- Q3 Transaction Fees Increased 25% Year-Over-Year

- Q3 Core Revenue Increased 17% Year-Over-Year

- Q3 Total Revenue Increased 19% Year-Over-Year

BILL (NYSE: BILL), a leading financial operations platform for

small and midsize businesses (SMBs), today announced financial

results for the third fiscal quarter ended March 31, 2024.

“We delivered strong profitable growth for the quarter,

continued our rapid pace of innovation, and executed with

persistent rigor and effectiveness,” said René Lacerte, BILL CEO

and Founder. “During the quarter, more than 450,000 small

businesses used our solutions to automate their financial

operations, empowering them with more time to focus on their

mission and thrive. With our transformative platform, large

ecosystem, and strong innovation roadmap, we are uniquely

positioned to be the essential financial operations platform for

millions of SMBs.”

“Our financial performance in the third quarter demonstrates the

strength of our business and strong execution capabilities,” said

John Rettig, BILL President and CFO. “Total revenue increased 19%

year-over-year while non-GAAP operating income increased 68%

year-over-year.”

Financial Highlights for the Third Quarter of Fiscal

2024:

- Total revenue was $323.0 million, an increase of 19%

year-over-year.

- Core revenue, which consists of subscription and transaction

fees, was $281.3 million, an increase of 17% year-over-year.

Subscription fees were $65.6 million, down 2% year-over-year.

Transaction fees were $215.7 million, up 25% year-over-year.

- Float revenue, which consists of interest on funds held for

customers, was $41.7 million.

- Gross profit was $268.0 million, representing an 83.0% gross

margin, compared to $223.7 million, or an 82.1% gross margin, in

the third quarter of fiscal 2023. Non-GAAP gross profit was $281.5

million, representing an 87.1% non-GAAP gross margin, compared to

$237.2 million, or an 87.0% non-GAAP gross margin, in the third

quarter of fiscal 2023.

- Operating loss was $27.6 million, compared to an operating loss

of $54.2 million in the third quarter of fiscal 2023. Non-GAAP

operating income was $58.5 million, compared to a non-GAAP

operating income of $34.8 million in the third quarter of fiscal

2023.

- Net income was $31.8 million, or $0.30 and $0.00 per share,

basic and diluted, respectively, compared to net loss of $31.1

million, or ($0.29) per share, basic and diluted, in the third

quarter of fiscal 2023. Non-GAAP net income was $68.6 million, or

$0.60 per diluted share, compared to non-GAAP net income of $48.2

million, or $0.41 per diluted share in the third quarter of fiscal

2023. Beginning with our fiscal third quarter 2024, non-GAAP net

income includes a non-GAAP provision for income taxes of 20%, which

was not included in our previously-issued guidance. This change is

reflected in comparable prior periods as well.

Business Highlights and Recent Developments

- Served 464,900 businesses using our solutions as of the end of

the third quarter.1

- Processed $71 billion in total payment volume in the third

quarter, an increase of 10% year-over-year.

- Processed 26 million transactions during the third quarter, an

increase of 20% year-over-year.

- Repurchased $748 million aggregate principal amount of BILL’s

outstanding 0.0% Convertible Senior Notes due 2025 and unwound a

portion of its capped call, resulting in a $34 million net benefit

to net income (loss).

Financial Outlook

We are providing the following guidance for the fiscal fourth

quarter ending June 30, 2024 and the full fiscal year ending June

30, 2024.

Q4 FY24 Guidance

FY24 Guidance

Total revenue (millions)

$320 - $330

$1,267 - $1,277

Year-over-year total revenue growth

8% - 11%

20% - 21%

Non-GAAP operating income (millions)

$40 - $50

$176 - $186

Non-GAAP net income (millions)2

$46.4 - $54.4

$227 - $235

Non-GAAP net income per diluted share2

$0.41 - $0.49

$1.96 - $2.03

The outlook for non-GAAP net income and non-GAAP net income per

diluted share includes a non-GAAP provision for income taxes of

20%.

___________________________

1

Businesses using more than one of our

solutions are included separately in the total for each solution

utilized.

2

The outlook for non-GAAP net income and

non-GAAP net income per diluted share includes a non-GAAP provision

for income taxes of 20%.

These statements are forward-looking and actual results may

differ materially. Refer to the Forward-Looking Statements safe

harbor below for information on the factors that could cause our

actual results to differ materially from these forward-looking

statements.

BILL has not provided a reconciliation of non-GAAP operating

income, non-GAAP net income or non-GAAP net income per share

guidance measures to the most directly comparable GAAP measures

because certain items excluded from GAAP cannot be reasonably

calculated or predicted at this time. Accordingly, a reconciliation

is not available without unreasonable effort.

Conference Call and Webcast Information

In conjunction with this announcement, BILL will host a

conference call for investors at 1:30 p.m. PT (4:30 p.m. ET) today

to discuss fiscal third quarter 2024 results and our outlook for

the fiscal fourth quarter ending June 30, 2024 and the fiscal year

ending June 30, 2024. The live webcast and a replay of the webcast

will be available at the Investor Relations section of BILL’s

website:

https://investor.bill.com/events-and-presentations/default.aspx.

About BILL

BILL (NYSE: BILL) is a leading financial operations platform for

small and midsize businesses (SMBs). As a champion of SMBs, we are

automating the future of finance so businesses can thrive. Our

integrated platform helps businesses to more efficiently control

their payables, receivables and spend and expense management.

Hundreds of thousands of businesses rely on BILL’s proprietary

member network of millions to pay or get paid faster. Headquartered

in San Jose, California, BILL is a trusted partner of leading U.S.

financial institutions, accounting firms, and accounting software

providers. For more information, visit bill.com.

Note on Forward-Looking Statements

This press release and the accompanying conference call contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, which are statements

other than statements of historical facts, and statements in the

future tense. Forward-looking statements are based on our

expectations as of the date of this press release and are subject

to a number of risks, uncertainties and assumptions, many of which

involve factors or circumstances that are beyond our control. These

statements include, but are not limited to, statements regarding

our expectations of future performance, including guidance for our

total revenue, non-GAAP operating income, non-GAAP net income, and

non-GAAP net income per share for the fiscal fourth quarter ending

June 30, 2024 and full fiscal year ending June 30, 2024, our

expectations for the growth of demand on our platform and the

expansion of our customers’ utilization of our services. These

risks and uncertainties include, but are not limited to

macroeconomic factors, including changes in interest rates,

inflation and volatile market environments, as well as fluctuations

in foreign exchange rates, our history of operating losses, our

recent rapid growth, the large sums of customer funds that we

transfer daily, the risk of loss, errors and fraudulent activity,

credit risk related to our BILL Divvy Corporate Cards, our ability

to attract new customers and convert trial customers into paying

customers, our ability to develop new products and services,

increased competition or new entrants in the marketplace, the

impact of our recent reduction-in-force, potential impacts of

acquisitions and investments, including our ability to integrate

acquired businesses, incorporate their technology effectively and

implement appropriate internal controls at such businesses, our

relationships with accounting firms and financial institutions, the

global impacts of ongoing geopolitical conflicts, and other risks

detailed in the registration statements and periodic reports we

file with the SEC, including our quarterly and annual reports,

which may be obtained on the Investor Relations section of BILL’s

website

(https://investor.bill.com/financials/sec-filings/default.aspx) and

on the SEC website at www.sec.gov. You should not rely on these

forward-looking statements, as actual results may differ materially

from those contemplated by these forward-looking statements as a

result of such risks and uncertainties. All forward-looking

statements in this press release are based on information available

to us as of the date hereof. We assume no obligation to update or

revise the forward-looking statements contained in this press

release or the accompanying conference call because of new

information, future events, or otherwise.

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with

U.S. generally accepted accounting principles (GAAP), this press

release and the accompanying tables contain, and the conference

call will contain, non-GAAP financial measures, including non-GAAP

gross profit, non-GAAP gross margin, non-GAAP operating expenses,

non-GAAP operating income, non-GAAP net income and non-GAAP net

income per share, basic and diluted. The non-GAAP financial

information is presented for supplemental informational purposes

only and is not intended to be considered in isolation or as a

substitute for, or superior to, financial information prepared and

presented in accordance with GAAP.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool.

We exclude the following items from non-GAAP gross profit and

non-GAAP gross margin:

- stock-based compensation and related payroll taxes

- depreciation expense and amortization of intangible assets

We exclude the following items from non-GAAP operating expenses

and non-GAAP operating income:

- stock-based compensation and related payroll taxes

- depreciation expense and amortization of intangible assets

- acquisition and integration-related expenses

- restructuring

We exclude the following items from non-GAAP net income and

non-GAAP net income per share:

- stock-based compensation expense and related payroll taxes

- depreciation expense and amortization of intangible assets

- acquisition and integration-related expenses

- restructuring

- gain on debt extinguishment and change on mark to market

derivatives associated with notes repurchase and capped call

unwind

- amortization of debt issuance costs

- non-GAAP provision for income taxes

It is important to note that the particular items we exclude

from, or include in, our non-GAAP financial measures may differ

from the items excluded from, or included in, similar non-GAAP

financial measures used by other companies in the same industry. We

also periodically review our non-GAAP financial measures and may

revise these measures to reflect changes in our business or

otherwise, including our blended U.S. statutory tax rate.

We believe that these non-GAAP financial measures provide useful

information about our financial performance, enhance the overall

understanding of our past performance and future prospects and

allow for greater transparency with respect to important metrics

used by our management for financial and operational

decision-making. We believe that these measures provide an

additional tool for investors to use in comparing our core

financial performance over multiple periods with other companies in

our industry.

We adjust the following items from one or more of our non-GAAP

financial measures:

Stock-based compensation and related payroll taxes charged to

cost of revenue and operating expenses. We exclude stock-based

compensation, which is a non-cash expense, and related payroll

taxes from certain of our non-GAAP financial measures because we

believe that excluding these items provide meaningful supplemental

information regarding operational performance. In particular,

companies calculate stock-based compensation expenses using a

variety of valuation methodologies and subjective assumptions while

the related payroll taxes are dependent on the price of our common

stock and other factors that are beyond our control and do not

correlate to the operation of our business.

Depreciation expense. We exclude depreciation expense from

certain of our non-GAAP financial measures because we believe that

excluding this non-cash expense provides meaningful supplemental

information regarding operational performance. Depreciation expense

does not include amortization of capitalized internal-use software

costs paid in cash.

Amortization of intangible assets. We exclude amortization of

acquired intangible assets from certain of our non-GAAP financial

measures because we believe that excluding this non-cash expense

provides meaningful supplemental information regarding our

operational performance.

Acquisition and integration-related expenses. We exclude

acquisition and integration-related expenses from certain of our

non-GAAP financial measures because these costs would have not

otherwise been incurred in the normal course of our business

operations. In addition, we believe that acquisition and

integration-related expenses are non-recurring charges unique to a

specific acquisition. Although we may engage in future

acquisitions, such acquisitions and the associated acquisition and

integration-related expenses are considered unique and not

comparable to other acquisitions.

Restructuring. We exclude costs incurred in connection with

formal restructuring plans from certain of our non-GAAP financial

measures because these costs are exceptional and would have not

otherwise been incurred in the normal course of our business

operations.

Gain on debt extinguishment and change on mark to market

derivatives associated with notes repurchase and capped call

unwind. We exclude gain on debt extinguishment and change on mark

to market derivatives associated with our March 2024 repurchase of

certain of our outstanding 0.0% Convertible Senior Notes due 2025

and the unwind of the capped calls from certain of our non-GAAP

financial measures because we believe that excluding this non-cash

gain provides better insight regarding our operational

performance.

Amortization of debt issuance costs. We exclude amortization of

debt issuance costs associated with our issuance of our convertible

senior notes and credit arrangement from certain of our non-GAAP

financial measures because we believe that excluding this non-cash

interest expense provides meaningful supplemental information

regarding our operational performance.

Non-GAAP provision for income taxes. Consists of assumed

provision for income taxes based on the statutory tax rate taking

into consideration the nature of the taxed item and the relevant

taxing jurisdiction.

There are material limitations associated with the use of

non-GAAP financial measures since they exclude significant expenses

and income that are required by GAAP to be recorded in our

financial statements. Please see the reconciliation tables at the

end of this release for the reconciliation of GAAP and non-GAAP

results.

Free Cash Flow

Free cash flow is a non-GAAP measure that we calculate as net

cash provided by (used in) operating activities, adjusted by

purchases of property and equipment and capitalization of

internal-use software costs. We believe that free cash flow is an

important liquidity measure of the cash that is available, after

capital expenditures, for operational expenses and investment in

our business. Free cash flow is useful to investors as a liquidity

measure because it measures our ability to generate or use cash.

One limitation of free cash flow is that it does not reflect our

future contractual commitments. Additionally, free cash flow does

not represent the total increase or decrease in our cash balance

for a given period. Once our business needs and obligations are

met, cash can be used to maintain a strong balance sheet and invest

in future growth.

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited, in thousands)

March 31,

2024

June 30,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

952,474

$

1,617,151

Short-term investments

837,140

1,043,110

Accounts receivable, net

29,891

28,233

Acquired card receivables, net

641,861

458,650

Prepaid expenses and other current

assets

256,199

170,111

Funds held for customers

3,510,918

3,355,909

Total current assets

6,228,483

6,673,164

Non-current assets:

Operating lease right-of-use assets,

net

61,466

68,988

Property and equipment, net

87,300

81,564

Intangible assets, net

300,764

361,427

Goodwill

2,396,509

2,396,509

Other assets

47,736

54,366

Total assets

$

9,122,258

$

9,636,018

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

6,824

$

8,519

Accrued compensation and benefits

27,619

32,901

Deferred revenue

17,547

26,328

Other accruals and current liabilities

263,603

194,733

Borrowings from credit facilities, net

—

135,046

Customer fund deposits

3,510,918

3,355,909

Total current liabilities

3,826,511

3,753,436

Non-current liabilities:

Deferred revenue

4,156

410

Operating lease liabilities

65,023

72,477

Borrowings from credit facilities, net

180,011

—

Convertible senior notes, net

966,242

1,704,782

Other long-term liabilities

21,582

18,944

Total liabilities

5,063,525

5,550,049

Commitments and contingencies

Stockholders' equity:

Common stock

2

2

Additional paid-in capital

5,165,049

4,946,623

Accumulated other comprehensive loss

(1,507

)

(4,488

)

Accumulated deficit

(1,104,811

)

(856,168

)

Total stockholders' equity

4,058,733

4,085,969

Total liabilities and stockholders'

equity

$

9,122,258

$

9,636,018

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited, in thousands except

per share amounts)

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Revenue

Subscription and transaction fees (2)

$

281,294

$

239,495

$

821,428

$

685,201

Interest on funds held for customers

41,734

33,060

125,080

77,284

Total revenue

323,028

272,555

946,508

762,485

Cost of revenue

Service costs (2)

43,845

37,897

135,988

109,683

Depreciation and amortization of

intangible assets (1)

11,167

10,953

33,427

31,742

Total cost of revenue

55,012

48,850

169,415

141,425

Gross profit

268,016

223,705

777,093

621,060

Operating expenses

Research and development (2)

81,594

78,761

257,145

232,791

Sales and marketing (2)

118,105

115,350

354,808

398,658

General and administrative (2)

81,573

71,719

252,482

207,837

Depreciation and amortization of

intangible assets (1)

12,262

12,093

37,403

36,149

Restructuring

2,104

—

27,195

—

Total operating expenses

295,638

277,923

929,033

875,435

Operating loss

(27,622

)

(54,218

)

(151,940

)

(254,375

)

Other income, net

59,801

23,622

118,026

46,591

Income (loss) before provision for income

taxes

32,179

(30,596

)

(33,914

)

(207,784

)

Provision for income taxes

370

542

2,559

70

Net income (loss)

$

31,809

$

(31,138

)

$

(36,473

)

$

(207,854

)

Net income (loss) per share attributable

to common stockholders:

Basic

$

0.30

$

(0.29

)

$

(0.34

)

$

(1.96

)

Diluted

$

0.00

$

(0.29

)

$

(0.34

)

$

(1.96

)

Weighted-average number of common shares

used to compute net income (loss) per share attributable to common

stockholders:

Basic

105,436

106,597

106,045

105,843

Diluted

111,176

106,597

106,045

105,843

(1) Depreciation expense does not

include amortization of capitalized internal-use software costs

paid in cash.

(2) Includes stock-based

compensation charged to revenue and expenses as follows (in

thousands):

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Revenue - subscription and transaction fees

$

446

$

—

$

1,303

$

—

Cost of revenue - service costs

2,190

2,421

7,124

6,720

Research and development

25,183

22,319

78,708

70,151

Sales and marketing

10,968

18,162

37,643

116,941

General and administrative

20,382

20,888

61,684

62,040

Restructuring

220

—

3,574

—

Total stock-based compensation (3)

$

59,389

$

63,790

$

190,036

$

255,852

(3)

Consists of acquisition related equity

awards (Acquisition Related Awards), which include equity awards

assumed and retention equity awards granted to certain employees of

acquired companies in connection with acquisitions, and modified

equity awards in connection with the Restructuring Plan

(Restructuring Awards), and non-acquisition related equity awards

(Non-Acquisition Related Awards), which include all other equity

awards granted to existing employees and non-employees in the

ordinary course of business. The following table presents

stock-based compensation recorded for the periods presented and as

a percentage of total revenue (in thousands):

Three Months Ended

March 31,

As a % of total

revenue

Nine Months Ended

March 31,

As a % of total

revenue

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

2024

2023

2024

2023

Acquisition Related Awards

$

3,567

$

10,813

1

%

4

%

$

12,962

$

103,727

1

%

14

%

Restructuring Awards

220

—

0

%

—

%

3,574

—

0

%

—

%

Non-Acquisition Related Awards

55,602

52,977

17

%

19

%

173,500

152,125

18

%

20

%

Total stock-based compensation

$

59,389

$

63,790

18

%

23

%

$

190,036

$

255,852

19

%

34

%

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Cash flows from operating

activities:

Net loss

$

31,809

$

(31,138

)

$

(36,473

)

$

(207,854

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Stock-based compensation

59,389

63,792

190,036

255,717

Amortization of intangible assets

20,220

20,221

60,663

59,984

Depreciation of property and equipment

3,209

2,826

10,167

7,907

Amortization of capitalized internal-use

software costs

2,593

1,108

6,332

3,009

Amortization of debt issuance costs

1,651

1,734

5,174

5,217

Accretion of discount on investments in

marketable debt securities

(15,114

)

(13,309

)

(39,285

)

(23,710

)

Accretion of discount on loans held for

investment

(5,531

)

(9

)

(5,531

)

(9

)

Provision for credit losses on acquired

card receivables and other financial assets

18,590

8,643

47,279

23,685

Gain on debt extinguishment

(35,715

)

—

(35,715

)

—

Non-cash operating lease expense

2,038

2,396

6,590

7,114

Deferred income taxes

(10

)

(343

)

(126

)

(1,169

)

Other

4,402

841

1,787

1,357

Changes in assets and liabilities:

Accounts receivable

(4,185

)

(2,917

)

(3,795

)

(9,969

)

Prepaid expenses and other current

assets

5,564

(2,854

)

5,413

(7,477

)

Other assets

(828

)

(160

)

(2,068

)

(2,040

)

Accounts payable

(2,131

)

(4,776

)

(1,898

)

(1,265

)

Other accruals and current liabilities

(14,132

)

(5,769

)

6,812

9,639

Operating lease liabilities

(2,642

)

(2,917

)

(7,559

)

(7,711

)

Other long-term liabilities

(2,570

)

(307

)

(2,617

)

(272

)

Deferred revenue

202

(3,031

)

(5,035

)

(4,740

)

Net cash provided by operating

activities

66,809

34,031

200,151

107,413

Cash flows from investing

activities:

Cash paid for acquisition, net of acquired

cash and cash equivalents

—

—

—

(28,902

)

Purchases of corporate and customer fund

short-term investments

(1,052,609

)

(753,325

)

(2,042,849

)

(2,394,518

)

Proceeds from maturities of corporate and

customer fund short-term investments

575,715

827,416

1,857,220

2,510,829

Proceeds from sale of corporate and

customer fund short-term investments

1,539

6,519

1,539

11,607

Purchases of loans held for investment

(108,830

)

(537

)

(218,943

)

(537

)

Principal repayments of loans held for

investment

97,561

325

191,861

325

Acquired card receivables, net

(127,508

)

(95,891

)

(139,850

)

(198,244

)

Purchases of property and equipment

(16

)

(3,338

)

(771

)

(6,499

)

Capitalization of internal-use software

costs

(3,833

)

(6,721

)

(14,595

)

(17,231

)

Proceeds from beneficial interest

—

—

—

2,080

Other

—

167

—

1,167

Net cash used in investing activities

(617,981

)

(25,385

)

(366,388

)

(119,923

)

Cash flows from financing

activities:

Payments for repurchase of convertible

senior notes

(710,931

)

—

(710,931

)

—

Proceeds from unwind of capped calls

10,252

—

10,252

—

Customer fund deposits liability and

other

(144,394

)

(371,938

)

155,376

(46,092

)

Prepaid card deposits

(4,292

)

14,249

(20,776

)

21,064

Repurchase of common stock

—

(24,001

)

(211,902

)

(24,001

)

Proceeds from line of credit

borrowings

45,000

22,500

45,000

60,000

Proceeds from exercise of stock

options

1,473

2,643

6,525

10,860

Tax withholdings related to net share

settlements of equity awards

(1,681

)

—

(1,681

)

—

Proceeds from issuance of common stock

under the employee stock purchase plan

8,649

9,385

16,495

17,879

Contingent consideration payout

(5,291

)

—

(10,762

)

—

Net cash provided by (used in) financing

activities

(801,215

)

(347,162

)

(722,404

)

39,710

Effect of exchange rate changes on cash,

cash equivalents, restricted cash and restricted cash

equivalents

(390

)

(170

)

(397

)

12

Net increase (decrease) in cash, cash

equivalents, restricted cash, and restricted cash

equivalents

(1,352,777

)

(338,686

)

(889,038

)

27,212

Cash, cash equivalents, restricted

cash, and restricted cash equivalents, beginning of period

4,688,580

3,908,613

4,224,841

3,542,715

Cash, cash equivalents, restricted

cash, and restricted cash equivalents, end of period

$

3,335,803

$

3,569,927

$

3,335,803

$

3,569,927

Reconciliation of cash, cash

equivalents, restricted cash, and restricted cash equivalents

within the condensed consolidated balance sheets to the amounts

shown in the condensed consolidated statements of cash flows

above:

Cash and cash equivalents

$

952,474

$

1,590,560

$

952,474

$

1,590,560

Restricted cash included in other current

assets

153,031

96,823

153,031

96,823

Restricted cash included in other

assets

5,297

6,724

5,297

6,724

Restricted cash and restricted cash

equivalents included in funds held for customers

2,225,001

1,875,820

2,225,001

1,875,820

Total cash, cash equivalents,

restricted cash, and restricted cash equivalents, end of

period

$

3,335,803

$

3,569,927

$

3,335,803

$

3,569,927

BILL HOLDINGS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited, in thousands except

percentages and per share amounts)

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Reconciliation of gross profit:

GAAP gross profit

$

268,016

$

223,705

$

777,093

$

621,060

Add:

Depreciation and amortization of intangible assets (1)

11,167

10,953

33,427

31,742

Stock-based compensation and related payroll taxes charged to cost

of revenue

2,277

2,514

7,351

6,933

Non-GAAP gross profit

$

281,460

$

237,172

$

817,871

$

659,735

GAAP gross margin

83.0

%

82.1

%

82.1

%

81.5

%

Non-GAAP gross margin

87.1

%

87.0

%

86.4

%

86.5

%

(1)

Consists of depreciation of property and

equipment and amortization of developed technology, excluding

amortization of capitalized internal-use software costs paid in

cash.

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Reconciliation of operating

expenses:

GAAP research and development expenses

$

81,594

$

78,761

$

257,145

$

232,791

Less - stock-based compensation and

related payroll taxes

(26,062

)

(23,274

)

(80,499

)

(71,940

)

Non-GAAP research and development

expenses

$

55,532

$

55,487

$

176,646

$

160,851

GAAP sales and marketing expenses

$

118,105

$

115,350

$

354,808

$

398,658

Less - stock-based compensation and

related payroll taxes

(11,417

)

(18,602

)

(38,508

)

(118,612

)

Non-GAAP sales and marketing expenses

$

106,688

$

96,748

$

316,300

$

280,046

GAAP general and administrative

expenses

$

81,573

$

71,719

$

252,482

$

207,837

Less:

Stock-based compensation and related

payroll taxes

(20,863

)

(21,334

)

(62,797

)

(63,241

)

Acquisition and integration-related

expenses

(3

)

(289

)

(972

)

(502

)

Non-GAAP general and administrative

expenses

$

60,707

$

50,096

$

188,713

$

144,094

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Reconciliation of operating loss:

GAAP operating loss

$

(27,622

)

$

(54,218

)

$

(151,940

)

$

(254,375

)

Add:

Depreciation and amortization of intangible assets (1)

23,429

23,046

70,830

67,891

Stock-based compensation and related payroll taxes charged to cost

of revenue and operating expenses (2)

60,619

65,724

189,155

260,726

Acquisition and integration-related expenses

3

289

972

502

Restructuring

2,104

—

27,195

—

Non-GAAP operating income

$

58,533

$

34,841

$

136,212

$

74,744

(1) Excludes amortization of

capitalized internal-use software costs paid in cash.

(2) Excludes stock-based

compensation charged to Restructuring.

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Reconciliation of net income (loss):

GAAP net income (loss)

$

31,809

$

(31,138

)

$

(36,473

)

$

(207,854

)

Add - GAAP provision for income taxes

370

542

2,559

70

Loss before taxes

32,179

(30,596

)

(33,914

)

(207,784

)

Add (less):

Depreciation and amortization of intangible assets (1)

23,429

23,046

70,830

67,891

Stock-based compensation and related payroll taxes charged to cost

of revenue and operating expenses

60,619

65,724

189,155

260,726

Acquisition and integration-related expenses

3

289

972

502

Restructuring

2,104

—

27,195

—

Gain on debt extinguishment and change on mark to market

derivatives associated with notes repurchase and capped call unwind

(34,297

)

—

(34,297

)

—

Amortization of debt issuance costs

1,651

1,734

5,174

5,217

Non-GAAP net income before non-GAAP tax adjustments (2)

85,688

60,197

225,115

126,552

Non-GAAP provision for income taxes (3)

(17,138

)

(12,039

)

(45,023

)

(25,310

)

Non-GAAP net income

$

68,550

$

48,158

$

180,092

$

101,242

(1)

Excludes amortization of capitalized

internal-use software costs paid in cash.

(2)

Non-GAAP net income before non-GAAP tax

adjustments reflects certain tax items differently than

historically presented. These differences consist of the addition

of the GAAP provision for income taxes listed above and the

omission of an adjustment for income tax effects associated with

acquisitions. Income tax effects associated with acquisitions were

$0.1 million for the nine months ended March 31, 2024, and $1.0

million and $1.5 million for the three and nine months ended March

31, 2023, respectively.

(3)

Beginning third fiscal quarter 2024, and

retrospectively applied to comparable periods, the non-GAAP

provision for income taxes is calculated using a blended tax rate

of 20%, taking into consideration the nature of the taxed item and

the applicable statutory tax rate in each relevant taxing

jurisdiction.

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Reconciliation of net income (loss) per share attributable

to

common stockholders, basic and

diluted:

GAAP net income (loss) per share attributable to common

stockholders, basic and diluted

$

0.30

$

(0.29

)

$

(0.34

)

$

(1.96

)

Add - GAAP provision for (benefit from) income taxes

0.00

0.01

0.02

0.00

Loss before taxes

0.30

(0.28

)

(0.32

)

(1.96

)

Add:

Depreciation and amortization of intangible assets (1)

0.22

0.22

0.67

0.64

Stock-based compensation and related payroll taxes charged to cost

of revenue and operating expenses

0.58

0.60

1.77

2.47

Acquisition and integration-related expenses

0.00

0.00

0.01

0.00

Restructuring

0.02

—

0.26

—

Gain on debt extinguishment and change on mark to market

derivatives associated with notes repurchase and capped call unwind

(0.33

)

—

(0.32

)

—

Amortization of debt issuance costs

0.02

0.02

0.05

0.05

Non-GAAP net income before non-GAAP tax adjustments per share

attributable to common stockholders,

basic

$

0.81

$

0.56

$

2.12

$

1.20

Non-GAAP net income before non-GAAP tax adjustments per share

attributable to common stockholders,

diluted

$

0.74

$

0.51

$

1.93

$

1.07

Less - Non-GAAP provision for income taxes

(0.16

)

(0.11

)

(0.42

)

(0.24

)

Non-GAAP net income per share attributable to common stockholders,

basic

$

0.65

$

0.45

$

1.70

$

0.96

Non-GAAP net income per share attributable to common stockholders,

diluted

$

0.60

$

0.41

$

1.54

$

0.86

(1) Excludes amortization of

capitalized internal-use software costs paid in cash.

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Shares used to compute GAAP and non-GAAP

net income (loss) per share attributable to common stockholders,

basic

105,436

106,597

106,045

105,843

Shares used to compute GAAP net income

(loss) per share attributable to common stockholders, diluted

111,176

106,597

106,045

105,843

Shares used to compute non-GAAP net income

per share attributable to common stockholders, diluted

115,059

117,213

116,666

117,993

BILL HOLDINGS, INC.

FREE CASH FLOW

(Unaudited, in thousands)

Three Months Ended

March 31,

Nine Months Ended

March 31,

2024

2023

2024

2023

Net cash provided by operating

activities

$

66,809

$

34,031

$

200,151

$

107,413

Purchases of property and equipment

(16

)

(3,338

)

(771

)

(6,499

)

Capitalization of internal-use software

costs

(3,833

)

(6,721

)

(14,595

)

(17,231

)

Free cash flow

$

62,960

$

23,972

$

184,785

$

83,683

BILL HOLDINGS, INC.

REMAINING PERFORMANCE

OBLIGATIONS

(Unaudited, in thousands)

March 31,

2024

June 30,

2023

Remaining performance obligations to be

recognized as revenue:

Within 2 years

$

80,555

$

101,177

Thereafter

17,524

29,960

Total

$

98,079

$

131,137

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502422896/en/

IR Contact:

Karen Sansot ksansot@hq.bill.com

Press Contact:

John Welton john.welton@hq.bill.com

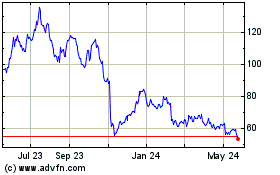

BILL (NYSE:BILL)

Historical Stock Chart

From Dec 2024 to Jan 2025

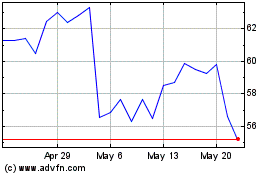

BILL (NYSE:BILL)

Historical Stock Chart

From Jan 2024 to Jan 2025