UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

☒ Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

FATHOM DIGITAL MANUFACTURING CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

Fathom Digital Manufacturing Corporation

1050 Walnut Ridge Drive

Hartland, WI 53029

Dear Stockholder, May 25, 2023

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Fathom Digital Manufacturing Corporation (“Fathom” or the “Company”) to be held on July 11, 2023, at 10:00 a.m. Central Time, virtually at www.virtualshareholdermeeting.com/FATH2023. The Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting physically.

You are being asked at the Annual Meeting to vote on the following matters:

•election of three incumbent Class I Directors for three-year terms expiring in 2026 (Proposal 1);

•ratification of Grant Thornton LLP as our independent registered public accounting firm for our 2023 fiscal year (Proposal 2);

•approval of an amendment to the Company’s Certificate of Incorporation (the “Charter”) to reflect new Delaware law provisions regarding senior officer exculpation (Proposal 3);

•approval of an amendment to the Charter to provide our Board of Directors with discretionary authority to effect a reverse stock split of our Class A and Class B common stock (Proposal 4); and

•transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Your interest in the Company and your vote are very important to us. The enclosed proxy materials contain detailed information regarding the business that will be considered at the Annual Meeting. It is important that all stockholders participate in the affairs of the Company, regardless of the number of shares owned. You may authorize your proxy via the Internet or telephone or, if you received a paper copy of the proxy materials, by mail by completing and returning the proxy card. Instructions for voting can be found on your notice of internet availability or proxy card. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/FATH2023, you must enter the 16-digit control number found on your proxy card, voting instruction form or notice you will receive. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

If you hold shares of the Company’s Class A common stock in “street name” through a broker, bank or other nominee, you must follow the instructions provided by your broker, bank or other nominee regarding how to instruct your broker, bank or other nominee to vote your shares, or obtain a proxy in your name from your broker, bank or other nominee.

We encourage you to vote your shares prior to the Annual Meeting. You may vote your shares through one of the methods described in the enclosed proxy statement. We strongly urge you to read the accompanying proxy statement carefully and to vote FOR the Class I Director nominees proposed by the Board of Directors, FOR ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for our 2023 fiscal year and FOR the other proposals by following the voting instructions contained in the proxy statement.

On behalf of the Company and our Board, I would like to express our appreciation for your ongoing interest in Fathom Digital Manufacturing Corporation.

|

|

|

Sincerely,

TJ Chung

Chairman of the Board |

This proxy statement is dated May 25, 2023, and is first being made available to stockholders via the Internet on or about May 25, 2023.

i

Fathom Digital Manufacturing Corporation

1050 Walnut Ridge Drive

Hartland, WI 53029

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 11, 2023

|

|

TIME |

10:00 a.m. Central Time |

VIRTUAL MEETING DETAILS |

www.virtualshareholdermeeting.com/FATH2023 |

ITEMS OF BUSINESS |

(1)Election of the three incumbent Class I Directors to serve on the Board of Directors for three-year terms expiring at the 2026 Annual Meeting of Stockholders once their respective successors have been duly elected and qualified or until their earlier resignation or removal (Proposal 1); |

|

(2)Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for our 2023 fiscal year (Proposal 2); |

|

(3)Approval of an amendment to the Company’s Certificate of Incorporation (the “Charter”) to reflect new Delaware law provisions regarding senior officer exculpation (Proposal 3); |

|

(4)Approval of an amendment to the Charter to provide our Board of Directors with discretion to effect a reverse stock split of our Class A and Class B common stock (Proposal 4); and |

|

(5)To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

RECORD DATE |

You are entitled to vote only if you were a stockholder of record at the close of business on May 12, 2023. |

PROXY VOTING |

It is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to vote online at www.proxyvote.com or via telephone by calling the toll-free number found on your proxy card or voting instructions form or complete and return a proxy card (no postage is required). |

The Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting physically. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/FATH2023, you must enter the 16-digit control number found on your proxy card, voting instruction form or notice you will receive. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on July 11, 2023: As permitted by rules adopted by the Securities and Exchange Commission, rather than mailing a full paper set of these proxy materials, we are mailing to many of the holders of our Class A common stock only a notice of internet availability of proxy materials containing instructions on how to access these proxy materials and submit their respective proxy votes online. This proxy statement, our 2022 Annual Report on Form 10-K, as amended, and the proxy card are available at www.proxyvote.com. You will need your notice of internet availability or proxy card to access these proxy materials.

|

|

|

By Order of the Board of Directors,

Mark Frost

Secretary |

Hartland, Wisconsin

May 25, 2023

ii

Table of Contents

iii

|

|

Annual Report |

Refers to our annual report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on April 7, 2023, as amended by the Form 10-K/A of Fathom filed with the SEC on May 1, 2023. |

Altimar II |

Refers to Altimar Acquisition Corp. II, a blank check company incorporated as a Cayman Islands exempted company. |

Altimar Founders |

Refers to Altimar Sponsor and certain equityholders of Altimar. |

Altimar Sponsor |

Refers to Altimar Sponsor II, LLC, a Delaware limited liability company. |

Business Combination |

Refers to the transactions contemplated by the Business Combination Agreement, which were completed on December 23, 2021. |

Business Combination Agreement or BCA |

Refers to the agreement dated as of July 15, 2021 (as the same has been or may be amended, modified, supplemented or waived from time to time), by and among Altimar II, Fathom OpCo and the other parties thereto. |

Bylaws |

Refers to the Amended and Restated Bylaws of the Company, adopted as of December 23, 2021. |

Charter |

Refers to the Company’s Certificate of Incorporation filed with the Delaware Secretary of State on December 23, 2021. |

Class A Shares |

Refers to the Class A common stock, par value $0.0001 per share, of Fathom. |

Class B Shares |

Refers to the Class B common stock, par value $0.0001 per share, of Fathom. |

Continental |

Refers to our stock transfer agent, Continental Stock Transfer & Trust Company. |

CORE Investors |

Refers to CORE Industrial Partners Fund I, L.P. and CORE Industrial Partners Fund I Parallel, L.P. |

DGCL |

Refers to the Delaware General Corporation Law, as amended. |

Exchange Act |

Refers to the U.S. Securities Exchange Act of 1934, as amended. |

Fathom, the Company, the firm, we, us and our |

Refers to Fathom Digital Manufacturing Corporation and its consolidated subsidiaries. |

Fathom OpCo |

Refers to Fathom Holdco, LLC, a Delaware limited liability company, the consolidated subsidiary of Fathom through which Fathom’s business is conducted. |

Financial Statements |

Refers to our consolidated and combined financial statements included in our Annual Report. |

Investor Rights Agreement |

Refers to the Investor Rights Agreement, dated as of December 23, 2021, by and among the Company, the CORE Investors and the other parties thereto. |

NYSE |

Refers to the New York Stock Exchange. |

SEC |

Refers to the U.S. Securities and Exchange Commission. |

Securities Act |

Refers to the U.S. Securities Act of 1933, as amended. |

Tax Receivable Agreement or TRA |

Refers to the Tax Receivable Agreement dated as of December 23, 2021 by and among Fathom, Fathom OpCo and the other parties thereto, or the amendment and restatement thereof dated as of April 4, 2023, as the context requires. |

iv

Fathom Digital Manufacturing Corporation

1050 Walnut Ridge Drive

Hartland, WI 53029

PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

The board of directors (the “Board”) of Fathom Digital Manufacturing Corporation, a Delaware corporation (“Fathom,” the “Company,” “we,” “us” or “our”), has prepared this proxy statement to solicit your proxy to vote upon certain matters at the Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”).

These proxy materials contain information regarding the Annual Meeting, to be held on July 11, 2023, beginning at 10:00 a.m. Central Time, electronically at www.virtualshareholdermeeting.com/FATH2023, and at any adjournment or postponement thereof. The Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting in person. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/FATH2023, you must enter the 16-digit control number found on your proxy card, voting instruction form or notice you will receive. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting. As permitted by the rules adopted by the Securities and Exchange Commission (the “SEC”), rather than mailing a full paper set of these proxy materials, we are mailing to the holders of our Class A Shares only a notice of internet availability of proxy materials (the “Notice”) containing instructions on how to access and review these proxy materials and submit their respective proxy votes online. If you receive the Notice and would like to receive a paper copy of these proxy materials, you should follow the instructions for requesting such materials located at www.proxyvote.com.

QUESTIONS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALS

It is anticipated that we will begin mailing the Notice, and that these proxy materials will first be made available online to our stockholders, on or about May 25, 2023. For those stockholders receiving paper materials, it is also anticipated that we will begin mailing this proxy statement, the proxy card, and our 2022 Annual Report on Form 10-K, as amended (the “Annual Report”) on or about May 25, 2023. The information regarding stock ownership and other matters in this proxy statement is as of May 12, 2023 (the “Record Date”), unless otherwise indicated.

What may I vote on?

You may vote on the following proposals:

•the election of the three incumbent Class I Directors to serve on the Board for three-year terms expiring at the 2026 Annual Meeting of Stockholders once their respective successors have been duly elected and qualified or until their earlier resignation or removal (Proposal 1);

•the ratification of the appointment of Grant Thornton LLP (“GT”) as our independent registered public accounting firm for our 2023 fiscal year (Proposal 2);

•the approval of an amendment to the Company’s Certificate of Incorporation (the “Charter”) to reflect new Delaware law provisions regarding senior officer exculpation (Proposal 3); and

•the approval of an amendment to the Charter to provide our Board of Directors with discretion to effect a reverse stock split of our Class A and Class B Shares (Proposal 4).

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE CLASS I DIRECTOR NOMINEES LISTED HEREIN, “FOR” THE RATIFICATION OF THE APPOINTMENT OF GT AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR 2023 FISCAL YEAR, “FOR” THE APPROVAL OF AN AMENDMENT OF THE COMPANY’S CHARTER REGARDING SENIOR OFFICER EXCULPATION AND “FOR” APPROVAL OF AN AMENDMENT TO THE COMPANY’S CHARTER TO PROVIDE OUR BOARD WITH DISCRETION TO EFFECT A REVERSE STOCK SPLIT OF OUR CLASS A SHARES AND CLASS B SHARES.

Who may vote?

Stockholders of record of our Class A Shares and Class B Shares are entitled to receive the Notice and these proxy materials and to vote their respective shares at the Annual Meeting. The Record Date for determination of stockholders entitled to vote at the Annual Meeting is the close

1

of business on May 12, 2023. As of the Record Date, there were 69,690,343 Class A Shares outstanding and 66,692,781 Class B Shares outstanding.

Holders of Class A Shares and Class B Shares vote as a single class on all matters presented to the Company’s stockholders for their vote or approval, except as otherwise required by our Charter and applicable law. Holders of our Class A Shares and Class B Shares are entitled to one vote for each share held of record by such holder on all matters on which stockholders generally are entitled to vote. For information about the holders of our Class A Shares and Class B Shares, please see “Proposal 1: Election of Three Incumbent Class I Directors—Controlled Company Exemption” and “Security Ownership of Certain Beneficial Holders and Management”

How do I vote?

We have elected to provide access to proxy materials over the Internet under the SEC’s “notice and access” rules to reduce the environmental impact and cost of the Annual Meeting. However, if you prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice. If you are attending the Annual Meeting electronically at www.virtualshareholdermeeting.com/FATH2023, you may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

Stockholders of Record

If your Class A Shares and/or Class B Shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered a stockholder of record with respect to those shares. As a stockholder of record, you have the right to vote by proxy.

You may vote by proxy in any of the following three ways:

•Internet. Go to www.proxyvote.com to use the Internet to transmit your voting instructions and for electronic delivery of information. Have your proxy card in hand when you access the website.

•Phone. You can vote by proxy by calling the toll-free number found on your proxy card or voting instruction form. You will need to use the 16-digit control number included on the proxy card to vote by telephone. The availability of telephone voting may depend on the voting process of the organization that holds your shares.

•Mail. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided, or return it to Vote Processing c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717.

Voting by any of these methods will not affect your right to attend the Annual Meeting and vote. However, for those who will not be voting electronically at www.virtualshareholdermeeting.com/FATH2023 at the Annual Meeting, your final voting instructions must be received by no later than 10:59 p.m. Central Time (11:59 p.m. Eastern Time) on July 11, 2023.

During the Annual Meeting, a list of stockholders entitled to vote will be available for examination at www.virtualshareholdermeeting.com/FATH2023. The list will also be available for 10 days prior to the Annual Meeting at our principal executive office at the address listed above on the cover page of this proxy statement.

Beneficial Owners

Most of the holders of our Class A Shares hold their shares through a broker, bank or other nominee, rather than directly in their own names. If you hold your Class A Shares in one of these ways, you are considered the beneficial owner of shares held in “street name,” and the Notice is being forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote. Your broker, bank or other nominee has enclosed a voting instruction form for you to use in directing the broker, bank or other nominee on how to vote your shares. Unless you provide specific voting instructions, your broker, bank or other nominee will only have the discretion to vote shares it holds on your behalf with respect to Proposal 2 (the ratification of GT as our independent registered public accounting firm for our 2023 fiscal year), but not with respect to Proposal 1 (the election of three incumbent Class I directors), Proposal 3 (approval of an amendment to the Charter to reflect new Delaware law provisions regarding senior officer exculpation), or Proposal 4 (approval of an amendment to the Charter to provide our Board with discretion to effect a reverse stock split of our Class A Shares and Class B Shares) as more fully described under “What is a broker ‘non-vote’?” below.

Can I change my vote?

Yes. If you are the stockholder of record, you may revoke your proxy before it is exercised by doing any of the following:

•sending a letter to us stating that your proxy is revoked;

•signing a new proxy and sending it to us; or

2

•attending the Annual Meeting and voting.

Beneficial owners should contact their broker, bank or other nominee for instructions on changing their votes.

How many votes must be present to hold the Annual Meeting?

A “quorum” is necessary to hold the Annual Meeting. The stockholders holding a majority of the voting power of the outstanding Class A Shares and Class B Shares, represented either in person or by proxy, shall constitute a quorum for the purposes of the Annual Meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum.

How many votes are needed to approve the proposals?

A “quorum” is necessary to hold the Annual Meeting. The stockholders holding a majority of the voting power of the outstanding stock of the class or classes entitled to vote, represented either in person or by proxy, shall constitute a quorum for the purposes of the Annual Meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum.

Election of Directors:

You may vote “FOR,” “AGAINST” or “ABSTAIN” for Proposal 1 (election of directors). At the Annual Meeting, a “FOR” vote by a plurality of votes cast is required for the election of directors. For this purpose, the three director nominees receiving the highest number of shares voted “FOR” their election will be elected. Abstention votes and broker “non-votes” are not considered votes cast for the foregoing purpose and will have no effect on the election of the director nominees.

Other Proposals:

You may vote “FOR,” “AGAINST” or “ABSTAIN” for Proposal 2 (the ratification of GT as our independent registered public accounting firm for our 2023 fiscal year), Proposal 3 (approval of an amendment to the Charter to reflect new Delaware law provisions regarding senior officer exculpation) and Proposal 4 (approval of an amendment to the Charter to provide our Board with discretion to effect a reverse stock split of our Class A Shares and Class B Shares). At the Annual Meeting, a “FOR” vote by a majority of votes cast is required for passage of these Proposals. For this purpose, a majority of the votes cast means that the number of shares voted “FOR” a Proposal must exceed the number of votes cast “AGAINST” that Proposal. Abstentions and broker “non-votes” are not considered votes cast for the foregoing purpose and will have no effect on the vote for these Proposals.

Relationship Between Proposals 3 and 4

The proposed amendments to the Company’s Charter described in Proposals 3 and 4 are being presented separately for approval by our stockholders, and the approval or rejection of either of the proposals will not affect the other proposal.

Where can I find the voting results of the Annual Meeting?

The Company will announce preliminary voting results at the Annual Meeting and publish final results in a Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting.

What is a broker “non-vote?”

If you are a beneficial owner of Class A Shares held in “street name” and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the broker, bank or other nominee that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, such organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is commonly referred to as a broker “non-vote.”

Proposal 1 (the election of three incumbent Class I directors) and Proposal 3 (the amendment to the Charter to reflect new Delaware law provisions regarding senior officer exculpation) are matters considered non-routine under applicable rules. A broker, bank or other nominee cannot vote your Class A Shares without your instructions on non-routine matters. For your vote of your Class A Shares to be counted in Proposal 1, Proposal 3 and Proposal 4, you will need to communicate your voting decisions to your broker, bank or other nominee before the date of the Annual Meeting using the voting instruction form provided by your broker, bank or other nominee.

Proposal 2 (the ratification of GT as our independent registered public accounting firm for our 2023 fiscal year) and Proposal 4 (approval of an amendment to the Charter to provide our Board with discretion to effect a reverse stock split of our Class A Shares and Class B Shares) are matters considered routine under applicable rules. A broker, bank or other nominee may generally vote your Class A Shares on routine matters without your specific voting instructions.

3

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as the inspector of election.

Will any other matters be acted on at the Annual Meeting?

As of the date of this proxy statement, we do not know of any other matters to be presented at the Annual Meeting. If any other matters properly come before the Annual Meeting, however, the persons named as proxies will be authorized to vote or otherwise act in accordance with their judgment.

Who pays for this proxy solicitation?

We will pay the expenses of soliciting proxies. In addition to solicitation by mail, proxies may be solicited in person or by telephone or other means by our directors or associates. We will reimburse brokers, banks and other nominees, custodians and fiduciaries for costs incurred by them in mailing these proxy materials to the beneficial owners of our common stock held of record by such persons.

Whom should I contact with other questions?

If you have additional questions about these proxy materials or the Annual Meeting, please contact Fathom Digital Manufacturing Corporation, Attn: Investor Relations, 1050 Walnut Ridge Drive, Hartland, WI 53029, Email: michael.cimini@fathommfg.com, Telephone: 262-563-5575.

4

PROPOSAL 1: ELECTION OF THREE INCUMBENT CLASS I DIRECTORS

Board Structure and the Nominees

Our Board currently consists of the ten directors listed below. Our directors are divided into three classes serving staggered three-year terms. Class I, Class II and Class III directors will serve until our annual meetings of stockholders in 2023, 2024 and 2025, respectively. At each annual meeting of stockholders, directors will be elected to succeed the class of directors whose terms have expired.

|

|

|

|

|

|

|

|

|

Name |

|

Age |

|

Director Class |

|

Serving Since |

|

Committee(s) |

Carey Chen |

|

50 |

|

III |

|

December 2021 |

|

N/A |

TJ Chung |

|

59 |

|

III |

|

December 2021 |

|

N/A |

Dr. Caralynn Nowinski Collens |

|

45 |

|

I |

|

December 2021 |

|

Audit; Compensation |

Adam DeWitt |

|

49 |

|

I |

|

December 2021 |

|

Audit; Nominating |

David Fisher |

|

53 |

|

III |

|

December 2021 |

|

Compensation*; Nominating |

Maria Green |

|

70 |

|

II |

|

December 2021 |

|

Compensation; Nominating |

Peter Leemputte |

|

65 |

|

II |

|

December 2021 |

|

Audit*; Compensation |

Ryan Martin |

|

44 |

|

I |

|

December 2021 |

|

N/A |

John May |

|

51 |

|

III |

|

December 2021 |

|

N/A |

Robert Nardelli |

|

74 |

|

II |

|

December 2021 |

|

Audit; Nominating* |

*Chair

In connection with the Business Combination, we entered into an investor rights agreement with the CORE Investors. The Investor Rights Agreement grants the CORE Investors the right to designate nominees to our Board subject to the maintenance of certain ownership requirements, as more fully described in our public filings with the SEC.

Subject to the Investor Rights Agreement, our Board’s Nominating and Corporate Governance Committee (the “Nominating Committee”) identifies and recommends to our Board nominees for election to the Board at the next annual meeting. Except as otherwise expressly provided in the Charter, the holders of our Class A Shares and Class B Shares are entitled to vote on all matters on which stockholders of a corporation are generally entitled to vote under the Delaware General Corporation Law (“DGCL”), including the election of our Board.

In connection with the Annual Meeting, and upon recommendation of the Nominating Committee, the Board has nominated each of the incumbent Class I directors, Dr. Nowinski Collens and Messrs. DeWitt and Martin for election as Class I directors (collectively, the “Nominees”), each for a three-year term expiring at our 2026 Annual Meeting of Stockholders once their respective successors have been duly elected and qualified or until their earlier resignation or removal. The Company’s Charter and Amended and Restated Bylaws (the “Bylaws” and, together with the Charter, the “Organizational Documents”) provide that each director shall be elected by a plurality of the votes cast at a meeting of stockholders for the election of directors. Set forth below is information concerning our directors as of May 12, 2023, and the key experience, qualifications and skills they bring to the Board.

The CORE Investors beneficially own Class A Shares and Class B Shares representing approximately 62.9% of the voting power of the Company’s outstanding capital stock. As a result, the CORE Investors have the power to elect each of the nominees named in this proxy statement. The CORE Investors have indicated that they intend to vote FOR the election of each of the Class I Director Nominees named in this proxy statement at the Annual Meeting.

All of the Class I Director nominees have consented to being named in this proxy statement and to serve if elected. However, if any of the nominees becomes unable to serve, proxy holders will have discretion and authority to vote for another nominee proposed by the Board. Alternatively, the Board may reduce the number of directors to be elected at the Annual Meeting.

Nominees for Class I Directors (Current term expires at the 2023 Annual Meeting of Stockholders)

Independent Directors

Dr. Caralynn Nowinski Collens—Class I Director. Dr. Nowinski Collens has served as a director of Fathom since December 2021. Dr. Collens is the Chief Executive Officer of Dimension Inx, a next-generation biofabrication company developing regenerative medical implants that repair tissues and organs. Prior to Dimension Inx, Dr. Nowinski Collens co-founded UI LABS, a first-of-its-kind technology organization focused on the digital future of industries, building the organization from concept in late 2011 through launch in 2014. As Chief Executive Officer, she drove the creation and growth of MxD, the U.S. hub for digital manufacturing (formerly DMDII), and the City Tech Collaborative, building a network of 350+ partner organizations, deploying $100M across 75+ solution development projects, and ultimately spinning out MxD and City Tech as independent entities in 2019. After starting her first company while a joint medical/business student at the University of Illinois at Chicago, Dr. Nowinski Collens spent her early career in venture capital and corporate finance, primarily focused on technology-based university spin-outs. Dr. Nowinski Collens is the former Chairman of the Board of Directors of MxD and serves on the Executive Council of Granite Creek Capital Partners. She is also a long-time board director and current Chair of Imerman Angels (one-on-one cancer support) and the Vice Chair and Trustee of the Chicago Sunday Evening Club. Dr. Nowinski Collens holds a dual MD / MBA from the University of Illinois College of Medicine and a BS from Northwestern University.

5

Adam DeWitt—Class I Director. Mr. DeWitt has served as a director of Fathom since December 2021. Mr. DeWitt is the Chief Executive Officer of Grubhub Inc. where he has led all functions of the U.S. business since June 2021. Prior to this role, Mr. DeWitt was Grubhub’s President and Chief Financial Officer. During his tenure of a decade at the company, Grubhub’s annual revenues have grown from $20 million to more than $2 billion, and he led the company through its initial public offering in 2014. Before joining Grubhub, Mr. DeWitt was the Chief Financial Officer of publicly-held optionsXpress Holdings, Inc. Mr. DeWitt serves on the board of directors and audit committee of Ritchie Bros. Auctioneers Incorporated (NYSE: RBA), a marketplace for heavy industrial, agricultural and transportation equipment. He is also a member of the board of directors of The Joffrey Ballet, and is the treasurer and a member of the board of trustees of the Bernard Zell Anshe Emet Day School. Mr. DeWitt holds a B.A. in Economics from Dartmouth College.

Non-Independent Director

Ryan Martin—Class I Director and Chief Executive Officer. Mr. Martin has served as the Chief Executive Officer of Fathom since January 2019 and as a Director of Fathom since December 2021. During this time, he has led the company through unprecedented growth, digital transformation, and multiple add-on acquisitions, which have rapidly expanded Fathom into one of the largest privately held digital manufacturers in North America. Prior to his role at Fathom, he most recently spent over 13 years in leadership roles at General Electric Company (NYSE: GE) spanning across sales, marketing, product development and general management. In his last role at GE, he served as an Executive on the GE additive leadership team ("GE Additive"), where he led the integration and expansion of the commercial team which experienced exponential growth and record-breaking orders in 2018. He was also critical in the integration of two international acquisitions into GE Additive and led the commercialization of multiple new products that GE Additive brought to the market. Mr. Martin graduated with Honors from the Ivy College of Business at Iowa State University. He is also an active member of Young Presidents Organization.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE CLASS I DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT.

Our Class II and Class III Directors (Current Terms Expire at the 2024 and 2025 Annual Meetings, Respectively)

Carey Chen—Class III Director. Mr. Chen has served as a director of Fathom since December 2021. Mr. Chen has served as a member of the Board of Directors Fathom OpCo since October 2019. He has served as President of Altix Corporation, a management consulting firm, since January 2023. Mr. Chen served as Chief Executive Officer of Cadrex Manufacturing Solutions from September 2021 to October 2022 and Chief Executive Officer of Incodema Group from August 2020 to September 2021. Immediately prior, he served as Executive Chairman and President of Cincinnati Incorporated from January 2015 to July 2020. Mr. Chen served as Vice President of Hypertherm, Inc. from 2006 to 2015, and held various operating and corporate roles including Vice President and General Manager – Light Industrial Businesses, Chief Financial Officer, and Chief Information Officer. Earlier in his career, Mr. Chen served as Vice President – Finance for Wiremold | Legrand (PARIS: LR.PA); Chief Financial Officer for Bayliner Marine Corp., a division of the Brunswick Corp. (NYSE: BC); and held various financial planning and strategic development roles for AlliedSignal, Inc. (NYSE: ALD). Mr. Chen currently serves as Chairman of the Board for Roberts Hawaii, Inc., and Hisco, Inc. He is also a Counselor of the American Welding Society and a Board Trustee of the American Welding Society Foundation. Mr. Chen holds an MBA from the University of Illinois at Urbana-Champaign, a B.S. in Applied Mathematics from the University of California at Los Angeles, and several U.S. patents.

TJ Chung—Class III Director. Mr. Chung has served as a director of Fathom since December 2021. Mr. Chung is a Founding Partner at CORE Industrial Partners. Before joining CORE, he spent 15 years as Chief Executive Officer / President of several high-growth electronics and technology businesses, all of which were private equity-backed or divisions of publicly traded corporations. He currently serves on the boards of Fathom OpCo, J&K Ingredients, Littlefuse (NASDAQ: LFUS), Airgain (NASDAQ: AIRG) and Mastercraft (NASDAQ: MCFT). Mr. Chung holds an MBA from Duke University’s Fuqua School of Business, a MS in Computer Science from North Carolina State University and a B.S. in Electrical Engineering from the University of Texas at Austin. He also serves on the advisory board of the Cockrell School of Engineering at the University of Texas at Austin and the advisory board of the Center of Entrepreneurship and Innovation at Duke University’s Fuqua School of Business.

David Fisher—Class III Director. Mr. Fisher has served as a director of Fathom since December 2021. Mr. Fisher has served as Chief Executive Officer and President of Enova International, Inc. (NYSE: ENVA), a provider of online financial services, since January 2013, and as Chairman of the Board of Directors of Enova since November 2014. From September 2011 to March 2012, Mr. Fisher served as Chief Executive Officer of optionsXpress Holdings, Inc. (“optionsXpress”), a retail online brokerage firm, and as Senior Vice President of Charles Schwab Corporation following its acquisition of optionsXpress. From October 2007 to September 2011, Mr. Fisher served as Chief Executive Officer of optionsXpress, from March 2007 to October 2007, as its President, and, from August 2004 to March 2007, as its Chief Financial Officer. Prior to joining optionsXpress, Mr. Fisher served as the Chief Financial Officer of Potbelly Sandwich Works from 2001 through 2004, of RBC Mortgage from 2000 through 2001 and of Prism Financial from December 1998 through January 2001. Mr. Fisher currently serves as a member of the board of directors GoHealth (NASDAQ: GOCO), a leading health insurance marketplace and Medicare-focused digital health company, and of FRISS, a provider of software solutions to insurance companies. He previously served on the board of directors of Just Eat Takeaway.com N.V., GrubHub, Inc. (NASDAQ: GRUB), Innerworkings, Inc. and Chicago Board Options Exchange. Mr. Fisher also serves on the Board of Trustees of the Museum of Science and Industry in Chicago. Mr. Fisher holds a B.S. in Finance from the University of Illinois at Urbana-Champaign and a J.D. from Northwestern University School of Law.

6

Maria Green—Class II Director. Ms. Green has served as a director of Fathom since December 2021. Ms. Green retired as Senior Vice President and General Counsel of Ingersoll Rand plc (NYSE: IR) in June 2019. Immediately prior to IR, she was Senior Vice President, General Counsel and Secretary at Illinois Tool Works (NYSE: ITW). During her 18 years with ITW, Ms. Green guided the company’s expansion through both acquisitions and organic growth. As General Counsel, she led the Environmental, Health and Safety Group as well as Government Affairs and Risk Management. At Ingersoll Rand, Ms. Green was a member of the Executive Leadership Team and a trusted advisor to the Chief Executive Officer on legal, compliance and strategy issues and led a team of 75 lawyers based in the U.S., Europe, Asia Pacific and Latin America. She co-chaired the Global Business Integrity Council and served as executive sponsor for an employee resource group. Ms. Green joined the board of Tennant Company (NYSE: TNC) as an independent director in March 2019 (Audit and Governance Committees) and was elected to the board of Wisconsin Energy Group (NYSE: WEC) in July 2019 (Audit and Governance Committees). Most recently, Ms. Green joined the board of directors of Littlefuse (NASDAQ: LFUS) in February 2020 (Audit and Governance Committees). Ms. Green holds a B.A. from the University of Pennsylvania and JD from Boston University Law School.

Peter Leemputte—Class II Director. Mr. Leemputte has served as a director of Fathom since December 2021. Mr. Leemputte was Chief Financial Officer and Treasurer at Keurig Green Mountain, Inc. (NASDAQ: KDP) from 2015 to 2016. Prior to Keurig Green Mountain, Inc., Mr. Leemputte was Executive Vice President and Chief Financial Officer at Mead Johnson Nutrition (NYSE: MJN) from 2008 to 2015. Before joining Mead Johnson Nutrition, Mr. Leemputte was Senior Vice President and Chief Financial Officer for Brunswick Corp. (NYSE: BC), and Chicago Title Corp. He has also held various management positions at Mercer Management Consulting, Armco Inc., FMC Corp. and BP (NYSE: BP). Mr. Leemputte has extensive experience in leading finance, accounting, IT, tax, audit and investor relations functions as a Chief Financial Officer at major U.S. corporations, and also led several IPO’s and sale of the companies. Mr. Leemputte has served on the board of Mastercraft (NASDAQ: MCFT) since 2016, Ecogensus LLC (privately held) since 2018, and served on the board of Beazer Homes (NYSE: BZH) from 2005 to 2020. Mr. Leemputte holds an MBA in Finance from the University of Chicago Booth School of Business and a B.S. in Chemical Engineering from Washington University in St. Louis.

John May—Class III Director. Mr. May has served as a director of Fathom since December 2021. Mr. May is the Founder and Managing Partner of CORE Industrial Partners. Before founding CORE, he spent 18 years working on transactions with several private equity sponsors, principally with the Blackstone Group (NYSE: BX) and H.I.G. Capital. In addition to Fathom's board, he currently serves on the boards all other CORE portfolio companies including Arizona Natural Resources, J&K Ingredients, Kelvix, Saylite, TCG Legacy, 3DXTECH, CGI Automated Manufacturing and RE3DTECH. Mr. May has both served on the board and was a divisional Chief Executive Officer for a public company. Mr. May graduated with Honors from East Carolina University with a business degree. He currently serves on the East Carolina University Foundation, Inc. Board of Directors and is Co-Vice Chair of the Investment Committee. He is also Co-Founder and Chairman of the Board for Imerman Angels, a 501(c)(3) Chicago-based cancer support organization. He also is an active member of YPO (Young Presidents’ Organization), a member of the Economic Club of Chicago and an Advisory Board member of the Industrial Exchange.

Robert Nardelli—Class II Director. Mr. Nardelli has served as a director of Fathom since December 2021. Mr. Nardelli was Chairman and Chief Executive Officer of Chrysler Corp. from 2007 to 2009. Prior to Chrysler, he was Chairman, President and Chief Executive Officer of The Home Depot (NYSE: HD). Before joining The Home Depot, he spent nearly 30 years at General Electric (NYSE: GE), holding the positions of President and Chief Executive Officer of GE Transportation Systems and Chief Executive Officer of GE Power Systems, among several other executive positions. In 2009, Mr. Nardelli joined Cerberus Capital Management as Chief Executive Officer of its operations group, Cerberus Operations and Advisory Company. For the next three years, he and his team turned around several distressed portfolio companies and developed a comprehensive turnaround toolkit. In 2012, Mr. Nardelli founded XLR-8, where he continues to play a key role as Senior Advisor to leading companies. Mr. Nardelli serves as a Partner and Senior Advisor to Emigrant Capital Corp.; Senior Advisor to EY, among others plus a number of equity investments. He sits on the Board of Directors for BWXT Technologies, Inc. (NYSE: BWXT), plus on the board of a number of private equity investment firms. Mr. Nardelli holds an MBA from the University of Louisville and a B.S. from Western Illinois University.

Board Composition

Our Charter and Bylaws provide for a classified Board consisting of three classes of directors, each serving staggered three-year terms, as follows:

• Our Class I directors are Dr. Caralynn Nowinski Collens, Adam DeWitt and Ryan Martin, and their initial terms expire at the Annual Meeting;

• Our Class II directors are Maria Green, Peter Leemputte and Robert Nardelli, and their terms will expire at the annual meeting of stockholders for the calendar year ended December 31, 2024; and

• Our Class III directors are Carey Chen, TJ Chung, David Fisher, and John May, and their terms will expire at the annual meeting of stockholders for the calendar year ended December 31, 2025.

Upon expiration of the term of a class of directors, directors for that class will be elected for three-year terms at the annual meeting of stockholders in the year in which that term expires. Each director’s term continues until the election and qualification of his or her successor or his or her earlier death, resignation or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors.

7

In addition, in connection with the Business Combination, we entered into an investor rights agreement pursuant to which we granted to the CORE Investors the right to designate nominees to our Board subject to the maintenance of certain ownership requirements. See Item 13. “Certain Relationships and Related Party Transactions, and Director Independence — Investor Rights Agreement” for additional information.

Committees of the Board

We have an Audit Committee (the “Audit Committee”), a Compensation Committee (the “Compensation Committee”) and the Nominating Committee of our Board, and we have such other committees as the Board shall determine from time to time. Each of the standing committees of the Board have the composition and responsibilities described below.

Each of these committees has a charter, which, along with our Code of Business Ethics and Conduct are available on our website at www.fathommfg.com. To the extent required by law, any amendments to the code, or any waivers of its requirements, are disclosed on our website. The information on our website is not part of this proxy statement and is not deemed to be incorporated by reference herein.

Audit Committee

The Audit Committee consists of Dr. Nowinski Collens and Messrs. Dewitt, Leemputte, and Nardelli, with Mr. Leemputte serving as Chair. The Audit Committee assists the Board in overseeing our accounting and financial reporting processes and the audits of our financial statements. Our Board has affirmatively determined that each of Dr. Nowinski Collens and Messrs. DeWitt, Leemputte and Nardelli meets the definition of “independent director” for purposes of the applicable stock exchange rules and the independence requirements of Rule10A-3under the Exchange Act. Our Board has also determined that each of Messrs. Dewitt, Leemputte, and Nardelli qualifies as an “audit committee financial expert” as defined by SEC rules.

Subject to a one-year phase-in period, The Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and stock exchange rules require an audit committee consisting of at least three members, each of whom must meet applicable standards of independent directors. Applicable stock exchange rules require that each member of the audit committee be financially literate and that at least one member of the audit committee have accounting or related financial management expertise.

Sarbanes-Oxley requires companies to disclose whether they have an “audit committee financial expert,” as defined by the SEC, on the audit committee. Generally, a director who satisfies the SEC’s “audit committee financial expert” definition will be deemed by the board of directors to satisfy the applicable stock market’s requirement that at least one member of the audit committee have accounting or related financial management expertise.

Compensation Committee

The Compensation Committee consists of Messrs. Fisher and Leemputte, Ms. Green, and Dr. Nowinski Collens, with Mr. Fisher serving as Chair. Because we are a “controlled company” within the meaning of the applicable stock exchange’s corporate governance standards, we are not required to have a fully independent compensation committee.

The Compensation Committee establishes salaries, incentives and other forms of compensation for officers and other employees. The Compensation Committee also administers our incentive compensation and benefit plans. If and when we are no longer a “controlled company” within the meaning of the applicable stock exchange’s corporate governance standards, our Compensation Committee will be required to comply with SEC and NYSE corporate governance standards.

Nominating and Corporate Governance Committee

The Nominating Committee consists of Messrs. DeWitt, Fisher and Nardelli, and Ms. Green, with Mr. Nardelli serving as Chair. This committee identifies, evaluates and recommends qualified nominees to serve on our Board, develops and oversees our internal corporate governance processes and maintains a management succession plan.

Because we are a “controlled company” within the meaning of the applicable stock exchange’s corporate governance standards, we are not required to have a fully independent Nominating Committee. If and when we are no longer a “controlled company” within the meaning of the applicable stock exchange’s corporate governance standards, the Nominating Committee will be required to comply with SEC and NYSE corporate governance standards.

Board and Committee Self-Evaluations

Fathom’s Board is a strong believer in continuous improvement. Accordingly, our Board utilizes a comprehensive, multi-part process for its ongoing self-evaluation to ensure that the Board and its committees are operating effectively and that their processes reflect best practices. Our Board believes that this process supports continuous improvement and provides opportunities to strengthen Board and its committees’ effectiveness.

8

Each year, the Nominating Committee oversees the self-evaluation process to ensure that the full Board and each committee conduct an assessment of their performance and solicit feedback for enhancement and improvement. The Board conducts an annual self-evaluation to review the effectiveness of the Board and its committees, led by Nominating Committee. In this comprehensive review, the annual self-evaluation process has among other things focused on:

• The composition of the Board, including the size, mix of skills and experience;

• The promotion of rigorous discussion and decision making by the Board and its committees;

• The number, delegated authority, composition and leadership of its committees;

• The overall functioning of the Board, its leadership and its committees;

• The quality and scope of the materials distributed in advance of meetings; and

• The Board’s access to Company executives and operations.

Self-evaluation items requiring follow-up and execution are monitored on an ongoing basis by the Board, each of the committees, and by management.

Controlled Company Exemption

Immediately following the completion of the Business Combination, the CORE Investors beneficially owned approximately 63.1% of our Class A Shares and Class B Shares, which generally votes together as a single class on matters submitted to a vote of our stockholders, including the election of directors. (The CORE Investors beneficially own approximately 62.9% of our Class A Shares and Class B Shares as of April 27, 2023.) Because more than 50% of the voting power for the election of directors of Fathom is held by the CORE Investors, Fathom is a “controlled company” under the NYSE listing requirements. If Fathom were to elect to take advantage of available listing requirement exemptions as a “controlled company” under the NYSE listing standards, Fathom would not be subject to the requirements that would otherwise require us to have: (i) a majority of “independent directors,” as defined under the listing standards of the NYSE; (ii) a nominating committee consisting solely of independent directors; (iii) compensation of our executive officers determined by a majority of the independent directors or a compensation committee consisting solely of independent directors; and (iv) director nominees selected, or recommended for our board’s selection, either by a majority of the independent directors or a nominating committee consisting solely of independent directors. Fathom may in the future elect to take advantage of the foregoing controlled company exemptions from the NYSE board and board committee independence requirements, but it has elected initially and presently to comply with the independence requirements applicable to non-controlled companies.

Director Independence

NYSE listing standards require that a majority of our Board be independent, subject to the controlled company exception. An “independent director” is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which in the opinion of the Board, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director.

Based on the NYSE independence guidelines, the Board has affirmatively determined that: (i) six of our current directors, Dr. Nowinski Collens and Ms. Green and Messrs. DeWitt, Fisher, Leemputte and Nardelli (A) have no relationships or only immaterial relationships with us, (B) meet the NYSE independence guidelines with respect to any such relationships and (C) are independent; and (ii) four of our current directors, Messrs. Chen, Chung, Martin and May are deemed not independent as Messrs. Chen, Chung and May are affiliated with the CORE Investors and Mr. Martin is our Chief Executive Officer (“CEO”).

Board’s Role in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. Our Board administers this oversight function directly, with support from its three standing committees, the Audit Committee, the Compensation Committee and the Nominating Committee, each of which addresses risks specific to its respective areas of oversight. In particular, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk taking. Our Nominating Committee provides oversight with respect to governance-related risks and monitors the effectiveness of our Corporate Governance Guidelines.

9

Other Board Information

Leadership Structure of the Board

We believe that the structure of our Board and its committees provides strong overall management of our Company. In accordance with our Corporate Governance Guidelines, our Board does not currently have a policy as to whether the offices of the Chair of the Board and CEO should be separate. Our Board, in consultation with our Nominating Committee, believes that it should have the flexibility to make this determination as circumstances require, and in a manner that it believes is best to provide appropriate leadership. Pursuant to our Corporate Governance Guidelines, from time to time, our Board may determine that it should have a Lead Independent Director who may perform such additional duties as our Board may otherwise determine and delegate. Our Nominating Committee will periodically consider our Board’s leadership structure and make recommendations to change the structure as it deems appropriate. Currently, Mr. Chung serves as our Chairman of the Board and Mr. Martin serves as our CEO and we do not have a Lead Independent Director. The Board believes that this overall structure meets the current corporate governance needs and oversight responsibilities of the Board. Mr. Chung oversees all Board meetings. Moreover, the Board believes that the independent directors, comprising a majority of the Board, provide effective oversight of management.

Director Attendance at Board Meetings and Annual Meeting of Stockholders

In 2022, the Board held four meetings. The Audit Committee met six times, the Compensation Committee met four times, and the Nominating Committee met three times. The Board and the Nominating Committee recognize the importance of director attendance at Board and committee meetings. In 2022:

• All directors attended all Board meetings; and

• Attendance for committee meetings was at least 75% for each director.

Due to the timing of the December 2021 Business Combination, Fathom did not hold an annual meeting of stockholders in 2022. Fathom has no formal policy on director attendance at annual meetings of stockholders, but members of the Board are strongly encouraged to attend annual meetings of stockholders.

Meetings of Non-Employee Directors

In accordance with our Corporate Governance Guidelines and the listing standards of the NYSE, our non-employee directors meet regularly in executive sessions of the Board without management present. Historically, Mr. Leemputte or Mr. Nardelli have typically presided over these executive sessions. Additionally, executive sessions of the non-management directors are led by the Chairs of the Compensation and Audit Committees, respectively, at least once per year.

Code of Business Ethics and Conduct

We have adopted a Code of Business Ethics and Conduct that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer, which is available on our website at https://investors.fathommfg.com/leadership-and-governance/governance-documents/default.aspx. The information on, or otherwise accessible through, our website does not constitute a part of this proxy statement. To the extent required by law, we expect to disclose any amendments to the code, or any waivers of its requirements, on our website.

Corporate Governance Guidelines

Our Board adheres to governance principles designed to ensure the continued vitality of the Board and excellence in the execution of its duties. The Board has had in place a set of Corporate Governance Guidelines reflecting these principles, including the Board’s policy of requiring a majority of the Board to be consist of independent directors (except as otherwise permitted by NYSE rules. See “---Controlled Company Exemption” above), the importance of stock ownership by the Board to align the interests of directors and stockholders, and access by the Board to Company management and independent advisors. Our Corporate Governance Guidelines are available on our website at https://investors.fathommfg.com/leadership-and-governance/governance-documents/default.aspx.

10

Communications to the Board

Stockholders and interested parties can contact the Board (including the Chairman of the Board and non-employee directors) through email at michael.cimini@fathommfg.com or through written communication sent to Fathom Digital Manufacturing Corporation, 1050 Walnut Ridge Drive, Hartland, Wisconsin 53029. Our Director, Investor Relations reviews all written communications and forwards to the Board a summary and/or copies of any such correspondence that is directed to the Board or that, in the opinion of the Director, Investor Relations, deals with the functions of the Board or Board committees or that she otherwise determines requires the Board’s or any Board committee’s attention. Concerns relating to accounting, internal accounting controls or auditing matters are immediately brought to the attention of our Chief Financial Officer and handled in accordance with procedures established by the Audit Committee with respect to such matters. From time to time, the Board may change the process by which stockholders may communicate with the Board.

Communications of a confidential nature can be made directly to our non-employee directors or the Chair of the Audit Committee regarding any matter, including any accounting, internal accounting control or auditing matter, by submitting such concerns to the Audit Committee. Any submissions to the Audit Committee should be marked confidential and addressed to the Chair of the Audit Committee, c/o Fathom, 1050 Walnut Ridge Drive, Hartland, Wisconsin 53029.

Limitation on Liability and Indemnification Matters

Our Charter contains provisions that limit the personal liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, our directors will not be personally liable to us or our stockholders arising from a breach of fiduciary duty as a director, unless:

• the presumption that directors are acting in good faith, on an informed basis, and with a view to the best interests of us and our stockholders has been rebutted; and

• it is proven that the director’s act or failure to act constituted a breach of his or her fiduciary duties as a director and such breach involved intentional misconduct, a knowing violation of law or receipt of an improper personal benefit.

Executive Officers of the Company

Set forth below is information concerning our executive officers as of May 12, 2023:

|

|

|

|

|

Name |

|

Age |

|

Position |

Ryan Martin(1) |

|

44 |

|

Director and Chief Executive Officer |

Mark Frost |

|

59 |

|

Chief Financial Officer |

Kurt Bork |

|

45 |

|

Vice President of Sales |

Ryan Martin—Director and CEO. Mr. Martin has served as the CEO of Fathom since January 2019 and as a Director of Fathom since December 2021. During this time, he has led the company through unprecedented growth, digital transformation, and multiple add-on acquisitions, which have rapidly expanded Fathom into one of the largest privately held digital manufacturers in North America. Prior to his role at Fathom, he most recently spent over 13 years in leadership roles at General Electric Company (NYSE: GE) spanning across sales, marketing, product development and general management. In his last role at GE, he served as an Executive on the GE additive leadership team ("GE Additive"), where he led the integration and expansion of the commercial team which experienced exponential growth and record-breaking orders in 2018. He was also critical in the integration of two international acquisitions into GE Additive and led the commercialization of multiple new products that GE Additive brought to the market. Mr. Martin graduated with Honors from the Ivy College of Business at Iowa State University. He is also an active member of YPO (Young Presidents Organization).

Mark Frost—CFO. Mr. Frost has served as the CFO at Fathom OpCo since April 2021. He brings over 30 years of financial and executive level management experience from both private and public companies. Most recently, Mr. Frost served as the Chief Financial Officer of Argon Medical Devices. Prior to Argon, Mr. Frost served as the Chief Financial Officer for three public healthcare companies including Analogic (NASDAQ: ALOG), AngioDynamics (NASDAQ: ANGO) and AMRI (NASDAQ: AMRI). Mr. Frost began his career with General Electric (NYSE: GE), where he served in a variety of roles in finance for 14 years. Mr. Frost holds a BA in International Relations and Economics from Colgate University. He is also a graduate of the INSEAD Global Executive Program and GE Financial Management Program.

Kurt Bork – Vice President of Sales. Mr. Bork has served as the Vice President of Sales and Marketing at Fathom since March 2023. Mr. Bork has more than 20 years of industry experience. Mr. Bork previously served as Vice President of Sales and Business Development at Mayville Engineering Company (NYSE: MEC), a publicly traded, Wisconsin-based company that provides a variety of manufacturing solutions across diverse end-markets. During his nine-year tenure at MEC, Mr. Bork led commercial and business development activities for the company’s extensive manufacturing infrastructure, including 20 facilities across the U.S. Prior to MEC he was Vice President, Business Development for ATEK Metal Technologies where he oversaw the business development efforts for the company’s highly engineered aluminum castings. Mr. Bork holds a MBA and a B.A. from Marquette University.

11

There are no family relationships among any of the directors or executive officers of the Company.

Delinquent Section16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who beneficially own more than 10% of our outstanding common stock to file reports of their stock ownership and changes in their ownership of our common stock with the SEC. To the Company’s knowledge, including the Company’s review of the copies of all such reports furnished to the Company and written representations that no other reports were required in 2022, all Section 16(a) filing requirements were satisfied on a timely basis, except the following reports: (i) one Form 4 filed in October 2022 (reporting one transaction) for Robert Nardelli, (ii) one Form 4 filed in October 2022 (reporting one transaction) for Richard Stump, and (iii) one Form 4 filed in October 2022 (reporting one transaction) for Carey Chen.

As an emerging growth company, we have opted to comply with the executive compensation disclosure rules applicable to smaller reporting companies, as such term is defined in the rules promulgated under the Securities Act. This section describes the material components of the executive compensation program for our CEO and our two other most highly compensated executive officers serving on December 31, 2022 whom we refer to as our Named Executive Officers (“NEOs”).

Introduction

For the fiscal year ended December 31, 2022, Fathom’s NEOs were:

•Richard Stump, Former Chief Commercial Officer.

The objective of Fathom’s compensation program is to provide a total compensation package to each NEO that will enable Fathom to attract, motivate and retain outstanding individuals, align the interests of our executive team with those of our stockholders, encourage individual and collective contributions to the successful execution of our short and long-term business strategies, and reward NEOs for favorable performance.

Summary Compensation Table

The following table shows information concerning the annual compensation for services provided to Fathom by our NEOs during the fiscal years ended December 31, 2022 and 2021. Additional information on our NEOs annual compensation for the 2022 fiscal year is provided in the narrative sections following the Summary Compensation Table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Position |

Year |

|

Salary ($) |

|

|

Bonus ($)(1) |

|

|

Stock Awards($)(2)(4) |

|

|

Option Awards($) (3)(4) |

|

|

Non-Equity Incentive Plan Compensation ($) |

|

|

All Other Compensation ($)(5) |

|

|

Total ($) |

|

Ryan Martin |

2022 |

$ |

|

425,500 |

|

|

— |

|

$ |

|

450,002 |

|

$ |

|

450,003 |

|

$ |

— |

|

$ |

|

31,325 |

|

$ |

|

1,356,830 |

|

Chief Executive Officer |

2021 |

$ |

|

335,827 |

|

|

$ |

100,000 |

|

$ |

|

13,965,579 |

|

$ |

— |

|

$ |

|

231,800 |

|

$ |

|

29,539 |

|

$ |

|

14,662,745 |

|

Mark Frost |

2022 |

$ |

|

350,192 |

|

|

— |

|

$ |

|

300,003 |

|

$ |

|

300,002 |

|

$ |

— |

|

$ |

|

10,869 |

|

$ |

|

961,066 |

|

Chief Financial Officer |

2021 |

$ |

|

225,000 |

|

|

— |

|

$ |

|

5,385,282 |

|

$ |

— |

|

$ |

|

163,883 |

|

$ |

|

40,293 |

|

$ |

|

5,814,458 |

|

Richard Stump |

2022 |

$ |

|

350,192 |

|

|

$ |

250,000 |

|

$ |

|

300,003 |

|

$ |

|

300,002 |

|

$ |

— |

|

$ |

|

12,200 |

|

$ |

|

1,212,397 |

|

Former Chief Commercial Officer |

2021 |

$ |

|

294,279 |

|

|

$ |

50,000 |

|

$ |

|

5,431,059 |

|

$ |

— |

|

$ |

|

163,833 |

|

$ |

|

11,600 |

|

$ |

|

5,950,771 |

|

(1)The amount reported in this column for Mr. Stump in 2022 represents a retention bonus (as described in more detail under “—Retention Bonus”).

(2)The amounts reported in this column for 2022 reflect the aggregate grant date fair value of restricted stock units (“RSUs”) awarded under the Fathom 2021 Omnibus Incentive Plan (the “2021 Omnibus Plan”) during 2022. The grant date fair value of the RSUs has been determined in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 718.

(3)The amounts reported in this column for 2022 represent the grant date fair value of nonqualified stock options under the 2021 Omnibus Plan granted during 2022. The grant date fair value of the options has been determined in accordance with ASC Topic 718.

(4)With respect to the amounts reported in these columns, there can be no assurance that these values will ever be realized. See Note 13, “Share-Based Compensation,” to the consolidated financial statements filed herewith in our Annual Report for the assumptions made in determining these values.

12

(5)The amounts in this column represent 401(k) plan matching contributions made to each NEO in the amount of $12,200 for Mr. Martin, an annual amount representing Mr. Martin’s $7,125 premium reimbursement for individual life insurance and $1,000 per month auto allowance.

(6)As previously disclosed, on March 30, 2023 Mr. Stump notified the Company of his intent to resign from employment, effective September 30, 2023 (the “Stump Separation Date”). In anticipation of his notice of resignation, Mr. Stump ceased being an executive officer of the Company effective March 30, 2023, but will continue to serve as a non-executive employee of the Company, in a transition and advisory role, until the Stump Separation Date (the “Stump Transition”).

Base Salaries

Base salary is paid to attract and retain qualified talent and is set at a level that is commensurate with the executive’s duties and authorities, contributions, prior experience and sustained performance, as well as considering market competitive levels. For 2022, the NEOs had the following base salary rates: Mr. Martin—$425,000, Mr. Stump—$350,000 and Mr. Frost—$350,000.

Annual Cash Bonuses

Annual cash bonuses can be earned if the NEOs achieve certain annual financial and operating performance metrics. For the 2022 performance year, target bonus opportunities as a percent of salary were Mr. Martin 100% of salary and Messrs. Frost and Stump 60% of base salary, with a maximum performance-based payout of up to 200% of target. In 2022, no annual cash bonuses were earned since performance was below the threshold goals set at the start of the year.

Retention Bonus

In March 2022, Mr. Stump received a retention performance bonus of $250,000. The bonus was pursuant to a 2020 amendment to his September 23, 2019 employment agreement (with such employment agreement otherwise being superseded by the Stump Offer Letter as defined in “—Agreements with our NEOs”), whereby if he remained employed following the delivery of the audited financial statements of Fathom OpCo for the 12 month period ending December 31, 2021, he would be eligible for a retention bonus of $250,000.

Employee Benefits

In addition to any individual benefits set forth in each NEOs employment arrangements (described below), the NEOs are generally eligible to participate in our executive and employee health and welfare, retirement and other employee benefit programs on the same basis as other employees of Fathom, subject to applicable law. Each NEO participates in the Midwest Composite Technologies, LLC 401(k) Profit Sharing Plan, sponsored by Fathom’s indirect subsidiary Midwest Composite Technologies, LLC under which eligible employees may elect to contribute a portion of their eligible compensation as pre-tax or Roth deferrals in accordance with the limitations imposed under the Internal Revenue Code of 1986, as amended (the “Code”). The plan provides for a safe harbor matching contribution equal to 100% of a participant’s salary deferrals, up to 4% of a participant’s total compensation, subject to limitations imposed under the Code. Other than the Fathom Executive Severance and Change in Control Plan (the “Severance Plan”), described in more detail below under Potential Payments Upon Termination or Change in Control, Fathom did not maintain any executive-specific benefit programs in 2022.

2021 Omnibus Incentive Plan

We established the 2021 Omnibus Plan in connection with the closing of the Business Combination in 2021. The purpose of the Omnibus Plan is: (i) to encourage profitability and growth through short-term and long-term incentives that are consistent with Fathom’s objectives; (ii) to give its participants an incentive for excellence in individual performance; (iii) to promote teamwork among its participants; and (iv) to give us a significant advantage in attracting and retaining key employees, directors, and consultants. The 2021 Omnibus Plan provides for the grant of awards in the form of incentive stock options within the meaning of Section 422 of the Code, nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, performance-based awards (including performance shares, performance units and performance bonus awards), and other stock-based or cash-based awards. A total of 16,737,876 Class A Shares was initially reserved and available for issuance under the 2021 Omnibus Plan.

Equity Incentive Awards

For regular annual equity grants in 2022, executives including the NEOs, received RSUs and nonqualified stock options that were equally weighted based on the fair value at date of grant. On February 25, 2022, the Company granted the following RSUs and options to the NEOs: 50,619 RSUs and 103,687 options to Mr. Martin, and 33,746 RSUs and 69,125 options to each of Messrs. Frost and Stump. The RSUs and options vest ratably in annual equal installments over three years, generally subject to the continued service of the NEO through each applicable vesting date.

Prior to the closing of the Business Combination, our employees were employed by Fathom OpCo, which was formed in April 2021 in connection with a series of transactions (the “Reorganization”) whereby Fathom OpCo became the direct parent to MCT Group Holdings, LLC (and its subsidiaries), a Delaware limited liability company (“MCT Holdings”), and Incodema Holdings, LLC, a Delaware limited liability company (“Incodema Holdings”). Following the closing of the Business Combination, Fathom became the managing member of Fathom OpCo

13

and the employer to Fathom OpCo’s employees. Historically, Fathom OpCo maintained the MCT Group Holdings, LLC 2019 Phantom Equity Bonus Plan (the “MCT Phantom Plan”) and the Incodema Holdings LLC 2020 Phantom Equity Bonus Plan (the “Incodema Phantom Plan,” together with the MCT Phantom Plan, the “Prior Phantom Plans”) Messrs. Martin and Stump participated under the MCT Phantom Plan and were eligible to receive awards of phantom equity at the discretion of the board of managers of MCT Holdings. In April 2021, prior to the Reorganization, Mr. Stump received an award of 500 phantom units under the MCT Phantom Plan. Messrs. Martin and Frost did not receive any phantom equity awards under the Prior Phantom Plans in 2021.

Phantom equity units awarded to Messrs. Martin and Stump in 2021 and prior years under the MCT Phantom Plan were subject to the following vesting conditions: (i) 25% would vest subject to the NEOs continued service with the MCT Group on each of the first four anniversaries of the NEOs employment commencement date, and would be accelerated in connection with a change in control of MCT Holdings; and (ii) 75% would vest if MCT Holdings’ investors realized a multiple on invested capital equal to at least 2.0x in connection with a change in control of MCT Holdings.

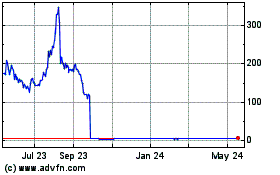

In connection with the Reorganization, the Prior Phantom Plans and all awards outstanding thereunder were terminated and replaced by a single phantom equity plan sponsored by Fathom OpCo and new awards thereunder, all of which contained terms and conditions that were substantially similar to the Prior Phantom Plans (the “Combined Phantom Plan”) and awards. The Combined Phantom Plan had a pool of phantom units equal to up to 10% of the total value receivable by common unit holders of Fathom OpCo on a sale of Fathom OpCo. Only 62.5% of the pool, or 6.25% of the total value receivable by common unit holders of Fathom OpCo on a sale of Fathom OpCo, had been granted prior to the Business Combination. Mr. Frost received a grant of 1,000 phantom units under the Combined Phantom Plan in July 2021 and Messrs. Martin and Stump’s awards under the Prior Phantom Plans were terminated and replaced by phantom units under the Combined Phantom Plan.