UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

November 2024

Commission File Number: 001-35158

PHOENIX NEW MEDIA LIMITED

Sinolight Plaza, Floor 16

No. 4 Qiyang Road

Wangjing, Chaoyang District, Beijing, 100102

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

TABLE OF CONTENTS

Exhibit 99.1 — Press release: Phoenix New Media Reports Third Quarter 2024 Unaudited Financial Results

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

PHOENIX NEW MEDIA LIMITED |

|

|

|

|

By: |

|

/s/ Edward Lu |

|

|

Name: |

|

Edward Lu |

|

|

Title: |

|

Chief Financial Officer |

|

Date: November 12, 2024 |

|

|

Exhibit 99.1

Phoenix New Media Reports Third Quarter 2024 Unaudited Financial Results

Live Conference Call to be Held at 8:30 PM U.S. Eastern Time on November 12, 2024

BEIJING, China, November 13, 2024 — Phoenix New Media Limited (NYSE: FENG) (“Phoenix New Media”, “ifeng” or the “Company”), a leading new media company in China, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Mr. Yusheng Sun, CEO of Phoenix New Media, stated, “During the third quarter, we continued to prioritize quality content dissemination, enhancing our media influence through exclusive reports and original content. Meanwhile, by expanding our marketing resources and optimizing our client portfolio, we continuously strengthened our monetization capabilities. Going forward, we will continue to encourage collaboration and innovation between content and marketing, and optimize our management and operational efficiency to ensure the healthy and sustainable development of our business.”

Third Quarter 2024 Financial Results

REVENUES

Total revenues in the third quarter of 2024 increased by 7.0% to RMB164.3 million (US$23.4 million) from RMB153.6 million in the same period of 2023, primarily due to the year-over-year increase in the Company’s net advertising revenues.

Net advertising revenues in the third quarter of 2024 increased by 10.5% to RMB148.4 million (US$21.1 million) from RMB134.3 million in the same period of 2023.

Paid services revenues in the third quarter of 2024 decreased by 17.6% to RMB15.9 million (US$2.3 million) from RMB19.3 million in the same period of 2023. Paid services revenues comprise (i) revenues from paid contents, mainly including digital reading, audio books, and paid videos, and (ii) revenues from E-commerce and others. Revenues from paid contents in the third quarter of 2024 decreased by 11.4% to RMB10.1 million (US$1.5 million) from RMB11.4 million in the same period of 2023, mainly due to the decrease in the content spending of certain customers in the third quarter of 2024. Revenues from E-commerce and others in the third quarter of 2024 decreased by 26.6% to RMB5.8 million (US$0.8 million) from RMB7.9 million in the same period of 2023, as the Company scaled down its E-commerce business in 2023.

COST OF REVENUES AND GROSS PROFIT

Cost of revenues in the third quarter of 2024 increased by 0.8% to RMB102.0 million (US$14.5 million) from RMB101.2 million in the same period of 2023.

Gross profit in the third quarter of 2024 increased by 18.9% to RMB62.3 million (US$8.9 million) from RMB52.4 million in the same period of 2023. Gross margin in the third quarter of 2024 was 37.9%, as compared to 34.1% in the same period of 2023.

To supplement the financial measures presented in accordance with the United States Generally Accepted Accounting Principles (“GAAP”), the Company has presented certain non-GAAP financial measures in this press release, which excluded the impact of certain reconciling items as stated in the “Use of Non-GAAP Financial Measures” section below. The related reconciliations to GAAP financial measures are presented in the accompanying “Unaudited Reconciliations of Non-GAAP Results of Operation Measures to the Nearest Comparable GAAP Measures.”

Non-GAAP gross margin in the third quarter of 2024, which excluded share-based compensation, increased to 37.9% from 34.4% in the same period of 2023.

OPERATING EXPENSES AND LOSS FROM OPERATIONS

Total operating expenses in the third quarter of 2024 decreased by 3.0% to RMB88.2 million (US$12.6 million) from RMB90.9 million in the same period of 2023, primarily attributable to the Company’s strict cost control measures.

Loss from operations in the third quarter of 2024 was RMB25.9 million (US$3.7 million), compared to loss from operations of RMB38.5 million in the same period of 2023. Operating margin in the third quarter of 2024 was negative 15.8%, compared to negative 25.1% in the same period of 2023.

Non-GAAP loss from operations in the third quarter of 2024, which excluded share-based compensation, was RMB25.9 million (US$3.7 million), compared to non-GAAP loss from operations of RMB37.7 million in the same period of 2023. Non-GAAP operating margin in the third quarter of 2024, which excluded share-based compensation, was negative 15.8%, compared to negative 24.6% in the same period of 2023.

OTHER INCOME OR LOSS

Other income or loss reflects net interest income, foreign currency exchange gain or loss, income or loss from equity investments, including impairment, fair value changes in investments, net, and others, net. Total net other income in the third quarter of 2024 was RMB6.9 million (US$1.0 million), compared to total net other income of RMB13.3 million in the same period of 2023, which mainly consisted of the following items:

•Net interest income in the third quarter of 2024 was RMB5.0 million (US$0.7 million), compared to RMB9.5 million in the same period of 2023.

•Foreign currency exchange gain in the third quarter of 2024 was RMB3.0 million (US$0.4 million), compared to a foreign currency exchange gain of RMB1.8 million in the same period of 2023.

•Others, net, in the third quarter of 2024 was a loss of RMB0.7 million (US$0.1 million), compared to a gain of RMB2.2 million in the same period of 2023. Others, net primarily consists of some non-operating gain or loss.

NET LOSS ATTRIBUTABLE TO PHOENIX NEW MEDIA LIMITED

Net loss attributable to Phoenix New Media Limited in the third quarter of 2024 was RMB18.5 million (US$2.6 million), compared to net loss attributable to Phoenix New Media Limited of RMB21.5 million in the same period of 2023. Net margin in the third quarter of 2024 was negative 11.3%, compared to negative 14.0% in the same period of 2023. Net loss per basic and diluted ordinary share in the third quarter of 2024 was RMB0.03 (US$0.00), compared to net loss per basic and diluted ordinary share of RMB0.04 in the same period of 2023.

Non-GAAP net loss attributable to Phoenix New Media Limited, which excluded share-based compensation, income or loss from equity investments, including impairment, and fair value changes in investments, net, was RMB18.0 million (US$2.6 million) in the third quarter of 2024, compared to non-GAAP net loss attributable to Phoenix New Media Limited of RMB20.5 million in the same period of 2023. Non-GAAP net margin in the third quarter of 2024 was negative 11.0%, compared to negative 13.3% in the same period of 2023. Non-GAAP net loss per basic and diluted ADS in the third quarter of 2024 was RMB1.50 (US$0.21), compared to non-GAAP net loss per basic and diluted ADS of RMB1.69 in the same period of 2023. “ADS(s)” refers to the Company's American Depositary Share(s), each representing 48 Class A ordinary shares of the Company.

In the third quarter of 2024, the Company’s weighted average number of ADSs used in the computation of basic and diluted net loss per ADS was 12,010,776. As of September 30, 2024, the Company had a total of 576,517,237 ordinary shares outstanding, or the equivalent of 12,010,776 ADSs.

CERTAIN BALANCE SHEET ITEMS

As of September 30, 2024, the Company’s cash and cash equivalents, term deposits and short term investments and restricted cash were RMB971.8 million (US$138.5 million).

Business Outlook

For the fourth quarter of 2024, the Company expects its total revenues to be between RMB197.9 million and RMB212.9 million; net advertising revenues are expected to be between RMB180.2 million and RMB190.2 million; and paid services revenues are expected to be between RMB17.7 million and RMB22.7 million.

All of the above forecasts reflect the current and preliminary view of the Company’s management, which are subject to changes and substantial uncertainty, particularly in view of the uncertainty of macroeconomic environment.

Conference Call Information

The Company will hold a conference call at 8:30 p.m. U.S. Eastern Time on November 12, 2024 (November 13, 2024 at 9:30 a.m. Beijing/Hong Kong time) to discuss its third quarter 2024 unaudited financial results and operating performance.

To participate in the call, please register in advance of the conference by clicking here (https://register.vevent.com/register/BIde0db448c1d143ba8f04c0d02d1ac7a3). Upon registering, each participant will receive the participant dial-in numbers and a unique access PIN, which will be used to join the conference call. Please dial in 10 minutes before the call is scheduled to begin.

A live and archived webcast of the conference call will also be available at the Company’s investor relations website at http://ir.ifeng.com.

Use of Non-GAAP Financial Measures

To supplement the consolidated financial statements presented in accordance with the United States Generally Accepted Accounting Principles (“GAAP”), Phoenix New Media Limited uses non-GAAP gross profit, non-GAAP gross margin, non-GAAP income or loss from operations, non-GAAP operating margin, non-GAAP net income or loss attributable to Phoenix New Media Limited, non-GAAP net margin and non-GAAP net income or loss per basic and diluted ADS, each of which is a non-GAAP financial measure. Non-GAAP gross profit is gross profit excluding share-based compensation. Non-GAAP gross margin is non-GAAP gross profit divided by total revenues. Non-GAAP income or loss from operations is income or loss from operations excluding share-based compensation. Non-GAAP operating margin is non-GAAP income or loss from operations divided by total revenues. Non-GAAP net income or loss attributable to Phoenix New Media Limited is net income or loss attributable to Phoenix New Media Limited excluding share-based compensation, income or loss from equity investments, including impairment and fair value changes in investments, net. Non-GAAP net margin is non-GAAP net income or loss attributable to Phoenix New Media Limited divided by total revenues. Non-GAAP net income or loss per basic and diluted ADS is non-GAAP net income or loss attributable to Phoenix New Media Limited divided by weighted average number of basic and diluted ADSs. The Company believes that separate analysis and exclusion of the aforementioned non-GAAP to GAAP reconciling items add clarity to the constituent parts of its performance. The Company reviews these non-GAAP financial measures together with the related GAAP financial measures to obtain a better understanding of its operating performance. It uses these non-GAAP financial measures for planning, forecasting and measuring results against the forecast. The Company believes that using these non-GAAP financial measures to evaluate its business allows both management and investors to assess the Company’s performance against its competitors and ultimately monitor its capacity to generate returns for investors. The Company also believes that these non-GAAP financial measures are useful supplemental information for investors and analysts to assess its operating performance without the effect of items like share-based compensation, income or loss from equity investments, including impairment, and fair value changes in investments, net, which have been and will continue to be significant recurring items. However, the use of these non-GAAP financial measures has material limitations as an analytical tool. One of the limitations of using these non-GAAP financial measures is that they do not include all items that impact the Company’s gross profit, income or loss from operations and net income or loss attributable to Phoenix New Media Limited for the period. In addition, because these non-GAAP financial measures are not calculated in the same manner by all companies, they may not be comparable to other similarly titled measures used by other companies. In light of the foregoing limitations, you should not consider these non-GAAP financial measures in isolation from, or as an alternative to, the financial measures prepared in accordance with GAAP.

Exchange Rate

This announcement contains translations of certain RMB amounts into U.S. dollars (“USD”) at specified rates solely for the convenience of the readers. Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB7.0176 to US$1.00, the noon buying rate in effect on September 30, 2024 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred could be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentations, all percentages are calculated using the numbers presented in the financial information contained in this earnings release.

About Phoenix New Media Limited

Phoenix New Media Limited (NYSE: FENG) is a leading new media company providing premium content on an integrated Internet platform, including PC and mobile, in China. Having originated from a leading global Chinese language TV network based in Hong Kong, Phoenix TV, the Company enables consumers to access professional news and other quality information and share user-generated content on the Internet through their PCs and mobile devices. Phoenix New Media's platform includes its PC channel, consisting of ifeng.com website, which comprises interest-based verticals and interactive services; its mobile channel, consisting of mobile news applications, mobile video application, digital reading applications and mobile Internet website; and its operations with the telecom operators that provides mobile value-added services.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Phoenix New Media’s strategic and operational plans, contain forward-looking statements. Phoenix New Media may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (“SEC”) on Forms 20-F and 6-K, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Phoenix New Media’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s goals and strategies; the Company’s future business development, financial condition and results of operations; the expected growth of online and mobile advertising, online video and mobile paid services markets in China; the Company’s reliance on online and mobile advertising for a majority of its total revenues; the Company’s expectations regarding demand for and market acceptance of its services; the Company’s expectations regarding maintaining and strengthening its relationships with advertisers, partners and customers; the Company’s investment plans and strategies; fluctuations in the Company’s quarterly operating results; the Company’s plans to enhance its user experience, infrastructure and services offerings; competition in its industry in China; and relevant government policies and regulations relating to the Company. Further information regarding these and other risks is included in the Company’s filings with the SEC, including its registration statement on Form F-1, as amended, and its annual reports on Form 20-F. All information provided in this press release and in the attachments is as of the date of this press release, and Phoenix New Media does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries please contact:

Phoenix New Media Limited

Muzi Guo

Email: investorrelations@ifeng.com

Phoenix New Media Limited

Unaudited Condensed Consolidated Balance Sheets

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

September 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

527,407 |

|

|

|

393,924 |

|

|

|

56,134 |

|

Term deposits and short term investments |

|

|

558,765 |

|

|

|

571,456 |

|

|

|

81,432 |

|

Restricted cash |

|

|

7,049 |

|

|

|

6,409 |

|

|

|

913 |

|

Accounts receivable, net |

|

|

293,854 |

|

|

|

325,352 |

|

|

|

46,362 |

|

Amounts due from related parties |

|

|

57,445 |

|

|

|

109,459 |

|

|

|

15,598 |

|

Prepayment and other current assets |

|

|

34,108 |

|

|

|

27,405 |

|

|

|

3,906 |

|

Total current assets |

|

|

1,478,628 |

|

|

|

1,434,005 |

|

|

|

204,345 |

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

7,237 |

|

|

|

5,286 |

|

|

|

753 |

|

Intangible assets, net |

|

|

20,050 |

|

|

|

14,466 |

|

|

|

2,061 |

|

Available-for-sale debt investments |

|

|

309 |

|

|

|

306 |

|

|

|

43 |

|

Equity investments, net |

|

|

101,221 |

|

|

|

97,154 |

|

|

|

13,845 |

|

Deferred tax assets |

|

|

70,170 |

|

|

|

70,170 |

|

|

|

9,999 |

|

Operating lease right-of-use assets, net |

|

|

67,950 |

|

|

|

51,853 |

|

|

|

7,389 |

|

Other non-current assets |

|

|

13,179 |

|

|

|

11,772 |

|

|

|

1,677 |

|

Total non-current assets |

|

|

280,116 |

|

|

|

251,007 |

|

|

|

35,767 |

|

Total assets |

|

|

1,758,744 |

|

|

|

1,685,012 |

|

|

|

240,112 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

122,133 |

|

|

|

140,359 |

|

|

|

20,001 |

|

Amounts due to related parties |

|

|

22,170 |

|

|

|

21,144 |

|

|

|

3,013 |

|

Advances from customers |

|

|

34,197 |

|

|

|

27,789 |

|

|

|

3,960 |

|

Taxes payable |

|

|

170,479 |

|

|

|

174,430 |

|

|

|

24,856 |

|

Salary and welfare payable |

|

|

86,444 |

|

|

|

74,794 |

|

|

|

10,658 |

|

Accrued expenses and other current liabilities |

|

|

71,656 |

|

|

|

64,541 |

|

|

|

9,197 |

|

Operating lease liabilities |

|

|

19,915 |

|

|

|

18,979 |

|

|

|

2,704 |

|

Total current liabilities |

|

|

526,994 |

|

|

|

522,036 |

|

|

|

74,389 |

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Long-term liabilities |

|

|

18,598 |

|

|

|

18,598 |

|

|

|

2,650 |

|

Operating lease liabilities |

|

|

49,529 |

|

|

|

34,467 |

|

|

|

4,912 |

|

Total non-current liabilities |

|

|

68,127 |

|

|

|

53,065 |

|

|

|

7,562 |

|

Total liabilities |

|

|

595,121 |

|

|

|

575,101 |

|

|

|

81,951 |

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

Phoenix New Media Limited shareholders' equity: |

|

|

|

|

|

|

|

|

|

Class A ordinary shares |

|

|

17,499 |

|

|

|

17,499 |

|

|

|

2,494 |

|

Class B ordinary shares |

|

|

22,053 |

|

|

|

22,053 |

|

|

|

3,143 |

|

Additional paid-in capital |

|

|

1,640,535 |

|

|

|

1,641,983 |

|

|

|

233,980 |

|

Treasury stock |

|

|

(655 |

) |

|

|

(1,480 |

) |

|

|

(211 |

) |

Statutory reserves |

|

|

99,342 |

|

|

|

99,342 |

|

|

|

14,156 |

|

Accumulated deficit |

|

|

(513,365 |

) |

|

|

(563,326 |

) |

|

|

(80,273 |

) |

Accumulated other comprehensive loss |

|

|

(40,397 |

) |

|

|

(43,771 |

) |

|

|

(6,237 |

) |

Total Phoenix New Media Limited shareholders' equity |

|

|

1,225,012 |

|

|

|

1,172,300 |

|

|

|

167,052 |

|

Noncontrolling interests |

|

|

(61,389 |

) |

|

|

(62,389 |

) |

|

|

(8,891 |

) |

Total shareholders' equity |

|

|

1,163,623 |

|

|

|

1,109,911 |

|

|

|

158,161 |

|

Total liabilities and shareholders' equity |

|

|

1,758,744 |

|

|

|

1,685,012 |

|

|

|

240,112 |

|

Phoenix New Media Limited

Unaudited Condensed Consolidated Statements of Comprehensive Income/(loss)

(Amounts in thousands, except for number of shares and per share (or ADS) data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net advertising revenues |

|

134,292 |

|

|

|

154,691 |

|

|

|

148,345 |

|

|

|

21,139 |

|

|

|

422,294 |

|

|

|

441,609 |

|

|

|

62,929 |

|

Paid service revenues |

|

19,316 |

|

|

|

13,627 |

|

|

|

15,933 |

|

|

|

2,270 |

|

|

|

57,887 |

|

|

|

43,979 |

|

|

|

6,267 |

|

Total revenues |

|

153,608 |

|

|

|

168,318 |

|

|

|

164,278 |

|

|

|

23,409 |

|

|

|

480,181 |

|

|

|

485,588 |

|

|

|

69,196 |

|

Cost of revenues |

|

(101,249 |

) |

|

|

(102,918 |

) |

|

|

(102,006 |

) |

|

|

(14,536 |

) |

|

|

(343,607 |

) |

|

|

(313,887 |

) |

|

|

(44,729 |

) |

Gross profit |

|

52,359 |

|

|

|

65,400 |

|

|

|

62,272 |

|

|

|

8,873 |

|

|

|

136,574 |

|

|

|

171,701 |

|

|

|

24,467 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

(38,481 |

) |

|

|

(39,592 |

) |

|

|

(44,226 |

) |

|

|

(6,302 |

) |

|

|

(107,007 |

) |

|

|

(120,700 |

) |

|

|

(17,200 |

) |

General and administrative expenses |

|

(34,108 |

) |

|

|

(17,071 |

) |

|

|

(26,689 |

) |

|

|

(3,803 |

) |

|

|

(113,817 |

) |

|

|

(69,891 |

) |

|

|

(9,959 |

) |

Technology and product development expenses |

|

(18,318 |

) |

|

|

(17,676 |

) |

|

|

(17,314 |

) |

|

|

(2,467 |

) |

|

|

(64,375 |

) |

|

|

(52,540 |

) |

|

|

(7,487 |

) |

Total operating expenses |

|

(90,907 |

) |

|

|

(74,339 |

) |

|

|

(88,229 |

) |

|

|

(12,572 |

) |

|

|

(285,199 |

) |

|

|

(243,131 |

) |

|

|

(34,646 |

) |

Loss from operations |

|

(38,548 |

) |

|

|

(8,939 |

) |

|

|

(25,957 |

) |

|

|

(3,699 |

) |

|

|

(148,625 |

) |

|

|

(71,430 |

) |

|

|

(10,179 |

) |

Other income/(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

9,475 |

|

|

|

8,751 |

|

|

|

4,995 |

|

|

|

712 |

|

|

|

27,074 |

|

|

|

23,883 |

|

|

|

3,403 |

|

Foreign currency exchange gain/(loss) |

|

1,827 |

|

|

|

(659 |

) |

|

|

2,953 |

|

|

|

421 |

|

|

|

(4,068 |

) |

|

|

1,892 |

|

|

|

270 |

|

Loss from equity method investments, including impairment |

|

(246 |

) |

|

|

(5,675 |

) |

|

|

(248 |

) |

|

|

(35 |

) |

|

|

(348 |

) |

|

|

(6,112 |

) |

|

|

(871 |

) |

Fair value changes in investments, net |

|

64 |

|

|

|

2,415 |

|

|

|

(174 |

) |

|

|

(25 |

) |

|

|

162 |

|

|

|

2,321 |

|

|

|

331 |

|

Others, net |

|

2,190 |

|

|

|

(91 |

) |

|

|

(658 |

) |

|

|

(94 |

) |

|

|

4,730 |

|

|

|

(663 |

) |

|

|

(94 |

) |

Loss before income taxes |

|

(25,238 |

) |

|

|

(4,198 |

) |

|

|

(19,089 |

) |

|

|

(2,720 |

) |

|

|

(121,075 |

) |

|

|

(50,109 |

) |

|

|

(7,140 |

) |

Income tax benefit/(expense) |

|

3,691 |

|

|

|

(93 |

) |

|

|

(551 |

) |

|

|

(79 |

) |

|

|

4,743 |

|

|

|

(852 |

) |

|

|

(121 |

) |

Net loss |

|

(21,547 |

) |

|

|

(4,291 |

) |

|

|

(19,640 |

) |

|

|

(2,799 |

) |

|

|

(116,332 |

) |

|

|

(50,961 |

) |

|

|

(7,261 |

) |

Net loss/(income) attributable to noncontrolling interests |

|

52 |

|

|

|

(1,170 |

) |

|

|

1,154 |

|

|

|

164 |

|

|

|

5,718 |

|

|

|

1,000 |

|

|

|

142 |

|

Net loss attributable to Phoenix New Media Limited |

|

(21,495 |

) |

|

|

(5,461 |

) |

|

|

(18,486 |

) |

|

|

(2,635 |

) |

|

|

(110,614 |

) |

|

|

(49,961 |

) |

|

|

(7,119 |

) |

Net loss |

|

(21,547 |

) |

|

|

(4,291 |

) |

|

|

(19,640 |

) |

|

|

(2,799 |

) |

|

|

(116,332 |

) |

|

|

(50,961 |

) |

|

|

(7,261 |

) |

Other comprehensive (loss)/income, net of tax: foreign currency translation adjustment |

|

(1,992 |

) |

|

|

952 |

|

|

|

(4,945 |

) |

|

|

(705 |

) |

|

|

8,834 |

|

|

|

(3,374 |

) |

|

|

(481 |

) |

Comprehensive loss |

|

(23,539 |

) |

|

|

(3,339 |

) |

|

|

(24,585 |

) |

|

|

(3,504 |

) |

|

|

(107,498 |

) |

|

|

(54,335 |

) |

|

|

(7,742 |

) |

Comprehensive loss/(income) attributable to noncontrolling interests |

|

52 |

|

|

|

(1,170 |

) |

|

|

1,154 |

|

|

|

164 |

|

|

|

5,718 |

|

|

|

1,000 |

|

|

|

142 |

|

Comprehensive loss attributable to Phoenix New Media Limited |

|

(23,487 |

) |

|

|

(4,509 |

) |

|

|

(23,431 |

) |

|

|

(3,340 |

) |

|

|

(101,780 |

) |

|

|

(53,335 |

) |

|

|

(7,600 |

) |

Net loss per Class A and Class B ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.04 |

) |

|

|

(0.01 |

) |

|

|

(0.03 |

) |

|

|

(0.00 |

) |

|

|

(0.19 |

) |

|

|

(0.09 |

) |

|

|

(0.01 |

) |

Diluted |

|

(0.04 |

) |

|

|

(0.01 |

) |

|

|

(0.03 |

) |

|

|

(0.00 |

) |

|

|

(0.19 |

) |

|

|

(0.09 |

) |

|

|

(0.01 |

) |

Net loss per ADS (1 ADS represents 48 Class A ordinary shares): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(1.77 |

) |

|

|

(0.45 |

) |

|

|

(1.54 |

) |

|

|

(0.22 |

) |

|

|

(9.12 |

) |

|

|

(4.16 |

) |

|

|

(0.59 |

) |

Diluted |

|

(1.77 |

) |

|

|

(0.45 |

) |

|

|

(1.54 |

) |

|

|

(0.22 |

) |

|

|

(9.12 |

) |

|

|

(4.16 |

) |

|

|

(0.59 |

) |

Weighted average number of Class A and Class B ordinary shares used in computing net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

582,324,325 |

|

|

|

576,517,237 |

|

|

|

576,517,237 |

|

|

|

576,517,237 |

|

|

|

582,324,325 |

|

|

|

576,877,332 |

|

|

|

576,877,332 |

|

Diluted |

|

582,324,325 |

|

|

|

576,517,237 |

|

|

|

576,517,237 |

|

|

|

576,517,237 |

|

|

|

582,324,325 |

|

|

|

576,877,332 |

|

|

|

576,877,332 |

|

Phoenix New Media Limited

Unaudited Condensed Segments Information

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net advertising service |

|

134,292 |

|

|

|

154,691 |

|

|

|

148,345 |

|

|

|

21,139 |

|

|

|

422,294 |

|

|

|

441,609 |

|

|

|

62,929 |

|

Paid services |

|

19,316 |

|

|

|

13,627 |

|

|

|

15,933 |

|

|

|

2,270 |

|

|

|

57,887 |

|

|

|

43,979 |

|

|

|

6,267 |

|

Total revenues |

|

153,608 |

|

|

|

168,318 |

|

|

|

164,278 |

|

|

|

23,409 |

|

|

|

480,181 |

|

|

|

485,588 |

|

|

|

69,196 |

|

Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net advertising service |

|

91,533 |

|

|

|

94,728 |

|

|

|

95,656 |

|

|

|

13,631 |

|

|

|

313,454 |

|

|

|

289,093 |

|

|

|

41,196 |

|

Paid services |

|

9,716 |

|

|

|

8,190 |

|

|

|

6,350 |

|

|

|

905 |

|

|

|

30,153 |

|

|

|

24,794 |

|

|

|

3,533 |

|

Total cost of revenues |

|

101,249 |

|

|

|

102,918 |

|

|

|

102,006 |

|

|

|

14,536 |

|

|

|

343,607 |

|

|

|

313,887 |

|

|

|

44,729 |

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net advertising service |

|

42,759 |

|

|

|

59,963 |

|

|

|

52,689 |

|

|

|

7,508 |

|

|

|

108,840 |

|

|

|

152,516 |

|

|

|

21,733 |

|

Paid services |

|

9,600 |

|

|

|

5,437 |

|

|

|

9,583 |

|

|

|

1,365 |

|

|

|

27,734 |

|

|

|

19,185 |

|

|

|

2,734 |

|

Total gross profit |

|

52,359 |

|

|

|

65,400 |

|

|

|

62,272 |

|

|

|

8,873 |

|

|

|

136,574 |

|

|

|

171,701 |

|

|

|

24,467 |

|

Phoenix New Media Limited

Unaudited Condensed Information of Cost of Revenues

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue sharing fees |

|

3,545 |

|

|

|

2,585 |

|

|

|

2,373 |

|

|

|

338 |

|

|

|

10,399 |

|

|

|

9,093 |

|

|

|

1,296 |

|

Content and operational costs |

|

91,093 |

|

|

|

93,630 |

|

|

|

93,686 |

|

|

|

13,351 |

|

|

|

309,927 |

|

|

|

285,816 |

|

|

|

40,729 |

|

Bandwidth costs |

|

6,611 |

|

|

|

6,703 |

|

|

|

5,947 |

|

|

|

847 |

|

|

|

23,281 |

|

|

|

18,978 |

|

|

|

2,704 |

|

Total cost of revenues |

|

101,249 |

|

|

|

102,918 |

|

|

|

102,006 |

|

|

|

14,536 |

|

|

|

343,607 |

|

|

|

313,887 |

|

|

|

44,729 |

|

Unaudited Reconciliations of Non-GAAP Results of Operations Measures to the Nearest Comparable GAAP Measures

(Amounts in thousands, except for number of ADSs and per ADS data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2023 |

|

|

Three Months Ended June 30, 2024 |

|

|

Three Months Ended September 30, 2024 |

|

|

GAAP |

|

|

Non-GAAP

Adjustments |

|

|

Non-

GAAP |

|

|

GAAP |

|

|

Non-GAAP

Adjustments |

|

|

Non-

GAAP |

|

|

GAAP |

|

|

Non-GAAP

Adjustments |

|

|

Non-

GAAP |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

52,359 |

|

|

|

406 |

|

(1) |

|

52,765 |

|

|

|

65,400 |

|

|

|

53 |

|

(1) |

|

65,453 |

|

|

|

62,272 |

|

|

|

27 |

|

(1) |

|

62,299 |

|

Gross margin |

|

34.1 |

% |

|

|

|

|

|

34.4 |

% |

|

|

38.9 |

% |

|

|

|

|

|

38.9 |

% |

|

|

37.9 |

% |

|

|

|

|

|

37.9 |

% |

Loss from operations |

|

(38,548 |

) |

|

|

832 |

|

(1) |

|

(37,716 |

) |

|

|

(8,939 |

) |

|

|

81 |

|

(1) |

|

(8,858 |

) |

|

|

(25,957 |

) |

|

|

33 |

|

(1) |

|

(25,924 |

) |

Operating margin |

|

(25.1 |

)% |

|

|

|

|

|

(24.6 |

)% |

|

|

(5.3 |

)% |

|

|

|

|

|

(5.3 |

)% |

|

|

(15.8 |

)% |

|

|

|

|

|

(15.8 |

)% |

|

|

|

|

|

832 |

|

(1) |

|

|

|

|

|

|

|

81 |

|

(1) |

|

|

|

|

|

|

|

33 |

|

(1) |

|

|

|

|

|

|

|

246 |

|

(2) |

|

|

|

|

|

|

|

5,675 |

|

(2) |

|

|

|

|

|

|

|

248 |

|

(2) |

|

|

|

|

|

|

|

(64 |

) |

(3) |

|

|

|

|

|

|

|

(2,415 |

) |

(3) |

|

|

|

|

|

|

|

174 |

|

(3) |

|

|

Net loss attributable to Phoenix New Media Limited |

|

(21,495 |

) |

|

|

1,014 |

|

|

|

(20,481 |

) |

|

|

(5,461 |

) |

|

|

3,341 |

|

|

|

(2,120 |

) |

|

|

(18,486 |

) |

|

|

455 |

|

|

|

(18,031 |

) |

Net margin |

|

(14.0 |

)% |

|

|

|

|

|

(13.3 |

)% |

|

|

(3.2 |

)% |

|

|

|

|

|

(1.3 |

)% |

|

|

(11.3 |

)% |

|

|

|

|

|

(11.0 |

)% |

Net loss per ADS-basic and diluted |

|

(1.77 |

) |

|

|

|

|

|

(1.69 |

) |

|

|

(0.45 |

) |

|

|

|

|

|

(0.18 |

) |

|

|

(1.54 |

) |

|

|

|

|

|

(1.50 |

) |

Weighted average number of ADSs used in computing basic and diluted net loss per ADS |

|

12,131,757 |

|

|

|

|

|

|

12,131,757 |

|

|

|

12,010,776 |

|

|

|

|

|

|

12,010,776 |

|

|

|

12,010,776 |

|

|

|

|

|

|

12,010,776 |

|

(1) Share-based compensation

(2) Loss from equity investments, including impairment

(3) Fair value changes in investments, net

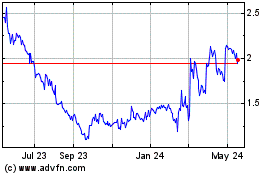

Phoenix New Media (NYSE:FENG)

Historical Stock Chart

From Oct 2024 to Nov 2024

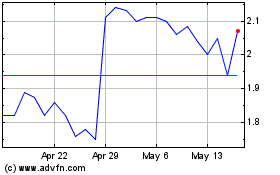

Phoenix New Media (NYSE:FENG)

Historical Stock Chart

From Nov 2023 to Nov 2024