Additional Proxy Soliciting Materials (definitive) (defa14a)

March 03 2023 - 4:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant x |

| |

| Filed by a Party other than the Registrant ¨ |

| |

| Check the appropriate box: |

| |

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material under §240.14a-12 |

| |

|

| AMC ENTERTAINMENT HOLDINGS, INC. |

(Name of Registrant as Specified In Its Charter) |

| |

| |

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and

0-11. |

The following communication was made available by Adam Aron, Chairman

and Chief Executive Officer of AMC Entertainment Holdings, Inc. (“AMC” or the “Company”),

on his Twitter account @CEOAdam, on March 3, 2023:

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect

of the Special Meeting of Stockholders (the “Special Meeting”) of the Company scheduled to be held on March 14,

2023 to vote on amendments to the Company’s Certificate of Incorporation that, together, if approved will enable all outstanding

AMC Preferred Equity Units (“APEs”) to convert into shares of the Company’s Class A common stock, par value

$0.01 per share (the “Common Stock”) as a result of an increase the number of authorized shares of Common Stock and

a 10-for-1 reverse split of the Common Stock. This communication does not constitute a solicitation of any vote or approval of the proposals

to be voted on at the Special Meeting. In connection with the Special Meeting, the Company filed with the Securities and Exchange Commission

(the “SEC”) and mailed to its stockholders a proxy statement regarding the business to be conducted at the Special

Meeting. The Company may also file other documents with the SEC regarding the business to be conducted at the Special Meeting. This communication

is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS

ARE URGED TO READ THE PROXY STATEMENT AND ANY AMENDMENTS THERETO (WHEN AVAILABLE) IN THEIR ENTIRETY AND ANY OTHER DOCUMENTS FILED OR

TO BE FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE BUSINESS TO BE CONDUCTED AT THE SPECIAL MEETING BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION WITH RESPECT TO THE BUSINESS TO BE CONDUCTED AT THE SPECIAL MEETING BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE BUSINESS TO BE CONDUCTED AT THE SPECIAL MEETING.

Stockholders may obtain a free copy of the proxy statement and other

documents the Company files with the SEC (when available) through the website maintained by the SEC at www.sec.gov. The Company

makes available free of charge on its investor relations website at www.investor.amctheatres.com copies of materials it files

with, or furnishes to, the SEC.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees

and other persons may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection

with the business to be conducted at the Special Meeting. Investors and security holders may obtain more detailed information regarding

the names, affiliations and interests of the Company’s directors and executive officers in the definitive proxy statement filed

in connection with the Special Meeting, which may be obtained free of charge from the sources indicated above. To the extent the holdings

of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in

the definitive proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed

with the SEC.

Forward Looking Statements

This communication includes “forward-looking statements”

within the meaning of the federal securities laws, including the safe harbor provisions of the Private Securities Litigation Reform Act

of 1995. In many cases, these forward-looking statements may be identified by the use of words such as “will,” “may,”

“could,” “would,” “should,” “believes,” “expects,” “anticipates,”

“estimates,” “intends,” “indicates,” “projects,” “goals,” “objectives,”

“targets,” “predicts,” “plans,” “seeks,” and variations of these words and similar expressions.

Any forward-looking statement speaks only as of the date on which it is made. These forward-looking statements may include, among other

things, statements related to AMC’s current expectations regarding the performance of its business, financial results, liquidity

and capital resources, and the impact to its business and financial condition of, and measures being taken in response to, the COVID-19

virus, and are based on information available at the time the statements are made and/or management’s good faith belief as of that

time with respect to future events, and are subject to risks, trends, uncertainties and other facts that could cause actual performance

or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks, trends, uncertainties

and facts include, but are not limited to, risks related to: the risk that required approvals from AMC’s stockholders are not obtained

at AMC’s special meeting, currently set to be held on March 14, 2023 (the “Special Meeting”); on February 20,

2023, stockholders commenced litigation seeking to prevent the conversion of AMC Preferred Equity Units into common without separate

common stock class approval at the Special Meeting, which will delay and if successful (or if additional litigation is commenced and

successful) could prevent the conversion of APE units into common stock, impede our ability to raise additional funds and materially

and adversely impact market prices and the value of APE units and common stock; the risks and uncertainties relating to the sufficiency

of AMC’s existing cash and cash equivalents and available borrowing capacity; AMC’s ability to obtain additional liquidity,

which if not realized or insufficient to generate the material amounts of additional liquidity that will be required unless it is able

to achieve more normalized levels of operating revenues, likely would result with AMC seeking an in-court or out-of-court restructuring

of its liabilities; the impact of the COVID-19 virus on AMC, the motion picture exhibition industry, and the economy in general; the

seasonality of AMC’s revenue and working capital; the continued recovery of the North American and international box office; AMC’s

significant indebtedness, including its borrowing capacity and its ability to meet its financial maintenance and other covenants; AMC’s

ability to achieve expected synergies, benefits and performance from its strategic initiatives; motion picture production and performance;

AMC’s lack of control over distributors of films; intense competition in the geographic areas in which AMC operates; increased

use of alternative film delivery methods or other forms of entertainment; shrinking exclusive theatrical release window; AMC’s

ability to optimize its theatre circuit; general and international economic, political, regulatory and other risks; limitations on the

availability of capital; AMC’s ability to refinance its indebtedness on favorable terms; availability of financing upon favorable

terms or at all; risks relating to impairment losses, including with respect to goodwill and other intangibles, and theatre and other

closure charges; AMC’s ability to recognize interest deduction carryforwards, net operating loss carryforwards, and other tax attributes

to reduce future tax liability; supply chain disruptions, labor shortages, increased cost and inflation; and other factors discussed

in the reports AMC has filed with the SEC. Should one or more of these risks, trends, uncertainties, or facts materialize, or should

underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by the forward-looking

statements contained herein. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of the date they are made. Forward-looking statements should not be read as a guarantee of future performance or results and

will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. For a detailed

discussion of risks, trends and uncertainties facing AMC, see the section entitled “Risk Factors” in AMC’s Form 10-K

for the year ended December 31, 2022, as filed with the SEC, and the risks, trends and uncertainties identified in AMC’s other

public filings. AMC does not intend, and undertakes no duty, to update any information contained herein to reflect future events or circumstances,

except as required by applicable law.

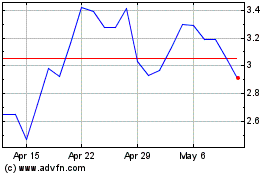

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

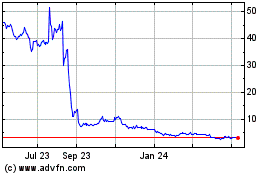

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024