Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 03 2025 - 4:24PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

|

Material Fact

January | 2025

|

| |

|

Azul Successfully Reaches

Individual Settlement Agreement

São Paulo, January 3, 2025

– Azul S.A., “Azul“ or ‘Company’, (B3:AZUL4, NYSE:AZUL), hereby informs its shareholders and the market

in general, in compliance with the provisions of CVM Resolution No. 44/2021 and considering the news published related to this matter,

that it has entered into an individual settlement agreement (”Agreement“) with the National Treasury Attorney’s Office

(“PGFN”) and the Special Secretariat of the Federal Revenue of Brazil (”RFB"), under the terms of Laws No. 13,988/2020

and 14,375/2022.

The Agreement aims to restructure Azul's

tax liabilities and involved an adjustment of the amount owed and a re-profiling of the payment schedule.

The total amount of debts renegotiated

in the Agreement is approximately R$2.9 billion, and this amount will be reduced by more than R$1.8 billion due to the conversion of judicial

deposits, the use of tax losses and effective reductions in interest and fines. The remaining balance, after these deductions, will be

paid within a period of 60 months for social security debts and within 120 months for other debts.

The effects of the Agreement will be reflected

in Azul’s next financial statements, to be disclosed to the market within the deadlines established by art. 22, III, and art. 27,

§ 2, of CVM Resolution No. 80/2022.

Azul will keep the market updated on any

further developments.

About Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL),

the largest airline in Brazil by number of flight departures and cities served, offers 1,000 daily flights to over 160 destinations. With

an operating fleet of over 180 aircraft and more than 16,000 Crewmembers, the Company has a network of 300 non-stop routes. Azul was named

by Cirium (leading aviation data analysis company) as the most on-time airline in the world in 2022, being the first Brazilian airline

to obtain this honor. In 2020 Azul was awarded best airline in the world by TripAdvisor, the first time a Brazilian flag carrier earned

the number one ranking in the Traveler’s Choice Awards. For more information visit ri.voeazul.com.br/en/.

Contacts:

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

Press Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 3, 2025

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

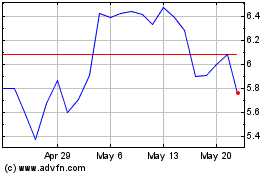

Azul (NYSE:AZUL)

Historical Stock Chart

From Dec 2024 to Jan 2025

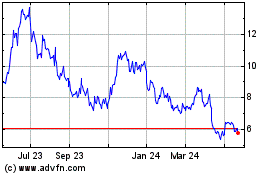

Azul (NYSE:AZUL)

Historical Stock Chart

From Jan 2024 to Jan 2025