0001000753FALSE00010007532024-11-152024-11-150001000753us-gaap:CommonStockMember2024-11-152024-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 15, 2024

Insperity, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-13998 | | 76-0479645 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

19001 Crescent Springs Drive

Kingwood, Texas 77339

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (281) 358-8986

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value per share | NSP | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under The Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under The Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 27, 2024, Insperity, Inc. (the “Company”) announced the retirement of Douglas S. Sharp, Executive Vice President of Finance, Chief Financial Officer and Treasurer, effective November 15, 2024. On November 15, 2024, the Company and Mr. Sharp entered into a consulting agreement. Under the consulting agreement, Mr. Sharp will be reasonably available to consult on the continued transition of his responsibilities and to provide financial advice, business advice, and other advisory services through March 31, 2025; receive $10,000 per month compensation; and, until the end of twenty-four months following the expiration or termination of the consulting agreement, agree not to engage in business activities that compete with the Company’s operations and not to solicit employees of the Company. A copy of the consulting agreement is attached as Exhibit 10.1 and is incorporated by reference.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| INSPERITY, INC. |

| |

| |

| |

| |

| |

| By: | /s/ Christian P. Callens |

| Christian P. Callens |

| Senior Vice President of Legal,

General Counsel and Secretary |

Date: November 21, 2024

Exhibit 10.1

[Insperity Letterhead]

November 15, 2024

Mr. Douglas S. Sharp

[Home address]

Re: Consulting Services

Dear Doug:

This letter agreement (this “Agreement”) confirms your engagement as a consultant for Insperity, Inc. (“Insperity”), effective as of November 16, 2024 (the “Effective Date”), following your retirement from Insperity Services, L.P. on November 15, 2024 (“Retirement Date”), subject to the terms and conditions of this Agreement.

1.Term. Your Consulting Services (as defined below) for Insperity shall commence as of the Effective Date and continue through March 31, 2025, subject to extensions as mutually agreed to by you and Insperity (the “Term”). Your Consulting Services shall terminate as of the last day of the Term (the “Expiration Date”).

2.Services. During the Term, you will report directly to the Executive Vice President of Finance, Chief Financial Officer and Treasurer of Insperity (the “CFO”) and will be reasonably available to provide financial advice, general business advice and other advisory services to the CFO, Chief Executive Officer, the Senior Vice President of Finance and Accounting or such other management personnel of Insperity (and its subsidiaries) as the CFO may direct (“Insperity Management”) with respect to the operations of Insperity, including assisting with the transition of your prior responsibilities and advising Insperity Management regarding pending matters, and such other related services as the CFO may reasonably request from time to time (the “Consulting Services”). The parties agree that in no event will you provide Consulting Services under this Agreement at a level that exceeds twenty percent (20%) of the average level of bona fide services performed by you as an employee of Insperity Services, L.P. for the thirty-six (36) month period preceding your Retirement Date.

3.Consulting Fee and Expenses and Use of Insperity Equipment.

a.Insperity will pay you a monthly consulting fee of ten thousand dollars ($10,000.00) (the “Fee”) during the Term. The Fee shall be paid to you no later than the tenth (10th) business day after the end of a full calendar month during the Term. If the first month and/or last month of the Term are less than a full calendar month, then the Fee for such partial month shall be pro-rated based on the number of days you provide Consulting Services during such month.

b.Notwithstanding anything to the contrary in this Agreement, in the event your Consulting Services pursuant to this Agreement terminate by reason of your death prior to the end of the original Term, then the Fees you would have been paid had you continued to provide the Consulting Services through the end of the original Term will be paid in a lump sum payment to your spouse. If you are not married on such service termination date, then Insperity will only be obligated to pay your estate for Consulting Services performed through your date of death.

c.During the Term, you shall not be eligible for reimbursement of business expenses unless preapproved in writing by Insperity.

d.While providing Consulting Services, you agree to use Insperity-provided equipment assigned to you, including the laptop computer and Insperity-provided email address.

e.Insperity affirms that the termination of your employment is considered to be a qualifying “Retirement” under the Company’s incentive compensation plans.

4.Independent Contractor Relationship. You are an independent contractor with respect to your performance of the Consulting Services and any or all other services provided under this Agreement. Insperity will not direct or exercise control over the manner or means by which the Consulting Services are provided. You will have the right to devote your business day and working efforts to other business and professional opportunities that do not interfere with the rendering of services to Insperity or violate compliance with the covenants in Section 9. You are not and shall not be deemed for any purpose to be an employee, agent, servant or representative of Insperity. You shall not be and are not entitled to participate in any employee benefit or compensation plans or programs of Insperity, or receive any other benefits provided to Insperity employees, irrespective of any later determination by a court, regulatory, governmental or pseudo governmental agency.

5.No Tax Withholding. Because you are acting in the capacity of an independent contractor, Insperity will not withhold from payments to be made to you any sums for income tax, unemployment insurance, social security, or any other tax or withholding. You specifically agree that the determination of any tax liability or other consequences of any payment made hereunder is your sole and complete responsibility, and that you will pay all taxes, if any, assessed on such payments under the applicable laws of any federal, state, local or other jurisdiction.

6.Section 409A. Payments under this Agreement are designed to be made in a manner that is exempt from or compliant with Section 409A of the Internal Revenue Code of 1986, and the provisions of this Agreement will be administered, interpreted and construed accordingly. Notwithstanding the foregoing, Insperity shall not have any liability to you with respect to Section 409A and the provisions of this Agreement will be administered, interpreted and construed accordingly (or disregarded to the extent such provision cannot be so administered, interpreted, or construed). All expenses eligible for reimbursement under any plan, policy or agreement shall be paid to you promptly, but in any event by no later than December 31st of the calendar year following the calendar year in which such expenses were incurred.

7.Confidential Treatment. You acknowledge and agree that you have acquired, and will in the future acquire as a result of the Consulting Services or otherwise, Proprietary Information of Insperity which is of a confidential or trade secret nature, and all of which has a great value to Insperity and is a substantial basis and foundation upon which Insperity’s business is predicated. Accordingly, other than in the legitimate performance of the Consulting Services, you agree:

a.to regard and preserve as confidential at all times all Proprietary Information;

b.to refrain from publishing or disclosing any part of the Proprietary Information and from using, copying or duplicating it in any way by any means whatsoever; and

c.not to use on your own behalf or on behalf of any third party or to disclose the Proprietary Information to any person or entity without the prior written consent of Insperity.

For purposes of this Agreement, “Propriety Information” includes all confidential or proprietary scientific or technical information, data, formulas and related concepts, business plans (both current and under development), client lists, pricing and cost data, promotion and marketing programs, trade secrets, or any other confidential or proprietary business information relating to the business of Insperity, whether in written or electronic form of writings, correspondence, notes, drafts, records, maps, invoices, technical and business logs, policies, computer programs, disks or otherwise. Proprietary Information does not include information that is or becomes publicly known through lawful means.

8.Property of Insperity. You acknowledge that all Proprietary Information (as defined above in Section 7) and other property of Insperity which you accumulate during your performance of the Consulting Services are the exclusive property of Insperity. Upon the expiration of the Term or earlier termination of this Agreement, or at any time upon Insperity’s request, you shall surrender and deliver to Insperity any equipment provided by Insperity, including, but not limited to, laptop computers, tablets or similar devices (and not keep, recreate or furnish to any third party) any and all work papers, reports, manuals, documents and the like (including all originals and copies thereof) in your possession which contain Proprietary Information relating to the business, prospects or plans of Insperity. Further, you agree to search for and delete all Insperity information, including Proprietary Information, from your computer, smartphone, tablet, or any other personal electronic storage devices, other than payroll information or other financial information that you may need for your tax filings, and, upon request, certify to Insperity that you have completed this search and deletion process.

9.Non-Competition; Non-Solicitation.

a.You agree that during your employment you acquired an intimate knowledge of the business operations of Insperity. You further agree that you will continue to assist Insperity in making, and provide advice with respect to, certain business decisions while providing Consulting Services. You and Insperity agree to the non-competition and non-solicitation provisions of this Section 9: (i) in consideration for access to the Proprietary Information (as defined above in Section 7) provided by Insperity to you; and (ii) to protect the Proprietary Information of Insperity disclosed or entrusted to you by Insperity or created or developed by you for Insperity, the business goodwill of Insperity developed through your efforts and the business opportunities disclosed or entrusted to you by Insperity.

b.Subject to the exceptions set forth in Section 9(c), you expressly covenant and agree that, during the Non-Compete Period: (i) you will refrain from carrying on or engaging in, directly or indirectly, any Competing Business in the Restricted Area; and (ii) you will not, directly or indirectly, own, manage, operate, join, become an employee, partner, owner or member of (or an independent contractor to), control or participate in or loan money to, sell or lease equipment to or sell or lease real property to any person or entity that engages in a Competing Business in the Restricted Area.

c.Notwithstanding the restrictions contained in Section 9(b), you may own an aggregate of not more than 1% of the outstanding capital stock or other equity security of any class of any corporation or other entity engaged in a Competing Business, if such capital stock or other equity security is listed on a national securities exchange or regularly traded in the over-the-counter market by a member of a national securities exchange, without violating the provisions of Section 9(b) above, provided that you do not have the power, directly or indirectly, to control or direct the management or affairs of any such corporation or other entity and are not involved in the management of such corporation or entity.

d.You further expressly covenant and agree that, during the Non-Solicit Period, you will not: (i) engage or employ, or solicit or contact with a view to the engagement or employment of, any

person who is an officer or employee of Insperity; or (ii) canvass, solicit, approach or entice away or cause to be canvassed, solicited, approached or enticed away from Insperity any person who or which is or was a customer of Insperity, during the Term or the two years prior to the Effective Date, and either (x) about which you received Proprietary Information or (y) with which you had contact or dealings on behalf of Insperity.

e.You expressly recognize that you will be provided with access to Proprietary Information and trade secrets as part of your performance of the Consulting Services and that the restrictive covenants set forth in this Agreement are reasonable and necessary in light of your role and access to the Proprietary Information.

f.For purposes of Section 9, references to Insperity shall include its affiliates and subsidiaries.

As used in this Agreement, the following terms shall have the following meanings:

“Business” means the professional employer organization (PEO) business or any other business in which Insperity is engaged during the Term or in which Insperity has taken material steps to engage during the prior two years of your service pursuant to this Agreement.

“Competing Business” means any person or entity that, wholly or in any significant part, engages in any business competing with the Business in the Restricted Area, including without limitation, Automatic Data Processing, Inc., G&A Outsourcing, Inc. (dba G&A Partners), JustWorks, Inc., Paychex, Inc., Rippling People Center Inc., TriNet Group, Inc., Vensure Employer Services, Inc., and each of their respective affiliates and subsidiaries.

“Non-Compete Period” means (i) the Term and (ii) during the twenty-four (24) month period following termination of the Consulting Services pursuant to this Agreement.

“Non-Solicit Period” means (i) the Term and (ii) during the twenty-four (24) month period following termination of the Consulting Services pursuant to this Agreement.

“Restricted Area” means any state in which Insperity (i) is then currently engaged in the Business, (ii) has engaged in the Business during the prior two years of your service pursuant to this Agreement, or (iii) is actively pursuing business opportunities for the Business, and in each such case you either (x) received Proprietary Information about Insperity’s operations in such location or (y) worked in such location during the prior two years of your service pursuant to this Agreement.

10.Miscellaneous.

a.Waiver or Modification. Any waiver by either party of a breach of any provision of this Agreement shall not operate as, or to be, construed to be a waiver of any other breach of such provision of this Agreement. The failure of a party to insist upon strict adherence to any term of this Agreement on one or more occasions shall not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Agreement. Neither this Agreement nor any part of it may be waived, changed or terminated orally, and any waiver, amendment or modification must be in writing and signed by each of the parties.

b.Successors and Assigns. The rights and obligations of Insperity under this Agreement shall be binding on and inure to the benefit of Insperity, its successors and permitted assigns. Your rights and obligations under this Agreement shall be binding on and inure to the benefit of you and your heirs and legal representatives. Insperity may assign this Agreement to a successor in interest, including the

purchaser of all or substantially all of the assets of Insperity, provided that Insperity shall remain liable hereunder unless the assignee purchased all or substantially all of the assets of Insperity. You may not assign any of your duties under this Agreement.

c.Termination. Either Party may terminate this Agreement upon breach of this Agreement by the party after having provided the other party ten (10) days’ prior written notice of such breach and an opportunity to cure such breach, if curable. Further, because money damages would not be sufficient remedy for any breach of Sections 7 or 9 by you or other breach of this Agreement, you acknowledge and agree that Insperity shall be entitled to enforce the provisions providing for the termination of any other amounts then owing to you, to take action to recoup any such payments made since your Retirement Date, and to specific performance and injunctive relief as remedies for such breach or any threatened breach. Such remedies shall not be deemed the exclusive remedies for a breach, including a breach of Section 7 or 9, but shall be in addition to all remedies available at law or in equity, including the recovery of damages from you and your agents. However, if it is determined that you have not committed a breach, then Insperity shall pay you all payments that had been suspended pending such determination.

d.Reasonableness; Enforcement. You acknowledge and agree that the geographic scope and duration of the covenants contained in Section 9 are fair and reasonable, and do not do not impose any greater restraint than is necessary to protect the legitimate business interests of Insperity, in light of: (a) the nature and wide geographic scope of the operations of the Business; (b) your contact with the Business in all jurisdictions in which it is conducted; (c) the fact that the Business is conducted throughout the Restricted Area; and (d) the amount of compensation and Proprietary Information that you are receiving in connection with the performance of such Consulting Services. It is the desire and intent of you and Insperity that the provisions of Section 9 be enforced to the fullest extent legally permitted, whether now or hereafter in effect and, therefore, to the extent permitted by applicable law, you and Insperity hereby waive the application of any provision of applicable law that would render any provision of Section 9 invalid or unenforceable, in whole or in part.

e.Counterparts. This Agreement may be executed in any number of counterparts, each of which shall, when executed, be deemed to be an original and all of which shall be deemed to be one and the same instrument; and all signatures need not appear on any one counterpart.

f.Governing Law; Dispute Resolution. This Agreement will be governed in all respects, including as to validity, interpretation and effect, by the internal laws of the State of Texas, without regard to any choice of law principles that would result in the application of the laws of another jurisdiction, except to the extent preempted by U.S. federal law. If any dispute arises with respect to any action, suit or other legal proceeding pertaining to this Agreement or to the interpretation of or enforcement of your rights under this Agreement, you and Insperity agree that exclusive jurisdiction for any such suit, action or legal proceeding is the federal or state courts situated in Houston, Harris County, Texas.

g.Severability. Any term or provision of this Agreement which is determined to be invalid or unenforceable by any court of competent jurisdiction in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity or unenforceability without rendering invalid or unenforceable the remaining terms and provisions of this Agreement or affecting the validity or enforceability of any of the terms or provisions of this Agreement in any other jurisdiction and such invalid or unenforceable provision shall be modified by such court so that it is enforceable to the extent permitted by applicable law.

h.Notices. Any notice, request, consent or approval required or permitted to be given under this Agreement or pursuant to law shall be sufficient if in writing, and if and when sent by certified or registered mail, with postage prepaid, to your residence (as noted in Insperity’s records), or to the attention of the CFO (with a copy to the General Counsel) at Insperity’s principal office, as the case may be.

i.No Third-Party Beneficiaries. This Agreement does not create, and shall not be construed as creating, any rights enforceable by any person not a party to this Agreement.

j.Survival. The covenants, agreements, representations, and warranties contained in this Agreement shall survive the termination of the Term and your termination of service with Insperity for any reason.

k.Entire Agreement. The terms of this Agreement when accepted and signed by you, represent the complete agreement and understanding between you and Insperity related to your Consulting Services. These terms supersede any and all other prior or contemporaneous oral or written agreements between you and Insperity with respect to your Consulting Services. You and Insperity acknowledge that no representations, inducements, promises or agreements, whether oral or written, express or implied, have been made to you by Insperity or anyone acting on behalf of Insperity that are not included in this Agreement and that no other agreement or promise not contained in this letter agreement shall be valid or binding on Insperity.

[Signature page follows.]

Please acknowledge your understanding of, and agreement to, the terms of your engagement as a consultant of Insperity by signing below and forwarding a copy (which can be in PDF) to me.

Sincerely,

Insperity, Inc.

/s/ Paul J. Sarvadi

Paul J. Sarvadi

Chairman of the Board & Chief Executive Officer

Agreed to and Accepted By:

/s/ Douglas S. Sharp

Douglas S. Sharp

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

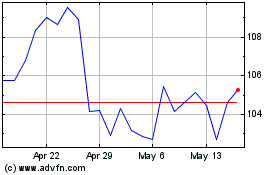

Insperity (NYSE:NSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

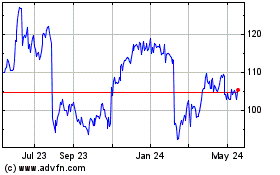

Insperity (NYSE:NSP)

Historical Stock Chart

From Feb 2024 to Feb 2025