Nokia Cuts Operating Margin Guidance Amid Challenging Market -- Update

December 12 2023 - 2:23AM

Dow Jones News

By Dominic Chopping

Nokia cut its operating margin guidance, with market conditions

in its mobile networks business remaining challenging due to

falling operator spending and the Indian market normalizing after a

period of rapid 5G roll-outs.

The Finnish telecom equipment maker said Tuesday that it now

targets a comparable operating margin target of at least 13% by

2026, from at least 14% previously.

The company has been experiencing a tough time, with demand

weakening due to customers facing a tough macroeconomic environment

beset by high inflation and rising interest rates. This sharp

downturn in telecom operator spending has seen Nokia recently

outline plans to cut as much as 16% of its workforce as it seeks to

save up to 1.2 billion euros ($1.29 billion).

Last week it cautioned that revenue was set to fall after U.S.

operator AT&T selected Ericsson and other vendors to build out

a new network.

"Nokia still sees a path to achieving the at least 14%

comparable operating margin target but considering the current

market conditions in mobile networks, this is deemed a prudent

change," the company said.

However, the company said it sees further opportunities to

increase margins beyond 2026 and believes the 14% target remains

achievable over the longer term.

It expects both its network infrastructure and cloud and network

services business to grow faster than the market through 2026 while

mobile networks will face challenges in 2024 and 2025 before

returning to grow faster than the market in 2026.

In a statement released ahead of an investor event, Nokia said

it expects mobile networks net sales to decline next year, with a

low-single digit operating margin. It has begun to shore up the

unit for resilience and profitability which will enable it to hit a

double-digit operating margin on net sales of around 10 billion

euros ($10.77 billion), compared with the EUR11.5 billion sales

level that would be required today.

The mobile networks unit will now also seek to accelerate its

offerings to faster-growing segments, such as enterprise, cloud

networks, open networks and the defense sector.

As part of these plans to increase its portfolio of products to

defense customers, it said separately Tuesday that it has agreed to

acquire military communication provider Fenix Group from

Enlightenment Capital. Financial terms of the deal weren't

disclosed.

Outside of mobile networks, the company's other business groups

continue to make good progress toward their long-term targets, it

said.

Moving forward, the company said its business groups will have

increased strategic autonomy to pursue investment that supports

growth, portfolio management, and deeper strategic

partnerships.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

December 12, 2023 03:08 ET (08:08 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

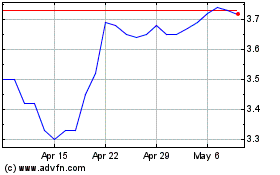

Nokia (NYSE:NOK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nokia (NYSE:NOK)

Historical Stock Chart

From Jan 2024 to Jan 2025