Custom Truck One Source, Inc. (NYSE: CTOS), a leading provider

of specialty equipment to the electric utility, telecom, rail,

forestry, waste management and other infrastructure-related end

markets, today reported financial results for its three months

ended March 31, 2024.

CTOS First-Quarter Highlights

- Total revenue of $411.3 million, a decrease of $40.9 million,

or 9.0%, compared to $452.2 million for the first quarter of 2023

primarily due to fewer rental asset sales and lower rental demand

from the utility end market

- Gross profit of $90.7 million, a decline of $19.0 million, or

17.3%, compared to $109.7 million for the first quarter of

2023

- Adjusted Gross Profit of $134.5 million, a decrease of $15.5

million, or 10.4%, compared to $150.0 million for the first quarter

of 2023

- Net loss of $14.3 million, compared to net income of $13.8

million in the first quarter of 2023

- Adjusted EBITDA of $77.4 million, a decrease of $27.8 million,

or 26.4% compared to the record $105.2 million posted in the first

quarter of 2023

“We continue to see strong demand in our TES segment, posting

double-digit growth for the sixth consecutive quarter. CTOS is well

positioned to capitalize on the secular tailwinds we see around AI

and data center investment, electrification, and utility grid

upgrades. We continue to be impacted by end-market supply chain,

regulatory and customer financing factors affecting the timing of

job starts of several large projects in our core T&D markets.

These delays impacted our first quarter results specifically in the

ERS segment, contributing to both lower rental revenue and rental

asset sales this quarter. We believe that this decline will be

temporary and anticipate a return to growth heading into 2025,”

said Ryan McMonagle, Chief Executive Officer of CTOS. “We continue

to see good demand in our infrastructure, rail and telecom end

markets which all contributed to our TES segment performance. Our

sales backlog remains at an elevated level, but we anticipate it

returning to a more normalized level as OEM production and overall

supply chain continue to improve. Recently, we announced the

acquisition of A&D Maintenance and Repair on Long Island, New

York and SOS Fleet Services in Alexandria, Louisiana, further

demonstrating our commitment to expanding our footprint to better

service our rental fleet and our customers,” McMonagle added.

Summary Actual Financial Results

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Rental revenue

$

106,171

$

118,288

$

120,244

Equipment sales

272,602

301,290

366,967

Parts sales and services

32,534

32,585

34,543

Total revenue

411,307

452,163

521,754

Gross Profit

$

90,709

$

109,661

$

126,824

Adjusted Gross Profit1

$

134,453

$

149,991

$

171,073

Net Income (Loss)

$

(14,335

)

$

13,800

$

16,122

Adjusted EBITDA1

$

77,376

$

105,200

$

118,361

1

Each of Adjusted Gross Profit and Adjusted

EBITDA is a non-GAAP measure. Further information and

reconciliations for our non-GAAP measures to the most directly

comparable measure under United States generally accepted

accounting principles (“GAAP”) are included at the end of this

press release.

Summary Actual Financial Results by Segment Our results

are reported for our three segments: Equipment Rental Solutions

(“ERS”), Truck and Equipment Sales (“TES”) and Aftermarket Parts

and Services (“APS”). ERS encompasses our core rental business,

inclusive of sales of used rental equipment to our customers. TES

encompasses our specialized truck and equipment production and new

equipment sales activities. APS encompasses sales and rentals of

parts, tools, and other supplies to our customers, as well as our

aftermarket repair service operations.

Equipment Rental Solutions

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Rental revenue

$

103,288

$

113,784

$

116,594

Equipment sales

32,740

92,136

68,023

Total revenue

136,028

205,920

184,617

Cost of rental revenue

29,800

29,060

28,222

Cost of equipment sales

24,098

71,081

49,799

Depreciation of rental equipment

42,697

39,512

43,230

Total cost of revenue

96,595

139,653

121,251

Gross profit

$

39,433

$

66,267

$

63,366

Truck and Equipment Sales

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Equipment sales

$

239,862

$

209,154

$

298,944

Cost of equipment sales

196,702

175,044

246,047

Gross profit

$

43,160

$

34,110

$

52,897

Aftermarket Parts and Services

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Rental revenue

$

2,883

$

4,504

$

3,650

Parts and services revenue

32,534

32,585

34,543

Total revenue

35,417

37,089

38,193

Cost of revenue

26,254

26,987

26,613

Depreciation of rental equipment

1,047

818

1,019

Total cost of revenue

27,301

27,805

27,632

Gross profit

$

8,116

$

9,284

$

10,561

Summary Combined Operating Metrics

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Ending OEC(a) (as of period end)

$

1,452,900

$

1,457,870

$

1,455,708

Average OEC on rent(b)

$

1,065,700

$

1,214,300

$

1,159,164

Fleet utilization(c)

73.3

%

83.6

%

77.6

%

OEC on rent yield(d)

40.5

%

39.6

%

41.1

%

Sales order backlog(e) (as of period

end)

$

537,292

$

855,049

$

688,559

(a)

Ending OEC — original equipment cost

(“OEC”) is the original equipment cost of units at the end of the

measurement period.

(b)

Average OEC on rent — Average OEC on rent

is calculated as the weighted-average OEC on rent during the stated

period.

(c)

Fleet utilization — total number of days

the rental equipment was rented during a specified period of time

divided by the total number of days available during the same

period and weighted based on OEC.

(d)

OEC on rent yield (“ORY”) — a measure of

return realized by our rental fleet during a period. ORY is

calculated as rental revenue (excluding freight recovery and

ancillary fees) during the stated period divided by the Average OEC

on rent for the same period. For periods of less than 12 months,

the ORY is adjusted to an annualized basis.

(e)

Sales order backlog — purchase orders

received for customized and stock equipment. Sales order backlog

should not be considered an accurate measure of future net

sales.

Management Commentary In the first quarter of 2024, total

revenue was $411.3 million, a decrease of 9.0% from the first

quarter of 2023. First quarter 2024 rental revenue decreased 10.2%

to $106.2 million, compared to $118.3 million in the first quarter

of 2023, due to lower utilization and a decline in average OEC on

rent. Equipment sales decreased 9.5% in the first quarter of 2024

to $272.6 million, compared to $301.3 million in the first quarter

of 2023, primarily driven by lower sales of used equipment due to

excess supply of equipment available in the market. Parts sales and

service revenue remained flat year-over-year.

In our ERS segment, rental revenue in the first quarter of 2024

was $103.3 million compared to $113.8 million in the first quarter

of 2023, a 9.2% decrease. Fleet utilization declined to 73.3%

compared to 83.6% in the first quarter of 2023, due to a decline in

demand in the utility market as a result of supply chain

constraints, environmental, regulatory, and customer financing

factors affecting the timing of transmission job starts. Average

OEC on rent decreased 12.2% year-over-year, primarily as a result

of the lower utilization in the quarter. Equipment sales decreased

$59.4 million in the first quarter of 2024 to $32.7 million

compared to $92.1 million in the first quarter of 2023, due to

excess supply of used equipment available in the market. ERS gross

profit in the first quarter of 2024 and 2023 was $39.4 million and

$66.3 million, respectively. Adjusted Gross Profit in the segment

was $82.1 million in the first quarter of 2024, compared to $105.8

million in the first quarter of 2023. Adjusted gross profit from

rentals, which excludes depreciation of rental equipment, decreased

to $73.5 million in the first quarter of 2024 compared to $84.7

million in the first quarter of 2023.

Revenue in our TES segment increased 14.7% to $239.9 million in

the first quarter of 2024, from $209.2 million in the first quarter

of 2023, primarily as a result of exiting 2023 with healthy

inventory levels due to the supply chain improvements experienced

in 2023 and historically high backlog levels that improved our

ability to produce and deliver more units during the first quarter

of 2024. Gross profit improved by 26.5% to $43.2 million in the

first quarter of 2024 compared to $34.1 million in the first

quarter of 2023. TES saw a reduction in backlog of 37.2% to $537.3

million compared to the first quarter of 2023, primarily for the

reasons detailed above.

APS segment revenue decreased $1.7 million in the first quarter

of 2024 to $35.4 million, compared to $37.1 million in the first

quarter of 2023 due to the decrease in rentals of tools and

accessories affected by the utility end-market softness. Gross

profit margin decreased to 22.9% in the first quarter of 2024 from

25.0% in the first quarter of 2023.

Net loss was $14.3 million in the first quarter of 2024,

compared to net income of $13.8 million for the first quarter of

2023. The $28.1 million decrease is primarily due to lower revenue

leading to decreased gross profit and higher interest expense on

variable-rate debt and variable-rate floor plan liabilities.

Adjusted EBITDA for the first quarter of 2024 was $77.4 million,

a decrease of 26.4%, compared to $105.2 million for the first

quarter of 2023. The decrease in Adjusted EBITDA was largely driven

by a decline in used equipment sales in our ERS segment as well as

higher costs associated with variable-rate floorplan liabilities as

a result of higher rates and inventory levels.

As of March 31, 2024, cash and cash equivalents was $8.0

million, Total Debt outstanding was $1,519.4 million, Net Debt was

$1,511.4 million and Net Leverage Ratio was 3.79x. Availability

under the senior secured credit facility was $194.5 million as of

March 31, 2024, and based on our borrowing base, we have an

additional $331.9 million of availability that we can potentially

utilize by upsizing our existing facility. For the three months

ended March 31, 2024 compared to December 31, 2023, Ending OEC

decreased by $5.0 million as we shifted allocation of new equipment

builds in favor of our TES segment in order to capitalize on a

continuing solid demand environment for vocational trucks. During

the three months ended March 31, 2024, CTOS purchased $6.4 million

of its common stock.

OUTLOOK We are updating our full-year revenue and

Adjusted EBITDA1, 4 guidance for 2024. We believe our ERS segment

will continue to experience near-term pressure in demand in the

utility market as a result of financing, supply chain, and

regulatory factors affecting the timing of job starts. These

headwinds in our utility end markets are driving lower OEC on rent

in our core ERS segment. We expect to grow our rental fleet (based

on net OEC) by low-single digits. Regarding TES, supply chain

improvements, healthy inventory levels, and historically high

backlog levels continue to improve our ability to produce and

deliver more units in 2024. While we are lowering our consolidated

revenue and Adjusted EBITDA1, 4 guidance for the year, we continue

to focus on generating meaningful free cash flow in 2024, and

reaffirm our target to generate more than $100 million of levered

free cash flow2, 4. However, we now expect to deliver a net

leverage3, 4 that decreases from current levels to less than 3.5

times by the end of the fiscal year. “We continue to have

confidence in the long-term strength of our end markets and the

continued execution by our teams to profitably grow our business,

better serve our customers and position CTOS for future growth. Our

updated outlook reflects the risks associated with some near-term

challenges for our rental customers in the T&D sector, which we

now expect could persist through the balance of the fiscal year.”

said Ryan McMonagle, Chief Executive Officer of CTOS.

2024 Consolidated Outlook

Revenue

$1,950 million

—

$2,130 million

Adjusted EBITDA1, 4

$400 million

—

$440 million

2024 Revenue Outlook by Segment

ERS

$680 million

—

$710 million

TES

$1,115 million

—

$1,255 million

APS

$155 million

—

$165 million

1

Adjusted EBITDA is a non-GAAP performance

measure that we use to monitor our results of operations, to

measure performance against debt covenants and performance relative

to competitors. Refer to the section below entitled “Non-GAAP

Financial and Performance Measures” for further information about

Adjusted EBITDA.

2

Levered Free Cash Flow is defined as net

cash provided by operating activities, less cash flow for investing

activities, excluding acquisitions, plus acquisition of inventory

through floor plan payables – non-trade less repayment of floor

plan payables – non-trade, both of which are included in cash flow

from financing activities in our Consolidated Statements of Cash

Flows. Levered Free Cash Flow should not be used to predict net

cash provided by operating activities as the difference between the

two measures is variable.

3

Net leverage ratio is a non-GAAP

performance measure used by management, and we believe it provides

useful information to investors because it is an important measure

to evaluate our debt levels and progress toward leverage targets,

which is consistent with the manner our lenders and management use

this measure. Refer to the section below entitled “Non-GAAP

Financial and Performance Measures” for further information about

net leverage ratio.

4

CTOS is unable to present a quantitative

reconciliation of its forward-looking Adjusted EBITDA, Net Leverage

Ratio and Levered Free Cash Flow for the year ending December 31,

2024 to its most directly comparable GAAP financial measure, net

income and cash flow from operating activities, because management

cannot reliably forecast net income on a forward-looking basis

without unreasonable efforts due to the high variability and

difficulty in predicting certain items that affect GAAP net income

including, but not limited to, customer buyout requests on rentals

with rental purchase options and income tax expense. Adjusted

EBITDA, Net Leverage Ratio and Levered Free Cash Flow should not be

used to predict net income or cash flow from operating activities

as the difference between the measures is variable.

CONFERENCE CALL INFORMATION The Company has scheduled a

conference call at 5:00 P.M. Eastern Time on May 2, 2024, to

discuss its first quarter 2024 financial results. A webcast will be

publicly available at: investors.customtruck.com. To listen by

phone, please dial 1-800-715-9871 or 1-646-307-1963 and provide the

operator with conference ID 2976854. A replay of the call will be

available until 11:59 p.m. ET, Thursday, May 9, 2024, by dialing

1-800-770-2030 or 1-609-800-9909 and entering passcode 2976854.

ABOUT CTOS CTOS is one of the largest providers of

specialty equipment, parts, tools, accessories and services to the

electric utility transmission and distribution, telecommunications,

and rail markets in North America, with a differentiated

“one-stop-shop” business model. CTOS offers its specialized

equipment to a diverse customer base for the maintenance, repair,

upgrade, and installation of critical infrastructure assets,

including electric lines, telecommunications networks, and rail

systems. The Company's coast-to-coast rental fleet of approximately

10,300 units includes aerial devices, boom trucks, cranes, digger

derricks, pressure drills, stringing gear, Hi-rail equipment,

repair parts, tools, and accessories. For more information, please

visit customtruck.com.

FORWARD-LOOKING STATEMENTS This press release includes

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995, as amended, and within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended,

and Section 27A of the Securities Act of 1933, as amended. When

used in this press release, the words “estimates,” “projected,”

“expects,” “anticipates,” “forecasts,” “suggests,” “plans,”

“targets,” “intends,” “believes,” “seeks,” “may,” “will,” “should,”

“future,” “propose” and variations of these words or similar

expressions (or the negative versions of such words or expressions)

are intended to identify forward-looking statements. These

forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company's management’s

control, that could cause actual results or outcomes to differ

materially from those discussed in this press release. This press

release is based on certain assumptions that the Company's

management has made in light of its experience in the industry, as

well as the Company’s perceptions of historical trends, current

conditions, expected future developments and other factors the

Company believes are appropriate in these circumstances. As you

read and consider this press release, you should understand that

these statements are not guarantees of performance or results. Many

factors could affect the Company’s actual performance and results

and could cause actual results to differ materially from those

expressed in this press release. Important factors, among others,

that may affect actual results or outcomes include: increases in

labor costs, our inability to obtain raw materials, component parts

and/or finished goods in a timely and cost-effective manner, and

our inability to manage our rental equipment in an effective

manner; competition in the equipment dealership and rental

industries; our sales order backlog may not be indicative of the

level of our future revenues; increases in unionization rate in our

workforce; our inability to recruit and retain the experienced

personnel, including skilled technicians, we need to compete in our

industries; our inability to attract and retain highly skilled

personnel and our inability to retain or plan for succession of our

senior management; material disruptions to our operation and

manufacturing locations as a result of public health concerns,

equipment failures, natural disasters, work stoppages, power

outages or other reasons; potential impairment charges; any further

increase in the cost of new equipment that we purchase for use in

our rental fleet or for sale as inventory; aging or obsolescence of

our existing equipment, and the fluctuations of market value

thereof; disruptions in our supply chain; our business may be

impacted by government spending; we may experience losses in excess

of our recorded reserves for receivables; uncertainty relating to

macroeconomic conditions, unfavorable conditions in the capital and

credit markets and our inability to obtain additional capital as

required; increases in price of fuel or freight; regulatory

technological advancement, or other changes in our core end-markets

may affect our customers’ spending; difficulty in integrating

acquired businesses and fully realizing the anticipated benefits

and cost savings of the acquired businesses, as well as additional

transaction and transition costs that we will continue to incur

following acquisitions; the interest of our majority stockholder,

which may not be consistent with the other stockholders; our

significant indebtedness, which may adversely affect our financial

position, limit our available cash and our access to additional

capital, prevent us from growing our business and increase our risk

of default; our inability to generate cash, which could lead to a

default; significant operating and financial restrictions imposed

by our debt agreements; changes in interest rates, which could

increase our debt service obligations on the variable rate

indebtedness and decrease our net income and cash flows;

disruptions or security compromises affecting our information

technology systems or those of our critical services providers

could adversely affect our operating results by subjecting us to

liability, and limiting our ability to effectively monitor and

control our operations, adjust to changing market conditions or

implement strategic initiatives; we are subject to complex laws and

regulations, including environmental and safety regulations that

can adversely affect cost, manner or feasibility of doing business;

material weakness in our internal control over financial reporting

which, if not remediated, could result in material misstatements in

our financial statements, we are subject to a series of risks

related to climate change; and increased attention to, and evolving

expectations for, sustainability and environmental, social and

governance initiatives. For a more complete description of these

and other possible risks and uncertainties, please refer to the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, and its subsequent reports filed with the Securities and

Exchange Commission. All forward-looking statements attributable to

the Company or persons acting on its behalf are expressly qualified

in their entirety by the foregoing cautionary statements.

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s except per share data)

2024

2023

2023

Revenue

Rental revenue

$

106,171

$

118,288

$

120,244

Equipment sales

272,602

301,290

366,967

Parts sales and services

32,534

32,585

34,543

Total revenue

411,307

452,163

521,754

Cost of Revenue

Cost of rental revenue

29,825

29,899

28,444

Depreciation of rental equipment

43,744

40,330

44,249

Cost of equipment sales

220,800

246,125

295,846

Cost of parts sales and services

26,229

26,148

26,391

Total cost of revenue

320,598

342,502

394,930

Gross Profit

90,709

109,661

126,824

Operating Expenses

Selling, general and administrative

expenses

57,995

56,991

59,429

Amortization

6,578

6,672

7,134

Non-rental depreciation

2,920

2,650

2,683

Transaction expenses and other

4,846

3,460

4,104

Total operating expenses

72,339

69,773

73,350

Operating Income

18,370

39,888

53,474

Other Expense

Interest expense, net

37,915

29,176

36,370

Financing and other expense (income)

(3,262

)

(3,951

)

(3,699

)

Total other expense

34,653

25,225

32,671

Income (Loss) Before Income

Taxes

(16,283

)

14,663

20,803

Income Tax Expense (Benefit)

(1,948

)

863

4,681

Net Income (Loss)

$

(14,335

)

$

13,800

$

16,122

Net Income (Loss) Per Share

Basic

$

(0.06

)

$

0.06

$

0.07

Diluted

$

(0.06

)

$

0.06

$

0.07

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited)

(in $000s)

March 31, 2024

December 31, 2023

Assets

Current Assets

Cash and cash equivalents

$

7,990

$

10,309

Accounts receivable, net

169,304

215,089

Financing receivables, net

19,824

30,845

Inventory

1,103,433

985,794

Prepaid expenses and other

26,069

23,862

Total current assets

1,326,620

1,265,899

Property and equipment, net

153,490

142,115

Rental equipment, net

931,690

916,704

Goodwill

703,836

704,011

Intangible assets, net

270,461

277,212

Operating lease assets

42,997

38,426

Other assets

21,421

23,430

Total Assets

$

3,450,515

$

3,367,797

Liabilities and Stockholders'

Equity

Current Liabilities

Accounts payable

$

119,250

$

117,653

Accrued expenses

67,176

73,847

Deferred revenue and customer deposits

26,482

28,758

Floor plan payables - trade

307,646

253,197

Floor plan payables - non-trade

459,792

409,113

Operating lease liabilities - current

6,729

6,564

Current maturities of long-term debt

6,066

8,257

Total current liabilities

993,141

897,389

Long-term debt, net

1,492,346

1,487,136

Operating lease liabilities -

noncurrent

37,398

32,714

Deferred income taxes

30,952

33,355

Total long-term liabilities

1,560,696

1,553,205

Commitments and contingencies

Stockholders' Equity

Common stock

25

25

Treasury stock, at cost

(62,958

)

(56,524

)

Additional paid-in capital

1,540,327

1,537,553

Accumulated other comprehensive loss

(8,508

)

(5,978

)

Accumulated deficit

(572,208

)

(557,873

)

Total stockholders' equity

896,678

917,203

Total Liabilities and Stockholders'

Equity

$

3,450,515

$

3,367,797

CUSTOM TRUCK ONE SOURCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited)

Three Months Ended March

31,

(in $000s)

2024

2023

Operating Activities

Net income (loss)

$

(14,335

)

$

13,800

Adjustments to reconcile net income (loss)

to net cash flow from operating activities:

Depreciation and amortization

56,160

52,091

Amortization of debt issuance costs

1,431

2,407

Provision for losses on accounts

receivable

1,882

1,872

Share-based compensation

2,730

3,147

Gain on sales and disposals of rental

equipment

(11,119

)

(21,320

)

Change in fair value of derivative and

warrants

(527

)

(525

)

Deferred tax expense

(2,403

)

514

Changes in assets and liabilities:

Accounts and financing receivables

21,064

17,161

Inventories

(116,823

)

(117,580

)

Prepaids, operating leases and other

(1,645

)

(4,987

)

Accounts payable

2,769

35,916

Accrued expenses and other liabilities

(5,745

)

1,328

Floor plan payables - trade, net

54,450

22,395

Customer deposits and deferred revenue

(2,264

)

(2,313

)

Net cash flow from operating

activities

(14,375

)

3,906

Investing Activities

Acquisition of business, net of cash

acquired

(1,410

)

—

Purchases of rental equipment

(75,552

)

(109,145

)

Proceeds from sales and disposals of

rental equipment

60,078

78,626

Purchase of non-rental property and cloud

computing arrangements

(16,527

)

(9,429

)

Net cash flow for investing activities

(33,411

)

(39,948

)

Financing Activities

Proceeds from debt

4,200

13,537

Share-based payments

(10

)

228

Borrowings under revolving credit

facilities

35,000

35,000

Repayments under revolving credit

facilities

(35,000

)

(10,331

)

Repayments of notes payable

—

(2,020

)

Finance lease payments

—

(377

)

Repurchase of common stock

(6,762

)

(1,122

)

Principal payments on long-term debt

(2,612

)

—

Acquisition of inventory through floor

plan payables - non-trade

162,781

187,381

Repayment of floor plan payables -

non-trade

(112,102

)

(168,447

)

Net cash flow from financing

activities

45,495

53,849

Effect of exchange rate changes on cash

and cash equivalents

(28

)

51

Net Change in Cash and Cash

Equivalents

(2,319

)

17,858

Cash and Cash Equivalents at Beginning

of Period

10,309

14,360

Cash and Cash Equivalents at End of

Period

$

7,990

$

32,218

Three Months Ended March

31,

(in $000s)

2024

2023

Supplemental Cash Flow

Information

Interest paid

$

23,098

$

13,130

Income taxes paid

2,133

10

Non-Cash Investing and Financing

Activities

Rental equipment and property and

equipment purchases in accounts payable

953

2,938

Rental equipment sales in accounts

receivable

2,210

621

CUSTOM TRUCK ONE SOURCE, INC. NON-GAAP FINANCIAL AND

PERFORMANCE MEASURES

In our press release and schedules, and on the related

conference call, we report certain financial measures that are not

required by, or presented in accordance with, United States

generally accepted accounting principles (“GAAP”). We utilize these

financial measures to manage our business on a day-to-day basis and

some of these measures are commonly used in our industry to

evaluate performance by excluding items considered to be

non-recurring. We believe these non-GAAP measures provide investors

expanded insight to assess performance, in addition to the standard

GAAP-based financial measures. The press release schedules

reconcile the most directly comparable GAAP measure to each

non-GAAP measure that we refer to. Although management evaluates

and presents these non-GAAP measures for the reasons described

herein, please be aware that these non-GAAP measures have

limitations and should not be considered in isolation or as a

substitute for revenue, operating income/loss, net income/loss,

earnings/loss per share or any other comparable measure prescribed

by GAAP. In addition, we may calculate and/or present these

non-GAAP financial measures differently than measures with the same

or similar names that other companies report, and as a result, the

non-GAAP measures we report may not be comparable to those reported

by others.

Adjusted EBITDA. Adjusted EBITDA is a non-GAAP

performance measure that we use to monitor our results of

operations, to measure performance against debt covenants and

performance relative to competitors. We believe Adjusted EBITDA is

a useful performance measure because it allows for an effective

evaluation of operating performance, without regard to financing

methods or capital structures. We exclude the items identified in

the reconciliations of net income (loss) to Adjusted EBITDA because

these amounts are either non-recurring or can vary substantially

within the industry depending upon accounting methods and book

values of assets, including the method by which the assets were

acquired, and capital structures. Adjusted EBITDA should not be

considered as an alternative to, or more meaningful than, net

income (loss) determined in accordance with GAAP. Certain items

excluded from Adjusted EBITDA are significant components in

understanding and assessing a company’s financial performance, such

as a company’s cost of capital and tax structure, as well as the

historical costs of depreciable assets, none of which are reflected

in Adjusted EBITDA. Our presentation of Adjusted EBITDA should not

be construed as an indication that results will be unaffected by

the items excluded from Adjusted EBITDA. Our computation of

Adjusted EBITDA may not be identical to other similarly titled

measures of other companies.

We define Adjusted EBITDA as net income or loss before interest

expense, income taxes, depreciation and amortization, share-based

compensation, and other items that we do not view as indicative of

ongoing performance. Our Adjusted EBITDA includes an adjustment to

exclude the effects of purchase accounting adjustments when

calculating the cost of inventory and used equipment sold. When

inventory or equipment is purchased in connection with a business

combination, the assets are revalued to their current fair values

for accounting purposes. The consideration transferred (i.e., the

purchase price) in a business combination is allocated to the fair

values of the assets as of the acquisition date, with amortization

or depreciation recorded thereafter following applicable accounting

policies; however, this may not be indicative of the actual cost to

acquire inventory or new equipment that is added to product

inventory or the rental fleets apart from a business acquisition.

Additionally, the pricing of rental contracts and equipment sales

prices for equipment is based on OEC, and we measure a rate of

return from rentals and sales using OEC. We also include an

adjustment to remove the impact of accounting for certain of our

rental contracts with customers containing a rental purchase option

that are accounted for under GAAP as a sales-type lease. We include

this adjustment because we believe continuing to reflect the

transactions as an operating lease better reflects the economics of

the transactions given our large portfolio of rental contracts.

These, and other, adjustments to GAAP net income or loss that are

applied to derive Adjusted EBITDA are specified by our senior

secured credit agreements.

Adjusted Gross Profit. We present total gross profit

excluding rental equipment depreciation (“Adjusted Gross Profit”)

as a non-GAAP financial performance measure. This measure differs

from the GAAP definition of gross profit, as we do not include the

impact of depreciation expense, which represents non-cash expense.

We use this measure to evaluate operating margins and the

effectiveness of the cost of our rental fleet.

Net Debt. We present the non-GAAP financial measure “Net

Debt,” which is total debt (the most comparable GAAP measure,

calculated as current and long-term debt, excluding deferred

financing fees, plus current and long-term finance lease

obligations) minus cash and cash equivalents. We believe this

non-GAAP measure is useful to investors to evaluate our financial

position.

Net Leverage Ratio. Net leverage ratio is a non-GAAP

performance measure used by management, and we believe it provides

useful information to investors because it is an important measure

to evaluate our debt levels and progress toward leverage targets,

which is consistent with the manner our lenders and management use

this measure. We define net leverage ratio as net debt divided by

Adjusted EBITDA.

CUSTOM TRUCK ONE SOURCE, INC.

ADJUSTED EBITDA RECONCILIATION

(unaudited)

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Net income (loss)

$

(14,335

)

$

13,800

$

16,122

Interest expense

25,015

22,363

24,712

Income tax expense (benefit)

(1,948

)

863

4,681

Depreciation and amortization

56,161

52,090

56,909

EBITDA

64,893

89,116

102,424

Adjustments:

Non-cash purchase accounting impact

(1)

2,960

7,199

6,190

Transaction and integration costs (2)

4,846

3,460

4,104

Sales-type lease adjustment (3)

2,474

2,803

2,722

Share-based payments (4)

2,730

3,147

2,997

Change in fair value of warrants (5)

(527

)

(525

)

(76

)

Adjusted EBITDA

$

77,376

$

105,200

$

118,361

Adjusted EBITDA is defined as net income, as adjusted for

provision for income taxes, interest expense, net, depreciation of

rental equipment and non-rental depreciation and amortization, and

further adjusted for the impact of the fair value mark-up of

acquired rental fleet, business acquisition and merger-related

costs, including integration, the impact of accounting for certain

of our rental contracts with customers that are accounted for under

GAAP as sales-type lease and stock compensation expense. This

non-GAAP measure is subject to certain limitations.

(1)

Represents the non-cash impact of purchase

accounting, net of accumulated depreciation, on the cost of

equipment and inventory sold. The equipment and inventory acquired

received a purchase accounting step-up in basis, which is a

non-cash adjustment to the equipment cost pursuant to our ABL

Credit Agreement and Indenture.

(2)

Represents transaction and process

improvement costs related to acquisitions of businesses, including

post-acquisition integration costs, which are recognized within

operating expenses in our Condensed Consolidated Statements of

Operations and Comprehensive Income (Loss). These expenses are

comprised of professional consultancy, legal, tax and accounting

fees. Also included are expenses associated with the integration of

acquired businesses. These expenses are presented as adjustments to

net income (loss) pursuant to our ABL Credit Agreement and

Indenture.

(3)

Represents the impact of sales-type lease

accounting for certain leases containing rental purchase options

(or “RPOs”), as the application of sales-type lease accounting is

not deemed to be representative of the ongoing cash flows of the

underlying rental contracts. The adjustments are made pursuant to

our ABL Credit Agreement and Indenture. The components of this

adjustment are presented in the table below:

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Equipment sales

$

(3,018

)

$

(24,172

)

$

(1,529

)

Cost of equipment sales

2,822

23,225

1,362

Gross profit

(196

)

(947

)

(167

)

Interest income

(2,742

)

(3,428

)

(3,770

)

Rental invoiced

5,412

7,178

6,659

Sales-type lease adjustment

$

2,474

$

2,803

$

2,722

(4)

Represents non-cash share-based

compensation expense associated with the issuance of stock options

and restricted stock units.

(5)

Represents the charge to earnings for the

change in fair value of the liability for warrants.

Reconciliation of Adjusted Gross Profit (unaudited)

The following table presents the reconciliation of Adjusted

Gross Profit:

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Revenue

Rental revenue

$

106,171

$

118,288

$

120,244

Equipment sales

272,602

301,290

366,967

Parts sales and services

32,534

32,585

34,543

Total revenue

411,307

452,163

521,754

Cost of Revenue

Cost of rental revenue

29,825

29,899

28,444

Depreciation of rental equipment

43,744

40,330

44,249

Cost of equipment sales

220,800

246,125

295,846

Cost of parts sales and services

26,229

26,148

26,391

Total cost of revenue

320,598

342,502

394,930

Gross Profit

90,709

109,661

126,824

Add: depreciation of rental equipment

43,744

40,330

44,249

Adjusted Gross Profit

$

134,453

$

149,991

$

171,073

Reconciliation of ERS Segment Adjusted Gross Profit and

Rental Gross Profit (unaudited)

The following table presents the reconciliation of ERS segment

Adjusted Gross Profit:

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Revenue

Rental revenue

$

103,288

$

113,784

$

116,594

Equipment sales

32,740

92,136

68,023

Total revenue

136,028

205,920

184,617

Cost of Revenue

Cost of rental revenue

29,800

29,060

28,222

Cost of equipment sales

24,098

71,081

49,799

Depreciation of rental equipment

42,697

39,512

43,230

Total cost of revenue

96,595

139,653

121,251

Gross profit

39,433

66,267

63,366

Add: depreciation of rental equipment

42,697

39,512

43,230

Adjusted Gross Profit

$

82,130

$

105,779

$

106,596

The following table presents the reconciliation of Adjusted ERS

Rental Gross Profit:

Three Months Ended March

31,

Three Months Ended

December 31,

(in $000s)

2024

2023

2023

Rental revenue

$

103,288

$

113,784

$

116,594

Cost of rental revenue

29,800

29,060

28,222

Adjusted Rental Gross Profit

$

73,488

$

84,724

$

88,372

Reconciliation of Net Debt (unaudited)

The following table presents the reconciliation of Net Debt:

(in $000s)

March 31, 2024

Current maturities of long-term debt

$

6,066

Long-term debt, net

1,492,346

Deferred financing fees

20,975

Less: cash and cash equivalents

(7,990

)

Net Debt

$

1,511,397

Reconciliation of Net Leverage Ratio (unaudited)

The following table presents the reconciliation of the Net

Leverage Ratio:

March 31, 2024

(in $000s)

Net Debt (as of period end)

$

1,511,397

Divided by: Adjusted EBITDA

$

399,105

Net Leverage Ratio

3.79

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502862418/en/

INVESTOR CONTACT Brian Perman, Vice President, Investor

Relations (816) 723 - 7906 investors@customtruck.com

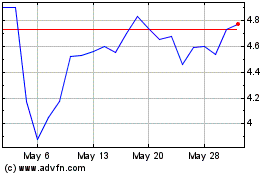

Custom Truck One Source (NYSE:CTOS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Custom Truck One Source (NYSE:CTOS)

Historical Stock Chart

From Nov 2023 to Nov 2024