NewMarket Corporation Authorizes New Share Repurchase Program

December 12 2024 - 4:01PM

Business Wire

The Board of Directors of NewMarket Corporation (NYSE: NEU) (the

“Company”) approved a new share repurchase program authorizing

management to repurchase up to $500 million of the Company’s

outstanding common stock through December 31, 2027, as market

conditions warrant and covenants under the Company’s existing debt

agreements permit. The new repurchase program will replace the

Company’s existing $500 million repurchase program approved by the

Board of Directors in October 2021, which will expire on December

31, 2024. Under the new program, the Company may conduct share

repurchases in the open market, in privately negotiated

transactions, through block trades or pursuant to any trading plan

that may be adopted in accordance with Rule 10b5-1 of the

Securities Exchange Act of 1934. The new program does not require

the Company to acquire any specific number of shares and may be

terminated or suspended at any time.

NewMarket Corporation is a holding company operating through its

subsidiaries Afton Chemical Corporation (Afton), Ethyl Corporation

(Ethyl), and American Pacific Corporation (AMPAC). The Afton and

Ethyl companies develop, manufacture, blend, and deliver chemical

additives that enhance the performance of petroleum products. AMPAC

is a manufacturer of specialty materials primarily used in solid

rocket motors for the aerospace and defense industries. The

NewMarket family of companies has a long-term commitment to its

people, to safety, to providing innovative solutions for its

customers, and to making the world a better place.

Some of the information contained in this press release

constitutes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Although

NewMarket’s management believes its expectations are based on

reasonable assumptions within the bounds of its knowledge of its

business and operations, there can be no assurance that actual

results will not differ materially from expectations.

Factors that could cause actual results to differ materially

from expectations include, but are not limited to, the availability

of raw materials and distribution systems; disruptions at

production facilities, including single-sourced facilities; hazards

common to chemical businesses; the ability to respond effectively

to technological changes in our industries; failure to protect our

intellectual property rights; sudden, sharp, or prolonged raw

material price increases; competition from other manufacturers;

current and future governmental regulations; the loss of

significant customers; termination or changes to contracts with

contractors and subcontractors of the U.S. government or directly

with the U.S. government; failure to attract and retain a

highly-qualified workforce; an information technology system

failure or security breach; the occurrence or threat of

extraordinary events, including natural disasters, terrorist

attacks, wars and health-related epidemics; risks related to

operating outside of the United States; political, economic, and

regulatory factors concerning our products; the impact of

substantial indebtedness on our operational and financial

flexibility; the impact of fluctuations in foreign exchange rates;

resolution of environmental liabilities or legal proceedings;

limitation of our insurance coverage; our inability to realize

expected benefits from investment in our infrastructure or from

acquisitions, or our inability to successfully integrate

acquisitions into our business; the underperformance of our pension

assets resulting in additional cash contributions to our pension

plans; and other factors detailed from time to time in the reports

that NewMarket files with the Securities and Exchange Commission,

including the risk factors in Part I, Item 1A. “Risk Factors” of

our Annual Report on Form 10-K for the year ended December 31, 2023

and Part II, Item 1A. “Risk Factors” of our Quarterly Report on

Form 10-Q for the quarterly period ended September 30, 2024, which

are available to shareholders at www.newmarket.com.

You should keep in mind that any forward-looking statement made

by NewMarket in the foregoing discussion speaks only as of the date

on which such forward-looking statement is made. New risks and

uncertainties arise from time to time, and it is impossible for us

to predict these events or how they may affect the Company. We have

no duty to, and do not intend to, update or revise the

forward-looking statements in this discussion after the date

hereof, except as may be required by law. In light of these risks

and uncertainties, you should keep in mind that the events

described in any forward-looking statement made in this discussion,

or elsewhere, might not occur.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210821417/en/

FOR INVESTOR INFORMATION CONTACT: William J.

Skrobacz Investor Relations Phone: 804.788.5555

Fax: 804.788.5688 Email:

investorrelations@newmarket.com

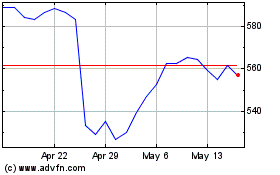

NewMarket (NYSE:NEU)

Historical Stock Chart

From Nov 2024 to Dec 2024

NewMarket (NYSE:NEU)

Historical Stock Chart

From Dec 2023 to Dec 2024