SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

11-K

ANNUAL REPORT

PURSUANT TO SECTION 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One):

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For

the fiscal year ended

December

31, 2016

.

OR

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 15 [d] OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

|

For the transition period from

to

Commission file number

1-10890

HORACE MANN SUPPLEMENTAL RETIREMENT AND SAVINGS PLAN

(Full title of the Plan)

HORACE MANN EDUCATORS CORPORATION

1 Horace Mann Plaza, Springfield, Illinois 62715

Registrant’s telephone number, including area code:

(217) 789 - 2500

(Name,

Address and Telephone Number of Issuer)

REQUIRED INFORMATION

Financial Statements:

Item 4. In lieu of the requirements of

Items

1-3,

audited financial statements and supplemental schedule are prepared in accordance with the requirements of ERISA for the Plan’s fiscal years ended December 31, 2016 and 2015, and are

presented on pages 2 through 14.

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Financial Statements and Supplemental Schedule

As of December 31, 2016 and 2015, and for the year ended December 31, 2016 with

Report of Independent Registered Public Accounting Firm

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Financial Statements and Supplemental Schedule

Years ended December 31, 2016 and 2015

Table of Contents

KPMG LLP

Aon

Center

Suite 5500

200 E. Randolph Street

Chicago, IL 60601-6436

Report of Independent Registered Public Accounting Firm

Horace Mann Service Corporation Pension Committee and the Board of Directors Horace

Mann Educators Corporation:

We have audited the accompanying statements of net assets available for benefits of the Horace Mann Supplemental Retirement

and Savings Plan (the Plan) as of December 31, 2016 and 2015, and the related statement of changes in net assets available for benefits for the year ended December 31, 2016. These financial statements are the responsibility of the

Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in

accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as

well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion,

the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the year ended

December 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the

accompanying Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2016, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s 2016 financial statements. The

supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but include supplemental information required by the Department of Labor’s Rules and Regulations for Reporting

and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to

the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the

supplemental information in the accompanying schedules, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and

Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2016, is fairly stated

in all material respects in relation to the 2016 financial statements as a whole.

Chicago, Illinois

June 23, 2017

KPMG LLP is a Delaware limited

liability partnership and the U.S. member

firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity.

1

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Statements of Net Assets Available for Benefits

December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Investments at fair value

|

|

$

|

96,988,785

|

|

|

$

|

89,738,695

|

|

|

Investments at contract value

|

|

|

76,514,618

|

|

|

|

69,051,066

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

|

173,503,403

|

|

|

|

158,789,761

|

|

|

Notes receivable from participants

|

|

|

3,589,971

|

|

|

|

2,903,872

|

|

|

Accrued interest

|

|

|

283,320

|

|

|

|

262,711

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

177,376,694

|

|

|

|

161,956,344

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

Accrued administrative expenses

|

|

|

168,695

|

|

|

|

75,815

|

|

|

Accrued liabilities

|

|

|

5,348

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

174,043

|

|

|

|

75,815

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

177,202,651

|

|

|

$

|

161,880,529

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

2

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2016

|

|

|

|

|

|

|

Additions:

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

8,073,430

|

|

|

Interest

|

|

|

3,230,179

|

|

|

Dividends

|

|

|

129,698

|

|

|

Other income

|

|

|

24,957

|

|

|

|

|

|

|

|

|

|

|

|

11,458,264

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

|

136,891

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

Employer

|

|

|

6,918,202

|

|

|

Participants

|

|

|

6,975,281

|

|

|

Rollover

|

|

|

2,059,730

|

|

|

|

|

|

|

|

|

Total contributions

|

|

|

15,953,213

|

|

|

|

|

|

|

|

|

Total additions

|

|

|

27,548,368

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

Benefits paid to participants

|

|

|

(11,887,594

|

)

|

|

Administrative expenses

|

|

|

(338,652

|

)

|

|

|

|

|

|

|

|

Total deductions

|

|

|

(12,226,246

|

)

|

|

|

|

|

|

|

|

Net increase during year

|

|

|

15,322,122

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

Beginning of year

|

|

|

161,880,529

|

|

|

|

|

|

|

|

|

End of year

|

|

$

|

177,202,651

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

3

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

(1)

|

General Plan Information

|

|

|

(a)

|

Description of the Plan

|

The Horace Mann Supplemental Retirement and Savings Plan

(the Plan) is sponsored by Horace Mann Service Corporation (HMSC) which is a wholly owned subsidiary of Horace Mann Educators Corporation (HMEC). HMSC is also the Plan Administrator. HMSC and HMEC are collectively referred to as the Company.

The following brief description of the Plan is provided for general information purposes. Participants should refer to the actual Plan document or the employee summary plan description for additional information.

The Plan is a defined-contribution 401(k) plan covering all employees of the Company. It is subject to the provisions of the Employee

Retirement Income Security Act of 1974 (ERISA), as amended.

|

|

(b)

|

Contributions and Vesting

|

The Company provides an employer

non-elective

(safe harbor) contribution on behalf of all eligible participants. The contribution is equal to 3% of participants’ eligible compensation for the plan year. The Plan may be amended to reduce or

suspend the

non-elective

safe harbor contribution, with at least a 30 day notice of the reduction or suspension to all eligible participants.

All new employees are subject to the Plan’s “auto-enrollment” provision which provides for an automatic employee deferral of 3%

deferral of their eligible compensation. However, new hires or other participants could elect to decrease or stop their contributions at any time.

Effective January 1, 2015 the Company will match, on a

dollar-for-dollar

basis, the first 5% of eligible compensation that participants contribute as employee

pre-tax

contributions, in

addition to the automatic 3% safe harbor contribution. Employees contributing zero or less than 3% to the Plan were

re-enrolled

with a contribution rate of 3% at January 1, 2015. Prior elections to

contribute zero or less than 3% expired on December 31, 2014. Participants can opt out or decrease their contributions to less than 3% at any time by filing an election with the Plan. The 3% auto-enrollment rate increased to 4% for 2016 and

will increase to 5% for 2017. Participants can voluntarily elect to defer up to 20% of their eligible earnings (subject to statutory limits).

The Company may also make employer regular profit sharing contributions to the Plan. The amount of the employer regular profit sharing

contributions, if any, is determined by the Company each year and allocated to all participants who satisfy the eligibility and allocation requirements of the Plan. There were no employer regular profit sharing contributions during 2016 or 2015.

Employee contributions and employer

non-elective

(safe harbor) contributions are 100% vested

immediately. Employer matching contributions and employer regular profit sharing contributions vest in accordance with the following schedule:

|

|

|

|

|

|

|

Years of Vesting Service

|

|

Vesting

Percentage

|

|

|

Less than 1 year

|

|

|

0

|

%

|

|

1 year but less than 2 years

|

|

|

20

|

%

|

|

2 years but less than 3 years

|

|

|

40

|

%

|

|

3 years but less than 4 years

|

|

|

60

|

%

|

|

4 years but less than 5 years

|

|

|

80

|

%

|

|

5 years or more

|

|

|

100

|

%

|

4

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

Contributions are self-directed by the participant to any or all of the Plan’s

investment options. If a participant does not designate an investment option, their contributions default to an appropriate Lifecycle Fund based on the participant’s attained age at the time of the deferral.

The total

pre-tax

participant contributions were limited to $18,000 in 2016 and 2015, respectively. The

limit will be subject to adjustments to reflect increases in the cost of living pursuant to Section 402(g) of the Internal Revenue Code. Participating employees who reached age 50 or older during the Plan year have the opportunity to make

pretax,

catch-up

contributions subject to federal limits, which were $6,000 in 2016 and 2015, respectively.

|

|

(c)

|

Participant Accounts and Benefits

|

Each participant’s account is credited

with the participant’s contribution, the Company’s contribution, an allocation of Plan investment earnings and charged with an allocation of administrative expenses. Allocations are based on account balances or specific participant

transactions as defined. The benefit to which a given participant is entitled is the benefit that can be provided from that participant’s vested account.

Except for participant loans, all Plan assets are in a Master

Trust held by The Northern Trust Quantitative Advisors, Inc. The Master Trust also included the specifically identified assets of the HMSC Money Purchase Pension Plan at 12/31/2015. All assets of the Master Trust were specifically identified as to

Plan ownership. At December 31, 2016 and 2015, the assets of the Plan represented 100% and 95% of the total assets in the Master Trust. The increased asset allocation was a result of the termination of the Horace Mann Money Purchase Pension

Plan on December 31, 2014 and subsequent distribution of all assets. The assets of the Plan are participant-directed investments and are deposited in a Horace Mann Life Insurance Company (HMLIC) Group Annuity Contract in the fixed account and

in an individual separate account, (Horace Mann Life Insurance Company 401(K) Separate Account), or HMEC Common Stock.

|

|

(e)

|

Transfers, Withdrawals, and Final Distributions

|

Participants may transfer all or

a portion of their account balance between the various investment funds on a daily basis. Participant withdrawals and final distributions (as allowed under the Plan) are permitted on a weekly basis. An administration fee is deducted from the

participant’s withdrawal proceeds.

5

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

Participants are eligible for a distribution of the Plan benefits upon termination of

service, whether by disability, retirement, death, or leaving the Company. In the event of financial hardship, as defined in the Plan document, participants may withdraw money from their accounts while they are still employed. Participants who have

attained age 59

1

⁄

2

may request a distribution of all or a portion of the value of the account. Withdrawals by the participant before attaining age 59

1

⁄

2

are subject to IRS penalties.

Participants’ forfeited unvested accounts are used to reduce

Company contributions. At December 31, 2016 and 2015, forfeited unvested accounts available to reduce future Company contributions were $0. In 2016 and 2015, the Company applied $0 of forfeitures against Company contributions.

|

|

(g)

|

Notes Receivable From Participants

|

Participants may borrow a minimum of $1,000

up to a maximum of 50% of their vested account balance but no more than $50,000. The minimum term for a loan is 12 months and the maximum is 60 months (180 months for primary residence loans). Participants may have up to two active loans at one

time. A loan administrative fee is deducted from the participant’s loan proceeds. Interest rates charged on loans ranged from 4.25% to 9.25% in both 2016 and 2015. The loans are secured by the balance in the participant’s account and are

carried at amortized cost. Principal and interest is paid ratably through monthly payroll deductions. Participants may also make additional payments throughout the month directly to the record keeper. No allowance for credit losses has been recorded

as of December 31, 2016 or 2015.

Although it has not expressed any intent to do so, the Company has

the right to terminate the Plan at any time, subject to the provisions of ERISA. In the event of a plan termination, participants become fully vested in their accounts.

|

(2)

|

Summary of Significant Accounting Policies

|

The accompanying financial statements have been prepared

using the accrual basis of accounting.

Investments held by a defined contribution plan are required to be reported at fair value except

for fully benefit responsive investment contracts. Contract value is the relevant measure for the portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because

contract value is the amount participants normally would receive if they were to initiate permitted transactions under the terms of the plan. The fixed fund is carried in the Statement of Net Assets Available for Benefits at contract value.

6

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

|

(b)

|

Investment Valuation and Income Recognition

|

The Plan’s investment balances

are carried on the Statements of Net Assets Available for Benefits as follows: Quoted market prices are used to value investments in common stock; shares of mutual funds held by the separate account are valued at the accumulated unit value based on

the net asset value of the funds, which in turn value their investment securities at fair value, and investments in the fixed fund are carried at contract value. Purchases and sales of securities are recorded on a trade-date basis. Interest income

is recorded as earned on an accrual basis. Dividend income is recognized when dividends are declared and paid.

|

|

(c)

|

Short-term investments

|

Short-term investments are comprised of money market

funds. The money market funds are valued at the daily closing price as reported by the fund. These funds are required to publish their daily net asset value (NAV) and to transact at that price.

|

|

(d)

|

Net Appreciation (Depreciation) of Investments

|

In the Statements of Changes in

Net Assets Available for Benefits, the Plan presents the net appreciation (depreciation) in the carrying amount of its investments which consists of realized gains or losses and the unrealized appreciation (depreciation) on those investments.

The Plan pays administrative expenses, consisting primarily of

recordkeeping, trustee, audit, and legal fees. All investment fees have been included in the quarterly performance gains or losses reported for individual Plan funds.

Individual service fees associated with optional features or services offered under the Plan are charged separately to participant’s

accounts.

Benefit payments are recorded when paid.

The preparation of the Plan’s financial statements in

conformity with U.S. generally accepted accounting principles requires the Plan Administrator to make estimates and assumptions that affect (1) the reported amounts of net assets available for benefits at the date of the financial statements

and (2) the reported amounts of changes in net assets available for benefits during the reporting period. Actual results could differ from those estimates.

|

|

(h)

|

Risks and Uncertainties

|

The Plan provides for investments in mutual funds, a

fixed interest rate fund, and Horace Mann Educators Corporation common stock. Investment securities are exposed to various risks including, but not limited to, interest rate, market and credit risks. Due to the level of risk associated with certain

investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants account balances and the amounts reported in the

Statements of Net Assets Available for Benefits.

7

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

|

(i)

|

Adopted Accounting Standards

|

Effective January 1, 2015, the Plan adopted

FASB Accounting Standards Update

No. 2015-12,

(Part I)

Fully

Benefit

Responsive

Investment

Contracts

, (Part II)

Plan

Investment

Disclosures

. Part I

eliminates the requirements to measure fully benefit responsive contracts at fair value and provide certain disclosures. Contract value is the only required measure for fully benefit-responsive contracts. Part II eliminates the requirements to

disclose individual investments that represent five percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. Part II also simplifies the level of disaggregation of

investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to disaggregate investments by nature, characteristics and

risks. Further, the disclosure of information about fair value measurements shall be provided by general type of plan assets. The ASU is effective for fiscal years beginning after December 15, 2015, with early adoption permitted. The Plan

elected to adopt the ASU early to reduce the complexity of reporting investments. The adoption was applied retrospectively and resulted in the elimination of the disclosures noted above. The adoption of this accounting guidance did not have an

effect on the Plan’s net assets available for benefits or changes in net assets available for benefits.

|

|

(j)

|

Reconciliation of Financial Statements to Form 5500

|

The following is a

reconciliation of net assets available for benefits per the financial statements at December 31, 2016 and 2015 to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Net assets available for benefits per the financial statements

|

|

$

|

177,202,651

|

|

|

$

|

161,880,529

|

|

|

Amounts allocated to deemed distributed loans

|

|

|

(262,946

|

)

|

|

|

(262,565

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits per the Form 5500

|

|

$

|

176,939,705

|

|

|

$

|

161,617,964

|

|

|

|

|

|

|

|

|

|

|

|

8

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

The following is a reconciliation of benefits paid to participants per the financial

statements for the year ended December 31, 2016 to Form 5500:

|

|

|

|

|

|

|

Benefits paid to participants per the financial statements

|

|

$

|

11,887,594

|

|

|

Add: amounts allocated to deemed distributed loans at December 31, 2016

|

|

|

262,946

|

|

|

Less: amounts allocated to deemed distributed loans at December 31, 2015

|

|

|

(262,565

|

)

|

|

|

|

|

|

|

|

|

|

|

Benefits paid to participants per the Form 5500

|

|

$

|

11,887,975

|

|

|

|

|

|

|

|

The Plan has evaluated subsequent events through June 23,

2017, the date the financial statements were available to be issued. On January1, 2017, the Plan was renamed the Horace Mann 401k Plan. The HMLIC fixed fund and 401(k) separate account mutual fund investment choices were removed on May 15, 2017

and replaced with a selection of external investment options. The Horace Mann Stock Fund remained in the Plan.

|

|

(a)

|

Group Annuity Contract (Fixed Account and 401(k) Separate Account)

|

In 1989, the

Plan entered into Group Annuity Contract 401K000001 with HMLIC. The Group Annuity Contract provides Fixed Account and Separate Account investment options.

Fixed Account

The Fixed

Account is a traditional fully benefit-responsive guaranteed investment contract. HMLIC maintains the contributions in a general account. The account is credited with earnings on the underlying investments and charged for participant withdrawals and

administrative expenses. The guaranteed investment contract issuer is contractually obligated to repay the principal and a specified interest rate that is guaranteed to the Plan. The actual credited interest rate on the group annuity contract was

4.50% for the years ended December 31, 2016 and 2015. The minimum guaranteed annual interest rate per the group annuity contract is 4.50%. The actual credited interest rate may be reset by HMLIC with 30 days advance notice.

This contract meets the fully benefit-responsive investment contract criteria and therefore is reported at contract value. Contract value is

the relevant measure for fully benefit-responsive investment contracts because this is the amount received by participants if they were to initiate permitted transactions under the terms of the Plan. Contract value, as reported to the Plan by HMLIC,

represents contributions made under the contract, plus earnings, less participant withdrawals, and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value.

9

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

Whenever an amount to be transferred, distributed, or disbursed from the Fixed Account

together with all amounts previously or simultaneously transferred, distributed, or disbursed for any reason in the calendar year of computation from the Fixed Account assets would exceed ten percent (10%) of the total assets of that account on

January 1 of the year of computation, the transfer, distribution or disbursement may be deferred up to six months. This is the only event that limits the ability of the Plan to transact the contract value with the participants.

The Plan’s ability to receive amounts due is dependent upon the issuer’s ability to meet its financial obligations. The issuer’s

ability to meet its contractual obligations may be affected by future economic and regulatory developments.

401(k) Separate Account

The investments of the underlying mutual funds held by 401(k) Separate Account, which are valued at net asset value (NAV), include

primarily common stocks, U.S. government and corporate bonds, and short-term commercial paper. Investments in mutual funds are valued at the daily closing price as reported by the fund. These funds are required to publish their daily NAV and to

transact at that price. Redemptions initiated by Plan participants may be made on any business day and are processed on the same business day. Pursuant to ASU

No. 2015-10

“Technical Corrections and

Improvements” the 401(k) Separate Account has a structure similar to a mutual fund, the fair value is readily determinable, is valued using the published fair value per share amounts and should be valued as a Level 1. This resulted in the

reclassification of the amount to reflect the investment in Level 1 for 2015.

The Plan’s HMEC Common Stock at December 31, 2016

and 2015 consisted of 105,833 units and 134,762 units, respectively, of HMEC common stock, which is traded on the New York Stock Exchange under the symbol HMN. The HMEC common stock is tracked on a unitized basis, whereby the value of a unit

reflects the combined market value of HMEC common stock and the cash equivalents held by the stock fund.

|

(4)

|

Fair Value of Financial Instruments

|

Fair value is defined as the exchange price that

would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. In determining fair

value, the Plan utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs that may be used to measure fair value are:

|

|

|

|

|

Level 1

|

|

Unadjusted quoted prices in active markets for identical assets or liabilities.

|

|

|

|

|

Level 2

|

|

Unadjusted observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by

observable market data for the assets or liabilities. Level 2 assets and liabilities include fixed maturity securities with quoted prices that are traded less frequently than exchange-traded instruments.

|

|

|

|

|

Level 3

|

|

Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose value is

determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation.

|

10

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

When the inputs used to measure fair value fall within different levels of the hierarchy, the

level within which fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement in its entirety. As a result, a Level 3 fair value measurement may include inputs that are observable

(Level 1 or Level 2) and unobservable (Level 3). Transfers into or out of Level 3 are reported as having occurred at the end of the reporting period in which the transfers were determined. There were no transfers into or out of level 3 in

either 2016 or 2015, respectively.

Common stocks are valued as Level 1 assets and are valued at the last reported sales price or

closing price by the national securities exchange on which it trades.

In June 2015, the FASB issued ASU

2015-10,

Technical

Corrections

and

Improvements

. This guidance included amendments to the definition of readily determinable fair value (RDFV) and clarified that investments in both

mutual funds and investments in structures similar to mutual funds have a RDFV when certain criteria are met. The Plan adopted the provisions of ASU

2015-10

during the annual reporting period beginning

January 1, 2016 and retrospectively applied to fiscal year 2015.

As a result of the adoption, Plan management

re-evaluated

the Plan’s investments as to whether they have RDFVs. Based on that reevaluation, certain accounting policy and NAV disclosures have been revised. Also, certain investments (i.e., mutual funds

holding primarily common stocks, U.S. government and corporate bonds, and short-term commercial paper) previously reported NAV as a practical expedient and excluded from the fair value hierarchy have been included as Level 1 investments for

purposes of the current year’s presentation.

Certain amounts have been reclassified to conform to the current year’s

presentation.

11

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

The following table sets forth by level, within the fair value hierarchy, the Plan’s

investments carried at fair value in the accompanying Statements of Net Assets Available for Benefits as of December 31, 2016 and 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of December 31, 2016

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

HMEC Common Stock

|

|

$

|

4,529,657

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

4,529,657

|

|

|

Mutual funds

|

|

|

92,309,124

|

|

|

|

—

|

|

|

|

—

|

|

|

|

92,309,124

|

|

|

COLTV Short Term Invt Fund

|

|

|

150,004

|

|

|

|

—

|

|

|

|

—

|

|

|

|

150,004

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments, at fair value

|

|

$

|

96,988,785

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

96,988,785

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of December 31, 2015

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

HMEC Common Stock

|

|

$

|

4,471,412

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

4,471,412

|

|

|

Mutual funds

|

|

|

85,142,763

|

|

|

|

—

|

|

|

|

—

|

|

|

|

85,142,763

|

|

|

COLTV Short Term INVT Fd

|

|

|

124,520

|

|

|

|

—

|

|

|

|

—

|

|

|

|

124,520

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments, at fair value

|

|

$

|

89,738,695

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

89,738,695

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Plan has received a determination letter from the Internal

Revenue Service (IRS) dated November 8, 2011, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the Code), and, therefore, the related trust is exempt from taxation. Once qualified, the Plan is

required to operate in conformity with the Code to maintain its qualification. The Plan Administrator believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan, as amended,

is qualified and the related trust is tax exempt. The Plan Administrator believes the Plan is no longer subject to income tax examination for years prior to 2013.

U.S. generally accepted accounting principles require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability

(or asset) if the Plan has taken an uncertain position that more likely

12

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Notes to Financial Statements

December 31, 2016 and 2015

than not would not be sustained upon examination by the Internal Revenue Service. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of

December 31, 2015, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions;

however, there are currently no audits for any tax periods in progress.

|

(6)

|

Related Party Transactions

|

Investment options available to Plan participants include

investments in the common stock of the Plan sponsor’s parent, HMEC, and investments in annuity contracts guaranteed by HMLIC, a subsidiary of HMEC.

The Parent provides staffing, building space, and supplies at no cost to the Plan.

13

Supplemental Schedule

Horace Mann Service Corporation

Horace Mann Supplemental Retirement and Savings Plan

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2016

EIN:

37-0972590

Plan: 004

|

|

|

|

|

|

|

|

|

|

|

Number

of Shares

or Units

|

|

|

Description of Asset

|

|

Current Value

|

|

|

|

|

|

|

HMLIC 401(k) Separate Account:*

|

|

|

|

|

|

|

504,289

|

|

|

Wilshire VIT Global Allocation Fund

|

|

$

|

17,323,031

|

|

|

|

1,084,736

|

|

|

Wilshire VIT 2035 ETF Fund

|

|

|

15,576,158

|

|

|

|

637,832

|

|

|

Wilshire VIT 2025 ETF Fund

|

|

|

9,509,692

|

|

|

|

350,492

|

|

|

Wilshire 5000 Index Portfolio Institutional

|

|

|

8,744,465

|

|

|

|

78,961

|

|

|

Fidelity VIP Mid Cap Portfolio

|

|

|

6,460,816

|

|

|

|

66,878

|

|

|

Fidelity VIP Growth Portfolio

|

|

|

5,044,045

|

|

|

|

45,651

|

|

|

T. Rowe Price Small Cap Stock Fund

|

|

|

4,933,379

|

|

|

|

38,595

|

|

|

T. Rowe Price Small Cap Value Fund

|

|

|

4,422,519

|

|

|

|

52,857

|

|

|

Wilshire Large Company Growth Portfolio Institutional

|

|

|

3,850,464

|

|

|

|

246,559

|

|

|

Wilshire VIT 2015 ETF Fund

|

|

|

3,815,083

|

|

|

|

99,211

|

|

|

Fidelity VIP Overseas Portfolio

|

|

|

3,062,220

|

|

|

|

90,332

|

|

|

J.P. Morgan Insurance Trust US Equity Portfolio

|

|

|

2,863,476

|

|

|

|

31,273

|

|

|

Wells Fargo Opportunity Fund

|

|

|

2,388,685

|

|

|

|

94,040

|

|

|

Davis Value Portfolio

|

|

|

2,335,374

|

|

|

|

52,747

|

|

|

Putnam VT

Multi-Cap

Growth Fund

|

|

|

1,979,717

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total funds

|

|

|

92,309,124

|

|

|

|

|

|

|

|

N/A

|

|

|

HMLIC Fixed Account*

|

|

|

76,514,618

|

|

|

|

|

|

|

|

150,004

|

|

|

COLTV Short Term INVT Fd

|

|

|

150,004

|

|

|

|

|

|

|

|

105,833

|

|

|

Horace Mann Educators Corporation Common Stock*

|

|

|

4,529,657

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

|

173,503,403

|

|

|

|

|

|

|

|

|

|

|

Participants Loans (561 loans, interest rates ranging from 4.25% to 9.25%, maturing

January 15, 2017 to December 31, 2031)

|

|

|

3,589,971

|

|

|

*

|

Represents a

party-in-interest.

|

All investments are participant-directed; therefore, historical cost information is not required.

See accompanying report of independent registered public accounting firm.

14

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Pension Plan Committee of the Horace Mann Supplemental Retirement and Savings Plan

has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date 23 June 2017

|

|

|

|

HORACE MANN SUPPLEMENTAL RETIREMENT AND SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

|

|

s Bret A. Conklin

|

|

|

|

|

|

|

|

Bret A. Conklin

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

15

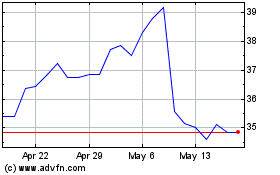

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jun 2024 to Jul 2024

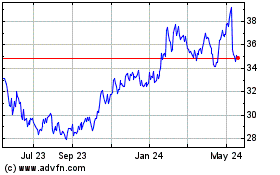

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jul 2023 to Jul 2024