American States Water Company Announces Proposed Decision Adopting Settlement Agreement In Its Water Utility General Rate Case

November 21 2024 - 3:30PM

Business Wire

American States Water Company (NYSE:AWR) announced that on

November 15, 2024, its regulated water utility subsidiary, Golden

State Water Company (“GSWC”), received a proposed decision from the

assigned administrative law judge at the California Public

Utilities Commission (“CPUC”) in connection with the pending

general rate case proceeding that will determine new water rates

for the years 2025 – 2027. A final decision by the CPUC is expected

as soon as the end of the fourth quarter of 2024. When a final

decision is issued by the CPUC, the new rates for 2025 will be

effective January 1, 2025.

On July 12, 2024, GSWC and the Public Advocates Office (“Cal

Advocates”) at the CPUC filed a joint motion to adopt a settlement

agreement between GSWC and Cal Advocates in the general rate case

proceeding. The proposed decision approves and adopts the

settlement agreement in its entirety. Among other things, the

settlement agreement authorizes GSWC to invest approximately $573.1

million in capital infrastructure over the three-year cycle in

order to continue to provide safe and reliable water utility

service to its customers, which includes $17.7 million of advice

letter capital investments to be filed for revenue recovery during

the second and third year attrition increases when those projects

are completed. In addition, the settlement agreement approves $58.2

million of advice letter capital investments already under

construction beginning in 2023 also to be filed for revenue

recovery during the second and third year attrition increases when

those projects are completed. The settlement agreement also allows

for additional increases in adopted revenues for 2026 and 2027

subject to an earnings test and changes to the forecasted

inflationary index values. Actual increases for 2026 and 2027 will

be determined at the time the filings to implement the new rate

increases are approved by the CPUC, and will be calculated using

inflationary index values at that time.

Furthermore, the proposed decision addressed the two remaining

unresolved 2025 revenue requirement issues related to GSWC’s sales

forecast and supply mix. The proposed decision adopts GSWC’s

recommended sales forecast and adopts a supply mix that splits the

difference between GSWC’s and Cal Advocates’ forecasts. The

proposed decision also addressed the unresolved issues related to

GSWC’s requests for certain regulatory mechanisms. With regards to

these requests, the proposed decision (i) rejects GSWC’s request

for continuation of a full sales and revenue decoupling mechanism

and a full cost balancing account for water supply, and instead

orders GSWC to transition to a modified rate adjustment mechanism

(a Monterey-style WRAM or “M-WRAM”) and an incremental cost

balancing account for supply costs, (ii) rejects GSWC’s sales

reconciliation and supply mix adjustment mechanisms, and (iii)

rejects GSWC’s request to modify the existing per- and

polyfluoroalkyl substances (“PFAS”) memorandum account to track

carrying costs on capital investments needed to comply with the new

PFAS maximum contaminant levels established by the Environmental

Protection Agency, and instead orders GSWC to file for recovery of

PFAS-related capital projects through a separate application or

future general rate case. The proposed decision adopts GSWC’s

M-WRAM rate design proposal, authorizing GSWC to increase the

revenue requirement in its service charges to between 45-48%

depending on the ratemaking area representing approximately 65% of

GSWC’s fixed costs in aggregate. GSWC will file comments on the

proposed decision by December 5, 2024. The proposed decision is

scheduled to be voted on by the CPUC on December 19, 2024.

"We are pleased to have received a proposed decision approving

the settlement agreement in its entirety for our water general rate

case, which allows GSWC to continue investing in utility

infrastructure to deliver safe and reliable water services to the

communities we serve," said Robert J. Sprowls, President and CEO of

American States Water Company. "We are, however, disappointed that

the proposed decision did not adopt the full sales and revenue

decoupling mechanism and full cost balancing account for water

supply because we believe the decision on those requests is

inconsistent with California public policy on water conservation

and keeping water rates affordable for low income customers.

Nonetheless, we remain committed to executing our infrastructure

investment and service delivery approach, ensuring value and

benefits for our customers."

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements can often be identified by words

such as “anticipate,” “estimate,” “expect,” “intend,” “may,”

“should” and similar phrases and expressions, and variations or

negatives of these words. They are not guarantees or assurances of

any outcomes, financial results, levels of activity, performance or

achievements, and readers are cautioned not to place undue reliance

upon them. The forward-looking statements are subject to a number

of estimates and assumptions, and known and unknown risks,

uncertainties and other factors, including those described in

greater detail in the Company’s filings with the SEC, particularly

those described in the Company’s Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. Readers are encouraged to review

the Company’s filings with the SEC for a more complete discussion

of risks and other factors that could affect any forward-looking

statements. The statements made herein speak only as of the date of

this press release and except as required by law, the Company does

not undertake any obligation to publicly update or revise any

forward-looking statement.

About American States Water Company

American States Water Company is the parent of Golden State

Water Company, Bear Valley Electric Service, Inc. and American

States Utility Services, Inc., serving over one million people in

ten states. Through its water utility subsidiary, Golden State

Water Company, the company provides water service to approximately

264,600 customer connections located within more than 80

communities in Northern, Coastal and Southern California. Through

its electric utility subsidiary, Bear Valley Electric Service,

Inc., the company distributes electricity to approximately 24,800

customer connections in the City of Big Bear Lake and surrounding

areas in San Bernardino County, California. Through its contracted

services subsidiary, American States Utility Services, Inc., the

company provides operations, maintenance and construction

management services for water distribution, wastewater collection,

and treatment facilities located on twelve military bases

throughout the country under 50-year privatization contracts with

the U.S. government and one military base under a 15-year

contract.

AWR has paid common dividends every year since 1931, and has

increased the dividends received by shareholders each calendar year

for 70 consecutive years, which places it in an exclusive group of

companies on the New York Stock Exchange that have achieved that

result. The company has grown its quarterly dividend rate at a

compound annual growth rate (“CAGR”) of 8.8% over the last five

years through 2024 and is on pace to achieve a 10-year CAGR of 8.0%

in its calendar year dividend payments through 2024. AWR's current

policy is to achieve a CAGR in the dividend of more than 7% over

the long-term.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120999837/en/

Eva G. Tang Senior Vice President-Finance, Chief Financial

Officer, Corporate Secretary and Treasurer Telephone: (909)

394-3600, ext. 707

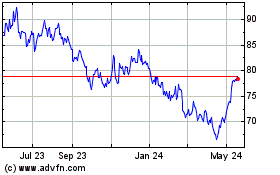

American States Water (NYSE:AWR)

Historical Stock Chart

From Nov 2024 to Dec 2024

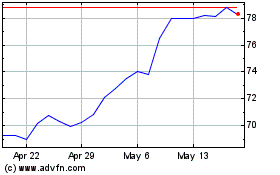

American States Water (NYSE:AWR)

Historical Stock Chart

From Dec 2023 to Dec 2024