Form 8-K - Current report

November 19 2024 - 7:00AM

Edgar (US Regulatory)

0001831097FALSE00018310972024-11-192024-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 19, 2024

_____________________________________________

agilon health, inc.

(Exact name of Registrant as Specified in Its Charter)

_____________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-40332 | | 37-1915147 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

6210 E Hwy 290, Suite 450 | | | | |

Austin, TX | | | | 78723 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 562 256-3800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AGL | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

agilon health, inc. will participate in the 2024 Wolfe Research Healthcare Conference, including a presentation on Tuesday, November 19th at 2:20 PM Eastern Time. A copy of the investor presentation is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

Interested investors and other parties may listen to a simultaneous webcast of the presentation on Tuesday, November 19th by visiting the “Events & Presentations” section of agilon health’s investor relations website at https://investors.agilonhealth.com. Replays will be available for on-demand listening shortly after the completion of the presentation.

The information set forth in this Item 7.01 of this Current Report on Form 8-K and the related information in Exhibit 99.1 attached hereto is being furnished herewith, and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be incorporated by reference in any filing with, the Securities and Exchange Commission under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference therein.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | agilon health, inc. |

| | | |

| Date: | November 19, 2024 | By: | /s/ JEFFREY SCHWANEKE |

| | | Jeffrey Schwanke

Chief Financial Officer |

November 19, 2024 Wolfe Investor Presentation Copyright © 2024 agilon health

2 Disclaimers and Forward-Looking Statements FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION Statements in this presentation that are not historical factual statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words or other comparable terms. Examples of forward-looking statements include, among other things: statements regarding growth opportunities, ability to deliver sustainable long-term value, demand for our products and services among PCPs and payors, expectations regarding primary care capacity and the senior population In the United States, business environment, long-term opportunities and strategic growth plans, cash flows, expected revenue and net income, total and average membership, Adjusted EBITDA, Medical Margin, geography entry costs and other financial projections, guidance and assumptions. Forward-looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations. While forward-looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be outside our control. These risks and uncertainties that could cause actual results and outcomes to differ from those reflected in forward looking statements include, but are not limited to: our history of net losses and the expectation that our expenses will increase in the future; failure to identify and develop successful new geographies, physician partners and payors, or execute upon our growth initiatives; success in executing our operating strategies or achieving results consistent with our historical performance; medical expenses incurred on behalf of our members may exceed revenues we receive; our ability to secure contracts with Medicare Advantage payors; our ability to grow new physician partner relationships sufficient to recover startup costs; availability of additional capital, on acceptable terms or at all, to support our business in the future; significant reduction in our membership; transition to a Total Care Model may be challenging for physician partners; public health crises, such as COVID-19, could adversely affect us; inaccuracy in estimates of our members’ risk adjustment factors, medical services expense, incurred but not reported claims, and earnings pursuant to payor contracts; the impact of restrictive clauses or exclusivity provisions in some of our contracts with physician partners; our ability to hire and retain qualified personnel; our ability to realize the full value of our intangible assets; security breaches, cybersecurity attacks, loss of data and other disruptions to our information systems; our ability to protect the confidentiality of our know-how and other proprietary and internally developed information; reliance on our subsidiaries; Environmental, Social, and Governance issues; reliance on a limited number of key payors; the limited terms of contracts with our payors and our ability to renew them upon expiration; our ability to navigate the changing healthcare payor market reliance on our payors, physician partners and other providers to operate our business; our ability to obtain accurate and complete diagnosis data; reliance on third-party software, data, infrastructure and bandwidth; consolidation and competition in the healthcare industry; the impact of changes to, and dependence on, federal government healthcare programs; uncertain or adverse economic and macroeconomic conditions, including a downturn or decrease in government expenditures; regulation of the healthcare industry and our and our physician partners’ ability to comply with such laws and regulations; federal and state investigations, audits and enforcement actions; repayment obligations arising out of payor audits; negative publicity regarding the managed healthcare industry generally; our use, disclosure and processing of personally identifiable information, protected health information, and de-identified data; failure to obtain or maintain an insurance license, a certificate of authority or an equivalent authorization; lawsuits not covered by insurance; changes in tax laws and regulations, or changes in related judgments or assumptions; our indebtedness and our potential to incur more debt; dependence on our subsidiaries for cash to fund all of our operations and expenses; provisions in our governing documents; ability to achieve a return on your investment depends on appreciation in the price of our common stock; the material weakness in our internal control over financial reporting and our ability to remediate such material weakness; and risks related to other factors discussed in our filings with the Securities and Exchange Commission (the “SEC”), including the factors discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which can be found at the SEC’s website at www.sec.gov. Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward-looking statements, which speak only as of the date on which they are made. NON-GAAP This presentation includes references to non‐GAAP financial measures, including but not limited to Medical Margin and Adjusted EBITDA. We believe medical margin and Adjusted EBITDA help identify underlying trends in our business and facilitate evaluation of period-to- period operating performance of our operations by eliminating items that are variable in nature and not considered by us in the evaluation of ongoing operating performance, allowing comparison of our recurring core business operating results over multiple periods. We also believe medical margin and Adjusted EBITDA provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics we use for financial and operational decision-making. We believe medical margin and Adjusted EBITDA or similarly titled non-GAAP measures are widely used by investors, securities analysts, ratings agencies, and other parties in evaluating companies in our industry as a measure of financial performance. Other companies may calculate medical margin and Adjusted EBITDA or similarly titled non-GAAP measures differently from the way we calculate these metrics. As a result, our presentation of medical margin and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, limiting their usefulness as comparative measures Medical Margin and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as an alternative to GAAP measures or other financial statement data presented in agilon’s consolidated financial statements. Reconciliation of such non-GAAP measures to the applicable GAAP measures are set forth in the appendix. TRADEMARKS All rights to the trademarks included herein, other than the Company’s trademarks, belong to their respective owners and our use hereof does not imply any endorsement by the owners of these trademarks. Copyright © 2024 agilon health

3 Taking key actions to drive improved profitability, improve execution and further strengthen our business Structural demand and business fundamentals strong despite macro headwinds Improving baseline mix exiting 2024 and stronger jumping off point for 2025 Strengthening the business for long-term success off strong and improving partner base Key Takeaways Robust growth has been a near-term headwind, but expect long-term powerful as environment and market mix stabilizes Copyright © 2024 agilon health

4 54% 64% 2023 2034 Structural Factors Drive Long-Term Demand Copyright © 2024 agilon health. 60M 74M 2023 2032 Growing Senior Population US Senior Population 2023–2030 85.6% 56.0% 23.1% 1 chronic condition 2 chronic conditions 3 chronic conditions Accelerating Health Burden % of adults age 65+ with one or more chronic conditions MA Enrollment Growing Share of Medicare Beneficiaries Enrolled in MA 0% 50% 100% 2022 2024 2026 2028 2030 Primary Care Capacity Primary Care Capacity is Strained ~10-20% Projected Shortage by 2030 210K PCPs serving 60M seniors (74M by 2032) need a better business model External sources: HRSA State of the Primary Care Workforce; Euromonitor

5 Number of Partnerships 10 15 20 26 Average Member Vintage (Years) 2.6 2.8 2.9 3.1 92K 143K 225K 365K 51K 82K 140K 160K 143K 225K 365K 525K 2021 2022 2023 2024 Existing Members New Members Pace of Growth in this Environment has Created Near-Term Challenges but Powerful Long-Term Opportunity Copyright © 2024 agilon health. • Added 292K members in ‘23/’24, 56% of membership • Average member vintage roughly flat over 3 years • ‘23 class, 27% of membership • Strong ‘24 class, 29% of membership, currently in year 1 Note: 2024 Reflects Q3 2024

6 MA Medical Margin (2024E, $PMPM, incurred) Exiting, Low Performance Year 2+, Near Term Path to Profitability Year 2+, Mid Performance Year 2+, High Performance Year 1 Average Member Vintage (years) 3 2 5 4 1 Membership* 75k 86k 139k 87k 138k # Partnerships 2 3 8 7 6 % of Partnerships (omits exits) 13% 33% 29% 25% Post Recent Exits, all Year 1+ Partnerships Producing Positive Medical Margin Year 1 partnerships performing above Year 2+ mid- performers (room to further mature) Partnerships being exited were driving AEBITDA loss 100% of remaining Year 1+ partnerships generating positive PMPM MM; >80% are generating positive AEBITDA Copyright © 2024 agilon health. Note: *Membership as of Q3 2024

7 Improving Outcomes and Lowering Healthcare Costs 2023 Standard ACO Gross Savings Rate* by Membership Copyright © 2024 agilon health. • ACO Reach: $150mm in gross savings (13% gross savings %); $37mm savings to Medicare Trust Fund; beat national trend by ~300 bps • agilon was one of only three Standard ACO parent companies that drove meaningful results at scale • agilon 2023MY STARs shows majority of partners above 4.25 STARs Membership Gross Savings Rate *Gross Savings Rate is savings rate after removing all model discounts (comparable across models and tracks) STARs Performance by Market Class 3.2 3.4 3.6 3.8 4.0 4.2 4.4 4.6 2018 2019 2020 2021 2022 2023 Class of 2018 Class of 2019 Class of 2020 Class of 2021 4 Star Benchmark Class of 2022

8 Actions We Are Taking to Strengthen the Platform for Long- Term Success Copyright © 2024 agilon health. Exiting 2 unprofitable partnerships Narrowing ‘25 exposure to Part D risk Increasing conservatism around new partners based on payor dynamics Rationalizing our payor footprint

9 Cash Flow Expectations Cash Flow Levers • Partnership exits • Tighter working capital management • Payor contract negotiations Anticipate current cash position and cash flow management levers allow us to manage through macro environment and take action to accelerate the path to profitability and break-even cash flow. • Adequate capital on the balance sheet to achieve break-even cash flow - expected to occur in 2027 • Cash flow burn to be reduced from 2025 to 2026 $399 $330 $220 $113 $35 $35 Q3 FY 24 FY 25 Cash ACO REACH Cash Copyright © 2024 agilon health.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Cover

|

Nov. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 19, 2024

|

| Entity Registrant Name |

agilon health, inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40332

|

| Entity Tax Identification Number |

37-1915147

|

| Entity Address, Address Line One |

6210 E Hwy 290

|

| Entity Address, Address Line Two |

Suite 450

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78723

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

AGL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001831097

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

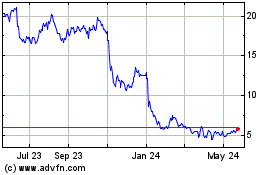

Agilon Health (NYSE:AGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Agilon Health (NYSE:AGL)

Historical Stock Chart

From Feb 2024 to Feb 2025