- Global entertainment platform delivers Q4 Net Income of $5

million (+112% YoY), at a 5.7% margin, EPS(1) of 10 cents (+100%

YoY), Adjusted EPS of 27 cents (+59% YoY) and Total Adjusted

EBITDA(2) of $37 million (+48% YoY) at a 40% margin.

- Full-Year Net Income of $26 million (+3% YoY) at a 7.4% margin,

Total Adjusted EBITDA of $139 million (-4% YoY) at a 39.4% margin

(in line with guidance of high 30’s) and Cash from Operations of

$71 million (+21% YoY).

- IMAX delivers 146 system installations for the full year, at

the high-end of initial installation guidance of 120 to 150.

- To start 2025, IMAX smashes box office record for Chinese New

Year slate with $130 million and counting — already up over 90%

from the previous best — led by “Ne Zha 2,” now the highest

grossing IMAX release of all time in China.

- IMAX expects in 2025 to deliver a record box office of more

than $1.2 billion along with Total Adjusted EBITDA margin(3) of

40%+ and system installations of 145 to 160.

IMAX Corporation (NYSE: IMAX) today reported solid financial

results for the fourth quarter and full-year of 2024, demonstrating

the value of its unique global entertainment platform and broad

content portfolio.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250219198942/en/

An infographic highlighting IMAX's recent

quarter. (Graphic: Business Wire)

“IMAX’s record-breaking Chinese New Year demonstrates the unique

advantages of our model – a richly diversified content portfolio

featuring the biggest Hollywood and local language blockbusters,

and a global network that allows us to capitalize on box office

momentum anywhere in the world,” said Rich Gelfond, CEO of

IMAX.

“2025 is already living up to its significant promise and yet

the bigger opportunity is still in front of us, with more Filmed

for IMAX® releases than ever in 2025 and arguably an even stronger

slate ahead in 2026. In China, the turnaround we’re witnessing this

year has been dramatic; in less than two months, our Chinese local

language box office has already exceeded the entirety of 2024."

“In 2024, IMAX further strengthened its position at the center

of global entertainment – expanding the roster of filmmakers

working with our technology, strengthening our studio marketing,

hitting the high-end of our installation guidance, and innovating

to expand our programming – including our deal with Netflix for the

release of Greta Gerwig’s ‘Narnia’ across the IMAX global network

in advance of its debut on the service.”

“With the headwinds we faced in China in 2024 beginning to lift,

we’re poised to build on the Fourth Quarter’s significant

double-digit growth in adjusted EBITDA and earnings per share. We

look forward to capitalizing on the promising opportunity ahead to

achieve a record year at the global box office and strong returns

for our shareholders.”

_______________

(1)

Diluted Net Income Per Share

(2)

Non-GAAP Financial Measure. See the

discussion at the end of this earnings release for a description of

the non-GAAP financial measures used herein, as well as

reconciliations to the most comparable GAAP amounts.

(3)

IMAX has not provided a quantitative

reconciliation of its Total Adjusted EBITDA margin outlook to a

GAAP net income margin outlook because it is unable, without making

unreasonable efforts, to project certain reconciling items. These

items include, but are not limited to share-based and other

non-cash compensation, unrealized investment gains,

transaction-related expenses, restructuring and other charges, and

write-downs, including asset impairments and credit loss reversal.

These items are inherently variable and uncertain and depend on

various factors, some of which are outside of the IMAX’s control or

ability to predict. For more information regarding the Company’s

use of non-GAAP financial measures, please see the section titled

“Non-GAAP Financial Measures” below.

Fourth Quarter and Full-Year Financial Highlights

Three Months Ended December

31,

(Unaudited)

Years Ended December

31,

In millions of U.S. Dollars, except per

share data

2024

2023

YoY %

Change

2024

2023

YoY %

Change

Total Revenue

$

92.7

$

86.0

8

%

$

352.2

$

374.8

(6

%)

Gross Margin

$

48.4

$

43.7

11

%

$

190.2

$

214.3

(11

%)

Gross Margin (%)

52.2

%

50.8

%

54.0

%

57.2

%

Total Adjusted EBITDA(1)(2)

$

37.2

$

25.2

48

%

$

138.9

$

144.0

(4

%)

Total Adjusted EBITDA Margin (%)(1)(2)

40.1

%

29.3

%

39.4

%

38.4

%

Net Income(3)

$

5.3

$

2.5

112

%

$

26.1

$

25.3

3

%

Diluted Net Income Per Share(3)

$

0.10

$

0.05

100

%

$

0.48

$

0.46

4

%

Adjusted Net Income(1)(3)

$

14.5

$

9.3

56

%

$

51.0

$

52.1

(2

%)

Adjusted Earnings Per Share(1)(3)

$

0.27

$

0.17

59

%

$

0.95

$

0.94

1

%

Weighted average shares outstanding (in

millions):

Basic

52.8

54.0

(2

%)

52.6

54.3

(3

%)

Diluted

54.7

55.0

(1

%)

53.9

55.1

(2

%)

_______________

(1)

Non-GAAP Financial Measure. See the

discussion at the end of this earnings release for a description of

the non-GAAP financial measures used herein, as well as

reconciliations to the most comparable GAAP amounts.

(2)

Total Adjusted EBITDA is before

adjustments for non-controlling interests. Total Adjusted EBITDA

per Credit Facility attributable to common shareholders, excluding

non-controlling interests, was $34.2 million and $124.7 million for

the three months and year ended December 31, 2024 (2023 - $23.0

million and $128.1 million). The Company’s Credit Facility covenant

is calculated on a trailing twelve month basis.

(3)

Attributable to common shareholders.

Fourth Quarter and Full-Year Segment

Results(1)

Content Solutions

Technology Products and

Services

Revenue

Gross Margin

Gross

Margin %

Revenue

Gross Margin

Gross

Margin %

4Q24

$

25.5

$

11.8

46

%

$

64.0

$

34.2

53

%

4Q23

19.1

9.7

51

%

62.5

29.9

48

%

% change

34

%

22

%

2

%

15

%

FY24

$

124.7

$

66.5

53

%

$

216.1

$

115.6

53

%

FY23

126.7

74.1

58

%

234.3

129.9

55

%

% change

(2

%)

(10

%)

(8

%)

(11

%)

_______________

(1)

Please refer to the Company’s Form 10-K

for the year ended December 31, 2024 for additional segment

information.

Content Solutions Segment

- Fourth quarter Content Solutions revenues and gross margin

increased 34% year-over-year to $26 million, and increased 22%

year-over-year to $12 million, respectively, driven by higher box

office, and highlighted by record Thanksgiving weekend box office

of $24 million.

- Fourth quarter box office of $204 million increased 20%

year-over-year and helped propel IMAX to near-record annual

domestic box office. Top grossing fourth quarter titles included

Gladiator 2 ($31 million), Venom: The Last Dance ($31 million),

Mufasa: The Lion King ($26 million) and Interstellar ($20

million)

Technology Products and Services Segment

- Fourth quarter Technology Products and Services revenues and

gross margin increased 2% to $64 million and increased 15% to $34

million year-over-year, respectively, driven by higher box office

related rental revenue that more than offset a lower level of sales

type system installations year-over-year.

- During the fourth quarter of 2024, the Company installed 58

systems, compared to 69 systems in the fourth quarter of 2023,

resulting in 146 system installations in the full year versus 128

system installations in the prior year. Of those, 28 systems in the

fourth quarter and 63 in the full year were under sales

arrangements, compared to 35 and 70 systems in the prior year,

respectively.

- Commercial network growth continues with the number of IMAX

locations increasing 2.5% year-over-year to 1,735 systems. The

Company ended 2024 with a backlog of 440 IMAX systems.

Operating Cash Flow and

Liquidity

Net cash provided by operating activities for full year 2024 was

$71 million, compared to $59 million in the prior year period,

reflecting improvements in working capital driven by higher

collections.

As of December 31, 2024, the Company’s available liquidity was

$418 million. The Company’s liquidity includes cash and cash

equivalents of $101 million, $263 million in available borrowing

capacity under the Credit Facility, and $54 million in available

borrowing capacity under IMAX China’s revolving facilities. Total

debt, excluding deferred financing costs, was $269 million as of

December 31, 2024.

In 2021, the Company issued $230.0 million of 0.500% Convertible

Senior Notes due 2026 (“Convertible Notes”). In connection with the

pricing of the Convertible Notes, the Company entered into

privately negotiated capped call transactions with an initial cap

price of $37.2750 per share of the Company’s common shares.

Share Count and Capital

Return

The weighted average basic and diluted shares outstanding in the

fourth quarter of 2024 were 52.8 million and 54.7 million,

respectively, compared to 54.0 million and 55.0 million in the

fourth quarter of 2023, a decrease of 2.2% and 0.5%,

respectively.

For the year ended December 31, 2024, the Company repurchased

1,166,370 common shares at an average price of $13.99 for a total

of $16 million, excluding commissions.

The Company is authorized under its share-repurchase program,

expiring June 30, 2026 to repurchase up to $400 million of its

common shares, of which approximately $151 million remains

available.

Supplemental Materials

For more information about the Company’s results, please refer

to the IMAX Investor Relations website located at

investors.imax.com.

Investor Relations Website and Social

Media

On a monthly basis, the Company posts quarter-to-date box office

results on the IMAX Investor Relations website located at

investors.imax.com. The Company expects to provide such updates

within five business days of month-end, although the Company may

change this timing without notice.

The Company may post additional information on the Company’s

corporate and Investor Relations websites which may be material to

investors. Accordingly, investors, media and others interested in

the Company should monitor the Company’s website in addition to the

Company’s press releases, SEC filings and public conference calls

and webcasts, for additional information about the Company.

References to our website address and domain names throughout this

release are for informational purposes only, or to fulfill specific

disclosure requirements of the Securities and Exchange Commission’s

rules or The New York Stock Exchange Listing Standards. These

references are not intended to, and do not, incorporate the

contents of our websites by reference into this release.

Conference Call

The Company will host a conference call today at 4:30 PM ET to

discuss its fourth quarter and full-year 2024 financial results.

This call is being webcast and can be accessed at

investors.imax.com. To access the call via telephone, interested

parties please pre-register here:

https://register.vevent.com/register/BI5416215ae6134b378b06870a2fb47726

and you will be provided with a dial-in number and unique pin. To

avoid delays, we encourage participants to dial into the conference

call ten minutes ahead of the scheduled start time. A replay of the

call will be available via webcast at investors.imax.com.

About IMAX Corporation

IMAX, an innovator in entertainment technology, combines

proprietary software, architecture, and equipment to create

experiences that take you beyond the edge of your seat to a world

you’ve never imagined. Top filmmakers and studios are utilizing

IMAX systems to connect with audiences in extraordinary ways,

making IMAX’s network among the most important and successful

theatrical distribution platforms for major event films around the

globe.

IMAX is headquartered in New York, Toronto, and Los Angeles,

with additional offices in London, Dublin, Tokyo, and Shanghai. As

of December 31, 2024, there were 1,807 IMAX systems (1,735

commercial multiplexes, 11 commercial destinations, 61

institutional) operating in 90 countries and territories. Shares of

IMAX China Holding, Inc., a subsidiary of IMAX Corporation, trade

on the Hong Kong Stock Exchange under the stock code “1970”.

IMAX®, IMAX 3D®, Experience It In IMAX®, The IMAX Experience®,

DMR®, Filmed For IMAX®, IMAX Live®, IMAX Enhanced® and IMAX

StreamSmart™ are trademarks and trade names of the Company or its

subsidiaries that are registered or otherwise protected under laws

of various jurisdictions. For more information, visit www.imax.com.

You can also connect with IMAX on Instagram

(www.instagram.com/company/imax), Facebook (www.facebook.com/imax),

LinkedIn (www.linkedin.com/company/imax), X (www.twitter.com/imax),

and YouTube (www.youtube.com/imaxmovies).

Forward-Looking

Statements

This earnings release contains forward looking statements that

are based on IMAX management’s assumptions and existing information

and involve certain risks and uncertainties which could cause

actual results to differ materially from future results expressed

or implied by such forward looking statements. These

forward-looking statements include, but are not limited to,

references to business and technology strategies and measures to

implement strategies, competitive strengths, goals, expansion and

growth of business, operations and technology, future capital

expenditures (including the amount and nature thereof), industry

prospects and consumer behavior, plans and references to the future

success of IMAX Corporation together with its consolidated

subsidiaries (the “Company”) and expectations regarding the

Company’s future operating, financial and technological results.

These forward-looking statements are based on certain assumptions

and analyses made by the Company in light of its experience and its

perception of historical trends, current conditions and expected

future developments, as well as other factors it believes are

appropriate in the circumstances. However, whether actual results

and developments will conform with the expectations and predictions

of the Company is subject to a number of risks and uncertainties,

including, but not limited to, risks associated with investments

and operations in foreign jurisdictions and any future

international expansion, including those related to economic,

political and regulatory policies of local governments and laws and

policies of the United States and Canada, as well as geopolitical

conflicts; risks related to the Company’s growth and operations in

China; the performance of IMAX remastered films and other films

released to the IMAX network; the signing of IMAX System

agreements; conditions, changes and developments in the commercial

exhibition industry; risks related to currency fluctuations; the

potential impact of increased competition in the markets within

which the Company operates, including competitive actions by other

companies; the failure to respond to change and advancements in

technology; risks relating to consolidation among commercial

exhibitors and studios; risks related to brand extensions and new

business initiatives; conditions in the in-home and out-of-home

entertainment industries; the opportunities (or lack thereof) that

may be presented to and pursued by the Company; risks related to

cyber-security and data privacy; risks related to the Company’s

inability to protect the Company’s intellectual property; risks

associated with the Company’s use of artificial intelligence and

exploration of additional use cases of artificial intelligence;

risks related to climate change; risks related to weather

conditions and natural disasters that may disrupt or harm the

Company’s business; risks related to the Company’s indebtedness and

compliance with its debt agreements; general economic, market or

business conditions; risks related to political, economic and

social instability; the failure to convert system backlog into

revenue; changes in laws or regulations; any statements of belief

and any statements of assumptions underlying any of the foregoing;

other factors and risks outlined in the Company’s periodic filings

with the SEC; and other factors, many of which are beyond the

control of the Company. Consequently, all of the forward-looking

statements made in this earnings release are qualified by these

cautionary statements, and actual results or anticipated

developments by the Company may not be realized, and even if

substantially realized, may not have the expected consequences to,

or effects on, the Company. These factors, other risks and

uncertainties and financial details are discussed in the Company’s

most recent Annual Report on Form 10-K. The Company undertakes no

obligation to update publicly or otherwise revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

IMAX Network and Backlog

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

2024

2023

System Signings(1):

Sales Arrangements

14

10

54

64

Traditional JRSA

5

25

76

65

Total IMAX System Signings

19

35

130

129

(1) System signings include new signings

of 15 in Q4 2024 and 32 in Q4 2023, and 57 in 2024 and 108 in

2023.

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

2024

2023

System Installations(1):

Sales Arrangements

27

35

63

70

Hybrid JRSA

—

3

—

5

Traditional JRSA

31

31

83

53

Total IMAX System Installations

58

69

146

128

(1) System installations include new

systems installations of 32 in Q4 2024, 47 in Q4 2023, 77 in 2024

and 86 in 2023.

As of December 31,

2024

2023

System Backlog:

Sales Arrangements

164

164

Hybrid JRSA

94

103

Traditional JRSA

182

183

Total System Backlog

440

450

As of December 31,

2024

2023

System Network:

Commercial Multiplex Systems

Sales Arrangements

838

769

Hybrid JRSA

126

138

Traditional JRSA

771

786

Total Commercial Multiplex Systems

1,735

1,693

Commercial Destination Systems

11

12

Institutional Systems

61

67

Total System Network

1,807

1,772

IMAX CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands of U.S. dollars,

except per share amounts)

Three Months Ended

Years Ended

December 31,

(Unaudited)

December 31,

2024

2023

2024

2023

Revenues

Technology sales

$

33,136

$

35,337

$

87,765

$

100,792

Image enhancement and maintenance

services

42,769

35,508

192,197

189,752

Technology rentals

13,794

12,954

62,560

75,566

Finance income

2,973

2,219

9,686

8,729

92,672

86,018

352,208

374,839

Costs and expenses applicable to

revenues

Technology sales

13,641

17,805

38,235

46,756

Image enhancement and maintenance

services

23,187

18,586

96,558

88,056

Technology rentals

7,479

5,939

27,215

25,686

44,307

42,330

162,008

160,498

Gross margin

48,365

43,688

190,200

214,341

Selling, general and administrative

expenses

32,414

35,070

132,701

144,406

Research and development

1,150

2,722

5,103

10,110

Amortization of intangible assets

1,550

1,250

5,758

4,578

Credit loss (reversal) expense, net

(10

)

170

(973

)

1,759

Asset impairments

—

144

—

144

Restructuring and other charges

3,749

1,593

3,749

2,946

Income from operations

9,512

2,739

43,862

50,398

Realized and unrealized investment

gains

33

29

127

465

Retirement benefits non-service

expense

(64

)

(179

)

(387

)

(411

)

Interest income

460

648

2,180

2,486

Interest expense

(1,617

)

(1,776

)

(8,084

)

(6,821

)

Income before taxes

8,324

1,461

37,698

46,117

Income tax (expense) benefit

(1,458

)

1,850

(4,996

)

(13,051

)

Net income

6,866

3,311

32,702

33,066

Net income attributable to non-controlling

interests

(1,560

)

(771

)

(6,643

)

(7,731

)

Net income attributable to common

shareholders

$

5,306

$

2,540

$

26,059

$

25,335

Net income per share attributable to

common shareholders:

Basic

$

0.10

$

0.05

$

0.49

$

0.47

Diluted

$

0.10

$

0.05

$

0.48

$

0.46

Weighted average shares outstanding (in

thousands):

Basic

52,770

53,973

52,650

54,310

Diluted

54,706

54,983

53,864

55,146

Additional Disclosure:

Depreciation and amortization

$

16,601

$

13,545

$

65,503

$

60,022

Amortization of deferred financing

costs

$

492

$

493

$

1,969

$

2,235

IMAX CORPORATION

CONSOLIDATED BALANCE

SHEETS

(In thousands of U.S. dollars,

except share amounts)

December 31,

December 31,

2024

2023

Assets

Cash and cash equivalents

$

100,592

$

76,200

Accounts receivable, net of allowance for

credit losses

107,669

136,259

Financing receivables, net of allowance

for credit losses

119,885

127,154

Variable consideration receivables, net of

allowance for credit losses

82,593

64,338

Inventories

32,840

31,584

Prepaid expenses

13,121

12,345

Film assets, net of accumulated

amortization

8,686

6,786

Property, plant and equipment, net of

accumulated depreciation

240,133

243,299

Other assets

22,441

20,879

Deferred income tax assets, net of

valuation allowance

14,499

7,988

Goodwill

52,815

52,815

Other intangible assets, net of

accumulated amortization

35,124

35,022

Total assets

$

830,398

$

814,669

Liabilities

Accounts payable

$

19,803

$

26,386

Accrued and other liabilities

100,916

111,013

Deferred revenue

52,686

67,105

Revolving credit facility borrowings, net

of unamortized debt issuance costs

36,356

22,924

Convertible notes and other borrowings,

net of unamortized discounts and debt issuance costs

229,901

229,131

Deferred income tax liabilities

12,521

12,521

Total liabilities

452,183

469,080

Commitments, contingencies and

guarantees

Non-controlling interests

680

658

Shareholders’ equity

Capital stock common shares — no par

value. Authorized — unlimited number.

52,946,200 issued and outstanding

(December 31, 2023 — 53,260,276 issued and outstanding)

401,420

389,048

Other equity

185,268

185,087

Statutory surplus reserve

4,051

3,932

Accumulated deficit

(274,675

)

(292,845

)

Accumulated other comprehensive loss

(16,598

)

(12,081

)

Total shareholders’ equity attributable

to common shareholders

299,466

273,141

Non-controlling interests

78,069

71,790

Total shareholders’ equity

377,535

344,931

Total liabilities and shareholders’

equity

$

830,398

$

814,669

IMAX CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands of U.S.

dollars)

Years Ended

December 31,

2024

2023

Operating Activities

Net income

$

32,702

$

33,066

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation and amortization

65,503

60,022

Amortization of deferred financing

costs

1,969

2,235

Credit loss (reversal) expense, net

(973

)

1,759

Write-downs, including asset

impairments

3,973

1,884

Deferred income tax benefit

(5,631

)

(1,447

)

Share-based and other non-cash

compensation

23,209

24,230

Unrealized foreign currency exchange

gain

(2,770

)

(212

)

Realized and unrealized investment

gain

(127

)

(465

)

Changes in assets and liabilities:

Accounts receivable

29,105

(1,907

)

Inventories

(1,501

)

(285

)

Film assets

(25,122

)

(20,394

)

Deferred revenue

(14,308

)

(3,882

)

Changes in other operating assets and

liabilities

(35,192

)

(35,989

)

Net cash provided by operating

activities

70,837

58,615

Investing Activities

Purchase of property, plant and

equipment

(8,428

)

(6,491

)

Investment in equipment for joint revenue

sharing arrangements

(24,341

)

(18,000

)

Acquisition of other intangible assets

(8,447

)

(8,344

)

Proceeds from sale of equity

securities

—

1,045

Net cash used in investing

activities

(41,216

)

(31,790

)

Financing Activities

Proceeds from revolving credit facility

borrowings

55,000

39,717

Repayments of revolving credit facility

borrowings

(42,000

)

(53,248

)

Proceeds from other borrowings

—

322

Repayments of other borrowings

(874

)

(53

)

Credit facility amendment fees paid

—

(46

)

Repurchase of common shares, IMAX

Corporation

(17,855

)

(26,823

)

Repurchase of common shares, IMAX

China

(116

)

(15

)

Taxes withheld and paid on employee stock

awards vested

(4,978

)

(6,466

)

Common shares issued - stock options

exercised

5,291

—

Principal payment under finance lease

obligations

(509

)

(480

)

Dividends paid to non-controlling

interests

—

(1,438

)

Net cash used in financing

activities

(6,041

)

(48,530

)

Effects of exchange rate changes on

cash

812

504

Increase (decrease) in cash and cash

equivalents during year

24,392

(21,201

)

Cash and cash equivalents, beginning of

year

76,200

97,401

Cash and cash equivalents, end of

year

$

100,592

$

76,200

Primary Reporting Groups

The Company’s Chief Executive Officer (“CEO”) is its Chief

Operating Decision Maker (“CODM”), as such term is defined under

U.S. GAAP. The CODM assesses segment performance based on segment

revenues and segment gross margins. Selling, general and

administrative expenses, research and development costs, the

amortization of intangible assets, provision for (reversal of)

current expected credit losses, certain write-downs, interest

income, interest expense, and income tax (expense) benefit are not

allocated to the Company’s segments.

The Company has two reportable segments:

(i)

Content Solutions, consists of services

provided to studios and other content creators, which principally

includes the digital remastering of films and other content into

IMAX formats for distribution to the IMAX network. To a lesser

extent, the Content Solutions segment also earns revenue from the

distribution of large-format documentary films and exclusive

experiences ranging from live performances to interactive events

with leading artists and creators, as well as film post-production

services.

(ii)

Technology Products and Services, which

includes results from the sale or lease of IMAX Systems, as well as

from the maintenance of IMAX Systems to exhibition customers. To a

lesser extent, the Technology Product and Services segment also

earns revenue from certain ancillary theater business activities,

including after-market sales of IMAX System parts and 3D

glasses.

Segment Revenue and Gross Margin

Three Months Ended

Years Ended

December 31,

(Unaudited)

December 31,

(In thousands of U.S. dollars)

2024

2023

2024

2023

Revenue

Content Solutions

$

25,513

$

19,093

$

124,731

$

126,698

Technology Products and Services

64,043

62,490

216,062

234,303

Sub-total for reportable segments

89,556

81,583

340,793

361,001

All Other(1)

3,116

4,435

11,415

13,838

Total

$

92,672

$

86,018

$

352,208

$

374,839

Gross Margin

Content Solutions

$

11,837

$

9,709

$

66,523

$

74,106

Technology Products and Services

34,222

29,880

115,553

129,946

Sub-total for reportable segments

46,059

39,589

182,076

204,052

All Other(1)

2,306

4,099

8,124

10,289

Total

$

48,365

$

43,688

$

190,200

$

214,341

_______________

(1)

All Other includes the results from the

Company’s streaming and consumer technology business, as well as

other ancillary activities.

IMAX CORPORATION NON-GAAP FINANCIAL

MEASURES

In this release, the Company presents adjusted net income

attributable to common shareholders and adjusted net income

attributable to common shareholders per basic and diluted share,

EBITDA, Adjusted EBITDA per Credit Facility, Adjusted EBITDA margin

as supplemental measures of the Company’s performance, which are

not recognized under U.S. GAAP. Adjusted net income or loss

attributable to common shareholders and adjusted net income or loss

attributable to common shareholders per basic and diluted share

exclude, where applicable: (i) share-based compensation; (ii)

realized and unrealized investment gains or losses; (iii)

transaction-related expenses; and (iv) restructuring and other

charges, as well as the related tax impact of these

adjustments.

The Company believes that these non-GAAP financial measures are

important supplemental measures that allow management and users of

the Company’s financial statements to view operating trends and

analyze controllable operating performance on a comparable basis

between periods without the after-tax impact of share-based

compensation and certain unusual items included in net income

attributable to common shareholders. Although share-based

compensation is an important aspect of the Company’s employee and

executive compensation packages, it is a non-cash expense and is

excluded from certain internal business performance measures.

A reconciliation from net income (loss) attributable to common

shareholders and the associated per share amounts to adjusted net

income attributable to common shareholders and adjusted net income

attributable to common shareholders per diluted share is presented

in the table below. Net income (loss) attributable to common

shareholders and the associated per share amounts are the most

directly comparable GAAP measures because they reflect the earnings

relevant to the Company’s shareholders, rather than the earnings

attributable to non-controlling interests.

In addition to the non-GAAP financial measures discussed above,

management also uses “EBITDA,” as such term is defined in the

Credit Agreement, and which is referred to herein as “Adjusted

EBITDA per Credit Facility.” As allowed by the Credit Agreement,

Adjusted EBITDA per Credit Facility includes adjustments in

addition to the exclusion of interest, taxes, depreciation and

amortization. Accordingly, this non-GAAP financial measure is

presented to allow a more comprehensive analysis of the Company’s

operating performance and to provide additional information with

respect to the Company’s compliance with its Credit Agreement

requirements, when applicable. In addition, the Company believes

that Adjusted EBITDA per Credit Facility presents relevant and

useful information widely used by analysts, investors and other

interested parties in the Company’s industry to evaluate, assess

and benchmark the Company’s results.

EBITDA is defined as net income or loss excluding: (i) income

tax expense or benefit; (ii) interest expense, net of interest

income; (iii) depreciation and amortization, including film asset

amortization; and (iv) amortization of deferred financing costs.

Adjusted EBITDA per Credit Facility is defined as EBITDA excluding:

(i) share-based and other non-cash compensation; (ii) realized and

unrealized investment gains or losses; (iii) transaction-related

expenses; (iv) restructuring and other charges costs; and (v)

write- downs, net of recoveries, including asset impairments and

credit loss expense or reversal.

A reconciliation of net income (loss) attributable to common

shareholders, which is the most directly comparable GAAP measure,

to EBITDA and Adjusted EBITDA per Credit Facility is presented in

the table below. Net income (loss) attributable to common

shareholders is the most directly comparable GAAP measure because

it reflects the earnings relevant to the Company’s shareholders,

rather than the earnings attributable to non-controlling

interests.

In this release, the Company also presents free cash flow, which

is not recognized under U.S. GAAP, as a supplemental measure of the

Company’s liquidity. The Company definition of free cash flow

deducts only normal recurring capital expenditures, including the

Company’s investment in joint revenue sharing arrangements, the

purchase of property, plant and equipment and the acquisition of

other intangible assets (from the Consolidated Statements of Cash

Flows), from net cash provided by or used in operating activities.

Management believes that free cash flow is a supplemental measure

of the cash flow available to reduce debt, add to cash balances,

and fund other financing activities. Free cash flow does not

represent residual cash flow available for discretionary

expenditures. A reconciliation of cash provided by operating

activities to free cash flow is presented below.

These non-GAAP measures may not be comparable to similarly

titled amounts reported by other companies. Additionally, the

non-GAAP financial measures used by the Company should not be

considered as a substitute for, or superior to, the comparable GAAP

amounts.

Adjusted EBITDA per Credit Facility

Three Months Ended

(Unaudited)

(In thousands of U.S. Dollars)

December 31, 2024

December 31, 2023

Revenues

$

92,672

$

86,018

Reported net income

$

6,866

$

3,311

Add (subtract):

Income tax expense

1,458

(1,850

)

Interest expense, net of interest

income

665

636

Depreciation and amortization, including

film asset amortization

16,601

13,545

Amortization of deferred financing

costs(1)

492

493

EBITDA

$

26,082

$

16,135

Share-based and other non-cash

compensation

5,948

6,400

Unrealized investment gains

(33

)

(29

)

Transaction-related expenses

—

327

Restructuring and other charges(2)

3,749

1,593

Write-downs, including asset impairments

and credit loss reversal

1,452

812

Total Adjusted EBITDA

$

37,198

$

25,238

Total Adjusted EBITDA margin

40.1

%

29.3

%

Less: Non-controlling interest

(2,990

)

(2,221

)

Adjusted EBITDA per Credit Facility -

attributable to common shareholders

$

34,208

$

23,017

_______________

(1)

The amortization of deferred financing

costs is recorded within Interest Expense in the Condensed

Consolidated Statement of Operations.

(2)

Reflects restructuring related costs in

connection with capturing efficiencies, centralizing certain

operational roles and costs incurred in connection with the

Company’s internal asset sale.

Twelve Months Ended

(In thousands of U.S. Dollars)

December 31, 2024(1)

December 31, 2023(1)

Revenues

$

352,208

$

374,839

Reported net income

$

32,702

$

33,066

Add (subtract):

Income tax expense

4,996

13,051

Interest expense, net of interest

income

3,936

2,101

Depreciation and amortization, including

film asset amortization

65,503

60,022

Amortization of deferred financing

costs(2)

1,969

2,235

EBITDA

$

109,106

$

110,475

Share-based and other non-cash

compensation

23,209

24,230

Unrealized investment gains

(127

)

(465

)

Transaction-related expenses

—

3,569

Restructuring and other charges(3)

3,749

2,946

Write-downs, including asset impairments

and credit loss reversal

2,999

3,273

Total Adjusted EBITDA

$

138,936

$

144,028

Total Adjusted EBITDA margin

39.4

%

38.4

%

Less: Non-controlling interest

$

(14,191

)

$

(15,869

)

Adjusted EBITDA per Credit Facility -

attributable to common shareholders

$

124,745

$

128,159

_______________

(1)

The Senior Secured Net Leverage Ratio is

calculated using Adjusted EBITDA per Credit Facility determined on

a trailing twelve-month basis.

(2)

The amortization of deferred financing

costs is recorded within Interest Expense in the Condensed

Consolidated Statement of Operations.

(3)

Reflects restructuring related costs in

connection with capturing efficiencies, centralizing certain

operational roles and costs incurred in connection with the

Company’s internal asset sale.

Adjusted Net Income Attributable to Common Shareholders and

Adjusted Net Income Per Share

Three Months Ended

December 31, 2024

(Unaudited)

Three Months Ended

December 31, 2023

(In thousands of U.S. Dollars, except per

share amounts)

Net Income

Per Diluted

Share

Net Income

Per Diluted

Share

Net income attributable to common

shareholders

$

5,306

$

0.10

$

2,540

$

0.05

Adjustments(1):

Share-based compensation

5,768

0.11

6,074

0.11

Unrealized investment gains

(33

)

—

(32

)

—

Transaction-related expenses

—

—

119

—

Restructuring and other charges(2)

3,749

0.07

1,335

0.02

Tax impact on items listed above

(322

)

(0.01

)

(747

)

(0.01

)

Adjusted net income(1)

$

14,468

$

0.27

$

9,289

$

0.17

Weighted average shares outstanding (in

thousands):

Basic

52,770

53,973

Diluted

54,706

54,983

_______________

(1)

Reflects amounts attributable to common

shareholders.

Years Ended December

31,

2024

2023

(In thousands of U.S. Dollars, except per

share amounts)

Net Income

Per Diluted

Share

Net Income

Per Diluted

Share

Net income attributable to common

shareholders

$

26,059

$

0.48

$

25,335

$

0.46

Adjustments(1):

Share-based compensation

22,454

0.42

23,184

0.42

Unrealized investment gains

(127

)

—

(558

)

(0.01

)

Transaction-related expenses

—

—

3,361

0.06

Restructuring and other charges(2)

3,749

0.07

2,688

0.05

Tax impact on items listed above

(1,125

)

(0.02

)

(1,931

)

(0.04

)

Adjusted net income(1)

$

51,010

$

0.95

$

52,079

$

0.94

Weighted average shares outstanding (in

thousands):

Basic

52,650

54,310

Diluted

53,864

55,146

_______________

(1)

Reflects amounts attributable to common

shareholders.

(2)

Reflects restructuring related costs in

connection with capturing efficiencies, centralizing certain

operational roles and costs incurred in connection with the

Company’s internal asset sale.

Free Cash Flow

Years Ended

December 31,

(In thousands of U.S. Dollars)

2024

2023

Net cash provided by operating

activities

$

70,837

$

58,615

Purchase of property, plant and

equipment

(8,428

)

(6,491

)

Acquisition of other intangible assets

(8,447

)

(8,344

)

Free cash flow before growth CAPEX(1)

53,962

43,780

Investment in equipment for joint revenue

sharing arrangements

(24,341

)

(18,000

)

Free cash flow

$

29,621

$

25,780

_______________

(1)

Growth CAPEX is defined as capital

expenditures associated with investments in equipment for joint

revenue sharing arrangements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219198942/en/

For additional information please contact:

Investors: IMAX Corporation, New York Jennifer Horsley

212-821-0154 jhorsley@IMAX.com

Media: IMAX Corporation, New York Mark Jafar 212-821-0102

mjafar@imax.com

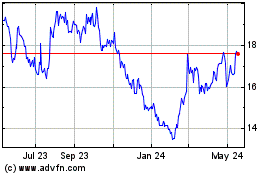

IMAX (NYSE:IMAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

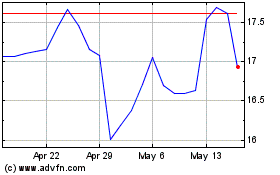

IMAX (NYSE:IMAX)

Historical Stock Chart

From Feb 2024 to Feb 2025