For Immediate Release

Chicago, IL – December 6, 2011 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Limited Brands Inc.

( LTD), Gap Inc. ( GPS), Hanesbrands

Inc. ( HBI), FedEx Corporation ( FDX) and

United Parcel Service ( UPS).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Monday’s Analyst

Blog:

Limited Brands’ Sales Rise

Limited Brands Inc. ( LTD), a specialty

retailer of women’s intimate and other apparel, beauty and personal

care products, recently posted better-than-expected sales results

for the four-week period ended November 26, 2011 on the heels of

healthy sales at its Victoria's Secret Stores and Bath & Body

Works.

The owner of Victoria's Secret Direct and La Senza chains has

sustained its growth momentum. Limited Brands’ comparable-store

sales for November 2011 rose 7% following an increase of 6% in

October 2011 and compared with a 10% jump in November 2010.

Comparable-store sales for November increased 11% at Victoria’s

Secret Stores & Victoria’s Secret Beauty and 6% at Bath &

Body Works & The White Barn Candle Co. but declined 7% at La

Senza. Sales at Victoria’s Secret Direct dropped 3%.

Limited Brands, which competes with Gap Inc. (

GPS) and Hanesbrands Inc. ( HBI), said that net

sales for November fell 2.3% to $872.6 million from $893 million

posted in the same month last year.

For the forty-three week period ended November 26, 2011,

comparable-store sales surged 10%, whereas net sales jumped 9.5% to

$7,721 million from $7,050 million reported in the prior-year

period.

Limited Brands is also actively managing its cash flows, and

returning much of its free cash via dividends and share

repurchases. The company announced a special dividend of $2 per

share payable on December 23, 2011, to shareholders of record as of

December 12, 2011. Considering this dividend, the company would

have returned $12 billion to stockholders since 2000.

Management expects to generate free cash flows of about $700

million during fiscal 2011, and exit the year with a cash balance

of about $800 million, taking into account the special dividend

that has been declared.

Currently, we have a long-term Neutral recommendation on the

stock. Moreover, Limited Brands holds a Zacks #3 Rank that

translates into a short-term Hold rating.

FedEx Raises Domestic Rates Again

FedEx Corporation ( FDX) will reportedly raise

its freight service prices for the next year. The company’s ground

and home delivery rates have been raised by 4.9%, effective

January.

The hike follows an average rate hike of 3.9% in U.S. domestic,

export and import services implemented in October. Concurrently,

FedEx had also introduced a general rate hike of 6.75%.

FedEx, along with its peers like United Parcel

Service ( UPS) have been successful in implementing rate

hikes even amid a gloomy economic outlook, given the strengthening

of freight market fundamentals. Further, the softness in U.S.

postal service’s business has also aided these companies to gain

significant market share.

Despite the price hike, FedEx expects to sustain top-line growth

in Ground and Freight segments on strong yields. Part of this

momentum is expected to come from international expansion.

Moreover, FedEx expects growth in Asia, Latin America, China,

India, Mexico and Brazil to augur well. The company also aims at

enhancing existing routes and making strategic acquisitions.

Accordingly, it bought AFL Pvt. Ltd, a logistics, distribution and

express business in India that improved its position in the freight

market. Its acquisition of MultiPack, a Mexican domestic express

package delivery company, in the second quarter this year was also

in sync with its growth strategy.

Further, the company is realigning its network capacity to match

weak international volumes due to the drop in Asian demand.

Consequently, FedEx has taken several initiatives including

reducing flights and frequencies as well as redeploying equipment

in other networks to reduce costs.

We believe all these strategic decisions would lead to improved

revenue, margins, earnings and cash flow this year and beyond.

However, increased investments, competitive threats, unionized

workforce and steeper fuel prices could limit the upside potential

of the stock.

We are currently reiterating our long-term Neutral rating on

FedEx. The stock retains a Zacks #3 (Hold) Rank for the short

term.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

FEDEX CORP (FDX): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

HANESBRANDS INC (HBI): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

UTD PARCEL SRVC (UPS): Free Stock Analysis Report

Zacks Investment Research

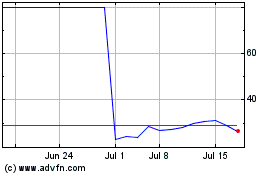

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

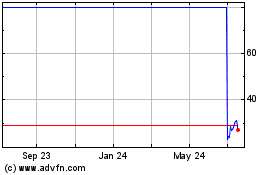

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024