Current Report Filing (8-k)

March 11 2020 - 3:16PM

Edgar (US Regulatory)

0000008818

false

0000008818

2020-03-10

2020-03-11

0000008818

us-gaap:CommonStockMember

2020-03-10

2020-03-11

0000008818

avy:SeniorNotesDue2025Member

2020-03-10

2020-03-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported) March 11, 2020

|

AVERY DENNISON CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

1-7685

|

95-1492269

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

207 Goode Avenue

Glendale, California

|

|

91203

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code (626) 304-2000

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

Common Stock, $1 par value

|

AVY

|

New York Stock Exchange

|

|

1.25% Senior Notes due 2025

|

AVY25

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On March 11, 2020,

Avery Dennison Corporation, a Delaware corporation (the “Company”), closed its previously announced sale of $500,000,000

aggregate principal amount of 2.650% Senior Notes due 2030 (the “Notes”). The net proceeds from the offering, after

deducting underwriting discounts and estimated offering expenses, were approximately $493.6 million. The Company intends to use

the net proceeds of the offering to repay existing indebtedness under its commercial paper program and the $250.0 million aggregate

principal amount of its 5.375% senior notes when they mature on April 15, 2020.

The offering of the

Notes was registered under an effective Registration Statement on Form S-3, filed by the Company on April 26, 2019 (Registration

No. 333-231039). The Notes were issued pursuant to an indenture, dated as of November 20, 2007, as supplemented by a sixth supplemental

indenture, dated as of March 11, 2020 (as supplemented, the “Indenture”), between the Company and The Bank of New York

Mellon Trust Company, N.A., as Trustee. The Notes bear interest at a rate of 2.650% per year, payable semi-annually in arrears

on April 30 and October 30 of each year, beginning on April 30, 2020. The Notes will mature on April 30, 2030. The Company may

redeem the notes, in whole or in part, at any time, at a redemption price equal to the greater of (a) 100% of the principal amount

of the Notes to be redeemed and (b) a “make-whole” amount as described in the Indenture, plus in either case accrued

and unpaid interest to, but not including, the redemption date; provided, however, that, if the Company redeems any Notes on or

after January 30, 2030 (the date falling three months prior to the maturity date of the Notes), the redemption price for the Notes

will be equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest to, but not including,

the redemption date. In the event of a change of control triggering event as described in the Indenture, the Company would be required

to offer to repurchase the Notes at a price equal to 101% of the principal amount plus accrued and unpaid interest to, but not

including, the repurchase date.

The Notes are unsecured

and unsubordinated obligations of the Company. The Notes rank equally and ratably with all of the Company’s other existing

and future unsecured and unsubordinated indebtedness and other liabilities; senior in right of payment to all of the Company’s

future subordinated indebtedness, if any; effectively junior to all of the Company’s future secured indebtedness, if any,

to the extent of the value of the assets securing such indebtedness; and structurally subordinated to all existing and future indebtedness

and other liabilities of the Company’s subsidiaries. The descriptions of the Indenture and the Notes contained herein are

summaries and are qualified in their entirety by the Indenture and Notes attached hereto as Exhibits 4.1, 4.2 and 4.3, respectively.

Attached hereto as

exhibits are the agreements and opinion relating to the offering. The exhibits are expressly incorporated herein and into the aforementioned

Registration Statement on Form S-3, and any amendments thereto.

Item 2.03 Creation of Direct Financial

Obligation or an Obligation Under an Off-Balance Sheet Arrangement.

The disclosure in Item

1.01 above is incorporated in this section by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

AVERY DENNISON CORPORATION

|

|

|

|

|

|

Date: March 11, 2020

|

|

|

|

|

By:

|

/s/ Gregory S. Lovins

|

|

|

|

Name:

|

Gregory S. Lovins

|

|

|

|

Title:

|

Senior Vice President and Chief Financial Officer

|

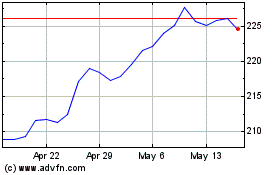

Avery Dennison (NYSE:AVY)

Historical Stock Chart

From Oct 2024 to Nov 2024

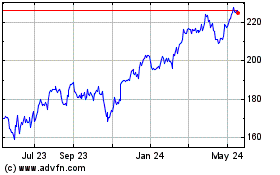

Avery Dennison (NYSE:AVY)

Historical Stock Chart

From Nov 2023 to Nov 2024