Zillow Group, Inc. (NASDAQ:Z) (NASDAQ:ZG), which houses a portfolio

of the largest and most vibrant real estate and home-related brands

on mobile and the web, today announced its consolidated financial

results for the quarter and full year ended December 31, 2017.

“Zillow Group had another fantastic year of record

results in 2017 and exceeded $1 billion in revenue for the first

time,” said Zillow Group CEO Spencer Rascoff. “We successfully

transitioned advertisers to an auction-based pricing model,

launched RealEstate.com, and continued to grow our emerging

marketplaces, including two strategic acquisitions. We believe the

next phase of our company’s evolution will make Zillow Group an

even more meaningful part of the home-shopping experience. In 2018,

we plan to deliver better experiences for consumers buying, selling

or renting a home, and strengthen our partnerships with real estate

professionals by aligning our growth with their success.”

Fourth Quarter 2017 Financial

Highlights

• Revenue increased 24% to a record $282.3

million from $227.6 million in the fourth quarter of 2016.

- Marketplace Revenue increased 26% to $265.6 million from $210.6

million in the fourth quarter of 2016.• Premier Agent

Revenue increased 21% to $199.5 million from $164.3 million in the

fourth quarter of 2016.• Other Real Estate Revenue1

increased 60% to $47.6 million from $29.8 million in the fourth

quarter of 2016.• Mortgages Revenue increased 12% to

$18.5 million from $16.5 million in the fourth quarter of

2016.

- Display Revenue decreased 1% to $16.7 million from $17.0

million in the fourth quarter of 2016, consistent with the

company’s strategy to deemphasize display advertising in the user

experience and instead focus on growth in marketplace revenue.

• GAAP net loss was $77.2 million in the

fourth quarter of 2017, or (27)% of Revenue, which includes the

impact of a $174.0 million non-cash impairment charge recorded in

connection with Trulia’s trade names and trademarks

indefinite-lived intangible asset, compared to GAAP net loss of

$23.5 million in the fourth quarter of 2016, or (10)% of

Revenue.

• Adjusted EBITDA was $70.9 million in the

fourth quarter of 2017, or 25% of Revenue, which was an increase

from $54.7 million in the fourth quarter of 2016, or 24% of

Revenue.

1 Other Real Estate Revenue primarily includes

revenue generated by Zillow Group Rentals and New Construction, as

well as revenue from the sale of various other advertising and

business software solutions.

Full Year 2017 Financial

Highlights

• Revenue increased 27% to a record

$1,076.8 million from $846.6 million in 2016.

- Marketplace Revenue increased 29% to $1,007.2 million from

$778.1 million in 2016.• Premier Agent Revenue increased

26% to $761.6 million from $604.3 million in

2016.• Other Real Estate Revenue increased 61% to $165.0

million from $102.6 million in 2016.• Mortgages Revenue

increased 13% to $80.6 million from $71.1 million in 2016.

- Display Revenue increased 2% to $69.6 million from $68.5

million in 2016.

• GAAP net loss was $94.4 million, or (9)% of

Revenue, which includes the impact of the $174.0 million non-cash

impairment charge, compared to GAAP net loss of $220.4 million in

2016, or (26)% of Revenue, which includes the impact of a

$130.0 million litigation settlement.

• Adjusted EBITDA was $236.3 million, or 22%

of Revenue, which was an increase from $14.8 million in 2016, or 2%

of Revenue.

Fourth Quarter 2017 Operating and

Business Highlights

• More than 151 million average monthly

unique users visited Zillow Group brands’ mobile apps and websites

during the fourth quarter of 2017, an increase of 8%

year-over-year.

• Visits to Zillow Group brands’ mobile apps

and websites Zillow®, Trulia®, StreetEasy® (included as of March

2017) and RealEstate.com (included as of June 2017) increased 21%

year-over-year to more than 1.4 billion during the fourth quarter

of 2017. Premier Agent revenue per visit increased 1% to $0.139

from $0.138 in the same period last year.

• The number of Premier Agent® advertisers,

including brokerages and other teams, spending more than $5,000 per

month grew by 70% year-over-year and increased 64% on a total

dollar basis during the fourth quarter of 2017.

• Total sales to Premier Agent advertisers

who have been customers for more than one year increased 41%

year-over-year during the fourth quarter of 2017.

• Sales to existing Premier Agent advertisers

accounted for 63% of total bookings during the fourth quarter of

2017.

Business Outlook - First Quarter and Full Year

2018

The following table presents Zillow Group’s business outlook for

the periods presented:

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ending |

|

Year Ending |

|

|

Zillow Group Outlook as of February 8, 2018 |

|

March 31, 2018 |

|

December 31, 2018 |

|

| (in

millions) |

|

|

|

|

|

|

|

|

|

| Revenue

|

|

$291 |

to |

$296 |

|

$1,302 |

to |

$1,317 |

|

| Premier Agent

revenue |

|

$206 |

to |

$208 |

|

$900 |

to |

$910 |

|

| Mortgages revenue |

|

$21 |

to |

$22 |

|

$95 |

to |

$96 |

|

| Rentals revenue

(1) |

|

$30 |

to |

$31 |

|

$144 |

to |

$146 |

|

| Other revenue (1) |

|

$34 |

to |

$35 |

|

$163 |

to |

$165 |

|

| Operating expenses |

|

$302 |

to |

$307 |

|

$1,240 |

to |

$1,255 |

|

| Net income (loss) |

|

$(18.3) |

to |

$(13.3) |

|

$38 |

to |

$53 |

|

| Adjusted EBITDA

(2) |

|

$42 |

to |

$47 |

|

$300 |

to |

$315 |

|

| Depreciation and

amortization |

|

$27 |

to |

$29 |

|

$118 |

to |

$123 |

|

| Share-based

compensation expense |

|

$26 |

to |

$28 |

|

$122 |

to |

$127 |

|

| Capital

expenditures |

|

|

*** |

|

|

$93 |

to |

$98 |

|

| Weighted average shares

outstanding — basic |

|

190.0 |

to |

192.0 |

|

193.0 |

to |

195.0 |

|

| Weighted average shares

outstanding — diluted |

|

197.5 |

to |

199.5 |

|

200.5 |

to |

202.5 |

|

| |

|

|

|

|

|

|

|

|

|

| *** Outlook not

provided |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

(1) Zillow Group will begin reporting Rentals

Revenue as a separate revenue category beginning with quarterly

reporting for the three months ending March 31, 2018. In addition,

Display Revenue will be included in the Other Revenue category and

not reported separately. Beginning in 2018, Other Real Estate

Revenue will be redefined as Other Revenue and will include revenue

from New Construction, dotloop, Display, as well as from the sale

of various other advertising and business software solutions.

(2) A reconciliation of forecasted Adjusted EBITDA to

forecasted net income (loss) is provided below in this press

release.

Conference Call and Webcast Information

Zillow Group CEO Spencer Rascoff and CFO Kathleen Philips will

host a live conference call and webcast to discuss the results

today at 2 p.m. Pacific Time (5 p.m. Eastern Time). A copy of

management’s prepared remarks will be made available on the

investor relations section of Zillow Group’s website at

http://investors.zillowgroup.com/results.cfm prior to the live

conference call and webcast to allow analysts and investors

additional time to review the details of the results.

Zillow Group’s management will first read the prepared remarks

and then answer questions submitted via Sli.do, in addition to

answering questions from dialed-in participants, during the live

conference call. Questions may be submitted at www.slido.com using

the event code #ZEarnings.

A link to the live webcast and recorded replay of the conference

call will be available on the investor relations section

of Zillow Group’s website

at http://investors.zillowgroup.com/results.cfm. The live call

may also be accessed via phone at (877) 643-7152 toll-free

domestically and at (443) 863-7921 internationally.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 that involve

risks and uncertainties, including, without limitation, statements

regarding our business outlook, strategic priorities, and

operational plans for 2018. Statements containing words such as

“may,” “believe,” “anticipate,” “expect,” “intend,” “plan,”

“project,” “will,” “projections,” “continue,” “business outlook,”

“forecast,” “estimate,” “outlook,” “guidance,” or similar

expressions constitute forward-looking statements. Differences in

Zillow Group’s actual results from those described in these

forward-looking statements may result from actions taken by Zillow

Group as well as from risks and uncertainties beyond Zillow Group’s

control. Factors that may contribute to such differences include,

but are not limited to, Zillow Group’s ability to maintain and

effectively manage an adequate rate of growth; Zillow Group’s

ability to innovate and provide products and services that are

attractive to its users and advertisers; Zillow Group’s ability to

compete successfully against existing or future competitors; Zillow

Group’s investment of resources to pursue strategies that may not

prove effective; the impact of the real estate industry on Zillow

Group’s business; the impact of pending litigation and other legal

and regulatory matters; Zillow Group’s ability to increase

awareness of the Zillow Group brands in a cost-effective manner;

Zillow Group’s ability to attract consumers to Zillow Group’s

mobile applications and websites; Zillow Group’s ability to

successfully integrate and realize the benefits of our past or

future strategic acquisitions or investments; the reliable

performance of Zillow Group’s network infrastructure and content

delivery processes; and Zillow Group’s ability to protect its

intellectual property. The foregoing list of risks and

uncertainties is illustrative, but is not exhaustive. For more

information about potential factors that could affect Zillow

Group’s business and financial results, please review the “Risk

Factors” described in Zillow Group’s Annual Report on Form 10-K for

the year ended December 31, 2016 filed with the Securities and

Exchange Commission, or SEC, and in Zillow Group’s other filings

with the SEC. Except as may be required by law, Zillow Group does

not intend, and undertakes no duty, to update this information to

reflect future events or circumstances.

Use of Non-GAAP Financial Measures

To provide investors with additional information

regarding our financial results, this press release includes

references to Adjusted EBITDA (including forecasted Adjusted

EBITDA) and non-GAAP net income (loss) per share, which are

non-GAAP financial measures. We have provided a reconciliation of

Adjusted EBITDA (historical and forecasted) to net income (loss)

(historical and forecasted), the most directly comparable GAAP

financial measure, and a reconciliation of net income (loss),

adjusted, to net loss, as reported on a GAAP basis, and the

calculations of non-GAAP net income (loss) per share - basic and

diluted, within this earnings release.

Adjusted EBITDA is a key metric used by our

management and board of directors to measure operating performance

and trends, and to prepare and approve our annual budget. The

exclusion of certain expenses in calculating Adjusted EBITDA

facilitates operating performance comparisons on a period-to-period

basis.

Our use of Adjusted EBITDA has limitations as an

analytical tool, and you should not consider it in isolation or as

a substitute for analysis of our results as reported under GAAP.

Some of these limitations are:

- Adjusted EBITDA does not reflect

our cash expenditures or future requirements for capital

expenditures or contractual commitments;

- Adjusted EBITDA does not reflect

changes in, or cash requirements for, our working capital

needs;

- Adjusted EBITDA does not consider

the potentially dilutive impact of share-based compensation;

- Although depreciation and

amortization are non-cash charges, the assets being depreciated and

amortized may have to be replaced in the future, and Adjusted

EBITDA does not reflect cash capital expenditure requirements for

such replacements or for new capital expenditure requirements;

- Adjusted EBITDA does not reflect

impairment costs;

- Adjusted EBITDA does not reflect

acquisition-related costs;

- Adjusted EBITDA does not reflect

the gain on divestiture of business;

- Adjusted EBITDA does not reflect

interest expense or other income;

- Adjusted EBITDA does not reflect

the loss on debt extinguishment;

- Adjusted EBITDA does not reflect

income tax benefit (expense); and

- Other companies, including

companies in our own industry, may calculate Adjusted EBITDA

differently than we do, limiting its usefulness as a comparative

measure.

Because of these limitations, you should consider Adjusted

EBITDA alongside other financial performance measures, including

various cash flow metrics, net loss and our other GAAP results.

Our presentation of non-GAAP net income (loss) per share

excludes the impact of share-based compensation expense, impairment

costs, acquisition-related costs, loss on debt extinguishment,

income tax benefit (expense) and the gain on divestiture of

business. This measure is not a key metric used by our management

and board of directors to measure operating performance or

otherwise manage the business. However, we provide non-GAAP net

income (loss) per share as supplemental information to investors,

as we believe the exclusion of share-based compensation expense,

impairment costs, acquisition-related costs, loss on debt

extinguishment, income tax benefit (expense) and the gain on

divestiture of business facilitates investors’ operating

performance comparisons on a period-to-period basis. You should not

consider these metrics in isolation or as substitutes for analysis

of our results as reported under GAAP.

About Zillow Group

Zillow Group (NASDAQ:Z) (NASDAQ:ZG) houses a portfolio of the

largest real estate and home-related brands on mobile and the web.

The company’s brands focus on all stages of the home lifecycle:

renting, buying, selling and financing. Zillow Group is committed

to empowering consumers with unparalleled data, inspiration and

knowledge around homes, and connecting them with the right local

professionals to help. The Zillow Group portfolio of consumer

brands includes real estate and rental marketplaces Zillow®,

Trulia®, StreetEasy®, HotPads®, Naked Apartments® and

RealEstate.com. In addition, Zillow Group provides a comprehensive

suite of marketing software and technology solutions to help real

estate, rental and mortgage professionals maximize business

opportunities and connect with millions of consumers. The company

operates a number of business brands for real estate, rental and

mortgage professionals, including Mortech®, dotloop®, Bridge

Interactive® and New Home Feed®. The company is headquartered

in Seattle.

Please visit http://investors.zillowgroup.com,

www.zillowgroup.com/ir-blog, and www.twitter.com/zillowgroup,

where Zillow Group discloses information about the company, its

financial information, and its business which may be deemed

material.

The Zillow Group logo is available at

http://zillowgroup.mediaroom.com/logos-photos.

Zillow, Premier Agent, Mortech, Bridge Interactive, StreetEasy,

HotPads and New Home Feed are registered trademarks of Zillow,

Inc. Trulia is a registered trademark of Trulia,

LLC. dotloop is a registered trademark of DotLoop, LLC. Naked

Apartments is a registered trademark of Naked Apartments,

LLC.

Twitter is a registered trademark of Twitter, Inc.

(ZFIN)

Reported Consolidated Results

| |

| ZILLOW GROUP, INC. |

| UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (in thousands) |

|

|

|

|

|

| |

|

| |

December 31,

2017 |

|

December 31,

2016 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

352,095 |

|

|

$ |

243,592 |

|

|

Short-term investments |

|

410,444 |

|

|

|

263,923 |

|

| Accounts

receivable, net |

|

54,396 |

|

|

|

40,527 |

|

| Prepaid

expenses and other current assets |

|

24,590 |

|

|

|

34,817 |

|

| Total current

assets |

|

841,525 |

|

|

|

582,859 |

|

| Property and equipment,

net |

|

112,271 |

|

|

|

98,288 |

|

| Goodwill |

|

1,931,076 |

|

|

|

1,923,480 |

|

| Intangible assets,

net |

|

319,711 |

|

|

|

527,464 |

|

| Other assets |

|

25,934 |

|

|

|

17,586 |

|

| Total assets |

$ |

3,230,517 |

|

|

$ |

3,149,677 |

|

| |

|

|

|

| Liabilities and

shareholders’ equity |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

3,587 |

|

|

$ |

4,257 |

|

| Accrued

expenses and other current liabilities |

|

61,373 |

|

|

|

38,427 |

|

| Accrued

compensation and benefits |

|

19,109 |

|

|

|

24,057 |

|

| Deferred

revenue |

|

31,918 |

|

|

|

29,154 |

|

| Deferred

rent, current portion |

|

2,400 |

|

|

|

1,347 |

|

| Total current

liabilities |

|

118,387 |

|

|

|

97,242 |

|

| Deferred rent, net of

current portion |

|

21,330 |

|

|

|

15,298 |

|

| Long-term debt |

|

385,416 |

|

|

|

367,404 |

|

| Deferred tax

liabilities and other long-term liabilities |

|

44,561 |

|

|

|

136,146 |

|

| Total liabilities |

|

569,694 |

|

|

|

616,090 |

|

| Shareholders’

equity: |

|

|

|

| Class A

common stock |

|

6 |

|

|

|

5 |

|

| Class B

common stock |

|

1 |

|

|

|

1 |

|

| Class C

capital stock |

|

13 |

|

|

|

12 |

|

|

Additional paid-in capital |

|

3,254,146 |

|

|

|

3,030,854 |

|

|

Accumulated other comprehensive loss |

|

(1,100 |

) |

|

|

(242 |

) |

|

Accumulated deficit |

|

(592,243 |

) |

|

|

(497,043 |

) |

| Total shareholders’

equity |

|

2,660,823 |

|

|

|

2,533,587 |

|

| Total liabilities and

shareholders’ equity |

$ |

3,230,517 |

|

|

$ |

3,149,677 |

|

| |

|

|

|

| |

|

| ZILLOW GROUP, INC. |

|

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (in thousands, except per share

data) |

|

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Year Ended |

|

| |

December 31, |

|

December 31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

282,330 |

|

|

$ |

227,612 |

|

|

$ |

1,076,794 |

|

|

$ |

846,589 |

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

| Cost of

revenue (exclusive of amortization) (1)(2) |

|

22,559 |

|

|

|

18,706 |

|

|

|

85,203 |

|

|

|

69,262 |

|

|

| Sales and

marketing (2) |

|

103,935 |

|

|

|

90,509 |

|

|

|

448,201 |

|

|

|

382,419 |

|

|

|

Technology and development (2) |

|

85,187 |

|

|

|

67,320 |

|

|

|

319,985 |

|

|

|

255,583 |

|

|

| General

and administrative (2) |

|

57,778 |

|

|

|

47,832 |

|

|

|

210,816 |

|

|

|

332,007 |

|

|

|

Impairment costs |

|

174,000 |

|

|

|

- |

|

|

|

174,000 |

|

|

|

- |

|

|

|

Acquisition-related costs |

|

97 |

|

|

|

533 |

|

|

|

463 |

|

|

|

1,423 |

|

|

| Gain on

divestiture of business |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,251 |

) |

|

| Total costs and

expenses |

|

443,556 |

|

|

|

224,900 |

|

|

|

1,238,668 |

|

|

|

1,039,443 |

|

|

| Income (loss) from

operations |

|

(161,226 |

) |

|

|

2,712 |

|

|

|

(161,874 |

) |

|

|

(192,854 |

) |

|

| Loss on debt

extinguishment |

|

- |

|

|

|

(22,757 |

) |

|

|

- |

|

|

|

(22,757 |

) |

|

| Other income |

|

1,415 |

|

|

|

716 |

|

|

|

5,385 |

|

|

|

2,711 |

|

|

| Interest expense |

|

(6,991 |

) |

|

|

(2,668 |

) |

|

|

(27,517 |

) |

|

|

(7,408 |

) |

|

| Loss before income

taxes |

|

(166,802 |

) |

|

|

(21,997 |

) |

|

|

(184,006 |

) |

|

|

(220,308 |

) |

|

| Income tax benefit

(expense) |

|

89,627 |

|

|

|

(1,494 |

) |

|

|

89,586 |

|

|

|

(130 |

) |

|

| Net loss |

$ |

(77,175 |

) |

|

$ |

(23,491 |

) |

|

$ |

(94,420 |

) |

|

$ |

(220,438 |

) |

|

| Net loss per share —

basic and diluted |

$ |

(0.41 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.51 |

) |

|

$ |

(1.22 |

) |

|

| Weighted-average shares

outstanding — basic and diluted |

|

189,439 |

|

|

|

181,852 |

|

|

|

186,453 |

|

|

|

180,149 |

|

|

| _________ |

|

|

|

|

|

|

|

|

| (1) Amortization of

website development costs and intangible assets included in

technology and development |

$ |

24,392 |

|

|

$ |

22,130 |

|

|

$ |

94,349 |

|

|

$ |

87,060 |

|

|

| |

|

|

|

|

|

|

|

|

| (2) Includes

share-based compensation expense as follows: |

|

|

|

|

|

|

|

|

| Cost of

revenue |

$ |

942 |

|

|

$ |

888 |

|

|

$ |

3,884 |

|

|

$ |

3,550 |

|

|

| Sales and

marketing |

|

5,041 |

|

|

|

5,754 |

|

|

|

22,735 |

|

|

|

23,320 |

|

|

|

Technology and development |

|

10,609 |

|

|

|

8,306 |

|

|

|

39,938 |

|

|

|

31,466 |

|

|

| General

and administrative |

|

12,817 |

|

|

|

10,818 |

|

|

|

47,014 |

|

|

|

48,582 |

|

|

|

Total |

$ |

29,409 |

|

|

$ |

25,766 |

|

|

$ |

113,571 |

|

|

$ |

106,918 |

|

|

| |

|

|

|

|

|

|

|

|

| Other Financial

Data: |

|

|

|

|

|

|

|

|

| Adjusted EBITDA

(3) |

$ |

70,859 |

|

|

$ |

54,749 |

|

|

$ |

236,315 |

|

|

$ |

14,826 |

|

|

| |

|

|

|

|

|

|

|

|

| (3)

See above for more information regarding our presentation of

Adjusted EBITDA. |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

| ZILLOW GROUP, INC. |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS |

| (in thousands) |

|

|

|

|

|

|

|

|

|

Year Ended |

| |

|

December 31, |

| |

|

|

2017 |

|

|

|

2016 |

|

| Operating

activities |

|

|

|

|

| Net loss |

|

$ |

(94,420 |

) |

|

$ |

(220,438 |

) |

| Adjustments to

reconcile net loss to net cash provided by operating activities,

net of amounts assumed in connection with acquisitions: |

|

|

|

|

|

Depreciation and amortization |

|

|

110,155 |

|

|

|

100,590 |

|

|

Share-based compensation expense |

|

|

113,571 |

|

|

|

106,918 |

|

| Loss on

debt extinguishment |

|

|

- |

|

|

|

22,757 |

|

|

Amortization of discount and issuance costs on 2021 Notes |

|

|

18,012 |

|

|

|

883 |

|

|

Impairment costs |

|

|

174,000 |

|

|

|

- |

|

| Deferred

income taxes |

|

|

(89,586 |

) |

|

|

(1,370 |

) |

| Loss on

disposal of property and equipment |

|

|

5,678 |

|

|

|

3,689 |

|

| Gain on

divestiture of business |

|

|

- |

|

|

|

(1,360 |

) |

| Bad debt

expense |

|

|

7,349 |

|

|

|

2,681 |

|

| Deferred

rent |

|

|

7,085 |

|

|

|

1,730 |

|

|

Amortization of bond premium |

|

|

431 |

|

|

|

1,489 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

| Accounts

receivable |

|

|

(21,203 |

) |

|

|

(13,324 |

) |

| Prepaid

expenses and other assets |

|

|

10,807 |

|

|

|

(13,260 |

) |

| Accounts

payable |

|

|

(373 |

) |

|

|

856 |

|

| Accrued

expenses and other current liabilities |

|

|

19,000 |

|

|

|

(5,065 |

) |

| Accrued

compensation and benefits |

|

|

(4,948 |

) |

|

|

12,463 |

|

| Deferred

revenue |

|

|

2,633 |

|

|

|

7,794 |

|

| Other

long-term liabilities |

|

|

- |

|

|

|

1,612 |

|

| Net cash provided by

operating activities |

|

|

258,191 |

|

|

|

8,645 |

|

| |

|

|

|

|

| Investing

activities |

|

|

|

|

| Proceeds from

maturities of investments |

|

|

259,227 |

|

|

|

199,369 |

|

| Purchases of

investments |

|

|

(407,032 |

) |

|

|

(175,210 |

) |

| Proceeds from sales of

investments |

|

|

- |

|

|

|

4,963 |

|

| Purchases of property

and equipment |

|

|

(66,728 |

) |

|

|

(62,060 |

) |

| Purchases of intangible

assets |

|

|

(11,907 |

) |

|

|

(9,662 |

) |

| Purchases of cost

method investments |

|

|

(10,000 |

) |

|

|

(10,000 |

) |

| Proceeds from

divestiture of a business |

|

|

579 |

|

|

|

3,200 |

|

| Cash paid for

acquisitions, net |

|

|

(11,533 |

) |

|

|

(16,319 |

) |

| Net cash used in

investing activities |

|

|

(247,394 |

) |

|

|

(65,719 |

) |

| |

|

|

|

|

| Financing

activities |

|

|

|

|

| Proceeds from issuance

of 2021 Notes, net of issuance costs |

|

|

- |

|

|

|

447,784 |

|

| Premiums paid for

Capped Call Confirmations |

|

|

- |

|

|

|

(36,616 |

) |

| Partial repurchase of

2020 Notes |

|

|

- |

|

|

|

(370,235 |

) |

| Proceeds from exercise

of stock options |

|

|

98,071 |

|

|

|

31,211 |

|

| Value of equity awards

withheld for tax liability |

|

|

(365 |

) |

|

|

(616 |

) |

| Net cash provided by

financing activities |

|

|

97,706 |

|

|

|

71,528 |

|

| Net increase in cash

and cash equivalents during period |

|

|

108,503 |

|

|

|

14,454 |

|

| Cash and cash

equivalents at beginning of period |

|

|

243,592 |

|

|

|

229,138 |

|

| Cash and cash

equivalents at end of period |

|

$ |

352,095 |

|

|

$ |

243,592 |

|

| |

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

| Cash paid

for interest |

|

$ |

9,198 |

|

|

$ |

6,325 |

|

| Noncash

transactions: |

|

|

|

|

|

Capitalized share-based compensation |

|

$ |

11,236 |

|

|

$ |

10,061 |

|

| Write-off

of fully depreciated property and equipment |

|

$ |

15,004 |

|

|

$ |

14,564 |

|

| Write-off

of fully amortized intangible assets |

|

$ |

5,473 |

|

|

$ |

9,293 |

|

| |

|

|

|

|

|

|

|

|

Adjusted EBITDA

The following table presents a reconciliation of Adjusted EBITDA

to net loss, the most directly comparable GAAP financial measure,

for each of the periods presented (in thousands, unaudited):

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

|

| |

|

December 31, |

|

December 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| Reconciliation

of Adjusted EBITDA to Net Loss: |

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(77,175 |

) |

|

$ |

(23,491 |

) |

|

$ |

(94,420 |

) |

|

$ |

(220,438 |

) |

|

| Other income |

|

|

(1,415 |

) |

|

|

(716 |

) |

|

|

(5,385 |

) |

|

|

(2,711 |

) |

|

| Depreciation and

amortization expense |

|

|

28,579 |

|

|

|

25,738 |

|

|

|

110,155 |

|

|

|

100,590 |

|

|

| Share-based

compensation expense |

|

|

29,409 |

|

|

|

25,766 |

|

|

|

113,571 |

|

|

|

106,918 |

|

|

| Impairment costs |

|

|

174,000 |

|

|

|

- |

|

|

|

174,000 |

|

|

|

- |

|

|

| Acquisition-related

costs |

|

|

97 |

|

|

|

533 |

|

|

|

463 |

|

|

|

1,423 |

|

|

| Gain on divestiture of

business |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,251 |

) |

|

| Interest expense |

|

|

6,991 |

|

|

|

2,668 |

|

|

|

27,517 |

|

|

|

7,408 |

|

|

| Loss on debt

extinguishment |

|

|

- |

|

|

|

22,757 |

|

|

|

- |

|

|

|

22,757 |

|

|

| Income tax (benefit)

expense |

|

|

(89,627 |

) |

|

|

1,494 |

|

|

|

(89,586 |

) |

|

|

130 |

|

|

| Adjusted

EBITDA (1) |

|

$ |

70,859 |

|

|

$ |

54,749 |

|

|

$ |

236,315 |

|

|

$ |

14,826 |

|

|

| |

|

|

|

|

|

|

|

|

|

(1) For the year ended December 31, 2016, Adjusted

EBITDA includes the impact of a $130.0 million litigation

settlement. Adjusted EBITDA for the year ended December 31, 2016

also includes $28.8 million in related legal costs.

Non-GAAP Net Income (Loss) per Share

The following table presents a reconciliation of net income

(loss), adjusted, to net loss, as reported on a GAAP basis, and the

calculation of non-GAAP net income (loss) per share - basic and

diluted, for each of the periods presented (in thousands, except

per share data, unaudited):

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

|

| |

|

December 31, |

|

December 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Net loss, as

reported |

|

$ |

(77,175 |

) |

|

$ |

(23,491 |

) |

|

$ |

(94,420 |

) |

|

$ |

(220,438 |

) |

|

| Share-based

compensation expense |

|

|

29,409 |

|

|

|

25,766 |

|

|

|

113,571 |

|

|

|

106,918 |

|

|

| Impairment costs |

|

|

174,000 |

|

|

|

- |

|

|

|

174,000 |

|

|

|

- |

|

|

| Acquisition-related

costs |

|

|

97 |

|

|

|

533 |

|

|

|

463 |

|

|

|

1,423 |

|

|

| Loss on debt

extinguishment |

|

|

- |

|

|

|

22,757 |

|

|

|

- |

|

|

|

22,757 |

|

|

| Income tax (benefit)

expense |

|

|

(89,627 |

) |

|

|

1,494 |

|

|

|

(89,586 |

) |

|

|

130 |

|

|

| Gain on divestiture of

business |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,251 |

) |

|

| Net

income (loss), adjusted |

|

$ |

36,704 |

|

|

$ |

27,059 |

|

|

$ |

104,028 |

|

|

$ |

(90,461 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Non-GAAP net income

(loss) per share - basic |

|

$ |

0.19 |

|

|

$ |

0.15 |

|

|

$ |

0.56 |

|

|

$ |

(0.50 |

) |

|

| Non-GAAP net income

(loss) per share - diluted |

|

$ |

0.19 |

|

|

$ |

0.14 |

|

|

$ |

0.53 |

|

|

$ |

(0.50 |

) |

|

| Weighted-average shares

outstanding - basic |

|

|

189,439 |

|

|

|

181,852 |

|

|

|

186,453 |

|

|

|

180,149 |

|

|

| Weighted-average shares

outstanding - diluted |

|

|

197,442 |

|

|

|

190,331 |

|

|

|

194,837 |

|

|

|

180,149 |

|

|

| |

|

|

|

|

|

|

|

|

|

Revenue by Type

The following tables present our revenue by type (in thousands,

unaudited) and as a percentage of total revenue for each of the

periods presented (unaudited):

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Year Ended |

|

| |

December 31, |

|

December 31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

| Marketplace

revenue: |

|

|

|

|

|

|

|

|

| Premier

Agent |

$ |

199,514 |

|

|

$ |

164,335 |

|

|

$ |

761,594 |

|

|

$ |

604,292 |

|

|

| Other

real estate |

|

47,564 |

|

|

|

29,788 |

|

|

|

164,991 |

|

|

|

102,635 |

|

|

|

Mortgages |

|

18,516 |

|

|

|

16,512 |

|

|

|

80,591 |

|

|

|

71,133 |

|

|

| Total Marketplace

revenue |

|

265,594 |

|

|

|

210,635 |

|

|

|

1,007,176 |

|

|

|

778,060 |

|

|

| Display revenue |

|

16,736 |

|

|

|

16,977 |

|

|

|

69,618 |

|

|

|

68,529 |

|

|

| Total

revenue |

$ |

282,330 |

|

|

$ |

227,612 |

|

|

$ |

1,076,794 |

|

|

$ |

846,589 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Year Ended |

|

| |

December 31, |

|

December 31, |

|

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| Percentage of

Total Revenue: |

|

|

|

|

|

|

|

|

| Marketplace

revenue: |

|

|

|

|

|

|

|

|

| Premier

Agent |

|

71 |

% |

|

|

72 |

% |

|

|

71 |

% |

|

|

71 |

% |

|

| Other

real estate |

|

17 |

% |

|

|

13 |

% |

|

|

15 |

% |

|

|

12 |

% |

|

|

Mortgages |

|

7 |

% |

|

|

7 |

% |

|

|

7 |

% |

|

|

8 |

% |

|

| Total Marketplace

revenue |

|

94 |

% |

|

|

93 |

% |

|

|

94 |

% |

|

|

92 |

% |

|

| Display revenue |

|

6 |

% |

|

|

7 |

% |

|

|

6 |

% |

|

|

8 |

% |

|

| Total

revenue |

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

Key Metrics

The following table sets forth our key metrics for each of the

periods presented:

| |

|

|

|

|

|

|

| |

Three Months Ended

December 31, |

|

2016 to 2017 |

|

| |

2017 |

|

2016 |

|

% Change |

|

| |

(in millions) |

|

|

|

| Average Monthly Unique

Users (1) |

151.6 |

|

140.1 |

|

8 |

% |

|

| Visits (2) |

1,435.6 |

|

1,189.7 |

|

21 |

% |

|

| |

|

|

|

|

|

|

(1) Zillow, StreetEasy, HotPads, Naked Apartments and

RealEstate.com (as of June 2017) measure unique users with Google

Analytics, and Trulia measures unique users with Adobe Analytics

(formerly called Omniture analytical tools).

(2) Visits includes visits to the Zillow, Trulia,

StreetEasy (as of March 2017) and RealEstate.com (as of June 2017)

mobile apps and websites. We measure Zillow, StreetEasy and

RealEstate.com visits with Google Analytics and Trulia visits with

Adobe Analytics.

Reconciliation of Forecasted Adjusted EBITDA to

Forecasted Net Income (Loss)

The following table presents a reconciliation of forecasted

Adjusted EBITDA to forecasted net income (loss) at the midpoint of

the range for each of the periods presented (in thousands,

unaudited):

| |

|

|

|

|

| |

|

Three Months Ending |

|

Year Ending |

|

|

|

March 31, 2018 |

|

December 31, 2018 |

| Reconciliation

of Forecasted Adjusted EBITDA to Forecasted Net Income

(Loss): |

|

|

|

|

| Forecasted Net income

(loss) |

|

$ |

(15,800 |

) |

|

$ |

45,500 |

|

| Forecasted Other

income |

|

|

(1,500 |

) |

|

|

(5,200 |

) |

| Forecasted Depreciation

and amortization expense |

|

|

28,000 |

|

|

|

120,500 |

|

| Forecasted Share-based

compensation expense |

|

|

27,000 |

|

|

|

124,500 |

|

| Forecasted Interest

expense |

|

|

6,800 |

|

|

|

27,200 |

|

| Forecasted Income tax

benefit |

|

|

- |

|

|

|

(5,000 |

) |

|

Forecasted Adjusted EBITDA |

|

$ |

44,500 |

|

|

$ |

307,500 |

|

| |

|

|

|

|

Contacts:

Raymond JonesInvestor

Relationsir@zillowgroup.com

Katie CurnuttePublic

Relationspress@zillow.com

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/3afbfd73-a73e-49a0-bbaa-c71b0d19eebf

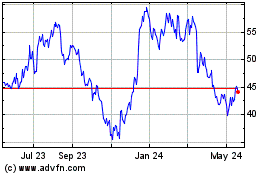

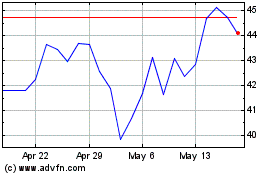

Zillow (NASDAQ:Z)

Historical Stock Chart

From Jun 2024 to Jul 2024

Zillow (NASDAQ:Z)

Historical Stock Chart

From Jul 2023 to Jul 2024