S&P Cuts Rating on Icahn Enterprises to Junk Status

May 17 2016 - 2:00PM

Dow Jones News

Standard & Poor's Global Ratings on Tuesday cut its rating

on Carl Icahn's investment firm to junk territory, citing the

firm's weak investment performance and high borrowing levels.

The one-notch downgrade places Icahn Enterprises LP at

double-B-plus, with a stable outlook. Mr. Icahn, best known as a

1980s corporate raider, owns about 90% of Icahn Enterprises. He

wasn't immediately available for comment.

S&P credit analyst Clayton Montgomery said Tuesday that the

downgrade reflects the weak share price performance of Icahn

Enterprises's key portfolio companies, including CVR Energy Inc.

and Federal Mogul. Those stocks are off 48% and 31%, respectively,

over the past 12 months.

Mr. Montgomery also pointed to Icahn Enterprises's elevated

loan-to-value ratio, which S&P projects to remain between 45%

and 60% over the next 12 months.

Shares in Mr. Icahn's firm, meanwhile, are down 43% over the

past 12 months.

Icahn Enterprises reported investments with a fair market value

of about $1.8 billion as of March 31, down from $3.4 billion at the

end of the year, according to regulatory filings. The rate of

return was negative 12.8%.

Icahn Enterprises has reported negative returns for the past two

years.

Mr. Icahn, who like George Soros has warned of a possible repeat

of the 2008 financial crisis, on Monday reported he had exited

numerous investment positions in the first quarter.

The stock traded fractionally lower on Tuesday afternoon.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

May 17, 2016 14:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

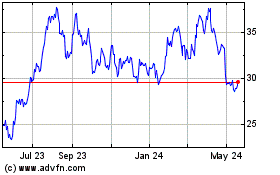

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

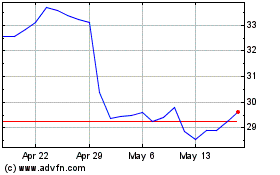

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jul 2023 to Jul 2024