New York Times Swings to Loss in the Quarter

July 28 2016 - 12:20PM

Dow Jones News

New York Times Co. swung to a second-quarter loss because of

costs to streamline its international operations and declines in

print and digital advertising.

While digital subscriber growth remained robust, rising 22% from

a year earlier, Chief Executive Mark Thompson said that

"advertising was tougher in the quarter, particularly on the print

side."

Advertising revenue fell 12% in the second quarter, offsetting

an increase of 3% in its circulation revenue.

Digital advertising fell 6.8%, declining for a second

consecutive quarter, as weaker display advertising sales offset

growth in branded content, mobile and programmatic advertising.

Print advertising fell 14%.

"We expect a marked improvement in digital advertising in the

third quarter," Mr. Thompson said on a call with analysts. "But we

do not expect print advertising headwinds to alleviate."

New York Times shares were down 1.5% to $12.60 in midday

trading.

Mr. Thompson said the company expects digital advertising to

post double-digit percentage growth in the second half of the year,

compared with a year earlier, noting there has been a turnaround

already this month.

In April, the paper announced that it would cut 70 jobs and move

some editing and production operations from Paris to New York and

Hong Kong as part of a restructuring of its international print

edition operations. More than 50 union-covered employees in the

U.S. took part in a voluntary buyout round that closed earlier this

month, according to the News Guild of New York. The company hasn't

disclosed the number of management employees who applied.

Mr. Thompson said the paper would continue to take steps "to

keep our cost base in line."

The Times added 51,000 net digital-only subscriptions in the

quarter for a total of 1.212 million online readers, Mr. Thompson

said. The publisher also added 16,000 new subscribers to its

separate crossword puzzle offering for a total of 212,000.

Overall, the Times reported a loss of $211,000, compared with a

year-earlier profit of $16.4 million. On a per-share basis, the

company posted break-even results, compared with year-earlier

earnings of 10 cents. Excluding restructuring charges related to

the streamlining of its international operations and other items,

adjusted per-share earnings from continuing operations fell to 11

cents from 13 cents. Revenue decreased 2.7% to $372.6 million.

Analysts polled by Thomson Reuters expected adjusted earnings of

11 cents a share and revenue of $375 million.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

July 28, 2016 13:05 ET (17:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

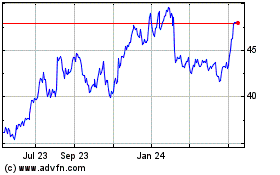

New York Times (NYSE:NYT)

Historical Stock Chart

From Apr 2024 to May 2024

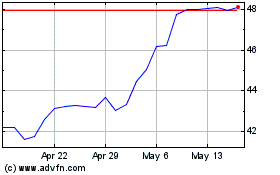

New York Times (NYSE:NYT)

Historical Stock Chart

From May 2023 to May 2024