Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive

aftermarket parts provider in North America that serves both

professional installer and do-it-yourself customers, announced its

financial results for the second quarter ended July 13, 2024.

“Our team delivered positive comparable sales growth while

navigating a challenging demand environment during the second

quarter. I would like to thank the team for their hard work and

dedication to serving our customers,” said Shane O’Kelly, president

and chief executive officer. “We continue to make progress on our

decisive actions with an increased focus on the Advance blended

box. This morning, we announced the sale of Worldpac for $1.5

billion. This transaction is a critical milestone in our turnaround

as it enables us to strengthen our balance sheet and streamline our

focus. The next chapter of our strategic and operational review

will now focus on the remaining Advance business, with the goal of

improving our sales trajectory and the productivity of all our

assets to deliver stronger returns for our shareholders.”

Second Quarter 2024 Results (1,2)

Second quarter 2024 net sales totaled $2.7 billion, which was

flat compared with the second quarter of the prior year. Comparable

store sales increased 0.4%.

The company's gross profit decreased 2.3% to $1.1 billion. Gross

profit margin was 41.5% compared with 42.5% in the second quarter

of the prior year. This was primarily due to the company's

strategic pricing investments and higher product costs.

SG&A expenses were $1.0 billion, or 38.9% of net sales

compared with 37.8% in the second quarter of 2023. This increase

was primarily due to wage investments in frontline team members and

an increase in professional fees, including costs associated with

the implementation of the company's strategic plan and the

remediation of the company’s previously-disclosed material

weaknesses. This was partially offset by a reduction in marketing

expenses.

The company's operating income was $71.8 million, or 2.7% of net

sales compared with 4.7% in the second quarter of 2023.

The company's effective tax rate was 27.5%, compared with 26.4%

in the second quarter of 2023. The company's diluted EPS was $0.75,

compared with $1.32 in the second quarter of 2023.

Net cash provided by operating activities was $87.8 million

through the second quarter of 2024 versus $167.1 million of cash

used in operating activities in the same period of the prior year.

Free cash flow through the second quarter of 2024 was an outflow of

$4.6 million compared with an outflow of $312.0 million in the same

period of the prior year.

Capital Allocation

On August 7, 2024, the company declared a regular cash dividend

of $0.25 per share to be paid on October 25, 2024, to all common

stockholders of record as of October 11, 2024.

_______________________________

(1) All comparisons are based on the same

time period in the prior year. The company calculates comparable

store sales based on the change in store or branch sales starting

once a location has been open for approximately one year and by

including e-commerce sales and excluding sales fulfilled by

distribution centers to independently owned Carquest locations.

Acquired stores are included in the company's comparable store

sales one year after acquisition. The company includes sales from

relocated stores in comparable store sales from the original date

of opening.

(2) As reported in the company’s fourth

quarter and full year 2023 earnings release, the company corrected

non-material errors in certain previously reported financials. All

comparisons are based on the corrected historical results as

presented in the company’s prior earnings release dated February

29, 2024.

Full Year 2024 Guidance

As of August 22, 2024

($ in millions, except per share data)

Low

High

Net sales

$

11,150

$

11,250

Comparable store sales (1)

(1.0

)%

0.0

%

Operating income margin

2.1

%

2.5

%

Diluted EPS

$

2.00

$

2.50

Capital expenditures

$

200

$

250

Free cash flow (2)

Minimum $100

(1)

The company calculates comparable store

sales based on the change in store or branch sales starting once a

location has been open for approximately one year and by including

e-commerce sales and excluding sales fulfilled by distribution

centers to independently owned Carquest locations. Acquired stores

are included in the company's comparable store sales one year after

acquisition. The company includes sales from relocated stores in

comparable store sales from the original date of opening.

(2)

Free cash flow is a non-GAAP measure. For

a better understanding of the company's non-GAAP adjustments, refer

to the reconciliation of non-GAAP financial measures in the

accompanying financial tables.

Investor Conference Call

The company will detail its results for the second quarter ended

July 13, 2024, via a webcast scheduled to begin at 8 a.m. Eastern

Time on Thursday, August 22, 2024. The webcast will be accessible

via the Investor Relations page of the company's website

(ir.AdvanceAutoParts.com).

To join by phone, please pre-register online for dial-in and

passcode information. Upon registering, participants will receive a

confirmation with call details and a registrant ID. While

registration is open through the live call, the company suggests

registering a day in advance or at minimum 10 minutes before the

start of the call. A replay of the conference call will be

available on the company's Investor Relations website for one

year.

About Advance Auto Parts

Advance Auto Parts, Inc. is a leading automotive aftermarket

parts provider that serves both professional installers and

do-it-yourself customers. As of July 13, 2024, Advance operated

4,776 stores and 321 Worldpac branches primarily within the United

States, with additional locations in Canada, Puerto Rico and the

U.S. Virgin Islands. The company also served 1,138 independently

owned Carquest branded stores across these locations in addition to

Mexico and various Caribbean islands. Additional information about

Advance, including employment opportunities, customer services, and

online shopping for parts, accessories and other offerings can be

found at www.AdvanceAutoParts.com.

Forward-Looking Statements

Certain statements herein are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements are usually identifiable by

words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “forecast, “guidance,” “intend,” “likely,” “may,” “plan,”

“position,” “possible,” “potential,” “probable,” “project,”

“should,” “strategy,” “will,” or similar language. All statements

other than statements of historical fact are forward-looking

statements, including, but not limited to, statements about the

company’s strategic initiatives, operational plans and objectives,

statements about the sale of the company’s Worldpac business,

including statements regarding the benefits of the sale and the

anticipated timing of closing, statements regarding expectations

for economic conditions, future business and financial performance,

as well as statements regarding underlying assumptions related

thereto. Forward-looking statements reflect the company’s views

based on historical results, current information and assumptions

related to future developments. Except as may be required by law,

the company undertakes no obligation to update any forward-looking

statements made herein. Forward-looking statements are subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those projected or implied by the

forward-looking statements. They include, among others, the

company’s ability to hire, train and retain qualified employees,

the timing and implementation of strategic initiatives,

deterioration of general macroeconomic conditions, geopolitical

conflicts, the highly competitive nature of the industry, demand

for the company’s products and services, the company’s ability to

consummate the sale of Worldpac on a timely basis or at all,

including failure to obtain the required regulatory approvals or to

satisfy the other conditions to the closing, the company’s use of

proceeds and ability to maintain credit ratings, access to

financing on favorable terms, complexities in the company’s

inventory and supply chain challenges with transforming and growing

its business. Please refer to “Item 1A. Risk Factors” of the

company’s most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission (“SEC”), as updated by the

company’s subsequent filings with the SEC, for a description of

these and other risks and uncertainties that could cause actual

results to differ materially from those projected or implied by the

forward-looking statements.

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(In thousands)

July 13, 2024

December 30, 2023

(Unaudited)

(Audited)

Assets

Current assets:

Cash and cash equivalents

$

479,418

$

503,471

Receivables, net

847,609

800,141

Inventories, net

4,903,490

4,857,702

Other current assets

229,623

215,707

Total current assets

6,460,140

6,377,021

Property and equipment, net

1,579,886

1,648,546

Operating lease right-of-use assets

2,596,201

2,578,776

Goodwill

990,266

991,743

Other intangible assets, net

577,275

593,341

Other assets

86,038

86,899

Total assets

$

12,289,806

$

12,276,326

Liabilities and

Stockholders' Equity

Current liabilities:

Accounts payable

$

4,048,321

$

4,177,974

Accrued expenses

694,970

671,237

Other current liabilities

513,483

458,194

Total current liabilities

5,256,774

5,307,405

Long-term debt

1,787,867

1,786,361

Noncurrent operating lease liabilities

2,177,074

2,215,766

Deferred income taxes

375,658

362,542

Other long-term liabilities

85,681

84,524

Total stockholders' equity

2,606,752

2,519,728

Total liabilities and stockholders’

equity

$

12,289,806

$

12,276,326

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(In thousands, except per share

data) (unaudited)

Twelve Weeks Ended

Twenty-Eight Weeks

Ended

July 13, 2024

July 15, 2023 (1)

July 13, 2024

July 15, 2023 (1)

Net sales

$

2,683,053

$

2,686,066

$

6,089,307

$

6,103,659

Cost of sales, including purchasing and

warehousing costs

1,568,745

1,545,611

3,545,924

3,501,277

Gross profit

1,114,308

1,140,455

2,543,383

2,602,382

Selling, general and administrative

expenses

1,042,557

1,014,495

2,385,610

2,378,484

Operating income

71,751

125,960

157,773

223,898

Other, net:

Interest expense

(18,668

)

(20,869

)

(43,543

)

(50,587

)

Other income, net

9,011

1,684

7,720

1,009

Total other, net

(9,657

)

(19,185

)

(35,823

)

(49,578

)

Income before provision for income

taxes

62,094

106,775

121,950

174,320

Provision for income taxes

17,103

28,198

36,947

47,420

Net income

$

44,991

$

78,577

$

85,003

$

126,900

Basic earnings per common share

$

0.75

$

1.32

$

1.43

$

2.14

Weighted-average common shares

outstanding

59,633

59,451

59,590

59,384

Diluted earnings per common share

$

0.75

$

1.32

$

1.42

$

2.13

Weighted-average common shares

outstanding

59,905

59,604

59,868

59,570

(1)

The condensed consolidated statement of

operations for the twelve and twenty-eight weeks ended July 15,

2023, reflects the correction of non-material errors the company

discovered in previously reported results.

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(In thousands) (unaudited)

Twenty-Eight Weeks

Ended

July 13, 2024

July 15, 2023 (1)

Cash flows from operating

activities:

Net income

$

85,003

$

126,900

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

167,443

162,974

Share-based compensation

27,653

26,791

(Gain) Loss and impairment of long-lived

assets

(15,645

)

859

Provision for deferred income taxes

13,634

21,497

Other, net

2,076

1,628

Net change in:

Receivables, net

(49,546

)

(97,022

)

Inventories, net

(53,472

)

(148,918

)

Accounts payable

(125,351

)

(319,785

)

Accrued expenses

33,166

118,781

Other assets and liabilities, net

2,853

(60,836

)

Net cash provided by (used in) operating

activities

87,814

(167,131

)

Cash flows from investing

activities:

Purchases of property and equipment

(92,445

)

(144,874

)

Proceeds from sales of property and

equipment

12,820

1,532

Net cash used in investing activities

(79,625

)

(143,342

)

Cash flows from financing

activities:

Borrowings under credit facilities

—

4,327,000

Payments on credit facilities

—

(4,417,000

)

Borrowings on senior unsecured notes

—

599,571

Dividends paid

(29,920

)

(179,347

)

Purchases of noncontrolling interests

(9,101

)

—

Proceeds from the issuance of common

stock

1,788

2,060

Repurchases of common stock

(4,617

)

(13,808

)

Other, net

(1,143

)

(4,531

)

Net cash (used in) provided by financing

activities

(42,993

)

313,945

Effect of exchange rate changes on

cash

10,751

949

Net (decrease) increase in cash and

cash equivalents

(24,053

)

4,421

Cash and cash equivalents,

beginning of period

503,471

270,805

Cash and cash equivalents, end of

period

$

479,418

$

275,226

(1)

The condensed consolidated statement of

cash flows for the twenty-eight weeks ended July 15, 2023, reflects

the correction of non-material errors the company discovered in

previously reported results.

Restatement of Previously Issued

Financial Statements

During the fiscal year ended December 30, 2023, the company

identified errors primarily impacting cost of sales, selling,

general and administrative costs and other income/expenses, net,

incurred in prior years but not previously recognized. The company

evaluated the errors and determined that the related impacts were

not material to the previously issued consolidated financial

statements for any prior period. A summary of the corrections to

the impacted financial statement line items in the company's

Consolidated Statement of Operations for the twelve and

twenty-eight weeks ended July 15, 2023, and the company's

Consolidated Statement of Cash Flows for the twenty-eight weeks

ended July 15, 2023, included in the company's previously filed

Annual Report on Form 10-K are presented below:

Condensed Consolidated

Statement of Operations

July 15, 2023

Twelve Weeks Ended

Twenty-Eight Weeks

Ended

(in thousands)

As Previously Reported

Adjustments

As Corrected

As Previously Reported

Adjustments

As Corrected

Cost of sales

$

1,537,997

$

7,614

$

1,545,611

$

3,484,927

$

16,350

$

3,501,277

Gross profit

1,148,069

(7,614

)

1,140,455

2,618,732

(16,350

)

2,602,382

Selling, general and administrative

expenses

1,013,701

794

1,014,495

2,394,365

(15,881

)

2,378,484

Operating income

134,368

(8,408

)

125,960

224,367

(469

)

223,898

Income before provision for income

taxes

115,183

(8,408

)

106,775

174,789

(469

)

174,320

Provision for income taxes

29,821

(1,623

)

28,198

46,776

644

47,420

Net income

$

85,362

$

(6,785

)

$

78,577

$

128,013

$

(1,113

)

$

126,900

Basic earnings per share

$

1.44

$

(0.12

)

$

1.32

$

2.16

$

(0.02

)

$

2.14

Diluted earnings per common share

$

1.43

$

(0.11

)

$

1.32

$

2.15

$

(0.02

)

$

2.13

Condensed Consolidated

Statement of Cash Flows

Twenty-Eight Weeks Ended July

15, 2023

(in thousands)

As Previously Reported

Adjustments

As Corrected

Net income

$

128,013

$

(1,113

)

$

126,900

Provision for deferred income taxes

16,249

5,248

21,497

Other, net

1,170

458

1,628

Net change in:

Receivables, net

(93,539

)

(3,483

)

(97,022

)

Inventories, net

(145,148

)

(3,770

)

(148,918

)

Accounts payable

(346,808

)

27,023

(319,785

)

Accrued expenses

120,888

(2,107

)

118,781

Other assets and liabilities, net

(36,008

)

(24,828

)

(60,836

)

Net cash used in operating activities

(164,559

)

(2,572

)

(167,131

)

Other, net (1)

(4,073

)

(458

)

(4,531

)

Net cash provided by financing

activities

314,403

(458

)

313,945

Effect of exchange rate changes on

cash

1,280

(331

)

949

Net increase in cash and cash

equivalents

7,782

(3,361

)

4,421

Cash and cash equivalents, beginning of

period

269,282

1,523

270,805

Cash and cash equivalents, end of

period

$

277,064

$

(1,838

)

$

275,226

(1)

The summary of corrections table above

inadvertently omitted disclosure for proceeds from the issuance of

common stock as follows: $2.1 million as previously reported, $0

adjustments and $2.1 million as corrected.

Reconciliation of Non-GAAP Financial

Measures

The company's financial results include certain financial

measures not derived in accordance with accounting principles

generally accepted in the United States of America (“GAAP”).

Management uses Free cash flow as a measure of its liquidity and

believes it is a useful indicator for potential investors of the

company's ability to implement growth strategies and service debt.

Free cash flow is a non-GAAP measure and should be considered in

addition to, but not as a substitute for, information contained in

the company's condensed consolidated statement of cash flows as a

measure of liquidity.

Reconciliation of

Free Cash Flow:(1)

Twenty-Eight Weeks

Ended

(in thousands)

July 13, 2024

July 15, 2023

Cash flows provided by operating

activities

$

87,814

$

(167,131

)

Purchases of property and equipment

(92,445

)

(144,874

)

Free cash flow

$

(4,631

)

$

(312,005

)

Adjusted Debt to

Adjusted EBITDAR: (1)

Four Quarters Ended

(In thousands, except adjusted debt to

adjusted EBITDAR ratio)

July 13, 2024

December 30, 2023

Total GAAP debt

$

1,787,867

$

1,786,361

Add: Operating lease liabilities

2,685,542

2,660,827

Adjusted debt

$

4,473,409

$

4,447,188

GAAP Net (loss) income

$

(12,162

)

$

29,735

Depreciation and amortization

310,923

306,454

Interest expense

81,012

88,055

Other expense, net

(12,237

)

(5,525

)

Provision for income taxes

(8,361

)

2,112

Rent expense

636,395

613,859

Share-based compensation

46,509

45,647

Other nonrecurring charges (2)

25,757

12,419

Transformation related charges

40,293

29,719

Adjusted EBITDAR

$

1,108,129

$

1,122,475

Adjusted Debt to Adjusted

EBITDAR

4.0

4.0

(1)

The four quarters ended July 13, 2024,

includes the correction of non-material errors the company

discovered in previously reported results.

(2)

The adjustments to the four quarters ended

July 13, 2024, and December 30, 2023, include expenses associated

with the company's material weakness remediation efforts and

professional executive recruiting fees.

NOTE: Management believes its Adjusted Debt to Adjusted EBITDAR

ratio (“leverage ratio”) is a key financial metric for debt

securities, as reviewed by rating agencies, and believes its debt

levels are best analyzed using this measure. The company’s goal is

to maintain an investment grade rating. The company's credit rating

directly impacts the interest rates on borrowings under its

existing credit facility and could impact the company's ability to

obtain additional funding. If the company was unable to maintain

its investment grade rating, this could negatively impact future

performance and limit growth opportunities. Similar measures are

utilized in the calculation of the financial covenants and ratios

contained in the company's financing arrangements. The leverage

ratio calculated by the company is a non-GAAP measure and should

not be considered a substitute for debt to net earnings, as

determined in accordance with GAAP. The company adjusts the

calculation to remove rent expense and to add back the company’s

existing operating lease liabilities related to their right-of-use

assets to provide a more meaningful comparison with the company’s

peers and to account for differences in debt structures and leasing

arrangements. The company’s calculation of its leverage ratio may

not be calculated in the same manner as other companies, and thus

may not be comparable to similarly titled measures used by other

companies.

Store Information

During the twenty-eight weeks ended July 13, 2024, 16 stores and

branches were opened and 26 were closed, resulting in a total of

5,097 stores and branches as of July 13, 2024, compared with a

total of 5,107 stores and branches as of December 30, 2023.

The below table summarizes the changes in the number of

company-operated store and branch locations during the twelve and

twenty-eight weeks ended July 13, 2024:

Twelve Weeks Ended

AAP

CARQUEST

WORLDPAC (1)

Total

April 20, 2024

4,483

294

320

5,097

New

7

1

1

9

Closed

(6

)

(3

)

—

(9

)

July 13, 2024

4,484

292

321

5,097

Twenty-Eight Weeks

Ended

AAP

CARQUEST

WORLDPAC (1)

Total

December 30, 2023

4,484

302

321

5,107

New

14

1

1

16

Closed

(15

)

(10

)

(1

)

(26

)

Converted

1

(1

)

—

—

July 13, 2024

4,484

292

321

5,097

(1)

Certain converted Autopart International

("AI") locations will remain branded as AI going forward.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821458253/en/

Investor Relations Contact: Lavesh Hemnani T: (919)

227-5466 E: invrelations@advanceautoparts.com Media Contact:

Darryl Carr T: (984) 389-7207 E:

AAPCommunications@advance-auto.com

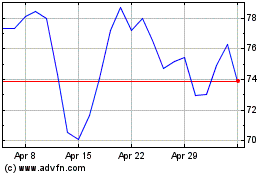

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Dec 2023 to Dec 2024