HIGHLIGHTS: (comparisons versus prior year period)

- Net sales of $340.1 million, down 13% primarily as a result of

the repositioning of Performance Chemicals

- Net loss of $56.0 million and diluted loss per share (EPS) of

$1.54; adjusted earnings of $19.1 million and diluted adjusted EPS

of $0.52

- Adjusted EBITDA of $76.9 million and adjusted EBITDA margin of

22.6%

- Operating cash flow of negative $12.1 million with free cash

flow of negative $28.7 million reflecting normal seasonal inventory

build and cash losses on crude tall oil (CTO) resales of $19.8

million

- Realized approximately $20 million of cost savings in Q1; on

track for $65 million to $75 million of cost savings in 2024

- Reiterating full year guidance of sales between $1.40 billion

and $1.55 billion and adjusted EBITDA between $365 million and $390

million

The results and guidance in this release

include non-GAAP financial measures. Refer to the section entitled

“Use of non-GAAP financial measures” within this release.

Ingevity Corporation (NYSE: NGVT) today reported its financial

results for the first quarter 2024.

First quarter net sales of $340.1 million declined 13% versus

the prior year quarter, primarily as a result of the repositioning

of the Performance Chemicals segment which included the exit of

certain end markets within the Industrial Specialties product line.

The lower sales also reflected weakness in industrial demand which

negatively impacted sales in Advanced Polymer Technologies and the

Industrial Specialties product line. The decline was partially

offset by higher sales in Performance Materials due to improved

pricing and strong automotive carbon volumes.

Pre-tax restructuring charges of $64.8 million and losses on CTO

resales of $26.5 million related to the repositioning of the

Performance Chemicals segment contributed to the net loss of $56.0

million and the resulting diluted loss per share (EPS) of $1.54.

Adjusted EBITDA was $76.9 million, down 26% versus the prior year

quarter with adjusted EBITDA margin of 22.6%.

“Performance Materials maintained the momentum we saw at the end

of 2023, with auto carbon volumes and pricing remaining strong, and

the continued popularity of hybrid vehicles,” said John Fortson,

president and CEO. “Advanced Polymer Technologies volumes were

lower versus this time last year, but we are encouraged by the last

two quarters of sequential volume growth. Performance Chemicals

sales were down as we closed a plant and exited certain low-margin

markets in our Industrial Specialties product line as part of our

strategic repositioning of Performance Chemicals. We expect

seasonal improvement in Performance Chemicals as we move into the

prime paving months over the next two quarters and are seeing good

momentum in the Road Technologies product line.”

Performance Materials

Sales in Performance Materials were $145.1 million in the

quarter, up 3% due to improved pricing and higher volumes in

automotive end markets across all regions. Segment EBITDA was $78.0

million, up 12% versus the prior year quarter primarily reflecting

lower input costs, particularly energy, and improved operational

efficiency, resulting in segment EBITDA margins of 53.8%.

“Performance Materials benefited from higher auto production in

North America and China, lower input costs, and increased pricing.

The business also improved operational efficiency and had no

downtime at the plants this quarter, generating near record EBITDA

margins of over 50%,” said Fortson. “I am extremely proud of the

efforts the team has made to continuously improve an already

attractive segment.”

Advanced Polymer Technologies

Sales in Advanced Polymer Technologies (APT) were down 27% to

$48.0 million due to demand weakness across the segment’s end

markets. Segment EBITDA was $9.5 million, down 31% due to lower

volume and price, partially offset by lower input costs. Segment

EBITDA margin was 19.8%.

“APT volumes and pricing are down versus a strong prior year

quarter as the industrial slowdown began impacting this segment

after the first quarter last year,” said Fortson. “We are pleased

with the sequential improvement with sales up 13% from Q4, largely

driven by Europe and the Americas. The segment delivered 20% EBITDA

margins due to lower input costs and the benefits we’re seeing from

cost savings actions taken last year, partially offset by lower

prices in China as the conditions there remain challenging.”

Performance Chemicals

Sales in Performance Chemicals were $147.0 million, down 21%

from prior year.

Road Technologies product line sales of $45.7 million were flat

to last year. Industrial Specialties product line sales of $101.3

million were down 28% due to the impact of the segment’s

repositioning as well as weaker industrial demand. The

repositioning is on track and we ceased production at the DeRidder,

LA site in February.

Segment EBITDA was negative $10.6 million, reflecting the impact

of lower sales volumes on plant utilization as well as sharply

higher CTO spend, partially offset by the impact of cost savings

initiatives.

“This quarter’s results reflect the early impact of Performance

Chemical’s repositioning as we exited certain lower margin end

markets. Also, CTO spend more than doubled compared to last year,”

said Fortson. “As we continue our repositioning efforts, we will

have less reliance on CTO, reducing the volatility of our raw

material costs. Products made from other oleo-based feedstocks will

continue to become a larger percentage of our offerings, and as we

move into the summer months the Road Technologies product line will

be a larger share of the segment results. We remain on track with

the savings targets and cash costs we shared last year, and our

commercial teams are making great progress in advancing products

that give existing customers a choice of feedstock, price point,

and chemical attributes, as well as moving forward in developing

products to serve new end markets for Ingevity.”

Liquidity/Other

First quarter operating cash flow was negative $12.1 million

with free cash flow of negative $28.7 million, reflecting typical

seasonal inventory build in the first quarter and the cash impact

of $19.8 million in losses on CTO resales. There were no share

repurchases for the quarter and $353.4 million remains available

under the current $500 million Board authorization. Net leverage

was 3.6 times, reflecting lower adjusted EBITDA compared to last

year.

Full Year 2024 Guidance

“We are pleased with first quarter performance and are

encouraged by the impressive results in Performance Materials, the

sequential improvement in APT, and the progress we made on the

repositioning efforts in Performance Chemicals. However, customer

order patterns continue to reflect caution regarding the pace of

recovery in industrial markets, which we believe will pick up in

the back half of the year. We are reiterating our full year

guidance of sales between $1.40 billion and $1.55 billion and

adjusted EBITDA between $365 million and $390 million,” said

Fortson.

Ingevity: Purify, Protect and Enhance

Ingevity provides products and technologies that purify, protect

and enhance the world around us. Through a team of talented and

experienced people, we develop, manufacture and bring to market

solutions that help customers solve complex problems and make the

world more sustainable. We operate in three reporting segments:

Performance Materials, which includes activated carbon; Advanced

Polymer Technologies, which includes caprolactone polymers; and

Performance Chemicals, which includes specialty chemicals and road

technologies. Our products are used in a variety of demanding

applications, including adhesives, agrochemicals, asphalt paving,

certified biodegradable bioplastics, coatings, elastomers,

lubricants, pavement markings, oil exploration and production and

automotive components. Headquartered in North Charleston, South

Carolina, Ingevity operates from 31 countries around the world and

employs approximately 1,700 people. The company’s common stock is

traded on the New York Stock Exchange (NYSE:NGVT). For more

information, visit ingevity.com.

Additional Information

The company will host a live webcast on Thursday, May 2, at

10:00 a.m. (Eastern) to discuss first quarter 2024 fiscal results.

The webcast can be accessed here or on the investors section of

Ingevity’s website. You may also listen to the conference call by

dialing 833 470 1428 (inside the U.S.) and entering access code

707574. Callers outside the U.S. can find global dial-in numbers

here. For those unable to join the live event, a recording will be

available beginning at approximately 2:00 p.m. (Eastern) on May 2,

2024, through May 1, 2025, at this replay link.

Use of non-GAAP financial measures: This press release

includes certain non‐GAAP financial measures intended to

supplement, not substitute for, comparable GAAP measures.

Reconciliations of non‐GAAP financial measures to GAAP financial

measures are provided within the Appendix to this press release.

Investors are urged to consider carefully the comparable GAAP

measures and the reconciliations to those measures provided. The

company does not attempt to provide reconciliations of

forward-looking non-GAAP guidance to the comparable GAAP measure

because the impact and timing of the factors underlying the

guidance assumptions are inherently uncertain and difficult to

predict and are unavailable without unreasonable efforts. In

addition, Ingevity believes such reconciliations would imply a

degree of certainty that could be confusing to investors.

Forward-looking statements: This press release contains

“forward‑looking statements” within the meaning of the Securities

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. Such statements generally include

the words “will,” “plans,” “intends,” “targets,” “expects,”

“outlook,” “guidance,” “believes,” “anticipates” or similar

expressions. Forward‑looking statements may include, without

limitation, anticipated timing, charges and costs of the

repositioning of our Performance Chemicals segment, including the

closure of our DeRidder, Louisiana plant; the potential benefits of

any acquisition or investment transaction, expected financial

positions, guidance, results of operations and cash flows;

financing plans; business strategies and expectations; operating

plans; capital and other expenditures; competitive positions;

growth opportunities for existing products; benefits from new

technology and cost‑reduction initiatives, plans and objectives;

litigation related strategies and outcomes; and markets for

securities. Actual results could differ materially from the views

expressed. Factors that could cause actual results to materially

differ from those contained in the forward‑looking statements, or

that could cause other forward‑looking statements to prove

incorrect, include, without limitation, charges, costs or actions,

including adverse legal or regulatory actions, resulting from, or

in connection with, the repositioning of our Performance Chemicals

segment, including the closure of our DeRidder, Louisiana plant;

losses due to resale of CTO at less than we paid for it; adverse

effects from general global economic, geopolitical and financial

conditions beyond our control, including inflation and the

Russia‑Ukraine war and Israel‑Gaza war; risks related to our

international sales and operations; adverse conditions in the

automotive market; competition from substitute products, new

technologies and new or emerging competitors; worldwide air quality

standards; a decrease in government infrastructure spending;

adverse conditions in cyclical end markets; the limited supply of

or lack of access to sufficient raw materials, or any material

increase in the cost to acquire such raw materials; issues with or

integration of future acquisitions and other investments; the

provision of services by third parties at several facilities,

including the impact of WestRock’s shutdown of its North Charleston

paper mill; supply chain disruptions; natural disasters and extreme

weather events; or other unanticipated problems such as labor

difficulties (including work stoppages), equipment failure or

unscheduled maintenance and repair; attracting and retaining key

personnel; dependence on certain large customers; legal actions

associated with our intellectual property rights; protection of our

intellectual property and other proprietary information;

information technology security breaches and other disruptions;

complications with designing or implementing our new enterprise

resource planning system; government policies and regulations,

including, but not limited to, those affecting the environment,

climate change, tax policies, tariffs and the chemicals industry;

and losses due to lawsuits arising out of environmental damage or

personal injuries associated with chemical or other manufacturing

processes, and the other factors detailed from time to time in the

reports we file with the Securities and Exchange Commission (the

“SEC”), including those described in Part I, Item 1A. Risk Factors

in our most recent Annual Report on Form 10‑K as well as in our

other filings with the SEC. These forward‑looking statements speak

only to management’s beliefs as of the date of this press release.

Ingevity assumes no obligation to provide any revisions to, or

update, any projections and forward‑looking statements contained in

this press release.

INGEVITY CORPORATION

Condensed Consolidated

Statements of Operations (Unaudited)

Three Months Ended March

31,

In millions, except per share

data

2024

2023

Net sales

$

340.1

$

392.6

Cost of sales

240.4

262.2

Gross profit

99.7

130.4

Selling, general and administrative

expenses

47.2

48.6

Research and technical expenses

6.8

8.8

Restructuring and other (income) charges,

net

62.8

5.6

Acquisition-related costs

0.3

1.9

Other (income) expense, net

32.2

(18.2

)

Interest expense, net

22.3

19.6

Income (loss) before income taxes

(71.9

)

64.1

Provision (benefit) for income taxes

(15.9

)

13.4

Net income (loss)

$

(56.0

)

$

50.7

Per share data

Basic earnings (loss) per share

$

(1.54

)

$

1.36

Diluted earnings (loss) per share

(1.54

)

1.35

Weighted average shares outstanding

Basic

36.3

37.2

Diluted

36.3

37.5

Segment Operating Results

(Unaudited)

Three Months Ended March

31,

In millions

2024

2023

Net sales

Performance Materials

$

145.1

$

141.4

Performance Chemicals

$

147.0

$

185.6

Pavement Technologies product line

45.7

45.8

Industrial Specialties product line

101.3

139.8

Advanced Polymer Technologies

$

48.0

$

65.6

Total net sales

$

340.1

$

392.6

Segment EBITDA (1)

Performance Materials

$

78.0

$

69.8

Performance Chemicals

(10.6

)

20.3

Advanced Polymer Technologies

9.5

13.8

Total segment EBITDA (1)

$

76.9

$

103.9

Interest expense, net

(22.3

)

(19.6

)

(Provision) benefit for income taxes

15.9

(13.4

)

Depreciation and amortization -

Performance Materials

(9.6

)

(10.0

)

Depreciation and amortization -

Performance Chemicals

(12.4

)

(13.8

)

Depreciation and amortization - Advanced

Polymer Technologies

(7.6

)

(7.3

)

Restructuring and other income (charges),

net (2) (3)

(65.3

)

(5.6

)

Acquisition and other-related costs (2)

(4)

(0.3

)

(2.7

)

Loss on CTO resales (2) (5)

(26.5

)

—

Gain (loss) on strategic investments (2)

(6)

(4.8

)

19.2

Net income (loss)

$

(56.0

)

$

50.7

_______________

(1)

Segment EBITDA is the primary measure used

by our chief operating decision maker to evaluate the performance

of and allocate resources among our operating segments. Segment

EBITDA is defined as segment net sales less segment operating

expenses (segment operating expenses consist of costs of sales,

selling, general and administrative expenses, research and

technical expenses, other (income) expense, net, excluding

depreciation and amortization). We have excluded the following

items from segment EBITDA: interest expense associated with

corporate debt facilities, interest income, income taxes,

depreciation, amortization, restructuring and other income

(charges), net, including inventory lower of cost or market charges

associated with restructuring actions, acquisition and

other-related income (costs), litigation verdict charges, gain

(loss) on strategic investments, loss on CTO resales, pension and

postretirement settlement and curtailment income (charges),

net.

(2)

For more information on these charges,

refer to the Reconciliation of Adjusted Earnings table on page

8.

(3)

The table below provides an allocation of

these charges between our three reportable segments to provide

investors, potential investors, securities analysts and others with

the information, should they choose, to apply such (income) charges

to each respective reportable segment for which the charges

relate.

Three Months Ended March

31,

In millions

2024

2023

Performance Materials

$

0.1

$

1.7

Performance Chemicals

65.3

3.1

Advanced Polymer Technologies

(0.1

)

0.8

Restructuring and other (income) charges,

net

$

65.3

$

5.6

(4)

The table below provides an allocation of

these charges between our three reportable segments to provide

investors, potential investors, securities analysts and others with

the information, should they choose, to apply such (income) charges

to each respective reportable segment for which the charges

relate.

Three Months Ended March

31,

In millions

2024

2023

Performance Materials

$

—

$

—

Performance Chemicals

0.3

2.7

Advanced Polymer Technologies

—

—

Acquisition and other-related (income)

costs, net

$

0.3

$

2.7

(5)

For the three months ended March 31, 2024,

charges relate to the Performance Chemicals reportable segment.

(6)

For the three months ended March 31, 2024,

gain (loss) on strategic investments relates to the Performance

Chemicals reportable segment. For the three months ended March 31,

2023, gain (loss) on strategic investments relates to the

Performance Materials segment.

Condensed Consolidated Balance

Sheets (Unaudited)

In millions

March 31, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

88.5

$

95.9

Accounts receivable, net

191.3

182.0

Inventories, net

325.5

308.8

Prepaid and other current assets

63.9

71.9

Current assets

669.2

658.6

Property, plant, and equipment, net

726.5

762.2

Goodwill

525.9

527.5

Other intangibles, net

302.8

336.1

Restricted investment

79.8

79.1

Strategic investments

94.1

99.2

Other assets

168.6

160.6

Total Assets

$

2,566.9

$

2,623.3

Liabilities

Accounts payable

$

153.1

$

158.4

Accrued expenses

70.5

72.3

Notes payable and current maturities of

long-term debt

84.7

84.4

Other current liabilities

43.4

47.8

Current liabilities

351.7

362.9

Long-term debt including finance lease

obligations

1,408.7

1,382.8

Deferred income taxes

64.4

70.9

Other liabilities

173.9

175.3

Total Liabilities

1,998.7

1,991.9

Equity

568.2

631.4

Total Liabilities and Equity

$

2,566.9

$

2,623.3

Condensed Consolidated

Statements of Cash Flows (Unaudited)

Three Months Ended March

31,

In millions

2024

2023

Cash provided by (used in) operating

activities:

Net income (loss)

$

(56.0

)

$

50.7

Adjustments to reconcile net income (loss)

to cash provided by (used in) operating activities:

Depreciation and amortization

29.6

31.1

Restructuring and other (income) charges,

net

62.8

5.6

Loss on CTO resales

26.5

—

(Gain) loss on strategic investment

4.8

(19.2

)

Other non-cash items

(10.2

)

34.4

Changes in operating assets and

liabilities, net of effect of acquisitions:

CTO resales spending, net

(19.8

)

—

Changes in other operating assets and

liabilities, net

(49.8

)

(97.3

)

Net cash provided by (used in) operating

activities

$

(12.1

)

$

5.3

Cash provided by (used in) investing

activities:

Capital expenditures

$

(16.6

)

$

(25.4

)

Proceeds from sale of strategic

investment

—

31.4

Other investing activities, net

0.3

(3.5

)

Net cash provided by (used in) investing

activities

$

(16.3

)

$

2.5

Cash provided by (used in) financing

activities:

Proceeds from revolving credit facility

and other borrowings

$

81.4

$

90.3

Payments on revolving credit facility and

other borrowings

(55.0

)

(60.3

)

Financing lease obligations, net

(0.4

)

(0.3

)

Tax payments related to withholdings on

vested equity awards

(2.6

)

(4.5

)

Proceeds and withholdings from share-based

compensation plans, net

—

2.6

Repurchases of common stock under publicly

announced plan

—

(33.4

)

Net cash provided by (used in) financing

activities

$

23.4

$

(5.6

)

Increase (decrease) in cash, cash

equivalents, and restricted cash

(5.0

)

2.2

Effect of exchange rate changes on

cash

(1.8

)

(0.4

)

Change in cash, cash equivalents, and

restricted cash(1)

(6.8

)

1.8

Cash, cash equivalents, and restricted

cash at beginning of period

111.9

84.3

Cash, cash equivalents, and restricted

cash at end of period (1)

$

105.1

$

86.1

(1) Includes restricted cash of $16.6

million and $8.2 million and cash and cash equivalents of $88.5

million and $77.9 million at March 31, 2024 and 2023, respectively.

Restricted cash is included within "Prepaid and other current

assets" and "Restricted investment" within the condensed

consolidated balance sheets.

Supplemental cash flow

information:

Cash paid for interest, net of capitalized

interest

$

17.0

$

15.3

Cash paid for income taxes, net of

refunds

2.9

4.7

Purchases of property, plant, and

equipment in accounts payable

2.7

4.3

Leased assets obtained in exchange for new

operating lease liabilities

0.4

3.9

Non-GAAP Financial Measures

Ingevity has presented certain financial measures, defined

below, which have not been prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”) and has provided

a reconciliation to the most directly comparable financial measure

calculated in accordance with GAAP on the following pages. These

financial measures are not meant to be considered in isolation nor

as a substitute for the most directly comparable financial measure

calculated in accordance with GAAP. Investors should consider the

limitations associated with these non-GAAP measures, including the

potential lack of comparability of these measures from one company

to another.

We believe these non-GAAP financial measures provide management

as well as investors, potential investors, securities analysts, and

others with useful information to evaluate the performance of the

business, because such measures, when viewed together with our

financial results computed in accordance with GAAP, provide a more

complete understanding of the factors and trends affecting our

historical financial performance, liquidity measures, and projected

future results.

Ingevity uses the following non-GAAP measures:

Adjusted earnings (loss) is defined as

net income (loss) plus restructuring and other (income) charges,

net, including inventory lower of cost or market charges associated

with restructuring actions, acquisition and other-related (income)

costs, pension and postretirement settlement and curtailment

(income) charges, loss on CTO resales, (gain) loss on strategic

investments, debt refinancing fees, litigation verdict charges, and

the income tax expense (benefit) on those items, less the provision

(benefit) from certain discrete tax items.

Diluted adjusted earnings (loss) per

share is defined as diluted earnings (loss) per common share plus

restructuring and other (income) charges, net, including inventory

lower of cost or market charges associated with restructuring

actions, per share, acquisition and other-related (income) costs

per share, pension and postretirement settlement and curtailment

(income) charges per share, loss on CTO resales per share, (gain)

loss on strategic investments per share, debt refinancing fees per

share, litigation verdict charge per share, and the income tax

expense (benefit) per share on those items, less the provision

(benefit) from certain discrete tax items per share.

Adjusted EBITDA is defined as net

income (loss) plus interest expense, net, provision (benefit) for

income taxes, depreciation, amortization, restructuring and other

(income) charges, net, including inventory lower of cost or market

charges associated with restructuring actions, acquisition and

other-related (income) costs, litigation verdict charges, (gain)

loss on strategic investments, loss on CTO resales, and pension and

postretirement settlement and curtailment (income) charges,

net.

Adjusted EBITDA Margin is defined as

Adjusted EBITDA divided by Net sales.

Free Cash Flow is defined as the sum

of net cash provided by (used in) the following items: operating

activities less capital expenditures.

Net Debt is defined as the sum of

notes payable, short-term debt, current maturities of long-term

debt and long-term debt including finance lease obligations less

the sum of cash and cash equivalents, restricted cash associated

with our new market tax credit financing arrangement, and

restricted investment associated with certain finance lease

obligations, excluding the allowance for credit losses on

held-to-maturity debt securities held within the restricted

investment.

Net Debt Ratio is defined as Net Debt

divided by the last twelve months Adjusted EBITDA, inclusive of

acquisition-related pro forma adjustments.

Ingevity's management also uses the above financial measures as

the primary measures of profitability and liquidity of the

business. In addition, Ingevity believes Adjusted EBITDA and

Adjusted EBITDA Margin are useful measures because they exclude the

effects of financing and investment activities as well as

non-operating activities.

GAAP Reconciliation of 2024 Adjusted EBITDA

Guidance

A reconciliation of net income to adjusted EBITDA as projected

for 2024 is not provided. Ingevity does not forecast net income as

it cannot, without unreasonable effort, estimate or predict with

certainty various components of net income. These components, net

of tax, include further restructuring and other income (charges),

net; additional acquisition and other-related (income) costs;

litigation verdict charges; additional pension and postretirement

settlement and curtailment (income) charges; and revisions due to

legislative tax rate changes. Additionally, discrete tax items

could drive variability in our projected effective tax rate. All of

these components could significantly impact such financial

measures. Further, in the future, other items with similar

characteristics to those currently included in adjusted EBITDA,

that have a similar impact on the comparability of periods, and

which are not known at this time, may exist and impact adjusted

EBITDA.

Reconciliation of Non-GAAP Financial

Measures

Reconciliation of Net Income

(Loss) (GAAP) to Adjusted Earnings (Loss) (Non-GAAP) and

Reconciliation of Diluted

Earnings (Loss) per Common Share (GAAP) to Diluted Adjusted

Earnings

per Share (Non-GAAP)

Three Months Ended March

31,

In millions, except per share data

(unaudited)

2024

2023

Net income (loss) (GAAP)

$

(56.0

)

$

50.7

Restructuring and other (income) charges,

net (1)

65.3

5.6

Acquisition and other-related costs

(2)

0.3

2.7

Loss on CTO resales (3)

26.5

—

(Gain) loss on strategic investments

(4)

4.8

(19.2

)

Tax effect on items above (5)

(22.7

)

2.6

Certain discrete tax provision (benefit)

(6)

0.9

(1.3

)

Adjusted earnings (loss)

(Non-GAAP)

$

19.1

$

41.1

Diluted earnings (loss) per common

share (GAAP)

$

(1.54

)

$

1.35

Restructuring and other (income) charges,

net

1.79

0.15

Acquisition and other-related costs

0.01

0.07

Loss on CTO resales

0.73

—

(Gain) loss on strategic investments

0.13

(0.51

)

Tax effect on items above

(0.62

)

0.07

Certain discrete tax provision

(benefit)

0.02

(0.04

)

Diluted adjusted earnings (loss) per

share (Non-GAAP)

$

0.52

$

1.09

Weighted average common shares outstanding

- Diluted

36.4

37.5

_______________

(1)

We regularly perform strategic reviews and

assess the return on our operations, which sometimes results in a

plan to restructure the business. These costs are excluded from our

reportable segment results; details of which are included in the

table below. For the details of these costs between our reportable

segments, see Segment Operating Results on page 2.

Three Months Ended March

31,

In millions

2024

2023

Work force reductions and other

$

—

$

3.1

Performance Chemicals' repositioning

62.3

—

Restructuring charges (1)

$

62.3

$

3.1

North Charleston plant transition

0.5

—

Business transformation costs

—

2.5

Other (income) charges, net (1)

$

0.5

$

2.5

Performance Chemicals' repositioning

inventory charges (2)

2.5

—

Restructuring and other (income) charges,

net (3)

$

65.3

$

5.6

__________

(1)

Amounts are recorded within Restructuring

and other (income) charges, net on the condensed consolidated

statement of operations.

(2)

Amounts are recorded within Cost of sales

on the condensed consolidated statement of operations.

(3)

For information on our Workforce

reductions and other, Performance Chemicals' repositioning, North

Charleston plant transition, and the Business transformation costs

please refer to Note 15, Restructuring and Other (Income) Charges,

net, in the Notes to the Consolidated Financial Statements included

in the Company’s Form 10-K for the year ended December 31, 2023,

filed on February 22, 2024. Updates will be provided in subsequent

filings of the Company's Form 10-Q in 2024.

(2)

Charges represent (gains) losses incurred

to complete and integrate acquisitions and other strategic

investments. Charges may include the expensing of the inventory

fair value step-up resulting from the application of purchase

accounting for acquisitions and certain legal and professional fees

associated with the completion of acquisitions and strategic

investments. For the details of these costs between our reportable

segments, see Segment Operating Results on page 2.

Three Months Ended March

31,

In millions

2024

2023

Legal and professional service fees

$

0.3

$

1.9

Acquisition-related (income) costs

$

0.3

$

1.9

Inventory fair value step-up amortization

(1)

—

0.8

Acquisition and other-related (income)

charges

$

0.3

$

2.7

_________________

(1) Included in Cost of sales on the

condensed consolidated statement of operations.

(3)

Due to the DeRidder Plant closure, as

noted in footnote 1 above, and the corresponding reduced CTO

refining capacity, we may be obligated, under an existing CTO

supply contract, to purchase CTO through 2025 at amounts in excess

of required CTO volumes. We intend to manage our CTO volumes by

reselling excess volumes (herein referred to as "CTO resales") in

the open market, which, based on what we believe to be market rates

today, may result in a loss of $50.0 million to $80.0 million in

2024.

(4)

We exclude gains and losses from strategic

investments from our segment results, as well as our non-GAAP

financial measures, because we do not consider such gains or losses

to be directly associated with the operational performance of the

segment. We believe that the inclusion of such gains or losses,

would impair the factors and trends affecting the historical

financial performance of our reportable segments. We continue to

include undistributed earnings or loss, distributions, amortization

or accretion of basis differences, and other-than-temporary

impairments for equity method investments that we believe are

directly attributable to the operational performance of such

investments, in our reportable segment results.

(5)

Income tax impact of non-GAAP adjustments

is the summation of the calculated income tax charge related to

each pre-tax non-GAAP adjustment. The non-GAAP adjustments relate

primarily to adjustments in the United States. As such, the income

tax effect is calculated using the statutory tax rates of 21% for

the United States and approximately 2.5% for state and local taxes,

applied to the non-GAAP adjustments.

(6)

Represents certain discrete tax items such

as excess tax benefits on stock compensation and impacts of

legislative tax rate changes

Reconciliation of Net Income

(Loss) (GAAP) to Adjusted EBITDA (Non-GAAP)

Three Months Ended March

31,

In millions, except percentages

(unaudited)

2024

2023

Net income (loss) (GAAP)

$

(56.0

)

$

50.7

Provision (benefit) for income taxes

(15.9

)

13.4

Interest expense, net

22.3

19.6

Depreciation and amortization

29.6

31.1

Restructuring and other (income) charges,

net (1)

65.3

5.6

Acquisition and other-related (income)

costs (1)

0.3

2.7

Loss on CTO resales (1)

26.5

—

(Gain) loss on strategic investments

(1)

4.8

(19.2

)

Adjusted EBITDA (Non-GAAP)

$

76.9

$

103.9

Net sales

$

340.1

$

392.6

Net income (loss) margin

(16.5

)%

12.9

%

Adjusted EBITDA margin

22.6

%

26.5

%

_______________

(1) For more information on these charges,

refer to the Reconciliation of Adjusted Earnings table on page

6.

Calculation of Free Cash Flow

(Non-GAAP)

Three Months Ended March

31,

In millions (unaudited)

2024

2023

Net cash provided by (used in) operating

activities

$

(12.1

)

$

5.3

Less: Capital expenditures

16.6

25.4

Free Cash Flow (Non-GAAP)

$

(28.7

)

$

(20.1

)

Calculation of Net Debt Ratio

(Non-GAAP)

In millions, except ratios

(unaudited)

March 31, 2024

Notes payable and current maturities of

long-term debt

$

84.7

Long-term debt including finance lease

obligations

1,408.7

Debt issuance costs

5.0

Total Debt

1,498.4

Less:

Cash and cash equivalents (1)

88.7

Restricted investment (2)

79.9

Net Debt

$

1,329.8

Net Debt Ratio (Non GAAP)

Adjusted EBITDA (3)

Twelve months ended December 31, 2023

$

396.8

Three months ended March 31, 2023

(103.9

)

Three months ended March 31, 2024

76.9

Adjusted EBITDA - last twelve months (LTM)

as of March 31, 2024

$

369.8

Net debt ratio (Non GAAP)

3.6x

_______________

(1)

Includes $0.2 million of Restricted Cash

related to the New Market Tax Credit arrangement.

(2)

Our restricted investment is a trust

managed in order to secure repayment of the finance lease

obligation associated with Performance Materials' Wickliffe,

Kentucky, manufacturing site at maturity. The trust, presented as

Restricted investment on our condensed consolidated balance sheets,

originally purchased long-term bonds that mature through 2026. The

principal received at maturity of the bonds, along with interest

income that is reinvested in the trust, are expected to be equal to

or more than the $80.0 million finance lease obligation that is due

in 2027. Excludes $0.1 million allowance for credit losses on

held-to-maturity debt securities.

(3)

Refer to the Reconciliation of Net Income

(GAAP) to Adjusted EBITDA (Non-GAAP) schedule on page 8 for the

reconciliation to the most comparable GAAP financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501821891/en/

Caroline Monahan 843-740-2068 media@ingevity.com

Investors: John E. Nypaver, Jr. 843-740-2002

investors@ingevity.com

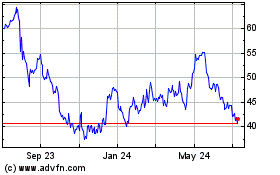

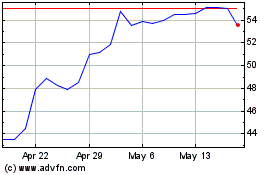

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Nov 2023 to Nov 2024