Highlights

- Metals Acquisition Limited was admitted to the ASX under the

code ‘MAC’ and is now dual listed on the ASX and NYSE.

- MAC raised A$325 million via the issue of 19,117,648 Chess

Depositary Interests (CDIs) at A$17.00 per CDI (the

Offer), being the top of the indicative price range for

MAC’s bookbuild.

- The implied market capitalisation of MAC following completion

of the Offer is A$1.18 billion, making MAC’s ASX listing the

largest mining listing on ASX in over 5 years, with the funds

raised under the Offer representing the largest amount raised for a

mining IPO on the ASX since July 2021.

- Strong support for the Offer was received from Australian and

offshore institutional investors, including MAC’s existing

shareholders.

- The dual listing on ASX provides MAC with greater liquidity and

access to capital from Australian institutional and retail

investors.

- Proceeds of the Offer will be used for further development of

the Company’s CSA Copper Mine in NSW, to pay a deferred payment due

to the previous owner of the CSA Copper Mine, Glencore, to fund

growth opportunities at CSA, for working capital and costs of the

Offer.

- MAC’s goal is to create a leading mid-tier, multi-asset

producer of metals critical to the decarbonisation of the global

economy.

- MAC has a disciplined acquisition strategy focused on operating

assets in stable global jurisdictions that have turnaround

potential to create value upside for shareholders.

- MAC is supported by a strong board and management team that

have collectively operated in the world’s Tier 1 mining regions

that is led by Australian CEO Mick McMullen, who was previously CEO

of North America’s Detour Gold Corporation and Stillwater Mining

Company.

Metals Acquisition Limited ARBN 671 963 198 (NYSE: MTAL; ASX:

MAC) (‘MAC’ or the ‘Company’) is pleased to announce

that following completion of its heavily oversubscribed initial

public offering in Australia of CDIs, the Company has commenced

trading on the Australian Securities Exchange (ASX) today

under the ticker ‘MAC’.

MAC raised A$325 million (before costs) via the issue of

19,117,648 CDIs at the top of the indicative price range, being

A$17.00 per CDI. Given the level of demand under the bookbuild

process in connection with the Offer, MAC determined to upsize the

raise from A$300 million to A$325 million. Based on the final price

of A$17.00 per CDI, at listing MAC has an implied total market

capitalisation of approximately A$1.18 billion. This cements MAC’s

IPO as the biggest ASX mining listing based on market

capitalisation in over 5 years.

Barrenjoey Markets Pty Limited and Canaccord Genuity (Australia)

Limited acted as joint lead managers to the IPO. Gilbert + Tobin,

Skadden, Arps, Slate, Meagher & Flom and Ogier are acting as

Australian, US and Jersey legal advisors to the Company in relation

to the Offer and ASX listing.

Also listed on the New York Stock Exchange (NYSE), MAC’s

goal is to acquire and operate metals and mining assets in

high-quality, stable jurisdictions around the world that are

critical in the electrification and decarbonisation of the global

economy.

The Company’s foundational asset is the CSA Copper Mine

(CSA) near Cobar, western New South Wales, which MAC

acquired from Glencore last year. CSA is the highest-grade copper

mine in Australia.

MAC will use the IPO proceeds to repay a A$127 million (US$82.9

million) deferred consideration facility to Glencore in connection

with the A$1.64 billion (US$1.1 billion) acquisition of CSA (which

was paid in full on 16 February 2024). It will also commit further

working capital to improve the mine’s production, development

opportunities and undertake in-mine, near-mine and regional

exploration.1

Backed by a strong board and management team, MAC is led by CEO

Mick McMullen, who has more than 30 years of senior leadership

experience in the exploration, financing, development, and

operations of mining companies globally.

Mr. McMullen grew up in western NSW and was previously CEO and

President of Canadian gold producer, Detour Gold Corporation, where

he increased Detour’s market capitalisation from C$2.1 billion to

C$4.9 billion over seven months leading to the C$4.9 billion

acquisition of Detour by Kirkland Lake Gold Ltd. He was CEO at US

palladium and platinum producer, Stillwater Mining Company,

increasing its market capitalisation from US$1.3 billion to US$2.2

billion, and its eventual US$2.7 billion sale to Sibanye Gold

Ltd.

Mr. McMullen said: “We are very pleased to have achieved an ASX

listing and thank our new shareholders for their support for MAC.

An Australian IPO and listing will allow us to pursue a range of

organic and inorganic growth opportunities in Australia and

globally to continue building shareholder value.

While we have made significant progress in improving overall

operational performance at our CSA Copper Mine to date, our initial

focus will be to assess further exploration, development, and

production improvement opportunities.

With a disciplined M&A strategy, we will continue to

evaluate prospects for growth through acquiring and operating

assets in stable mining jurisdictions that will benefit from a

turnaround and optimisation program to enhance value.

The listing is an important milestone for the Company as we

continue to expand and work towards our long-term goal of owning

and operating multiple metals and mining assets that are critical

to the electrification and decarbonisation of the global economy

and become a notable player in the industry.

As we grow, we are focused on ESG stewardship and a firm

commitment to the responsible and sustainable discovery,

development, extraction, and use of mineral resources. We are also

committed to ensuring our assets are operated safely in partnership

with local communities and other stakeholders.

On behalf of the Board and employees, I would like to thank our

new shareholders for their support in what has been a strongly

backed ASX IPO. We have received outstanding support and interest

throughout the IPO process from investors, many of whom are

existing holders continuing to support our vision.”

This announcement is authorised for release by the Board of

Directors.

About Metals Acquisition Limited

Metals Acquisition Limited is a company focused on operating and

acquiring metals and mining businesses in high-quality, stable

jurisdictions that are critical in the electrification and

decarbonisation of the global economy. It is dual-listed on the New

York Stock Exchange and the Australian Securities Exchange.

MAC owns and operates the CSA Copper Mine in Cobar, NSW,

Australia, which it acquired from Glencore plc in 2023. CSA is the

highest grade, producing copper asset in Australia, producing ~40kt

of copper per annum; and ~450koz of silver. MAC is looking for in

and near-mine growth opportunities and CSA, while seeking further

acquisitions.

With a strong focus on environmental, social and governance

stewardship, MAC’s team uses its deep technical and cost reduction

expertise to identify assets with operational upside, cost

reduction potential and/or expansion opportunities to extract value

for shareholders.

MAC’s expertise extends across all commodities, including base

metals, precious metals, battery metals, and through the value

chain – from upstream mining through downstream processing and

commodities trading, in all major mining jurisdictions.

For more information, please visit metalsacquisition.com

Forward Looking Statements

This press release includes “forward-looking statements.” MAC’s

actual results may differ from expectations, estimates, and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions)

are intended to identify such forward-looking statements. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult

to predict. Factors that may cause such differences include, but

are not limited to: the ability to recognize the anticipated

benefits of the business combination, which may be affected by,

among other things; the supply and demand for copper; the future

price of copper; the timing and amount of estimated future

production, costs of production, capital expenditures and

requirements for additional capital; cash flow provided by

operating activities; unanticipated reclamation expenses; claims

and limitations on insurance coverage; the uncertainty in mineral

resource estimates; the uncertainty in geological, metallurgical

and geotechnical studies and opinions; infrastructure risks; and

dependence on key management personnel and executive officers; and

other risks and uncertainties. MAC cautions that the foregoing list

of factors is not exclusive. MAC cautions readers not to place

undue reliance upon any forward-looking statements, which speak

only as of the date made. MAC does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions, or

circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or

CSA Mine’s financial results is included from time to time in MAC’s

public reports filed with the SEC. If any of these risks

materialize or MAC’s assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. There may be additional risks that MAC

does not presently know, or that MAC currently believes are

immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or

forecasts of future events and views as of the date of this

communication. MAC anticipates that subsequent events and

developments will cause its assessments to change. However, while

MAC may elect to update these forward-looking statements at some

point in the future, MAC specifically disclaims any obligation to

do so, except as required by law. These forward- looking statements

should not be relied upon as representing MAC’s assessment as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

______________________________ 1 Further details concerning the

use of funds raised under the Offer are set out in the announcement

titled ‘Pre-quotation disclosure’ dated 16 February 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240220718410/en/

Company:

Mick McMullen Chief Executive Officer Metals

Acquisition Limited mick.mcmullen@metalsacqcorp.com

Dan Vujcic Chief Development Officer Metals Acquisition

Limited +61 461 304 393 dan.vujcic@metalsacqcorp.com

Media

Shane Murphy FTI Consulting +61 420 945 291

shane.murphy@fticonsulting.com

Jane Munday FTI Consulting +61 488 400 248

jane.munday@fticonsulting.com

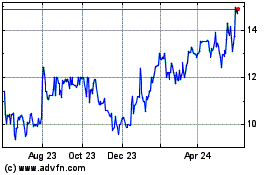

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

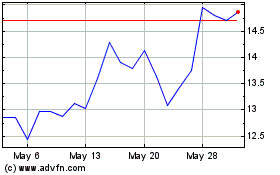

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Feb 2024 to Feb 2025