UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

| For the month of |

October |

|

2024 |

| Commission File Number |

001-41722 |

|

|

| METALS ACQUISITION LIMITED |

| (Translation of registrant’s name into English) |

| |

|

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

METALS ACQUISITION LIMITED |

| |

|

|

(Registrant) |

| |

|

|

|

|

| Date: |

October 18, 2024 |

|

By: |

/s/ Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

18 October 2024

Notice

of Annual General Meeting

Metals Acquisition

Limited ARBN 671 963 198 (NYSE: MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey, Channel Islands (MAC

or the Company) advises that the Annual General Meeting of the Company (the Meeting) has been scheduled as follows:

| Date - |

Thursday,

21 November 2024 (New York / Jersey)

Friday, 22 November 2024 (Sydney) |

| Time - |

5:00pm

(New York)

10:00pm (Jersey)

9:00am (Sydney) |

| Venue - |

Will be held as a hybrid meeting via a virtual online platform and also deemed to be held at the Company’s Australian registered office at 'CSA Mine’ 1 Louth Road, Cobar, NSW 2835. The Chairman will be attending the Meeting virtually. Shareholders and CDI Holders who wish to attend in person the Meeting at the venue must register in advance via investors@metalsacqcorp.com by no later than Friday, 8 November 2024. Please note that the venue has limits on the number of attendees. Confirmation will be sent to the Shareholders and CDI Holders wishing to attend in person the Meeting at the venue.

Shareholders and CDI Holders are encouraged to vote in advance via the instructions provided in the enclosed Notice of Meeting. |

Enclosed is a Notice

of Meeting, Proxy Form and CDI Voting Instruction Form (the Notice) detailing the business to be dealt with at the Meeting. No

hard copy of the Notice will be circulated to Shareholders (including CDN) and CDI Holders in the Company (together, the Security

Holders) unless the Security Holders have elected to receive the Notice in paper form. Security Holders can view and download the

Notice (as well as an electronic copy of the Company’s 2023 Annual Report) from the Company's website at https://www.metalsacquisition.com/overview/default.aspx.

The Company encourages

Shareholders to vote by completing and returning the enclosed Proxy Form in accordance with the instructions on the instructions on the

Proxy Form by no later than 10:00pm (Jersey time) on Tuesday, 19 November 2024 / 5:00pm (EDT) on Tuesday, 19

November 2024 / 9:00am (AEDT) on Wednesday, 20 November 2024). Similarly, CDI Holders are encouraged to complete and

return the enclosed CDI Voting Instruction Form to CDN by no later than 11:00pm (Jersey time) on Monday, 18 November 2024 6:00pm

(EDT) on Monday, 18 November 2024 / 10:00am (AEDT) on Tuesday, 19 November 2024).

-ENDS-

This announcement

is authorised for release by Chris Rosario and Trevor Hart, Joint Company Secretaries.

Contacts

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited

investors@metalsacqcorp.com |

Morne Engelbrecht

Chief Financial Officer

Metals Acquisition Limited |

About Metals

Acquisition Limited

Metals Acquisition

Limited (NYSE: MTAL; ASX:MAC) is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions

that are critical in the electrification and decarbonization of the global economy.

Metals Acquisition

Limited

ARBN 671 963 198

Notice

of Annual General Meeting

and Explanatory Memorandum

Date of Meeting

Thursday, 21 November 2024 (New York

/ Jersey)

Friday, 22 November 2024 (Sydney)

Time of Meeting

5:00pm (New York)

10:00pm (Jersey)

9:00am (Sydney)

Place of Meeting

Virtual Online Platform: https://meetnow.global//MR6WLZZ

The Company will

publish a virtual meeting guide on the ASX and the Company’s website prior to the Meeting outlining how Shareholders and CDI Holders

will be able to participate in the Meeting virtually.

Venue: The Meeting

will be deemed to be held at the Company’s Australian registered office at 'CSA Mine’ 1 Louth Road, Cobar, NSW 2835.

To register your

attendance in person at the Venue, please email investors@metalsacqcorp.com by no later than Friday, 8 November 2024. Please note that

the Venue has limits on the number of attendees. Confirmation will be sent to you if you are able to attend in person at the Venue.

A Proxy Form

and a CDI Voting Instruction Form are enclosed or have otherwise been provided to you (as applicable).

THIS DOCUMENT

IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

This Notice

of Meeting should be read in its entirety. If Security Holders are in doubt as to how they should vote, they should seek advice from

their professional advisers prior to voting.

The Company

encourages Shareholders to vote by completing and returning the enclosed Proxy Form in accordance with the instructions on the Proxy

Form by no later than 10:00pm (Jersey time) on Tuesday, 19 November 2024 / 5:00pm (EDT) on Tuesday, 19 November 2024 / 9:00am (AEDT)

on Wednesday, 20 November 2024). Similarly, CDI Holders are encouraged to complete and return the enclosed CDI Voting Instruction Form

to CDN by no later than 11:00pm (Jersey time) on Monday, 18 November 2024 / 6:00pm (EDT) on Monday, 18 November 2024 / 10:00am (AEDT)

on Tuesday, 19 November 2024).

Metals Acquisition Limited

ARBN 671 963 198

Notice

of Annual General Meeting

Notice is given

that the Annual General Meeting of Shareholders of Metals Acquisition Limited (ARBN 671 963 198) will be held as a hybrid meeting via

a virtual online platform and also deemed to be held at the Company’s Australian registered office at 'CSA Mine’ 1 Louth

Road, Cobar, NSW 2835 on Thursday, 21 November 2024 (New York / Jersey) / Friday, 22 November 2024 (Sydney) for the purpose of transacting

the following business referred to in this Notice of Annual General Meeting.

Shareholders will

be able to participate in the Meeting, including being able to ask questions and vote. CDI Holders will also be able to participate in

the Meeting, including being able to ask questions, however CDI Holders will not have the ability to vote at the Meeting unless appointed

as a proxy. The Company will publish a virtual meeting guide on the ASX and the Company’s website prior to the Meeting outlining

how Shareholders and CDI Holders will be able to participate in the Meeting virtually.

No hard copy of

the Notice will be circulated to Securityholders unless the Securityholders have elected to receive the Notice in paper form. Securityholders

can view and download the Notice (as well as an electronic copy of the Company’s 2023 Annual Report) from the Company's website

at

https://www.metalsacquisition.com/overview/default.aspx.

AGENDA

Receipt of Financial Statements and

Reports

To receive the

annual financial statements of the Company and the report of the Directors and of the Auditor for the financial year ended 31 December

2023.

| There

is no requirement for Shareholders to approve the financial statements or reports. |

| | |

| 1 | Resolution

1 – Re-election of Director – Mick McMullen |

To

consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That

Mick McMullen, who ceases to hold office in accordance with Article 20.2 of the Articles of Association and, being eligible, offers himself

for election, be elected a Director.”

| 2 | Resolution

2 – Re-election of Director – Charles McConnell |

To

consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That

Charles McConnell, who ceases to hold office in accordance with Article 20.2 of the Articles of Association and, being eligible, offers

himself for election, be elected a Director.”

| 3 | Resolution

3 – Re-election of Director – Graham van’t Hoff |

To

consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That

Graham van’t Hoff, who ceases to hold office in accordance with Article 20.2 of the Articles of Association and Listing Rule 14.4

and, being eligible, offers himself for election, be elected a Director.”

| 4 | Resolution 4 – Re-election

of Director – Leanne Heywood |

To

consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That

Leanne Heywood, who ceases to hold office in accordance with Article 20.2 of the Articles of Association and Listing Rule 14.4 and, being

eligible, offers herself for election, be elected a Director.”

| 5 | Resolution 5 – Re-election

of Director – Anne Templeman Jones |

To

consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That

Anne Templeman Jones, who ceases to hold office in accordance with Listing Rule 14.4 and, being eligible, offers herself for election,

be elected a Director.”

| 6 | Resolution

6 – Re-election of Director – Mohit Rungta |

To

consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That

Mohit Rungta, who ceases to hold office in accordance with Listing Rule 14.4 and, being eligible, offers himself for election, be elected

a Director.”

| 7 | Resolution 7 – Re-appointment

of auditors |

To

consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That,

in accordance with Article 113(3) of the Jersey Companies Law and Article 31.1 of the Articles of Association, that EY be re-appointed

as auditors of the Company to hold office from the conclusion of the meeting until the conclusion of the next annual general meeting

of the Company and that the directors be authorised to fix EY’s remuneration.”

| 8 | Resolution 8 – Amendment

to the Articles of Association |

To consider and,

if thought fit, to pass the following resolution as a special resolution:

"That

for the purpose of Article 11(1) of the Jersey Companies Law and for all other purposes, the Articles of Association of the Company be

amended as follows:

Article

15.10 of the Articles of Association be deleted in its entirety and replaced with the following new Article 15.10:

"Content

of notice

| 15.10 | Notice of a general meeting

shall specify each of the following: |

| (a) | the

place, the date and the time of the meeting in the case of any meeting which includes a physical

location, or if the directors determine that the meeting is only to be held virtually, the

date and time of the meeting and the place of such meeting shall be deemed to be held at

the Registered Office; |

| (b) | if

the meeting is to be held in two or more places, it is only to be held as a virtual meeting

or will be a combination of these, the technology that will be used to facilitate the meeting; |

| (c) | subject

to Articles 15.10(d) and 15.20, the general nature of the business to be transacted; |

| (d) | if

a resolution is proposed as a Special Resolution, the text of that resolution; and |

| (e) | in

the case of an annual general meeting, that the meeting is an annual general meeting." |

Article

16.1 of the Articles of Association to be deleted in its entirety and replaced with the following new Article 16.1:

"Quorum

| 16.1 | No

business shall be transacted at any general meeting unless a quorum of Members is present

at the time when the meeting proceeds to business. The quorum for general meetings is: |

| (a) | if

the Company has only one Member, that Member present in person or by proxy; or |

| (b) | if

the Company has more than one Member, at least two Members present in person or by proxy

(so long as at least two individuals form the quorum)." |

Article

16.2 of the Articles of Association to be deleted in its entirety and replaced with the following new Article 16.2:

“Use

of technology

| 16.2 | (i) A

person may participate at a general meeting by conference telephone or other communications

equipment or technology by means of which persons participating in the meeting can communicate

with each other. Participation by a person in a general meeting in this manner is treated

as a presence in person at that meeting, irrespective of whether the general meeting is held

only through a combination of physical venues and/or virtually. |

(ii) The inability of one or more Members to access, or to continue to access, the meeting using virtual meeting technology will not affect the validity of the meeting or any business conducted at the meeting, provided that sufficient Members are able to participate in the meeting as are required to constitute a quorum.

(iii) If,

before or during a general meeting, any technical difficulty occurs, which may materially impact the participation of Members who are

not present in the same location as the chair of the meeting, the chair may:

| (a) | continue the meeting; or |

| (b) | adjourn

the meeting until the difficulty is remedied or to such other time and location as the chair

deems appropriate.” |

The

word 'chairman' to be replaced with the word 'chair' wherever it appears throughout the Articles of Association."

| 9 | Resolution 9 – Change of

Company name |

To consider and,

if thought fit, to pass the following resolution as a special resolution:

"That

for the purpose of Article 14(1) of the Jersey Companies Law and for all other purposes,

the name of the Company be changed from “Metals Acquisition Limited”

to “MAC Copper Limited” (Change of Company Name), for all references to the Company’s name in the Memorandum

of Association and the Articles of Association be replaced with references to “MAC Copper Limited” and that any one or more

of the Directors or officers of the Company be authorised to do all such acts, ends and things and execute all such documents as considered

necessary, desirable or expedient for the purposes of, or in connection with, the implementation of and giving effect to the Change of

Company Name and to attend to any necessary registration and/or filings for and on behalf of the Company.”

| 10 | Resolution 10 – Ratification

of prior issue of CDIs – October 2024 Placement |

To consider and, if thought

fit to pass the following resolution as an ordinary resolution:

“That,

for the purpose of Listing Rule 7.4 and for all other purposes, Shareholders ratify the issue of 8,333,334 CDIs (at an issue price of

A$18 each) on 14 October 2024 to sophisticated and professional investors on the terms and conditions set out in the Explanatory Memorandum.”

Voting exclusion statement:

The Company will disregard any votes cast in favour of the Resolution by or on behalf of:

(a) a

person who participated in the issue or is a counterparty to the agreement being approved; or

(b) an

Associate of those persons.

However,

this does not apply to a vote cast in favour of the Resolution by:

(a) a

person as proxy or attorney for a person who is entitled to vote on the Resolution, in accordance with the directions given to the

proxy or attorney to vote on the Resolution in that way; or

(b) the

Chair of the Meeting as proxy or attorney for a person who is entitled to vote on the Resolution, in accordance with a direction

given to the Chair to vote on the Resolution as the Chair decides; or

(c) a

holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following

conditions are met:

(i)

the beneficiary provides written confirmation to the holder that the beneficiary is not

excluded from voting, and is not an Associate of a person excluded from voting, on the Resolution; and

(ii)

the holder votes on the Resolution in accordance with directions given by the beneficiary

to the holder to vote in that way. |

OTHER BUSINESS

| To

transact such other business as may be properly presented at the Meeting. |

Details of the

definitions and abbreviations used in this Notice are set out in the Glossary to the Explanatory Memorandum.

By order of the Board

Chris Rosario

General Counsel & Joint Company

Secretary

Dated: 18 October 2024

Virtual Meeting

Given

the diverse spread of Security Holders, the Company has determined that the Meeting may be accessed virtually. Please refer to the information

below on how Security Holders can participate in the Meeting.

Who is entitled

to vote at the Meeting?

The

Board has determined that a Shareholder’s entitlement to vote at the Meeting will be the entitlement of that person set out in

the register of Shareholders as at the Record Date.

If

you are a Shareholder at the Record Date, you may vote your Shares at the Meeting.

Each

Shareholder has one vote for each Share held at the Record Date.

Each

CDI Holder is entitled to direct CDN to vote one Share for every CDI held by the CDI Holder.

What does it

mean to be a CDI Holder?

CDIs are issued

by the Company through CDN and traded on the Australian Securities Exchange. If you own CDIs, then you are the beneficial owner of one

Share for every CDI that you own. CDN is considered the Shareholder for the purposes of voting at the Meeting. As the beneficial owner,

you have the right to direct CDN as to how to vote the Shares underlying your CDIs. As a beneficial owner, you are invited to attend

the Meeting.

For the purposes

of this Notice and Proxy Form, a representative appointed by CDN shall be considered the same as a proxy and referred to as a proxy in

the Notice.

Under the rules

governing CDIs, CDN is not permitted to vote on your behalf on any matter to be considered at the Meeting unless you specifically instruct

CDN how to vote. We encourage you to communicate your voting instructions to CDN in advance of the Meeting to ensure that your vote will

be counted by completing the CDI Voting Instruction Form and returning it in accordance with the instructions specified on that form.

Attending and

participating virtually

All Shareholders

and CDI Holders are invited to attend the Meeting.

To log in, Shareholders

will need the control number provided on their Proxy Form. If you are not a Shareholder or do not have a control number (including CDI

Holders), you may still access the Meeting as a guest, but you will not be able to submit questions or vote at the Meeting.

To attend in person

at the Venue, Shareholders will need to register their attendance at the Venue by emailing investors@metalsacqcorp.com by no later than

Friday, 8 November 2024. Please note that the Venue has limits on the number of attendees. Confirmation will be sent to you if you are

able to attend in person at the Venue.

The Meeting will

begin promptly at 5:00pm (EDT) / 10.00pm (Jersey time) on Thursday, 21 November 2024 (New York / Jersey) / 9:00am (AEDT) on Friday, 22

November 2024 (Sydney). The Company encourages you to access the Meeting prior to the start time. Online access will open at 9:45pm (Jersey

time) / 4:45pm (EDT) on Thursday, 21 November 2024 (New York / Jersey) / 8:45am (AEDT) on Friday, 22 November 2024 (Sydney) and you should

allow ample time to log in to the Meeting webcast and test your computer audio system. We recommend that you carefully review the procedures

needed to gain admission in advance.

A recording of

the Meeting will be available at https://meetnow.global//MR6WLZZ for 90 days after the Meeting.

Holders of CDIs

will be entitled to receive notice of, and to attend as guests (but not vote at) the Meeting.

Only Shareholders

or their proxies will be able to vote, and ask questions. You are strongly encouraged to submit questions to the Company prior to the

Meeting (see instructions below).

How do I vote

my Shares?

If

you are a Shareholder, there are four ways you can vote at the Meeting:

| (1) | by attending

in person at the Venue; |

| (2) | by completing,

signing and returning the Proxy Form in accordance with the instructions on the Proxy Form; |

| (3) | online in accordance

with the instructions on the Proxy Form; or |

| (4) | virtually at

the Meeting by following the instructions set out in the virtual meeting guide to be published

on the ASX and the Company’s website prior to the Meeting. |

Valid

proxies must be received by no later than 10:00pm (Jersey time) on Tuesday, 19 November 2024 / 5:00pm (EDT) on Tuesday,

19 November 2024 / 9:00am (AEDT) on Wednesday, 20 November 2024).

Voting by proxy

| · | A

Shareholder entitled to attend and vote is entitled to appoint one or more proxies. Each

proxy will have the right to vote on a poll and also to speak at the Meeting. |

| · | The

appointment of the proxy may specify the proportion or the number of votes that the proxy

may exercise. Where more than one proxy is appointed and the appointment does not specify

the proportion or number of the Shareholder's votes each proxy may exercise, the votes will

be divided equally among the proxies (i.e. where there are two proxies, each proxy may exercise

half of the votes). |

| · | A

proxy need not be a Shareholder or a CDI Holder. |

| · | The

proxy can be either an individual or a body corporate. |

| · | If

a proxy is not directed how to vote on an item of business, the proxy may generally vote,

or abstain from voting, as they think fit. |

| · | Should

any resolution, other than those specified in this Notice, be proposed at the Meeting, a

proxy may vote on that resolution as they think fit. |

| · | If

a proxy is instructed to abstain from voting on an item of business, they are directed not

to vote on the Shareholder's behalf on the poll and the Shares that are the subject of the

proxy appointment will not be counted in calculating the required majority. |

| · | Shareholders

who return their Proxy Forms with a direction how to vote, but who do not nominate the identity

of their proxy, will be taken to have appointed the Chair of the Meeting as their proxy to

vote on their behalf. If a Proxy Form is returned but the nominated proxy does not attend

the Meeting, the Chair of the Meeting will act in place of the nominated proxy and vote in

accordance with any instructions. Proxy appointments in favour of the Chair of the Meeting,

the secretary or any Director that do not contain a direction how to vote will be used, where

possible, to support each of the Resolutions proposed in this Notice, provided they are entitled

to cast votes as a proxy under the voting exclusion rules which apply to some of the proposed

Resolutions. |

| · | To

be effective, proxies must be received by 10:00pm (Jersey time) on Tuesday, 19

November 2024 / 5:00pm (EDT) on Tuesday, 19 November 2024 / 9:00am (AEDT)

on Wednesday, 20 November 2024). Proxies received after this time will be invalid. |

Voting by a

corporate Shareholder

A Shareholder that

is a corporation may appoint an individual to act as its duly authorised representative and vote at the Meeting in accordance with the

above instructions. A corporate Shareholder wishing to act by a duly authorised representative must have identified that person to the

Company by writing in accordance with article 18 of the Articles of Association by 10:00pm (Jersey time) on Thursday, 21 November

2024 / 5:00pm (EDT) on Thursday, 21 November 2024 / 9:00am (AEDT) on Friday, 22 November 2024).

Rights of CDI

Holders

CDI

Holders at the Record Date are entitled to receive this Notice and to attend the Meeting virtually or any adjournment or postponement

of the Meeting but are not entitled to vote virtually at the Meeting. Ahead of the Meeting, CDI Holders may vote as set out under ‘How

do I vote my CDIs?’. Each CDI represents one Share and therefore, each CDI Holder will be entitled to direct one vote for every

CDI they hold.

How

do I vote my CDIs?

If

you are a CDI Holder on the Record Date, you can vote prior to the Meeting by instructing CDN (as the underlying Shareholder) to vote

the Shares underlying your CDIs pursuant to your instructions in the CDI Voting Instruction Form.

Valid

completed CDI Voting Instruction Forms must be received by no later than 11:00pm (Jersey time) on Monday, 18 November 2024

/ 6:00pm (EDT) on Monday, 18 November 2024 / 10:00am (AEDT) on Tuesday, 19 November 2024).

If

you hold Shares and CDIs, you will need to separately vote your Shares and CDIs in accordance with the instructions set out above.

Please

note that if you transmute your CDIs to Shares following the Record Date, you will need to instruct CDN (as Shareholder at the Record

Date) to vote your CDIs and given you did not hold Shares as at the Record Date, you will not be entitled to vote at the Meeting.

Undirected

proxies

The

Chair intends to vote any undirected proxies in favour of all Resolutions.

Questions at

the Meeting

Only

Shareholders as of the Record Date who attend and participate in the Meeting will have an opportunity to submit questions live during

a designated portion of the Meeting. The Company also encourages Shareholders to submit questions in advance of the Meeting in accordance

with the instructions below.

During

the Meeting, the Company will spend up to 15 minutes answering Shareholder questions that comply with the Meeting rules of procedure.

To ensure the orderly conduct of the Meeting, we encourage you to submit questions in advance. If substantially similar questions are

received, the Company will group such questions together and provide a single response to avoid repetition. Shareholders must have their

control number provided on their Proxy Form available to ask questions during the Meeting.

Submission of

written questions to the Company or the auditor in advance of the Meeting

Shareholders

and CDI Holders (once that CDI Holder has directed CDN (as the underlying Shareholder) to vote the Shares underlying the CDI Holder’s

CDIs via the CDI Voting Form) may submit a written question to the Company in advance of the Meeting by going to www.investorvote.com.au

and logging in with your control number.

The

Company asks that all pre-Meeting questions be received by the Company no later than one week before the date of the AGM, being 10:00pm

(Jersey time) on Thursday, 14 November 2024 / 5:00pm (EDT) on Thursday, 14 November 2024 / 9:00am (AEDT)

on Friday, 15 November 2024).

The

Company’s Auditor will also be available to answer any questions from Security Holders at the Meeting.

What if I have

technical difficulties or trouble accessing the virtual Meeting?

The

Company will have technicians ready to assist you with any technical difficulties you may have accessing the Meeting. If you encounter

any difficulties accessing the Meeting during check-in or during the Meeting, please call the technical support number that will be posted

on the Meeting login page: https://meetnow.global//MR6WLZZ

Enquiries

Security

Holders may email investors@metalsacqcorp.com if they have any queries in respect of the matters set out in these documents.

Metals Acquisition Limited

ARBN 671 963 198

EXPLANATORY

MEMORANDUM

This Explanatory

Memorandum is intended to provide Security Holders with sufficient information to assess the merits of the Resolutions contained in the

accompanying Notice of Annual General Meeting of the Company.

Certain abbreviations

and other defined terms are used throughout this Explanatory Memorandum. Defined terms are generally identifiable by the use of an upper

case first letter. Details of the definitions and abbreviations are set out in the Glossary to the Explanatory Memorandum.

Financial Statements

and Reports

Under the Corporations

Act, an Australian company listed on the ASX is required in each calendar year to lay its audited financial statements before its shareholders

at an annual general meeting. The Corporations Act does not require a vote of shareholders on the reports or statements. However, shareholders

are given opportunity to raise questions or comments in relation to the management of the Company at an annual general meeting.

MAC, being a company

incorporated in Jersey, Channel Islands is not required to meet the Corporations Act requirements to lay before the Meeting its audited

annual financial report and other related reports. However, the Company is required to comply with the Jersey Companies Law which requires

the Company to lay its audited financial statements before its shareholders at its annual general meeting.

In accordance with

the Jersey Companies Law, the business of the Meeting will include receipt of the Company’s audited financial statements and the

reports for the financial year ended 31 December 2023.

The Company’s

audited financial statements and the reports for the financial year ended 31 December 2023 are contained in the Company’s 2023

Annual Report which is available on the Company’s website at: https://www.metalsacquisition.com/overview/default.aspx.

Any Security Holder

who would like to receive a hard copy of the 2023 Annual Report should contact investors@metalsacqcorp.com.

| 1 | Background

to Resolutions 1 – 4 - Re-election of Directors |

Article 20.2 of

the Articles of Associations provides that the Directors shall be divided into three classes designated as Class I, Class II, and Class

III. At the first annual general meeting of the Company, the initial term of office of the Class I Directors shall expire and Class I

Directors shall be elected for a full term of three years. At the second annual meeting, the initial term of term of office of the Class

II Directors shall expire and Class II Directors shall be elected for a full term of three years. At the third annual meeting, the term

of office of the Class III Directors shall expire and Class III Directors shall be elected for a full term of three years.

It was resolved

that the following Directors would be designated as Class I directors:

| Class

I |

Mick McMullen.

Charles McConnell

Leanne Heywood

Graham van't Hoff

|

The initial term

of the Class I Directors will expire and, being eligible to seek re-election, they each seek to be re-elected as Directors.

| 2 | Resolution

1 – Re-election of Director – Mick McMullen |

Mick McMullen is

the CEO of the Company and was designated as a Class I Director. In accordance with Article 20.2 of the Articles of Association, Mick

McMullen, ceases to hold office as a Director by way of rotation and, being eligible, offers himself for re-election as a Director.

Article 20.2 of

the Articles of Association applies to Mick McMullen in his capacity as a Director, notwithstanding his position as CEO. For the avoidance

of doubt, Mr McMullen will retain his position as CEO of the Company regardless of whether he is re-elected as a Director.

Qualifications

Mick McMullen has

over 30 years of senior leadership experience in the exploration, financing, development and operations of mining companies globally.

Mr McMullen most recently served as the CEO and President at Detour Gold Corporation, a 600,000 ounce per annum gold producer in Canada

from May 2019 to January 2020. During his tenure, Mr McMullen took the market capitalisation from C$2.1 billion to C$4.9 billion

over 7 months (date of deal announcement), which represented an internal rate of return of 208%, leading to the acquisition by Kirkland

Lake Gold Ltd in 2020. Mr McMullen also served as CEO at Stillwater Mining Company between 2013 and 2017 and as Technical Advisor from

May 2017 to December 2018 where he was instrumental to the increase in market capitalisation.

Mr McMullen is

also a qualified Geologist and received his B.Sc. from Newcastle University in 1992.

Independence

Mick McMullen is

not considered to be an independent Director due to his executive role with the Company.

Board recommendation

Based on Mick McMullen’s

relevant experience and qualifications, the Board (in the absence of Mick McMullen), supports his re-election as a Director of the Company

and recommends that Security Holders vote in favour of Resolution 1.

| 3 | Resolution

2 – Re-election of Director – Charles McConnell |

Charles McConnell

was designated as a Class I Director. In accordance with Article 20.2 of the Articles of Association, Charles McConnell, ceases to hold

office by way of rotation and, being eligible, offers himself for re-election as a Director.

Qualifications

Charles McConnell

is a global executive and technology Subject Matter Expert (SME) within energy and power, petrochemicals technology, and the investment-business

development marketplace who has led the growth of multimillion-dollar businesses and new business units. Mr McConnell currently serves

as Executive Director of Carbon Management and Energy Sustainability at the University of Houston since 2018. Mr McConnell was previously

the Assistant Secretary of Energy at the US Department of Energy, Vice President of Carbon Management at Battelle Energy Technology in

Columbus, Ohio and also spent 31 years at Praxair, Inc. (now Linde).

Mr McConnell holds

a bachelor’s degree in chemical engineering from Carnegie-Mellon University in 1977 and an MBA in Finance from Cleveland State

University in 1984.

Independence

Charles McConnell

is considered to be an independent Director.

Board recommendation

Based on Charles

McConnell’s relevant experience and qualifications, the Board (in the absence of Charles McConnell), supports his re-election as

a Director of the Company and recommends that Security Holders vote in favour of Resolution 2.

| 4 | Resolution

3 – Re-election of Director – Graham van’t Hoff |

Listing Rule 14.4

provides that a director appointed to fill a casual vacancy or as an addition to the Board mut not hold office (without re-election)

past the next annual general meeting of the entity.

Graham van’t

Hoff, having been appointed by the Board as a casual appointment on 15 November 2023, and being designated as a Class I Director, ceases

to hold office in accordance with the requirements of Article 20.2 of the Articles of Association and Listing Rule 14.4, and, being eligible,

offers himself for re-election as a Director.

Qualifications

Graham van’t

Hoff is a global business executive with a successful track record of scaling businesses and driving growth through restructurings, technology

integration and project management discipline. He has considerable experience in areas relating to strategy, operations, health and safety,

governance and risk, deal making and commercial practice, and business and functional integration.

Mr van’t

Hoff finished his 35 year career with Royal Dutch Shell PLC (NYSE:SHEL) as the Executive Vice President of Global Chemicals where he

was responsible for the company’s US$25 billion global chemicals business. Previously, he held positions such as Chairman of CNOOC

& Shell Petrochemicals Co. Ltd. Guangdong, China, Chairman of Shell U.K. Limited, General Manager for Shell Chemicals Europe BV,

Director Information Technology Strategy at Shell International Ltd., and Chief Information Officer of Shell Chemicals U.K. Ltd. He served

on the Executive Committees of each of CEFIC, the European Chemical Industry association, where he was responsible for a restructuring

of CEFIC that resulted in CEFIC being voted the best EU trade association two years running, the American Chemistry Council, and ICCA,

the International Council of Chemical Associations. He was a founder member of the Alliance To End Plastic Waste.

Mr van’t

Hoff currently also serves on the boards of 5E Advanced Materials, Inc., Verde Clean Fuels, Inc., and the Oxford University Chemistry

Advisory Board. Mr van’t Hoff received graduate and undergraduate degrees in Chemistry from the University of Oxford and a graduate

degree with distinction from Alliance Manchester Business School.

Independence

Graham van’t

Hoff is considered to be an independent Director notwithstanding that he was nominated as a Director by BEP Special Situations VI LLC

(BEP) on the basis that does not have a material business relationship with a substantial holder of the Company, including because

he is not employed or remunerated by BEP.

Board recommendation

Based on Graham

van’t Hoff’s relevant experience and qualifications, the Board (in the absence of Graham van’t Hoff), supports his

re-election as a Director of the Company and recommends that Security Holders vote in favour of Resolution 3.

| 5 | Resolution

4 – Re-election of Director – Leanne Heywood |

Listing Rule 14.4

provides that a director appointed to fill a casual vacancy or as an addition to the Board mut not hold office (without re-election)

past the next annual general meeting of the entity.

Leanne Heywood,

having been appointed by the Board as a casual appointment on 1 May 2024, and being designated as a Class I Director, ceases to hold

office in accordance with the requirements of Article 20.2 of the Articles of Association and Listing Rule 14.4, and, being eligible,

offers herself for re-election as a Director

Qualifications

Leanne Heywood

is an experienced non-executive director with broad general management experience gained through an international career in the mining

sector, including 10 years with the Rio Tinto Copper Group.

Ms Heywood currently

serves as a non-executive director, and is responsible for a diverse range of committee chairs and committee memberships for Arcadium

Lithium (NYSE:LTHM), a global lithium chemicals producer, Midway Limited (ASX:MWY) a wood fibre processor and exporter, and Snowy Hydro

Limited, an integrated energy company supporting the transition to renewables.

Ms Heywood received

the 2021 Medal of the Order of Australia and was named 2019 NSW Business Woman of the Year. She holds a Bachelor of Business (Accounting),

an Executive MBA (Melbourne Business School) and is a member of the Australian Institute of Company Directors (GAICD) and CPA Australia

(FCPA).

Independence

Leanne Heywood

is considered to be an independent Director.

Board Recommendation

Based on Leanne

Heywood’s relevant experience and qualifications, the Board (in the absence of Leanne Heywood), supports her re-election as a Director

of the Company and recommends that Security Holders vote in favour of Resolution 4.

| 6 | Resolution

5 – Re-election of Director – Anne Templeman Jones |

Listing Rule 14.4

provides that a director appointed to fill a casual vacancy or as an addition to the Board mut not hold office (without re-election)

past the next annual general meeting of the entity.

Anne Templeman

Jones, having been appointed by the Board as a casual appointment on 22 July 2024, ceases to hold office in accordance with the requirements

of Listing Rule 14.4, and, being eligible, offers herself for re-election as a Director

Qualifications

Anne Templeman

Jones is an accomplished listed company director with extensive expertise in strategy, financial oversight, operational management, governance,

and risk management, with a particular emphasis on cyber security and artificial intelligence across various sectors, including banking

and financial services, energy (oil & gas, mining, chemicals, and renewable energy), consumer goods, and manufacturing.

Ms Templeman Jones

has substantial experience managing cyber risk and implementing comprehensive cyber security frameworks. She is adept at addressing the

complexities of AI technologies and ensuring organizations are resilient against cyber threats. Her proficiency in industry standards,

including NIST and Essential 8, demonstrates her commitment to effective cyber security management and internal control monitoring.

Her professional

development includes numerous prestigious accreditations and programs:

| · | University of Cambridge Institute

for Sustainability Leadership (2022) |

| · | MIT Cyber Security, Technology,

and Application (2018) |

| · | Cyber Security courses at Tel

Aviv University (2017, 2018, 2019, 2021), covering topics such as AI, robotics, GDPR, data, and cloud security |

| · | MIT School of Management (2019)

focusing on the implications of computer and AI intelligence for business strategy |

| · | Diligent Climate Leadership (2023) |

| · | ANU School of Cybernetics for

AI and Generative AI (2023) |

In addition, Ms Templeman Jones participated in the AICC Israel Trade Missions focused on cyber security (October 2017) and the World

in Transition program (2022), further enhancing her knowledge and network in the cyber security domain.

Throughout her

30-year executive career, Ms Templeman Jones has held significant leadership positions in corporate and private banking with institutions

including Westpac Banking Corporation, Australia and New Zealand Banking Group Ltd, and Bank of Singapore. She served as Chairman of

Commonwealth Bank’s financial advice companies and has been on the boards of various organizations, including Worley Ltd, Blackmores

Ltd, GUD Holdings Limited, the Citadel Group Ltd, Cuscal Ltd, HT&E Limited, Pioneer Credit Ltd, TAL Superannuation Fund, and HBF’s

private and general insurance companies.

Currently, Ms Templeman

Jones is a Non-Executive Director for the Commonwealth Bank of Australia, Trifork AG, and New South Wales Treasury Corporation. Ms Templeman

Jones is also dedicated to supporting the non-profit sector through her involvement with the Australian Indigenous Minority Supplier

Office Limited (trading as Supply Nation).

Independence

Anne Templeman

Jones is considered to be an independent Director.

Board recommendation

Based on Anne Templeman

Jones’ relevant experience and qualifications, the Board (in the absence of Anne Templeman Jones), supports her re-election as

a Director of the Company and recommends that Security Holders vote in favour of Resolution 5.

| 7 | Resolution

6 – Re-election of Director – Mohit Rungta |

Listing Rule 14.4

provides that a director appointed to fill a casual vacancy or as an addition to the Board mut not hold office (without re-election)

past the next annual general meeting of the entity.

Mohit Rungta, having

been appointed by the Board as a casual appointment on 22 July 2024, ceases to hold office in accordance with the requirements of Listing

Rule 14.4, and, being eligible, offers himself for re-election as a Director.

Qualifications

Mohit Rungta has

been with the Glencore group since 2016 and currently leads Business Development for the company’s Copper department. His tenure

has seen him play a pivotal role in numerous copper mergers, acquisitions, and divestitures, including the sale of the Cobar mine and

the acquisition of MARA Project.

Mr Rungta started

his career in Glencore’s Copper Marketing department. He subsequently moved to Mopani, Glencore's Copper asset in Zambia, where

he was responsible for the Commercial Operations of the asset. Following the sale of Mopani, Mr Rungta returned to Glencore’s head

office in Switzerland and joined the Business Development team.

Mr Rungta is committed

to developing the copper portfolio sustainably and profitably by integrating strategic foresight, leadership, and effective collaboration.

Mr Rungta holds

a B.Com (Hons) from the University of Delhi and an MSc in Finance from the London School of Economics.

Independence

Mohit Rungta is

not considered to be an independent Director by reason of being an employee of Glencore (or its related parties), who is a substantial

holder of the Company’s Shares.

Board recommendation

Based on Mohit

Rungta’s relevant experience and qualifications, the Board (in the absence of Mohit Rungta), supports his re-election as a Director

of the Company and recommends that Security Holders vote in favour of Resolution 6.

| 8 | Resolution

7 – Re-appointment of auditors |

Background

Article 113(3)

of the Jersey Companies Law and Article 31.1 of the Articles of Association require that the Company seek shareholder approval for the

ongoing appointment of the Company’s auditors.

EY was appointed

as the Company’s auditor in 2023 and, for completeness, audited the Company’s financial statements for the financial year

ending 31 December 2023. Representatives of EY will be present at the Meeting. EY will have an opportunity to make a statement if they

so desire and will be available to respond to appropriate questions

This resolution

seeks Shareholder approval for the re-appointment of EY as the Company’s auditors to hold office from the conclusion of the Meeting

until the conclusion of the next annual general meeting of the Company and that the directors be authorised to fix EY’s remuneration.

Board recommendation

The Board recommends

that Security Holders vote in favour of Resolution 7.

| 9 | Resolution

8 – Amendment to Articles of Association |

General

The Company adopted

the Articles of Association by special resolution on 23 May 2023. Resolution 8 seeks Shareholder approval as a special resolution to

adopt the amendments to the Articles of Association set therein.

Background to

proposed amendments

Recently, there

have been a number of developments in law and general corporate and commercial practice for listed entities, including entities listed

on the NYSE and the ASX. Legislative amendments have been made to enable technology to be used to facilitate the holding of virtual meetings

and the delivery of certain notices and documents to shareholders (including notices of meetings).

If Resolution 8

is approved the Articles of Association will be amended to ensure consistency with developments in general corporate and commercial practice.

Accordingly, the Directors consider it appropriate to amend the Articles of Association to ensure, in particular, that the Company can

take such actions now permitted or mandated by applicable law.

Summary of the

proposed amendments

The proposed changes

to the Articles of Association are administrative or relatively minor in nature. A brief overview of the key themes of the proposed amendments

are outlined in the table below. This overview is not exhaustive and does not identify all of the proposed amendments to the Articles

of Association. Importantly, there have been no fundamental changes to Shareholders' rights, such as the right to vote at a general meeting

or to participate in dividends.

| Topic |

Summary

of proposed amendments to Articles of Association |

Use

of technology

for meetings |

While the Articles

of Association already provides for meetings to be held in two or more places using virtual meeting technology, the proposed amendments

would enable the Company to conduct hybrid meetings and virtual meetings, including by clarifying that any general meeting of the

shareholders of the Company may be held virtually without having to specify a physical location for the meeting.

This will align

the Company with general market practice and, given the diverse spread of Shareholders and CDI Holders around the world, the Directors

do not consider that there will be any impact on the ability of Shareholders and CDI Holders to participate in any general meeting. |

| Quorum |

This

amendment seeks to remove the requirement in the Articles of Association that the quorum for any general meeting includes attendance

by shareholders holding in aggregate not less than a single majority of all voting share capital of the Company. This will regularise

the quorum provisions to require two shareholders to be present in person or by proxy and therefore bring the company in line with

market standards. |

Amended Articles

of Association

A copy of the amended

Articles of Association, marked up to show the proposed changes, is available on the Company’s website at: https://www.metalsacquisition.com/overview/default.aspx.

Copies may also be obtained by emailing investors@metalsacqcorp.com.

Board recommendation

The Board unanimously

recommend that Security Holders vote in favour of Resolution 8 as the Board believes, based on the information available, including the

information contained in this Explanatory Memorandum, the proposed amendments will improve the Articles of Association and better align

with market practice.

Each Director intends

to vote all the Shares or CDIs controlled by them in favour of the proposed amendments to the Articles of Association.

Resolution 8 is

a special resolution and therefore requires approval of two-thirds of the votes cast by Shareholders present and eligible to vote (in

person, by proxy, by attorney or, in the case of a corporate Shareholder, by a corporate representative).

| 10 | Resolution

9 – Change of Company name |

General

In accordance with

Article 14(1) of the Jersey Companies Law, if a Jersey incorporated company wants to change its name, it must pass a special resolution

to adopt a new name. Resolution 9 seeks Shareholder approval as a special resolution for the change of name of the Company from “Metals

Acquisition Limited” to “MAC Copper Limited”.

The Board believes

that the Change of Company Name is necessary to better reflect the business activities of the Company and positioning within the market.

The name change is, in part, being made in response to significant feedback from our North American stakeholders, who have expressed

concerns that our current name is causing confusion as not all market participants identify that the company is no longer a “SPAC”

(special purpose acquisition company) and is now a traditional company listed on NYSE and the ASX.

The Board has approved

the Change of Company Name subject to the approval of Security Holders.

In accordance with

Article 14(2) of the Jersey Companies Law, the Change of Company Name will take effect on the date on which the altered certificate of

incorporation is issued by the registrar.

Board recommendation

Each Director intends

to vote all the Shares or CDIs controlled by them in favour of the Change of Company Name.

Resolution 9 is

a special resolution and therefore requires approval of two-thirds of the votes cast by Shareholders present and eligible to vote (in

person, by proxy, by attorney or, in the case of a corporate Shareholder, by a corporate representative).

| 11 | Resolution

10 – Ratification of prior issue of CDIs – October 2024 Placement |

As announced on

9 October 2024, the Company raised approximately A$150 million (approximately US$103 million) through the issue of 8,333,334 CDIs (Placement

CDIs) at an issue price of A$18.00 per CDI to sophisticated and professional investors (the Placement).

Broadly speaking,

and subject to a number of exceptions, Listing Rule 7.1 limits the amount of Equity Securities that a listed company can issue without

the approval of its shareholders over any 12-month period to 15% of the fully paid ordinary securities it had on issue at the start of

that period.

The Placement does

not fit within any of these exceptions and, as it has not yet been approved by the Company’s Shareholders, it effectively uses

up part of the 15% limit in Listing Rule 7.1, reducing the Company’s capacity to issue further Equity Securities without Shareholder

approval under Listing Rule 7.1 for the 12-month period following the date the Company issued Shares pursuant to the Placement.

Listing Rule 7.4

allows the shareholders of a company to approve an issue of Equity Securities after it has been made or agreed to be made. If they do,

the issue is taken to have been approved under Listing Rule 7.1 and so does not reduce the Company’s capacity to issue further

Equity Securities without Shareholder approval under that rule.

The Company wishes

to retain as much flexibility as possible to issue additional Equity Securities into the future without having to obtain Shareholder

approval for such issues under Listing Rule 7.1 and therefore seeks Shareholder approval to ratify the issue of CDIs pursuant to the

Placement under and for the purposes of Listing Rule 7.4.

Technical information

required for the purpose of Listing Rule 14.1A

If Resolution 10

is passed, the CDIs issued pursuant to the Placement will be excluded in calculating the Company’s 15% limit in Listing Rule 7.1,

effectively increasing the number of Equity Securities the Company can issue without Shareholder approval over the 12-month period following

the date the Company issued CDIs pursuant to the Placement.

If Resolution 10

is not passed, the CDIs issued pursuant to the Placement will be included in calculating the Company’s 15% limit in Listing Rule

7.1, effectively decreasing the number of Equity Securities the Company can issue without Shareholder approval over the 12-month period

following the date the Company issued CDIs pursuant to the Placement.

Technical information

required for the purpose of Listing Rule 7.5

The following information

in relation to the CDIs the subject of the Placement is provided to Shareholders for the purposes of Listing Rule 7.5:

| (a) | the Placement CDIs were issued to sophisticated

and professional investors and other investors qualifying under section 708 of the Corporations

Act, each of which is an unrelated party of the Company. The placees were selected following

a bookbuild process by Barrenjoey Markets Pty Limited. In accordance with paragraph 7.4 of

ASX Guidance Note 21, the Company confirms that, other than United Super Pty Ltd ABN 46 006

261 623 as trustee for the Construction and Building Unions Superannuation Fund ABN 75 493

363 (a substantial holder of the Company who was issued 777,778 CDIs, being more than 1%

of the issued capital of the Company), no related parties of the Company, members of the

Company’s Key Management Personnel, substantial holders of the Company, advisers of

the Company or an associate of any of these parties were issued more than 1% of the issued

capital of the Company; |

| (b) | 8,333,334 Placement CDIs were issued (each

of which represent one Share in the capital of the Company); |

| (c) | the Placement CDIs issued were fully paid

and rank equally in all respects with the Company’s existing CDIs; |

| (d) | the Placement CDIs were issued on 14 October

2024; |

| (e) | the Placement CDIs were issued at an issue

price of A$18.00 per CDI; |

| (f) | proceeds

of the Placement will be used to optimise MAC’s balance sheet and de-lever by retiring

its existing US$145 million Mezzanine Debt Facility at the earliest practicable date while

also providing additional flexibility to pursue strategic inorganic growth opportunities; |

| (g) | the Placement CDIs were not issued under

an agreement, other than customary placement confirmation letters; and |

| (h) | a voting exclusion applies in respect

of this Resolution as set out in the Notice of Meeting. |

Directors recommendation

The Board believes

that the ratification of the Placement is beneficial for the Company as it allows the Company to retain the flexibility to issue further

securities representing up to 15% of the Company’s share capital during the next 12 months. Accordingly, the Board unanimously

recommends Security Holders vote in favour of Resolution 10.

GLOSSARY

AEDT means

Australian Eastern Daylight Time.

Articles of

Association means the Company’s articles of association, as amended from time to time.

Associate

has the meaning given to that term in the Listing Rules.

ASX means

ASX Limited ABN 98 008 624 691 and, where the context permits, the Australian Securities Exchange operated by ASX Limited.

Auditor means

EY.

Board means

the Directors.

CDIs means

CHESS Depositary Interests over Shares.

CDI Holder

means a holder of CDIs.

CDI Voting Instruction

Form means the CDI voting instruction form accompanying the Notice.

CDN means

CHESS Depositary Nominees Pty Ltd ACN 071 346 506.

Chair or Chairman

means the chairman of the Directors from time to time.

Company

or MAC means Metals Acquisition Limited ARBN 671 963 198.

Corporations

Act means Corporations Act 2001 (Cth).

Directors

means the directors of the Company.

Equity Securities

has the meaning given to that term in the Listing Rules.

Explanatory

Memorandum means the explanatory memorandum accompanying the Notice.

EDT means

Eastern Daylight Time (United States).

EY means

Ernst & Young LLP.

Jersey Companies

Law means the Companies (Jersey) Law 1991.

Listing Rules

means the ASX Listing Rules.

Meeting means

the annual general meeting of the Company convened by the Notice.

Memorandum of

Association means the Company's memorandum of association, as amended from time to time.

Notice means

the Notice of Annual General Meeting.

Placement has

the meaning given in section 11 of the Explanatory Memorandum.

Placement CDIs

has the meaning given in section 11 of the Explanatory Memorandum.

Proxy Form

means the proxy form accompanying the Notice.

Record Date

means Friday, 11 October 8:00pm (EDT), Saturday, 12 October 2024 1:00am (Jersey time), Saturday, 12 October 2024 11:00am (AEDT).

Resolution

means a resolution contained in the Notice.

Security Holder

means a Shareholder (including CDN) or CDI Holder.

Shareholder

means a holder of Shares from time to time.

Share means

a fully paid ordinary share in the capital of the Company.

Trading

Day means a day determined by ASX to be a trading day in accordance

with the Listing Rules.

Venue

means the Company's Australian registered office at 'CSA Mine’ 1 Louth Road, Cobar, NSW 2835.

Exhibit 99.2

| 1 - Election of Director -

Mick McMullen

4 - Election of Director -

Leanne Heywood

2 - Election of Director -

Charles McConnell

5 - Election of Director -

Anne Templeman Jones

3 - Election of Director -

Graham van’t Hoff

6 - Election of Director -

Mohit Rungta

1UPX

Using a black ink pen, mark your votes with an X as shown in this example.

Please do not write outside the designated areas.

041MRD

+

+

A Proposals — The Board of Directors recommend a vote FOR all the nominees listed and FOR Proposals 7 - 10.

7. Re-appointment of auditors

To consider and, if thought fit, to pass the following resolution as

an ordinary resolution: That, in accordance with Section 113(3) of

the Jersey Companies Law and Article 31.1 of the Articles of

Association, that EY be re-appointed as auditors of the Company

to hold office from the conclusion of the meeting until the

conclusion of the next annual general meeting of the Company and

that the directors be authorised to fix EY’s remuneration.

8. Amendment to the Articles of Association

To consider and, if thought fit, to pass the following resolution

as a special resolution: That for the purpose of Section 11(1) of

the Jersey Companies Law and for all other purposes, the

Articles of Association of the Company be amended on the

terms and conditions set out in the Explanatory Memorandum.

For Against Abstain

For Against Abstain

For Against Abstain For Against Abstain For Against Abstain

Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title.

Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

B Authorized Signatures — This section must be completed for your vote to count. Please date and sign below.

9. Change of Company name

To consider and, if thought fit, to pass the following resolution

as a special resolution: That for the purpose of Section 14 of the

Jersey Companies Law and for all other purposes, the name of

the Company be changed from “Metals Acquisition Limited” to

“MAC Copper Limited”.

10. Ratification of prior issue of CDIs – October 2024 For Against Abstain

To consider and, if thought fit to pass the following resolution

as an ordinary resolution: That, for the purpose of Listing Rule

7.4 and for all other purposes, Shareholders ratify the issue of

8,333,334 CDIs (at an issue price of A$18 each) on 14 October

2024 to sophisticated and professional investors on the terms

and conditions set out in the Explanatory Memorandum.

q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q

2024 Annual Meeting Proxy Card

For Against Abstain

You may vote online or by phone instead of mailing this card.

Online

Go to www.investorvote.com/MTAL or scan

the QR code — login details are located in

the shaded bar below.

Save paper, time and money!

Sign up for electronic delivery at

www.investorvote.com/MTAL

Phone

Call toll free 1-800-652-VOTE (8683) within

the USA, US territories and Canada

Your vote matters – here’s how to vote! |

| Small steps make an impact.

Help the environment by consenting to receive electronic

delivery, sign up at www.investorvote.com/MTAL

Notice of 2024 Annual Meeting of Stockholders

Proxy Solicited by Board of Directors for Annual Meeting — November 22, 2024 (AU) | November 21, 2024 (US)

Patrice Merrin (Chair), or any of them, each with the power of substitution, are hereby authorized to represent and vote the shares of the undersigned, with

all the powers which the undersigned would possess if personally present, at the Annual Meeting of Metals Acquisition Limited to be held on Friday,

November 22, 2024, 9:00 (AEDT) / 5:00 pm (EST) 10:00 pm (Jersey time) on Thursday, November 21, 2024 or at any postponement or adjournment thereof.

Shares represented by this proxy will be voted by the stockholder. If no such directions are indicated, the Proxies will have authority to vote FOR the election

of the Board of Directors and FOR items 7-10.

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting.

(Items to be voted appear on reverse side)

Proxy — Metals Acquisition Limited

q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q

Change of Address — Please print new address below. Comments — Please print your comments below.

C Non-Voting Items

+

+

Important notice regarding the Internet availability of proxy materials for the Annual Meeting of Shareholders.

The material is available at: www.investorvote.com/MTAL

The 2024 Annual Meeting of Metals Acquisition Limited will be held on

Friday, November 22, 2024, 9:00 am (AEDT) / 5:00 pm (EST) 10:00 pm (Jersey time) on Thursday, November 21, 2024,

virtually via the internet at meetnow.global/MR6WLZZ.

To access the virtual meeting, you must have the information that is printed in the shaded bar

located on the reverse side of this form. |

Exhibit 99.3

Exhibit 99.3

| SRN/HIN: I9999999999

Phone:

1300 850 505 (within Australia)

+61 3 9415 4000 (outside Australia)

Online:

www.investorcentre.com/contact

Need assistance?

Metals Acquisition Limited Annual General Meeting

Control Number: 999999

PIN: 99999

The Metals Acquisition Limited Annual General Meeting will be held at 9:00am (AEDT) on Friday, 22

November 2024 (5:00pm (EDT)/10:00pm (Jersey time) on Thursday, 21 November 2024). You are

encouraged to participate in the meeting using the following options:

To lodge a proxy, access the Notice of Meeting and other meeting documentation visit

www.investorvote.com.au and use the below information:

MAKE YOUR VOTE COUNT

For your vote to be effective it must be received by 10:00am (AEDT) on Tuesday,19 November

2024 (6:00pm (EDT)/11:00pm (Jersey time) on Monday,18 November 2024).

ATTENDING THE MEETING VIRTUALLY

As a beneficial owner, you are invited to attend the Annual General Meeting as a guest,

however because you are not a shareholder of record, you cannot vote the fully paid ordinary

shares underlying your CDIs in person at the virtual annual meeting at:

https://meetnow.global//MR6WLZZ.

You will have the ability to submit questions real-time via the meeting website but you

can visit our online voting site at www.investorvote.com.au and submit a question before

9:00am (AEDT) on Friday, 15 November 2024 (5:00pm (EDT)/10:00pm (Jersey time) on

Thursday, 14 November 2024).

The meeting will be held at:

The Company’s Australian registered office at 'CSA Mine’ 1 Louth Road, Cobar, NSW 2835.

Shareholders and CDI Holders who wish to attend the Meeting at the venue must register in

advance via investors@metalsacqcorp.com by no later than Friday, 8 November 2024.

ATTENDING THE MEETING IN PERSON

No hard copy of the Notice of Meeting will be circulated to securityholders unless the securityholders have

elected to receive the Notice of Meeting in paper form. Securityholders can view and download the Notice of

Meeting (as well as an electronic copy of the Company’s 2023 Annual Report). To do so, contact

Computershare.

MAC

MR SAM SAMPLE

FLAT 123

123 SAMPLE STREET

THE SAMPLE HILL

SAMPLE ESTATE

SAMPLEVILLE VIC 3030

Samples/000001/000001

*L000001* |

| SRN/HIN: I9999999999

MAC

MR SAM SAMPLE

FLAT 123

123 SAMPLE STREET

THE SAMPLE HILL

SAMPLE ESTATE

SAMPLEVILLE VIC 3030

Each CHESS Depositary Interest (CDI) is equivalent to one fully paid ordinary share in the

capital of the Company Share, so that every 1 (one) CDI registered in your name at 11:00am

(AEDT)/ 1:00am (Jersey time) Saturday, 12 October 2024 (8:00pm (EDT) on Friday, 11

October 2024) entitles you to one vote.

You can vote by completing, signing and returning your CDI Voting Instruction Form. This form

gives your voting instructions to CHESS Depositary Nominees Pty Ltd, which will vote the

underlying Shares on your behalf. You need to return the form no later than the time and date

shown above to give CHESS Depositary Nominees Pty Ltd enough time to tabulate all CHESS

Depositary Interest votes and to vote on the underlying Shares.

For your vote to be effective it must be

received by 10:00am (AEDT) Tuesday, 19

November 2024 (6:00pm (EDT)/11:00pm

(Jersey time) on Monday, 18 November

2024)

YOUR VOTE IS IMPORTANT

Phone:

1300 855 080 (within Australia)

+61 3 9415 4000 (outside Australia)

Online:

www.investorcentre.com/contact

Need assistance?

CDI Voting Instruction Form

Lodge your Form:

Online:

Lodge your vote online at

www.investorvote.com.au using your

secure access information or use your

mobile device to scan the personalised

QR code.

Your secure access information is

By Mail:

Computershare Investor Services Pty Limited

GPO Box 242

Melbourne VIC 3001

Australia

By Fax:

1800 783 447 within Australia or

+61 3 9473 2555 outside Australia

PLEASE NOTE: For security reasons it

is important that you keep your SRN/HIN

confidential.

How to Vote on Items of Business

SIGNING INSTRUCTIONS FOR POSTAL FORMS

Online:

XX

Control Number: 999999

PIN: 99999

Individual: Where the holding is in one name, the securityholder must sign.

Joint Holding: Where the holding is in more than one name, all of the securityholders should

sign.

Power of Attorney: If you have not already lodged the Power of Attorney with the Australian

registry, please attach a certified photocopy of the Power of Attorney to this form when you

return it.

Companies: Only duly authorised officer/s can sign on behalf of a company. Please sign in

the boxes provided, which state the office held by the signatory, ie Sole Director, Sole

Company Secretary or Director and Company Secretary. Delete titles as applicable.

Samples/000001/000002/i12

*M00000112Q02* |

|

I 9999999999

For Against Abstain

1 Re-election of Director – Mick McMullen

2 Re-election of Director – Charles McConnell

3 Re-election of Director – Graham Van't Hoff

4 Re-election of Director – Leanne Heywood

5 Re-election of Director – Anne Templeman Jones

6 Re-election of Director – Mohit Rungta

7 Re-appointment of auditors

310558_01_V5

8 Amendment to the Articles of Association

9 Change of Company name

10 Ratification of prior issue of CDIs – October 2024 Placement

Change of address. If incorrect,

mark this box and make the

correction in the space to the left.

Securityholders sponsored by a

broker (reference number

commences with ‘X’) should advise

your broker of any changes.

I/We being a holder of CHESS Depositary Interests of Metals Acquisition Limited hereby direct CHESS Depositary Nominees Pty Ltd to vote the

Shares underlying my/our holding at the Annual General Meeting of Metals Acquisition Limited to be held at The Company’s Australian

registered office at 'CSA Mine’ 1 Louth Road, Cobar, NSW 2835 and as a virtual meeting at 9:00am (AEDT) on Friday, 22 November 2024

(5:00pm (EDT)/10:00pm (Jersey time) on Thursday, 21 November 2024) and at any adjournment or postponement of that meeting.

By execution of this CDI Voting Form the undersigned hereby authorises CHESS Depositary Nominees Pty Ltd to appoint such proxies or their

substitutes to vote in their discretion on such business as may properly come before the meeting.

PLEASE NOTE: If you mark the Abstain box for an item, you are directing CHESS Depositary Nominees Pty

Ltd or their appointed proxy not to vote on your behalf on a show of hands or a poll and your votes will not be

counted in computing the required majority.

I ND

M A C 3 1 0 5 5 8 A

MR SAM SAMPLE

FLAT 123

123 SAMPLE STREET

THE SAMPLE HILL

SAMPLE ESTATE

SAMPLEVILLE VIC 3030

Voting Instructions to CHESS Depositary Nominees Pty Ltd

CHESS Depositary Nominees Pty Ltd will vote as directed

CDI Voting Instruction Form Please mark to indicate your directions

Step 1

XX

Step 2

Items of Business

This section must be completed.

Individual or Securityholder 1 Securityholder 2 Securityholder 3

Sole Director & Sole Company Secretary Director Director/Company Secretary

Update your communication details By providing your email address, you consent to receive future Notice

Mobile Number Email Address of Meeting & Proxy communications electronically

(Optional)

Step 3

Signature of Securityholder(s)

Date

/ / |

| Dear Securityholder,

We have been trying to contact you in connection with your securityholding in Metals Acquisition Limited. Unfortunately,

our correspondence has been returned to us marked “Unknown at the current address”. For security reasons we have

flagged this against your securityholding which will exclude you from future mailings, other than notices of meeting.

Please note if you have previously elected to receive a hard copy Annual Report (including the financial report, directors’

report and auditor’s report) the dispatch of that report to you has been suspended but will be resumed on receipt of

instructions from you to do so.

We value you as a securityholder and request that you supply your current address so that we can keep you informed

about our Company. Where the correspondence has been returned to us in error we request that you advise us of this

so that we may correct our records.

You are requested to include the following;

> Securityholder Reference Number (SRN);

> ASX trading code;

> Name of company in which security is held;

> Old address; and

> New address.

Please ensure that the notification is signed by all holders and forwarded to our Share Registry at:

Computershare Investor Services Pty Limited

GPO Box 2975

Melbourne Victoria 3001

Australia

Note: If your holding is sponsored within the CHESS environment you need to advise your sponsoring participant (in

most cases this would be your broker) of your change of address so that your records with CHESS are also updated.

Yours sincerely

Metals Acquisition Limited

MACRM

MR RETURN SAMPLE

123 SAMPLE STREET

SAMPLE SURBURB

SAMPLETOWN VIC 3030

Samples/000002/000005/i12

*M00000212Q03* |

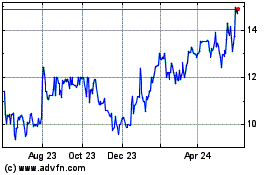

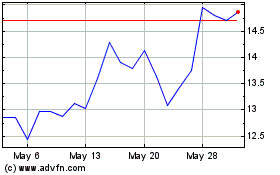

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Feb 2024 to Feb 2025