Citizens M&A Outlook Finds Dealmaker Sentiment at a Five-Year High

January 08 2025 - 8:01AM

Business Wire

Economic growth expected to drive activity as

valuations stabilize, inflation worries fade

Optimism about the dealmaking environment has reached a

five-year high, according to Citizens’ 2025 M&A Outlook. The

14th annual survey of 400 leaders at U.S. middle-market companies

and private equity firms revealed that 54% of decision-makers

believe the current M&A environment is strong.

Economic growth and easing inflation are among the most-cited

factors fueling middle-market businesses’ M&A plans in 2025.

Fifty-seven percent of all respondents expect the U.S. economy to

improve in the year ahead, up from just 47% last year, and 59% of

middle-market companies believe that the economic growth backdrop

will make business easier.

The bullish outlook for dealmaking is also supported by more

upbeat expectations for valuations, particularly among PE firms and

larger middle-market businesses. Nearly 90% of all respondents

expect valuations to be stable or higher over the next year.

“The prevailing headwinds of recent years have really

moderated,” said Jason Wallace, head of Citizens M&A Advisory.

“We see companies and sponsors coming into 2025 with big plans and

this year’s survey shows how focused they are on the growth

environment.”

PE firms are especially bullish. Sixty-eight percent believe the

current M&A environment is strong, an increase from just 52%

last year. In addition, 64% expect deal flow to increase in 2025,

particularly as more PE-backed assets come to market.

While dealmaking conditions vary across sectors, buyers and

sellers are perceived to be on fairly equal footing overall,

supporting confidence in the outlook. Notably, the seller pool has

expanded substantially, with 73% of middle-market companies

identifying as potential sellers in the year ahead, an increase

from 63% last year.

Meanwhile, PE firms look ready to shop. Ninety percent of

sponsors that anticipate an increase in deal flow in 2025 also

expect to buy more than they did in 2024. This combination of

willing middle-market sellers and eager PE acquirers could create a

conducive environment for dealmaking, especially as small and

mid-size businesses become increasingly comfortable with PE

partners.

“Valuations have stabilized and buyers and sellers find

themselves on fairly equal footing, which should reinforce

confidence in dealmaking,” added Wallace. “The enthusiasm is

palpable, and we are seeing a high level of M&A interest among

both corporates and sponsors.”

Other key findings from the 2025 survey include:

- Growing openness to partial sales. One factor supporting

the growth of the seller pool in 2025 is an elevated interest in

partial sales. In fact, among middle-market companies, the majority

of would-be sellers say they are more open to a partial sale or

ancillary business-unit sale, rather than a full exit.

- Artificial intelligence could drive dealmaking. A recent

Citizens survey shows that clear use cases for AI are emerging. As

the technology continues to mature, the race to add AI capabilities

could support dealmaking. In fact, among PE firms that anticipate

an increase in deal flow this year, 38% cite a desire to add AI

companies and capabilities to their portfolio as a key driver of

activity, up from 25% last year.

- Interest in international deals persists. Among

middle-market companies, 52% of sellers and 46% of buyers say they

would consider international deals. Notably, PE firms are even more

bullish. Seventy-four percent say they are significantly more

likely to consider investment opportunities outside the U.S. in

2025, up from 54% last year.

The survey was conducted among U.S.-based middle-market

businesses ($25 million to $1 billion in revenue), as well as PE

firms (fund size less than $1.5 billion) that are active in the

acquisition and sale of U.S.-based companies with revenue between

$50 million and $1 billion. Core business sectors included

Citizens’ industry specialties of aerospace, defense and government

services; business services; consumer; real estate, gaming, lodging

and leisure; healthcare; industrials; technology, media and

telecommunications; transportation and logistics; and financial

services, as well as other industries.

Business executives at 274 middle-market firms and 126 PE firms

who are directly involved in decision-making related to M&A

(owners/partners, CEOs, presidents and other C-level executives and

directors) completed a phone or web-based survey between October

and November 2024.

For more information on this year’s Citizens Middle Market

M&A Outlook, please visit our website here. To register for a

Jan. 23 webinar on the report, please go here.

Citizens specializes in middle-market mergers and acquisitions.

Citizens combines sector intelligence with a client-focused

approach to realize our clients' true value. The Citizens team has

more than 100 M&A professionals specializing in a range of

industries across the United States. Citizens M&A Advisory is

part of Citizens JMP Securities, LLC, a subsidiary of Citizens

Financial Group (NYSE: CFG).

About Citizens Financial Group,

Inc.

Citizens Financial Group, Inc. is one of the nation’s oldest and

largest financial institutions, with $219.7 billion in assets as of

September 30, 2024. Headquartered in Providence, Rhode Island,

Citizens offers a broad range of retail and commercial banking

products and services to individuals, small businesses,

middle-market companies, large corporations and institutions.

Citizens helps its customers reach their potential by listening to

them and by understanding their needs in order to offer tailored

advice, ideas and solutions. In Consumer Banking, Citizens provides

an integrated experience that includes mobile and online banking, a

full-service customer contact center and the convenience of

approximately 3,100 ATMs and approximately 1,000 branches in 14

states and the District of Columbia. Consumer Banking products and

services include a full range of banking, lending, savings, wealth

management and small business offerings. In Commercial Banking,

Citizens offers a broad complement of financial products and

solutions, including lending and leasing, deposit and treasury

management services, foreign exchange, interest rate and commodity

risk management solutions, as well as loan syndication, corporate

finance, merger and acquisition, and debt and equity capital

markets capabilities. More information is available at

www.citizensbank.com or visit us on X (formerly Twitter), LinkedIn

or Facebook.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108160867/en/

Frank Quaratiello frank.quaratiello@citizensbank.com

617.543.5810

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Dec 2024 to Jan 2025

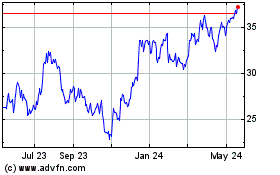

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Jan 2024 to Jan 2025