Statement of Changes in Beneficial Ownership (4)

June 11 2015 - 3:27PM

Edgar (US Regulatory)

Exhibit 99.1

1. Each restricted stock unit (“RSU”) represents

a contingent right to receive one share of Class A common stock of Arlington Asset Investment Corp. (the “Company”).

2. Represents pro rata annual grant of RSUs pursuant to the

Company’s 2014 Long-Term Incentive Plan (the “2014 Plan”) in connection with the reporting person’s service

as a non-employee director of the Company. The RSUs vest immediately on the award grant date. Vested RSUs are converted into shares

of Class A common stock on a one-for-one basis, with any fractional shares being settled in cash, upon the later of the reporting

person’s separation from service on the board of directors or the first anniversary of the grant date (the “Settlement

Date”). If a change in control occurs before the Settlement Date, the settlement will occur on the control change date.

RSUs previously granted to the reporting person pursuant to

Company’s 2011 Long-Term Incentive Plan (the “2011 Plan”) vested immediately on the award grant date. RSUs previously

granted to the reporting person pursuant to the Amended and Restated Friedman, Billings, Ramsey Group, Inc. Non-Employee Director

Stock Compensation Plan (the “NED Plan”) and the Company’s 2004 Long-Term Incentive Plan (the “2004 Plan”)

vested on the first anniversary of the award grant date. Under the 2011 Plan, the NED Plan and the 2004 Plan, vested RSUs are converted

into shares of Class A common stock on a one-for-one basis upon the reporting person’s separation from service on the board

of directors.

The reporting person does not have voting rights with respect

to, but receives dividend equivalent payments on, outstanding RSUs.

3. Represents: (i) 179 RSUs granted on July 2, 2003 pursuant

to the NED Plan, which vested on July 2, 2004; (ii) 9 RSUs granted on July 31, 2003 pursuant to the NED Plan, which vested on July

31, 2004; (iii) 13 RSUs granted on October 1, 2003 pursuant to the NED Plan, which vested on October 1, 2004; (iv) 10 RSUs granted

on January 2, 2004 pursuant to the NED Plan, which vested on January 2, 2005; (v) 10 RSUs granted on April 13, 2004 pursuant to

the NED Plan, which vested on April 13, 2005; (vi) 189 RSUs granted on May 20, 2004 pursuant to the 2004 Plan, which vested on

May 20, 2005; (vii) 92 RSUs granted on August 3, 2004 pursuant to the 2004 Plan, which vested on August 3, 2005; (viii) 355 RSUs

granted on June 10, 2005 pursuant to the 2004 Plan, which vested on June 10, 2006; (ix) 474 RSUs granted on June 9, 2006 pursuant

to the 2004 Plan, which vested on June 9, 2007; (x) 722 RSUs granted on June 8, 2007 pursuant to the 2004 Plan, which vested on

June 8, 2008; (xi) 2,409 RSUs granted on June 5, 2008 pursuant to the 2004 Plan, which vested on June 5, 2009; (xii) 12,171 RSUs

granted on June 1, 2009 pursuant to the 2004 Plan, which vested on June 1, 2010; (xiii) 5,213 RSUs granted on June 2, 2010 pursuant

to the 2004 Plan, which vested on June 2, 2011; (xiv) 3,544 RSUs granted on June 2, 2011 pursuant to the 2011 Plan, which vested

on June 2, 2011; (xv) 4,346 RSUs granted on June 6, 2012 pursuant to the 2011 Plan, which vested on June 6, 2012; (xvi) 3,359 RSUs

granted on June 6, 2013 pursuant to the 2011 Plan, which vested on June 6, 2013; (xvii) 3,339 RSUs granted on June 11, 2014 pursuant

to the 2011 Plan, which vested on June 11, 2014; and (xviii) 4,481 RSUs granted on June 10, 2015 pursuant to the 2014 Plan, which

vested on June 10, 2015. The number of RSUs granted on July 2, 2003, July 31, 2003, October 1, 2003, January 2, 2004, April 13,

2004, May 20, 2004, August 3, 2004, June 10, 2005, June 9, 2006, June 8, 2007, June 5, 2008 and June 1, 2009 have been adjusted

to reflect the 1-for-20 reverse stock split that was effected on October 6, 2009.

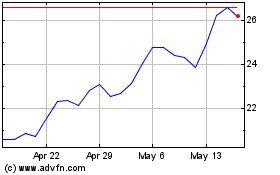

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024