false000175567200017556722024-07-312024-07-310001755672dei:OtherAddressMember2024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): July 31, 2024

Corteva, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38710 | | 82-4979096 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of Incorporation) | | File Number) | | Identification No.) |

9330 Zionsville Road,

Indianapolis, Indiana 46268

974 Centre Road,

Wilmington, Delaware 19805

(Address of principal executive offices)(Zip Code)

(833) 267-8382

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

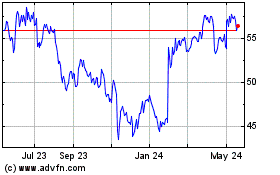

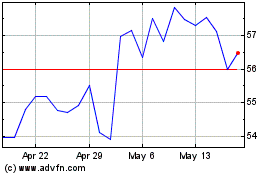

| Common Stock, par value $0.01 per share | | CTVA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On July 31, 2024, Corteva, Inc. (the "Company") announced its consolidated financial results for the quarter ended June 30, 2024. A copy of the Company’s press release and financial statement schedules are furnished herewith on Form 8-K as Exhibits 99.1 and 99.2, respectively. The information contained in this report, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. In addition, the information contained in this report shall not be deemed to be incorporated by reference into any registration statement or other document filed by the Company under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On July 31, 2024, the Company also announced David J. Anderson, executive vice president and chief financial officer, notified the Company on July 26, 2024, of his intent to retire effective September 16, 2024. David P. Johnson, age 57, will replace Mr. Anderson as executive vice president and chief financial officer effective September 16, 2024. Effective at the same time, Mr. Anderson will likewise retire from his position as a director and chief financial officer of the Company’s subsidiary, EIDP, Inc. and will be replaced by Mr. Johnson. Mr. Anderson will remain employed with the Company through February 2025 as an advisor to the CEO.

Mr. Johnson served as Atkore Inc.’s chief financial officer and chief accounting officer of Atkore Inc. from August 2018 through August 9, 2024, and has more than 30 years of experience in strategic and financial planning, risk assessment, mergers & acquisitions, global tax strategies, international operations, and internal controls. Prior to joining Atkore Inc., Mr. Johnson served in various finance leadership roles at Eaton Corporation from 1995 through 2018. Most recently at Eaton, Mr. Johnson was vice president-finance & operations for the electrical sector business, where he was responsible for sector financial planning, analysis, and reporting; compliance, credit & collections; government accounting; as well as global purchasing, manufacturing strategies, logistics and distribution. Prior to that, Mr. Johnson was vice president-finance and planning for the Americas region (Eaton Electrical) where he was responsible for reporting, planning, acquisitions, and implementing common financial policies / reporting across numerous recently acquired businesses. During his tenure at Eaton, Mr. Johnson held other roles of progressive responsibilities, including plant controller, division controller, director of finance & business development, vice president finance & business development, and vice president finance & planning-Europe, Middle East, and Asia. Mr. Johnson earned a Master of Business Administration from Duquesne University and a Bachelor of Science in Finance from Indiana University of Pennsylvania.

Mr. Johnson’s annual salary will be $725,000. His incentive opportunity under the Company’s annual Performance Reward Plan for the 2024 performance year is set at 100% of his base salary, prorated for his time of service. Mr. Johnson will also receive a one-time sign-on award of $450,000 to compensate him for the forfeiture of certain annual incentives.

Mr. Johnson will receive a one-time equity award having a fair market value of $2.8 million, consisting of restricted stock units (“RSUs”) to be granted under the 2019 Corteva Omnibus Incentive Plan (the “OIP”) on September 16, 2024. The RSUs will vest ratably in three equal annual installments on the first through third anniversary of the grant date provided that Mr. Johnson is an active employee on the vesting date.

Mr. Johnson will also receive an annual grant of long-term incentive awards under the OIP having a fair market value of $2.2 million on September 16, 2024. The annual long-term incentive award grant will consist of (i) 60% performance-based RSUs (“PSUs”), which will vest at the end of a three-year performance period commencing January 1, 2024 depending upon the achievement of certain performance goals, (ii) 20% stock options, which will vest in three equal annual installments following the grant date, and (iii) 20% RSUs, which will vest in three equal annual installments following the grant date, subject, in each case, to Mr. Johnson’s employment through the applicable vesting dates.

The RSUs, PSUs, and stock options will be subject to the terms and conditions of the OIP and will have termination provisions as set forth in award agreements that are generally consistent with the Company’s prior grants to named executive officers.

Mr. Johnson will be eligible to participate in the Company’s Change in Control and Executive Severance Plan and will be subject to the Company’s share ownership guidelines, which require Mr. Johnson to reach share ownership equal to four times his base salary. Mr. Johnson is also entitled to receive certain moving expenses under the Company’s relocation policy capped at $750,000. Mr. Johnson will be eligible to receive certain welfare and other benefits generally available to the Company’s executives.

There are no family relationships between Mr. Johnson and any of the Company’s directors or executive officers, and there are no transactions involving Mr. Johnson requiring disclosure under Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure

The Company issued a news release on July 31, 2024, announcing Mr. Anderson’s retirement and the hiring of Mr. Johnson. A copy of this news release is furnished as Exhibit 99.3. The Company is furnishing the information under this item, including Exhibit 99.3, pursuant to Item 7.01, “Regulation FD Disclosure”.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Press Release dated July 31, 2024, announcing second quarter 2024 results |

| Financial Statement Schedules dated July 31, 2024 |

| Press Release dated July 31, 2024, announcing CFO change |

| 104 | The cover page from the Company’s Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | CORTEVA, INC. |

| | (Registrant) |

| | |

| | /s/ Brian Titus |

| | |

| | Brian Titus |

| | Vice President and Controller |

July 31, 2024

1 News Release 2Q/1H 2024 Corteva Reports Second Quarter and First Half 2024 Results, Updates Full-Year Guidance • Solid first half results led by the strength of the Seed business and operational execution • Crop Protection industry impacted by residual destocking and competitive pressures • Updated 2024 revenue and operating EBITDA1 guidance lowered to reflect market dynamics • Share buyback program and dividend increase demonstrate strong balance sheet and cash flow INDIANAPOLIS, Ind., July 31, 2024 – Corteva, Inc. (NYSE: CTVA) (“Corteva” or the “Company”) today reported financial results for the second quarter and six months ended June 30, 2024. 2Q 2024 Results Overview Net Sales Income from Cont. Ops (After Tax) EPS GAAP $6.11B $1.06B $1.51 vs. 2Q 2023 +1% +20% +23% Organic1 Sales Operating EBITDA1 Operating EPS1 NON-GAAP $6.17B $1.92B $1.83 vs. 2Q 2023 +2% +10% +14% 1H 2024 Results Overview Net Sales Income from Cont. Ops (After Tax) EPS GAAP $10.60B $1.43B $2.03 vs. 1H 2023 (3)% (4)% (2)% Organic1 Sales Operating EBITDA1 Operating EPS1 NON-GAAP $10.75B $2.95B $2.72 vs. 1H 2023 (2)% (1)% (1)% First Half 2024 Highlights • First half 2024 net sales declined 3% versus prior year as Crop Protection declines more than offset Seed gains. Organic1 sales decreased 2% in the same period. • Seed net sales grew 2% and organic1 sales increased 4%. Price was up 5% globally, led by North America2 with the continued execution on the Company’s price for value strategy. Volume declines were driven primarily by unfavorable weather and reduced planted area in EMEA2. • Crop Protection net sales and organic1 sales both decreased 11%. Volume declines were driven by weather and destocking impacts in EMEA2, as well as just-in-time purchasing behavior in North America2. Price declined 4% reflecting a broad-based competitive price environment. • GAAP income and earnings per share (EPS) from continuing operations were $1.43 billion and $2.03 per share for the first half of 2024, respectively. • Operating EBITDA1 and Operating EPS1 were $2.95 billion, and $2.72 per share for the first half of 2024, respectively. • The Company updated full-year 2024 guidance3 and expects net sales in the range of $17.2 billion to $17.5 billion. Operating EBITDA1 is expected to be in the range of $3.4 billion to $3.6 billion. Operating EPS1 is expected to be in the range of $2.60 to $2.80 per share. Cash provided by operating activities – continuing operations is expected to be in the range of $2.1 billion to $2.6 billion. Free Cash Flow1 is expected to be in the range of $1.5 billion to $2.0 billion. The Company plans to repurchase approximately $1.0 billion shares in 2024. 1. Organic Sales, Operating EPS, Operating EBITDA, and Free Cash Flow are non-GAAP measures. See page 6 for further discussion. 2. North America is defined as U.S. and Canada. EMEA is defined as Europe, Middle East and Africa. 3. The Company does not provide the most comparable GAAP measure on a forward-looking basis. See page 5 for further discussion. 4. Enlist E3™ soybeans are jointly developed by Corteva Agriscience LLC and M.S. Technologies L.L.C.

News Release 2Q/1H 2024 2 Chuck Magro Chief Executive Officer Summary of Second Quarter 2024 For the second quarter ended June 30, 2024, net sales increased 1% versus the same period last year. Organic1 sales increased 2%. Volume was flat versus the prior-year period as Crop Protection growth offset lower Seed volumes. Crop Protection volume increased 6% over the prior-year driven primarily by Latin America and North America2 on demand for new products and spinosyns, partially offset by residual destocking and unfavorable weather in EMEA2. Seed volume declined 2% versus prior year due to earlier seasonal deliveries in North America2 partially offset by the delayed season in EMEA2 into second quarter. Price increased 2% versus prior year, reflecting continued execution on the Company’s price for value strategy and improved product mix in Seed, partially offset by the competitive price environment in Crop Protection. GAAP income from continuing operations after income taxes was $1.06 billion in second quarter 2024 compared to $880 million in second quarter 2023. Operating EBITDA1 for the second quarter was $1.92 billion, up 10% compared to prior year, translating into approximately 250 basis points of margin improvement. 2Q 2Q % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change Net Sales $6,112 $6,045 1% 2% North America $4,400 $4,319 2% 2% EMEA $673 $714 (6)% 1% Latin America $650 $608 7% 7% Asia Pacific $389 $404 (4)% (1)% 1H 1H % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change Net Sales $10,604 $10,929 (3)% (2)% North America $6,487 $6,521 (1)% (1)% EMEA $2,261 $2,527 (11)% (4)% Latin America $1,165 $1,160 - (3)% Asia Pacific $691 $721 (4)% (1)%

News Release 2Q/1H 2024 3 Seed Summary Seed net sales were $4.33 billion in the second quarter of 2024, up from $4.26 billion in the second quarter of 2023. The sales increase was driven by a 5% increase in price, partially offset by a 2% decline in volume and a 1% unfavorable impact from portfolio. The price increase was broad-based, led by North America2, on improved product mix and the continued execution of the Company’s price for value strategy. Lower volumes were driven by earlier seasonal deliveries in North America versus prior year, partially offset by the delayed season in EMEA2 into the second quarter. Segment operating EBITDA was $1.70 billion in the second quarter of 2024, up 16% from the second quarter of 2023. Price execution, reduction of net royalty expense, and ongoing cost and productivity actions more than offset investment in R&D, higher commodity costs, and lower volumes. Segment operating EBITDA margin improved by approximately 500 basis points versus the prior-year period. 2Q 2Q % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $3,753 $3,696 2% 2% EMEA $251 $231 9% 27% Latin America $207 $208 - (1)% Asia Pacific $120 $129 (7)% (5)% Total 2Q Seed Net Sales $4,331 $4,264 2% 3% 2Q Seed Operating EBITDA $1,698 $1,458 16% N/A Seed net sales were $7.1 billion in the first half of 2024, up from $7.0 billion in the first half of 2023. The sales increase was driven by a 5% increase in price, partially offset by a 1% decline in volume, a 1% unfavorable portfolio impact and a 1% unfavorable currency impact. The increase in price was driven by strong demand for top technology offerings and operational execution globally, with global corn and soybean prices up 6% and 4%, respectively. Pricing actions more than offset currency impacts in EMEA2. The decline in volume was driven primarily by unfavorable weather and reduced planted area in EMEA2. Unfavorable currency impacts were led by the Turkish Lira. Segment operating EBITDA was $2.4 billion in the first half of 2024, up 16% from the first half of 2023. Price execution, reduction of net royalty expense, and ongoing cost and productivity actions more than offset higher commodity costs, investment in R&D, the unfavorable impact of currency, and lower volumes. Segment operating EBITDA margin improved by approximately 420 basis points versus the prior-year period. 1H 1H % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $5,224 $5,019 4% 4% EMEA $1,169 $1,243 (6)% 5% Latin America $478 $467 2% (1)% Asia Pacific $211 $230 (8)% (5)% Total 1H Seed Net Sales $7,082 $6,959 2% 4% 1H Seed Operating EBITDA $2,446 $2,110 16% N/A

News Release 2Q/1H 2024 4 Crop Protection Summary Crop Protection net sales were approximately $1.8 billion in the second quarter of 2024, flat with the second quarter of 2023. The flat sales growth over the prior period was driven by a 6% increase in volume offset by a 5% decline in price and a 1% unfavorable impact from currency. The increase in volume was driven primarily by Latin America and North America2 on demand for new products and spinosyns, partially offset by residual destocking and unfavorable weather in EMEA2. The price decline was broad-based, reflecting the competitive pricing environment for the Crop Protection industry globally. Segment operating EBITDA was $255 million in the second quarter of 2024, down 20% from the second quarter of 2023. Competitive pricing and raw material cost inflation more than offset volume growth and productivity savings. Segment operating EBITDA margin declined by 365 basis points versus the prior-year period. 2Q 2Q % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $647 $623 4% 4% EMEA $422 $483 (13)% (12)% Latin America $443 $400 11% 11% Asia Pacific $269 $275 (2)% 1% Total 2Q Crop Protection Net Sales $1,781 $1,781 - 1% 2Q Crop Protection Operating EBITDA $255 $320 (20)% N/A Crop Protection net sales were approximately $3.5 billion in the first half of 2024 compared to approximately $4.0 billion in the first half of 2023. The sales decrease was driven by a 7% decrease in volume, a 4% decline in price, and a 1% unfavorable impact from currency. These declines were partially offset by a 1% favorable portfolio impact. The decrease in volume was primarily due to residual destocking and unfavorable weather impacts in EMEA2, as well as just-in- time purchasing behavior in North America2. Pricing gains in EMEA2 were more than offset by declines in North America2 and Latin America, reflecting competitive price pressure. Unfavorable currency impacts were led by the Turkish Lira. The portfolio impact was driven by the Biologicals acquisitions. Segment operating EBITDA was $565 million in the first half of 2024, down 39% from the first half of 2023. Pricing pressure, lower volumes, raw material cost inflation and the unfavorable impact of currency, more than offset productivity savings. Segment operating EBITDA margin contracted by approximately 720 basis points versus the prior-year period. 1H 1H % % ($ in millions, except where noted) 2024 2023 Change Organic1 Change North America $1,263 $1,502 (16)% (16)% EMEA $1,092 $1,284 (15)% (13)% Latin America $687 $693 (1)% (5)% Asia Pacific $480 $491 (2)% 1% Total 1H Crop Protection Net Sales $3,522 $3,970 (11)% (11)% 1H Crop Protection Operating EBITDA $565 $923 (39)% N/A

News Release 2Q/1H 2024 5 2024 Guidance On-farm demand for inputs remain steady and farmers continue to prioritize top-tier seed technology. Against this backdrop, our Seed business has outperformed the market, likely gaining market share and improving operational efficiency. While the global Crop Protection industry volume has begun to stabilize, pricing pressures have become more pronounced due to the competitive environment and tighter farmer margins. As a result, Corteva now expects net sales in the range of $17.2 billion to $17.5 billion, growth of 1% at the mid-point. Operating EBITDA1 is expected to be in the range of $3.4 billion to $3.6 billion, growth of 4% at the mid-point. Operating EPS1 is expected to be in the range of $2.60 to $2.80 per share, flat at the mid-point. Cash provided by operating activities – continuing operations is expected to be in the range of $2.1 billion to $2.6 billion. Free Cash Flow1 is expected to be in the range of $1.5 billion to $2.0 billion. The Company plans to repurchase approximately $1.0 billion shares in 2024. The Company is not able to reconcile its forward-looking non-GAAP financial measures, except for Free Cash Flow, to its most comparable U.S. GAAP financial measures, as it is unable to predict with reasonable certainty items outside of its control, such as Significant Items, without unreasonable effort. Second Quarter Conference Call The Company will host a live webcast of its second quarter and first half 2024 earnings conference call with investors to discuss its results and outlook tomorrow, August 1, 2024, at 10:00 a.m. ET. The slide presentation that accompanies the conference call is posted on the Company’s Investor Events and Presentations page. A replay of the webcast will also be available on the Investor Events and Presentations page. About Corteva Corteva, Inc. (NYSE: CTVA) is a global pure-play agriculture company that combines industry-leading innovation, high-touch customer engagement and operational execution to profitably deliver solutions for the world’s most pressing agriculture challenges. Corteva generates advantaged market preference through its unique distribution strategy, together with its balanced and globally diverse mix of seed, crop protection, and digital products and services. With some of the most recognized brands in agriculture and a technology pipeline well positioned to drive growth, the company is committed to maximizing productivity for farmers, while working with stakeholders throughout the food system as it fulfills its promise to enrich the lives of those who produce and those who consume, ensuring progress for generations to come. More information can be found atwww.corteva.com. Cautionary Statement About Forward-Looking Statements This report contains certain estimates and forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and may be identified by their use of words like “plans,” “expects,” “will,” “anticipates,” “believes,” “intends,” “projects,” “estimates,” “outlook,” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about Corteva’s financial results or outlook; strategy for growth; product development; regulatory approvals; market position; capital allocation strategy; liquidity; environmental, social and governance (“ESG”) targets and initiatives; the anticipated benefits of acquisitions, restructuring actions, or cost savings initiatives; and the outcome of contingencies, such as litigation and environmental matters, are forward-looking statements. Forward-looking statements and other estimates are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements and other estimates also involve risks and uncertainties, many of which are beyond Corteva’s control. While the list of factors presented below is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Corteva’s business, results of operations and financial condition. Some of the important factors that could cause Corteva’s actual results to differ materially from those projected in any such forward-looking statements include: (i) failure to obtain or maintain the necessary regulatory approvals for some of Corteva’s products; (ii) failure to successfully develop and commercialize Corteva’s pipeline; (iii) effect of the degree of public understanding and acceptance or perceived public acceptance of Corteva’s biotechnology and other agricultural products; (iv) effect of changes in agricultural and related policies of governments and international organizations; (v) costs of complying with evolving regulatory requirements and the effect of actual or alleged violations of environmental laws or permit requirements; (vi) effect of climate change and unpredictable seasonal and weather factors; (vii) failure to comply with competition and antitrust laws; (viii) effect of competition in Corteva’s industry; (ix) competitor’s establishment of an intermediary platform for distribution of Corteva's products; (x) impact of Corteva's dependence on third parties with respect to certain of its raw materials or licenses and commercialization; (xi) effect of volatility in Corteva's input costs; (xii) risk related to geopolitical and military conflict; (xii) risks related to environmental litigation and the indemnification obligations of legacy EIDP liabilities in connection with the separation of Corteva; (xiv) risks related to Corteva's global operations; (xv) failure to effectively manage acquisitions, divestitures, alliances, restructurings, cost savings initiatives, and other portfolio actions; (xvi) effect of industrial espionage and other disruptions to Corteva’s supply chain, information technology or network systems;(xvii) failure of Corteva’s customers to pay their debts to Corteva, including customer financing programs; (xviii) failure to raise capital through the capital markets or short-term borrowings on terms acceptable to Corteva; (xix) increases in pension and other post-employment benefit plan funding obligations; (xx) capital markets sentiment towards ESG matters; (xxi) risks related to pandemics or epidemics; (xxii) Corteva’s intellectual property rights or defense against intellectual property claims asserted by others; (xxiii) effect of counterfeit products; (xxiv) Corteva’s dependence on intellectual property cross-license agreements; and (xxv) other risks related to the Separation from DowDuPont. Additionally, there may be other risks and uncertainties that Corteva is unable to currently identify or that Corteva does not currently expect to have a material impact on its business. Where, in any forward-looking statement or other estimate, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Corteva’s management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Corteva disclaims and does not undertake any obligation to update or revise any forward-looking statement, except as required by applicable law. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements is included in the “Risk Factors” section of Corteva’s Annual Report on Form 10-K, as modified by subsequent Quarterly Reports on Forms 10-Q and Current Reports on Form 8-K.

News Release 2Q/1H 2024 6 Regulation G (Non-GAAP Financial Measures) This earnings release includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures may include organic sales, organic growth (including by segment and region), operating EBITDA, operating EBITDA margin, operating earnings (loss) per share, and base income tax rate. Management uses these measures internally for planning and forecasting, including allocating resources and evaluating incentive compensation. Management believes that these non-GAAP measures best reflect the ongoing performance of the Company during the periods presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful comparison of year over year results. These non-GAAP measures supplement the Company’s U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Reconciliations for these non-GAAP measures to U.S. GAAP are provided in the Selected Financial Information and Non-GAAP Measures starting on page A-5 of the Financial Statement Schedules. Corteva is not able to reconcile its forward-looking non-GAAP financial measures, except for Free Cash Flow, to its most comparable U.S. GAAP financial measures, as it is unable to predict with reasonable certainty items outside of the Company’s control, such as Significant Items, without unreasonable effort. For Significant items reported in the periods presented, refer to page A-8 of the Financial Statement Schedules. Beginning January 1, 2020, the Company presents accelerated prepaid royalty amortization expense as a significant item. Accelerated prepaid royalty amortization represents the non-cash charge associated with the recognition of upfront payments made to Monsanto in connection with the Company’s non-exclusive license in the United States and Canada for Monsanto’s Genuity® Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits. During the ramp-up period of Enlist E3TM, Corteva has begun to significantly reduce the volume of products with the Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits beginning in 2021, with expected minimal use of the trait platform thereafter. During 2023, the company committed to restructuring activities to optimize the Crop Protection network of manufacturing and external partners, which are expected to be substantially complete in 2024. The company expects to record approximately $180 million to $230 million net pre-tax restructuring charges during 2024 for these activities. Organic sales is defined as price and volume and excludes currency and portfolio and other impacts, including significant items. Operating EBITDA is defined as earnings (loss) (i.e., income (loss) from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits (costs), foreign exchange gains (losses), and net unrealized gain or loss from mark-to-market activity for certain foreign currency derivative instruments that do not qualify for hedge accounting, excluding the impact of significant items. Non-operating benefits (costs) consists of non-operating pension and other post- employment benefit (OPEB) credits (costs), tax indemnification adjustments, and environmental remediation and legal costs associated with legacy businesses and sites. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the Company as pre-tax income or expense. Operating EBITDA margin is defined as Operating EBITDA as a percentage of net sales. Operating earnings (loss) per share is defined as “earnings (loss) per common share from continuing operations - diluted” excluding the after-tax impact of significant items, the after-tax impact of non-operating benefits (costs), the after-tax impact of amortization expense associated with intangible assets existing as of the Separation from DowDuPont, and the after-tax impact of net unrealized gain or loss from mark-to-market activity for certain foreign currency derivative instruments that do not qualify for hedge accounting. Although amortization of the Company’s intangible assets is excluded from these non-GAAP measures, management believes it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in amortization of additional intangible assets. Net unrealized gain or loss from mark-to-market activity for certain foreign currency derivative instruments that do not qualify for hedge accounting represents the non-cash net gain (loss) from changes in fair value of certain undesignated foreign currency derivative contracts. Upon settlement, which is within the same calendar year of execution of the contract, the realized gain (loss) from the changes in fair value of the non-qualified foreign currency derivative contracts will be reported in the relevant non-GAAP financial measures, allowing quarterly results to reflect the economic effects of the foreign currency derivative contracts without the resulting unrealized mark to fair value volatility. Base income tax rate is defined as the effective tax rate excluding the impacts of foreign exchange gains (losses), non-operating benefits (costs), amortization of intangibles (existing as of the Separation), mark- to- market gains (losses) on certain foreign currency contracts not designated as hedges, and significant items. The Company also uses Free Cash Flow as a non-GAAP measure to evaluate and discuss its liquidity position and ability to generate cash. Free Cash Flow is defined as cash provided by (used for) operating activities – continuing operations, less capital expenditures. We believe that Free Cash Flow provides investors with meaningful information regarding the Company’s ongoing ability to generate cash through core operations, and our ability to service our indebtedness, pay dividends (when declared), make share repurchases, and meet our ongoing cash needs for our operations. ® TM Corteva Agriscience and its affiliated companies. 07/31/2024 Media Contact Bethany Shively +1 202-997-9438 bethany.shively@corteva. com Investor Contact Kim Booth +1 302-485-3704 kimberly.a.booth@corteva.com

A-1

Corteva, Inc.

Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 6,112 | | | $ | 6,045 | | | $ | 10,604 | | | $ | 10,929 | |

| Cost of goods sold | 2,918 | | | 3,137 | | | 5,468 | | | 5,908 | |

| Research and development expense | 357 | | | 329 | | | 689 | | | 645 | |

| Selling, general and administrative expenses | 1,054 | | | 1,045 | | | 1,790 | | | 1,771 | |

| Amortization of intangibles | 174 | | | 174 | | | 351 | | | 334 | |

| Restructuring and asset related charges - net | 92 | | | 60 | | | 167 | | | 93 | |

| Other income (expense) - net | (113) | | | (134) | | | (212) | | | (205) | |

| Interest expense | 66 | | | 82 | | | 107 | | | 113 | |

| Income (loss) from continuing operations before income taxes | 1,338 | | | 1,084 | | | 1,820 | | | 1,860 | |

| Provision for (benefit from) income taxes on continuing operations | 282 | | | 204 | | | 388 | | | 373 | |

| Income (loss) from continuing operations after income taxes | 1,056 | | | 880 | | | 1,432 | | | 1,487 | |

| Income (loss) from discontinued operations after income taxes | — | | | (163) | | | 47 | | | (171) | |

| | | | | | | |

| Net income (loss) | 1,056 | | | 717 | | | 1,479 | | | 1,316 | |

| | | | | | | |

| Net income (loss) attributable to noncontrolling interests | 3 | | | 3 | | | 7 | | | 7 | |

| | | | | | | |

| Net income (loss) attributable to Corteva | $ | 1,053 | | | $ | 714 | | | $ | 1,472 | | | $ | 1,309 | |

| | | | | | | |

| Basic earnings (loss) per share of common stock: | | | | | | | |

| Basic earnings (loss) per share of common stock from continuing operations | $ | 1.51 | | | $ | 1.23 | | | $ | 2.04 | | | $ | 2.08 | |

| Basic earnings (loss) per share of common stock from discontinued operations | — | | | (0.23) | | | 0.07 | | | (0.24) | |

| Basic earnings (loss) per share of common stock | $ | 1.51 | | | $ | 1.00 | | | $ | 2.11 | | | $ | 1.84 | |

| | | | | | | |

| Diluted earnings (loss) per share of common stock: | | | | | | | |

| Diluted earnings (loss) per share of common stock from continuing operations | $ | 1.51 | | | $ | 1.23 | | | $ | 2.03 | | | $ | 2.07 | |

| Diluted earnings (loss) per share of common stock from discontinued operations | — | | | (0.23) | | | 0.07 | | | (0.24) | |

| Diluted earnings (loss) per share of common stock | $ | 1.51 | | | $ | 1.00 | | | $ | 2.10 | | | $ | 1.83 | |

| | | | | | | |

| Average number of shares outstanding used in earnings (loss) per share (EPS) calculation (in millions) | | | | | | | |

| Basic | 695.9 | | 710.8 | | 698.1 | | 711.8 |

| Diluted | 698.1 | | 713.7 | | 700.4 | | 714.8 |

A-2

Corteva, Inc.

Consolidated Balance Sheets

(Dollars in millions, except share amounts)

| | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 | | June 30, 2023 |

| Assets | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 1,839 | | | $ | 2,644 | | | $ | 2,563 | |

| Marketable securities | | 120 | | | 98 | | | 53 | |

Accounts and notes receivable, net | | 7,615 | | | 5,488 | | | 7,955 | |

| Inventories | | 4,893 | | | 6,899 | | | 5,628 | |

| Other current assets | | 892 | | | 1,131 | | | 1,008 | |

| | | | | | |

| Total current assets | | 15,359 | | | 16,260 | | | 17,207 | |

| Investment in nonconsolidated affiliates | | 113 | | | 115 | | | 83 | |

| Property, plant and equipment | | 9,088 | | | 8,956 | | | 8,797 | |

| Less: Accumulated depreciation | | 4,933 | | | 4,669 | | | 4,491 | |

| Net property, plant and equipment | | 4,155 | | | 4,287 | | | 4,306 | |

| Goodwill | | 10,490 | | | 10,605 | | | 10,539 | |

| Other intangible assets | | 9,238 | | | 9,626 | | | 9,985 | |

| Deferred income taxes | | 538 | | | 584 | | | 524 | |

| | | | | | |

| Other assets | | 1,571 | | | 1,519 | | | 1,545 | |

| | | | | | |

| Total Assets | | $ | 41,464 | | | $ | 42,996 | | | $ | 44,189 | |

| | | | | | |

| Liabilities and Equity | | | | | | |

| Current liabilities | | | | | | |

| Short-term borrowings and finance lease obligations | | $ | 2,253 | | | $ | 198 | | | $ | 3,023 | |

| Accounts payable | | 3,300 | | | 4,280 | | | 3,379 | |

| Income taxes payable | | 488 | | | 174 | | | 396 | |

| Deferred revenue | | 413 | | | 3,406 | | | 656 | |

| Accrued and other current liabilities | | 2,499 | | | 2,351 | | | 2,892 | |

| | | | | | |

| Total current liabilities | | 8,953 | | | 10,409 | | | 10,346 | |

| Long-term debt | | 2,471 | | | 2,291 | | | 2,290 | |

| Other noncurrent liabilities | | | | | | |

| Deferred income tax liabilities | | 607 | | | 899 | | | 1,134 | |

| Pension and other post employment benefits - noncurrent | | 2,452 | | | 2,467 | | | 2,236 | |

| Other noncurrent obligations | | 1,560 | | | 1,651 | | | 1,722 | |

| | | | | | |

| Total noncurrent liabilities | | 7,090 | | | 7,308 | | | 7,382 | |

| | | | | | |

| Commitments and contingent liabilities | | | | | | |

| | | | | | |

| Stockholders' equity | | | | | | |

| Common stock, $0.01 par value; 1,666,667,000 shares authorized; issued at June 30, 2024 - 693,617,000; December 31, 2023 - 701,260,000; and June 30, 2023 - 709,516,000 | | 7 | | | 7 | | | 7 | |

| Additional paid-in capital | | 27,504 | | | 27,748 | | | 27,877 | |

| Retained earnings (accumulated deficit) | | 992 | | | (41) | | | 1,013 | |

| Accumulated other comprehensive income (loss) | | (3,324) | | | (2,677) | | | (2,677) | |

| Total Corteva stockholders' equity | | 25,179 | | | 25,037 | | | 26,220 | |

| Noncontrolling interests | | 242 | | | 242 | | | 241 | |

| Total equity | | 25,421 | | | 25,279 | | | 26,461 | |

| Total Liabilities and Equity | | $ | 41,464 | | | $ | 42,996 | | | $ | 44,189 | |

A-3

Corteva, Inc.

Consolidated Statement of Cash Flows

(Dollars in millions, except per share amounts)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Operating activities | | | |

| | | |

| Net income (loss) | $ | 1,479 | | | $ | 1,316 | |

| (Income) loss from discontinued operations after income taxes | (47) | | | 171 | |

| Adjustments to reconcile net income (loss) to cash provided by (used for) operating activities: | | | |

| Depreciation and amortization | 619 | | | 593 | |

| Provision for (benefit from) deferred income tax | (303) | | | (129) | |

Net periodic pension and OPEB (credits) costs | 82 | | | 71 | |

| Pension and OPEB contributions | (95) | | | (91) | |

| Net (gain) loss on sales of property, businesses, consolidated companies, and investments | (17) | | | (1) | |

| Restructuring and asset related charges - net | 167 | | | 93 | |

| | | |

| | | |

| | | |

| Other net loss | 245 | | | 192 | |

| Changes in operating assets and liabilities, net | | | |

| Accounts and notes receivable | (2,427) | | | (1,892) | |

| Inventories | 1,783 | | | 1,320 | |

| Accounts payable | (913) | | | (1,560) | |

| Deferred revenue | (2,978) | | | (2,758) | |

| Other assets and liabilities | 406 | | | 195 | |

| Cash provided by (used for) operating activities - continuing operations | (1,999) | | | (2,480) | |

| Cash provided by (used for) operating activities - discontinued operations | (159) | | | (19) | |

| Cash provided by (used for) operating activities | (2,158) | | | (2,499) | |

| Investing activities | | | |

| Capital expenditures | (262) | | | (250) | |

| Proceeds from sales of property, businesses, and consolidated companies - net of cash divested | 20 | | | 34 | |

| Acquisitions of businesses - net of cash acquired | — | | | (1,463) | |

| Investments in and loans to nonconsolidated affiliates | — | | | (4) | |

| | | |

| Purchases of investments | (136) | | | (7) | |

| Proceeds from sales and maturities of investments | 65 | | | 106 | |

| Proceeds from settlement of net investment hedge | 15 | | | 42 | |

| Other investing activities, net | (7) | | | (2) | |

| Cash provided by (used for) investing activities | (305) | | | (1,544) | |

| Financing activities | | | |

| Net change in borrowings (less than 90 days) | 628 | | | 885 | |

| Proceeds from debt | 2,559 | | | 3,427 | |

| Payments on debt | (943) | | | (372) | |

| Repurchase of common stock | (504) | | | (332) | |

| Proceeds from exercise of stock options | 28 | | | 26 | |

| Dividends paid to stockholders | (223) | | | (213) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other financing activities, net | (27) | | | (42) | |

| Cash provided by (used for) financing activities | 1,518 | | | 3,379 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash equivalents | (72) | | | 9 | |

| | | |

| Increase (decrease) in cash, cash equivalents and restricted cash equivalents | (1,017) | | | (655) | |

| Cash, cash equivalents and restricted cash equivalents at beginning of period | 3,158 | | | 3,618 | |

| Cash, cash equivalents and restricted cash equivalents at end of period | $ | 2,141 | | | $ | 2,963 | |

A-4

Corteva, Inc.

Consolidated Segment Information

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| SEGMENT NET SALES - SEED | | 2024 | | 2023 | | 2024 | | 2023 |

| Corn | | $ | 2,683 | | | $ | 2,673 | | | $ | 4,770 | | | $ | 4,652 | |

| Soybean | | 1,317 | | | 1,255 | | | 1,609 | | | 1,524 | |

| Other oilseeds | | 186 | | | 194 | | | 431 | | | 495 | |

| Other | | 145 | | | 142 | | | 272 | | | 288 | |

| Seed | | $ | 4,331 | | | $ | 4,264 | | | $ | 7,082 | | | $ | 6,959 | |

| | | | | | | | |

| | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| SEGMENT NET SALES - CROP PROTECTION | | 2024 | | 2023 | | 2024 | | 2023 |

| Herbicides | | $ | 946 | | | $ | 986 | | | $ | 1,832 | | | $ | 2,228 | |

| Insecticides | | 415 | | | 331 | | | 788 | | | 740 | |

| Fungicides | | 250 | | | 252 | | | 545 | | | 611 | |

| Other | | 170 | | | 212 | | | 357 | | | 391 | |

| Crop Protection | | $ | 1,781 | | | $ | 1,781 | | | $ | 3,522 | | | $ | 3,970 | |

| | | | | | | | |

| | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| GEOGRAPHIC NET SALES - SEED | | 2024 | | 2023 | | 2024 | | 2023 |

North America 1 | | $ | 3,753 | | | $ | 3,696 | | | $ | 5,224 | | | $ | 5,019 | |

EMEA 2 | | 251 | | | 231 | | | 1,169 | | | 1,243 | |

Latin America | | 207 | | | 208 | | | 478 | | | 467 | |

Asia Pacific | | 120 | | | 129 | | | 211 | | | 230 | |

Rest of World 3 | | 578 | | | 568 | | | 1,858 | | | 1,940 | |

| Net Sales | | $ | 4,331 | | | $ | 4,264 | | | $ | 7,082 | | | $ | 6,959 | |

| | | | | | | | |

| | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| GEOGRAPHIC NET SALES - CROP PROTECTION | | 2024 | | 2023 | | 2024 | | 2023 |

North America 1 | | $ | 647 | | | $ | 623 | | | $ | 1,263 | | | $ | 1,502 | |

EMEA 2 | | 422 | | | 483 | | | 1,092 | | | 1,284 | |

Latin America | | 443 | | | 400 | | | 687 | | | 693 | |

Asia Pacific | | 269 | | | 275 | | | 480 | | | 491 | |

Rest of World 3 | | 1,134 | | | 1,158 | | | 2,259 | | | 2,468 | |

| Net Sales | | $ | 1,781 | | | $ | 1,781 | | | $ | 3,522 | | | $ | 3,970 | |

| | | | | | | | |

| 1. Reflects U.S. & Canada | | | | | | | | |

| 2. Reflects Europe, Middle East, and Africa | | | | | | | | |

| 3. Reflects EMEA, Latin America, and Asia Pacific | | | | | | | | |

A-5

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2024 |

| Net Sales (GAAP) | | $ | 6,112 | | | $ | 10,604 | |

| Add: Impacts from Currency and Portfolio | | 60 | | | 144 | |

| Organic Sales (Non-GAAP) | | $ | 6,172 | | | $ | 10,748 | |

| | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| OPERATING EBITDA | | 2024 | | 2023 | | 2024 | | 2023 |

| Seed | | $ | 1,698 | | | $ | 1,458 | | | $ | 2,446 | | | $ | 2,110 | |

| Crop Protection | | 255 | | | 320 | | | 565 | | | 923 | |

| Corporate Expenses | | (36) | | | (32) | | | (60) | | | (56) | |

| Operating EBITDA (Non-GAAP) | | $ | 1,917 | | | $ | 1,746 | | | $ | 2,951 | | | $ | 2,977 | |

| | | | | | | | |

| RECONCILIATION OF INCOME (LOSS) FROM CONTINUING OPERATIONS AFTER INCOME TAXES TO OPERATING EBITDA | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income (loss) from continuing operations after income taxes (GAAP) | | $ | 1,056 | | | $ | 880 | | | $ | 1,432 | | | $ | 1,487 | |

| Provision for (benefit from) income taxes on continuing operations | | 282 | | | 204 | | | 388 | | | 373 | |

| Income (loss) from continuing operations before income taxes (GAAP) | | 1,338 | | | 1,084 | | | 1,820 | | | 1,860 | |

| Depreciation and amortization | | 312 | | | 306 | | | 619 | | | 593 | |

| Interest income | | (25) | | | (54) | | | (60) | | | (94) | |

| Interest expense | | 66 | | | 82 | | | 107 | | | 113 | |

Exchange (gains) losses1 | | 78 | | | 104 | | | 137 | | | 140 | |

Non-operating (benefits) costs2 | | 30 | | | 44 | | | 82 | | | 87 | |

| | | | | | | | |

| Mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | | (19) | | | 63 | | | (18) | | | 78 | |

Significant items (benefit) charge3 | | 137 | | | 117 | | | 264 | | | 200 | |

| | | | | | | | |

| Operating EBITDA (Non-GAAP) | | $ | 1,917 | | | $ | 1,746 | | | $ | 2,951 | | | $ | 2,977 | |

1.Refer to page A-15 for pre-tax and after tax impacts of exchange (gains) losses.

2.Non-operating (benefits) costs consists of non-operating pension and other post-employment benefit (OPEB) credits (costs), tax indemnification adjustments, and environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the Company as pre-tax income or expense.

3.Refer to page A-10 for pre-tax and after tax impacts of significant items.

A-6

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| PRICE - VOLUME - CURRENCY ANALYSIS |

| REGION | | |

| Q2 2024 vs. Q2 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 81 | | 2 | % | $ | 83 | | 2 | % | 3 | % | (1) | % | — | % | — | % |

EMEA2 | (41) | | (6) | % | 7 | | 1 | % | 2 | % | (1) | % | (3) | % | (4) | % |

Latin America | 42 | | 7 | % | 41 | | 7 | % | (7) | % | 14 | % | — | % | — | % |

Asia Pacific | (15) | | (4) | % | (4) | | (1) | % | 1 | % | (2) | % | (3) | % | — | % |

| Rest of World | (14) | | (1) | % | 44 | | 3 | % | (1) | % | 4 | % | (2) | % | (2) | % |

| Total | $ | 67 | | 1 | % | $ | 127 | | 2 | % | 2 | % | — | % | — | % | (1) | % |

| | | | | | | | |

| SEED | | | | | | | | |

| Q2 2024 vs. Q2 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 57 | | 2 | % | $ | 58 | | 2 | % | 5 | % | (3) | % | — | % | — | % |

EMEA2 | 20 | | 9 | % | 63 | | 27 | % | 8 | % | 19 | % | (6) | % | (12) | % |

Latin America | (1) | | — | % | (3) | | (1) | % | (2) | % | 1 | % | 1 | % | — | % |

Asia Pacific | (9) | | (7) | % | (7) | | (5) | % | 10 | % | (15) | % | (2) | % | — | % |

| Rest of World | 10 | | 2 | % | 53 | | 9 | % | 5 | % | 4 | % | (2) | % | (5) | % |

| Total | $ | 67 | | 2 | % | $ | 111 | | 3 | % | 5 | % | (2) | % | — | % | (1) | % |

| | | | | | | | |

| CROP PROTECTION |

| Q2 2024 vs. Q2 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 24 | | 4 | % | $ | 25 | | 4 | % | (5) | % | 9 | % | — | % | — | % |

EMEA | (61) | | (13) | % | (56) | | (12) | % | (1) | % | (11) | % | (1) | % | — | % |

Latin America | 43 | | 11 | % | 44 | | 11 | % | (10) | % | 21 | % | — | % | — | % |

Asia Pacific | (6) | | (2) | % | 3 | | 1 | % | (4) | % | 5 | % | (3) | % | — | % |

| Rest of World | (24) | | (2) | % | (9) | | (1) | % | (5) | % | 4 | % | (1) | % | — | % |

| Total | $ | — | | — | % | $ | 16 | | 1 | % | (5) | % | 6 | % | (1) | % | — | % |

A-7

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SEED PRODUCT LINE | | | | | | | |

| Q2 2024 vs. Q2 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

Corn2 | $ | 10 | | — | % | $ | 41 | | 2 | % | 5 | % | (3) | % | (1) | % | (1) | % |

| Soybeans | 62 | | 5 | % | 62 | | 5 | % | 4 | % | 1 | % | — | % | — | % |

Other oilseeds2 | (8) | | (4) | % | 4 | | 2 | % | 2 | % | — | % | (1) | % | (5) | % |

| Other | 3 | | 2 | % | 4 | | 3 | % | 12 | % | (9) | % | (1) | % | — | % |

| Total | $ | 67 | | 2 | % | $ | 111 | | 3 | % | 5 | % | (2) | % | — | % | (1) | % |

| | | | | | | | |

| CROP PROTECTION PRODUCT LINE |

| Q2 2024 vs. Q2 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| Herbicides | $ | (40) | | (4) | % | $ | (34) | | (3) | % | (5) | % | 2 | % | (1) | % | — | % |

| Insecticides | 84 | | 25 | % | 87 | | 26 | % | (4) | % | 30 | % | (1) | % | — | % |

| Fungicides | (2) | | (1) | % | 1 | | — | % | (9) | % | 9 | % | (1) | % | — | % |

| Other | (42) | | (20) | % | (38) | | (18) | % | — | % | (18) | % | (2) | % | — | % |

| Total | $ | — | | — | % | $ | 16 | | 1 | % | (5) | % | 6 | % | (1) | % | — | % |

1.Organic sales is defined as price and volume and excludes currency and portfolio and other impacts, including significant items.

2.Other during the three months ended June 30, 2023 includes the revenue recognized relating to seed sales associated with the Russia Exit. Refer to schedule A-10 for further detail on significant items.

A-8

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| PRICE - VOLUME - CURRENCY ANALYSIS |

| REGION | | |

| First Half 2024 vs. First Half 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | (34) | | (1) | % | $ | (36) | | (1) | % | 2 | % | (3) | % | — | % | — | % |

EMEA2 | (266) | | (11) | % | (96) | | (4) | % | 6 | % | (10) | % | (4) | % | (3) | % |

Latin America | 5 | | — | % | (40) | | (3) | % | (5) | % | 2 | % | 2 | % | 1 | % |

Asia Pacific | (30) | | (4) | % | (9) | | (1) | % | 1 | % | (2) | % | (3) | % | — | % |

| Rest of World | (291) | | (7) | % | (145) | | (3) | % | 2 | % | (5) | % | (3) | % | (1) | % |

| Total | $ | (325) | | (3) | % | $ | (181) | | (2) | % | 2 | % | (4) | % | (1) | % | — | % |

| | | | | | | | |

| SEED | | | | | | | | |

| First Half 2024 vs. First Half 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | 205 | | 4 | % | $ | 205 | | 4 | % | 4 | % | — | % | — | % | — | % |

EMEA2 | (74) | | (6) | % | 65 | | 5 | % | 10 | % | (5) | % | (5) | % | (6) | % |

Latin America | 11 | | 2 | % | (5) | | (1) | % | 2 | % | (3) | % | 3 | % | — | % |

Asia Pacific | (19) | | (8) | % | (12) | | (5) | % | 9 | % | (14) | % | (3) | % | — | % |

| Rest of World | (82) | | (4) | % | 48 | | 3 | % | 8 | % | (5) | % | (3) | % | (4) | % |

| Total | $ | 123 | | 2 | % | $ | 253 | | 4 | % | 5 | % | (1) | % | (1) | % | (1) | % |

| | | | | | | | |

| CROP PROTECTION |

| First Half 2024 vs. First Half 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| North America | $ | (239) | | (16) | % | $ | (241) | | (16) | % | (5) | % | (11) | % | — | % | — | % |

EMEA | (192) | | (15) | % | (161) | | (13) | % | 2 | % | (15) | % | (3) | % | 1 | % |

Latin America | (6) | | (1) | % | (35) | | (5) | % | (11) | % | 6 | % | 1 | % | 3 | % |

Asia Pacific | (11) | | (2) | % | 3 | | 1 | % | (3) | % | 4 | % | (3) | % | — | % |

| Rest of World | (209) | | (8) | % | (193) | | (7) | % | (2) | % | (5) | % | (2) | % | 1 | % |

| Total | $ | (448) | | (11) | % | $ | (434) | | (11) | % | (4) | % | (7) | % | (1) | % | 1 | % |

A-9

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SEED PRODUCT LINE | | | | | | | |

| First Half 2024 vs. First Half 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

Corn2 | $ | 118 | | 3 | % | $ | 190 | | 4 | % | 6 | % | (2) | % | (1) | % | — | % |

| Soybeans | 85 | | 6 | % | 85 | | 6 | % | 4 | % | 2 | % | — | % | — | % |

Other oilseeds2 | (64) | | (13) | % | (5) | | (1) | % | 7 | % | (8) | % | (5) | % | (7) | % |

| Other | (16) | | (6) | % | (17) | | (6) | % | 5 | % | (11) | % | — | % | — | % |

| Total | $ | 123 | | 2 | % | $ | 253 | | 4 | % | 5 | % | (1) | % | (1) | % | (1) | % |

| | | | | | | | |

| CROP PROTECTION PRODUCT LINE |

| First Half 2024 vs. First Half 2023 | Percent Change Due To: |

| Net Sales Change (GAAP) | Organic Change 1 (Non-GAAP) | Price & | | | Portfolio / |

| $ | % | $ | % | Product Mix | Volume | Currency | Other |

| Herbicides | $ | (396) | | (18) | % | $ | (389) | | (17) | % | (4) | % | (13) | % | (1) | % | — | % |

| Insecticides | 48 | | 6 | % | 71 | | 10 | % | (1) | % | 11 | % | (4) | % | — | % |

| Fungicides | (66) | | (11) | % | (56) | | (9) | % | (4) | % | (5) | % | (2) | % | — | % |

| Other | (34) | | (9) | % | (60) | | (15) | % | (2) | % | (13) | % | (2) | % | 8 | % |

| Total | $ | (448) | | (11) | % | $ | (434) | | (11) | % | (4) | % | (7) | % | (1) | % | 1 | % |

1.Organic sales is defined as price and volume and excludes currency and portfolio and other impacts, including significant items.

2.Other during the six months ended June 30, 2023 includes the revenue recognized relating to seed sales associated with the Russia Exit. Refer to schedule A-10 for further detail on significant items.

A-10

Corteva, Inc.

Significant Items

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| SIGNIFICANT ITEMS BY SEGMENT (PRE-TAX) | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Seed | $ | (31) | | | $ | (58) | | | $ | (47) | | | $ | (64) | |

| Crop Protection | (79) | | | (58) | | | (176) | | | (129) | |

| Corporate | (27) | | | (1) | | | (41) | | | (7) | |

| Total significant items before income taxes | $ | (137) | | | $ | (117) | | | $ | (264) | | | $ | (200) | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SIGNIFICANT ITEMS - PRE-TAX, AFTER TAX, AND EPS IMPACTS | | | | | | | | |

| | | | | | | | | | |

| | Pre-tax | | After tax8 | | ($ Per Share) |

| | 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |

| 1st Quarter | | | | | | | | | | | |

Restructuring and asset related charges, net1 | $ | (75) | | | $ | (33) | | | $ | (56) | | | $ | (25) | | | $ | (0.08) | | | $ | (0.03) | |

Estimated settlement expense2 | (54) | | | (49) | | | (41) | | | (37) | | | (0.06) | | | (0.05) | |

Inventory write-offs3 | — | | | (4) | | | — | | | (4) | | | — | | | (0.01) | |

Gain (loss) on sale of assets and equity investments3 | 4 | | | 3 | | | 3 | | | 1 | | | 0.01 | | | — | |

Seed sale associated with Russia Exit3 | — | | | 19 | | | — | | | 14 | | | — | | | 0.02 | |

Acquisition-related costs4 | (2) | | | (19) | | | (1) | | | (17) | | | — | | | (0.02) | |

1st Quarter — Total | $ | (127) | | | $ | (83) | | | $ | (95) | | | $ | (68) | | | $ | (0.13) | | | $ | (0.09) | |

| 2nd Quarter | | | | | | | | | | | |

Restructuring and asset related charges, net1 | $ | (92) | | | $ | (60) | | | $ | (69) | | | $ | (45) | | | $ | (0.10) | | | $ | (0.06) | |

Estimated settlement expense2 | (47) | | | (41) | | | (36) | | | (31) | | | $ | (0.05) | | | $ | (0.04) | |

Inventory write-offs3 | 2 | | | (3) | | | 2 | | | (3) | | | — | | | — | |

Gain (loss) on sale of assets and equity investments3 | 3 | | | — | | | 2 | | | — | | | — | | | — | |

Seed sale associated with Russia Exit3 | — | | | (1) | | | — | | | (1) | | | — | | | (0.01) | |

Acquisition-related costs4 | (3) | | | (15) | | | (2) | | | (12) | | | — | | | (0.02) | |

Employee retention credit5 | — | | | 3 | | | — | | | 2 | | | — | | | — | |

Income tax items6 | — | | | — | | | — | | | 29 | | | — | | | 0.04 | |

2nd Quarter — Total | $ | (137) | | | $ | (117) | | | $ | (103) | | | $ | (61) | | | $ | (0.15) | | | $ | (0.09) | |

| | | | | | | | | | | | |

Year-to-date Total7 | | $ | (264) | | | $ | (200) | | | $ | (198) | | | $ | (129) | | | $ | (0.28) | | | $ | (0.18) | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1.Second and first quarter 2024 includes restructuring and asset related benefits (charges) of $(92) and $(75), respectively. The charges relate to a $(57) and $(55) charge for the second and first quarter, respectively, primarily associated with the Crop Protection Operations Strategy Restructuring Program and a $(35) and $(20) charge for the second and first quarter, respectively, related to non-cash accelerated prepaid royalty amortization expense related to Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits.

Second and first quarter 2023 includes restructuring and asset related benefits (charges) of $(60) and $(33), respectively. The charges primarily relate to a $(52) and $(16) charge for the second and first quarter, respectively, related to non-cash accelerated prepaid royalty amortization expense related to Roundup Ready 2 Yield® and Roundup Ready 2 Xtend® herbicide tolerance traits and a $(7) and $(11) charge for the first and second quarter, respectively, associated with the 2022 Restructuring Actions.

2.Second and first quarter 2024 included estimated Lorsban® related charges of $(47) and $(54), respectively. Second and first quarter 2023 included estimated Lorsban® related charges of $(41) and $(49), respectively.

3.Second and first quarter 2024 includes a benefit of $3 and $4, respectively, related to the 2022 Restructuring Actions consisting of a gain on the sale of assets. Second quarter of 2024 also includes a $2 benefit associated with sales of inventory previously reserved for in association with the 2022 Restructuring Actions.

A-11

Corteva, Inc.

Significant Items

(Dollars in millions, except per share amounts)

Second and first quarter 2023 includes a benefit (charge) of $(1) and $19, respectively, relating to the sale of seeds already under production in Russia when the decision to exit the country was made and that the Company was contractually required to purchase, which consisted of $30 and $41 of net sales and $31 and $22 of cost of goods sold, respectively. Second quarter 2023 also includes a charge of $(3) associated with activities related to the 2022 Restructuring Actions consisting of inventory write offs. First quarter 2023 also includes a benefit (charge) of $(11) and $(4) associated with activities related to the 2022 Restructuring Actions consisting of a loss on the sale of the Company's interest in an equity investment and inventory write-offs.

4.Second and first quarter 2024 includes acquisition-related costs relating to third-party integration costs associated with the completed acquisitions of Stoller and Symborg.

Second and first quarter 2023 includes acquisition-related costs relating to transaction and third-party integration costs associated with the completed acquisitions of Stoller and Symborg and the recognition of the inventory fair value step-up.

5.Second quarter 2023 includes a benefit of $3 relating to an adjustment due to a change in estimate related to the Employee Retention Credit that the Company earned pursuant to the Coronavirus Aid, Relief, and Economic Security ("CARES") Act as enhanced by the Consolidated Appropriations Act ("CAA") and American Rescue Plan Act ("ARPA").

6.Second quarter 2023 includes a tax benefit of $29 related to the impact of changes to deferred taxes associated with a tax currency change for a legal entity and an adjustment due to a change in estimate related to a worthless stock deduction in the U.S.

7.Earnings per share for the year may not equal the sum of quarterly earnings per share due to the changes in average share calculations.

8.Unless specifically addressed in the notes above, the income tax effect on significant items was calculated based upon the enacted laws and statutory income tax rates applicable in the tax jurisdiction(s) of the underlying non-GAAP adjustment.

A-12

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Earnings (Loss) Per Share (Non-GAAP) | | | | | | | | |

| Operating earnings (loss) per share is defined as earnings (loss) per share from continuing operations – diluted, excluding non-operating (benefits) costs, amortization of intangibles (existing as of Separation), net unrealized gain or loss from mark-to-market activity on certain foreign currency derivative instruments that do not qualify for hedge accounting, and significant items. |

| | | | | | | | |

| | Three Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | $ | | $ | | EPS (diluted) | | EPS (diluted) |

| Net income (loss) from continuing operations attributable to Corteva (GAAP) | | $ | 1,053 | | | $ | 877 | | | $ | 1.51 | | | $ | 1.23 | |

Less: Non-operating benefits (costs), after tax 1 | | (21) | | | (35) | | | (0.03) | | | (0.04) | |

| Less: Amortization of intangibles (existing as of Separation), after tax | | (118) | | | (118) | | | (0.16) | | | (0.17) | |

| Less: Mark-to-market gains (losses) on certain foreign currency contracts not designated as hedges, after tax | | 15 | | | (48) | | | 0.02 | | | (0.07) | |

| Less: Significant items benefit (charge), after tax | | (103) | | | (61) | | | (0.15) | | | (0.09) | |

Operating Earnings (Loss) (Non-GAAP)2 | | $ | 1,280 | | | $ | 1,139 | | | $ | 1.83 | | | $ | 1.60 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | $ | | $ | | EPS (diluted) | | EPS (diluted) |

| Net income (loss) from continuing operations attributable to Corteva (GAAP) | | $ | 1,425 | | | $ | 1,480 | | | $ | 2.03 | | | $ | 2.07 | |

Less: Non-operating benefits (costs), after tax 1 | | (61) | | | (68) | | | (0.09) | | | (0.10) | |

| Less: Amortization of intangibles (existing as of Separation), after tax | | (235) | | | (236) | | | (0.34) | | | (0.33) | |

| Less: Mark-to-market gains (losses) on certain foreign currency contracts not designated as hedges, after tax | | 14 | | | (59) | | | 0.02 | | | (0.08) | |

| Less: Significant items benefit (charge), after tax | | (198) | | | (129) | | | (0.28) | | | (0.18) | |

Operating Earnings (Loss) (Non-GAAP)2 | | $ | 1,905 | | | $ | 1,972 | | | $ | 2.72 | | | $ | 2.76 | |

1.Non-operating benefits (costs) consists of non-operating pension and other post-employment benefit (OPEB) credits (costs), tax indemnification adjustments, and environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the Company as pre-tax income or expense.

2.Refer to page A-14 for the Non-GAAP reconciliation of operating EBITDA to operating earnings (loss) per share.

A-13

Corteva, Inc.

Operating EBITDA to Operating Earnings (Loss) Per Share

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating EBITDA to Operating Earnings (Loss) Per Share | | | | | | |

| | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Operating EBITDA (Non-GAAP)1 | | $ | 1,917 | | | $ | 1,746 | | | $ | 2,951 | | | $ | 2,977 | |

| Depreciation | | (138) | | | (132) | | | (268) | | | (259) | |

| Amortization of intangibles (post Separation) | | (20) | | | (19) | | | (43) | | | (25) | |

| Interest Income | | 25 | | | 54 | | | 60 | | | 94 | |

| Interest Expense | | (66) | | | (82) | | | (107) | | | (113) | |

(Provision for) benefit from income taxes on continuing operations before significant items, non-operating benefits (costs), amortization of intangibles (existing as of Separation), mark-to-market gains (losses) on certain foreign currency contracts not designated as hedges, and exchange gains (losses) (Non-GAAP)1 | | (387) | | | (334) | | | (581) | | | (579) | |

Base income tax rate from continuing operations (Non-GAAP)1 | | 22.5 | % | | 21.3 | % | | 22.4 | % | | 21.7 | % |

Exchange gains (losses), after tax2 | | (48) | | | (91) | | | (100) | | | (116) | |

| Net (income) loss attributable to non-controlling interests | | (3) | | | (3) | | | (7) | | | (7) | |

Operating Earnings (Loss) (Non-GAAP)1 | | $ | 1,280 | | | $ | 1,139 | | | $ | 1,905 | | | $ | 1,972 | |

| Diluted Shares (in millions) | | 698.1 | | | 713.7 | | | 700.4 | | | 714.8 | |

Operating Earnings (Loss) Per Share (Non-GAAP)1 | | $ | 1.83 | | | $ | 1.60 | | | $ | 2.72 | | | $ | 2.76 | |

1.Refer to pages A-5 through A-9, A-12 and A-14 for Non-GAAP reconciliations.

2.Refer to page A-15 for pre-tax and after tax impacts of exchange gains (losses).

A-14

Corteva, Inc.

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Base Income Tax Rate to Effective Income Tax Rate |

| Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), significant items, amortization of intangibles (existing as of Separation), mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges, and non-operating (benefits) costs. |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Income (loss) from continuing operations before income taxes (GAAP) | $ | 1,338 | | | $ | 1,084 | | | 1,820 | | | $ | 1,860 | |

Add: Significant items (benefit) charge 1 | 137 | | | 117 | | | 264 | | | 200 | |

| | | | | | | |

| Non-operating (benefits) costs | 30 | | | 44 | | | 82 | | | 87 | |

| Amortization of intangibles (existing as of Separation) | 154 | | | 155 | | | 308 | | | 309 | |

| Mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | (19) | | | 63 | | | (18) | | | 78 | |

Less: Exchange gains (losses)2 | (78) | | | (104) | | | (137) | | | (140) | |

Income (loss) from continuing operations before income taxes, significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges, and exchange gains (losses) (Non-GAAP) | $ | 1,718 | | | $ | 1,567 | | | $ | 2,593 | | | $ | 2,674 | |

| | | | | | | |

Provision for (benefit from) income taxes on continuing operations (GAAP) | $ | 282 | | | $ | 204 | | | $ | 388 | | | $ | 373 | |

Add: Tax benefits on significant items (benefit) charge1 | 34 | | | 56 | | | 66 | | | 71 | |

| | | | | | | |

| Tax expenses on non-operating (benefits) costs | 9 | | | 9 | | | 21 | | | 19 | |

| Tax benefits on amortization of intangibles (existing as of Separation) | 36 | | | 37 | | | 73 | | | 73 | |

| Tax benefits on mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | (4) | | | 15 | | | (4) | | | 19 | |

Tax benefits on exchange gains (losses)2 | 30 | | | 13 | | | 37 | | | 24 | |

Provision for (benefit from) income taxes on continuing operations before significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges, and exchange gains (losses) (Non-GAAP) | $ | 387 | | | $ | 334 | | | $ | 581 | | | $ | 579 | |

| | | | | | | |

Effective income tax rate (GAAP) | 21.1 | % | | 18.8 | % | | 21.3 | % | | 20.1 | % |

| Significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), and mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges effect | 0.7 | % | | 3.0 | % | | 0.9 | % | | 1.8 | % |

| Tax rate from continuing operations before significant items, non-operating (benefits) costs, amortization of intangibles (existing as of Separation), and mark-to-market (gains) losses on certain foreign currency contracts not designated as hedges | 21.8 | % | | 21.9 | % | | 22.2 | % | | 21.8 | % |

Exchange gains (losses), net effect2 | 0.7 | % | | (0.5) | % | | 0.2 | % | | (0.2) | % |

Base income tax rate from continuing operations (Non-GAAP) | 22.5 | % | | 21.3 | % | | 22.4 | % | | 21.7 | % |

| | | | | | | |

| 1. See page A-10 for further detail on the Significant Items. |

| 2. See page A-15 for further details of exchange gains (losses). |

|

|

A-15

Corteva, Inc.

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange Gains (Losses) | | | | | | | | |

| The Company routinely uses foreign currency exchange contracts to offset its net exposures, by currency, related to the foreign currency-denominated monetary assets and liabilities. The objective of this program is to maintain an approximately balanced position in foreign currencies in order to minimize, on an after-tax basis, the effects of exchange rate changes on net monetary asset positions. The hedging program gains (losses) are largely taxable (tax deductible) in the United States (U.S.), whereas the offsetting exchange gains (losses) on the remeasurement of the net monetary asset positions are often not taxable (tax deductible) in their local jurisdictions. The net pre-tax exchange gains (losses) are recorded in other income (expense) - net and the related tax impact is recorded in provision for (benefit from) income taxes on continuing operations in the Consolidated Statements of Operations. |

| | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Subsidiary Monetary Position Gain (Loss) | | | | | | | | |

| Pre-tax exchange gain (loss) | | $ | (66) | | | $ | (48) | | | $ | (43) | | | $ | (78) | |

| Local tax (expenses) benefits | | 28 | | | (1) | | | 18 | | | 8 | |

| Net after tax impact from subsidiary exchange gain (loss) | | $ | (38) | | | $ | (49) | | | $ | (25) | | | $ | (70) | |

| | | | | | | | |

| Hedging Program Gain (Loss) | | | | | | | | |

| Pre-tax exchange gain (loss) | | $ | (12) | | | $ | (56) | | | $ | (94) | | | $ | (62) | |

| Tax (expenses) benefits | | 2 | | | 14 | | | 19 | | | 16 | |

| Net after tax impact from hedging program exchange gain (loss) | | $ | (10) | | | $ | (42) | | | $ | (75) | | | $ | (46) | |

| | | | | | | | |

| Total Exchange Gain (Loss) | | | | | | | | |

| Pre-tax exchange gain (loss) | | $ | (78) | | | $ | (104) | | | $ | (137) | | | $ | (140) | |

| Tax (expenses) benefits | | 30 | | | 13 | | | 37 | | | 24 | |

| Net after tax exchange gain (loss) | | $ | (48) | | | $ | (91) | | | $ | (100) | | | $ | (116) | |

| | | | | | | | |

| Non-Controlling Interest Adjustment | | $ | — | | | $ | — | | | $ | 1 | | | $ | — | |

| | | | | | | | |

| Net after-tax exchange gain (loss) attributable to Corteva | | $ | (48) | | | $ | (91) | | | $ | (99) | | | $ | (116) | |

| | | | | | | | |

| As shown above, the "Total Exchange Gain (Loss)" is the sum of the "Subsidiary Monetary Position Gain (Loss)" and the "Hedging Program Gain (Loss)." |

|

| | | | |

A-16

Corteva, Inc.