false

0001766478

0001766478

2024-07-18

2024-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (date of earliest event reported):

July 18, 2024

Angel

Oak Mortgage REIT, Inc.

(Exact name of registrant as specified in its

charter)

Maryland |

001-40495 |

37-1892154 |

(State

or other jurisdiction of incorporation or

organization) |

(Commission

File

Number) |

(I.R.S.

Employer Identification

No.) |

3344 Peachtree Road Northeast, Suite 1725, Atlanta, Georgia 30326

(Address of Principal Executive Offices and Zip

Code)

Registrant’s telephone number, including

area code: (404) 953-4900

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.01 par value per share |

AOMR |

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging

growth company |

¨ |

| |

|

| If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

¨ |

Item 1.01 Entry into a Material Definitive Agreement.

On July 18, 2024, Angel Oak Mortgage REIT, Inc. (the “Company”)

entered into a stock repurchase agreement (the “Stock Repurchase Agreement”) with Xylem Finance LLC, a Delaware limited liability

company (“Xylem”) and an affiliate of Davidson Kempner Capital Management LP, to repurchase between $5.0 million and $20.0

million of shares of the Company’s common stock, par value $0.01 per share (the “common stock”), owned by Xylem (the

“Share Repurchase”).

Specifically, pursuant to the Stock Repurchase Agreement, the Company

has agreed to repurchase from Xylem, as soon as practicable following the initial closing of the Company’s senior notes offering

(the “Notes Offering”), shares of common stock at a purchase price per share based on (1) the volume-weighted average

price of shares of the common stock for the five trading days up to and including the trading day immediately preceding the launch of

the Notes Offering less (2) a discount of 3.15% of the share price determined pursuant to clause (1) above.

The Stock Repurchase Agreement provides that the aggregate repurchase

price to be paid to Xylem in the Share Repurchase is dependent on the aggregate principal amount of the notes sold in the Notes Offering

and ranges from (1) an aggregate repurchase price of $5.0 million if $25.0 million in aggregate principal amount of notes are sold

in the Notes Offering (excluding any amounts sold pursuant to the underwriters exercise of any over-allotment option) to (2) an

aggregate repurchase price of $20.0 million if $50.0 million in aggregate principal amount of notes are sold in the Notes Offering (excluding

any amounts sold pursuant to the underwriters exercise of any over-allotment option) with the aggregate repurchase price being determined

based on linear interpolation within such ranges, less an amount equal to $50.0 thousand. If more than $50.0 million in aggregate principal

amount of notes are sold in the Notes Offering (excluding any amounts sold pursuant to the underwriters exercise of any over-allotment

option), the Company will repurchase shares of common stock from Xylem having an aggregate repurchase price of $20.0 million, less an

amount equal to $50.0 thousand.

The Share Repurchase is conditioned only upon the Company’s

sale of an aggregate principal amount of notes sold in the Notes Offering equaling or exceeding $25.0 million (excluding any amounts

sold pursuant to the underwriters exercise of any over-allotment option) and the initial closing of the Notes Offering taking place by

August 15, 2024.

The closing of the Share Repurchase is expected to occur as soon as

practicable following the initial closing of the Notes Offering. The Stock Repurchase Agreement contains customary representations, warranties

and covenants of the parties.

The foregoing description of the Stock Repurchase Agreement does not

purport to be complete and is subject to and is qualified in its entirety by reference to the Stock Repurchase Agreement, a copy of which

is attached hereto as Exhibit 10.1 and the terms of which are incorporated herein by reference. For more information on Xylem’s

relationship to the Company, see the section titled “Corporate Governance Matters—Information Regarding the Board of Directors”

“Certain Relationships and Related Party Transactions—Shareholder Rights Agreements” and “Beneficial Ownership

of Common Stock by Certain Beneficial Owners and Management” in the Company’s Definitive Proxy Statement on Schedule 14A,

as filed with the Securities and Exchange Commission (the “SEC”) on April 3, 2024, which disclosure is incorporated

herein by reference.

Item 2.02. Results of Operations and Financial Condition.

Estimated Preliminary Financial Results for and as of the Quarter

Ended June 30, 2024

The Company is providing preliminary unaudited results for the three

months ended June 30, 2024 based on currently available information.

The Company’s preliminary estimates of earnings per share of

common stock and Distributable Earnings (as defined below) per share of common stock for the quarter ended June 30, 2024 are set

forth below.

| | |

| Three

Months Ended

June 30, 2024 | |

| Earnings per share of common

stock, basic and diluted | |

| $(0.04)

to $0.01 | |

| Distributable Earnings per share of

common stock, basic and diluted * | |

| $(0.12)

to $(0.07) | |

| * |

“Distributable

Earnings” is a non-GAAP measure and is defined as net income (loss) allocable to common stockholders as calculated in accordance

with generally accepted accounting principles in the United States of America (“GAAP”), excluding (1) unrealized

gains and losses on the Company’s aggregate portfolio, (2) impairment losses, (3) extinguishment of debt, (4) non-cash

equity compensation expense, (5) the incentive fee earned by the Company’s external manager, Falcons I, LLC (the “Manager”),

(6) realized gains or losses on swap terminations and (7) certain other nonrecurring gains or losses. A reconciliation

of Distributable Earnings to net income (loss) allocable to common stockholders, calculated in accordance with GAAP is set forth

below. |

The Company’s preliminary estimates of book value (as defined

below) per share of common stock and economic book value per share of common stock as of June 30, 2024 are set forth below.

| | |

| As

of June 30, 2024 | |

| Book value per share of common stock | |

| $9.98

to $10.49 | |

| Economic book value per share of common stock* | |

| $12.90

to $13.41 | |

| * |

“Economic

book value” is a non-GAAP financial measure of the Company’s financial position. To calculate its economic book value,

the portions of the Company’s non-recourse financing obligation held at amortized cost are adjusted to fair value. A reconciliation

of economic book value and economic book value per share of common stock to total stockholders’ equity and book value per share

of common stock is set forth below. |

The Company has provided estimated ranges, rather than specific amounts,

for the preliminary operating results described above primarily because the Company’s closing procedures for the quarter ended

June 30, 2024 are not yet complete and, as a result, the Company’s final results upon completion of the closing procedures

may vary from the preliminary estimates. These estimates, which are the responsibility of the Company’s management, were prepared

by the Company’s management in connection with the preparation of the Company’s financial statements and are based upon a

number of assumptions. Additional items that may require adjustments to the preliminary operating results may be identified and could

result in material changes to the Company’s estimated preliminary operating results. Estimates of operating results are inherently

uncertain and the Company undertakes no obligation to update this information. The Company’s independent auditor has not audited,

reviewed, compiled or performed any procedures with respect to this preliminary financial information. Accordingly, the Company’s

independent auditor does not express an opinion or provide any form of assurance with respect thereto.

Reconciliation of Estimated Preliminary Distributable Earnings

to Estimated Net Income (Loss) Allocable to Common Stockholders

The Company believes that the presentation of Distributable Earnings

provides investors with a useful measure to facilitate comparisons of financial performance among its real estate investment trust (“REIT”)

peers, but has important limitations. The Company believes Distributable Earnings as described above helps evaluate its financial performance

without the impact of certain transactions but is of limited usefulness as an analytical tool. As a REIT, the Company is generally required

to distribute at least 90% of its annual REIT taxable income and to pay U.S. federal income tax at the regular corporate rate to the

extent that it annually distributes less than 100% of such taxable income. Given these requirements and the Company’s belief that

dividends are generally one of the principal reasons that stockholders invest in its common stock, generally the Company intends to attempt

to pay dividends to its stockholders in an amount equal to its REIT taxable income, if and to the extent authorized by the Company’s

Board of Directors (the “Board”). Distributable Earnings is one of a number of factors considered by the Board in declaring

dividends and, while not a direct measure of REIT taxable income, over time, the measure can be considered a useful indicator of the

Company’s dividends. Distributable Earnings should not be viewed in isolation and is not a substitute for net income computed in

accordance with GAAP. The Company’s methodology for calculating Distributable Earnings may differ from the methodologies employed

by other REITs to calculate the same or similar supplemental performance measures, and as a result, its Distributable Earnings may not

be comparable to similar measures presented by other REITs.

The Company also uses Distributable Earnings to determine the incentive

fee, if any, payable to its Manager pursuant to its management agreement with its Manager.

The following table reconciles, for the quarter ended June 30,

2024, the Company’s estimated preliminary range of Distributable Earnings to its estimated preliminary range of net income (loss)

allocable to common stockholders, which the Company believes is the most directly comparable GAAP measure:

| | |

Three Months Ended | |

| | |

June 30, 2024 | |

| | |

(in thousands except for share and per

share

data) | |

| | |

Low | | |

High | |

| Net income (loss) allocable to common stockholders | |

$ | (893 | ) | |

$ | 348 | |

| Adjustments: | |

| | | |

| | |

| Net unrealized (gains) losses on trading

securities | |

| 1,813 | | |

| 1,813 | |

| Net unrealized (gains) losses on derivatives | |

| (2,592 | ) | |

| (2,592 | ) |

| Net unrealized (gains) losses on residential

loans in securitization trusts and non-recourse securitization obligation | |

| 2,579 | | |

| 2,579 | |

| Net unrealized (gains) losses on residential

loans | |

| (4,431 | ) | |

| (4,431 | ) |

| Net unrealized (gains) losses on commercial

loans | |

| (27 | ) | |

| (27 | ) |

| Non-cash equity

compensation expense | |

| 630 | | |

| 630 | |

| Distributable Earnings | |

$ | (2,920 | ) | |

$ | (1,680 | ) |

| Earnings (loss) per share of common stock, basic | |

$ | (0.04 | ) | |

$ | 0.01 | |

| Earnings (loss) per share of common stock, diluted | |

$ | (0.04 | ) | |

$ | 0.01 | |

| Distributable Earnings per share of common stock, basic | |

$ | (0.12 | ) | |

$ | (0.07 | ) |

| Distributable Earnings per share

of common stock, diluted | |

$ | (0.12 | ) | |

$ | (0.07 | ) |

| Weighted average number of shares of common stock

outstanding, basic | |

| 24,810,021 | | |

| 24,810,021 | |

| Weighted average number of shares of common stock

outstanding, diluted | |

| 24,981,729 | | |

| 24,981,729 | |

The Company’s actual results may vary from the preliminary estimates

upon the completion of its quarter end closing procedures.

Reconciliation of Estimated Preliminary Economic

Book Value and Economic Book Value per Share of Common Stock to Estimated Preliminary Total Stockholders’ Equity and Book Value

per Share of Common Stock

“Economic book value” is a non-GAAP financial measure

of the Company’s financial position. To calculate its economic book value, the portions of the Company’s non-recourse financing

obligation held at amortized cost are adjusted to fair value. These adjustments are also reflected in the table below in the Company’s

end of period total stockholders’ equity. The Company considers economic book value to provide investors with a useful supplemental

measure to evaluate its financial position as it reflects the impact of fair value changes for the Company’s legally held retained

bonds, irrespective of the accounting model applied for GAAP reporting purposes. Economic book value does not represent and should not

be considered as a substitute for book value per share of common stock or stockholders’ equity, as determined in accordance with

GAAP, and the Company’s calculation of this measure may not be comparable to similarly titled measures reported by other companies.

The following table reconciles, as of the quarter ended June 30,

2024, the Company’s estimated preliminary range of economic book value and economic book value per share of common stock to its

estimated preliminary range of total stockholders’ equity and book value per share of common stock, which the Company believes

are the most directly comparable GAAP measures:

| | |

As of June 30,

2024 | |

| | |

| (in

thousands except for share and per share data) | |

| | |

| Low | | |

| High | |

| Total stockholders’ equity | |

$ | 249,411 | | |

$ | 262,201 | |

| Adjustments: | |

| | | |

| | |

| Fair value adjustment

for securitized debt held at amortized cost | |

$ | 73,053 | | |

$ | 73,053 | |

| Stockholders’

equity including economic book value adjustments | |

$ | 322,464 | | |

$ | 335,254 | |

| Number of shares of common stock outstanding at period end | |

| 24,998,549 | | |

| 24,998,549 | |

| Book value per share of common stock | |

$ | 9.98 | | |

$ | 10.49 | |

| Economic book value per share of common stock | |

$ | 12.90 | | |

$ | 13.41 | |

The Company’s actual results may vary from the preliminary estimates

upon the completion of its quarter end closing procedures.

Statements herein which are not historical fact may be deemed forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements relate to expectations,

beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not

historical facts. The forward-looking statements are based on the Company’s beliefs, assumptions and expectations of its future

performance, taking into account all information currently available to it. These beliefs, assumptions and expectations can change as

a result of many possible events or factors, not all of which are known to the Company or are within its control. You can identify these

forward-looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “should,” “seeks,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates” or the negative version of these words

or other comparable words. The forward-looking statements speak only as of the date of this Report or as of the date they are made, and

the Company does not undertake any obligation to update any forward-looking statements except as required by law. Information about factors

affecting the Company and the forward-looking statements is available in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, as such factors may be updated from time to time in the Company’s periodic filings with

the SEC, which are available at www.sec.gov.

In light of these risks and uncertainties, there can be no assurances

that the results referred to in the forward-looking statements contained herein will in fact occur. Except to the extent required by

applicable law or regulation, the Company undertakes no obligation to, and expressly disclaims any such obligation to, update or revise

any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, changes to future

results over time or otherwise.

The information contained in this Item 2.02 is being “furnished”

and shall not be deemed “filed” with the SEC for purposes of Section 18 of the Exchange Act or otherwise subject to

the liabilities under such section. Furthermore, such information shall not be deemed incorporated by reference in any filing under the

Securities Act unless specifically identified as being incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit No.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date:

July 18, 2024 |

ANGEL

OAK MORTGAGE REIT, INC. |

| |

|

| |

By: |

/s/

Brandon Filson |

| |

Name:

|

Brandon

Filson |

| |

Title:

|

Chief

Financial Officer and Treasurer |

Exhibit

10.1

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE

AGREEMENT (this “Agreement”) is entered into as of July 18, 2024 by and between Angel Oak Mortgage

REIT, Inc., a Maryland corporation (the “Company”), and Xylem Finance LLC, a Delaware limited liability

company (the “Selling Stockholder”).

Recitals

WHEREAS, the Selling Stockholder

owns an aggregate of 7,389,791 shares of the Company’s common stock, par value $0.01 per share (“Common Stock”);

WHEREAS, the Company intends

to offer and sell its senior notes (the “Notes”) in an underwritten public offering (the “Notes Offering”)

pursuant to the Company’s shelf registration statement (No. 333-280531) on Form S-3, filed with the U.S. Securities and

Exchange Commission on June 27, 2024;

WHEREAS, the Selling Stockholder

desires to sell to the Company, and the Company desires to repurchase from the Selling Stockholder, an aggregate number of shares of Common

Stock determined pursuant to Section 1(a) of this Agreement (the “Shares”) at a price per Share determined

pursuant to Section 1(b) of this Agreement (the “Share Price”), upon the terms and subject to the conditions

set forth in this Agreement (the “Repurchase”); and

WHEREAS, concurrently with

the execution and delivery of this Agreement, each of the Selling Stockholder and the Company is executing and delivering a letter agreement

containing certain representations, warranties and agreements of the Selling Stockholder in connection herewith (the “Big Boy

Representation Letter Agreement”).

NOW, THEREFORE, in consideration

of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the undersigned hereby agree as follows:

Agreement

1. Repurchase.

| (a) | Purchase and Sale. At the Closing (as defined below), the Company hereby agrees to repurchase from

the Selling Stockholder, and the Selling Stockholder hereby agrees to sell and deliver, or cause to be delivered, to the Company, the

number of Shares (rounded down to the nearest whole share) determined by dividing the aggregate purchase price determined pursuant

to this Section 1(a) (the “Aggregate Purchase Price”) by the Share Price. The Aggregate Purchase Price

shall be determined based on the aggregate principal amount of Notes (“Aggregate Principal Amount of Notes”) sold in

the Notes Offering (excluding any amounts sold pursuant to the Underwriters’ Option (as defined below)) in accordance with the table

set forth below: |

| |

Aggregate Principal Amount of Notes

Sold in the Notes Offering |

|

Aggregate Purchase Price |

| $ |

25,000,000 |

|

$ |

5,000,000 |

| $ |

30,000,000 |

|

$ |

8,000,000 |

| $ |

35,000,000 |

|

$ |

11,000,000 |

| $ |

40,000,000 |

|

$ |

14,000,000 |

| $ |

45,000,000 |

|

$ |

17,000,000 |

| $ |

50,000,000 |

|

$ |

20,000,000 |

The exact “Aggregate Principal Amount

of Notes Sold in the Notes Offering” and corresponding “Aggregate Purchase Price” may not be set forth in the table

above, in which case, the Aggregate Purchase Price shall be determined by straight-line interpolation between the lowest and highest amounts

reflected in the columns in the table above entitled “Aggregate Principal Amount of the Notes Sold in the Notes Offering”

and “Aggregate Purchase Price.” For purposes of this Section 1(a), the “Aggregate Principal Amount of Notes Sold

in the Notes Offering” shall exclude any Notes sold in the Notes Offering pursuant to any option to purchase additional Notes exercised

by the underwriters in connection with the Notes Offering (the “Underwriters’ Option”). For purposes of this

Section 1(a), if more than $50,000,000 in Aggregate Principal Amount of Notes are sold in the Notes Offering (excluding any amounts

sold pursuant to the Underwriters’ Option), the Aggregate Purchase Price for the Shares shall equal $20,000,000.

| (b) | Share Price. The Share Price shall be (i) the volume-weighted average price of the Common

Stock as displayed on Bloomberg page “AOMR US EQUITY VWAP” (or, if such page is not available, its equivalent successor

page) for the five trading days up to and including the trading day immediately preceding the launch of the Notes Offering less

(ii) a discount of 3.15% of the Share Price determined pursuant to clause (i) in this Section 1(b). |

| (c) | Closing. Subject to the terms and conditions of this Agreement and the delivery of the deliverables

contemplated by Section 1(d) of this Agreement, the closing of the sale of the Shares contemplated hereby (the “Closing”)

will take place as soon as practicable following the initial closing of the Notes Offering (and in any event no later than the Company’s

receipt of the deliverables required to be delivered by the Selling Stockholder pursuant to Section 1(d)) via the electronic exchange

of deliverables, or such other time, date or place as shall be agreed upon in writing by the parties. |

| (d) | Closing Deliveries and Actions. At the Closing, the Selling Stockholder shall deliver, or cause

to be delivered, the Shares to the Company by electronically transferring such Shares to the account(s) designated by the Company

and executing such other documents and performing such further actions as the Company or its transfer agent may reasonably require to

carry out and give effect to the Repurchase, and the Company shall deliver to the Selling Stockholder by wire transfer, in accordance

with written instructions to be provided by the Selling Stockholder no later than two business days prior to the Closing, immediately

available funds in an amount (rounded to the nearest whole cent) determined by (i) multiplying (a) the number of Shares

determined pursuant to Section 1(a) of this Agreement by (b) the Share Price determined pursuant to Section 1(b) of

this Agreement (ii) less an amount equal to $50,000.00 (such amount, the “Repurchase Price”); and the Selling

Stockholder shall deliver, or cause to be delivered, as soon as possible after execution of this Agreement but in any event no later than

two business days prior to the Closing, a properly completed duly executed IRS Form W-9 of the Selling Stockholder upon which the

Company may rely on to avoid any withholding tax attributable to payments to Selling Stockholder made under this Agreement. |

| (e) | Other Payments. The Selling Stockholder agrees to pay all stamp, stock transfer and similar duties

and taxes, if any, in connection with the Repurchase. |

| (f) | Condition to Settlement. The obligation of the Selling Stockholder to sell and deliver the Shares

to the Company and the obligation of the Company to purchase and pay the Repurchase Price for the Shares at the Closing are conditioned

only upon the Company’s sale of an Aggregate Principal Amount of Notes sold in the Notes Offering equaling or exceeding $25,000,000

(excluding any amounts sold pursuant to the Underwriters’ Option) and the initial closing of the Notes Offering occurring by August 15,

2024 (the “Outside Date”). |

2. Representations

of the Company. The Company represents and warrants to the Selling Stockholder that, as of the date hereof and at the Closing:

| (a) | The Company is a corporation duly organized, validly existing and in good standing under the laws of the

State of Maryland. |

| (b) | The Company has the full power and authority to execute, deliver and carry out the terms and provisions

of this Agreement and to consummate the transactions contemplated hereby, and has taken all necessary action to authorize the execution,

delivery and performance of this Agreement. |

| (c) | This Agreement has been duly and validly authorized, executed and delivered by the Company and constitutes

a legal, valid and binding agreement of the Company, enforceable against the Company in accordance with its terms, except to the extent

that (i) such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws now or hereafter

in effect affecting creditors’ rights generally and (ii) the remedy of specific performance and injunctive and other forms

of equitable relief may be subject to certain equitable defenses and to the discretion of the court before which any proceedings therefor

may be brought. |

| (d) | The execution and delivery of this Agreement and the consummation of the transactions contemplated hereby

will not conflict with, result in the breach of any of the terms or conditions of, constitute a default under or violate, accelerate or

permit the acceleration of any other similar right of any other party under the Articles of Amendment and Restatement of the Company,

as amended, or the Third Amended and Restated Bylaws of the Company, any law, rule or regulation or any agreement, lease, mortgage,

note, bond, indenture, license or other document or undertaking to which the Company is a party or by which the Company or its properties

may be bound, nor will such execution, delivery and consummation violate any order, writ, injunction or decree of any federal, state,

local or foreign court, administrative agency or governmental or regulatory authority or body (each, an “Authority”)

to which the Company or any of its properties is subject, the effect of any of which, either individually or in the aggregate, would have,

or reasonably be expected to have, a material adverse effect on the consolidated financial position, stockholders’ equity or results

of operations of the Company and its subsidiaries, taken as a whole, or materially impact the Company’s ability to consummate the

transactions contemplated by this Agreement (a “Material Adverse Effect”); and no consent, approval, authorization,

order, registration or qualification of or with any such Authority is required for the consummation by the Company of the transactions

contemplated by this Agreement, except such consents, approvals, authorizations and orders as would not, individually or in the aggregate,

reasonably be expected to have a Material Adverse Effect. |

| (e) | The Company acknowledges that it has not relied upon any express or implied representations or warranties

of any nature made by or on behalf of the Selling Stockholder, whether or not any such representations, warranties or statements were

made in writing or orally, except as expressly set forth for the benefit of the Company in this Agreement or in the Big Boy Representation

Letter Agreement. |

3. Representations

of the Selling Stockholder. The Selling Stockholder represents and warrants to the Company that, as of the date hereof and at the

Closing:

| (a) | The Selling Stockholder is a limited liability company duly organized, validly existing and in good standing

under the laws of the State of Delaware. |

| (b) | The Selling Stockholder has the full power and authority to execute, deliver and carry out the terms and

provisions of this Agreement and to consummate the transactions contemplated hereby, and has taken all necessary action to authorize the

execution, delivery and performance of this Agreement. |

| (c) | This Agreement has been duly and validly authorized, executed and delivered by the Selling Stockholder,

and constitutes a legal, valid and binding agreement of the Selling Stockholder, enforceable against the Selling Stockholder in accordance

with its terms, except to the extent that (i) such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium

or other similar laws now or hereafter in effect affecting creditors’ rights generally and (ii) the remedy of specific performance

and injunctive and other forms of equitable relief may be subject to certain equitable defenses and to the discretion of the court before

which any proceedings therefor may be brought. |

| (d) | The sale of the Shares to be sold by the Selling Stockholder hereunder and the execution and delivery

of this Agreement and the consummation of the transactions contemplated hereby will not conflict with, result in the breach of any of

the terms or conditions of, constitute a default under or violate, accelerate or permit the acceleration of any other similar right of

any other party under the governing organizational documents of the Selling Stockholder, any law, rule or regulation, or any agreement,

lease, mortgage, note, bond, indenture, license or other document or undertaking, to which the Selling Stockholder is a party or by which

the Selling Stockholder or its properties may be bound, nor will such execution, delivery and consummation violate any order, writ, injunction

or decree of any Authority to which the Selling Stockholder or any of its properties is subject, the effect of any of which, either individually

or in the aggregate, would affect the validity of the Shares to be sold by the Selling Stockholder or reasonably be expected to materially

impact the Selling Stockholder’s ability to perform its obligations under this Agreement; and no consent, approval, authorization,

order, registration or qualification of or with any such Authority is required for the performance by the Selling Stockholder of its obligations

under this Agreement and the consummation by the Selling Stockholder of the transactions contemplated by this Agreement in connection

with the Shares to be sold by the Selling Stockholder hereunder, except such consents, approvals, authorizations and orders as would not,

individually or in the aggregate, reasonably be expected to have a material adverse effect on the Selling Stockholder’s ability

to consummate the transactions contemplated by this Agreement. |

| (e) | The Selling Stockholder has, and immediately prior to the delivery of the Shares to the Company at the

Closing, the Selling Stockholder will have, valid and unencumbered title to the Shares to be sold by the Selling Stockholder hereunder

at such time of delivery. At the Closing, valid title to the Shares shall vest with the Company, free and clear of any and all liens,

claims, charges, pledges, encumbrances and security interests. |

4. Publicity.

Each of the Selling Stockholder and the Company agrees that it shall not, and that it shall cause its affiliates and representatives not

to, (a) publish, release or file any initial press release or other public statement or announcement relating to the transactions

contemplated by this Agreement (an “Initial Press Release”) before providing a copy of such release, statement or announcement

to the other, and (b) after the date hereof, publish, release or file any subsequent press release or other public statement or announcement

relating to the transactions contemplated by this Agreement that is materially inconsistent with any such Initial Press Release.

5. Notices.

All notices, demands or other communications to be given or delivered under or by reason of the provisions of this Agreement will be in

writing and will be deemed to have been given when delivered personally, mailed by certified or registered mail (return receipt requested

and postage prepaid), sent via a nationally recognized overnight courier, or sent via email (receipt of which is confirmed) to the recipient.

Such notices, demands and other communications shall be sent as follows:

To the Selling Stockholder:

Xylem Finance LLC

c/o Davidson Kempner Capital Management LP

520 Madison Avenue, 30th Floor

New York, NY 10022

Attention: Brandon Janes; Andrew Tan; Vikram Shankar

E-mail: bjanes@dkp.com;

atan@dkp.com; vshankar@dkp.com

With a copy to (which shall

not constitute notice):

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, California 92626

Attention: Darren Guttenberg and Drew Capurro

Email: darren.guttenberg@lw.com;

drew.capurro@lw.com

To the Company:

Angel Oak Mortgage REIT, Inc.

3344 Peachtree Road NE, Suite 1725

Atlanta, Georgia 30326

Attention: Brandon Filson and David Gordon

Email: brandon.filson@angeloakcapital.com;

david.gordon@angeloakcapital.com

With a copy to (which shall

not constitute notice):

Sidley Austin LLP

787 Seventh Avenue

New York, New York 10019

Attention: J. Gerard Cummins and Adam Gross

Email: jcummins@sidley.com; adam.gross@sidley.com

or such other address or to the attention of such

other person as the recipient party shall have specified by prior written notice to the sending party.

6. Withholding.

The Company shall be entitled to deduct and withhold from any amount otherwise payable pursuant to this Agreement such amounts as it is

required to deduct and withhold with respect to the making of such payment under any applicable provision of federal, state, local or

foreign tax law. Any amounts so deducted or withheld shall be paid over to the appropriate governmental authority. Before making any such

deduction or withholding (other than with respect to compensatory payments), to the extent reasonably feasible and subject to any applicable

requirements of law, including laws relating to the timing, withholding and payment of taxes, the Company shall use commercially reasonable

efforts to provide to the Selling Stockholder prior notice of any applicable payor’s intention to make such deduction or withholding

in order for the Selling Stockholder to obtain reduction of or relief from such deduction or withholding from the applicable governmental

authority and/or execute and deliver to or file with such governmental authority and/or the Company such affidavits, certificates and

other documents as may reasonably be expected to afford to the Selling Stockholder reduction of or relief from such deduction or withholding;

provided that such efforts to obtain such relief or reduction does not subject the Company or its paying agent to any potential

liability to such governmental authority for any such claimed withholding and payment. If any amount is so withheld, such withheld amounts

shall be treated for all purposes of this Agreement as having been paid to the Selling Stockholder with respect to which such deduction

or withholding was imposed.

7. Miscellaneous.

| (a) | Survival of Representations and Warranties. All representations and warranties contained herein

or made in writing by any party in connection herewith shall survive the execution and delivery of this Agreement and the consummation

of the transactions contemplated hereby until the expiration of the applicable statute of limitations. |

| (b) | Termination. This Agreement shall be automatically terminated if (i) the Notes Offering is

terminated prior to the initial closing thereof, (ii) the Company has sold an Aggregate Principal Amount of Notes in the Notes Offering

in amount that is less than $25,000,000 (excluding any amounts sold pursuant to the Underwriters’ Option), or (iii) the initial

closing of the Notes Offering has not occurred by the Outside Date. This Agreement may be terminated at any time by the mutual written

consent of each of the parties hereto. |

| (c) | Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner

as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal, or unenforceable

in any respect under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect

any other provision or any other jurisdiction, but this Agreement will be reformed, construed, and enforced in such jurisdiction as if

such invalid, illegal or unenforceable provision had never been contained herein. |

| (d) | Complete Agreement. The Big Boy Representation Letter Agreement is hereby incorporated herein and

made a part hereof as if set forth in full herein. This Agreement, together with the Big Boy Representation Letter Agreement, supersedes

all prior agreements and understandings (whether written or oral) between the Company and the Selling Stockholder with respect to the

subject matter hereof. |

| (e) | Counterparts. This Agreement may be executed by any one or more of the parties hereto in any number

of counterparts, each of which shall be deemed to be an original, but all such counterparts shall together constitute one and the same

instrument. This Agreement, and any and all agreements and instruments executed and delivered in accordance herewith, to the extent signed

and delivered by means of facsimile or other electronic format or signature (including email, “pdf,” “tif,” “jpg,”

DocuSign and Adobe Sign), shall be treated in all manner and respects and for all purposes as an original signature and an original agreement

or instrument and shall be considered to have the same legal effect, validity and enforceability as if it were the original signed version

thereof delivered in person. |

| (f) | Successors and Assigns. Neither this Agreement nor any of the rights, interests or obligations

hereunder shall be assigned, in whole or in part, by either party without the prior written consent of the other party. Except as otherwise

provided herein, this Agreement shall bind and inure to the benefit of and be enforceable by the Selling Stockholder and the Company and

their respective successors and assigns. |

| (g) | No Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties

and their successors and permitted assigns and nothing herein express or implied shall give or shall be construed to confer any legal

or equitable rights or remedies to any person other than the parties to this Agreement and such successors and permitted assigns. |

| (h) | Governing

Law. THIS AGREEMENT AND ANY MATTERS RELATED TO THIS TRANSACTION SHALL BE GOVERNED BY

AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO PRINCIPLES

OF CONFLICT OF LAWS THAT WOULD RESULT IN THE APPLICATION OF ANY LAW OTHER THAN THE LAWS OF

THE STATE OF NEW YORK. The Company and the Selling Stockholder each agrees that any suit

or proceeding arising in respect of this Agreement will be tried exclusively in the U.S.

District Court for the Southern District of New York or, if that court does not have subject

matter jurisdiction, in any state court located in The City and County of New York, and the

Company and the Selling Stockholder each agrees to submit to the jurisdiction of, and to

venue in, such courts. |

| (i) | Waiver of Jury Trial. The Company and the Selling Stockholder each hereby irrevocably waives, to

the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating

to this Agreement or the transactions contemplated hereby. |

| (j) | Mutuality of Drafting. The parties have participated jointly in the negotiation and drafting of

this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly

drafted by the parties, and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship

of any provision of the Agreement. |

| (k) | Remedies. The parties hereto agree and acknowledge that money damages may not be an adequate remedy

for any breach of the provisions of this Agreement and that any party may in its sole discretion apply to any court of law or equity of

competent jurisdiction (without posting any bond or deposit) for specific performance or other injunctive relief in order to enforce,

or prevent any violations of, the provisions of this Agreement. |

| (l) | Amendment and Waiver. The provisions of this Agreement may be amended or waived only with the prior

written consent of the Company and the Selling Stockholder. |

| (m) | Expenses. Each of the Company and the Selling Stockholder shall bear its own expenses in connection

with the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby. |

[Signatures appear on following pages.]

IN WITNESS WHEREOF, the parties

hereto have executed this Stock Repurchase Agreement as of the date first written above.

| COMPANY: |

| | ANGEL OAK MORTGAGE REIT, INC. |

| | By: | /s/

Brandon Filson |

| | Name: | Brandon

Filson |

| | Title: | Chief

Financial Officer and Treasurer |

| |

SELLING

STOCKHOLDER: |

| |

Xylem

Finance LLC |

| |

By: |

Midtown Acquisitions GP LLC, its Manager |

| | By: | /s/ Patrick W. Dennis |

| | Name: | Patrick W. Dennis |

| | Title: | Co-Deputy Executive Managing Member |

[Signature Page to Stock Repurchase Agreement]

v3.24.2

Cover

|

Jul. 18, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 18, 2024

|

| Entity File Number |

001-40495

|

| Entity Registrant Name |

Angel

Oak Mortgage REIT, Inc.

|

| Entity Central Index Key |

0001766478

|

| Entity Tax Identification Number |

37-1892154

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

3344 Peachtree Road Northeast

|

| Entity Address, Address Line Two |

Suite 1725

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

404

|

| Local Phone Number |

953-4900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.01 par value per share

|

| Trading Symbol |

AOMR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

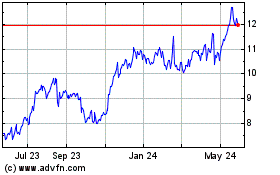

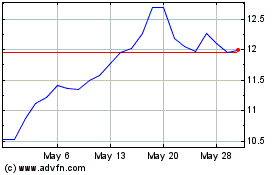

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Jul 2023 to Jul 2024