UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07732

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue

of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: March 31, 2024

Date of reporting period: March 31, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

MAR 03.31.24

ANNUAL REPORT

ALLIANCEBERNSTEIN

GLOBAL HIGH INCOME FUND

(NYSE: AWF)

|

|

|

|

|

| Investment Products Offered |

|

• Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how

the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and

Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its

complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at

www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is

the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

|

|

|

| FROM THE PRESIDENT |

|

|

Dear Shareholder,

We’re pleased to provide

this report for AllianceBernstein Global High Income Fund, Inc. (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

At AB, we’re striving to help our clients achieve better outcomes by:

| + |

|

Fostering diverse perspectives that give us a distinctive approach to navigating global capital markets

|

| + |

|

Applying differentiated investment insights through a connected global research network |

| + |

|

Embracing innovation to design better ways to invest and leading-edge mutual-fund solutions |

Whether you’re an individual investor or a multibillion-dollar institution, we’re putting our knowledge and experience to work for you every day.

For more information about AB’s comprehensive range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in AB mutual funds—and for placing your trust in our firm.

Sincerely,

Onur Erzan

President and Chief Executive

Officer, AB Mutual Funds

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 1 |

ANNUAL REPORT

May 7, 2024

This report provides management’s discussion of fund performance for AllianceBernstein Global High Income Fund, Inc. for the annual reporting period ended

March 31, 2024. The Fund is a closed-end fund and its shares of common stock trade on the New York Stock Exchange.

The Fund seeks high current income and, secondarily, capital appreciation.

RETURNS AS OF MARCH 31, 2024 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

6 Months |

|

|

12 Months |

|

|

|

|

| ALLIANCEBERNSTEIN GLOBAL HIGH INCOME FUND (NAV) |

|

|

10.89% |

|

|

|

15.06% |

|

|

|

|

| Primary Benchmark:

Bloomberg Global High Yield Index (USD

hedged) |

|

|

10.57% |

|

|

|

13.36% |

|

|

|

|

Blended Benchmark:

33% JPM GBI-EM / 33% JPM EMBI Global/

33% Bloomberg US Corporate HY 2% Issuer Capped Index |

|

|

8.27% |

|

|

|

7.90% |

|

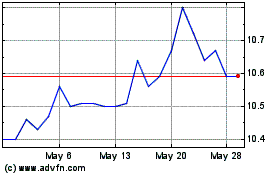

The Fund’s market price per share on March 31, 2024, was $10.62. The Fund’s NAV per share on March 31, 2024, was

$11.21. For additional financial highlights, please see pages 105-106.

Please keep in mind that high, double-digit returns

are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions.

INVESTMENT RESULTS

The table above shows the Fund’s performance compared with its primary benchmark, the Bloomberg Global High

Yield Index (USD hedged), as well as its blended benchmark for the six- and 12-month periods ended March 31, 2024. The blended benchmark is composed of equal

weightings of the JPMorgan Government Bond Index-Emerging Markets (“JPM GBI-EM”) (local currency-denominated), the JPMorgan Emerging Markets Bond Index Global (“JPM EMBI Global”) and the

Bloomberg US Corporate High Yield (“HY”) 2% Issuer Capped Index.

During both periods, the Fund outperformed its primary benchmark and the blended

benchmark. Over the 12-month period, security selection was the largest contributor to relative performance, from security selection in US investment-grade and high-yield corporate bonds, eurozone high-yield

corporates and emerging-market (“EM”) sovereign and corporate bonds. Yield-curve positioning also contributed, as an overweight to the six-month part of the yield curve in the US and an underweight

to the six-month part of the eurozone yield-curve contributed more to performance than losses from overweights to the two- to 10-year parts of the US yield-curve. At the country level, an underweight to

the eurozone contributed. From a currency perspective, a short in the euro also added to performance. Sector

|

|

|

|

|

| 2 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

allocation detracted, mostly from an underweight to EM sovereign bonds, and off-benchmark exposure to US investment-grade corporates, US Treasuries and

commercial mortgage-backed securities (“CMBS”) that were partially offset by gains from off-benchmark exposure to collateralized loan obligations and an underweight to emerging-market corporate

bonds.

During the six-month period, security selection was the greatest contributor, as selections among US

investment-grade and high-yield corporate bonds, eurozone high-yield corporates and emerging-market sovereign bonds contributed. An underweight to the eurozone and an overweight to the US contributed from a country allocation perspective.

Yield-curve positioning also added to performance, mainly from an overweight to the six-month part of the US curve and an underweight to the six-month part of the

eurozone curve that was partially offset by losses from overweights to the two- and five-year parts of the US yield-curve and underweights to the 20- and 30-year parts of the US yield-curve. Sector allocation detracted, mostly from an underweight to emerging-market sovereign bonds and off-benchmark exposure to US

investment-grade corporates, US Treasuries, bank loans, agency risk-sharing transactions and CMBS that were partially offset by a gain from an overweight to US high-yield corporate bonds. Currency decisions also detracted, because of a short

position in the euro.

During both periods, the Fund used interest rate swaps and futures to manage and hedge duration risk and/or to take active yield-curve

positioning. Currency forwards were used to hedge foreign currency exposure and to take active currency risk. Credit default swaps were also utilized to effectively gain exposure to specific sectors. Total return swaps were used to create synthetic

high-yield exposure in the Fund, while written options and purchased options were used to put spread for downside protection.

During both the six-month and

12-month period, the utilization of leverage on behalf of the Fund contributed positively to performance.

MARKET REVIEW AND INVESTMENT

STRATEGY

Over the 12-month period ended March 31, 2024, fixed-income government bond market yields were

extremely volatile in all major developed markets, and developed-market government bond returns started to diverge based on individual country rates of growth, inflation expectations and central bank decisions. Most central banks raised interest

rates substantially to combat inflation, then paused further interest-rate hikes later in the period and are on the cusp of beginning monetary easing. Government bond returns in aggregate were positive, with the highest return in Switzerland, while

US Treasury returns were only slightly positive. Overall, developed-market investment-grade corporate bonds solidly outperformed government bonds, including in the US and eurozone. High-yield corporate bonds advanced and significantly outperformed

government bonds—especially in the eurozone and US. Emerging-market hard-currency

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 3 |

sovereign bonds outperformed developed-market treasuries by a wide margin. Emerging-market hard-currency corporate bonds had strong relative positive returns and outperformed developed-market

corporates by credit quality. Among sovereigns and corporates, emerging-market high yield outperformed investment grade by a material margin during the period. Local-currency sovereign bonds exceeded developed-market treasuries yet trailed other

risk sectors as the US dollar gained on most currencies during the period.

The Fund’s Investment Management Team (the “Team”) seeks to generate high

current income and, secondarily, capital appreciation. The Fund is a globally diversified portfolio that takes full advantage of the Team’s best research ideas by pursuing high-income opportunities across all fixed-income sectors. The Fund

invests primarily (and without limit) in corporate debt securities from US and non-US issuers, as well as government bonds from both developing and developed countries, including the US. Under normal market

conditions, the Fund invests substantially in lower-rated bonds, but may also invest in investment-grade and unrated debt securities.

INVESTMENT POLICIES

The Fund invests without limit in securities denominated

in non-US currencies as well as those denominated in the US dollar. The Fund may also invest, without limit, in sovereign debt securities issued by emerging and developed nations and in debt securities of US

and non-US corporate issuers. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages 5-8 and “Note E—Risks

Involved in Investing in the Fund” of the Notes to Financial Statements on pages 100-103.

|

|

|

|

|

| 4 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

DISCLOSURES AND RISKS

AllianceBernstein Global High Income Fund

Shareholder Information

Weekly comparative net asset value (“NAV”) and market price information about the Fund is published each Saturday in Barron’s

and in other newspapers in a table called “Closed-End Funds.” Daily NAV and market price information, and additional information regarding the Fund, is available at www.abfunds.com and

www.nyse.com. For additional shareholder information regarding this Fund, please see pages 110-111.

Benchmark

Disclosure

All indices are unmanaged and do not reflect fees and expenses associated with the active management of a fund portfolio. The Bloomberg

Global High Yield Index (USD hedged) represents non-investment grade fixed-income securities of companies in the US, and developed and emerging markets, hedged to the US dollar. The JPM® GBI-EM represents the performance of local currency government bonds issued by emerging markets. The JPM EMBI Global (market-capitalization weighted)

represents the performance of US dollar-denominated Brady bonds, Eurobonds and trade loans issued by sovereign and quasi-sovereign entities. The Bloomberg US Corporate HY 2% Issuer Capped Index is the 2% Issuer Capped component of the US Corporate

High Yield Index, which represents the performance of fixed-income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million and at least one year to maturity. An investor cannot invest directly in an

index, and its results are not indicative of the performance of any specific investment, including the Fund.

A Word About Risk

Market Risk: The market value of a security may move up or down, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less

than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer, industry, sector of the economy or the market as a whole. Global economies and financial markets are increasingly

interconnected, which increases the probabilities that conditions in one country or region might adversely impact issuers in a different country or region. Conditions affecting the general economy, including political, social, or economic

instability at the local, regional, or global level may also affect the market value of a security. Health crises, such as pandemic and epidemic diseases, as well as other incidents that interrupt the expected course of events, such as natural

disasters, including fires, earthquakes and flooding, war or civil disturbance, acts of terrorism, power outages and other unforeseeable and external events, and the public response to or fear of such diseases or events, have had, and may in the

future have, an adverse effect on the

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 5 |

DISCLOSURES AND RISKS (continued)

Fund’s

investments and net asset value and can lead to increased market volatility. For example, the diseases or events themselves or any preventative or protective actions that governments may take in respect of such diseases or events may result in

periods of business disruption, inability to obtain raw materials, supplies and component parts, and reduced or disrupted operations for the Fund’s portfolio companies. The occurrence and pendency of such diseases or events could adversely

affect the economies and financial markets either in specific countries or worldwide.

Interest-Rate Risk: Changes in interest rates will affect the value of

investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is

generally greater for fixed-income securities with longer maturities or durations. The Fund may be subject to a greater risk of rising interest rates than would normally be the case due to the recent end of a period of historically low rates and the

effect of potential central bank monetary policy, and government fiscal policy, initiatives and resulting market reactions to those initiatives.

Credit Risk:

An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or

guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a

fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Below Investment-Grade Securities Risk:

Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to

greater price volatility due to such factors as specific corporate developments and negative perceptions of the junk bond market generally and may be more difficult to trade than other types of securities.

Duration Risk: Duration is a measure that relates the expected price volatility of a fixed-income security to changes in interest rates. The duration of a

fixed-income security may be shorter than or equal to full maturity of a fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise.

|

|

|

|

|

| 6 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

DISCLOSURES AND RISKS (continued)

Inflation Risk:

This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the

Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Foreign

(Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and

may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

Emerging-Market Risk: Investments in emerging-market

countries may have more risk because the markets are less developed and less liquid and are subject to increased economic, political, regulatory or other uncertainties.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

Leverage Risk: As a result of the Fund’s use of leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of

changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Derivatives Risk: Investments in derivatives may be

difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. A short position in a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying

asset, which could cause the Fund to suffer a potentially unlimited loss. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk,

which is the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable or unwilling to honor its contractual obligations to the Fund.

Illiquid Investments Risk: Illiquid investments risk exists when certain investments are or become difficult to purchase or sell. Difficulty in selling such

investments may result in sales at disadvantageous prices affecting the value of your investment in the Fund. Causes of illiquid investments risk may include low trading volumes, large positions and heavy redemptions of Fund shares. Illiquid

investments risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally decline.

Management

Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 7 |

DISCLOSURES AND RISKS (continued)

no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no

guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

Mortgage-Related and/or Other Asset-Backed

Securities Risk: The Fund may invest in mortgage-backed and/or other asset-backed securities, including securities backed by mortgages and assets with an international or emerging-markets origination and securities backed by non-performing loans at the time of investment. Investments in mortgage-related and other asset-backed securities are subject to certain additional risks. The value of these securities may be particularly sensitive

to changes in interest rates. These risks include “extension risk”, which is the risk that, in periods of rising interest rates, issuers may delay the payment of principal, and “prepayment risk”, which is the risk that, in

periods of falling interest rates, issuers may pay principal sooner than expected, exposing the Fund to a lower rate of return upon reinvestment of principal. Mortgage-backed securities offered by nongovernmental issuers and other asset-backed

securities may be subject to other risks, such as higher rates of default in the mortgages or assets backing the securities or risks associated with the nature and servicing of mortgages or assets backing the securities.

As with all investments, you may lose money by investing in the Fund.

An

Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current

performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes. Historical

performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares and assumes the reinvestment of dividends and capital gains distributions at prices obtained pursuant to the

Fund’s dividend reinvestment plan.

|

|

|

|

|

| 8 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

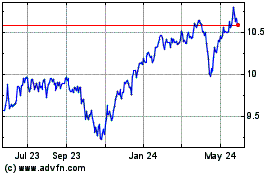

HISTORICAL PERFORMANCE

GROWTH OF A $10,000 INVESTMENT IN

THE FUND (unaudited)

3/31/2014 TO 3/31/2024

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein Global High Income Fund based on market

prices (from 3/31/2014 to 3/31/2024) as compared with the performance of the Fund’s benchmarks. The chart assumes the reinvestment of dividends and capital gains distributions at prices obtained pursuant to the Fund’s dividend reinvestment

plan.

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 9 |

HISTORICAL PERFORMANCE (continued)

AVERAGE ANNUAL

RETURNS AS OF MARCH 31, 2024 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NAV

Returns |

|

|

Market

Price |

|

|

|

|

| 1 Year |

|

|

15.06% |

|

|

|

18.43% |

|

|

|

|

| 5 Years |

|

|

4.75% |

|

|

|

5.95% |

|

|

|

|

| 10 Years |

|

|

5.05% |

|

|

|

4.78% |

|

AVERAGE ANNUAL RETURNS

AS OF THE MOST

RECENT CALENDAR QUARTER-END

MARCH 31, 2024 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NAV

Returns |

|

|

Market

Price |

|

|

|

|

| 1 Year |

|

|

15.06% |

|

|

|

18.43% |

|

|

|

|

| 5 Years |

|

|

4.75% |

|

|

|

5.95% |

|

|

|

|

| 10 Years |

|

|

5.05% |

|

|

|

4.78% |

|

Performance assumes the reinvestment of dividends and capital gains distributions at prices obtained pursuant to the Fund’s dividend

reinvestment plan.

|

|

|

|

|

| 10 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

PORTFOLIO SUMMARY

March 31, 2024 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): 966.4

| 1 |

The Fund’s security type breakdown is expressed as a percentage of total investments and may vary over time. The

Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” security type weightings represent 0.2% or

less in the following: Common Stocks, Preferred Stocks, Asset-Backed Securities and Rights. |

| 2 |

The Fund’s country breakdown is expressed as a percentage of total investments and may vary over time. The Fund

also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.7% or less in

the following: Angola, Argentina, Austria, Cayman Islands, Chile, China, Czech Republic, Dominican Republic, Ecuador, Egypt, El Salvador, Finland, Ghana, Guatemala, Hong Kong, Indonesia, Ireland, Israel, Jamaica, Japan, Jersey (Channel Islands),

Kazakhstan, Kuwait, Macau, Malaysia, Netherlands, Nigeria, Norway, Panama, Peru, Romania, Senegal, Slovenia, South Africa, Sweden, Switzerland, Trinidad and Tobago, Turkey, Ukraine, Venezuela and Zambia. |

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 11 |

PORTFOLIO OF INVESTMENTS

March 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| CORPORATES - NON-INVESTMENT GRADE –

56.7% |

|

|

|

|

|

|

|

|

|

|

|

|

| Industrial – 50.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic – 3.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| Advanced Drainage Systems,

Inc.

5.00%, 09/30/2027(a)(b) |

|

|

U.S.$ |

|

|

|

140 |

|

|

$ |

135,790 |

|

| 6.375%, 06/15/2030(b) |

|

|

|

|

|

|

364 |

|

|

|

365,701 |

|

| Alcoa Nederland Holding

BV

6.125%, 05/15/2028(b) |

|

|

|

|

|

|

649 |

|

|

|

649,969 |

|

| 7.125%, 03/15/2031(b) |

|

|

|

|

|

|

441 |

|

|

|

449,223 |

|

| Arsenal AIC Parent

LLC

8.00%, 10/01/2030(b) |

|

|

|

|

|

|

728 |

|

|

|

764,194 |

|

| ASP Unifrax Holdings,

Inc.

5.25%, 09/30/2028(b) |

|

|

|

|

|

|

1,976 |

|

|

|

1,275,289 |

|

| 7.50%, 09/30/2029(b) |

|

|

|

|

|

|

1,244 |

|

|

|

687,942 |

|

| Baffinland Iron Mines Corp./Baffinland Iron Mines LP

8.75%, 07/15/2026(b) |

|

|

|

|

|

|

373 |

|

|

|

344,561 |

|

| Cleveland-Cliffs,

Inc.

7.00%, 03/15/2032(b) |

|

|

|

|

|

|

2,998 |

|

|

|

3,040,127 |

|

| Constellium SE

3.125%, 07/15/2029(b) |

|

|

EUR |

|

|

|

1,109 |

|

|

|

1,106,618 |

|

| Crown Americas LLC/Crown Americas Capital Corp. VI

4.75%, 02/01/2026 |

|

|

U.S.$ |

|

|

|

333 |

|

|

|

327,581 |

|

| CVR Partners LP/CVR Nitrogen Finance Corp.

6.125%, 06/15/2028(b) |

|

|

|

|

|

|

360 |

|

|

|

346,140 |

|

| Domtar Corp.

6.75%, 10/01/2028(b) |

|

|

|

|

|

|

140 |

|

|

|

127,489 |

|

| Element Solutions,

Inc.

3.875%, 09/01/2028(b) |

|

|

|

|

|

|

1,370 |

|

|

|

1,255,786 |

|

| ERP Iron Ore

LLC

9.04%, 12/31/2019(c)(d)(e)(f)(g) |

|

|

|

|

|

|

240 |

|

|

|

76,802 |

|

| FMG Resources August 2006 Pty

Ltd.

4.375%, 04/01/2031(b) |

|

|

|

|

|

|

2,125 |

|

|

|

1,899,334 |

|

| 4.50%, 09/15/2027(b) |

|

|

|

|

|

|

819 |

|

|

|

786,014 |

|

| 5.875%, 04/15/2030(b) |

|

|

|

|

|

|

86 |

|

|

|

84,548 |

|

| 6.125%, 04/15/2032(b) |

|

|

|

|

|

|

2,651 |

|

|

|

2,620,859 |

|

| Glatfelter Corp.

4.75%, 11/15/2029(b) |

|

|

|

|

|

|

77 |

|

|

|

65,530 |

|

| Graham Packaging Co.,

Inc.

7.125%, 08/15/2028(b) |

|

|

|

|

|

|

698 |

|

|

|

633,188 |

|

| Graphic Packaging International LLC

3.75%, 02/01/2030(b) |

|

|

|

|

|

|

1,661 |

|

|

|

1,479,607 |

|

| Hecla Mining Co.

7.25%, 02/15/2028 |

|

|

|

|

|

|

282 |

|

|

|

283,225 |

|

|

|

|

|

|

| 12 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| Hudbay Minerals,

Inc.

4.50%, 04/01/2026(b) |

|

|

U.S.$ |

|

|

|

401 |

|

|

$ |

387,489 |

|

| INEOS Finance

PLC

6.375%, 04/15/2029(b) |

|

|

EUR |

|

|

|

1,160 |

|

|

|

1,253,222 |

|

| 7.50%, 04/15/2029(b) |

|

|

U.S.$ |

|

|

|

848 |

|

|

|

852,512 |

|

| INEOS Quattro Finance 2

PLC

8.50%, 03/15/2029(b) |

|

|

EUR |

|

|

|

1,726 |

|

|

|

1,965,427 |

|

| 9.625%, 03/15/2029(b) |

|

|

U.S.$ |

|

|

|

548 |

|

|

|

588,964 |

|

| INEOS Styrolution Ludwigshafen

GmbH

2.25%, 01/16/2027(b) |

|

|

EUR |

|

|

|

104 |

|

|

|

103,608 |

|

| Ingevity Corp.

3.875%, 11/01/2028(b) |

|

|

U.S.$ |

|

|

|

495 |

|

|

|

447,195 |

|

| Intelligent Packaging Holdco Issuer LP

9.00% (9.00% Cash or 9.75% PIK), 01/15/2026(b)(c) |

|

|

|

|

|

|

611 |

|

|

|

574,809 |

|

| Intelligent Packaging Ltd. Finco, Inc./Intelligent Packaging Ltd.

Co-Issuer LLC

6.00%, 09/15/2028(b) |

|

|

|

|

|

|

361 |

|

|

|

344,199 |

|

| Magnetation LLC/Mag Finance

Corp.

11.00%, 05/15/2018(d)(e)(f)(g)(h) |

|

|

|

|

|

|

2,857 |

|

|

|

– 0 |

– |

| Mineral Resources

Ltd.

8.125%, 05/01/2027(b) |

|

|

|

|

|

|

158 |

|

|

|

159,775 |

|

| Olympus Water US Holding

Corp.

7.125%, 10/01/2027(b) |

|

|

|

|

|

|

755 |

|

|

|

763,096 |

|

| 9.75%, 11/15/2028(b) |

|

|

|

|

|

|

1,750 |

|

|

|

1,865,756 |

|

| Roller Bearing Co. of America,

Inc.

4.375%, 10/15/2029(b) |

|

|

|

|

|

|

143 |

|

|

|

131,018 |

|

| SCIL IV LLC/SCIL USA Holdings

LLC

4.375%, 11/01/2026(b) |

|

|

EUR |

|

|

|

320 |

|

|

|

341,814 |

|

| 5.375%, 11/01/2026(b) |

|

|

U.S.$ |

|

|

|

1,039 |

|

|

|

1,008,478 |

|

| Sealed Air

Corp.

6.875%, 07/15/2033(b) |

|

|

|

|

|

|

564 |

|

|

|

588,216 |

|

| SNF Group SACA

3.125%, 03/15/2027(b) |

|

|

|

|

|

|

655 |

|

|

|

604,972 |

|

| 3.375%, 03/15/2030(b) |

|

|

|

|

|

|

951 |

|

|

|

822,619 |

|

| SunCoke Energy,

Inc.

4.875%, 06/30/2029(b) |

|

|

|

|

|

|

395 |

|

|

|

357,928 |

|

| Trinseo Materials Operating SCA/Trinseo

Materials Finance, Inc.

5.375%, 09/01/2025(b) |

|

|

|

|

|

|

58 |

|

|

|

46,400 |

|

| Vibrantz Technologies,

Inc.

9.00%, 02/15/2030(b) |

|

|

|

|

|

|

1,887 |

|

|

|

1,743,479 |

|

| WR Grace Holdings

LLC

4.875%, 06/15/2027(b) |

|

|

|

|

|

|

1,186 |

|

|

|

1,128,101 |

|

| 5.625%, 08/15/2029(b) |

|

|

|

|

|

|

61 |

|

|

|

54,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,939,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 13 |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| Capital Goods – 4.6% |

|

| ARD Finance SA

5.00% (5.00% Cash or 5.75% PIK),

06/30/2027(b)(c) |

|

EUR |

|

|

3,069 |

|

|

$ |

933,128 |

|

| Ardagh Metal Packaging Finance USA

LLC/Ardagh Metal Packaging Finance PLC

4.00%, 09/01/2029(b) |

|

U.S.$ |

|

|

985 |

|

|

|

794,136 |

|

| 6.00%, 06/15/2027(b) |

|

|

|

|

684 |

|

|

|

663,330 |

|

| Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc.

2.125%, 08/15/2026(b) |

|

EUR |

|

|

1,442 |

|

|

|

1,333,703 |

|

| 4.125%, 08/15/2026(b) |

|

U.S.$ |

|

|

3,282 |

|

|

|

2,977,186 |

|

| 5.25%, 08/15/2027(b) |

|

|

|

|

639 |

|

|

|

401,212 |

|

| Ball Corp.

6.00%, 06/15/2029 |

|

|

|

|

1,607 |

|

|

|

1,621,903 |

|

| 6.875%, 03/15/2028 |

|

|

|

|

553 |

|

|

|

567,281 |

|

| Bombardier, Inc.

7.25%, 07/01/2031(b) |

|

|

|

|

862 |

|

|

|

864,435 |

|

| 7.875%, 04/15/2027(b) |

|

|

|

|

1,055 |

|

|

|

1,056,619 |

|

| 8.75%, 11/15/2030(b) |

|

|

|

|

1,295 |

|

|

|

1,384,031 |

|

| Calderys Financing

LLC

11.25%, 06/01/2028(b) |

|

|

|

|

2,089 |

|

|

|

2,247,544 |

|

| Clean Harbors,

Inc.

4.875%, 07/15/2027(b) |

|

|

|

|

25 |

|

|

|

24,250 |

|

| 6.375%, 02/01/2031(b) |

|

|

|

|

393 |

|

|

|

395,775 |

|

| Crown Americas LLC

5.25%, 04/01/2030 |

|

|

|

|

411 |

|

|

|

396,561 |

|

| Eco Material Technologies,

Inc.

7.875%, 01/31/2027(b) |

|

|

|

|

3,007 |

|

|

|

3,054,090 |

|

| EnerSys

4.375%, 12/15/2027(b) |

|

|

|

|

935 |

|

|

|

884,948 |

|

| 6.625%, 01/15/2032(b) |

|

|

|

|

1,170 |

|

|

|

1,179,803 |

|

| Enviri Corp.

5.75%, 07/31/2027(b) |

|

|

|

|

1,384 |

|

|

|

1,302,685 |

|

| Esab Corp.

6.25%, 04/15/2029(b) |

|

|

|

|

544 |

|

|

|

546,907 |

|

| F-Brasile SpA/F-Brasile US

LLC

Series XR

7.375%, 08/15/2026(b) |

|

|

|

|

957 |

|

|

|

956,695 |

|

| GFL Environmental,

Inc.

6.75%, 01/15/2031(b) |

|

|

|

|

523 |

|

|

|

535,995 |

|

| Griffon Corp.

5.75%, 03/01/2028 |

|

|

|

|

1,079 |

|

|

|

1,057,163 |

|

| Husky Injection Molding Systems Ltd./Titan Co-Borrower

LLC

9.00%, 02/15/2029(b) |

|

|

|

|

370 |

|

|

|

382,671 |

|

|

|

|

|

|

| 14 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| LSB Industries,

Inc.

6.25%, 10/15/2028(a)(b) |

|

|

U.S.$ |

|

|

|

1,348 |

|

|

$ |

1,297,920 |

|

| Madison IAQ LLC

5.875%, 06/30/2029(b) |

|

|

|

|

|

|

359 |

|

|

|

329,116 |

|

| Maxim Crane Works Holdings Capital LLC

11.50%, 09/01/2028(b) |

|

|

|

|

|

|

340 |

|

|

|

368,638 |

|

| Moog, Inc.

4.25%, 12/15/2027(b) |

|

|

|

|

|

|

379 |

|

|

|

356,969 |

|

| Mueller Water Products,

Inc.

4.00%, 06/15/2029(b) |

|

|

|

|

|

|

291 |

|

|

|

263,989 |

|

| Oscar AcquisitionCo LLC/Oscar Finance, Inc.

9.50%, 04/15/2030(b) |

|

|

|

|

|

|

372 |

|

|

|

366,942 |

|

| Paprec Holding

SA

7.25%, 11/17/2029(b) |

|

|

EUR |

|

|

|

569 |

|

|

|

654,237 |

|

| Stericycle,

Inc.

3.875%, 01/15/2029(b) |

|

|

U.S.$ |

|

|

|

1,076 |

|

|

|

975,810 |

|

| TK Elevator Midco

GmbH

4.375%, 07/15/2027(b) |

|

|

EUR |

|

|

|

585 |

|

|

|

607,591 |

|

| TK Elevator US Newco,

Inc.

5.25%, 07/15/2027(b) |

|

|

U.S.$ |

|

|

|

306 |

|

|

|

295,675 |

|

| TransDigm, Inc.

4.625%, 01/15/2029 |

|

|

|

|

|

|

1,595 |

|

|

|

1,480,536 |

|

| 4.875%, 05/01/2029 |

|

|

|

|

|

|

1,954 |

|

|

|

1,816,156 |

|

| 6.375%, 03/01/2029(b) |

|

|

|

|

|

|

83 |

|

|

|

83,254 |

|

| 6.75%, 08/15/2028(b) |

|

|

|

|

|

|

2,508 |

|

|

|

2,544,765 |

|

| 7.125%, 12/01/2031(b) |

|

|

|

|

|

|

3,137 |

|

|

|

3,235,838 |

|

| 7.50%, 03/15/2027 |

|

|

|

|

|

|

118 |

|

|

|

118,105 |

|

| Trinity Industries,

Inc.

7.75%, 07/15/2028(b) |

|

|

|

|

|

|

1,073 |

|

|

|

1,101,743 |

|

| Triumph Group,

Inc.

9.00%, 03/15/2028(b) |

|

|

|

|

|

|

2,265 |

|

|

|

2,388,079 |

|

| Tutor Perini

Corp.

6.875%, 05/01/2025(b) |

|

|

|

|

|

|

61 |

|

|

|

60,528 |

|

| WESCO Distribution,

Inc.

6.375%, 03/15/2029(b) |

|

|

|

|

|

|

371 |

|

|

|

374,898 |

|

| 6.625%, 03/15/2032(b) |

|

|

|

|

|

|

375 |

|

|

|

381,218 |

|

| 7.125%, 06/15/2025(b) |

|

|

|

|

|

|

20 |

|

|

|

20,026 |

|

| 7.25%, 06/15/2028(b) |

|

|

|

|

|

|

271 |

|

|

|

276,697 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44,960,781 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Communications - Media – 6.9% |

|

| Advantage Sales & Marketing, Inc.

6.50%, 11/15/2028(b) |

|

|

|

|

|

|

723 |

|

|

|

680,873 |

|

| Altice Financing

SA

5.00%, 01/15/2028(b) |

|

|

|

|

|

|

516 |

|

|

|

424,302 |

|

| 5.75%, 08/15/2029(b) |

|

|

|

|

|

|

2,724 |

|

|

|

2,178,035 |

|

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 15 |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| AMC Networks, Inc.

4.25%, 02/15/2029 |

|

U.S.$ |

|

|

1,084 |

|

|

$ |

768,531 |

|

| 4.75%, 08/01/2025 |

|

|

|

|

890 |

|

|

|

889,145 |

|

| 10.25%, 01/15/2029(b) |

|

|

|

|

1,083 |

|

|

|

1,090,862 |

|

| Arches Buyer,

Inc.

6.125%, 12/01/2028(b) |

|

|

|

|

907 |

|

|

|

760,999 |

|

| Banijay Entertainment

SASU

7.00%, 05/01/2029(b) |

|

EUR |

|

|

603 |

|

|

|

683,178 |

|

| 8.125%, 05/01/2029(b) |

|

U.S.$ |

|

|

805 |

|

|

|

831,586 |

|

| Cable One, Inc.

4.00%, 11/15/2030(b) |

|

|

|

|

139 |

|

|

|

108,453 |

|

| CCO Holdings LLC/CCO Holdings Capital Corp.

4.50%, 08/15/2030(b) |

|

|

|

|

4,665 |

|

|

|

3,918,662 |

|

| 4.50%, 06/01/2033(b) |

|

|

|

|

2,851 |

|

|

|

2,224,988 |

|

| 4.75%, 02/01/2032(b) |

|

|

|

|

7,063 |

|

|

|

5,771,285 |

|

| 6.375%, 09/01/2029(b) |

|

|

|

|

1,760 |

|

|

|

1,670,817 |

|

| 7.375%, 03/01/2031(b) |

|

|

|

|

2,762 |

|

|

|

2,708,210 |

|

| Clear Channel Outdoor Holdings, Inc.

5.125%, 08/15/2027(b) |

|

|

|

|

512 |

|

|

|

483,258 |

|

| CMG Media Corp.

8.875%, 12/15/2027(b) |

|

|

|

|

478 |

|

|

|

314,131 |

|

| CSC Holdings LLC

4.50%, 11/15/2031(b) |

|

|

|

|

981 |

|

|

|

694,236 |

|

| 4.625%, 12/01/2030(b) |

|

|

|

|

1,142 |

|

|

|

580,159 |

|

| 5.375%, 02/01/2028(b) |

|

|

|

|

2,721 |

|

|

|

2,340,418 |

|

| 5.75%, 01/15/2030(b) |

|

|

|

|

2,178 |

|

|

|

1,152,284 |

|

| 7.50%, 04/01/2028(b) |

|

|

|

|

1,032 |

|

|

|

694,115 |

|

| 11.25%, 05/15/2028(b) |

|

|

|

|

824 |

|

|

|

817,242 |

|

| 11.75%, 01/31/2029(b) |

|

|

|

|

581 |

|

|

|

581,157 |

|

| Deluxe Corp.

8.00%, 06/01/2029(b) |

|

|

|

|

17 |

|

|

|

15,655 |

|

| DISH DBS Corp.

5.125%, 06/01/2029 |

|

|

|

|

2,807 |

|

|

|

1,176,208 |

|

| 5.25%, 12/01/2026(b) |

|

|

|

|

3,571 |

|

|

|

2,816,398 |

|

| 5.75%, 12/01/2028(b) |

|

|

|

|

2,596 |

|

|

|

1,785,009 |

|

| 5.875%, 11/15/2024(i) |

|

|

|

|

1,821 |

|

|

|

1,740,225 |

|

| 7.75%, 07/01/2026 |

|

|

|

|

274 |

|

|

|

183,138 |

|

| Gray Television,

Inc.

5.375%, 11/15/2031(b) |

|

|

|

|

1,364 |

|

|

|

895,356 |

|

| iHeartCommunications,

Inc.

4.75%, 01/15/2028(b) |

|

|

|

|

60 |

|

|

|

42,092 |

|

| 5.25%, 08/15/2027(b) |

|

|

|

|

1,499 |

|

|

|

1,075,025 |

|

| 6.375%, 05/01/2026 |

|

|

|

|

547 |

|

|

|

465,728 |

|

| LCPR Senior Secured Financing

DAC

5.125%, 07/15/2029(b) |

|

|

|

|

2,910 |

|

|

|

2,429,916 |

|

| 6.75%, 10/15/2027(b) |

|

|

|

|

1,098 |

|

|

|

1,029,180 |

|

|

|

|

|

|

| 16 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| Lions Gate Capital Holdings

LLC

5.50%, 04/15/2029(b) |

|

|

U.S.$ |

|

|

|

461 |

|

|

$ |

352,481 |

|

| McGraw-Hill Education,

Inc.

5.75%, 08/01/2028(b) |

|

|

|

|

|

|

1,123 |

|

|

|

1,056,111 |

|

| Outfront Media Capital LLC/Outfront Media Capital Corp.

4.625%, 03/15/2030(b) |

|

|

|

|

|

|

376 |

|

|

|

337,277 |

|

| Paramount Global

6.25%, 02/28/2057 |

|

|

|

|

|

|

245 |

|

|

|

214,923 |

|

| 6.375%, 03/30/2062 |

|

|

|

|

|

|

343 |

|

|

|

316,376 |

|

| Radiate Holdco LLC/Radiate Finance, Inc.

4.50%, 09/15/2026(b) |

|

|

|

|

|

|

1,849 |

|

|

|

1,470,659 |

|

| Sinclair Television Group,

Inc.

4.125%, 12/01/2030(b) |

|

|

|

|

|

|

1,613 |

|

|

|

1,172,855 |

|

| 5.50%, 03/01/2030(b) |

|

|

|

|

|

|

382 |

|

|

|

275,231 |

|

| Sirius XM Radio,

Inc.

3.875%, 09/01/2031(b) |

|

|

|

|

|

|

40 |

|

|

|

33,338 |

|

| 4.00%, 07/15/2028(b) |

|

|

|

|

|

|

4,573 |

|

|

|

4,184,291 |

|

| 5.00%, 08/01/2027(b) |

|

|

|

|

|

|

837 |

|

|

|

805,831 |

|

| Summer BC Holdco B

SARL

5.75%, 10/31/2026(b) |

|

|

EUR |

|

|

|

1,395 |

|

|

|

1,477,601 |

|

| TEGNA, Inc.

5.00%, 09/15/2029 |

|

|

U.S.$ |

|

|

|

333 |

|

|

|

298,698 |

|

| Townsquare Media,

Inc.

6.875%, 02/01/2026(b) |

|

|

|

|

|

|

113 |

|

|

|

110,243 |

|

| Univision Communications,

Inc.

6.625%, 06/01/2027(b) |

|

|

|

|

|

|

1,593 |

|

|

|

1,559,285 |

|

| 7.375%, 06/30/2030(b) |

|

|

|

|

|

|

1,186 |

|

|

|

1,173,562 |

|

| 8.00%, 08/15/2028(b) |

|

|

|

|

|

|

1,261 |

|

|

|

1,285,080 |

|

| Urban One, Inc.

7.375%, 02/01/2028(b) |

|

|

|

|

|

|

2,526 |

|

|

|

2,150,632 |

|

| VZ Vendor Financing II

BV

2.875%, 01/15/2029(b) |

|

|

EUR |

|

|

|

885 |

|

|

|

824,070 |

|

| Ziggo Bond Co.

BV

5.125%, 02/28/2030(b) |

|

|

U.S.$ |

|

|

|

1,770 |

|

|

|

1,513,762 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66,633,162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Communications - Telecommunications – 2.6% |

|

| Altice France Holding

SA

4.00%, 02/15/2028(b) |

|

|

EUR |

|

|

|

332 |

|

|

|

86,261 |

|

| 6.00%, 02/15/2028(b) |

|

|

U.S.$ |

|

|

|

359 |

|

|

|

101,950 |

|

| 10.50%, 05/15/2027(b) |

|

|

|

|

|

|

2,710 |

|

|

|

1,009,475 |

|

| Altice France

SA/France

3.375%, 01/15/2028(b) |

|

|

EUR |

|

|

|

885 |

|

|

|

685,696 |

|

| 5.125%, 01/15/2029(b) |

|

|

U.S.$ |

|

|

|

391 |

|

|

|

268,813 |

|

| 5.125%, 07/15/2029(b) |

|

|

|

|

|

|

5,220 |

|

|

|

3,537,131 |

|

| 5.50%, 01/15/2028(b) |

|

|

|

|

|

|

492 |

|

|

|

350,887 |

|

| 5.50%, 10/15/2029(b) |

|

|

|

|

|

|

1,761 |

|

|

|

1,210,696 |

|

| 8.125%, 02/01/2027(b) |

|

|

|

|

|

|

526 |

|

|

|

406,335 |

|

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 17 |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| Consolidated Communications,

Inc.

6.50%, 10/01/2028(b) |

|

|

U.S.$ |

|

|

|

1,486 |

|

|

$ |

1,304,140 |

|

| Embarq Corp.

7.995%, 06/01/2036 |

|

|

|

|

|

|

984 |

|

|

|

534,970 |

|

| Frontier Communications Holdings

LLC

6.75%, 05/01/2029(b) |

|

|

|

|

|

|

1,209 |

|

|

|

1,077,291 |

|

| Hughes Satellite Systems Corp.

6.625%, 08/01/2026 |

|

|

|

|

|

|

302 |

|

|

|

177,976 |

|

| Iliad Holding

SASU

6.50%, 10/15/2026(b) |

|

|

|

|

|

|

519 |

|

|

|

513,794 |

|

| Level 3 Financing,

Inc.

3.40%, 03/01/2027(b) |

|

|

|

|

|

|

584 |

|

|

|

450,884 |

|

| 3.75%, 07/15/2029(b) |

|

|

|

|

|

|

1,018 |

|

|

|

459,540 |

|

| 4.25%, 07/01/2028(b) |

|

|

|

|

|

|

769 |

|

|

|

361,863 |

|

| 4.625%, 09/15/2027(b) |

|

|

|

|

|

|

1,451 |

|

|

|

962,423 |

|

| Lorca Telecom Bondco

SA

4.00%, 09/18/2027(b) |

|

|

EUR |

|

|

|

952 |

|

|

|

997,251 |

|

| Telecom Italia Capital SA

7.20%, 07/18/2036 |

|

|

U.S.$ |

|

|

|

259 |

|

|

|

252,956 |

|

| 7.72%, 06/04/2038 |

|

|

|

|

|

|

1,565 |

|

|

|

1,565,119 |

|

| United Group BV

3.625%, 02/15/2028(b) |

|

|

EUR |

|

|

|

237 |

|

|

|

240,485 |

|

| 4.625%, 08/15/2028(b) |

|

|

|

|

|

|

481 |

|

|

|

496,891 |

|

| 6.75%, 02/15/2031(b) |

|

|

|

|

|

|

616 |

|

|

|

681,157 |

|

| 8.13% (EURIBOR 3 Month + 4.25%),

02/01/2029(b)(i) |

|

|

|

|

|

|

539 |

|

|

|

583,397 |

|

| Vmed O2 UK Financing I

PLC

4.25%, 01/31/2031(b) |

|

|

U.S.$ |

|

|

|

530 |

|

|

|

448,436 |

|

| 4.75%, 07/15/2031(b) |

|

|

|

|

|

|

3,639 |

|

|

|

3,136,895 |

|

| 7.75%, 04/15/2032(b) |

|

|

|

|

|

|

1,918 |

|

|

|

1,926,148 |

|

| Windstream Escrow LLC/Windstream Escrow Finance Corp.

7.75%, 08/15/2028(b) |

|

|

|

|

|

|

453 |

|

|

|

419,765 |

|

| Zayo Group Holdings,

Inc.

4.00%, 03/01/2027(b) |

|

|

|

|

|

|

443 |

|

|

|

364,386 |

|

| 6.125%, 03/01/2028(b) |

|

|

|

|

|

|

128 |

|

|

|

88,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,701,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer Cyclical - Automotive – 2.4% |

|

| Adient Global Holdings

Ltd.

4.875%, 08/15/2026(b) |

|

|

|

|

|

|

438 |

|

|

|

427,083 |

|

| American Axle & Manufacturing, Inc.

5.00%, 10/01/2029 |

|

|

|

|

|

|

220 |

|

|

|

197,579 |

|

| 6.875%, 07/01/2028 |

|

|

|

|

|

|

866 |

|

|

|

861,699 |

|

| Aston Martin Capital Holdings

Ltd.

10.00%, 03/31/2029(b) |

|

|

|

|

|

|

639 |

|

|

|

651,934 |

|

| Dana Financing Luxembourg

SARL

5.75%, 04/15/2025(b) |

|

|

|

|

|

|

55 |

|

|

|

54,773 |

|

|

|

|

|

|

| 18 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| Dana, Inc.

4.25%, 09/01/2030 |

|

|

U.S.$ |

|

|

|

760 |

|

|

$ |

671,514 |

|

| 5.375%, 11/15/2027 |

|

|

|

|

|

|

109 |

|

|

|

106,727 |

|

| 5.625%, 06/15/2028 |

|

|

|

|

|

|

182 |

|

|

|

177,589 |

|

| Exide

Technologies

11.00%, 10/31/2024(d)(e)(f)(g)(h)(k) |

|

|

|

|

|

|

4,147 |

|

|

|

– 0 |

– |

| Goodyear Tire & Rubber Co. (The)

5.625%, 04/30/2033 |

|

|

|

|

|

|

636 |

|

|

|

580,771 |

|

| IHO Verwaltungs GmbH

3.75% (3.75% Cash or 4.50% PIK), 09/15/2026(b)(c) |

|

|

EUR |

|

|

|

885 |

|

|

|

942,294 |

|

| 3.875% (3.875% Cash or 4.625% PIK), 05/15/2027(b)(c) |

|

|

|

|

|

|

338 |

|

|

|

357,542 |

|

| 6.00% (6.00% Cash or 6.75% PIK), 05/15/2027(b)(c) |

|

|

U.S.$ |

|

|

|

1,984 |

|

|

|

1,981,818 |

|

| 8.75% (8.75% Cash or 9.50% PIK), 05/15/2028(b)(c) |

|

|

EUR |

|

|

|

306 |

|

|

|

357,628 |

|

| Jaguar Land Rover Automotive

PLC

5.50%, 07/15/2029(b) |

|

|

U.S.$ |

|

|

|

1,206 |

|

|

|

1,154,276 |

|

| 5.875%, 01/15/2028(b) |

|

|

|

|

|

|

705 |

|

|

|

694,348 |

|

| 7.75%, 10/15/2025(b) |

|

|

|

|

|

|

1,207 |

|

|

|

1,219,065 |

|

| Mclaren Finance

PLC

7.50%, 08/01/2026(b) |

|

|

|

|

|

|

1,973 |

|

|

|

1,733,961 |

|

| PM General Purchaser

LLC

9.50%, 10/01/2028(b) |

|

|

|

|

|

|

1,250 |

|

|

|

1,277,498 |

|

| Real Hero Merger Sub 2,

Inc.

6.25%, 02/01/2029(b) |

|

|

|

|

|

|

1,530 |

|

|

|

1,339,295 |

|

| Tenneco, Inc.

8.00%, 11/17/2028(b) |

|

|

|

|

|

|

2,794 |

|

|

|

2,549,030 |

|

| Titan International, Inc.

7.00%, 04/30/2028 |

|

|

|

|

|

|

1,465 |

|

|

|

1,446,040 |

|

| ZF Europe Finance

BV

2.00%, 02/23/2026(a)(b) |

|

|

EUR |

|

|

|

200 |

|

|

|

206,468 |

|

| ZF Finance GmbH

Series

E

2.00%, 05/06/2027(b) |

|

|

|

|

|

|

200 |

|

|

|

200,774 |

|

| 2.75%, 05/25/2027(b) |

|

|

|

|

|

|

900 |

|

|

|

923,787 |

|

| ZF North America Capital,

Inc.

4.75%, 04/29/2025(b) |

|

|

U.S.$ |

|

|

|

2,357 |

|

|

|

2,328,418 |

|

| 6.875%, 04/14/2028(b) |

|

|

|

|

|

|

504 |

|

|

|

522,985 |

|

| 7.125%, 04/14/2030(b) |

|

|

|

|

|

|

504 |

|

|

|

531,117 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,496,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer Cyclical - Entertainment – 2.3% |

|

| AMC Entertainment Holdings,

Inc.

7.50%, 02/15/2029(b) |

|

|

|

|

|

|

142 |

|

|

|

95,865 |

|

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 19 |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| Carnival Corp.

4.00%, 08/01/2028(b) |

|

|

U.S.$ |

|

|

|

1,739 |

|

|

$ |

1,619,878 |

|

| 7.00%, 08/15/2029(b) |

|

|

|

|

|

|

243 |

|

|

|

252,920 |

|

| 7.625%, 03/01/2026(b) |

|

|

EUR |

|

|

|

311 |

|

|

|

341,971 |

|

| Carnival Holdings Bermuda

Ltd.

10.375%, 05/01/2028(b) |

|

|

U.S.$ |

|

|

|

3,548 |

|

|

|

3,871,277 |

|

| Cedar Fair LP

5.25%, 07/15/2029 |

|

|

|

|

|

|

85 |

|

|

|

80,479 |

|

| Cedar Fair LP/Canada’s Wonderland Co./Magnum Management Corp./Millennium

Op

5.375%, 04/15/2027 |

|

|

|

|

|

|

85 |

|

|

|

83,615 |

|

| Cinemark USA,

Inc.

5.25%, 07/15/2028(b) |

|

|

|

|

|

|

492 |

|

|

|

465,845 |

|

| Lindblad Expeditions

LLC

6.75%, 02/15/2027(b) |

|

|

|

|

|

|

365 |

|

|

|

367,236 |

|

| Merlin Entertainments Group US Holdings, Inc.

7.375%, 02/15/2031(b) |

|

|

|

|

|

|

1,076 |

|

|

|

1,084,869 |

|

| Motion Bondco

DAC

4.50%, 11/15/2027(b) |

|

|

EUR |

|

|

|

670 |

|

|

|

694,315 |

|

| NCL Corp., Ltd.

5.875%, 03/15/2026(b) |

|

|

U.S.$ |

|

|

|

545 |

|

|

|

538,160 |

|

| 5.875%, 02/15/2027(b) |

|

|

|

|

|

|

80 |

|

|

|

78,919 |

|

| 8.125%, 01/15/2029(b) |

|

|

|

|

|

|

922 |

|

|

|

976,375 |

|

| Royal Caribbean Cruises

Ltd.

5.375%, 07/15/2027(b) |

|

|

|

|

|

|

1,159 |

|

|

|

1,142,289 |

|

| 5.50%, 08/31/2026(b) |

|

|

|

|

|

|

948 |

|

|

|

938,842 |

|

| 5.50%, 04/01/2028(b) |

|

|

|

|

|

|

4,222 |

|

|

|

4,170,334 |

|

| Six Flags Entertainment

Corp.

7.25%, 05/15/2031(b) |

|

|

|

|

|

|

1,082 |

|

|

|

1,095,550 |

|

| Viking Cruises

Ltd.

5.875%, 09/15/2027(b) |

|

|

|

|

|

|

715 |

|

|

|

701,842 |

|

| 7.00%, 02/15/2029(b) |

|

|

|

|

|

|

1,752 |

|

|

|

1,759,392 |

|

| 9.125%, 07/15/2031(b) |

|

|

|

|

|

|

83 |

|

|

|

90,752 |

|

| VOC Escrow Ltd.

5.00%, 02/15/2028(b) |

|

|

|

|

|

|

1,749 |

|

|

|

1,684,324 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,135,049 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer Cyclical - Other – 3.2% |

|

| Adams Homes,

Inc.

7.50%, 02/15/2025(b) |

|

|

|

|

|

|

194 |

|

|

|

194,258 |

|

| Affinity

Interactive

6.875%, 12/15/2027(b) |

|

|

|

|

|

|

396 |

|

|

|

370,582 |

|

| Brookfield Residential Properties, Inc./Brookfield Residential US LLC

4.875%, 02/15/2030(b) |

|

|

|

|

|

|

1,097 |

|

|

|

983,266 |

|

| 6.25%, 09/15/2027(b) |

|

|

|

|

|

|

1,411 |

|

|

|

1,380,512 |

|

|

|

|

|

|

| 20 | ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND |

|

abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|

| Builders FirstSource,

Inc.

5.00%, 03/01/2030(b) |

|

U.S.$ |

|

|

466 |

|

|

$ |

444,433 |

|

| 6.375%, 03/01/2034(b) |

|

|

|

|

1,119 |

|

|

|

1,123,295 |

|

| Century Communities,

Inc.

3.875%, 08/15/2029(b) |

|

|

|

|

406 |

|

|

|

365,583 |

|

| 6.75%, 06/01/2027 |

|

|

|

|

31 |

|

|

|

31,144 |

|

| Churchill Downs,

Inc.

4.75%, 01/15/2028(b) |

|

|

|

|

491 |

|

|

|

467,380 |

|

| Cirsa Finance International

SARL

6.50%, 03/15/2029(b) |

|

EUR |

|

|

559 |

|

|

|

617,056 |

|

| Five Point Operating Co. LP/Five Point Capital Corp.

10.50%, 01/15/2028(i) |

|

U.S.$ |

|

|

1,306 |

|

|

|

1,346,314 |

|

| Forestar Group,

Inc.

3.85%, 05/15/2026(b) |

|

|

|

|

385 |

|

|

|

367,705 |

|

| Hilton Domestic Operating Co.,

Inc.

3.625%, 02/15/2032(b) |

|

|

|

|

1,593 |

|

|

|

1,372,607 |

|

| 3.75%, 05/01/2029(b) |

|

|

|

|

699 |

|

|

|

640,896 |

|

| 5.875%, 04/01/2029(b) |

|

|

|

|

1,286 |

|

|

|

1,287,941 |

|

| 6.125%, 04/01/2032(b) |

|

|

|

|

738 |

|

|

|

740,785 |

|

| Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Esc

4.875%, 07/01/2031(b) |

|

|

|

|

560 |

|

|

|

501,655 |

|

| 5.00%, 06/01/2029(b) |

|

|

|

|

1,598 |

|

|

|

1,491,009 |

|

| 6.625%, 01/15/2032(b) |

|

|

|

|

500 |

|

|

|

501,482 |

|

| Installed Building Products,

Inc.

5.75%, 02/01/2028(b) |

|

|

|

|

291 |

|

|

|

283,895 |

|

| Jacobs Entertainment,

Inc.

6.75%, 02/15/2029(b) |

|

|

|

|

2 |

|

|

|

1,939 |

|

| Marriott Ownership Resorts,

Inc.

4.50%, 06/15/2029(b) |

|

|

|

|

514 |

|

|

|

469,876 |

|

| Mattamy Group

Corp.

4.625%, 03/01/2030(b) |

|

|

|

|

95 |

|

|

|

86,430 |

|

| MGM Resorts International

4.625%, 09/01/2026 |

|

|

|

|

549 |

|

|

|

536,693 |

|

| 4.75%, 10/15/2028 |

|

|

|

|

1,047 |

|

|

|

995,542 |

|

| 5.50%, 04/15/2027 |

|

|

|

|

1,163 |

|

|

|

1,153,379 |

|

| 5.75%, 06/15/2025 |

|

|

|

|

30 |

|

|

|

29,967 |

|

| Miller Homes Group Finco

PLC

7.00%, 05/15/2029(b) |

|

GBP |

|

|

679 |

|

|

|

798,252 |

|

| 9.15% (EURIBOR 3 Month + 5.25%),

05/15/2028(b)(j) |

|

EUR |

|

|

514 |

|

|

|

551,500 |

|

| Miter Brands Acquisition Holdco, Inc./MIWD

Borrower LLC

6.75%, 04/01/2032(b) |

|

U.S.$ |

|

|

361 |

|

|

|

362,234 |

|

| Mohegan Tribal Gaming

Authority

8.00%, 02/01/2026(b) |

|

|

|

|

442 |

|

|

|

431,168 |

|

|

|

|

|

|

| abfunds.com |

|

ALLIANCEBERNSTEIN GLOBAL HIGH INCOME

FUND | 21 |

PORTFOLIO OF INVESTMENTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount

(000) |

|

|

U.S. $ Value |

|

| |

|