Enzo Biochem Reports Second Quarter Fiscal 2024 Results and Provides Business Update

March 13 2024 - 3:26PM

Enzo Biochem, Inc. (NYSE: ENZ) (“Enzo” or the “Company”) today

announced financial results for the second quarter ended January

31, 2024.

Second Quarter Highlights

- The Company's Life

Science division's second-quarter revenue of $8.5 million improved

year-over-year by 14%. During the 2024 period, we experienced a 25%

revenue increase in the United States, driven by increased product

demand in the drug development and cell and gene therapy market

segments. Revenue for the six months ended January 31, 2024 of

$16.4 million improved 12% compared to the same period in the prior

year.

- The Life

Science division's second-quarter gross margin was 49%, which

improved by 1,000 basis points year-over-year from 39%, and was

also a sequential 500 basis point improvement from 44%. The

six-month YTD margin was 47% which was also a 1,000 basis point

improvement compared to the prior year. This favorable result was

driven by the reported revenue increase, mix of products sold, and

ongoing cost containment initiatives, including, but not limited

to, a workforce reduction for continuing operations.

- The Life Science

division reported second-quarter net income of $1.1 million,

compared to net income of $0.2 million in the prior year period.

The net loss in the Corporate & Other segment decreased

year-over-year by $1.2 million.

- Enzo ended the

second quarter with aggregate cash and cash equivalents of $60.2

million, a reduction of $23.1 million from July 31, 2023, primarily

due to the significant paydown of accounts payable and accrued

liabilities post the clinical lab asset sale. The Company’s current

ratio was 3.2 as of January 31, 2024.

- Net loss from

continuing operations for Q2 FY24 was $0.9 million or ($0.02) per

common share, compared to a net loss in the prior year’s second

quarter of $2.9 million or ($0.06) per common share.

- Net loss,

representing the results of continuing and discontinued operations

for Q2 FY24, was $3.1 million, or ($0.06) per common share,

compared to a net loss in the prior year’s second quarter of $11.3

million, or ($0.23) per common share. The weighted average basic

common shares outstanding as of January 31, 2024, was 50.5

million.

“Enzo’s strategy is to deliver sustainable, profitable revenue

growth through market focus, technical strength, and operational

conservatism. We are pleased to report a third consecutive quarter

with double-digit revenue growth in the life science division, and

I am proud of the team's hard work resulting in higher gross margin

and improved profitability in the second quarter within our Life

Science division,” said Kara Cannon, Enzo’s Chief Executive

Officer. These achievements were driven by aligning our products in

high-growth market segments made up of our drug development

customers, while relying on our existing, stable global

infrastructure to provide comprehensive, quality customer service.

I am very encouraged by our financial and operational progress, and

I am optimistic about our ability to maintain this positive

momentum to deliver on longer-term goals.”

About Enzo Biochem

Enzo Biochem, a pioneer in molecular diagnostics, contributes to

advancing healthcare with its comprehensive portfolio of technical

platforms and reagent sets supporting a diverse range of biomedical

research and translational science needs. A leader in innovation

and product development for over 45 years, scientists have trusted

Enzo Biochem to manufacture and supply a comprehensive portfolio of

thousands of high-quality products, including antibodies, genomic

probes, assays, biochemicals, and proteins. The Company’s

proprietary products and technologies play central roles in all

translational research and drug development areas, including cell

biology, genomics, assays, immunohistochemistry, and small molecule

chemistry. Enzo Biochem, Inc.’s Life Science division supports the

work of research centers and industry partners, shaping the future

of healthcare worldwide. Enzo Biochem, Inc. has a broad and deep

intellectual property portfolio, with patent coverage across many

vital enabling technologies. For more information, please

visit Enzo.com or follow Enzo Biochem

on X and LinkedIn.

Forward-Looking Statements

Except for historical information, the matters discussed in this

release may be considered "forward-looking" statements within the

meaning of Section 27A of the Securities Act of 1933, as amended

and Section 21E of the Securities Exchange Act of 1934, as amended.

Such statements include declarations regarding the intent, belief

or current expectations of the Company and its management,

including those related to cash flow, gross margins, revenues, and

expenses which are dependent on a number of factors outside of the

control of the Company including, inter alia, the markets for the

Company’s products, cost of goods sold, other expenses, government

regulations, litigation, and general business conditions. See Risk

Factors in the Company’s Form 10-K for the fiscal year ended July

31, 2023. Investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve a

number of risks and uncertainties that could materially affect

actual results. The Company disclaims any obligations to update any

forward-looking statement as a result of developments occurring

after the date of this release.

| Enzo Biochem

Contacts |

| For Enzo

Biochem: |

| Patricia Eckert, Chief Financial

OfficerEnzo Biochem631-755-5500peckert@enzo.com |

Use of Non-GAAP Financial Measures by Enzo

The non-GAAP financial measures contained in this press release

(including, without limitation, Adjusted net income (loss), EBITDA,

and Adjusted EBITDA), are not GAAP measures of the Company’s

financial performance or liquidity and should not be considered as

alternatives to net income (loss) as a measure of financial

performance or cash flows from operations as measures of liquidity,

or any other performance measure derived in accordance with GAAP. A

reconciliation of such non-GAAP measures is included in the

presentation of the Company’s financial results for the second

quarter ended January 31, 2024 contained herein and is also

available in the investor relations section of the Company’s

website (https://www.enzo.com).

The Company believes the presentation of these non-GAAP measures

provides useful additional information to investors because they

provide information consistent with that on which management

evaluates the financial performance of the Company. The Company

manages its business based on its operating cash flows. It refers

to EBITDA as its primary indicator of performance, and refers to

Adjusted EBITDA to further exclude items of a non-recurring nature.

It is reasonable to expect that one or more excluded items will

occur in future periods, though the amounts recognized can vary

significantly from period to period. You are encouraged to evaluate

each adjustment to a non-GAAP financial measure and the reasons

management considers it appropriate for supplemental analysis. Our

presentation of these measures should not be construed as an

inference that our future results will be unaffected by unusual or

non-recurring items.

We refer you to the tables attached to this press release, which

includes reconciliation tables of GAAP net income (loss) to

Adjusted net income (loss) and GAAP net income (loss) to EBITDA and

Adjusted EBITDA.

| ENZO

BIOCHEM, INC. |

| (in thousands,

except per share data) |

| |

|

|

|

|

|

|

|

| |

Three months

ended |

|

Six months

ended |

|

Selected operations data: |

January

31, |

|

January

31, |

| |

(unaudited) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

8,553 |

|

|

$ |

7,514 |

|

|

$ |

16,359 |

|

|

$ |

14,617 |

|

| |

|

|

|

|

|

|

|

| Gross

profit |

|

4,224 |

|

|

|

2,898 |

|

|

|

7,679 |

|

|

|

5,412 |

|

| |

|

|

|

|

|

|

|

| Gross profit

% |

|

49 |

% |

|

|

39 |

% |

|

|

47 |

% |

|

|

37 |

% |

| |

|

|

|

|

|

|

|

| Operating

loss |

|

(2,185 |

) |

|

|

(4,545 |

) |

|

|

(7,655 |

) |

|

|

(9,173 |

) |

| |

|

|

|

|

|

|

|

| Net loss

from continuing operations |

|

(863 |

) |

|

|

(2,892 |

) |

|

|

(6,538 |

) |

|

|

(8,245 |

) |

| Net loss

from discontinued operations |

|

(2,198 |

) |

|

|

(8,428 |

) |

|

|

(3,139 |

) |

|

|

(13,710 |

) |

| Net

loss |

$ |

(3,061 |

) |

|

$ |

(11,320 |

) |

|

$ |

(9,677 |

) |

|

$ |

(21,955 |

) |

| |

|

|

|

|

|

|

|

| Net loss per

common share- basic and diluted- Continuing Operations |

($0.02 |

) |

|

($0.06 |

) |

|

($0.13 |

) |

|

($0.17 |

) |

| Net loss per

common share- basic and diluted- Discontinued Operations |

($0.04 |

) |

|

($0.17 |

) |

|

($0.06 |

) |

|

($0.28 |

) |

| Total net

loss per basic and diluted common share |

($0.06 |

) |

|

($0.23 |

) |

|

($0.19 |

) |

|

($0.45 |

) |

| |

|

|

|

|

|

|

|

| Weighted

average common shares outstanding - basic and diluted |

|

50,490 |

|

|

|

48,729 |

|

|

|

50,337 |

|

|

|

48,725 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Selected balance sheet data: |

1/31/2024 (unaudited) |

|

7/31/2023 (unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

| Cash and

cash equivalents (includes restricted cash of $1,000 at

7/31/23) |

$ |

60,241 |

|

|

$ |

83,373 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Working

capital |

|

55,637 |

|

|

|

58,467 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Stockholders' equity |

|

70,775 |

|

|

|

78,462 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Total

assets |

|

99,077 |

|

|

|

121,880 |

|

|

|

|

|

| The following table

presents a reconciliation of reported net loss and basic and

diluted net loss per share to adjusted net income (loss) and basic

and diluted net loss per share adjusted, for the three and six

months ended January 31, 2024 and 2023: |

| |

|

|

|

|

|

|

|

| ENZO

BIOCHEM, INC. |

| Adjusted Net income

(loss) Reconciliation Table |

| (Unaudited, in

thousands, except per share data) |

| |

|

|

|

|

|

|

|

| |

Three months

ended |

|

Six months

ended |

| |

January 31, |

|

January 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Reported

GAAP net loss |

$ |

(3,061 |

) |

|

$ |

(11,320 |

) |

|

$ |

(9,677 |

) |

|

$ |

(21,955 |

) |

| Adjusted

for: |

|

|

|

|

|

|

|

|

Discrete legal matters |

|

613 |

|

|

|

174 |

|

|

|

1,476 |

|

|

|

196 |

|

|

Fair value adjustment |

|

383 |

|

|

|

- |

|

|

|

711 |

|

|

|

- |

|

|

Discrete separation expenses |

|

69 |

|

|

|

982 |

|

|

|

1,742 |

|

|

|

1,808 |

|

|

Strategic initiative expenses |

|

- |

|

|

|

759 |

|

|

|

- |

|

|

|

1,648 |

|

|

Discontinued operations loss |

|

2,198 |

|

|

|

8,428 |

|

|

|

3,139 |

|

|

|

13,710 |

|

|

Adjusted net income (loss) |

$ |

202 |

|

|

$ |

(977 |

) |

|

$ |

(2,609 |

) |

|

$ |

(4,593 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted

Shares Outstanding: |

|

|

|

|

|

|

|

| Basic and

diluted |

|

50,490 |

|

|

|

48,729 |

|

|

|

50,337 |

|

|

|

48,725 |

|

| |

|

|

|

|

|

|

|

| Basic and

diluted earnings per share: |

|

|

|

|

|

|

|

| Basic and

diluted net income (loss) per share GAAP |

($0.06 |

) |

|

($0.23 |

) |

|

($0.19 |

) |

|

($0.45 |

) |

| |

|

|

|

|

|

|

|

| Basic and

diluted net income (loss) per share adjusted |

|

$0.00 |

|

|

($0.02 |

) |

|

($0.05 |

) |

|

($0.09 |

) |

| |

|

|

|

|

|

|

|

| The following table

presents a reconciliation of reported GAAP net loss for the three

and six months ended January 31, 2024 and 2023, respectively to

EBITDA and Adjusted EBITDA: |

| |

|

|

|

|

|

|

|

| ENZO

BIOCHEM, INC. |

| EBITDA &

Adjusted EBITDA Reconciliation Table |

| (Unaudited, in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

Three months

ended |

Six months

ended |

|

|

January 31, |

|

January 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| GAAP net

loss |

$ |

(3,061 |

) |

|

$ |

(11,320 |

) |

|

$ |

(9,677 |

) |

|

$ |

(21,955 |

) |

| Plus

(minus): |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

267 |

|

|

|

262 |

|

|

|

537 |

|

|

|

510 |

|

|

Interest income, net |

|

(893 |

) |

|

|

(63 |

) |

|

|

(1,870 |

) |

|

|

(135 |

) |

| EBITDA |

|

(3,687 |

) |

|

|

(11,121 |

) |

|

|

(11,010 |

) |

|

|

(21,580 |

) |

| |

|

|

|

|

|

|

|

| Adjusted

for: |

|

|

|

|

|

|

|

|

Discrete legal matters |

|

613 |

|

|

|

174 |

|

|

|

1,476 |

|

|

|

196 |

|

|

Fair value adjustment |

|

383 |

|

|

|

- |

|

|

|

711 |

|

|

|

- |

|

|

Discrete separation expenses |

|

69 |

|

|

|

982 |

|

|

|

1,742 |

|

|

|

1,808 |

|

|

Strategic initiative expenses |

|

- |

|

|

|

759 |

|

|

|

- |

|

|

|

1,648 |

|

|

Discontinued operations loss |

|

2,198 |

|

|

|

8,428 |

|

|

|

3,139 |

|

|

|

13,710 |

|

|

Foreign exchange (gain) loss |

|

(693 |

) |

|

|

(1,472 |

) |

|

|

318 |

|

|

|

(675 |

) |

| Adjusted

EBITDA |

$ |

(1,117 |

) |

|

$ |

(2,250 |

) |

|

$ |

(3,624 |

) |

|

$ |

(4,893 |

) |

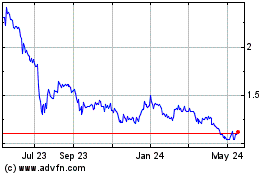

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

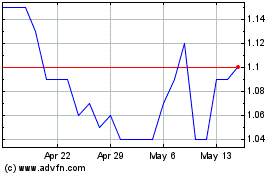

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Feb 2024 to Feb 2025