United States

Securities and

exchange commission

washington, d.c. 20549

FORM 6-K

report of foreign

private issuer

pursuant to rule 13a-16 or 15d-16 of

the securities exchange act of 1934

For the month of January 2024

Commission File Number 1-15224

Energy Company of Minas Gerais

(Translation of Registrant’s Name into English)

Avenida Barbacena, 1200

30190-131 Belo Horizonte, Minas Gerais, Brazil

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F a

Form 40-F ___

Index

Item Description

of Items

Forward-Looking Statements

This report contains statements about expected future events and financial

results that are forward-looking and subject to risks and uncertainties. Actual results could differ materially from those predicted in

such forward-looking statements. Factors which may cause actual results to differ materially from those discussed herein include those

risk factors set forth in our most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. CEMIG undertakes

no obligation to revise these forward-looking statements to reflect events or circumstances after the date hereof, and claims the protection

of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG

By: /s/ Leonardo George de Magalhães .

Name: Leonardo George de Magalhães

Title: Chief Finance and Investor Relations

Officer

Date: January 10, 2024

| 1. | Notice to Shareholders dated December 14, 2023 – Dividends/Interest on Equity |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

NOTICE TO SHAREHOLDERS

Declaration of Interest on Equity

We hereby inform our shareholders that the Board of Directors

approved the declaration of Interest on Equity - IoE. Detailed information about the payment is as follows:

| 1. | Gross amount: R$1,322,561,000.00

(one billion, three hundred and twenty-two million, five hundred and sixty-one thousand reais) |

| 2. | Gross amount per share: R$0.60102079554

per share, to be paid with the mandatory minimum dividend for 2023, with a 15% withholding income tax, except for shareholders exempt

from said withholding, under the law in force; |

| 3. | Date “with rights”:

shareholders of record on December 21, 2023 holding common and preferred shares will be entitled to the payment; |

4.

Date “ex-rights”:

December 22, 2023;

| 5. | Payment date: 2 (two) equal

installments, the first of which to be paid by June 30, 2024, and the second by December 30, 2024. |

Shareholders whose shares are not held in custody at CBLC

and whose registration data is outdated are advised to go to a branch of Banco Itaú Unibanco S.A. (the institution managing CEMIG’s

Registered Share System) bearing their personal documents for the due update of their registration data.

Belo Horizonte - MG, December 14, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 2. | Notice to the Market dated December 11, 2023 – Cemig selected for DJSI for the 24th consecutive year |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31.300.040.127

NOTICE TO THE MARKET

Cemig selected for DJSI for the 24th consecutive year

COMPANHIA ENERGÉTICA DE MINAS GERAIS –

CEMIG (“Cemig” or “Company”), a publicly-held company with shares traded on the stock exchanges of São

Paulo, New York, and Madrid, according to its commitment to adopting the best Corporate Governance practices, hereby informs its shareholders

and the market in general that it has been selected, for the 24th time, to be part of the Dow Jones Sustainability World Index (DJSI World).

For 24 consecutive years, Cemig has been part of DJSI World, since its creation in 1999.

Cemig remains as the only company in the electricity

sector outside Europe to be part of the index, in its 2023/2024 edition, together with 7 European companies.

DJSI World is an index composed of shares from the largest

companies in the world that, within their different economic sectors, stand out for their sustainability-driven performance and their

adaptation to market trends, being capable of creating shareholder value in the medium and long term. The index composition is annually

renewed and is a world reference for investors and international financial agencies that use the index to make socially responsible investment

decisions. The new composition of DJSI World gathers 256 companies from several countries chosen among more than 3,000 pre-selected companies

from different economic sectors.

The companies were evaluated based on a survey and public

information. The selection was conducted by S&P Dow Jones Indices (“S&P DJI”), an institution specialized in asset

management and offer of products and services related to sustainable investments, and the entire process is audited by Deloitte.

Remaining in the Dow Jones Sustainability Index for 24

consecutive years reiterates Cemig’s commitment to continue using sustainable practices in its relationship with employees and suppliers,

creating value for its shareholders and contributing to the well-being of society.

Further details on the socio-environmental practices adopted

by Cemig are available in the sustainability reports at www.cemig.com.br.

Belo Horizonte/MG - December 11, 2023.

Leonardo George de Magalhães

Chief Financial and Investor Relations Officer

| 3. | Notice to the Market dated December 21, 2023 – Cemig concludes partial redemption of foreign debt bonds |

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31.300.040.127

CEMIG GERAÇÃO E TRANSMISSÃO

S.A. - CEMIG GT

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 06.981.176/0001-58

Company Registry (NIRE): 31.300.020.550

MATERIAL FACT

Cemig concludes partial redemption of foreign debt bonds

COMPANHIA ENERGÉTICA DE MINAS GERAIS –

CEMIG (“Cemig”), a category “A” publicly held company with shares traded in the stock exchanges of São

Paulo, New York, and Madrid, and CEMIG GERAÇÃO E TRANSMISSÃO S.A. – CEMIG-GT (“Cemig GT”),

a category “B” publicly held company, a wholly-owned subsidiary of Cemig, pursuant to the provisions of Resolution 44, of

August 23, 2021, as amended, issued by the Brazilian Securities and Exchange Commission (“CVM”), hereby informs its

shareholders and the market in general that it has concluded the anticipated partial redemption, without premium payment and through the

exercise of a purchase option (“call”), of debt bonds issued in the foreign market, maturing in December 2024,

remunerated at 9.25% p.a., in the principal amount of US$375,000,000.00 (three hundred and seventy-five million U.S. dollars) (9.25%

Senior Notes due 2024, “Notes”). The redemption represented a reduction of R$1,823,400,000.00 (one billion, eight

hundred and twenty-three million and four hundred thousand reais) in the Company’s gross debt, substantially reducing its exposure

in U.S. dollars.

Thus, the outstanding balance of the Notes, maturing

in December 2024, is now US$381,000,000.00 (three hundred and eighty-one million U.S. dollars).

This Material Fact is merely informative and shall

not, under any circumstance, be construed as an offer to purchase or solicitation of an offer for the sale of the Notes in any jurisdiction

in which an offer to purchase or solicitation of an offer for a sale is prohibited, under the securities laws of any such state or jurisdiction,

including Brazil. The redemption was exclusively carried out to investors in the foreign market and shall not be registered with the CVM

or offered in Brazil.

Cemig and Cemig GT reaffirm their commitment to keeping

the market timely informed of the matter contained in this Material Fact, according to applicable law and regulation. Any communication

to shareholders and the market in general relating to the Notes will be made on the websites of CVM (www.cvm.gov.br), B3 – Brasil,

Bolsa, Balcão S.A. (http://www.b3.com.br/pt_br/), and Cemig (https://ri.cemig.com.br/).

Belo Horizonte/MG - December 21, 2023.

Leonardo George de Magalhães

Vice President of Finance and Investor Relations

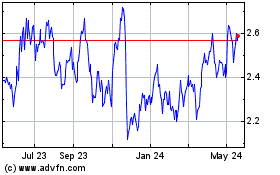

Companhia Energetica de ... (NYSE:CIG)

Historical Stock Chart

From Dec 2024 to Jan 2025

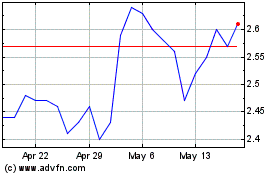

Companhia Energetica de ... (NYSE:CIG)

Historical Stock Chart

From Jan 2024 to Jan 2025