AZZ incorporated Reports Results for the Fourth Quarter and Fiscal-Year 2004

April 15 2004 - 7:00AM

PR Newswire (US)

AZZ incorporated Reports Results for the Fourth Quarter and

Fiscal-Year 2004 FORT WORTH, Texas, April 15 /PRNewswire-FirstCall/

-- AZZ incorporated , a manufacturer of electrical products and a

provider of galvanizing services, today announced unaudited

financial results for the fourth quarter and fiscal year ended

February 29, 2004. Revenues for the fourth quarter were $32.5

million compared to $39.8 million for the same quarter last year.

Net income for the quarter was $1.2 million, or $0.22 per diluted

share, compared to net income of $1.4 million, or $0.27 per diluted

share, in last year's fiscal fourth quarter. Incoming orders for

the fourth quarter were $33.1 million for a book to ship ratio of

102 percent for the quarter. For the year, the Company reported

unaudited revenues of $136.2 million compared to fiscal year 2003

revenues of $183.4 million. Net income for the year was $4.3

million, or $0.79 per diluted share, compared to net income of $8.6

million, or $1.63 per diluted share, last year. Guidance, which had

previously been issued for fiscal 2004, was for earnings per

diluted share of $0.72 to $0.78 and revenues of $135 to $140

million. Backlog at year-end was $53.1 million compared to $49.1

million at the end of fiscal 2003. Incoming orders were $140.2 for

the year and resulted in a book to ship ratio of 103% for the year.

Outstanding bank debt at the end of the fiscal year was $30.9

million, a decrease of $13.7 million from the year ended February

28, 2003. AZZ's long- term debt to equity ratio of .37 to 1 at the

end of the fiscal year compares favorably to the .60 to 1 for the

same period last year. Revenues for the Electrical and Industrial

Products Segment were $21.5 million for the fourth quarter,

compared to $28.3 million for the comparable period last year.

Operating income for this segment was $1.7 million, compared to

$2.8 million in the fourth quarter of last year. For the fiscal

year ended February 29, 2004, revenues for this segment were $88.9

million and operating income was $6.4 million compared to $134.9

million and $14.9 million, respectively, for the prior fiscal year.

David H. Dingus, president and chief executive officer of AZZ

incorporated commented, "The operating results for the quarter and

year exceeded our internal expectations and earnings guidance we

had previously issued, despite a continuation of the difficult

market conditions and intense competition. We have sized our

operations to reflect these conditions and have continued our

efforts to improve operating efficiencies and financial

performance. Improvement in coverage and participation in the

international electrical markets was a key goal we set for

ourselves. Fiscal 2004 saw some encouraging results in this

program. With our previously announced operating structure in China

and, improved representation in the Middle East and Asia, we are

better positioned to take advantage of these market which are

experiencing growth. We believe all actions that have been taken in

fiscal 2004 do position us to better compete in both domestic and

international markets and we are positioned well to benefit from

sustained recovery in our served markets. Additionally, we did see

improvement in the fourth quarter of our quotation and bookings

activity related to our transmission products, and we are

encouraged by the increased quotation activity." Revenues for the

Company's Galvanizing Services Segment were $11.0 million for the

fourth quarter, compared to $11.5 million in the previous year's

comparable quarter. Operating income for the segment was $2.4

million for the quarter, compared to $ 2.0 million in the previous

year's comparable quarter. For the fiscal year ended February 29,

2004, revenues were $47.3 million and operating income was $8.6

million compared to $48.5 million and $9.0 million, respectively

for the prior fiscal year. Mr. Dingus continued, "Despite the

complexities brought about by the changes in price of steel and

zinc, we had another solid year in our Galvanizing Services

Segment. The decrease in operating income on a year over year basis

can be directly linked to increased cost of natural gas. Going

forward, we will be faced with the potential impact of steel price

increases on our volume levels, and our ability to offset increases

in the cost of zinc with improved efficiency and price increases.

While market conditions may inhibit our ability to fully recover

the anticipated increases, we are anticipating another solid year

of performance from this segment." Mr. Dingus concluded, "Based

upon the evaluation of information currently available to

management, we are estimating FY 2005 earnings to be within the

range of $0.75 to $0.85 per diluted share, and revenues to be

within the range of $140 to $150 million. Included in our projected

earnings is a one-time expenditure of approximately $650,000 to be

expensed during fiscal 2005 associated with the implementation cost

of our ERP system. Anticipated benefits will be realized in FY

2006." AZZ incorporated will conduct a conference call to discuss

financial results for fiscal year 2004 at 4:15 P.M. Eastern on

April 15, 2004. Interested parties can access the conference call

by dialing (877) 356-5706. The call will be web cast via the

Internet at http://www.azz.com/AZZinvest.htm. A replay of the call

will be available for three days at (800) 642-1687 confirmation

#6286534, or for 30 days at http://www.azz.com/AZZinvest.htm. AZZ

incorporated is a specialty electrical equipment manufacturer

serving the global growth markets of power generation, transmission

and distribution, as well as, a leading provider of hot dip

galvanizing services to the steel fabrication market nationwide.

Except for the statements of historical fact, this release may

contain forward-looking statements that involve risks and

uncertainties some of which are detailed from time to time in

documents filed by the Company with the SEC. Those risks and

uncertainties include, but are not limited to: changes in customer

demand and response to products and services offered by the

Company, including demand by the electrical power generation

markets, electrical transmission and distribution markets, the

industrial markets, and the hot dip galvanizing markets; prices and

raw material cost, including zinc and natural gas which are used in

the hot dip galvanizing process; changes in the economic conditions

of the various markets the Company serves, foreign and domestic,

customer requested delays of shipments, acquisition opportunities,

adequacy of financing, and availability of experienced management

employees to implement the Company's growth strategy. The Company

can give no assurance that such forward-looking statements will

prove to be correct. AZZ incorporated Condensed Consolidated

Statement of Income (in thousands except per share amount) Three

Months Ended Twelve Months Ended February 29, February 28, February

29, February 28, 2004 2003 2004 2003 (unaudited) (unaudited)

(unaudited) __________ Net sales $32,505 $39,797 $136,201 $183,370

Income before taxes $1,982 $2,357 $6,878 $13,895 Net income $1,228

$1,419 $4,263 $8,615 Net income per share Basic $0.23 $0.27 $0.80

$1.63 Diluted $0.22 $0.27 $0.79 $1.63 Diluted average shares

outstanding 5,476 5,294 5,397 5,300 Condensed Consolidated Balance

Sheet (in thousands) February 29, 2004 February 28, 2003

(unaudited) ________________ Assets: Current assets $43,713 $55,056

Net property, plant and equipment $34,201 $36,612 Other assets, net

$42,112 $42,369 Total assets $120,026 $134,037 Liabilities and

shareholders' equity: Current liabilities $23,504 $31,346 Long term

debt due after one year $25,375 $37,875 Other liabilities $1,850

$1,407 Shareholders' equity $69,297 $63,409 Total liabilities and

shareholders' equity $120,026 $134,037 Condensed Consolidated

Statement of Cash Flow (in thousands) Twelve Months Ended Twelve

Months Ended February 29, 2004 February 28,2003 (unaudited)

_________________ Net cash provided by (used in) operating

activities $14,963 $22,927 Net cash provided by (used in) investing

activities ($2,920) ($3,941) Net cash provided by (used in)

financing activities ($12,582) ($18,740) Net increase (decrease) in

cash and cash equivalents ($539) $246 Cash and cash equivalents at

beginning of year $1,984 $1,738 Cash and cash equivalents at end of

quarter $1,445 $1,984 DATASOURCE: AZZ incorporated CONTACT: Dana

Perry, Vice President - Finance and CFO of AZZ incorporated,

+1-817-810-0095; or Retail, Robert Blum, or Institutional/Analysts,

Joe Dorame, or Media, Kristen Klein, all of RCG Capital Markets

Group, Inc., +1-480-675-0400, for AZZ incorporated Web site:

http://www.azz.com/AZZinvest.htm http://www.azz.com/

Copyright

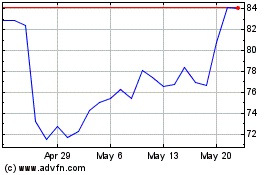

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

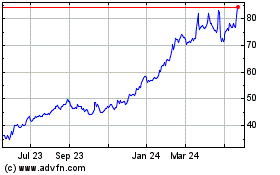

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024