UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )

(Name of Issuer)

Common Stock, $0.05 par value per share

(Title of Class of Securities)

(CUSIP Number)

|

William Charters

5537 Newcastle Lane

Calabasas, CA 91302

(925) 330-6016

|

Stephen Salvadore

38 Sunset Drive

East Greenwich, RI 02818

(646) 320 0191

|

Gary Wyetzner

64 Norris Avenue

Metuchen, NJ 08840

(646) 484-0540

|

With a copy to:

Christopher P. Davis

Kleinberg, Kaplan, Wolff & Cohen, P.C.

500 Fifth Avenue

New York, NY 10110

(212) 986-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or

240.13d-1(g), check the following box [ ].

|

1

|

NAME OF REPORTING PERSONS

Gary Wyetzner

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)[X]

(b)[ ]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF SHARES

BENEFICIALLY

|

7

|

SOLE VOTING POWER

30,607

|

|

OWNED BY

EACH

REPORTING

|

8

|

SHARED VOTING POWER

0

|

|

PERSON

WITH

|

9

|

SOLE DISPOSITIVE POWER

30,607

|

| |

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

30,607

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.34%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

1

|

NAME OF REPORTING PERSONS

Stephen Salvadore

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)[X]

(b)[ ]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF SHARES

BENEFICIALLY

|

7

|

SOLE VOTING POWER

27,569

|

|

OWNED BY

EACH

REPORTING

|

8

|

SHARED VOTING POWER

35,055

|

|

PERSON

WITH

|

9

|

SOLE DISPOSITIVE POWER

27,569

|

| |

10

|

SHARED DISPOSITIVE POWER

35,055

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

62,624

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.75%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

1

|

NAME OF REPORTING PERSONS

Aurora Salvadore

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)[X]

(b)[ ]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF SHARES

BENEFICIALLY

|

7

|

SOLE VOTING POWER

0

|

|

OWNED BY

EACH

REPORTING

|

8

|

SHARED VOTING POWER

4,055

|

|

PERSON

WITH

|

9

|

SOLE DISPOSITIVE POWER

0

|

| |

10

|

SHARED DISPOSITIVE POWER

4,055

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,055

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.18%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

1

|

NAME OF REPORTING PERSONS

Barbara Salvadore

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)[X]

(b)[ ]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF SHARES

BENEFICIALLY

|

7

|

SOLE VOTING POWER

0

|

|

OWNED BY

EACH

REPORTING

|

8

|

SHARED VOTING POWER

31,000

|

|

PERSON

WITH

|

9

|

SOLE DISPOSITIVE POWER

0

|

| |

10

|

SHARED DISPOSITIVE POWER

31,000

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,000

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.36%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

1

|

NAME OF REPORTING PERSONS

William Charters

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)[X]

(b)[ ]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF SHARES

BENEFICIALLY

|

7

|

SOLE VOTING POWER

80,000

|

|

OWNED BY

EACH

REPORTING

|

8

|

SHARED VOTING POWER

0

|

|

PERSON

WITH

|

9

|

SOLE DISPOSITIVE POWER

80,000

|

| |

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

80,000

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.51%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

Item 1. Security and Issuer.

This Schedule 13D (the “Schedule 13D”) is being filed with respect to the shares of common stock (the “Shares”) of Regis Corporation, a

Minnesota corporation (the “Company”).

Item 2. Identity and Background.

(a) This Schedule 13D is being filed on behalf of the

following Reporting Persons (collectively, the “Reporting Persons”): Gary Wyetzner, Stephen Salvadore, Aurora Salvadore, Barbara Salvadore and William Charters, each of whom is a United States citizen.

(b) The business address of Mr. Wyetzner is 64 Norris Avenue,

Metuchen, NJ 08840. The business address of Stephen Salvadore, Aurora Salvadore and Barbara Salvadore is 38 Sunset Drive, East Greenwich, RI 02818. The business address of Mr. Charters is 5537 Newcastle Lane, Calabasas, CA 91302.

(c) The principal occupation of Mr. Wyetzner is as an

independent financial strategist. The principal occupation of Mr. Salvadore is as a venture capitalist. The principal occupation of Aurora Salvadore is as an interior designer. Barbara Salvadore is retired, and has no principal occupation. The

principal occupation of Mr. Charters is an investor.

(d, e) During the past five years, no Reporting Person has been convicted in a

criminal proceeding, or been a party to a civil proceeding, required to be disclosed pursuant to Items 2(d) or (e) of Schedule 13D.

(f) The citizenship of each of the Reporting Persons is set forth in paragraph (a)

of this Item.

Item 3. Source and Amount of Funds or Other Consideration.

The total amount of funds used by the Reporting Persons to make all purchases of Shares beneficially owned by the Reporting Persons, as reported in Item 5(a,b) was approximately

$3,006,711.65. The source of funds for purchases of Shares by each of the Reporting Persons is the personal funds of the applicable Reporting Person.

Item 4. Purpose of Transaction

On January 8, 2024, the Reporting Persons issued a letter (the “Letter”) to the chairman of the board of directors of the Issuer. The Letter is attached hereto as Exhibit

99.2. The public is encouraged to read the Letter and form its own opinions.

The Reporting Persons believe the securities of the Issuer are significantly undervalued and represent an attractive investment opportunity. Depending upon overall market

conditions, other investment opportunities available to the Reporting Persons, and the availability of securities of the Issuer at prices that would make the purchase or sale of such securities desirable, the Reporting Persons may endeavor (i) to

increase or decrease their respective positions in the Issuer through, among other things, the purchase or sale of securities of the Issuer on the open market or in private transactions, including through a trading plan created under Rule 10b5-1(c)

or otherwise, on such terms and at such times as the Reporting Persons may deem advisable and/or (ii) to enter into transactions that increase or hedge their economic exposure to the Common Stock without affecting their beneficial ownership of

shares of Common Stock.

Except as set forth in the Letter, no Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) -

(j) of Item 4 of Schedule 13D except as set forth herein or such as would occur upon or in connection with completion of, or following, any of the actions discussed herein. The Reporting Persons may develop additional plans and/or make further

proposals with respect to, or with respect to potential changes in, the operations, management, the certificate of incorporation and bylaws, Board composition, ownership, capital or corporate structure, dividend policy, strategy and plans of the

Issuer, potential strategic transactions involving the Issuer or certain of the Issuer's businesses or assets, or may change their intention with respect to any and all matters referred to in this Item 4. The Reporting Persons intend to continue to

communicate with the Issuer's management and Board about a broad range of operational and strategic matters. The Reporting Persons intend to review their investment in the Issuer on a continuing basis and may from time to time in the future express

their views to and/or meet with management, the Board, other shareholders or third parties and/or formulate plans or proposals regarding the Issuer, its assets or its securities. Such plans or proposals may include one or more plans that relate to or

would result in any of the actions set forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer

(a) The aggregate percentage of Shares reported owned by each

person named herein is based upon 2,279,417 Shares outstanding as of November 29, 2023, which is the total number of Shares outstanding as reported in the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission on

December 1, 2023.

As of the close of business on the date hereof, Mr. Wyetzner individually beneficially owned 30,607 Shares, constituting approximately 1.34% of all of the

outstanding Shares.

As of the close of business on the date hereof, Mr. Salvadore individually beneficially owned 27,569 Shares, constituting approximately 1.21% of all of the

outstanding Shares.

As of the close of business on the date hereof, Aurora Salvadore individually beneficially owned 4,055 Shares, constituting approximately 0.18% of all of

the outstanding Shares.

As of the close of business on the date hereof, Barbara Salvadore individually beneficially owned 31,000 Shares, constituting approximately 1.36% of all of

the outstanding Shares.

Mr. Salvadore may be deemed to beneficially own the 4,055 Shares held by Aurora Salvadore and the 31,000 Shares held by Barbara Salvadore by virtue of his

position as investment manager of the accounts holding such Shares.

As of the close of business on the date hereof, Mr. Charters individually beneficially owned 80,000 Shares, constituting approximately 3.51% of all of the

outstanding Shares.

The Reporting Persons, in the aggregate, beneficially own 173,231 Shares, constituting approximately 7.6% of the outstanding Shares.

(b) Mr. Wyetzner has sole power (i) to vote or direct the

vote of, and (ii) to dispose or direct the disposition of, 30,607 Shares held by Mr. Wyetzner.

Mr. Salvadore has sole power (i) to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 27,569 Shares held by Mr. Salvadore.

Mr. Salvadore has shared power with Aurora Salvadore power (i) to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 4,055 Shares held by Aurora Salvadore. Mr. Salvadore has shared power with Barbara Salvadore power (i)

to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 31,000 Shares held by Barbara Salvadore.

Mr. Charters has sole power (i) to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 80,000 Shares held by Mr. Charters.

(c) During the past sixty (60) days, the Reporting Persons have not entered into any transactions in the Shares except as set

forth on Schedule 1 hereto.

(d) No Person other than the Reporting Persons has the right to receive or the power to direct the receipt of

distributions or dividends from, or the proceeds from the transfer of, the reported securities.

(e) Not Applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect

to Securities of the Issuer.

The Reporting Persons have entered into a joint filing agreement, dated as of January 5, 2024, a

copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 7. Material to be filed as Exhibits

| Exhibit 99.1 |

Joint Filing Agreement to Schedule 13D-G by and among Gary Wyetzner, Stephen Salvadore, Aurora Salvadore, Barbara Salvadore and William Charters, dated as of January 9, 2024.

|

| Exhibit 99.2 |

Letter to the Chairman of the Board of Directors of Regis Corporation, dated as of January 9, 2024.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in the

Statement is true, complete and correct.

Dated: January 9, 2024

|

/s/ Gary Wyetzner

|

|

GARY WYETZNER

|

|

/s/ Stephen Salvadore

|

|

STEPHEN SALVADORE

|

|

/s/ Aurora Salvadore

|

|

AURORA SALVADORE

|

|

/s/ Barbara Salvadore

|

|

BARBARA SALVADORE

|

|

/s/ William Charters

|

|

WILLIAM CHARTERS

|

SCHEDULE 1

Transactions in the Common Stock of the Issuer by Reporting Persons During the Past 60 Days

|

Date

|

Buy/Sell

|

Security

|

Approximate

Price Per Share12

|

Amount of Shares Bought/(Sold) 3

|

Gary Wyetzner

|

11/10/2023

|

BUY

|

Common Stock

|

$7.60

|

265

|

|

|

11/17/2023

|

BUY

|

Common Stock

|

$8.40

|

5

|

|

|

12/14/2023

|

BUY

|

Common Stock

|

$7.74

|

130

|

|

|

12/15/2023

|

BUY

|

Common Stock

|

$6.59

|

475

|

|

Stephen Salvadore

|

12/20/2023

|

SELL

|

Common Stock

|

$6.18

|

(916)

|

|

|

12/21/2023

|

SELL

|

Common Stock

|

$6.10

|

(1,300)

|

|

|

12/26/2023

|

SELL

|

Common Stock

|

$6.02

|

(6,000)

|

|

Barbara Salvadore

|

12/29/2023

|

BUY

|

Common Stock

|

$9.56

|

8,920

|

|

|

1/2/2024

|

BUY

|

Common Stock

|

$9.00

|

1,385

|

|

William Charters

|

11/13/2023

|

BUY

|

Common Stock

|

$8.00

|

1,722

|

|

|

11/14/2023

|

BUY

|

Common Stock

|

$9.60

|

2,028

|

|

|

11/15/2023

|

BUY

|

Common Stock

|

$10.00

|

1,250

|

|

|

11/27/2023

|

BUY

|

Common Stock

|

$7.20

|

3,853

|

|

|

11/28/2023

|

BUY

|

Common Stock

|

$7.00

|

3,647

|

|

|

11/29/2023

|

BUY

|

Common Stock

|

$7.21

|

10,750

|

|

|

11/30/2023

|

BUY

|

Common Stock

|

$7.87

|

3,000

|

|

|

12/1/2023

|

BUY

|

Common Stock

|

$6.80

|

2,000

|

|

|

12/4/2023

|

BUY

|

Common Stock

|

$6.75

|

8,000

|

|

|

12/5/2023

|

BUY

|

Common Stock

|

$6.66

|

2,000

|

|

|

12/6/2023

|

BUY

|

Common Stock

|

$6.77

|

1,000

|

|

|

12/8/2023

|

SELL

|

Common Stock

|

$9.43

|

(880)

|

|

|

12/8/2023

|

BUY

|

Common Stock

|

$9.55

|

2,880

|

|

|

12/13/2023

|

BUY

|

Common Stock

|

$9.22

|

780

|

|

|

12/14/2023

|

BUY

|

Common Stock

|

$8.10

|

6,221

|

|

|

12/15/2023

|

BUY

|

Common Stock

|

$6.67

|

2,000

|

|

|

12/18/2023

|

BUY

|

Common Stock

|

$6.70

|

3,000

|

|

|

12/19/2023

|

BUY

|

Common Stock

|

$6.60

|

1,000

|

|

|

12/20/2023

|

BUY

|

Common Stock

|

$6.05

|

1,000

|

|

|

12/22/2023

|

BUY

|

Common Stock

|

$6.00

|

1,000

|

|

|

12/26/2023

|

BUY

|

Common Stock

|

$6.53

|

1,000

|

|

|

12/27/2023

|

BUY

|

Common Stock

|

$9.85

|

1,000

|

|

|

12/28/2023

|

BUY

|

Common Stock

|

$10.02

|

1,000

|

|

|

1/2/2024

|

BUY

|

Common Stock

|

$8.95

|

2,000

|

|

1 Split-adjusted.

2 Excluding any brokerage fees.

3 Split-adjusted.

EXHIBIT 99.1

JOINT FILING AGREEMENT

WHEREAS, the undersigned (collectively, the “Reporting Persons”) from time to time make filings with the Securities and Exchange

Commission pursuant to Regulation 13D-G under the Securities Exchange Act of 1934, as amended; and

WHEREAS, the Reporting Persons prefer to make joint filings on behalf of all Reporting Persons rather than individual filings on

behalf of each of the Reporting Persons;

NOW, THEREFORE, the undersigned hereby agree as follows with each of the other Reporting Persons:

1. Each of the Reporting Persons is individually eligible to make joint filings.

2. Each of the Reporting Persons is responsible for timely making joint filings and any amendments thereto.

3. Each of the Reporting Persons is responsible for the completeness and accuracy of the information concerning such person contained in joint filings.

4. None of the Reporting Persons is responsible for the completeness or accuracy of the information concerning the other Reporting Persons contained in joint filings, unless such person knows or has reason to believe

that such information is inaccurate.

5. The undersigned agree that each joint filing made on or after the date hereof with respect to Common Stock of Regis Corporation will be, and any amendment thereto will be, made on behalf of each of the Reporting

Persons.

[Signature Page Follows]

Dated: January 9, 2024

|

/s/ Gary Wyetzner

|

|

GARY WYETZNER

|

|

/s/ Stephen Salvadore

|

|

STEPHEN SALVADORE

|

|

/s/ Aurora Salvadore

|

|

AURORA SALVADORE

|

|

/s/ Barbara Salvadore

|

|

BARBARA SALVADORE

|

|

/s/ William Charters

|

|

WILLIAM CHARTERS

|

EXHIBIT 99.2

|

William Charters

5537 Newcastle Lane

Calabasas, CA 91302

(925) 330-6016

|

Stephen Salvadore

38 Sunset Drive

East Greenwich, RI 02818

(646) 320 0191

|

Gary Wyetzner

64 Norris Avenue

Metuchen, NJ 08840

(646) 484-0540

|

January 9, 2024

Regis Corporation

3701 Wayzata Boulevard

Minneapolis, MN 55416

Attention: David J. Grissen, Chairman of the Board of Directors

Dear Mr. Grissen,

Our group beneficially owns approximately 173,231 shares of Regis Corporation (the “Company”), representing approximately 7.6%

of the issued and outstanding stock. Members of our group have considerable and wide-ranging experience in distressed investing, investment banking, financial restructuring, technology implementation, and managing businesses. We have resources to

commit more capital, but our concern regarding the direction of the Company tempers our enthusiasm.

We believe the Company has been significantly mismanaged and requires new leadership and governance. We seldom witness a

Board of Directors (the “Board”) that has presided over this much value destruction and continues on as business as usual. We have a plan where all stakeholders including franchisees, creditors, and shareholders, would benefit. We request two board

seats to infuse the necessary skills and shareholder representation into the Company and steer it away from stale and destructive ideas that could lead to insolvency, which would harm all stakeholders. More specifically, we believe that four current

directors should step down promptly, that the Board should be reduced in size to five independent directors and the CEO, and that our two highly qualified candidates be appointed to the Board now.

The Company recently stunned the market by announcing it is evaluating strategic alternatives, including raising capital

with an equity component. This was surprising given the Company has almost 2 years before its term loan matures and, we believe, sufficiently ample room under its bank covenants to operate. Given the Company’s current business performance, efforts

should be made to increase cash flow by eliminating excessive costs rather than pursuing what could be a band-aid financing initiative that allows for future value destruction against stakeholders while management and the Board continue to be over

compensated relative to their performance.

The Company should significantly cut expenses by eliminating wasteful and misguided spending. We believe cost cuts would not

have a negative impact on the Company’s royalty stream and would be immediately accretive to earnings. Given a higher cash flow profile, the Company could begin paying down existing debt and improve prospects for refinancing its debt facility within 20

months.

We find it remarkable that a company like Regis exists, where a few cost cuts can result in net earnings close to its market

cap within a business quarter. Once the Company has stabilized, efforts to improve operations using “off the shelf” technology could be implemented to attract and retain customers. The Board and current CEO have overseen the incredible collapse of

Regis’ equity market value to under $20 million which represents a stock decline of over 80% in the last couple of years alone. Half of the Board is over their own publicly disseminated tenure limit guidelines promoting a culture mired in status quo

rather than change. It is clear to our group that the Board needs new members to effectuate a successful turnaround for all stakeholders.

Company’s Strategy

For the last several years, the Company has insisted upon expensive in-person meetings to assess its franchisees’ wants and needs. It was agreed

that the franchisees needed a technology platform to help customer acquisition, retention, and overall experience. The Company’s Zenoti solution seems promising but the roll-out has been 18 months delayed due to poor execution.

While Zenoti was and continues to be implemented, management spends significant money on in-person training that is

inefficient and incredibly expensive. The Company flies nearly one thousand stylists including the entire management team to stylist events around the country for training, food, drinks, entertainment (e.g., Las Vegas, Miami). These participants

represent a tiny percentage of all stylists, and these events result in a terrible return on investment.

Online training and other applicable technologies have advanced greatly in the last three years, and new ideas are exactly

what this Company needs to compete. Although we believe the Company has some extraordinary and energized franchisees, it is unlikely that management can develop a strategy to stem market share losses due to non-merit-based compensation and insufficient

technology skills.

The many franchisees we’ve spoken with feel the Company’s current management team does not have the skills to develop and

execute a winning strategy. They are also upset by excessive compensation paid to the management team and to the Board. The objective reality has been a small group of upper management has been richly rewarded despite the delayed roll-out of Zenoti,

zero pay-down of debt, and a collapsing stock price. Incentives need to be realigned so that executives prosper as stockholders gain and other stakeholders benefit.

Cost Savings

As of the last quarter, the Company has a trailing twelve-month EBITDA of $25 million, excluding one-time items. With net debt of $160 million, including

anticipated future incoming Zenoti payments, the Company’s EBITDA is levered 6.4x. But as an asset-light franchisor, it has virtually no CapEx and, due to losses inflicted by Covid, won’t be paying taxes for the foreseeable future. The EBITDA only

needs to cover the actual interest expense that is expected to be approximately $21 million (including the pay-in-kind portion) next year if interest rates don’t increase.

We believe the Company should cut unnecessary expenses, which by our estimation could increase EBITDA to $38 million, reducing leverage to 4.21x. These cost

cuts would allow debt to be reduced, prospects of refinancings to increase, and investment in more scalable technology to be pursued. So, here are the steps to reduce costs, enhance shareholder equity, and potentially significantly increase the stock

price:

1) Eliminate Parties (Estimated Annual Savings:

$2 million): The Company is flying franchisees out for another Las Vegas party in January 2024. Almost 1,000 guests attended its January 2023 event which was a sequel to its October 2022 event. It has had at

least one more party in Miami during 2023. Although there is a training component to these events, those trainings can easily be done locally or through technology. Franchisees that we have spoken to refer to these events as wasteful boondoggles.

Flying thousands of people, including the entire management team around the country paying for their food, hotel, and entertainment is a wasteful endeavor given the Company’s levered financial position. Even if franchisees pay part of this money

through their marketing budget, this still is not a good use of capital.

2) Reduce cash compensation (Estimated Annual

Savings: $3+ million): The current CEO, who was originally hired as a consultant 3 years ago earning approximately $300,000 per year, made $2,000,000 in CASH last year. He also made $2,000,000 in his first year

as CEO. Other executives have also made much more than justified, especially given the company’s size, financial condition, and stock performance. The management team’s lack of basic understanding of the Zenoti platform and poor execution has already

permanently cost the company and shareholders millions of dollars in Zenoti migration payments. We don’t have a problem paying executives for performance; but, given the Company’s indebtedness, compensation should be linked to achievements to

increase EBITDA and should be significantly stock-based compensation.

3) Restructure the Board (Estimated Annual Savings: $1 million):

The 7 independent directors don’t purchase shares in the Company and are each paid $200,000 per year. Almost $1,500,000 is paid to the Board annually. The stock component of last year’s board compensation consisted of options that represented almost

1.5 percent of outstanding shares. Comparable companies used in Regis’ proxy to justify this level of pay are much larger than Regis. Additionally, the Board is in violation of its own Corporate Governance tenure limit guidelines created to encourage

new ideas. Three directors have served more than Regis’ corporate governance tenure limit of 10 years, including the Chairman of the Corporate Governance Committee. Another director is over the Company’s 75-year age limit at 78 years old and is serving

their 9th year. This company requires at most five independent directors, each making significantly less.

4) Make stylist training more efficient (Estimated Annual Savings:

$5 million): The Company has extended its training network significantly, costing millions of dollars. This is a departure from previous management’s vision of leveraging technology. The Company sends

trainers, paying for flights and hotels to train just a small number of stylists. This large network is unnecessary and very costly. Technology can replace big pieces of this. If done correctly, seasoned stylists can be trained using technology as well

as other programs.

5) Roll-off of Remaining Company Owned Stores (Estimated Annual

Savings: $2 million): A large portion of the remaining company owned store leases terminate in January 2024 and will reduce costs going forward.

Regis is a simple business where the franchisees pay for advertising, training of new stylists, and growth CapEx to expand. We find it very difficult to see what

comprises the $47 million in SG&A. Regis won’t break out its SG&A, but if the franchisees are paying for virtually everything, using $47 million to significantly overpay employees, throw parties, and extend an unnecessary training network is

irresponsible and needs to be stopped for the benefit of stockholders and other stakeholders.

In summary, we believe management needs new governance to make sure incentives are aligned, spending is rational, and franchisees have the

technology needed to compete in a competitive industry. The Company has time before its debt maturity to increase cash flow, pay down debt, and improve refinancing prospects. Current management’s plan to presently pursue a strategic deal, before

curtailing spending and addressing operational support issues, could relieve financial pressure but could be papering over the structural problems of misaligned incentives and poor governance, ultimately jeopardizing all stakeholders.

We would like to work with the Board to strengthen governance. Positioning Regis Corporation for success includes right-sizing the Board, retiring four board

members to encourage new ideas (i.e., the purpose of the tenure limit guidelines), and choosing new board members who have extensive experience in strategy development, leading edge technology implementation, and raising capital. We are asking for two

seats to bring these skills to the Board.

We would like a response to our suggested strategy and Board request within the next 7 to 10 days, and we are ready to engage constructively

with senior management and the Board for the benefit of all stockholders.

Thank you. Regards,

|

/s/ William Charters

|

|

WILLIAM CHARTERS

|

|

/s/ Stephen Salvadore

|

|

STEPHEN SALVADORE

|

|

/s/ Gary Wyetzner

|

|

GARY WYETZNER

|

Regis (NYSE:RGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

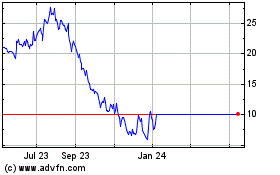

Regis (NYSE:RGS)

Historical Stock Chart

From Apr 2023 to Apr 2024