false

0001209028

0001209028

2023-12-14

2023-12-14

0001209028

us-gaap:CommonClassAMember

2023-12-14

2023-12-14

0001209028

aaic:Sec7.00SeriesbCumulativePerpetualRedeemablePreferredStockMember

2023-12-14

2023-12-14

0001209028

aaic:Sec8.250SeriescFixedtofloatingRateCumulativeRedeemablePreferredStockMember

2023-12-14

2023-12-14

0001209028

aaic:Sec6.000SeniorNotesDue2026Member

2023-12-14

2023-12-14

0001209028

aaic:Sec6.75SeniorNotesDue2025Member

2023-12-14

2023-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2023 (December 14, 2023)

ARLINGTON ASSET INVESTMENT CORP.

(EF Merger Sub Inc., as successor by merger

to Arlington Asset Investment Corp.)

(Exact name of Registrant as Specified in Its

Charter)

| Virginia |

001-34374 |

54-1873198 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File

Number) |

(IRS Employer

Identification No.) |

| |

|

|

| 53 Forest Avenue |

|

| Old Greenwich, Connecticut |

|

06870 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (203) 698-1200

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock |

|

AAIC |

|

New York Stock Exchange |

| 7.00% Series B Cumulative Perpetual Redeemable Preferred Stock |

|

AAIC PrB |

|

New York Stock Exchange |

| 8.250% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

AAIC PrC |

|

New York Stock Exchange |

| 6.000% Senior Notes due 2026 |

|

AAIN |

|

New York Stock Exchange |

| 6.75% Senior Notes due 2025 |

|

AIC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

This Current Report on Form 8-K

is being filed in connection with the consummation on December 14, 2023 (the “Closing Date”), of the transactions contemplated

by that certain Agreement and Plan of Merger, dated as of May 29, 2023 (the “Merger Agreement”), by and among Arlington

Asset Investment Corp., a Virginia corporation (“Arlington”), Ellington Financial Inc., a Delaware corporation (“EFC”),

EF Merger Sub Inc., a Virginia corporation and a direct wholly owned subsidiary of EFC (“Merger Sub”), and, solely for the

limited purposes set forth in the Merger Agreement, Ellington Financial Management LLC, a Delaware limited liability company (“EFC

Manager”). Pursuant to the Merger Agreement, on the Closing Date, Arlington merged with and into Merger Sub (the “Merger”),

with Merger Sub continuing as the surviving corporation of the Merger. The combined company will continue to operate under the name “Ellington

Financial Inc.” and its shares of common stock, $0.001 par value per share (“EFC Common Stock”), will continue to trade

on the New York Stock Exchange (the “NYSE”) under the ticker symbol “EFC.” The following events took place in

connection with the consummation of the Merger.

| Item 1.01. | Entry into a Material Definitive Agreement. |

The information contained

in the Introductory Note of this Current Report on Form 8-K is incorporated herein by reference to this Item 1.01.

Third Supplemental Indenture (2025

Senior Notes)

On the Closing Date, in connection

with the consummation of the Merger, Arlington, Merger Sub, EFC, Computershare Trust Company, National Association, as successor to Wells

Fargo Bank, National Association, as trustee, and The Bank of New York Mellon, as trustee, entered into the Third Supplemental Indenture,

dated as of December 14, 2023 (the “2025 Senior Notes Third Supplemental Indenture”) to the Indenture, dated as of May 1,

2013 (the “2025 Senior Notes Base Indenture”), the First Supplemental Indenture, dated as of May 1, 2013 (the “2025

Senior Notes First Supplemental Indenture”), and the Second Supplemental Indenture, dated as of March 18, 2015 (the “2025

Senior Notes Second Supplemental Indenture” and, the 2025 Senior Notes Base Indenture as amended and supplemented by the 2025 Senior

Notes First Supplemental Indenture, the 2025 Senior Notes Second Supplemental Indenture and the 2025 Senior Notes Third Supplemental Indenture,

the “2025 Senior Notes Indenture”), relating to Arlington’s 6.75% Senior Notes due 2025 (the “2025 Senior Notes”).

Pursuant to the 2025 Senior Notes Third Supplemental Indenture, effective upon the consummation of the Merger, among other things, (i) Merger

Sub expressly assumed all of Arlington’s obligations under the 2025 Senior Notes Indenture and the 2025 Senior Notes and (ii) EFC

guaranteed payment of the principal of, and premium, if any, and interest on the 2025 Senior Notes and all other amounts, if any, due

and payable under the 2025 Senior Notes.

The foregoing description

of the 2025 Senior Notes Base Indenture, the 2025 Senior Notes First Supplemental Indenture, the 2025 Senior Notes Second Supplemental

Indenture, the 2025 Senior Notes Third Supplemental Indenture, the form of 2025 Senior Notes and the transactions contemplated thereby

is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of

the 2025 Senior Notes Base Indenture, the 2025 Senior Notes First Supplemental Indenture, the 2025 Senior Notes Second Supplemental Indenture,

the 2025 Senior Notes Third Supplemental Indenture and the form of 2025 Senior Notes, which are attached hereto as Exhibits 4.1, 4.2,

4.3, 4.4 and 4.5, respectively, and are incorporated herein by reference.

Second Supplemental Indenture (2026

Senior Notes)

On the Closing Date, in connection

with the consummation of the Merger, Arlington, Merger Sub, EFC and The Bank of New York Mellon, as trustee, entered into the Second Supplemental

Indenture, dated as of December 14, 2023 (the “2026 Senior Notes Second Supplemental Indenture”) to the Indenture, dated

as of January 10, 2020 (the “2026 Senior Notes Base Indenture”), and the First Supplemental Indenture, dated as of July 15,

2021 (the “2026 Senior Notes First Supplemental Indenture” and, the 2026 Senior Notes Base Indenture as amended and supplemented

by the 2026 Senior Notes First Supplemental Indenture and the 2026 Senior Notes Second Supplemental Indenture, the “2026 Senior

Notes Indenture”), relating to Arlington’s 6.000% Senior Notes due 2026 (the “2026 Senior Notes”). Pursuant to

the 2026 Senior Notes Second Supplemental Indenture, effective upon the consummation of the Merger, among other things, (i) Merger

Sub expressly assumed all of Arlington’s obligations under the 2026 Senior Notes Indenture and the 2026 Senior Notes and (ii) EFC

guaranteed payment of the principal of, and premium, if any, and interest on the 2026 Senior Notes and all other amounts, if any, due

and payable under the 2026 Senior Notes.

The foregoing description

of the 2026 Senior Notes Base Indenture, the 2026 Senior Notes First Supplemental Indenture, the 2026 Senior Notes Second Supplemental

Indenture, the form of 2026 Senior Notes and the transactions contemplated thereby is only a summary, does not purport to be complete

and is subject to, and qualified in its entirety by, reference to the full text of the 2026 Senior Notes Base Indenture, the 2026 Senior

Notes First Supplemental Indenture, the 2026 Senior Notes Second Supplemental Indenture and the form of 2026 Senior Notes, which are attached

hereto as Exhibits 4.6, 4.7, 4.8 and 4.9, respectively, and are incorporated herein by reference.

| Item 1.02. | Termination of a Material Definitive Agreement. |

On December 14, 2023,

Arlington and Equiniti Trust Company, LLC (f/k/a American Stock Transfer and Trust Company, LLC) (“Equiniti”), as rights agent,

terminated Arlington’s rights agreement, by and between Arlington and Equiniti, dated as of June 5, 2009, as amended (the “Rights

Agreement”). In connection with the termination of the Rights Agreement, all of the outstanding preferred share purchase rights

issued pursuant to the Rights Agreement were terminated and are no longer outstanding.

| Item 2.01. | Completion of Acquisition or Disposition of Assets. |

The information contained

in the Introductory Note of this Current Report on Form 8-K is incorporated herein by reference to this Item 2.01.

On December 14, 2023,

Arlington, EFC, Merger Sub and EFC Manager completed the Merger pursuant to the terms of the Merger Agreement. On the Closing Date, Arlington

merged with and into Merger Sub, with Merger Sub continuing as the surviving corporation. As contemplated by the Merger Agreement, the

articles of merger were filed with the State Corporation Commission of the Commonwealth of Virginia, and the Merger was effective at 9:00

a.m., Eastern Time, on the Closing Date (the “Effective Time”).

At the Effective Time, each

outstanding share of Class A common stock, par value $0.01 per share, of Arlington (“Arlington Common Stock”) (excluding

any shares held by EFC or Merger Sub or by any wholly owned subsidiary of EFC, Merger Sub or Arlington (“Cancelled Shares”))

was automatically converted into the right to receive the following (the “Per Share Common Merger Consideration”):

| · | from EFC, 0.3619 shares of EFC Common Stock; and |

| · | from EFC Manager, $0.09 in cash. |

No

fractional shares of EFC Common Stock were issued in the Merger. Cash will be paid in lieu of any fractional shares of EFC Common

Stock that would otherwise have been received as a result of the Merger.

Additionally, at the Effective

Time, (a) each share of 7.00% Series B Cumulative Perpetual Redeemable Preferred Stock, $0.01 par value per share, of Arlington

(the “Arlington Series B Preferred Stock”) issued and outstanding immediately prior to the Effective Time was automatically

converted into the right to receive one share of newly-designated 7.00% Series D Cumulative Perpetual Redeemable Preferred Stock,

$0.001 par value per share, of EFC (the “EFC Series D Preferred Stock”) and (b) each share of 8.250% Series C Fixed-to-Floating Rate

Cumulative Redeemable Preferred Stock, $0.01 par value per share, of Arlington (the “Arlington Series C Preferred Stock”)

issued and outstanding immediately prior to the Effective Time was automatically converted into the right to receive one share of newly-designated

8.250% Series E Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, $0.001 par value per share, of EFC (the “EFC

Series E Preferred Stock”).

Furthermore, effective immediately

prior to the Effective Time:

| · | all outstanding shares of restricted stock issued under Arlington’s 2021 Long-Term Incentive

Plan, 2014 Long-Term Incentive Plan, 2011 Long-Term Incentive Plan or Non-Employee Director Stock Compensation Plan (each, as

amended from time to time, an “Arlington Equity Plan”) became fully vested; |

| · | all outstanding awards of performance restricted stock units (“Performance RSUs”), other than

awards of stock price Performance RSUs granted to Arlington’s executive officers (“Stock Price Performance RSUs”), issued

under an Arlington Equity Plan became earned and fully vested with respect to (x) the number of shares of Arlington Common Stock

subject to such award of Performance RSUs immediately prior to the Effective Time based on the achievement of the applicable performance

goals at maximum performance levels, plus (y) the number of shares of Arlington Common Stock attributable to any

dividend equivalent rights that had been accrued with respect to such award of Performance RSUs but were unpaid as of immediately prior

to the Effective Time; |

| · | all outstanding Stock Price Performance RSUs issued under an Arlington Equity Plan became earned and fully

vested with respect to (x) the number of shares of Arlington Common Stock subject to such award of Stock Price Performance RSUs immediately

prior to the Effective Time based on the achievement of the applicable performance goals at the actual level of performance, plus (y) the

number of shares of Arlington Common Stock attributable to any dividend equivalent rights that had accrued with respect to such award

of Stock Price Performance RSUs but were unpaid as of immediately prior to the Effective Time; and |

| · | all outstanding awards of deferred stock units issued under an Arlington Equity Plan became fully vested; |

and, in each case, all shares of Arlington

Common Stock represented thereby became entitled to receive the Per Share Common Merger Consideration.

The issuances of shares of

EFC Common Stock, EFC Series D Preferred Stock and EFC Series E Preferred Stock in connection with the Merger were registered

under the Securities Act of 1933, as amended, pursuant to EFC’s registration statement on Form S-4 (Registration No. 333-273309),

which was declared effective by the SEC on November 2, 2023 (the “Registration Statement”). The proxy statement/prospectus

included in the Registration Statement contains additional information regarding the Merger and incorporated by reference additional information

regarding the Merger from Current Reports on Form 8-K filed by Arlington and EFC.

Per the terms of the transactions

described in the Merger Agreement, approximately 11.0 million shares of EFC Common Stock will be issued in connection with the Merger

to former holders of Arlington Common Stock, and former Arlington common stockholders will own approximately 14% of the common equity

of EFC as the combined company following the consummation of the Merger.

The foregoing description

of the Merger and the other transactions contemplated by the Merger Agreement is only a summary, does not purport to be complete and is

subject to, and qualified in its entirety by, reference to the full text of the Merger Agreement, which was previously filed as Exhibit 2.1

to Arlington’s Current Report on Form 8-K filed with the SEC on May 31, 2023, and is incorporated herein by reference.

| Item 3.01. | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

The information set forth

in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

In connection with the consummation

of the Merger, Arlington notified the NYSE on the Closing Date that: (i) each share of Arlington Common Stock issued and outstanding

immediately prior to the Effective Time (other than Cancelled Shares, which were automatically canceled and retired and ceased to exist)

was cancelled and converted into the right to receive (A) from EFC, 0.3619 newly-issued shares of EFC Common Stock and (B) from

EFC Manager, a cash amount equal to $0.09 per share, (ii) each share of Arlington Series B Preferred Stock issued and outstanding

immediately prior to the Effective Time was cancelled and converted into the right to receive one share of newly-designated EFC Series D

Preferred Stock and (iii) each share of Arlington Series C Preferred Stock issued and outstanding immediately prior to the Effective

Time was cancelled and converted into the right to receive one share of newly-designated EFC Series E Preferred Stock. In connection

with the foregoing, Arlington requested that the NYSE file with the SEC a notification of removal from listing on Form 25 with respect

to each of the Arlington Common Stock, the Arlington Series B Preferred Stock and the Arlington Series C Preferred Stock, in

order to effect the delisting of the Arlington Common Stock, Arlington Series B Preferred Stock and Arlington Series C Preferred

Stock from the NYSE. Such delistings will result in the termination of the registration of each of the Arlington Common Stock, Arlington

Series B Preferred Stock and Arlington Series C Preferred Stock under Section 12(b) of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). Merger Sub, as successor by merger to Arlington, intends to file a Form 15

with the SEC to terminate the registration of the Arlington Common Stock, Arlington Series B Preferred Stock and Arlington Series C

Preferred Stock under Section 12(g) of the Exchange Act and to suspend Arlington’s reporting obligations under Sections

13 and 15(d) of the Exchange Act.

| Item 3.03. | Material Modification to Rights of Security Holders. |

The information set forth

in the Introductory Note, Item 2.01, Item 3.01 and Item 5.01 of this Current Report on Form 8-K is incorporated by reference

into this Item 3.03.

As

of the Effective Time, holders of Arlington Common Stock immediately prior to the Effective Time ceased to have any rights as common stockholders

of Arlington (other than their right to receive the Per Share Common Merger Consideration from EFC and EFC Manager, or as otherwise provided

by the Merger Agreement or by law). As of the Effective Time, (i) holders of Arlington Series B Preferred Stock immediately

prior to the Effective Time ceased to have any rights as preferred stockholders of Arlington (other than the right to receive shares of

EFC Series D Preferred Stock from EFC or as otherwise provided by the Merger Agreement or by law) and (ii) holders of Arlington

Series C Preferred Stock immediately prior to the Effective Time ceased to have any rights as preferred stockholders of Arlington

(other than the right to receive shares of EFC Series E Preferred Stock from EFC or as otherwise provided by the Merger Agreement

or by law).

The rights of holders of capital

stock of EFC are governed by EFC’s Certificate of Incorporation, including the Certificates of Designations, as amended, thereto,

and EFC’s Amended and Restated Bylaws. The description of the capital stock of EFC has previously been set forth in the section

entitled “Description of EFC Capital Stock” in the proxy statement/prospectus included in the Registration Statement, which

section is hereby incorporated by reference into this Item 3.03.

| Item 5.01. | Changes in Control of Registrant. |

The information set forth

in the Introductory Note, Item 1.02, Item 2.01, Item 3.03 and Item 5.02 of this Current Report on Form 8-K is incorporated

by reference into this Item 5.01.

At the Effective Time, pursuant

to the Merger Agreement, a change in control of Arlington occurred, and Arlington merged with and into Merger Sub, with

Merger Sub continuing as the surviving corporation. In connection with the consummation of the Merger, each share of Arlington

Common Stock issued and outstanding immediately prior to the Effective Time (excluding any Cancelled Shares) was cancelled and converted

into the right to receive the Per Share Common Merger Consideration. EFC and EFC Manager funded the cash portion of the Per Share Common

Merger Consideration with cash on hand. In addition, (a) each share of Arlington Series B Preferred Stock issued and outstanding

immediately prior to the Effective Time was automatically converted into the right to receive one share of newly-designated EFC Series D

Preferred Stock and (b) each share of Arlington Series C Preferred Stock issued and outstanding immediately prior to the Effective

Time was automatically converted into the right to receive one share of newly-designated EFC Series E Preferred Stock.

In the Merger Agreement, EFC

agreed to take all necessary corporate action so that upon and after the Effective Time, the size of the board of directors of EFC (the

“Board”) would be increased by one member, and Arlington would designate one

individual (the “Director Designee”) to serve on the Board until EFC’s 2024 annual meeting of stockholders. On

December 14, 2023, EFC, Merger Sub, EFC Manager, Arlington and J. Rock Tonkel, Jr. entered into a letter agreement, pursuant

to which (i) Arlington informed EFC, Merger Sub and EFC Manager that Arlington designated Mr. Tonkel as the Director Designee,

(ii) the parties to the Merger Agreement and Mr. Tonkel acknowledged their agreement that the Director Designee will not become

a member of the Board until the earlier of (a) February 21, 2024 and (b) five business days following the date Mr. Tonkel

provides EFC with written notice of his desire to be appointed to the Board, and (iii) Arlington and Mr. Tonkel waived their

rights under the Merger Agreement to the extent it required that the Director Designee become a member of the Board prior to the date

referenced in the preceding clause (ii).

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

The information set forth

in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.02.

At the Effective Time and

in connection with the Merger, each member of the board of directors of Arlington ceased to be a director of Arlington. These directors

are Daniel E. Berce, J. Rock Tonkel, Jr., David W. Faeder, Melinda H. McClure, Ralph S. Michael, III and Anthony P. Nader, III.

Their respective removals were not a result of any disagreements between Arlington and any of the directors on any matter relating to

Arlington’s operations, policies or practices.

At the Effective Time, and

in connection with the Merger, each of the executive officers of Arlington were terminated and ceased to be an executive officer of Arlington.

These executive officers are J. Rock Tonkel, Jr., Richard Konzmann and Benjamin J. Strickler.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description |

| 2.1 |

Agreement and Plan of Merger, dated as of May 29, 2023, by and among EFC, Merger Sub, Arlington and, solely for the limited purposes set forth therein, EFC Manager (incorporated by reference to Exhibit 2.1 of Arlington’s Current Report on Form 8-K filed on May 30, 2023). |

| 4.1 |

Indenture, dated as of May 1, 2013, by and between Arlington and Wells Fargo Bank, National Association, as trustee (incorporated by reference to Exhibit 4.1 of Arlington’s Current Report on Form 8-K filed on May 1, 2013). |

| 4.2 |

First Supplemental Indenture, dated as of May 1, 2013, by and between Arlington and Wells Fargo Bank, National Association, as trustee (incorporated by reference to Exhibit 4.2 of Arlington’s Current Report on Form 8-K filed on May 1, 2013). |

| 4.3 |

Second Supplemental Indenture, dated as of March 18, 2015, by and among Arlington, Wells Fargo Bank, National Association, as original trustee, and The Bank of New York Mellon, as series trustee (incorporated by reference to Exhibit 4.3 to Arlington’s Form 8-A filed on March 18, 2015). |

| 4.4* |

Third Supplemental Indenture, dated as of December 14, 2023, by and among Arlington, Merger Sub, EFC, Computershare Trust Company, National Association, as successor to Wells Fargo Bank, National Association, as trustee, and The Bank of New York Mellon, as trustee. |

| 4.5 |

Form of 6.750% Senior Notes due 2025 (incorporated by reference to Exhibit 4.3 to Arlington’s Current Report on Form 8-K filed on March 17, 2015). |

| 4.6 |

Indenture governing the Senior Debt Securities by and between Arlington and The Bank of New York Mellon, as trustee (incorporated by reference to Exhibit 4.1 to Arlington’s Registration Statement on Form S-3 (File No. 333-235885) filed on January 10, 2020). |

| 4.7 |

First Supplemental Indenture, dated as of July 15, 2021, by and between Arlington and The Bank of New York Mellon, as trustee (incorporated by reference to Exhibit 4.5 to Arlington’s Registration Statement on Form 8-A filed on July 15, 2021). |

| 4.8* |

Second Supplemental Indenture, dated as of December 14, 2023, by and among Arlington, Merger Sub, EFC and The Bank of New York Mellon, as trustee. |

| 4.9 |

Form of 6.000% Senior Notes due 2026 (incorporated by reference to Exhibit 4.6 to Arlington’s Registration Statement on Form S-3 (File No. 333-235885) filed on January 10, 2020). |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Filed herewith.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

EF MERGER SUB INC.

(as successor by merger to Arlington Asset Investment Corp.) |

| |

|

|

| Date: December 15, 2023 |

|

|

| |

By: |

/s/ Laurence Penn |

| |

Name: |

Laurence Penn |

| |

Title: |

Chief Executive Officer and President |

Exhibit 4.4

THIRD SUPPLEMENTAL INDENTURE

among

ARLINGTON ASSET INVESTMENT CORP.,

EF MERGER SUB INC.,

ELLINGTON FINANCIAL INC.,

COMPUTERSHARE TRUST COMPANY, NATIONAL ASSOCIATION,

as successor to

WELLS FARGO BANK, NATIONAL ASSOCIATION, as Trustee

and

THE BANK OF NEW YORK MELLON, as Trustee

Dated as of December 14, 2023

THIRD SUPPLEMENTAL INDENTURE

THIS THIRD SUPPLEMENTAL INDENTURE dated as of December 14,

2023 (this “Third Supplemental Indenture”) is entered into among Arlington Asset Investment Corp., a Virginia

corporation (the “Original Company”), EF Merger Sub Inc., a Virginia corporation (the “Successor

Company”), Ellington Financial Inc., a Delaware corporation (the “Guarantor”), Computershare Trust Company,

National Association, as successor to Wells Fargo Bank, National Association, a national banking association, as a trustee (the “Original

Trustee”) under the Base Indenture referred to below, and The Bank of New York Mellon, a New York banking corporation, as a

trustee (the “Series Trustee”). All capitalized terms used but not defined in this Third Supplemental Indenture

shall have the respective meanings set forth in the Base Indenture (as defined below).

RECITALS OF THE ORIGINAL COMPANY, THE SUCCESSOR

COMPANY AND THE GUARANTOR

WHEREAS, the Original Company and the Original

Trustee entered into the Indenture dated as of May 1, 2013 (the “Base Indenture”), providing for the issuance

by the Company from time to time of Securities, to be issued in one or more series;

WHEREAS, pursuant to the First Supplemental Indenture

to the Base Indenture dated as of May 1, 2013 (the “First Supplemental Indenture”), entered into between

the Original Company and the Original Trustee, the Original Company issued a series of Securities designated as its 6.625% Senior

Notes due 2023 (the “Notes due 2023”);

WHEREAS, pursuant to the Second Supplemental Indenture

to the Base Indenture dated as of March 18, 2015 (the “Second Supplemental Indenture”), entered into among

the Original Company, the Original Trustee and the Series Trustee, the Original Company issued a series of Securities designated

as its 6.750% Senior Notes due 2025 (the “Notes due 2025” and together with the Notes due 2023, the “Notes”);

WHEREAS, Computershare Trust Company, National

Association, is the successor Trustee to the Original Trustee under the Indenture, as a result of Computershare Trust Company, National

Association acquiring the corporate trust business of the Original Trustee;

WHEREAS, Article Eight of the Indenture provides

(among other things) that the Company shall not merge with any other Person, unless either the Company shall be the continuing entity,

or the successor (if other than the Company) entity shall be a Person organized and existing under the laws of the United States or a

State thereof and such successor entity shall expressly assume the due and punctual payment of the principal of (and premium or Make-Whole

Amount, if any) and any interest (including all Additional Amounts, if any, payable pursuant to Section 1011 of the Base Indenture,

according to their tenor, and the due and punctual performance and observance of all of the covenants and conditions of the Indenture

to be performed by the Company by supplemental indenture;

WHEREAS, the Agreement and Plan of Merger dated

as of May 29, 2023 among Ellington Financial Inc., a Delaware corporation, the Successor Company, the Original Company and,

solely for the limited purposes set forth therein, Ellington Financial Management LLC provides for the merger (the “Merger”)

of the Original Company with and into the Successor Company, with the Successor Company surviving the Merger;

WHEREAS, the Guarantor wishes to provide for a

full and unconditional guarantee of all Securities;

WHEREAS, pursuant to Section 901(1) of

the Indenture, without the consent of any Holders of Securities or coupons, the Company, when authorized by or pursuant to a Board Resolution,

and the Trustee, at any time and from time to time, may enter into one or more indentures supplemental to the Indenture to evidence the

succession of another Person to the Company and the assumption by any such successor of the covenants of the Company in the Indenture

and in the Securities;

WHEREAS, pursuant to Section 901(9) of

the Indenture, without the consent of any Holders of Securities or coupons, the Company, when authorized by or pursuant to a Board Resolution,

and the Trustee, at any time and from time to time, may enter into one or more indentures supplemental to the Indenture to cure any ambiguity,

to correct or supplement any provision therein which may be defective or inconsistent with any other provision therein, or to make any

other provisions with respect to matters or questions arising under the Indenture which shall not be inconsistent with the provisions

of the Indenture or to make any other changes, provided that in each case, such provisions shall not adversely affect the interests

of the Holders of Securities of any series or any related coupons in any material respect; and

WHEREAS, the Original Company, the Successor Company

and the Guarantor have duly authorized the execution and delivery of this Third Supplemental Indenture;

NOW, THEREFORE, in consideration of the premises,

agreements and obligations set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, the parties hereto hereby agree, for the equal and proportionate benefit of all Holders of the Securities, as follows:

ARTICLE I

Relation to Indenture; References

Section 1.01.

With respect to the Securities of each and every series Outstanding under the Indenture, this Third Supplemental Indenture

constitutes an integral part of the Indenture.

ARTICLE II

Assumption of Obligations

Section 2.01.

Effective upon the consummation of the Merger, and pursuant to and in accordance with Sections 801 of the Indenture, the

Successor Company hereby expressly assumes all of the obligations of the Original Company under the Indenture and all Securities, including

without limitation (i) the due and punctual payment of the principal of (and premium or Make-Whole Amount, if any) and any interest

(including all Additional Amounts, if any, payable pursuant to Section 1011 of the Indenture) on all of the Securities issued under

the Indenture that are Outstanding as of the date hereof, according to their tenor and (ii) the due and punctual performance and

observance of all of the covenants and conditions of the Indenture to be performed by the Original Company.

ARTICLE III

Guarantee

Section 3.01.

The Guarantor hereby fully, unconditionally and absolutely guarantees to the Holders of all the Securities and to the Trustee

the due and punctual payment of the principal of, and premium, if any, and interest on all the Securities and all other amounts, if any,

due and payable under all the Securities by the Company, when and as such principal, premium, if any, and interest and other amounts,

if any, shall become due and payable, whether at the Stated Maturity thereof or by declaration of acceleration thereof, call for redemption

thereof or otherwise, according to the terms of the Securities and the Indenture. The Guarantor shall be subrogated to all rights of the

Holders of the Securities and the Trustee against the Company in respect of any amounts paid by the Guarantor pursuant to the guarantee

set forth above.

ARTICLE IV

Miscellaneous

Section 4.01.

This Third Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New York without

regard to conflicts of laws principles thereof (except for Sections 5-1401 and 5-1402 of the New York General Obligations Law). This Third

Supplemental Indenture is subject to the provisions of the Trust Indenture Act that are required to be part of the Indenture and shall,

to the extent applicable, be governed by such provisions.

Section 4.02.

In case any provision in this Third Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality

and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

Section 4.03.

This Third Supplemental Indenture may be executed in counterparts, each of which will be an original, but such counterparts

will together constitute but one and the same Third Supplemental Indenture. The exchange of copies of this Third Supplemental Indenture

and of signature pages by facsimile, .pdf transmission, email or other electronic means shall constitute effective execution and

delivery of this Third Supplemental Indenture for all purposes. Signatures of the parties hereto transmitted by facsimile, .pdf transmission,

email or other electronic means shall be deemed to be their original signatures for all purposes and shall have the same validity, legal

effect, and admissibility in evidence as an original manual signature. This Third Supplemental Indenture shall be valid, binding and enforceable

against a party only when executed and delivered by an authorized individual on behalf of such party by means of (i) any electronic

signature permitted by the federal Electronic Signatures in Global and National Commerce Act, state enactments of the Uniform Electronic

Transactions Act, and/or any other relevant electronic signatures law, including relevant provisions of the Uniform Commercial Code as

enacted in any state of the United States of America, (ii) an original manual signature or (iii) a faxed, scanned, or photocopied

manual signature.

Section 4.04.

The Base Indenture, as supplemented and amended by the First Supplemental Indenture, the Second Supplemental Indenture and

this Third Supplemental Indenture, is in all respects ratified and confirmed.

Section 4.05.

The provisions of this Third Supplemental Indenture shall become effective upon the consummation of the Merger. The Successor

Company shall deliver a written notice to the Trustee on the date of the consummation of the Merger notifying the Trustee that the Merger

has been consummated.

Section 4.06.

The recitals contained in this Third Supplemental Indenture shall be taken as the statements of the Original Company, the Successor

Company and the Guarantor. Each Trustee under the Indenture assumes no responsibility for such recitals, and makes no representations

as to the validity or sufficiency of this Third Supplemental Indenture. Notwithstanding the preceding provision of this Section 4.06,

Computershare Trust Company, National Association, hereby represents and warrants that it is the successor Trustee to the Original Trustee

under the Indenture, as a result of Computershare Trust Company, National Association acquiring the corporate trust business of the Original

Trustee.

IN WITNESS WHEREOF, the parties hereto have caused

this Third Supplemental Indenture to be duly executed and delivered, all as of the date first above written.

| |

Original Company: |

| |

|

| |

ARLINGTON ASSET INVESTMENT CORP. |

| |

|

| |

By: |

/s/ Richard E. Konzmann |

| |

Name: Richard E. Konzmann |

| |

Title: Executive Vice President, Chief Financial Officer and Treasurer |

| |

|

| |

Successor Company: |

| |

|

| |

EF MERGER SUB INC. |

| |

|

| |

By: |

/s/ Laurence Penn |

| |

Name: |

Laurence Penn |

| |

Title: |

President and Chief Executive Officer |

| |

|

| |

Guarantor: |

| |

|

| |

ELLINGTON FINANCIAL INC. |

| |

|

| |

By: |

/s/ Laurence Penn |

| |

Name: |

Laurence Penn |

| |

Title: |

President and Chief Executive Officer |

| |

Trustee: |

| |

|

| |

COMPUTERSHARE TRUST COMPANY, NATIONAL ASSOCIATION, as Trustee |

| |

|

| |

By: |

/s/ Elisabeth A. Brewster |

| |

|

Authorized Signatory |

| |

|

Vice President |

| |

Trustee: |

| |

|

| |

THE BANK OF NEW YORK MELLON, |

| |

as Trustee |

| |

|

| |

By: |

/s/ Francine Kincaid |

| |

Name: |

Francine Kincaid |

| |

Title: |

Vice President |

Exhibit 4.8

SECOND SUPPLEMENTAL INDENTURE

among

ARLINGTON ASSET INVESTMENT CORP.,

EF MERGER SUB INC.,

ELLINGTON FINANCIAL INC.

and

THE BANK OF NEW YORK MELLON, as Trustee

Dated as of December 14, 2023

SECOND SUPPLEMENTAL INDENTURE

THIS SECOND SUPPLEMENTAL INDENTURE dated as of

December 14, 2023 (this “Second Supplemental Indenture”) is entered into among Arlington Asset Investment

Corp., a Virginia corporation (the “Original Company”), EF Merger Sub Inc., a Virginia corporation (the “Successor

Company”), Ellington Financial Inc., a Delaware corporation (the “Guarantor”), and The Bank of New York

Mellon, a New York banking corporation, as trustee (the “Trustee”). All capitalized terms used but not defined in this

Second Supplemental Indenture shall have the respective meanings set forth in the Base Indenture (as defined below).

RECITALS OF THE ORIGINAL COMPANY, THE SUCCESSOR

COMPANY AND THE GUARANTOR

WHEREAS, the Original Company and the Trustee are

parties to the Indenture dated as of January 10, 2020 (the “Base Indenture”), providing for the issuance

by the Company from time to time of Securities, to be issued in one or more series;

WHEREAS, pursuant to the First Supplemental Indenture

to the Base Indenture dated as of July 15, 2021 (the “First Supplemental Indenture”), the Original Company

issued a series of Securities designated as its 6.000% Senior Notes due 2026 (the “Notes due 2026”);

WHEREAS, Article Eight of the Indenture provides

(among other things) that the Company shall not merge with any other Person, unless either the Company shall be the continuing entity,

or the successor (if other than the Company) entity shall be a Person organized and existing under the laws of the United States or a

State thereof and such successor entity shall expressly assume the due and punctual payment of the principal of (and premium or Make-Whole

Amount, if any) and any interest (including all Additional Amounts, if any, payable pursuant to Section 1011 of the Base Indenture,

according to their tenor, and the due and punctual performance and observance of all of the covenants and conditions of the Indenture

to be performed by the Company by supplemental indenture;

WHEREAS, the Agreement and Plan of Merger dated

as of May 29, 2023 among Ellington Financial Inc., a Delaware corporation, the Successor Company, the Original Company and,

solely for the limited purposes set forth therein, Ellington Financial Management LLC provides for the merger (the “Merger”)

of the Original Company with and into the Successor Company, with the Successor Company surviving the Merger;

WHEREAS, the Guarantor wishes to provide for a

full and unconditional guarantee of all Securities;

WHEREAS, pursuant to Section 901(1) of

the Indenture, without the consent of any Holders of Securities or coupons, the Company, when authorized by or pursuant to a Board Resolution,

and the Trustee, at any time and from time to time, may enter into one or more indentures supplemental to the Indenture to evidence the

succession of another Person to the Company and the assumption by any such successor of the covenants of the Company in the Indenture

and in the Securities;

WHEREAS, pursuant to Section 901(9) of

the Indenture, without the consent of any Holders of Securities or coupons, the Company, when authorized by or pursuant to a Board Resolution,

and the Trustee, at any time and from time to time, may enter into one or more indentures supplemental to the Indenture to cure any ambiguity,

to correct or supplement any provision therein which may be defective or inconsistent with any other provision therein, or to make any

other provisions with respect to matters or questions arising under the Indenture which shall not be inconsistent with the provisions

of the Indenture or to make any other changes, provided that in each case, such provisions shall not adversely affect the interests

of the Holders of Securities of any series or any related coupons in any material respect; and

WHEREAS, the Original Company, the Successor Company

and the Guarantor have duly authorized the execution and delivery of this Second Supplemental Indenture;

NOW, THEREFORE, in consideration of the premises,

agreements and obligations set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, the parties hereto hereby agree, for the equal and proportionate benefit of all Holders of the Securities, as follows:

ARTICLE I

Relation to Indenture; References

Section 1.01.

With respect to the Securities of each and every series Outstanding under the Indenture, this Second Supplemental Indenture

constitutes an integral part of the Indenture.

ARTICLE II

Assumption of Obligations

Section 2.01.

Effective upon the consummation of the Merger, and pursuant to and in accordance with Sections 801 of the Indenture, the

Successor Company hereby expressly assumes all of the obligations of the Original Company under the Indenture and all Securities, including

without limitation (i) the due and punctual payment of the principal of (and premium or Make-Whole Amount, if any) and any interest

(including all Additional Amounts, if any, payable pursuant to Section 1011 of the Indenture) on all of the Securities issued under

the Indenture that are Outstanding as of the date hereof, according to their tenor and (ii) the due and punctual performance and

observance of all of the covenants and conditions of the Indenture to be performed by the Original Company.

ARTICLE III

Guarantee

Section 3.01.

The Guarantor hereby fully, unconditionally and absolutely guarantees to the Holders of all the Securities and to the Trustee

the due and punctual payment of the principal of, and premium, if any, and interest on all the Securities and all other amounts, if any,

due and payable under all the Securities by the Company, when and as such principal, premium, if any, and interest and other amounts,

if any, shall become due and payable, whether at the Stated Maturity thereof or by declaration of acceleration thereof, call for redemption

thereof or otherwise, according to the terms of the Securities and the Indenture. The Guarantor shall be subrogated to all rights of the

Holders of the Securities and the Trustee against the Company in respect of any amounts paid by the Guarantor pursuant to the guarantee

set forth above.

ARTICLE IV

Miscellaneous

Section 4.01.

This Second Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New York

without regard to conflicts of laws principles thereof (except for Sections 5-1401 and 5-1402 of the New York General Obligations Law).

This Second Supplemental Indenture is subject to the provisions of the Trust Indenture Act that are required to be part of the Indenture

and shall, to the extent applicable, be governed by such provisions.

Section 4.02.

In case any provision in this Second Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality

and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

Section 4.03.

This Second Supplemental Indenture may be executed in counterparts, each of which will be an original, but such counterparts

will together constitute but one and the same Second Supplemental Indenture. The exchange of copies of this Second Supplemental Indenture

and of signature pages by facsimile, .pdf transmission, email or other electronic means shall constitute effective execution and

delivery of this Second Supplemental Indenture for all purposes. Signatures of the parties hereto transmitted by facsimile, .pdf transmission,

email or other electronic means shall be deemed to be their original signatures for all purposes and shall have the same validity, legal

effect, and admissibility in evidence as an original manual signature. This Second Supplemental Indenture shall be valid, binding and

enforceable against a party only when executed and delivered by an authorized individual on behalf of such party by means of (i) any

electronic signature permitted by the federal Electronic Signatures in Global and National Commerce Act, state enactments of the Uniform

Electronic Transactions Act, and/or any other relevant electronic signatures law, including relevant provisions of the Uniform Commercial

Code as enacted in any state of the United States of America, (ii) an original manual signature or (iii) a faxed, scanned, or

photocopied manual signature.

Section 4.04.

The Base Indenture, as supplemented and amended by the First Supplemental Indenture and this Second Supplemental Indenture,

is in all respects ratified and confirmed.

Section 4.05.

The provisions of this Second Supplemental Indenture shall become effective upon the consummation of the Merger. The Successor

Company shall deliver a written notice to the Trustee on the date of the consummation of the Merger notifying the Trustee that the Merger

has been consummated.

Section 4.06.

The recitals contained in this Second Supplemental Indenture shall be taken as the statements of the Original Company, the

Successor Company and the Guarantor. The Trustee under the Indenture assumes no responsibility for such recitals, and makes no representations

as to the validity or sufficiency of this Second Supplemental Indenture.

(Signature Pages Follow)

IN WITNESS WHEREOF, the parties hereto have caused

this Second Supplemental Indenture to be duly executed and delivered, all as of the date first above written.

| |

Original Company: |

| |

|

| |

ARLINGTON ASSET INVESTMENT CORP. |

| |

|

| |

By: |

/s/ Richard E. Konzmann |

| |

Name: Richard E. Konzmann |

| |

Title: Executive Vice President, Chief Financial Officer and Treasurer |

| |

|

| |

Successor Company: |

| |

|

| |

EF MERGER SUB INC. |

| |

|

| |

By: |

/s/ Laurence Penn |

| |

Name: |

Laurence Penn |

| |

Title: |

President and Chief Executive Officer |

| |

|

| |

Guarantor: |

| |

|

| |

ELLINGTON FINANCIAL INC.. |

| |

|

| |

By: |

/s/ Laurence Penn |

| |

Name: |

Laurence Penn |

| |

Title: |

Chief Executive Officer and President |

| |

Trustee: |

| |

|

| |

THE BANK OF NEW YORK MELLON, |

| |

as Trustee |

| |

|

| |

By: |

/s/ Francine Kincaid |

| |

Name: |

Francine Kincaid |

| |

Title: |

Vice President |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aaic_Sec7.00SeriesbCumulativePerpetualRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aaic_Sec8.250SeriescFixedtofloatingRateCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aaic_Sec6.000SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aaic_Sec6.75SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

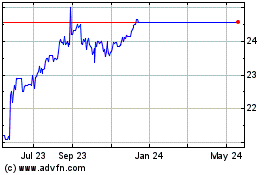

Arlington Asset Investment (NYSE:AAIC-C)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arlington Asset Investment (NYSE:AAIC-C)

Historical Stock Chart

From Feb 2024 to Feb 2025