Revenue increased 28% to $1.45 billion,

Medicare Advantage membership increased 37% to 525,000, and total

members on the agilon platform grew 39% to 657,000

Third quarter results were affected by

lower-than-expected 2024 risk adjustment, negative prior year

development mainly from risk adjustment and Part D, and higher

current year medical expenses

Adjusted full year guidance reflects Q3

results and updated Q4 cost trends

agilon health, inc. (NYSE: AGL), the trusted partner empowering

physicians to transform health care in our communities, today

announced results for the third quarter ended September 30,

2024.

“Our full-risk model enables primary care physicians to deliver

high-quality care to their senior patients. Our Q3 results show

that our membership is growing across our 26 partnerships, and it

also highlights why we are taking necessary actions to strengthen

execution within our platform and proactively manage the

challenging Medicare Advantage environment,” said Steve Sell, chief

executive officer. “Against that backdrop, we have initiated steps

with select partners to exit two unprofitable partnerships and

other payor contracts by the end of 2024. While the overall

Medicare Advantage environment will eventually realign, it is

important that we take these actions in the interim to strengthen

the run-rate for our business into 2025 and better position our

platform and network for long-term success.”

Third Quarter 2024

Results:

- Compared to previous guidance, third quarter 2024 gross profit

and medical margin was negatively impacted as a result of

additional information received from payors in the third quarter.

This included prior year development of $60 million primarily

related to risk adjustment revenue and Part D medical expense; a

reduction of estimated 2024 risk adjustment of $65 million; and

higher current year medical expense of $25 million primarily in the

third quarter.

- Total members on the agilon platform increased to 657,000 as of

September 30, 2024, comprising 525,000 Medicare Advantage members

and 132,000 ACO model beneficiaries. Medicare Advantage membership

increased 37% year-over-year, with 4.8% growth in same-partner

geographies.

- Total revenue of $1.45 billion in the third quarter 2024

increased 28% compared to $1.14 billion in the third quarter 2023.

Year-over-year total revenue growth was primarily driven by

membership growth in new markets and same geography growth.

- Gross profit was negative $64 million in the third quarter 2024

compared to positive $37 million in the third quarter 2023. Net

loss was $118 million in the third quarter 2024 compared to a net

loss of $31 million in the third quarter 2023. The year-over-year

reduction in gross profit and higher net losses resulted from the

factors discussed above.

- Medical margin was negative $58 million during the third

quarter 2024, compared to $111 million for the same period 2023.

The $169 million year-over-year medical margin reduction also

resulted from the factors mentioned above.

- Adjusted EBITDA loss was $96 million in the third quarter 2024

compared to positive $6 million for the same period in 2023. The

year-over-year change is attributable to the factors discussed

above.

Key Financial and Operating Metrics

($M):

(Third Quarter 2024 vs. 2023)

Three Months Ended

September 30,

Change

2024

2023

% YoY

Medicare Advantage Members1

525,000

384,000

37%

ACO Model Members1, 2

132,000

88,000

51%

Total Members Live on Platform1, 2

657,000

472,000

39%

Avg. Medicare Advantage Members

535,000

389,000

38%

Total revenues

$1,451

$1,137

28%

Gross Profit

($64)

$37

NM

Medical Margin

($58)

$111

(153%)

Net (Loss) Income

($118)

($31)

NM

Adjusted EBITDA3

($96)

$6

NM

Geography Entry Costs

$7

$18

(60%)

- Membership metrics reflect end of period results.

- agilon’s ACO model entities are not included within its

consolidated financial results.

- agilon’s ACO model entities contributed $12 million to Adjusted

EBITDA during the third quarter 2024 and $18 million in third

quarter 2023.

Capital Position and Balance Sheet:

agilon health’s balance sheet as of September 30, 2024 included

cash, cash equivalents and marketable securities of $399 million

and total debt of $35 million. At the end of the quarter agilon

health had $113 million of cash associated with the Company’s

unconsolidated ACO model entities.

Outlook for Fiscal Year 2024

($M):

Guidance below includes results from the third quarter 2024 and

updated cost trends for the fourth quarter 2024. Medical margin

guidance below includes approximately $100 million of negative

prior period development. Guidance for fiscal year 2024 does not

reflect the impact of actions the Company is currently undertaking

or plans to take before the close of the fiscal year.

Year Ended December 31,

2024

Updated Guidance

Previous Guidance

Low

High

Low

High

Medicare Advantage Members1

526,000

528,000

518,000

520,000

ACO Model Members1,2

127,000

129,000

123,000

128,000

Total Members Live on Platform1

653,000

657,000

641,000

648,000

Avg. Medicare Advantage Members

522,000

522,000

513,000

514,000

Total Revenues

$6,050

$6,065

$6,010

$6,040

Medical Margin

$210

$240

$400

$450

Adjusted EBITDA3

($155)

($135)

($60)

($15)

Geography Entry Costs4

$37

$33

$55

$45

- Membership reflects management’s outlook for end of

period.

- agilon’s partnered ACO model entities are not consolidated

within its financial results.

- Adjusted EBITDA contribution from ACO model is expected to be

approximately $38 million for fiscal year 2024.

- Geography Entry Costs represent the corresponding expense

included in the low-end and high-end of management’s outlook for

adjusted EBITDA.

Outlook for Fourth Quarter 2024

($M):

Quarter Ended December

31, 2024

Low

High

Medicare Advantage Members1

526,000

528,000

ACO Model Members1,2

127,000

129,000

Total Members Live on Platform1

653,000

657,000

Avg. Medicare Advantage Members

526,000

527,000

Total Revenues

$1,512

$1,527

Medical Margin

$5

$35

Adjusted EBITDA3

($85)

($65)

Geography Entry Costs4

$14

$10

- Membership reflects management’s outlook for end of

period.

- agilon’s partnered ACO model entities are not consolidated

within its financial results.

- Adjusted EBITDA contribution from ACO model is expected to be

approximately $5 million for the fourth quarter 2024.

- Geography Entry Costs represent the corresponding expense

included in the low-end and high-end of management’s outlook for

adjusted EBITDA.

The Company has not reconciled guidance for medical margin to

gross profit or adjusted EBITDA to net income (loss), the most

comparable GAAP measures, and has not provided forward-looking

guidance for net income (loss) in each case because of the

uncertainty around certain items that may impact gross profit or

net income (loss), including non-cash stock-based compensation.

Webcast and Conference Call:

agilon health will host a conference call to discuss third

quarter 2024 results on Thursday, November 7, 2024 at 4:30 PM

Eastern Time. The conference call can be accessed by dialing (833)

470-1428 for U.S. participants and +1 (404) 975-4839 for

international participants and referencing participant code 520026.

A simultaneous listen-only, live webcast can be accessed by

visiting the “Events & Presentations” section of agilon’s

Investor Relations website at https://investors.agilonhealth.com. A

replay of the call will be available via webcast for on-demand

listening shortly after the completion of the call.

About agilon health

agilon health is the trusted partner empowering physicians to

transform health care in our communities. Through our partnerships

and purpose-built platform, agilon is accelerating at scale how

physician groups and health systems transition to a value-based

Total Care Model for their senior patients. agilon provides the

technology, people, capital, process, and access to a peer network

of 2,800+ PCPs that allow its physician partners to maintain their

independence and focus on the total health of their most vulnerable

patients. Together, agilon and its physician partners are creating

the healthcare system we need – one built on the value of care, not

the volume of fees. The result: healthier communities and empowered

doctors. agilon is the trusted partner in 30+ diverse communities

and is here to help more of our nation's leading physician groups

and health systems have a sustained, thriving future. For more

information visit www.agilonhealth.com and connect with us on

Instagram, LinkedIn and YouTube.

Forward-Looking Statements

Statements in this release that are not historical factual

statements are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include, among other things, statements

regarding our and our officers’ intent, belief or expectation as

identified by the use of words such as “believes,” “expects,”

“may,” “will,” “shall,” “should,” “would,” “could,” “seeks,”

“aims,” “projects,” “is optimistic,” “intends,” “plans,”

“estimates,” “anticipates” or the negative versions of these words

or other comparable terms. Examples of forward-looking statements

include, among other things: statements regarding our expectations

related to operating and financial results, our ability to

negotiate more favorable economic terms in our payor contracts, the

value of and demand for our full-risk model for primary care

physicians, the strengthening of our value proposition to

physicians and payers, our ability to efficiently exit unprofitable

markets, and our long-term opportunities and strategic growth plans

and alignment with the macro environment, expected revenue, medical

costs, net income and gross profit, total and average membership,

Adjusted EBITDA, Medical Margin, geography entry costs and other

financial projections and assumptions, including our fiscal year

and third quarter 2024 guidance. Forward-looking statements reflect

our current expectations and views about future events and are

subject to risks and uncertainties that could significantly affect

our future financial condition and results of operations. While

forward-looking statements reflect our good faith belief and

assumptions we believe to be reasonable based upon current

information, we can give no assurance that our expectations or

forecasts will be attained. Forward-looking statements are subject

to known and unknown risks and uncertainties, many of which may be

outside our control. These risks and uncertainties that could cause

actual results and outcomes to differ from those reflected in

forward-looking statements include, but are not limited to: our

history of net losses and the expectation that our expenses will

increase in the future; failure to identify and develop successful

new geographies, physician partners and payors, or execute upon our

growth initiatives; success in executing our operating strategies

or achieving results consistent with our historical performance;

medical expenses incurred on behalf of our members may exceed

revenues we receive; our ability to secure contracts with Medicare

Advantage payors; our ability to grow new physician partner

relationships sufficient to recover startup costs; availability of

additional capital, on acceptable terms or at all, to support our

business in the future; significant reduction in our membership;

transition to a Total Care Model may be challenging for physician

partners; public health crises, such as COVID-19, could adversely

affect us; inaccuracy in estimates of our members’ risk adjustment

factors, medical services expense, incurred but not reported

claims, and earnings pursuant to payor contracts; the impact of

restrictive clauses or exclusivity provisions in some of our

contracts with physician partners; our ability to hire and retain

qualified personnel; our ability to realize the full value of our

intangible assets; security breaches, cybersecurity attacks, loss

of data and other disruptions to our information systems; our

ability to protect the confidentiality of our know-how and other

proprietary and internally developed information; reliance on our

subsidiaries; Environmental, Social, and Governance issues;

reliance on a limited number of key payors; the limited terms of

contracts with our payors and our ability to renew them upon

expiration; our ability to navigate the changing healthcare payor

market reliance on our payors, physician partners and other

providers to operate our business; our ability to obtain accurate

and complete diagnosis data; reliance on third-party software,

data, infrastructure and bandwidth; consolidation and competition

in the healthcare industry; the impact of changes to, and

dependence on, federal government healthcare programs; uncertain or

adverse economic and macroeconomic conditions, including a downturn

or decrease in government expenditures; regulation of the

healthcare industry and our and our physician partners’ ability to

comply with such laws and regulations; federal and state

investigations, audits and enforcement actions; repayment

obligations arising out of payor audits; negative publicity

regarding the managed healthcare industry generally; our use,

disclosure and processing of personally identifiable information,

protected health information, and de-identified data; failure to

obtain or maintain an insurance license, a certificate of authority

or an equivalent authorization; lawsuits not covered by insurance;

changes in tax laws and regulations, or changes in related

judgments or assumptions; our indebtedness and our potential to

incur more debt; dependence on our subsidiaries for cash to fund

all of our operations and expenses; provisions in our governing

documents; ability to achieve a return on your investment depends

on appreciation in the price of our common stock; the material

weakness in our internal control over financial reporting and our

ability to remediate such material weakness; and risks related to

other factors discussed in our filings with the Securities and

Exchange Commission (the “SEC”), including the factors discussed

under “Risk Factors” in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, which can be found at the

SEC’s website at www.sec.gov. Except as required by law, we do not

undertake, and hereby disclaim, any obligation to update any

forward-looking statements, which speak only as of the date on

which they are made.

agilon health, inc.

Condensed Consolidated Balance

Sheets

In thousands, except per share

data

September 30,

2024

December 31,

2023

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

148,161

$

107,570

Restricted cash and equivalents

5,629

6,759

Marketable securities

244,766

380,773

Receivables, net

1,368,349

942,461

Prepaid expenses and other current assets,

net

44,854

42,513

Total current assets

1,811,759

1,480,076

Property and equipment, net

28,194

27,576

Intangible assets, net

73,412

63,769

Goodwill

24,133

24,133

Other assets

153,913

145,312

Total assets

$

2,091,411

$

1,740,866

LIABILITIES AND STOCKHOLDERS’ EQUITY

(DEFICIT)

Current liabilities:

Medical claims and related payables

$

1,190,665

$

737,724

Accounts payable, accrued expenses and

other

218,492

239,432

Total current liabilities

1,409,157

977,156

Long-term debt, net of current portion

34,884

32,308

Other liabilities

72,498

70,381

Total liabilities

1,516,539

1,079,845

Commitments and contingencies

Stockholders' equity (deficit):

Common stock, $0.01 par value: 2,000,000

shares authorized; 411,960 and 406,387 shares issued and

outstanding, respectively

4,120

4,064

Additional paid-in capital

2,051,638

1,986,899

Accumulated deficit

(1,481,187

)

(1,326,826

)

Accumulated other comprehensive income

(loss)

301

(2,298

)

Total agilon health, inc. stockholders'

equity (deficit)

574,872

661,839

Noncontrolling interests

—

(818

)

Total stockholders’ equity (deficit)

574,872

661,021

Total liabilities and stockholders’ equity

(deficit)

$

2,091,411

$

1,740,866

agilon health, inc.

Condensed Consolidated

Statements of Operations

In thousands, except per share

data

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenues:

Medical services revenue

$

1,447,697

$

1,133,457

$

4,528,471

$

3,253,810

Other operating revenue

3,235

3,406

9,573

6,480

Total revenues

1,450,932

1,136,863

4,538,044

3,260,290

Expenses:

Medical services expense

1,505,950

1,022,871

4,323,852

2,853,266

Other medical expenses

9,149

77,153

171,096

242,486

General and administrative (including

noncash stock-based compensation expense of $13,259, $20,619,

$48,375, and $53,650, respectively)

63,123

72,058

209,157

221,064

Depreciation and amortization

6,218

4,075

17,969

11,308

Total expenses

1,584,440

1,176,157

4,722,074

3,328,124

Income (loss) from operations

(133,508

)

(39,294

)

(184,030

)

(67,834

)

Other income (expense):

Income (loss) from equity method

investments

2,047

14,659

17,686

24,507

Other income (expense), net

16,061

5,423

26,794

20,402

Interest expense

(1,622

)

(1,617

)

(4,603

)

(4,665

)

Income (loss) before income

taxes

(117,022

)

(20,829

)

(144,153

)

(27,590

)

Income tax benefit (expense)

590

(1,210

)

306

(524

)

Income (loss) from continuing

operations

(116,432

)

(22,039

)

(143,847

)

(28,114

)

Discontinued operations:

Income (loss) before gain (loss) on

sales

(1,183

)

(9,444

)

(1,701

)

(4,205

)

Gain (loss) on sales of assets, net

—

—

(8,763

)

—

Total discontinued operations

(1,183

)

(9,444

)

(10,464

)

(4,205

)

Net income (loss)

(117,615

)

(31,483

)

(154,311

)

(32,319

)

Noncontrolling interests’ share in

(earnings) loss

—

47

(50

)

156

Net income (loss) attributable to

common shares

$

(117,615

)

$

(31,436

)

$

(154,361

)

$

(32,163

)

Net income (loss) per common share,

basic and diluted

Continuing operations

$

(0.29

)

$

(0.06

)

$

(0.35

)

$

(0.07

)

Discontinued operations

$

—

$

(0.02

)

$

(0.03

)

$

(0.01

)

Weighted average shares

outstanding

Basic

411,591

405,787

410,604

412,077

Diluted

411,591

405,787

410,604

412,077

agilon health, inc.

Condensed Consolidated

Statements of Cash Flows

In thousands

(unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net income (loss)

$

(154,311

)

$

(32,319

)

Adjustments to reconcile net income (loss)

to net cash used in operating activities:

Depreciation and amortization

17,969

15,014

Stock-based compensation expense

48,375

53,980

Loss (income) from equity method

investments

(17,686

)

(24,507

)

Distributions of earnings from equity

method investments

3,340

—

(Gain) loss on sale of assets, net

3,784

—

Other noncash items

(491

)

(1,511

)

Changes in operating assets and

liabilities:

24,824

(105,690

)

Net cash provided by (used in) operating

activities

(74,196

)

(95,033

)

Cash flows from investing

activities:

Purchase of property and equipment

(9,985

)

(11,898

)

Purchase of intangible assets

(18,877

)

(3,535

)

Investment in loans receivable and

other

(9,742

)

(8,778

)

Investments in marketable securities

(12,006

)

(107,020

)

Proceeds from maturities of marketable

securities and other

166,828

133,894

Net cash paid in business combination

—

(44,479

)

Net cash provided by (used in) investing

activities

116,218

(41,816

)

Cash flows from financing

activities:

Proceeds from equity issuances, net

1,189

11,462

Common stock repurchase

—

(200,000

)

Repayments of long-term debt

(3,750

)

(3,750

)

Net cash provided by (used in) financing

activities

(2,561

)

(192,288

)

Net increase (decrease) in cash, cash

equivalents and restricted cash and equivalents

39,461

(329,137

)

Cash, cash equivalents and restricted cash

and equivalents from continuing operations, beginning of period

114,329

475,912

Cash, cash equivalents and restricted cash

and equivalents from discontinued operations, beginning of

period

—

31,768

Cash, cash equivalents and restricted

cash and equivalents, beginning of period

114,329

507,680

Cash, cash equivalents and restricted cash

and equivalents from continuing operations, end of period

153,790

169,660

Cash, cash equivalents and restricted cash

and equivalents from discontinued operations, end of period

—

8,883

Cash, cash equivalents and restricted

cash and equivalents, end of period

$

153,790

$

178,543

agilon health, inc.

Key Operating Metrics

In thousands

(unaudited)

GROSS PROFIT

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Total revenues

$

1,450,932

$

1,136,863

$

4,538,044

$

3,260,290

Medical services expense

(1,505,950

)

(1,022,871

)

(4,323,852

)

(2,853,266

)

Other medical expenses(1)

(9,149

)

(77,153

)

(171,096

)

(242,486

)

Gross profit

$

(64,167

)

$

36,839

$

43,096

$

164,538

______________________________________________________________

(1)

Represents physician compensation expense

related to surplus sharing and other care management expenses that

help to create medical cost efficiency. Includes costs in

geographies that are in implementation and are not yet generating

revenue and investments to grow existing markets. For the three

months ended September 30, 2024 and 2023, costs incurred in

implementing geographies were $1.4 million and $10.3 million,

respectively. For the nine months ended September 30, 2024 and

2023, costs incurred in implementing geographies were $2.0 million

and $20.3 million, respectively.

GENERAL AND ADMINISTRATIVE COSTS,

INCLUDING PLATFORM SUPPORT COSTS

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Platform support costs

$

42,353

$

41,590

$

129,752

$

126,923

Geography entry costs(1)

5,857

8,064

21,182

28,620

Severance and related costs

1,453

—

4,736

188

Stock-based compensation expense

13,259

20,619

48,375

53,650

Other(2)

201

1,785

5,112

11,683

General and administrative

$

63,123

$

72,058

$

209,157

$

221,064

______________________________________________________________

(1)

Represents direct geography entry costs,

including investments to develop and expand our platform and costs

in geographies that are in implementation and are not yet

generating revenue and investments to grow existing markets.

(2)

Includes transaction-related costs.

Our platform support costs, which include regionally-based

support personnel and other operating costs to support our

geographies, are expected to decrease over time as a percentage of

revenue as our physician partners add members and our revenue

grows. Our operating expenses at the enterprise level include

resources and technology to support payor contracting, clinical

program development, quality, data management, finance, and legal

and compliance functions.

agilon health, inc.

Non-GAAP Financial

Measures

In thousands

(unaudited)

MEDICAL MARGIN

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Gross profit(1)

$

(64,167

)

$

36,839

$

43,096

$

164,538

Other operating revenue

(3,235

)

(3,406

)

(9,573

)

(6,480

)

Other medical expenses

9,149

77,153

171,096

242,486

Medical margin

$

(58,253

)

$

110,586

$

204,619

$

400,544

______________________________________________________________

(1)

Gross profit is defined as total revenues

less medical services expense and other medical expenses.

ADJUSTED EBITDA

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net income (loss)(1)

$

(117,615

)

$

(31,483

)

$

(154,311

)

$

(32,319

)

(Income) loss from discontinued

operations, net of income taxes

1,183

9,444

10,464

4,205

Interest expense

1,622

1,617

4,603

4,665

Income tax expense (benefit)

(590

)

1,210

(306

)

524

Depreciation and amortization

6,218

4,075

17,969

11,308

Severance and related costs

1,453

—

4,736

188

Stock-based compensation expense

13,259

20,619

48,375

53,650

EBITDA adjustments related to equity

method investments(2)

9,719

3,702

15,025

8,426

Other(3)

(11,718

)

(3,631

)

(16,800

)

(8,587

)

Adjusted EBITDA

$

(96,469

)

$

5,553

$

(70,245

)

$

42,060

______________________________________________________________

(1)

Includes direct geography entry costs,

including investments to develop and expand our platform and costs

in geographies that are in implementation and are not yet

generating revenue and investments to grow existing markets. For

the three months ended September 30, 2024 and 2023, (i) $1.4

million and $10.3 million, respectively, are included in other

medical expenses and (ii) $5.8 million and $8.0 million,

respectively, are included in general and administrative expenses.

For the nine months ended September 30, 2024 and 2023, (i) $2.0

million and $20.3 million, respectively, are included in other

medical expenses and (ii) $21.2 million and $28.6 million,

respectively, are included in general and administrative

expenses.

(2)

Includes elimination of certain

administrative services provided by agilon health, inc. to equity

method investments.

(3)

Includes interest income,

transaction-related costs and elimination of certain administrative

services provided by agilon health, inc. to equity method

investments.

agilon health, inc.

Supplemental Financial

Information

In thousands

(unaudited)

Three Months Ended

September 30, 2024

Nine Months Ended

September 30, 2024

Medicare Advantage

(Consolidated)

CMS ACO Models

(Unconsolidated)

Medicare Advantage

(Consolidated)

CMS ACO Models

(Unconsolidated)

Medical services revenue

$

1,447,697

$

454,410

$

4,528,471

$

1,341,484

Other operating revenue

3,235

—

9,573

—

Total revenues

1,450,932

454,410

4,538,044

1,341,484

Medical services expense

(1,505,950

)

(413,189

)

(4,323,852

)

(1,218,902

)

Other medical expenses

(9,149

)

(23,817

)

(171,096

)

(71,490

)

Gross profit

(64,167

)

17,404

43,096

51,092

Other operating revenue

(3,235

)

—

(9,573

)

—

Other medical expenses

9,149

23,817

171,096

71,490

Medical margin

$

(58,253

)

$

41,221

$

204,619

$

122,582

Certain of our operations are not consolidated for the period

presented because we do not have the ability to control certain

activities due to another party’s control of the entities’ board of

directors. Although revenues of the unconsolidated operations are

not recorded as revenues by us, income (loss) from equity method

investments is nonetheless a significant portion of our overall

earnings. See Note 14 to the Condensed Consolidated Financial

Statements in the Quarterly Report on Form 10-Q for the period

ending September 30, 2024 for additional discussion on our equity

method investments.

In addition to providing results that are determined in

accordance with GAAP, we present Medical Margin and Adjusted

EBITDA, which are non-GAAP financial measures.

We define Medical Margin as medical services revenue after

medical services expense is deducted. Medical services expense

represents costs incurred for medical services provided to our

members. As our platform matures over time, we expect Medical

Margin to increase in absolute dollars. However, Medical Margin per

member per month (PMPM) may vary as the percentage of new members

brought onto our platform fluctuates. New membership added to the

platform is typically dilutive to Medical Margin PMPM. We believe

this metric provides insight into the economics of our capitation

arrangements as it includes all medical services expense directly

associated with our members’ care.

We define Adjusted EBITDA as net income (loss) adjusted to

exclude: (i) income (loss) from discontinued operations, net of

income taxes, (ii) interest expense, (iii) income tax expense

(benefit), (iv) depreciation and amortization, (v) stock-based

compensation expense, (vi) severance and related costs, and (vii)

certain other items that are not considered by us in the evaluation

of ongoing operating performance. We reflect our share of Adjusted

EBITDA for equity method investments by applying our actual

ownership percentage for the period to the applicable reconciling

items on an entity-by-entity basis.

Gross profit is the most directly comparable GAAP measure to

Medical Margin. Net income (loss) is the most directly comparable

GAAP measure to Adjusted EBITDA.

We believe Medical Margin and Adjusted EBITDA help identify

underlying trends in our business and facilitate evaluation of

period-to-period operating performance of our operations by

eliminating items that are variable in nature and not considered by

us in the evaluation of ongoing operating performance, allowing

comparison of our recurring core business operating results over

multiple periods. We also believe Medical Margin and Adjusted

EBITDA provide useful information about our operating results,

enhance the overall understanding of our past performance and

future prospects, and allow for greater transparency with respect

to key metrics we use for financial and operational

decision-making. We believe Medical Margin and Adjusted EBITDA or

similarly titled non-GAAP measures are widely used by investors,

securities analysts, ratings agencies, and other parties in

evaluating companies in our industry as a measure of financial

performance. Other companies may calculate Medical Margin and

Adjusted EBITDA or similarly titled non-GAAP measures differently

from the way we calculate these metrics. As a result, our

presentation of Medical Margin and Adjusted EBITDA may not be

comparable to similarly titled measures of other companies,

limiting their usefulness as comparative measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107938098/en/

Investor Contact Leland Thomas Investor Relations

investors@agilonhealth.com

Media Contact Maureen Merkle Communications

media@agilonhealth.com

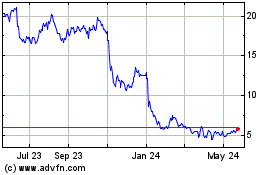

Agilon Health (NYSE:AGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Agilon Health (NYSE:AGL)

Historical Stock Chart

From Feb 2024 to Feb 2025