Metals Acquisition Limited (NYSE: MTAL) (ASX:MAC):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241021314602/en/

Figure 1 – CSA Copper Mine Long Section

(Graphic: Business Wire)

Metals Acquisition Limited (“MAC” or the “Company”) today

provides a market update on the continuing exploration and resource

development at the CSA Copper Mine:

Highlights

- All results reported in this release are after the cut-off date

(August 31, 2023) for the 2023 Resource and Reserve and will be

incorporated in the 2024 Resource and Reserve Estimate update.

- Results from QTS North (“QTSN”) include:

- 12.5m @ 5.4% Cu from 103.0m and 19.8m @ 10.9% Cu from 177.1m in

UDD23021

- 27.3m @ 8.7% Cu from 126.0m in UDD23019

- 8.1m @ 7.3% Cu from 143.6m, 4.9m @ 10.9% Cu from 168.8m, 4.3m @

8.3% Cu from 177.3m and 13.3m @ 9.2% Cu from 183.7m in

UDDD24063

- Results from QTS Central (“QTSC”) include:

- 23.6m @ 5.2% Cu from 98.7 m in UDD24017

- 6.3m @ 11.3% Cu from 84.0m in UDD24012

- 6.6m @ 8.4% Cu from 54.3m in UDD24010

- Results for QTSS Upper A include:

- 3.8m @ 17.1% Cu from 214.3m in QSDD061

Discussion

Underground exploration continued to focus on the down dip and

along strike extensions of the QTSN and QTSC deposits, as well as

the shallower, up dip portions of the East and West deposits and

QTSS Upper.

Results are reported as down hole widths. A complete list of

September quarter 2024 resource drilling results is contained in

Table 1 at the end of this report.

MAC CEO, Mick McMullen commented, “The CSA deposits continue to

deliver the high-grade intervals we have come to expect from it.

The drilling of the Inferred and mineralised extensions of QTSN

have shown good continuity with strike extensions adding to the

tonnes per vertical metre of the mineralisation. Having a core

deposit that grades in excess of 8% Cu provides us with a lot of

flexibility all through the cycle. As we continue to refine mining

methods and manage dilution better than in the past, we are seeing

the benefit in the mill with the September quarter mill feed grade

at 4% Cu.

QTSSU-A has been drilled from surface now to provide us the

confidence to commence development works in the near term. In

addition, we see good potential for additional discovery between

this deposit and the main mine with over 600m of poorly tested

strike extension in this area that the development will pass

through. Our intention is to push the development past QTSSU-A to

the Pink Panther prospect that is located 250m further to the South

East along strike to provide both a drill platform and potential

access for development if that prospect can be converted to a

resource.

Finally, drilling of the high-grade Zn mineralisation above the

East and West lenses has confirmed the presence as indicated by

historical data and as Polymetals (“POL”) advance their planning

for restart of the Endeavour mill this should dovetail well with

our timing for potentially mining this material.”

CSA Copper Mine

The CSA Copper Mine is a world class mine that consists of a

series of mineralized lenses that extend from surface to a depth of

over 2.3km. The main deposits are QTSN, QTSC, QTSS, Eastern and

Western lenses with additional mineralisation in the near surface

QTSS Upper A zone. Approximately 75% of the resources are contained

in QTSN.

Refer to Figure 1 below for the location of the various

deposits.

Exploration Results

Drilling has been targeting conversion of Inferred resource to

Measured and Indicated for inclusion in the Reserve Estimate, as

well as the known mineralized lenses to add incremental

resources.

The location of the significant drill results is shown in Figure

2 below.

At QTSN, the most recent drilling continues to confirm the

location of the Inferred Resource and will enable it to be upgraded

as well as confirmation of the smaller mineralized lenses adjacent

to the existing resource. This can be seen in Figures 3 to 4. QTSN

is characterised by a series of high-grade lenses (grading plus 5%

Cu) that can range in width from 10-35m surrounded by a lower grade

halo on the footwall.

As drilling has progressed down dip it would appear that tonnes

per vertical metre are increasing and drilling is now pushed down

well into the Inferred resources (refer to Fig 3 & Fig 3A)

which will be helpful for upgrading of that material.

The 13.3m @ 9.2% Cu in UDD24063 is completely outside any of the

current resource of known mineralisation and has significantly

extended the strike length of QTSN to the south and is a high

priority area for follow up infill drilling.

QTSC is located adjacent to QTSN and is centred around a depth

of 1.4km and is open both up and down dip. QTSC is typically

narrower than QTSN but higher grade. As seen in Figures 4 and 5 the

most recent drilling continues to confirm the presence of the

high-grade mineralisation below the current working level through

the Inferred Resource and into mineralised material that will both

extend the resource beyond its current limits and extend the

Measured and Indicated material for inclusion into the 2024 Mineral

Reserve.

The interval in UDD24017 is substantially thicker than typically

seen at QTSC and in the middle of the Inferred resource which

should have a materially positive impact for classification of this

resource.

The shallow (< 400m from surface) portions of the CSA Copper

Mine include substantial mineralisation around the existing

workings that are the up-dip portion of the Eastern and Western

lenses as seen in Figure 5. This material is at approximately the

same elevation as the QTSS Upper deposit located approximately 600m

to the south of the main mine as seen in Figure 5 also.

Drilling in the Pb- Zn areas over the Eastern lens has

intersected high grade Zn mineralisation plus Pb and Cu immediately

adjacent to existing development. MACs focus is on the Cu

mineralisation within the rest of the mine, however with the

agreement signed with Polymetals in the June quarter MAC now has

access to Zn material processing capacity. Results returned during

the quarter (refer Fig 6) from Upper Pb-Zn Eastern and Western

Lenses (“Pb-Zn”) include:

- 1.7m @ 3.3% Zn, 1.5% Pb, 0.1% Cu & 7g/t Ag from 176.8m

(EWDD24003)

- 5.8m @ 8.3% Zn, 3.9% Pb, 0.2% Cu & 11g/t Ag from 190.2m

(EWDD24003)

- 5.7m @ 3.5% Zn, 0.87% Pb, 0.7% Cu & 19g/t Ag from 219m

(EWDD24003)

QTSS Upper A is a narrow (1.5 to 4m) but very high-grade zone of

mineralisation that is much shallower than the rest of the mine.

This lens starts approximately 120m below surface and extends to

approximately 350m below surface.

As the majority of the mineral resource for QTSS Upper is in the

Inferred category, this material is being drilling out from surface

to upgrade the classification for detailed mine planning. The

production guidance that MAC has published does not include any

Inferred material, and as such, any production from QTSS Upper

would be in excess of the production guidance.

Figure 7 illustrates the recent Cu and Zn results from this

deposit which are typically narrow but very high grade and close to

surface.

Qualified Person Statement

The information in this announcement that relates to Exploration

Results at the CSA Copper Mine is based on information compiled or

reviewed by Eliseo Apaza, a Qualified Person for the purpose of S-K

1300 who is a Member of the Australian Institute of Mining and

Metallurgy. Mr Apaza is employed by a wholly owned subsidiary of

the Company. Mr. Apaza has given (and not withdrawn) written

consent to the inclusion in the report of the results reported here

and the form and context in which it appears.

This announcement is authorised for release by Mick McMullen,

Chief Executive Officer and Director.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) is a company

focused on operating and acquiring metals and mining businesses in

high quality, stable jurisdictions that are critical in the

electrification and decarbonization of the global economy.

Cautionary and Forward Looking Statements

This release has been prepared by Metals Acquisition Limited

(“Company” or “MAC”) and includes “forward-looking statements.” The

forward-looking information is based on the Company’s expectations,

estimates, projections and opinions of management made in light of

its experience and its perception of trends, current conditions and

expected developments, as well as other factors that management of

the Company believes to be relevant and reasonable in the

circumstances at the date that such statements are made, but which

may prove to be incorrect. Assumptions have been made by the

Company regarding, among other things: the price of copper,

continuing commercial production at the CSA Copper Mine without any

major disruption, the receipt of required governmental approvals,

the accuracy of capital and operating cost estimates, the ability

of the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when

required and on reasonable terms. Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions

which may have been used by the Company. Although management

believes that the assumptions made by the Company and the

expectations represented by such information are reasonable, there

can be no assurance that the forward-looking information will prove

to be accurate.

MAC’s actual results may differ from expectations, estimates,

and projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions)

are intended to identify such forward- looking statements. These

forward-looking statements include, without limitation, MAC’s

expectations with respect to future performance of the CSA Copper

Mine. These forward-looking statements involve significant risks

and uncertainties that could cause the actual results to differ

materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult

to predict. Factors that may cause such differences include, but

are not limited to: the supply and demand for copper; the future

price of copper; the timing and amount of estimated future

production, costs of production, capital expenditures and

requirements for additional capital; cash flow provided by

operating activities; unanticipated reclamation expenses; claims

and limitations on insurance coverage; the uncertainty in Mineral

Resource estimates; the uncertainty in geological, metallurgical

and geotechnical studies and opinions; infrastructure risks;; and

other risks and uncertainties indicated from time to time in MAC’s

other filings with the SEC and the ASX. MAC cautions that the

foregoing list of factors is not exclusive. MAC cautions readers

not to place undue reliance upon any forward-looking statements,

which speak only as of the date made. MAC does not undertake or

accept any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions,

or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or

CSA Copper Mine’s financial results is included from time to time

in MAC’s public reports filed with the SEC and the ASX. If any of

these risks materialize or MAC’s assumptions prove incorrect,

actual results could differ materially from the results implied by

these forward-looking statements. There may be additional risks

that MAC does not presently know, or that MAC currently believes

are immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or

forecasts of future events and views as of the date of this

communication. MAC anticipates that subsequent events and

developments will cause its assessments to change. However, while

MAC may elect to update these forward-looking statements at some

point in the future, MAC specifically disclaims any obligation to

do so, except as required by law. These forward-looking statements

should not be relied upon as representing MAC’s assessment as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

JORC / SK-1300

MAC is subject to the reporting requirements of both the

Securities Exchange Act of 1934 (US) and applicable Australian

securities laws (including the ASX Listing Rules), and as a result,

has separately reported its Exploration Results according to the

standards applicable to those requirements. U.S. reporting

requirements are governed by S-K 1300, as issued by the SEC.

Australian reporting requirements are governed by Australasian

Joint Ore Reserve Committee Code, 2012 edition (JORC). Both sets of

reporting standards have similar goals in terms of conveying an

appropriate level of consistency and confidence in the disclosures

being reported, but the standards embody slightly different

approaches and definitions. All disclosure of Exploration Results

in this report are reported in accordance with S-K 1300. For JORC

and ASX Listing Rule compliant disclosure (including JORC Table 1

analysis) please see the Company’s separate release to be released

on ASX on 22 October 2024.

Table 1 – Significant Drill Results for QTSN, QTSC, QTSSU-A

& Eastern Systems

Cu Results

Hole

East (MG)

North (MG)

RL. (MG)

EOH (m)

Azimuth (MG)

Dip

From (m)

To (m)

Length (m)

Cu %

Ag g/t

System

UDD21145

5,873.10

3,862.57

8,475.64

250.10

110.0

-5.0

94.5

101.0

6.5

4.8

26

QTS North

UDD22118

5,844.25

4,216.52

8,513.65

410.50

52.4

-35.0

283.8

290.8

7.0

4.8

14

QTS North

UDD23008

5,872.81

3,863.55

8,474.09

371.00

85.6

-59.4

108.7

112.0

3.3

4.7

19

QTS North

UDD23011

5,872.90

3,862.90

8,474.10

326.00

103.8

-58.9

110.9

114.9

4.0

7.3

35

QTS North

118.1

121.8

3.7

3.3

0

QTS North

181.8

187.2

5.4

5.5

42

QTS North

254.0

257.3

3.3

3.3

15

QTS North

UDD23019

5,903.65

3,963.35

8,417.72

250.00

83.0

-46.0

34.7

38.7

4.0

3.0

0

QTS North

82.6

88.2

5.6

6.5

25

QTS North

103.8

107.5

3.7

5.0

13

QTS North

126.0

153.3

27.3

8.7

37

QTS North

161.0

164.3

3.3

3.1

13

QTS North

UDD23035

5,850.64

4,148.23

8,443.31

330.00

110.5

-22.2

173.5

176.6

3.1

3.1

12

QTS North

185.2

189.7

4.5

5.5

29

QTS North

205.0

211.7

6.7

6.7

41

QTS North

214.7

218.3

3.6

3.7

17

QTS North

222.2

227.1

4.9

2.6

5

QTS North

UDD23098

5,850.23

4,149.51

8,442.73

330.30

82.5

-45.0

187.9

203.6

15.7

4.0

18

QTS North

209.9

230.6

20.7

3.7

11

QTS North

262.0

268.0

6.0

3.5

11

QTS North

UDD23099

5,850.42

4,149.58

8,442.78

300.00

82.5

-40.0

174.8

187.1

12.3

3.9

20

QTS North

192.0

199.0

7.0

4.5

7

QTS North

201.1

212.1

11.0

4.3

8

QTS North

229.0

232.0

3.0

4.4

28

QTS North

243.9

249.0

5.1

5.3

10

QTS North

UDT24020A

5,839.18

4,209.38

8,443.29

497.00

63.5

-34.0

275.8

280.6

4.8

6.2

13

QTS North

UDD20143

5,873.03

3,862.78

8,474.16

400.00

105.7

-48.0

95.5

101.9

6.4

5.3

24

QTS North

UDD23021

5,903.13

3,964.45

8,417.63

280.00

55.0

-49.0

103.0

115.5

12.5

5.4

17

QTS North

131.4

135.9

4.5

4.2

11

QTS North

138.4

142.9

4.5

3.1

4

QTS North

177.1

196.9

19.8

10.9

37

QTS North

228.4

231.7

3.3

6.9

41

QTS North

UDD23093

5,850.58

4,148.66

8,443.05

332.03

101.2

-31.0

192.0

198.9

6.9

3.5

8

QTS North

208.0

231.0

23.0

3.9

13

QTS North

UDD23094

5,850.38

4,148.58

8,442.79

362.00

103.8

-39.0

171.6

174.6

3.0

4.6

35

QTS North

204.3

207.9

3.6

3.2

7

QTS North

224.5

235.0

10.5

3.9

19

QTS North

UDD23096

5,850.03

4,148.46

8,442.61

422.00

110.0

-50.5

212.5

218.1

5.6

3.8

9

QTS North

222.5

230.0

7.5

4.0

0

QTS North

249.8

254.0

4.2

3.6

10

QTS North

257.7

265.0

7.3

2.8

12

QTS North

275.0

280.0

5.0

6.3

16

QTS North

292.0

295.5

3.5

2.9

30

QTS North

UDD24062

5,871.71

3,859.79

8,476.46

210.00

140.0

8.0

110.0

114.0

4.0

6.0

35

QTS North

134.9

144.3

9.4

2.9

23

QTS North

UDD24063

5,870.81

3,860.53

8,474.32

565.50

145.0

-35.0

143.6

151.7

8.1

7.3

47

QTS North

168.8

173.7

4.9

10.9

44

QTS North

177.3

181.6

4.3

8.3

42

QTS North

183.7

197.0

13.3

9.2

53

QTS North

201.3

206.5

5.2

4.7

18

QTS North

UDD24136

5,870.90

3,861.60

8,474.08

466.70

130.0

-50.0

135.4

139.0

3.6

3.4

40

QTS North

150.8

156.0

5.2

4.1

24

QTS North

173.0

182.0

9.0

2.7

11

QTS North

220.5

224.3

3.8

3.2

11

QTS North

UDD23032

5,872.95

3,862.98

8,474.12

300.00

101.0

-52.5

93.0

96.3

3.3

8.6

59

QTS North

98.6

102.4

3.8

3.1

10

QTS North

UDD23041

5,839.10

4,207.41

8,443.54

330.00

98.0

-33.0

184.4

198.5

14.1

6.3

21

QTS North

201.9

206.7

4.8

5.2

10

QTS North

249.0

252.9

3.9

10.3

15

QTS North

UDD24060

5,872.94

3,860.32

8,476.48

350.00

125.0

7.0

124.3

128.0

3.7

3.9

39

QTS North

UDD24016

6,078.18

3,585.93

8,619.57

106.60

114.4

-41.0

75.7

79.4

3.7

6.2

8

QTS Central

UDD24017

6,077.89

3,585.86

8,619.29

150.20

117.5

-50.1

86.7

92.7

6.0

4.5

0

QTS Central

98.7

122.3

23.6

5.2

14

QTS Central

UDD24005

6,078.86

3,589.07

8,620.35

90.00

55.9

-14.1

71.7

76.3

4.6

6.7

15

QTS Central

UDD24008

6,078.80

3,587.39

8,620.08

88.70

82.5

-25.1

57.5

66.5

9.0

5.2

10

QTS Central

UDD24009

6,078.08

3,587.36

8,619.51

116.00

79.8

-49.5

95.7

98.8

3.1

3.1

5

QTS Central

UDD24010

6,078.90

3,586.42

8,620.58

80.00

100.4

-15.3

54.3

60.9

6.6

8.4

106

QTS Central

UDD24012

6,078.38

3,586.59

8,619.63

101.00

100.1

-44.7

84.0

90.3

6.3

11.3

20

QTS Central

* Note: Boreholes intersections criteria based on Copper grade

>2.5% and >3m.

Hole

East (MG)

North (MG)

RL. (MG)

EOH (m)

Azimuth (MG)

Dip

From (m)

To (m)

Length (m)

Cu %

Ag g/t

System

QSDD061

6,378.57

3,030.45

10,259.66

289.10

280.3

-66.6

214.3

218.1

3.8

17.1

41

QTSSU-A

QSDD062

6,378.96

3,030.28

10,260.04

212.50

272.4

-58.3

193.7

196.6

2.9

4.1

12

QTSSU-A

QSDD071

6,436.06

2,903.27

10,258.00

347.20

274.5

-67.3

312.0

314.4

2.4

6.8

22

QTSSU-A

* Note: The intersects criteria is not apply to Eastern and QTS

South Upper A due to their mineralization styles as narrow

vein.

Zinc Results

Hole

East (MG)

North (MG)

RL. (MG)

EOH (m)

Azimuth (MG)

Dip

From (m)

To (m)

Length (m)

Cu %

Ag g/t

Pb %

Zn %

EWDD24003

5,860.00

3,720.00

10,272.00

581.10

268.4

-57.2

176.8

178.5

1.7

0.1

7

1.5

3.3

190.2

196.0

5.8

0.2

11

3.9

8.3

219.0

224.7

5.7

0.7

19

0.8

3.5

QSDD071

6,436.06

2,903.27

10,258.00

347.20

274.5

-67.3

302.7

305.2

2.5

1.2

18

6.9

16.2

* Note: The intersects criteria is not apply to Eastern and QTS

South Upper A due to their mineralization styles as narrow

vein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021314602/en/

Mick McMullen Chief Executive Officer Metals Acquisition Limited

investors@metalsacqcorp.com

Morné Engelbrecht Chief Financial Officer Metals Acquisition

Limited

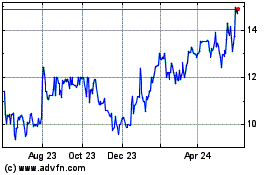

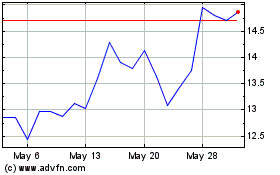

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Feb 2024 to Feb 2025