish to attend the Meeting and vote in person (or have another person attend and vote on behalf of the Non-Registered

Shareholder), the Non-Registered Shareholder should strike out the names of the persons named in the form of proxy and insert the Non-Registered

Shareholder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow

the directions indicated on the form. In either case, Non-Registered Shareholders should carefully follow the instructions of their

Intermediaries and their service companies, including those regarding when and where the voting instruction form or the proxy is to be

delivered.

The Company may also use Broadridge’s QuickVote™ service. Laurel

Hill Advisory Group may contact eligible Non-Registered Shareholders who have not objected to the Company knowing who they are (non-objecting

beneficial owners) to conveniently obtain their vote directly over the telephone.

Shareholders who have questions or need assistance with voting their

shares may contact Laurel Hill Advisory Group, the proxy solicitation agent, by telephone at: 1-877-452-7184 (North American Toll Free)

or 416-304-0211 (Outside North America); or by email at: assistance@laurelhill.com.

Appointment and Revocation of Proxies

The persons named in the form of proxy accompanying this Management Information

Circular are directors and/or officers of the Company. A Shareholder of the Company has the right to appoint a person or company (who

need not be a Shareholder), other than the persons whose names appear in such form of proxy, to attend and act for and on behalf of such

Shareholder at the Meeting and at any adjournment thereof. Such right may be exercised by either striking out the names of the persons

specified in the form of proxy and inserting the name of the person or company to be appointed in the blank space provided in the form

of proxy, or by completing another proper form of proxy and, in either case, delivering the completed and executed proxy to TSX Trust

Company in time for use at the Meeting in the manner specified in the Notice of Meeting.

A registered Shareholder of the Company who has given a proxy may revoke

the proxy at any time prior to use by: (a) depositing an instrument in writing, including another completed form of proxy, executed

by such registered Shareholder or by his or her attorney authorized in writing or by electronic signature or, if the registered Shareholder

is a corporation, by an officer or attorney thereof properly authorized, either: (i) at the office of the Company, c/o 3710 –

33rd Street NW, Calgary, Alberta, Canada T2L 2M1 at any time prior to 10:00 a.m. (Calgary time) on the second last business

day preceding the day of the Meeting or any adjournment thereof; (ii) with TSX Trust Company, 100 Adelaide Street West, Suite 301,

Toronto, Ontario, Canada, M5H 4H1 at any time prior to 12:00 p.m. (Toronto time) on the second last business day preceding the

day of the Meeting or any adjournment thereof; or (iii) with the chairman of the Meeting on the day of the Meeting or any adjournment

thereof; (b) transmitting, by telephone or electronic means, a revocation that complies with paragraphs (i), (ii) or (iii) above

and that is signed by electronic signature, provided that the means of electronic signature permits a reliable determination that the

document was created or communicated by or on behalf of such Shareholder or by or on behalf of his or her attorney, as the case may be;

or (c) in any other manner permitted by law including attending the Meeting in person.

Only registered Shareholders have the right to revoke a proxy. A Non-Registered

Shareholder who has submitted a proxy can change their vote by contacting the Intermediary through which the Non-Registered Shareholder’s

Common Shares are held in sufficient time prior to the Meeting to arrange to change their vote and, if necessary, revoke the proxy.

Exercise of Discretion by Proxies

The Common Shares represented by an appropriate form of proxy will be voted

or withheld from voting on any ballot that may be conducted at the Meeting, or at any adjournment thereof, in accordance with the instructions

of the Shareholder thereon. In the absence of instructions, such Common Shares will be voted for each of the matters referred to in

the Notice of Meeting as specified thereon.

The enclosed form of proxy, when properly completed and signed, confers

discretionary authority upon the persons named therein to vote on any amendments to or variations of the matters identified in the Notice

of Meeting and on other matters, if any, which may properly be brought before the Meeting or any adjournment thereof. At the date

hereof, management of the Company knows of no such amendments or variations or other matters to be brought before the Meeting. However,

if any other matters which are not now known to management of the Company should properly be brought before the Meeting, or any adjournment

thereof, the Common Shares represented by such proxy will be voted on such matters in accordance with the judgment of the person named

as proxy therein.

Signing of Proxy

The form of proxy must be signed by the Shareholder of the Company or the

duly appointed attorney of the Shareholder of the Company authorized in writing or, if the Shareholder of the Company is a corporation,

by a duly authorized officer of such corporation. A form of proxy signed by the person acting as attorney of the Shareholder of the Company

or in some other representative capacity, including an officer of a corporation which is a Shareholder of the Company, should indicate

the capacity in which such person is signing and should be accompanied by the appropriate instrument evidencing the qualification and

authority to act of such person, unless such instrument has previously been filed with the Company. A Shareholder of the Company or his

or her attorney may sign the form of proxy or a power of attorney authorizing the creation of a proxy by electronic signature provided

that the means of electronic signature permits a reliable determination that the document was created or communicated by or on behalf

of such Shareholder or by or on behalf of his or her attorney, as the case may be.

Cautionary

Note Regarding Forward-Looking Statements

This Management Information Circular contains express or implied forward-looking

statements pursuant to U.S. Federal securities laws and/or “forward-looking information” within the meaning of applicable

Canadian securities laws (collectively, “forward-looking statements”). In some cases, forward-looking statements can

be identified by terminology such as “may”, “will”, “expect”, “plan”, “anticipate”,

“believe”, “intend”, “potential”, “continue”, “should”, “future”

or the negative of these terms or other comparable terminology. In particular, this Management Information Circular contains forward-looking

statements pertaining to the anticipated effects, benefits and risks of the Consolidation (as defined herein) and the Company’s

plans and expectations with respect to regaining compliance with Nasdaq (as defined herein) listing requirements. These forward-looking

statements and their implications are based on the current expectations of the management of XORTX only, and are subject to a number of

factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements.

Except as otherwise required by law, XORTX undertakes no obligation to publicly release any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. More detailed information

about the risks and uncertainties affecting XORTX is contained under the heading “Risk Factors” in XORTX’s Registration

Statement on Form F-1 filed with the SEC, which is available on the SEC’s website, www.sec.gov (including any documents forming

a part thereof or incorporated by reference therein), as well as in its reports, public disclosure documents and other filings with the

securities commissions and other regulatory bodies in Canada, which are available on www.sedarplus.com.

VOTING SECURITIES

AND PRINCIPAL HOLDERS THEREOF

Description of Share Capital

The Company is authorized to issue an unlimited number of Common Shares.

Each Common Share entitles the holder of record thereof to one vote per Common Share at all meetings of the Shareholders. As at the close

of business on September 12, 2023, there were 17,989,687 Common Shares outstanding.

Record Date

The directors of the Company have fixed September 12, 2023 as the record

date for the determination of the Shareholders entitled to receive notice of the Meeting. Shareholders of record at the close of business

on September 12, 2023, will be entitled to vote at the Meeting and at all adjournments thereof.

Ownership of Securities of the Company

To the knowledge of the directors and officers of the Company, as at the

date of this Management Information Circular, no individual or corporation beneficially owns, directly or indirectly, or exercises control

or direction over, voting securities of the Company carrying more than 10% of the voting rights attached to any class of voting securities

of the Company.

PARTICULARS

OF MATTERS TO BE ACTED UPON

On October 13, 2021, the Common Shares were listed on the NASDAQ Capital

Market (“Nasdaq”). On November 22, 2022, the Company was notified by Nasdaq of

its failure to comply with the Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Price Requirement”), requiring the

Common Shares to maintain a minimum bid price of US$1.00 per Common Share, and was given until May 22, 2023 to regain compliance. The

Company now has until November 20, 2023 to meet the requirement (the “Second Compliance Period”). If at any

time during the Second Compliance Period, the closing bid price of the Common Shares is at least US$1.00 per Common Share for at least

a minimum of 10 consecutive business days, Nasdaq will provide the Company with written notification that the Company has achieved compliance

with the Minimum Bid Price Requirement and will consider deficiency matters closed. If compliance with the Minimum Bid Price Requirement

cannot be demonstrated by November 20, 2023, Nasdaq will provide written notification that the Common Shares will be delisted. At

that time, the Company may appeal Nasdaq’s determination to a Nasdaq Hearings Panel (the “Panel”). The

Company would remain listed pending the Panel’s decision. There can be no assurance that if the Company does appeal a subsequent

delisting determination, that such appeal would be successful. Accordingly, there can be no assurance that the Company will be

able to regain compliance with the Minimum Bid Price Requirement or maintain its listing on Nasdaq.

At the Meeting, Shareholders will be asked to consider and, if thought

appropriate, to approve, confirm and adopt, with or without variation, an ordinary resolution to amend the articles of the Company to

consolidate all of the Company’s issued and outstanding Common Shares on an up to nine to one (9:1) basis (the “Consolidation”),

with the ratio to be selected and implemented by the board of directors of the Company (the “Board”) (if at all) at

any time prior to delisting to ensure continued listing on Nasdaq. On a post-Consolidation basis, assuming a nine to one Consolidation,

the Company will have, as of the effective date of the Consolidation, 1,998,854 Common Shares issued and outstanding, assuming completion

on the basis of one (1) new Common Share for every nine (9) pre-Consolidation Common Shares outstanding. All outstanding options

and warrants and other rights to acquire securities of the Company, if any, will be adjusted for the Consolidation, in accordance with

the adjustment provisions contained in the instruments governing such securities.

The number of pre-Consolidation Common Shares in the ratio must be a whole

number of Common Shares. The Consolidation remains subject to receipt of all necessary regulatory approvals, including approval of the

TSX Venture Exchange (the “TSXV”).

If the Board decides to implement the Consolidation on the basis of nine

to one, upon completion of the Consolidation the number of Common Shares issued and outstanding will be reduced from 17,989,687 Common

Shares as of September 12, 2023 to approximately 1,998,854 Common Shares.

It is the position of the Board that the Consolidation is in the best interests

of the Company, its Shareholders and other stakeholders and that the benefits of the Consolidation could include:

| |

· |

Compliance with Minimum Bid Price Requirement for Continued Listing on Nasdaq: The Consolidation is expected to result in the Company regaining compliance to maintain its listing on Nasdaq, a U.S. based stock exchange that provides greater access to capital. |

| |

· |

Anticipated Higher Share Price: The Consolidation is expected to result in the trading price of the Common Shares increasing to reflect the Consolidation ratio. A higher price per share would place the Company’s Common Shares at a level that is more typical of shares of other widely-owned publicly traded companies that are in XORTX’s peer group of companies. |

| |

· |

Increased Investor Interest: A higher post-Consolidation price of the Common Shares could increase investor interest in the Company as a higher price per share may qualify the Common Shares for certain institutional investors and investment funds that otherwise may be prevented under their investing mandates or guidelines from investing in the Common Shares at the current price. Also, a smaller number of Common Shares trading at a higher price may make the Company more attractive to other new investors, and could further enhance the value of the Common Shares held by current Shareholders. |

As of the date of this Management Information Circular, to regain compliance

for continued listing on Nasdaq, the Common Shares will require Consolidation to meet the Minimum Bid Price Requirement of US$1.00. Accordingly,

in order to meet the Minimum Bid Price Requirement, the Board and management are recommending Shareholder approval of the potential Consolidation

outlined above as this provides the Board with flexibility to achieve the desired results of the Consolidation to meet Nasdaq’s

Minimum Bid Requirement to regain compliance for the Company’s listing on Nasdaq. The Company’s listing on Nasdaq is required

to continue to advance the Company’s products to clinical trial phase. In determining the Consolidation ratio within the range to

be authorized by the Share Consolidation Resolution (as defined below), the Board may consider a series of factors, including the following:

| |

· |

historical trading prices and trading volumes of the Common Shares; |

| |

· |

the Common Shares’ continuing eligibility to remain listed on Nasdaq; |

| |

· |

the anticipated impact of the Consolidation on future trading prices and trading volumes of the Common Shares; |

| |

· |

trading price thresholds that affect the ability of certain equity market participants to invest or recommend investments in the Common Shares; |

| |

· |

the adequacy of public distribution of the Common Shares following the implementation of the Consolidation; and |

| |

· |

prevailing general market and economic conditions. |

If the Share Consolidation Resolution is approved and the Board determines

to proceed with the Consolidation, the Consolidation will take effect on a date to be coordinated with the TSXV and Nasdaq and announced

in advance by the Company. The Consolidation will be implemented on the basis authorized by the Shareholders and determined by the Board,

as described above.

No further action on the part of Shareholders will be required in order

for the Board to implement the Consolidation. The Share Consolidation Resolution also authorizes the Board to elect not to proceed with,

and abandon, the Consolidation at any time if it determines, in its sole discretion, to do so. The Board would exercise this right if

it determined that the Consolidation was no longer required or in the best interests of the Company and its Shareholders.

Certain Risks of the Consolidation

No Guarantee of an Increased Share Price or Trading Liquidity

The effect of the Consolidation upon the market price of the Common Shares

cannot be predicted with any certainty, and the history of similar share consolidations for corporations similar to the Company is varied.

There can be no assurance that the total market capitalization of the Common Shares immediately following the Consolidation will be equal

to or greater than the total market capitalization immediately before the Consolidation. In addition, there can be no assurance that the

per-share market price of the Common Shares following the Consolidation will remain higher than the per-share market price immediately

before the Consolidation or equal or exceed the direct arithmetical result of the Consolidation. In addition, a decline in the market

price of the Common Shares after the Consolidation may result in a greater percentage decline than would occur in the absence of the Consolidation.

There can also be no assurance that the implementation of the Consolidation

will, in and of itself, guarantee the continued listing of the Common Shares on Nasdaq or any other exchange on which the Common Shares

are listed or that the Common Shares will not be delisted at some future date from the such stock exchanges because the Company fails

to meet the applicable continued listing requirements.

Although the Company believes that establishing a higher market price for

the Common Shares could increase investment interest for the Common Shares by potentially expanding the pool of investors that may consider

investing, there is no assurance that implementing the Consolidation will achieve this result.

Shareholders May Hold Odd Lots Following the Consolidation

The Consolidation may lead to an increase in the number of Shareholders

who will hold “odd lots”; that is, a number of shares not evenly divisible into board lots (a board lot is either 100, 500

or 1,000 shares, depending on the price of the shares). As a general rule, the cost to Shareholders transferring an odd lot of Common

Shares is somewhat higher than the cost of transferring a “board lot”. Nonetheless, despite the risks and the potential increased

cost to Shareholders in transferring odd lots of post-Consolidation Common Shares, the Board believes the Consolidation is in the best

interest of all Shareholders and the Company.

Effect on Common Share Certificates

If the Board decides to proceed with the Consolidation, a letter of transmittal

(the “Letter of Transmittal”) will be sent to registered Shareholders. In order to obtain a certificate(s) representing

the post-Consolidation Common Shares after giving effect to the Consolidation, each registered Shareholder will be requested to complete

and execute the Letter of Transmittal and deliver same to TSX Trust Company or Continental Stock Transfer & Trust Company (collectively,

the “Transfer Agent”), together with their Common Share certificates representing their pre-Consolidation Common Shares

in accordance with the instructions set out in the Letter of Transmittal. The certificates that are surrendered shall be exchanged for

new certificates (or direct registration statements) representing the number of post-Consolidation Common Shares to which such registered

Shareholder is entitled as a result of the Consolidation. No delivery of a new certificate (or direct registration statement) to a registered

Shareholder will be made until the registered Shareholder has surrendered his, her or its existing certificates representing the pre-Consolidation

Common Shares. Until surrendered, each Common Share certificate representing pre-Consolidation Common Shares shall be deemed for all purposes

to represent the number of post-Consolidation Common Shares to which the holder is entitled as a result of the Consolidation. In the event

that the Consolidation is not implemented, all Common Share certificates delivered pursuant to a Letter of Transmittal will be returned

to the respective registered Shareholders. In addition, after the exchange of pre-Consolidation Common Share certificates for post-Consolidation

Common Share certificates (or direct registration statements), Shareholders will have no further interest with respect to any fractional

pre-Consolidation Common Shares.

Registered Shareholders who do not deliver their Common Share certificates

representing pre-Consolidation Common Shares and all other required documents to the Transfer Agent on or before the sixth anniversary

of the effective date of the Consolidation will lose their rights to receive post-Consolidation Common Shares in exchange for their existing

pre-Consolidation Common Shares. Non-registered Shareholders holding their Common Shares through an Intermediary should note that Intermediaries

may have different procedures for processing the Consolidation than those that will be put in place by the Company for registered Shareholders.

If you hold your Common Shares with an Intermediary and you have questions in this regard, you are encouraged to contact your Intermediary.

Any registered Shareholder whose share certificate(s) have been lost, destroyed

or stolen will be entitled to a replacement share certificate only after complying with the requirements that customarily apply in connection

with lost, stolen or destroyed certificates.

The method chosen for delivery of share certificates and Letters of Transmittal

to the Transfer Agent is the responsibility of the registered Shareholder and neither the Company nor the Transfer Agent will have any

liability in respect of share certificates and/or Letters of Transmittal which are not actually received by the Transfer Agent.

REGISTERED SHAREHOLDERS SHOULD NEITHER DESTROY NOR SUBMIT ANY SHARE

CERTIFICATE UNTIL HAVING RECEIVED A LETTER OF TRANSMITTAL.

No

Fractional Shares

No fractional Common Shares will be issued pursuant to the Consolidation

and no cash will be paid in lieu of fractional post-Consolidation Common Shares. In the case of fractional Common Shares resulting from

the Consolidation, fractions of a Common Share shall be rounded down to the nearest whole Common Share. The elimination of fractional

interests will reduce the number of post-Consolidation registered Shareholders to the extent that there are registered Shareholders holding

Common Shares that are less than the consolidation ratio. This is not, however, the purpose for which the Company is proposing to effect

the Consolidation.

No Dissent Rights

Under the Business Corporations Act (British Columbia) (“Business

Corporations Act”), the Shareholders do not have any dissent and appraisal rights with respect to the proposed Consolidation.

Shareholder Approval Authorizing the Consolidation

Pursuant to the Company’s articles, the Company may by ordinary resolution

consolidate all or any of its unissued, or fully paid issued, shares, and, if applicable, alter its notice of articles and articles accordingly.

At the Meeting, Shareholders will be asked to consider and, if thought

appropriate, approve the following ordinary resolution (the “Share Consolidation Resolution”), with or without variation,

to approve the proposed Consolidation:

“RESOLVED, as an ordinary resolution of the shareholders of XORTX

Therapeutics Inc. (”XORTX”), with or without amendment, that:

| |

1. |

XORTX Therapeutics Inc. (the “Company”) be and it is hereby authorized to file articles of amendment under the Business Corporations Act (British Columbia) (the “Business Corporations Act”) to amend its articles of association (“Articles”) to change the number of issued and outstanding common shares of the Company (the “Common Shares”) by consolidating the issued and outstanding Common Shares on the basis of up to nine (9) pre-consolidation Common Shares for every one (1) post-consolidation Common Shares (the “Consolidation”), such amendment to become effective at a date in the future to be determined by the board of directors of the Company (the “Board”) when the Board considers it to be in the best interests of the Company to implement such Consolidation, but in any event not later than one year after the date on which this resolution is approved, subject to approval of the TSX Venture Exchange and any other securities exchange on which the Common Shares are then listed. |

| |

2. |

The amendment to the Articles giving effect to the Consolidation will provide that no fractional Common Shares will be issued in connection with the Consolidation and that the number of post-Consolidation Common Shares to be received by a registered shareholder will be rounded down to the nearest whole number of Common Shares that such holder would otherwise be entitled to receive upon the implementation of the Consolidation. |

| |

3. |

Notwithstanding that this ordinary resolution has been duly adopted by the shareholders of the Company the Board be and it is hereby authorized, in its sole discretion, to revoke this ordinary resolution in whole or in part at any time prior to its being given effect without further notice to, or approval of, the shareholders of the Company. |

| |

4. |

Any one director or officer of the Company be and is hereby authorized to do all such further acts and things and execute all such documents and instruments as may be necessary or desirable to give effect to the matters contemplated by this ordinary resolution, including but not limited to the filing of amendments to the articles and notice of articles under the Business Corporations Act.” |

Management recommends that the Shareholders vote in favour of the ordinary

resolution to approve the Consolidation as set out above. In order for the ordinary resolution to approve the Consolidation to be effective,

it must be approved by the affirmative vote of a majority of the votes cast in respect thereof by Shareholders present in person or by

proxy at the Meeting. In the absence of contrary directions, the persons named in the enclosed form of proxy intend to vote in favour

of the approval of the Consolidation.

AUDITOR

The auditors of the Company are Smythe LLP Chartered Professional Accountants.

INTEREST OF

CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

To the knowledge of the Company, no person who has been a director or executive

officer of the Company since the beginning of the Company’s most recently completed financial year, nor any associate or affiliate

of such persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters

to be acted upon at the Meeting, other than in a capacity as a holder of securities of the Company, in which case the Consolidation, if

implemented, will treat such persons identically to the general body of holders of the same class of securities on a per security basis.

INTEREST OF

INFORMED PERSONS IN MATERIAL TRANSACTIONS

As of September 20, 2023, no director or executive officer of the Company

who beneficially owns, or controls or directs, directly or indirectly more than 10% of the outstanding Common Shares or any known associate

or affiliate of such persons, has or has had any material interest direct or indirect, in any transaction since the commencement of the

Company’s most recently completed financial year or in any proposed transaction that has materially affected or would materially

affect the Company or any of its subsidiaries.

OTHER MATTERS

WHICH MAY COME BEFORE THE MEETING

Management knows of no matters to come before the Meeting other than as

set forth in the Notice of Meeting. However, if other matters which are not known to management should properly come before the Meeting,

the accompanying proxy will be voted on such matters in accordance with the best judgment of the persons voting the proxy.

ADDITIONAL

INFORMATION

Additional information relating to the Company can be found on SEDAR+ at

www.sedarplus.com. Financial information is provided in the Company’s audited consolidated financial statements and management’s

discussion and analysis for its most recently completed financial year. The Company will provide any Shareholder of the Company, without

charge, upon request to the Corporate Secretary of the Company a copy of this Management Information Circular, the Company’s financial

statements and management’s discussion and analysis.

APPROVAL

The contents of this Management Information Circular and the sending thereof

to the Shareholders of the Company have been approved by the directors of the Company.

DATED at Calgary, Alberta, this 20th day of September, 2023.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

|

| |

“Anthony Giovinazzo” |

|

| |

Anthony Giovinazzo |

| |

Chairman |

Exhibit 99.3

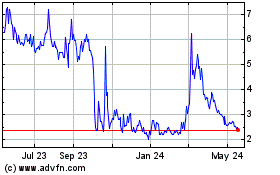

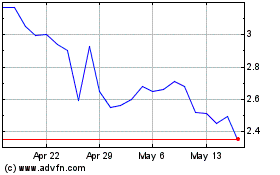

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Nov 2023 to Nov 2024