AZZ Inc's 4Q Earnings Beat by a Penny - Analyst Blog

April 09 2013 - 6:18AM

Zacks

Electrical equipment manufacturer AZZ Inc.

(AZZ) posted earnings per share of 50 cents in the fourth quarter

of fiscal 2013, a penny ahead of the Zacks Consensus Estimate. The

quarterly earnings also surpassed the year-ago earnings of 46 cents

per share.

In fiscal 2013, earnings per share were $2.01 versus $1.61 reported

in fiscal 2012, reflecting an increase of 24.8%.

Total Revenue

Total revenue increased 14% year over year to $140.4 million in the

reported quarter from $123.6 million a year ago. Better performance

from its Electrical and Industrial Products and Galvanizing Service

segments resulted in the upbeat results.

Revenues however missed the Zacks Consensus Estimate of $146

million.

Fiscal 2013 revenue was $570.6 million, up 22% from $469.1 million

in the prior fiscal.

Fiscal Fourth Quarter Highlights

Cost of sales, as a percentage of revenue, contracted 91 basis

points year over year. Operating income grew 0.9% to $26.3

million.

The backlog of the company at the end of the quarter was $221.7

million, up substantially from $138.6 million reported a year ago.

AZZ Inc. benefited from the acquired backlog of Nuclear Logistics

Inc, which came under its umbrella in Jun 2012.

The order booking of $146.3 million was also higher than $130.2

million booked in the comparable prior-year period. Overseas orders

constituted 35% of the backlog, which is an encouraging sign for

the company.

Interest expenses dropped to $3.27 million from $3.48 million,

indicating a reduction in the debt level.

Fiscal 2014 Guidance

The strong performance in fiscal 2013 prompted the company to make

an upward revision to its fiscal 2014 guidance. It now

expects earnings in the range of $2.65 to $2.95 per share, up from

the prior range of $2.50 to $2.75. The revised guidance takes into

account the likely contribution from the acquisition of Aquilex

SRO.

The company also revised its revenue expectation for fiscal

2014. Fiscal 2014 revenue is expected in the range of $825

million to $900 million, up from the previous expectation of $625

million to $660 million.

Other Company Release

Mistras Group Inc. (MG) reported earnings of 7

cents per share in the third quarter of fiscal 2013, falling short

of the Zacks Consensus Estimate of 17 cents. However, total revenue

of $134 million surpassed the Zacks Consensus Estimate by $2

million.

Our Take

We believe the strong backlog will definitely help the company to

post better results in the forthcoming quarters. We believe

international orders will not only boost its order book but provide

a cushion for the company against any softness in domestic demand.

In addition, strategic acquisitions will provide meaningful

synergies to the company’s performance.

The company currently has a Zacks Rank #1 (Strong Buy).

Universal Electronics Inc. (UEIC) and

Capstone Turbine Corp. (CPST) are also doing well

in this space, with both retaining a Zacks Rank #2 ( Buy).

Headquartered in Forts Worth, Texas, AZZ Inc. was founded in 1956.

With a market capitalization of $1.18 billion, the company

primarily caters to industrial customers in the United States and

Canada and has 2,154 full time employees.

AZZ INC (AZZ): Free Stock Analysis Report

CAPSTONE TURBIN (CPST): Free Stock Analysis Report

MISTRAS GROUP (MG): Free Stock Analysis Report

UNIVL ELECTRS (UEIC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

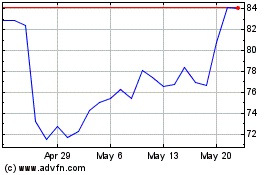

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

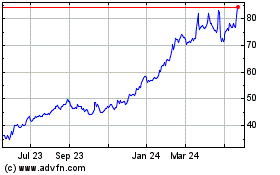

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024