Ten Nuveen Closed-End Funds Announce Availability of 19(a) Notices

September 30 2022 - 3:15PM

Business Wire

The 19(a) distribution notices for ten Nuveen closed-end funds

are now available. These informational notices provide further

details on the sources of the funds’ regular monthly or quarterly

distributions and follows the most recent monthly and quarterly

distribution announcements. The full text of these notices is

available below or on the Nuveen website via Distribution Source

Estimates.

Important Information Regarding

Distributions

September 30, 2022: THIS NOTICE IS FOR INFORMATIONAL

PURPOSES ONLY. NO ACTION IS REQUIRED ON YOUR PART. If you would

like to receive this notice and other shareholder information

electronically, please visit www.investordelivery.com if you

receive distributions and statements from your financial advisor or

brokerage account. An electronic copy of this notice is also posted

under distribution notices at www.nuveen.com/cef.

This notice provides shareholders with information regarding

fund distributions, as required by current securities laws. You

should not draw any conclusions about the Fund’s investment

performance from the amount of this distribution or from the terms

of the Fund’s Managed Distribution Policy.

The following table provides estimates of the Funds’

distribution sources, reflecting year-to-date cumulative experience

through the month-end prior to the latest distribution. The Funds

attribute these estimates equally to each regular distribution

throughout the year. Consequently, the estimated information as of

the specified month-end shown below is for the current

distribution, and also represents an updated estimate for all prior

months in the year. It is estimated that JRS, QQQX, SPXX, DIAX,

NDMO, JRI and NPCT have distributed more than their income and net

realized capital gains; therefore, a portion of the distributions

may be (and is shown below as being estimated to be) a return of

capital. A return of capital may occur, for example, when some or

all of the money that you invested in the Fund is paid back to you.

A return of capital distribution does not necessarily reflect the

Fund’s investment performance and should not be confused with

“yield” or “income.”

The amounts and sources of distributions reported in this 19(a)

Notice are only estimates and are not being provided for tax

reporting purposes. The actual amounts and sources of the amounts

for tax reporting purposes will depend upon the Funds’ investment

experience during the remainder of its fiscal year and may be

subject to changes based on tax regulations. Each Fund will send a

Form 1099-DIV for the calendar year that will tell you how to

report these distributions for federal income tax purposes. More

details about each Fund’s distributions and the basis for these

estimates are available on www.nuveen.com/cef.

Data as of 8/31/2022

Current Quarter

Fiscal YTD

Estimated Percentages

Estimated Sources of

Distribution

Estimated Sources of

Distribution

of Distribution 1

Per Share

LT

ST

Return of

Per Share

LT

ST

Return of

LT

ST

Return of

Distribution

NII

Gains

Gains

Capital

Distribution

NII

Gains

Gains

Capital

NII

Gains

Gains

Capital

JRS (FYE 12/31)

.2090

0.0362

0.0000

0.1005

0.0723

0.6270

0.1086

0.0000

0.3014

0.2170

17.3%

0.0%

48.1%

34.6%

QQQX (FYE 12/31)

.4934

0.0001

0.0815

0.2341

0.1778

1.4802

0.0002

0.2444

0.7022

0.5334

0.0%

16.5%

47.4%

36.0%

SPXX (FYE 12/31)

.2940

0.0302

0.0255

0.0669

0.1713

0.8820

0.0907

0.0766

0.2008

0.5139

10.3%

8.7%

22.8%

58.3%

BXMX (FYE 12/31)

.2365

0.0215

0.0632

0.1518

0.0000

0.7095

0.0644

0.1897

0.4554

0.0000

9.1%

26.7%

64.2%

0.0%

DIAX (FYE 12/31)

.2867

0.0537

0.0252

0.0836

0.1242

0.8601

0.1612

0.0755

0.2508

0.3726

18.7%

8.8%

29.2%

43.3%

JCE (FYE 12/31)

.3952

0.0199

0.0000

0.3753

0.0000

1.1856

0.0598

0.0000

1.1258

0.0000

5.0%

0.0%

95.0%

0.0%

NMAI (FYE 12/31)

.3500

0.1306

0.2194

0.0000

0.0000

1.0500

0.3919

0.6581

0.0000

0.0000

37.3%

62.7%

0.0%

0.0%

1 Net investment income (NII) is a

projection through the end of the current calendar quarter using

actual data through the stated month-end date above. Capital gain

amounts are as of the stated date above. JRS owns REIT securities

which attribute their distributions to various sources including

NII, gains, and return of capital. The estimated per share sources

above include an allocation of the NII based on prior year

attributions which can be expected to differ from the actual final

attributions for the current year.

Data as of 8/31/2022

Current Month

Fiscal YTD

Estimated Percentages

Estimated Sources of

Distribution

Estimated Sources of

Distribution

of Distribution 1

Per Share

LT

ST

Return of

Per Share

LT

ST

Return of

LT

ST

Return of

Distribution

NII

Gains

Gains

Capital

Distribution

NII

Gains

Gains

Capital

NII

Gains

Gains

Capital

NDMO (FYE 10/31)

.0765

0.0425

0.0000

0.0000

0.0340

0.7650

0.4253

0.0000

0.0000

0.3397

55.6%

0.0%

0.0%

44.4%

JRI (FYE 12/31)

.0965

0.0642

0.0000

0.0000

0.0323

0.7720

0.5136

0.0000

0.0000

0.2584

66.5%

0.0%

0.0%

33.5%

NPCT (FYE 12/31)

.1030

0.0616

0.0000

0.0000

0.0414

0.8240

0.4931

0.0000

0.0000

0.3309

59.8%

0.0%

0.0%

40.2%

1 Net investment income (NII) and capital

gain amounts are as of the stated month-end date above.

The following table provides information regarding distributions

and total return performance over various time periods. This

information is intended to help you better understand whether

returns for the specified time periods were sufficient to meet

distributions.

Data as of 8/31/2022

Annualized

Cumulative

Inception Date

Quarterly

Distribution

Fiscal

YTD

Distribution

NAV

5-Year

Return on NAV2

Fiscal YTD

Distribution Rate on

NAV1

Fiscal YTD

Return on NAV

Fiscal YTD

Distribution Rate on

NAV1

JRS (FYE 12/31)

Nov-2001

.2090

.6270

9.78

4.72%

8.55%

-23.18%

6.41%

QQQX (FYE 12/31)

Jan-2007

.4934

1.4802

22.45

7.37%

8.79%

-21.15%

6.59%

SPXX (FYE 12/31)

Nov-2005

.2940

.8820

15.55

6.20%

7.56%

-13.89%

5.67%

BXMX (FYE 12/31)

Oct-2004

.2365

.7095

13.03

5.11%

7.26%

-11.80%

5.45%

DIAX (FYE 12/31)

Apr-2005

.2867

.8601

15.73

4.25%

7.29%

-10.04%

5.47%

JCE (FYE 12/31)

Mar-2007

.3952

1.1856

13.95

7.66%

11.33%

-15.17%

8.50%

NMAI (FYE 12/31)

Nov-2021

.3500

1.0500

15.53

-17.66%

9.01%

-19.20%

6.76%

1As a percentage of 8/31/2022 NAV.

2 NMAI 5 year return figure reflects the

annualized since inception return on NAV

Data as of 8/31/2022

Annualized

Cumulative

Inception Date

Monthly

Distribution

Fiscal

YTD

Distribution

NAV

5-Year

Return on NAV2

Fiscal YTD

Distribution Rate on

NAV1

Fiscal YTD

Return on NAV

Fiscal YTD

Distribution Rate on

NAV1

NDMO (FYE 10/31)

Aug-2020

.0765

.7650

11.82

-5.74%

7.77%

-19.83%

6.47%

JRI (FYE 12/31)

Apr-2012

.0965

.7720

14.83

1.62%

7.81%

-10.60%

5.21%

NPCT (FYE 12/31)

Apr-2021

.1030

.8240

13.55

-19.97%

9.12%

-18.72%

6.08%

1As a percentage of 8/31/2022 NAV.

2 NPCT and NDMO 5 year return figure

reflects the annualized since inception return on NAV

For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $1.1 trillion in assets under management as

of 3o Jun 2022 and operations in 27 countries. Its investment

specialists offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

FORWARD LOOKING STATEMENTS

Certain statements made in this release are forward-looking

statements. Actual future results or occurrences may differ

significantly from those anticipated in any forward-looking

statements due to numerous factors. These include, but are not

limited to:

• market developments;

• legal and regulatory developments; and

• other additional risks and uncertainties.

Nuveen and the closed-end funds managed by Nuveen and its

affiliates undertake no responsibility to update publicly or revise

any forward-looking statement.

EPS-2447796PR-E0922W

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220930005502/en/

Financial Professionals 800-752-8700

Investors 800-257-8787

Media media-inquiries@nuveen.com

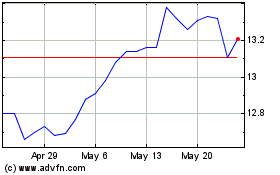

Nuveen S&P 500 Buy Write... (NYSE:BXMX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nuveen S&P 500 Buy Write... (NYSE:BXMX)

Historical Stock Chart

From Nov 2023 to Nov 2024