0000874761FALSE11/2/202300008747612023-11-022023-11-020000874761us-gaap:CommonStockMember2023-11-022023-11-020000874761aes:CorporateUnitsMember2023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________________________________________________________

FORM 8-K

________________________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 2, 2023

_____________________________________________________________________________________________________

THE AES CORPORATION

(Exact name of registrant as specified in its charter)

_________________________________________________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-12291 | | 54-1163725 |

| (State or other jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

4300 Wilson Boulevard

Arlington, Virginia 22203

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(703) 522-1315

NOT APPLICABLE

(Former name or former address, if changed since last report)

_________________________________________________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | AES | New York Stock Exchange |

| Corporate Units | AESC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

_________________________________________________________________________________________________________________

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, The AES Corporation (“AES” or the “Company”) issued a press release announcing its financial results for the quarter and year ended September 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 attached hereto and is incorporated by reference herein. Such information is furnished pursuant to Item 2.02 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general incorporation language in such filing.

Item 7.01 Regulation FD Disclosure.

On November 2, 2023, AES issued a press release announcing its financial results for the quarter ended September 30, 2023, its most recent guidance and provided additional forward-looking information. A copy of the press release is being furnished as Exhibit 99.1 attached hereto and is incorporated by reference herein. Such information is furnished pursuant to Item 7.01 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

Safe Harbor Disclosure

This news release contains forward-looking statements within the meaning of the Securities Act and of the Exchange Act. Such forward-looking statements include, but are not limited to, those related to future earnings, growth, and financial and operating performance. Forward-looking statements are not intended to be a guarantee of future results, but instead constitute AES’ current expectations based on reasonable assumptions. Forecasted financial information is based on certain material assumptions. These assumptions include, but are not limited to, our expectations regarding accurate projections of future interest rates, commodity price and foreign currency pricing, continued normal levels of operating performance and electricity volume at our distribution companies and operational performance at our generation businesses consistent with historical levels, as well as execution of PPAs, conversion of our backlog and growth investments at normalized investment levels, rates of return consistent with prior experience and the COVID-19 pandemic.

Actual results could differ materially from those projected in our forward-looking statements due to risks, uncertainties and other factors. Important factors that could affect actual results are discussed in AES’ filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the risks discussed under Item 1A “Risk Factors” and Item 7: Management’s Discussion & Analysis in AES’ 2022 Annual Report on Form 10-K and in subsequent reports filed with the SEC. Readers are encouraged to read AES’ filings to learn more about the risk factors associated with AES’ business. AES undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Any Stockholder who desires a copy of the Company’s 2022 Annual Report on Form 10-K filed March 1, 2023, or subsequent filings with the SEC, may obtain a copy (excluding the exhibits thereto) without charge by addressing a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203. Exhibits also may be requested, but a charge equal to the reproduction cost thereof will be made. A copy of the Annual Report on Form 10-K may also be obtained by visiting the Company’s website at www.aes.com.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit No. Description

99.1 Press Release issued by The AES Corporation, dated November 2, 2023

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf of the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | THE AES CORPORATION |

| | | |

| Date: | November 2, 2023 | By: | /s/ Stephen Coughlin |

| | Name: | Stephen Coughlin |

| | Title: | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| Press Release issued by The AES Corporation, dated November 2, 2023 |

| |

| |

| |

| |

| |

| |

| 101 | Inline XBRL Document Set for the Cover Page from this Current Report on Form 8-K, formatted as Inline XBRL |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Press Release

Investor Contact: Susan Harcourt 703-682-1204, susan.harcourt@aes.com

Media Contact: Amy Ackerman 703-682-6399, amy.ackerman@aes.com

AES Expects Full Year 2023 Adjusted EPS to be in the Top Half of Guidance Range of $1.65 to $1.75

Remains on Track to Deliver on Strategic and Financial Objectives

Strategic Accomplishments

•Signed new contracts for 3.7 GW of renewables in year-to-date 2023

•On track to complete construction of 3.5 GW of renewables in 2023

•Agreed to minority sell-downs of businesses in the Dominican Republic and Panama for $190 million in asset sale proceeds, securing full year 2023 asset sales target

•Awarded up to $2.4 billion of grant funding by the US Department of Energy for two green hydrogen hubs with AES participation

Q3 2023 Financial Highlights

•Q3 2023 Diluted EPS of $0.32, compared to $0.59 in Q3 2022

•Q3 2023 Adjusted EPS1 of $0.60, compared to $0.63 in Q3 2022

•Q3 2023 Net Income of $291 million, compared to $446 million in Q3 2022

•Q3 2023 Adjusted EBITDA with Tax Attributes2,3 of $1,008 million, compared to $991 million in Q3 2022

◦Q3 2023 Adjusted EBITDA2 of $990 million, compared to $931 million in Q3 2022

Financial Position and Outlook

•With year-to-date Adjusted EPS1 of $1.03, now expect full year Adjusted EPS1 to be in top half of guidance range of $1.65 to $1.75

◦Reaffirming annualized Adjusted EPS1 growth target of 7% to 9% through 2025, off a base year of 2020

•Reaffirming 2023 guidance for Adjusted EBITDA2 of $2,600 to $2,900 million

◦Reaffirming annualized growth target2 of 17% to 20% excluding the Energy Infrastructure SBU through 2027, off a base of 2023 guidance

ARLINGTON, Va., November 2, 2023 – The AES Corporation (NYSE: AES) today reported financial results for the quarter ended September 30, 2023.

"We had a strong third quarter across the board and are on track to deliver on all of our financial and strategic objectives," said Andrés Gluski, AES President and Chief Executive Officer. "We fully expect to complete construction of 3.5 GW of new renewables this year, which is more than double compared to last year.

1 Adjusted EPS is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EPS and a description of the adjustments to reconcile Adjusted EPS to Diluted EPS for the quarter and nine months ended September 30, 2023. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EPS guidance without unreasonable effort.

2 Adjusted EBITDA is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EBITDA and a description of the adjustments to reconcile Adjusted EBITDA to Net Income for the quarter and nine months ended September 30, 2023. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EBITDA guidance without unreasonable effort.

3 Pre-tax effect of Production Tax Credits, Investment Tax Credits, and depreciation tax expense allocated to tax equity investors.

Demand for renewables with long-term contracts remains exceptionally strong across the sector, and particularly from our primary customers, large technology companies and data centers. As a result of this demand, we have signed a total of 3.7 GW of contracts for new renewables so far this year and expect to sign at least 5 GW before the end of the year."

"We expect to be in the top half of our Adjusted EPS4 guidance range for 2023 and we are reaffirming all of our short- and long-term financial guidance metrics. Our hedging programs and low-risk commercial structure ensure that we continue to have limited exposure to interest rates," said Stephen Coughlin, AES Executive Vice President and Chief Financial Officer. "We have already secured our asset sale proceeds target and external financing needs for the year, further strengthening our balance sheet. Additionally, we are accelerating and increasing our asset sale program to eliminate any need for new equity until at least 2026."

Q3 2023 Financial Results

Third quarter 2023 Net Income was $291 million, a decrease of $155 million compared to third quarter 2022. This decrease is the result of lower contributions from LNG transactions versus 2022 at the Energy Infrastructure Strategic Business Unit (SBU), partially offset by favorable contributions at the Utilities, Renewables, and New Energy Technologies SBUs.

Third quarter 2023 Adjusted EBITDA5 (a non-GAAP financial measure) was $990 million, an increase of $59 million compared to third quarter 2022, primarily driven by higher contributions at the Utilities SBU, favorable weather conditions and new businesses at the Renewables SBU, higher revenues under a PPA termination agreement at the Energy Infrastructure SBU, and improved margins at Fluence at the New Energy Technologies SBU. These positive drivers were partially offset by favorable LNG transactions in 2022 at the Energy Infrastructure SBU.

During the third quarter of 2023, the Company realized Tax Attributes6 of $18 million, a decrease of $42 million compared to third quarter 2022.

Third quarter 2023 Diluted Earnings Per Share from Continuing Operations (Diluted EPS) was $0.32, a decrease of $0.27 compared to third quarter 2022, primarily reflecting higher long-lived asset impairments in 2023 and lower earnings at the Energy Infrastructure SBU mainly due to unrealized foreign currency losses and favorable LNG transactions in 2022. These negative drivers were partially offset by higher contributions at the Utilities SBU due to the 2022 recognition of previously deferred fuel and energy purchases and favorable

4 Adjusted EPS is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EPS and a description of the adjustments to reconcile Adjusted EPS to Diluted EPS for the quarter and nine months ended September 30, 2023. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EPS guidance without unreasonable effort.

5 Adjusted EBITDA is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EBITDA and a description of the adjustments to reconcile Adjusted EBITDA to Net Income for the quarter and nine months ended September 30, 2023. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EBITDA guidance without unreasonable effort.

6 Pre-tax effect of Production Tax Credits, Investment Tax Credits, and depreciation tax expense allocated to tax equity investors.

weather conditions and new businesses at the Renewables SBU.

Third quarter 2023 Adjusted Earnings Per Share7 (Adjusted EPS, a non-GAAP financial measure) was $0.60, a decrease of $0.03, compared to third quarter 2022, mainly driven by lower contributions from the Energy Infrastructure SBU, higher Parent interest, and a higher adjusted tax rate, partially offset by higher contributions at the Utilities SBU.

Strategic Accomplishments

•As of today, the Company’s backlog, which consists of projects with signed contracts, but which are not yet operational, is 13,138 MW, including 5,761 MW under construction.

•In year-to-date 2023, the Company completed the construction or acquisition of 1,314 MW of wind, solar and energy storage and expects to complete a total of 3.5 GW by year-end 2023.

•In year-to-date 2023, the Company has signed 3,740 MW of contracts for new renewables.

•In September 2023, the Company agreed to minority sell-downs of its businesses in the Dominican Republic and Panama, for a total of $190 million in asset sale proceeds.

Guidance and Expectations7,8

The Company is reaffirming its 2023 guidance for Adjusted EBITDA8 of $2,600 to $2,900 million, and its expectation for annualized growth in Adjusted EBITDA8 of 3% to 5% through 2027, from a base of its reaffirmed 2023 guidance. Excluding the Company's Energy Infrastructure SBU, annualized growth in Adjusted EBITDA8 is expected to be 17% to 20% through 2027, from a base of 2023 guidance.

The Company now expects full year 2023 Adjusted EPS7 to be in the top half of the guidance range of $1.65 to $1.75. Growth in 2023 is expected to be primarily driven by new renewables expected to come online. This growth is expected to be partially offset by lower margins from the Company's LNG business, due to normalization of LNG prices and the roll-off of a gas supply contract, lower contract margins in Chile, and higher interest expense in Colombia.

The Company is reaffirming its annualized growth target for Adjusted EPS7 of 7% to 9% through 2025, from a base year of 2020. The Company is also reaffirming its annualized growth target for Adjusted EPS7 of 6% to 8% through 2027, from a base of its reaffirmed 2023 guidance of $1.65 to $1.75.

The Company's 2023 guidance is based on foreign currency and commodity forward curves as of September 30, 2023.

7 Adjusted EPS is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EPS and a description of the adjustments to reconcile Adjusted EPS to Diluted EPS for the quarter and nine months ended September 30, 2023. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EPS guidance without unreasonable effort.

8 Adjusted EBITDA is a non-GAAP financial measure. See attached "Non-GAAP Measures" for definition of Adjusted EBITDA and a description of the adjustments to reconcile Adjusted EBITDA to Net Income for the quarter and nine months ended September 30, 2023. The Company is not able to provide a corresponding GAAP equivalent or reconciliation for its Adjusted EBITDA guidance without unreasonable effort.

Non-GAAP Financial Measures

See Non-GAAP Measures for definitions of Adjusted Earnings Per Share, Adjusted Pre-Tax Contribution, and Adjusted EBITDA, as well as reconciliations to the most comparable GAAP financial measures.

Attachments

Condensed Consolidated Statements of Operations, Segment Information, Condensed Consolidated Balance Sheets, Condensed Consolidated Statements of Cash Flows, Non-GAAP Financial Measures and Parent Financial Information.

Conference Call Information

AES will host a conference call on Friday, November 3, 2023 at 10:00 a.m. Eastern Time (ET). Interested parties may listen to the teleconference by dialing 1-833-470-1428 at least ten minutes before the start of the call. International callers should dial +1-404-975-4839. The Participant Access Code for this call is 309600. Internet access to the conference call and presentation materials will be available on the AES website at www.aes.com by selecting “Investors” and then “Presentations and Webcasts.”

A webcast replay, as well as a replay in downloadable MP3 format, will be accessible at www.aes.com beginning shortly after the completion of the call.

About AES

The AES Corporation (NYSE: AES) is a Fortune 500 global energy company accelerating the future of energy. Together with our many stakeholders, we're improving lives by delivering the greener, smarter energy solutions the world needs. Our diverse workforce is committed to continuous innovation and operational excellence, while partnering with our customers on their strategic energy transitions and continuing to meet their energy needs today. For more information, visit www.aes.com.

Safe Harbor Disclosure

This news release contains forward-looking statements within the meaning of the Securities Act of 1933 and of the Securities Exchange Act of 1934. Such forward-looking statements include, but are not limited to, those related to future earnings, growth and financial and operating performance. Forward-looking statements are not intended to be a guarantee of future results, but instead constitute AES’ current expectations based on reasonable assumptions. Forecasted financial information is based on certain material assumptions. These assumptions include, but are not limited to, our expectations regarding accurate projections of future interest rates, commodity price and foreign currency pricing, continued normal levels of operating performance and electricity volume at our distribution companies and operational performance at our generation businesses

consistent with historical levels, as well as the execution of PPAs, conversion of our backlog and growth investments at normalized investment levels, rates of return consistent with prior experience and the COVID-19 pandemic.

Actual results could differ materially from those projected in our forward-looking statements due to risks, uncertainties and other factors. Important factors that could affect actual results are discussed in AES’ filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the risks discussed under Item 1A: “Risk Factors” and Item 7: "Management’s Discussion & Analysis" in AES’ Annual Report on Form 10-K and in subsequent reports filed with the SEC. Readers are encouraged to read AES’ filings to learn more about the risk factors associated with AES’ business. AES undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except where required by law.

Any Stockholder who desires a copy of the Company’s 2022 Annual Report on Form 10-K filed March 1, 2023 with the SEC may obtain a copy (excluding the exhibits thereto) without charge by addressing a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203. Exhibits also may be requested, but a charge equal to the reproduction cost thereof will be made. A copy of the Annual Report on Form 10-K may be obtained by visiting the Company’s website at www.aes.com.

Website Disclosure

AES uses its website, including its quarterly updates, as channels of distribution of Company information. The information AES posts through these channels may be deemed material. Accordingly, investors should monitor our website, in addition to following AES' press releases, quarterly SEC filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about AES when you enroll your e-mail address by visiting the "Subscribe to Alerts" page of AES' Investors website. The contents of AES' website, including its quarterly updates, are not, however, incorporated by reference into this release.

THE AES CORPORATION

Condensed Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in millions, except per share amounts) |

| Revenue: | | | | | | | |

| Non-Regulated | $ | 2,571 | | | $ | 2,651 | | | $ | 7,051 | | | $ | 6,944 | |

| Regulated | 863 | | | 976 | | | 2,649 | | | 2,613 | |

| Total revenue | 3,434 | | | 3,627 | | | 9,700 | | | 9,557 | |

| Cost of Sales: | | | | | | | |

| Non-Regulated | (1,813) | | | (1,839) | | | (5,392) | | | (5,237) | |

| Regulated | (703) | | | (896) | | | (2,298) | | | (2,335) | |

| Total cost of sales | (2,516) | | | (2,735) | | | (7,690) | | | (7,572) | |

| Operating margin | 918 | | | 892 | | | 2,010 | | | 1,985 | |

| General and administrative expenses | (64) | | | (51) | | | (191) | | | (149) | |

| Interest expense | (326) | | | (276) | | | (966) | | | (813) | |

| Interest income | 144 | | | 100 | | | 398 | | | 270 | |

| Loss on extinguishment of debt | — | | | (1) | | | (1) | | | (8) | |

| Other expense | (12) | | | (10) | | | (38) | | | (51) | |

| Other income | 12 | | | 4 | | | 36 | | | 80 | |

| Gain (loss) on disposal and sale of business interests | — | | | 1 | | | (4) | | | — | |

| | | | | | | |

| Asset impairment expense | (158) | | | (50) | | | (352) | | | (533) | |

| Foreign currency transaction gains (losses) | (100) | | | 8 | | | (209) | | | (60) | |

| | | | | | | |

| INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND EQUITY IN EARNINGS OF AFFILIATES | 414 | | | 617 | | | 683 | | | 721 | |

| Income tax expense | (109) | | | (145) | | | (179) | | | (186) | |

| Net equity in losses of affiliates | (14) | | | (26) | | | (43) | | | (54) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| NET INCOME | 291 | | | 446 | | | 461 | | | 481 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Less: Net income attributable to noncontrolling interests and redeemable stock of subsidiaries | (60) | | | (25) | | | (118) | | | (124) | |

| NET INCOME ATTRIBUTABLE TO THE AES CORPORATION | $ | 231 | | | $ | 421 | | | $ | 343 | | | $ | 357 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| BASIC EARNINGS PER SHARE: | | | | | | | |

| | | | | | | |

| | | | | | | |

| NET INCOME ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 0.34 | | | $ | 0.63 | | | $ | 0.51 | | | $ | 0.53 | |

| DILUTED EARNINGS PER SHARE: | | | | | | | |

| | | | | | | |

| | | | | | | |

| NET INCOME ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | $ | 0.32 | | | $ | 0.59 | | | $ | 0.48 | | | $ | 0.50 | |

| DILUTED SHARES OUTSTANDING | 712 | | | 711 | | | 712 | | | 711 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| THE AES CORPORATION |

| Strategic Business Unit (SBU) Information |

| (Unaudited) |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| REVENUE | | | | | | | |

| Renewables SBU | $ | 708 | | | $ | 532 | | | $ | 1,744 | | | $ | 1,407 | |

| Utilities SBU | 880 | | | 994 | | | 2,703 | | | 2,674 | |

| Energy Infrastructure SBU | 1,861 | | | 2,126 | | | 5,239 | | | 5,553 | |

| New Energy Technologies SBU | — | | | — | | | 75 | | | 2 | |

| Corporate and Other | 29 | | | 24 | | | 96 | | | 81 | |

| Eliminations | (44) | | | (49) | | | (157) | | | (160) | |

| Total Revenue | $ | 3,434 | | | $ | 3,627 | | | $ | 9,700 | | | $ | 9,557 | |

THE AES CORPORATION

Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| September 30, 2023 | | December 31,

2022 |

| (in millions, except share and per share data) |

| ASSETS | | | |

| CURRENT ASSETS | | | |

| Cash and cash equivalents | $ | 1,765 | | | $ | 1,374 | |

| Restricted cash | 365 | | | 536 | |

| Short-term investments | 538 | | | 730 | |

| Accounts receivable, net of allowance for doubtful accounts of $9 and $5, respectively | 1,725 | | | 1,799 | |

| Inventory | 798 | | | 1,055 | |

| Prepaid expenses | 161 | | | 98 | |

| Other current assets | 1,472 | | | 1,533 | |

| Current held-for-sale assets | 493 | | | 518 | |

| Total current assets | 7,317 | | | 7,643 | |

| NONCURRENT ASSETS | | | |

| Property, Plant and Equipment: | | | |

| Land | 492 | | | 470 | |

| Electric generation, distribution assets and other | 27,998 | | | 26,599 | |

| Accumulated depreciation | (8,602) | | | (8,651) | |

| Construction in progress | 7,647 | | | 4,621 | |

| Property, plant and equipment, net | 27,535 | | | 23,039 | |

| Other Assets: | | | |

| Investments in and advances to affiliates | 894 | | | 952 | |

| Debt service reserves and other deposits | 205 | | | 177 | |

| Goodwill | 362 | | | 362 | |

| Other intangible assets, net of accumulated amortization of $486 and $434, respectively | 2,290 | | | 1,841 | |

| Deferred income taxes | 428 | | | 319 | |

| | | |

| Loan receivable, net of allowance of $24 and $26, respectively | 990 | | | 1,051 | |

| Other noncurrent assets, net of allowance of $16 and $51, respectively | 3,140 | | | 2,979 | |

| | | |

| Total other assets | 8,309 | | | 7,681 | |

| TOTAL ASSETS | $ | 43,161 | | | $ | 38,363 | |

| LIABILITIES AND EQUITY | | | |

| CURRENT LIABILITIES | | | |

| Accounts payable | $ | 1,641 | | | $ | 1,730 | |

| Accrued interest | 379 | | | 249 | |

| Accrued non-income taxes | 269 | | | 249 | |

| Accrued and other liabilities | 2,442 | | | 2,151 | |

| Recourse debt | 700 | | | — | |

| Non-recourse debt, including $1,015 and $416, respectively, related to variable interest entities | 3,060 | | | 1,758 | |

| Current held-for-sale liabilities | 328 | | | 354 | |

| Total current liabilities | 8,819 | | | 6,491 | |

| NONCURRENT LIABILITIES | | | |

| Recourse debt | 4,864 | | | 3,894 | |

| Non-recourse debt, including $1,781 and $2,295, respectively, related to variable interest entities | 18,767 | | | 17,846 | |

| Deferred income taxes | 1,257 | | | 1,139 | |

| | | |

| Other noncurrent liabilities | 2,775 | | | 3,168 | |

| | | |

| Total noncurrent liabilities | 27,663 | | | 26,047 | |

| Commitments and Contingencies | | | |

| Redeemable stock of subsidiaries | 1,423 | | | 1,321 | |

| EQUITY | | | |

| THE AES CORPORATION STOCKHOLDERS’ EQUITY | | | |

Preferred stock (without par value, 50,000,000 shares authorized; 1,043,050 issued and outstanding at September 30, 2023 and December 31, 2022) | 838 | | | 838 | |

| Common stock ($0.01 par value, 1,200,000,000 shares authorized; 819,051,591 issued and 669,629,035 outstanding at September 30, 2023 and 818,790,001 issued and 668,743,464 outstanding at December 31, 2022) | 8 | | | 8 | |

| Additional paid-in capital | 6,449 | | | 6,688 | |

| Accumulated deficit | (1,292) | | | (1,635) | |

| Accumulated other comprehensive loss | (1,410) | | | (1,640) | |

| Treasury stock, at cost (149,422,556 and 150,046,537 shares at September 30, 2023 and December 31, 2022, respectively) | (1,814) | | | (1,822) | |

| Total AES Corporation stockholders’ equity | 2,779 | | | 2,437 | |

| NONCONTROLLING INTERESTS | 2,477 | | | 2,067 | |

| Total equity | 5,256 | | | 4,504 | |

| TOTAL LIABILITIES AND EQUITY | $ | 43,161 | | | $ | 38,363 | |

THE AES CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in millions) | | (in millions) |

| OPERATING ACTIVITIES: | | | | | | | |

| Net income | $ | 291 | | | $ | 446 | | | $ | 461 | | | $ | 481 | |

| Adjustments to net income: | | | | | | | |

| Depreciation and amortization | 286 | | | 266 | | | 836 | | | 800 | |

| Loss on disposal and sale of business interests | — | | | (1) | | | 4 | | | — | |

| Impairment expense | 159 | | | 50 | | | 358 | | | 533 | |

| Deferred income taxes | 17 | | | 43 | | | (102) | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Loss of affiliates, net of dividends | 18 | | | 26 | | | 47 | | | 78 | |

| Emissions allowance expense | 72 | | | 80 | | | 211 | | | 319 | |

| Loss on realized/unrealized foreign currency | 113 | | | 25 | | | 184 | | | 45 | |

| Other | 50 | | | (36) | | | 150 | | | (1) | |

| Changes in operating assets and liabilities: | | | | | | | |

| (Increase) decrease in accounts receivable | (44) | | | (147) | | | 16 | | | (409) | |

| (Increase) decrease in inventory | (23) | | | (134) | | | 253 | | | (361) | |

| (Increase) decrease in prepaid expenses and other current assets | 5 | | | 71 | | | 76 | | | (116) | |

| (Increase) decrease in other assets | (78) | | | 157 | | | (4) | | | 251 | |

| Increase (decrease) in accounts payable and other current liabilities | 118 | | | (43) | | | (187) | | | 108 | |

| Increase (decrease) in income tax payables, net and other tax payables | 18 | | | (17) | | | (67) | | | (131) | |

| Increase (decrease) in deferred income | 8 | | | (11) | | | 50 | | | 48 | |

| Increase (decrease) in other liabilities | 112 | | | 9 | | | 23 | | | 4 | |

| Net cash provided by operating activities | 1,122 | | | 784 | | | 2,309 | | | 1,649 | |

| INVESTING ACTIVITIES: | | | | | | | |

| Capital expenditures | (1,899) | | | (1,052) | | | (5,295) | | | (2,711) | |

| Acquisitions of business interests, net of cash and restricted cash acquired | (21) | | | (7) | | | (311) | | | (114) | |

| Proceeds from the sale of business interests, net of cash and restricted cash sold | — | | | — | | | 98 | | | 1 | |

| | | | | | | |

| Sale of short-term investments | 296 | | | 309 | | | 1,002 | | | 654 | |

| Purchase of short-term investments | (144) | | | (397) | | | (764) | | | (1,091) | |

| Contributions and loans to equity affiliates | (35) | | | (33) | | | (147) | | | (202) | |

| | | | | | | |

| | | | | | | |

| Affiliate repayments and returns of capital | — | | | 71 | | | — | | | 71 | |

| Purchase of emissions allowances | (46) | | | (122) | | | (161) | | | (415) | |

| Other investing | (74) | | | (11) | | | (95) | | | (18) | |

| Net cash used in investing activities | (1,923) | | | (1,242) | | | (5,673) | | | (3,825) | |

| FINANCING ACTIVITIES: | | | | | | | |

| Borrowings under the revolving credit facilities and commercial paper program | 17,265 | | | 1,114 | | | 33,981 | | | 4,214 | |

| Repayments under the revolving credit facilities and commercial paper program | (16,359) | | | (513) | | | (32,168) | | | (2,782) | |

| Issuance of recourse debt | — | | | 200 | | | 1,400 | | | 200 | |

| Repayments of recourse debt | — | | | — | | | — | | | (29) | |

| Issuance of non-recourse debt | 327 | | | 422 | | | 1,784 | | | 3,554 | |

| Repayments of non-recourse debt | (318) | | | (303) | | | (1,262) | | | (1,772) | |

| Payments for financing fees | (9) | | | (45) | | | (76) | | | (83) | |

| Purchases under supplier financing arrangements | 489 | | | 126 | | | 1,307 | | | 299 | |

| Repayments of obligations under supplier financing arrangements | (237) | | | (100) | | | (1,099) | | | (234) | |

| Distributions to noncontrolling interests | (26) | | | (36) | | | (173) | | | (129) | |

| Acquisitions of noncontrolling interests | (11) | | | (1) | | | (12) | | | (541) | |

| Contributions from noncontrolling interests | 45 | | | 94 | | | 63 | | | 122 | |

| Sales to noncontrolling interests | 182 | | | 107 | | | 371 | | | 336 | |

| Issuance of preferred shares in subsidiaries | — | | | — | | | 3 | | | 60 | |

| | | | | | | |

| Dividends paid on AES common stock | (111) | | | (105) | | | (333) | | | (316) | |

| Payments for financed capital expenditures | (1) | | | (14) | | | (8) | | | (23) | |

| | | | | | | |

| | | | | | | |

| Other financing | (25) | | | (7) | | | (38) | | | (13) | |

| Net cash provided by financing activities | 1,211 | | | 939 | | | 3,740 | | | 2,863 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (71) | | | (26) | | | (108) | | | (44) | |

| Increase in cash, cash equivalents and restricted cash of held-for-sale businesses | (14) | | | (72) | | | (20) | | | (93) | |

| Total increase in cash, cash equivalents and restricted cash | 325 | | | 383 | | | 248 | | | 550 | |

| Cash, cash equivalents and restricted cash, beginning | 2,010 | | | 1,651 | | | 2,087 | | | 1,484 | |

| Cash, cash equivalents and restricted cash, ending | $ | 2,335 | | | $ | 2,034 | | | $ | 2,335 | | | $ | 2,034 | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | |

| Cash payments for interest, net of amounts capitalized | $ | 223 | | | $ | 231 | | | $ | 735 | | | $ | 654 | |

| Cash payments for income taxes, net of refunds | 67 | | | 62 | | | 267 | | | 203 | |

| | | | | | | |

| | | | | | | |

| SCHEDULE OF NONCASH INVESTING AND FINANCING ACTIVITIES: | | | | | | | |

| | | | | | | |

| Initial recognition of contingent consideration for acquisitions (see Note 18) | $ | (3) | | | (15) | | | 215 | | | 15 | |

| Noncash recognition of new operating and financing leases | $ | 16 | | | 35 | | | 187 | | | 129 | |

| Noncash contributions from noncontrolling interests | $ | 30 | | | — | | | 60 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED EBITDA, ADJUSTED PTC AND ADJUSTED EPS

EBITDA is defined as earnings before interest income and expense, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding the impact of NCI and interest, taxes, depreciation, and amortization of our equity affiliates, adding back interest income recognized under service concession arrangements, and excluding gains or losses of both consolidated entities and entities accounted for under the equity method due to (a) unrealized gains or losses related to derivative transactions and equity securities; (b) unrealized foreign currency gains or losses; (c) gains, losses, benefits and costs associated with dispositions and acquisitions of business interests, including early plant closures, and gains and losses recognized at commencement of sales-type leases; (d) losses due to impairments; (e) gains, losses and costs due to the early retirement of debt; and (f) net gains at Angamos, one of our businesses in the Energy Infrastructure SBU, associated with the early contract terminations with Minera Escondida and Minera Spence. Adjusted EBITDA with Tax Attributes is defined as Adjusted EBITDA, adding back the pre-tax effect of Production Tax Credits ("PTCs"), Investment Tax Credits ("ITCs"), and depreciation tax expense allocated to tax equity investors.

The GAAP measure most comparable to EBITDA, Adjusted EBITDA, and Adjusted EBITDA with Tax Attributes is net income. We believe that EBITDA, Adjusted EBITDA, and Adjusted EBITDA with Tax Attributes better reflect the underlying business performance of the Company. Adjusted EBITDA is the most relevant measure considered in the Company’s internal evaluation of the financial performance of its segments. Factors in this determination include the variability due to unrealized gains or losses related to derivative transactions or equity securities remeasurement, unrealized foreign currency gains or losses, losses due to impairments, strategic decisions to dispose of or acquire business interests or retire debt, the non-recurring nature of the impact of the early contract terminations at Angamos, and the variability of allocations of earnings to tax equity investors, which affect results in a given period or periods. In addition, each of these metrics represent the business performance of the Company before the application of statutory income tax rates and tax adjustments, including the effects of tax planning, corresponding to the various jurisdictions in which the Company operates. EBITDA, Adjusted EBITDA, and Adjusted EBITDA with Tax Attributes should not be construed as alternatives to net income, which is determined in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| Reconciliation of Adjusted EBITDA (in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 291 | | | $ | 446 | | | $ | 461 | | | $ | 481 | |

| Income tax expense (benefit) | 109 | | | 145 | | | 179 | | | 186 | |

| Interest expense | 326 | | | 276 | | | 966 | | | 813 | |

| Interest income | (144) | | | (100) | | | (398) | | | (270) | |

| Depreciation and amortization | 286 | | | 266 | | | 836 | | | 800 | |

| EBITDA | $ | 868 | | | $ | 1,033 | | | $ | 2,044 | | | $ | 2,010 | |

| | | | | | | |

Less: Adjustment for noncontrolling interests and redeemable stock of subsidiaries (1) | (183) | | | (174) | | | (508) | | | (486) | |

| Less: Income tax expense (benefit), interest expense (income) and depreciation and amortization from equity affiliates | 27 | | | 36 | | | 93 | | | 93 | |

| Interest income recognized under service concession arrangements | 18 | | | 19 | | | 54 | | | 58 | |

| Unrealized derivative and equity securities losses (gains) | 10 | | | (8) | | | 3 | | | — | |

| Unrealized foreign currency losses | 97 | | | 3 | | | 161 | | | 23 | |

| Disposition/acquisition losses | 8 | | | 4 | | | 21 | | | 36 | |

| Impairment losses | 145 | | | 17 | | | 318 | | | 497 | |

| Loss on extinguishment of debt | — | | | 1 | | | 1 | | | 7 | |

| | | | | | | |

| Adjusted EBITDA | $ | 990 | | | $ | 931 | | | $ | 2,187 | | | $ | 2,238 | |

| Tax attributes allocated to tax equity investors | 18 | | | 60 | | | 69 | | | 109 | |

Adjusted EBITDA with Tax Attributes (2) | $ | 1,008 | | | $ | 991 | | | $ | 2,256 | | | $ | 2,347 | |

_______________________________

(1) The allocation of earnings to tax equity investors from both consolidated entities and equity affiliates is removed from Adjusted EBITDA.

(2) Adjusted EBITDA with Tax Attributes includes the impact of the share of the ITCs, PTCs, and depreciation expense allocated to tax equity investors under the HLBV accounting method and recognized as Net loss attributable to noncontrolling interests and redeemable stock of subsidiaries on the Condensed Consolidated Statements of Operations. All of the tax attributes are related to the Renewables SBU.

Adjusted PTC is defined as pre-tax income from continuing operations attributable to The AES Corporation excluding gains or losses of the consolidated entity due to (a) unrealized gains or losses related to derivative transactions and equity securities; (b) unrealized foreign currency gains or losses; (c) gains, losses, benefits, and costs associated with dispositions and acquisitions of business interests, including early plant closures, and gains and losses recognized at commencement of sales-type leases; (d) losses due to impairments; (e) gains, losses, and costs due to the early retirement of debt; and (f) net gains at Angamos, one of our businesses in the Energy Infrastructure SBU, associated with the early contract terminations with Minera Escondida and Minera Spence. Adjusted PTC also includes net equity in earnings of affiliates on an after-tax basis adjusted for the same gains or losses excluded from consolidated entities.

Adjusted EPS is defined as diluted earnings per share from continuing operations excluding gains or losses of both consolidated entities and entities accounted for under the equity method due to (a) unrealized gains or losses related to derivative transactions and equity securities; (b) unrealized foreign currency gains or losses; (c) gains, losses, benefits and costs associated with dispositions and acquisitions of business interests, including early plant closures, and the tax impact from the repatriation of sales proceeds, and gains and losses recognized at commencement of sales-type leases; (d) losses due to impairments; (e) gains, losses and costs due to the early retirement of debt; (f) net gains at Angamos, one of our businesses in the Energy

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED EBITDA, ADJUSTED PTC AND ADJUSTED EPS

Infrastructure SBU, associated with the early contract terminations with Minera Escondida and Minera Spence; and (g) tax benefit or expense related to the enactment effects of 2017 U.S. tax law reform and related regulations and any subsequent period adjustments related to enactment effects, including the 2021 tax benefit on reversal of uncertain tax positions effectively settled upon the closure of the Company's U.S. tax return exam.

The GAAP measure most comparable to Adjusted PTC is income from continuing operations attributable to AES. The GAAP measure most comparable to Adjusted EPS is diluted earnings per share from continuing operations. We believe that Adjusted PTC and Adjusted EPS better reflect the underlying business performance of the Company and are considered in the Company’s internal evaluation of financial performance. Factors in this determination include the variability due to unrealized gains or losses related to derivative transactions or equity securities remeasurement, unrealized foreign currency gains or losses, losses due to impairments, strategic decisions to dispose of or acquire business interests or retire debt, and the non-recurring nature of the impact of the early contract terminations at Angamos, which affect results in a given period or periods. In addition, for Adjusted PTC, earnings before tax represents the business performance of the Company before the application of statutory income tax rates and tax adjustments, including the effects of tax planning, corresponding to the various jurisdictions in which the Company operates. Adjusted PTC and Adjusted EPS should not be construed as alternatives to income from continuing operations attributable to AES and diluted earnings per share from continuing operations, which are determined in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 | | Three Months Ended September 30, 2022 | | Nine Months Ended September 30, 2023 | | Nine Months Ended September 30, 2022 | |

| Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | | Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | | Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | | Net of NCI (1) | | Per Share (Diluted) Net of NCI (1) | |

| (in millions, except per share amounts) | |

| Income from continuing operations, net of tax, attributable to AES and Diluted EPS | $ | 231 | | | $ | 0.32 | | | $ | 421 | | | $ | 0.59 | | | $ | 343 | | | $ | 0.48 | | | $ | 357 | | | $ | 0.50 | | |

| Add: Income tax expense from continuing operations attributable to AES | 101 | | | | | 128 | | | | | 136 | | | | | 149 | | | | |

| Pre-tax contribution | $ | 332 | | | | | $ | 549 | | | | | $ | 479 | | | | | $ | 506 | | | | |

| Adjustments | | | | | | | | | | | | | | | | |

| Unrealized derivative and equity securities losses (gains) | $ | 9 | | | $ | 0.01 | | | $ | (8) | | | $ | (0.01) | | | $ | 3 | | | $ | — | | (2) | $ | (2) | | | $ | — | | |

| Unrealized foreign currency losses | 96 | | | 0.14 | | (3) | 3 | | | — | | | 160 | | | 0.22 | | (4) | 23 | | | 0.03 | | (5) |

| Disposition/acquisition losses | 8 | | | 0.01 | | | 4 | | | 0.01 | | | 21 | | | 0.03 | | | 36 | | | 0.05 | | (6) |

| Impairment losses | 145 | | | 0.21 | | (7) | 17 | | | 0.02 | | (8) | 318 | | | 0.45 | | (9) | 497 | | | 0.70 | | (10) |

| Loss on extinguishment of debt | 3 | | | — | | | 4 | | | 0.01 | | | 7 | | | 0.01 | | | 20 | | | 0.03 | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Less: Net income tax expense (benefit) | | | (0.09) | | (11) | | | 0.01 | | | | | (0.16) | | (12) | | | (0.13) | | (13) |

| Adjusted PTC and Adjusted EPS | $ | 593 | | | $ | 0.60 | | | $ | 569 | | | $ | 0.63 | | | $ | 988 | | | $ | 1.03 | | | $ | 1,080 | | | $ | 1.18 | | |

_____________________________

(1)NCI is defined as Noncontrolling Interests.

(2)Amount primarily relates to unrealized derivative losses due to the termination of a PPA of $72 million, or $0.10 per share and unrealized derivative losses at AES Clean Energy of $20 million, or $0.03 per share, offset by unrealized derivative gains at the Energy Infrastructure SBU of $108 million, or $0.15 per share.

(3)Amount primarily relates to unrealized foreign currency losses mainly associated with the devaluation of long-term receivables denominated in Argentine pesos of $60 million, or $0.08 per share, unrealized foreign currency losses at AES Andes of $21 million, or $0.03 per share, and unrealized foreign currency losses on debt in Brazil of $10 million, or $0.01 per share.

(4)Amount primarily relates to unrealized foreign currency losses mainly associated with the devaluation of long-term receivables denominated in Argentine pesos of $109 million, or $0.15 per share, and unrealized foreign currency losses at AES Andes of $54 million, or $0.08 per share.

(5)Amount primarily relates to unrealized foreign currency losses mainly associated with the devaluation of long-term receivables denominated in Argentine pesos of $19 million, or $0.03 per share.

(6)Amount primarily relates to the recognition of an allowance on the AES Gilbert sales-type lease receivable as a cost of disposition of a business interest of $20 million, or $0.03 per share.

(7)Amount primarily relates to asset impairments at TEG and TEP of $76 million and $58 million, respectively, or $0.19 per share.

(8)Amount primarily relates to asset impairment at Jordan of $19 million, or $0.03 per share.

(9)Amount primarily relates to asset impairments at the Norgener coal-fired plant in Chile of $136 million, or $0.19 per share, at TEG and TEP of $76 million and $58 million, respectively, or $0.19 per share, the GAF Projects at AES Renewable Holdings of $18 million, or $0.03 per share, and at Jordan of $16 million, or $0.02 per share.

(10)Amount primarily relates to asset impairment at Maritza of $468 million, or $0.66 per share, and at Jordan of $19 million, or $0.03 per share.

(11)Amount primarily relates to income tax benefits associated with the asset impairments at TEG and TEP of $34 million, or $0.05 per share and income tax benefits associated with unrealized foreign currency losses at AES Andes of $6 million, or $0.01 per share.

(12)Amount primarily relates to income tax benefits associated with the asset impairments at the Norgener coal fired plant in Chile of $35 million, or $0.05 per share and at TEG and TEP of $34 million, or $0.05 per share, income tax benefits associated with the recognition of unrealized losses due to the termination of a PPA of $18 million, or $0.02 per share, and income tax benefits associated with unrealized foreign currency losses at AES Andes of $14 million, or $0.02 per share.

(13)Amount primarily relates to income tax benefits associated with the impairment at Maritza of $73 million, or $0.10 per share, and at Jordan of $8 million, or $0.01 per share.

| | | | | | | | | | | | | | |

| The AES Corporation |

| Parent Financial Information |

Parent only data: last four quarters | | | | |

| (in millions) | 4 Quarters Ended |

| Total subsidiary distributions & returns of capital to Parent | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 |

| Actual | Actual | Actual | Actual |

Subsidiary distributions1 to Parent & QHCs | $ | 1,625 | | $ | 1,383 | | $ | 1,489 | | $ | 1,298 | |

| Returns of capital distributions to Parent & QHCs | 116 | | 56 | | 56 | | — | |

| Total subsidiary distributions & returns of capital to Parent | $ | 1,741 | | $ | 1,439 | | $ | 1,545 | | $ | 1,298 | |

| Parent only data: quarterly | | | | |

| (in millions) | Quarter Ended |

| Total subsidiary distributions & returns of capital to Parent | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 |

| Actual | Actual | Actual | Actual |

Subsidiary distributions1 to Parent & QHCs | $ | 311 | | $ | 205 | | $ | 356 | | $ | 753 | |

| Returns of capital distributions to Parent & QHCs | 60 | | — | | 56 | | — | |

| Total subsidiary distributions & returns of capital to Parent | $ | 371 | | $ | 205 | | $ | 412 | | $ | 753 | |

| |

(in millions) | Balance at |

| September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 |

Parent Company Liquidity2 | Actual | Actual | Actual | Actual |

Cash at Parent & Cash at QHCs3 | $ | 51 | | $ | 35 | | $ | 117 | | $ | 24 | |

Availability under credit facilities | 857 | | 883 | | 970 | | 1,141 | |

| Ending liquidity | $ | 908 | | $ | 918 | | $ | 1,087 | | $ | 1,165 | |

____________________________

(1)Subsidiary distributions received by Qualified Holding Companies ("QHCs") excluded from Schedule 1. Subsidiary Distributions should not be construed as an alternative to Consolidated Net Cash Provided by Operating Activities, which is determined in accordance with US GAAP. Subsidiary Distributions are important to the Parent Company because the Parent Company is a holding company that does not derive any significant direct revenues from its own activities but instead relies on its subsidiaries’ business activities and the resultant distributions to fund the debt service, investment and other cash needs of the holding company. The reconciliation of the difference between the Subsidiary Distributions and Consolidated Net Cash Provided by Operating Activities consists of cash generated from operating activities that is retained at the subsidiaries for a variety of reasons which are both discretionary and non-discretionary in nature. These factors include, but are not limited to, retention of cash to fund capital expenditures at the subsidiary, cash retention associated with non-recourse debt covenant restrictions and related debt service requirements at the subsidiaries, retention of cash related to sufficiency of local GAAP statutory retained earnings at the subsidiaries, retention of cash for working capital needs at the subsidiaries, and other similar timing differences between when the cash is generated at the subsidiaries and when it reaches the Parent Company and related holding companies.

(2)Parent Company Liquidity is defined as cash available to the Parent Company, including cash at qualified holding companies (QHCs), plus available borrowings under our existing credit facility. AES believes that unconsolidated Parent Company liquidity is important to the liquidity position of AES as a Parent Company because of the non-recourse nature of most of AES’ indebtedness.

(3)The cash held at QHCs represents cash sent to subsidiaries of the company domiciled outside of the US. Such subsidiaries have no contractual restrictions on their ability to send cash to AES, the Parent Company. Cash at those subsidiaries was used for investment and related activities outside of the US. These investments included equity investments and loans to other foreign subsidiaries as well as development and general costs and expenses incurred outside the US. Since the cash held by these QHCs is available to the Parent, AES uses the combined measure of subsidiary distributions to Parent and QHCs as a useful measure of cash available to the Parent to meet its international liquidity needs.

v3.23.3

Cover Document

|

Nov. 02, 2023 |

| Entity Information [Line Items] |

|

| Entity Central Index Key |

0000874761

|

| Entity Emerging Growth Company |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| City Area Code |

703

|

| Local Phone Number |

522-1315

|

| Written Communications |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 02, 2023

|

| Entity Registrant Name |

THE AES CORPORATION

|

| Entity Address, Address Line One |

4300 Wilson Boulevard

|

| Entity File Number |

001-12291

|

| Entity Tax Identification Number |

54-1163725

|

| Entity Address, City or Town |

Arlington

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22203

|

| Amendment Flag |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

AES

|

| Entity Listing, Description |

NYSE

|

| Corporate Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Corporate Units

|

| Trading Symbol |

AESC

|

| Entity Listing, Description |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aes_CorporateUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

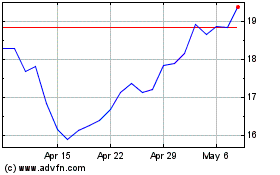

AES (NYSE:AES)

Historical Stock Chart

From Apr 2024 to May 2024

AES (NYSE:AES)

Historical Stock Chart

From May 2023 to May 2024