Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

November 27 2024 - 1:10PM

Edgar (US Regulatory)

Registration Statement No. 333-275898

Filed Pursuant to Rule 433

| ACCELERATED RETURN NOTES® (ARNs®) |

|

| Accelerated Return Notes® Linked to the Energy Select Sector SPDR® Fund |

| Issuer |

Royal Bank of Canada (“RBC”). References on this page to “we,” “us” or “our” mean RBC. |

| Principal Amount |

$10.00 per unit |

| Term |

Approximately 14 months |

| Market Measure |

The Energy Select Sector SPDR® Fund (Bloomberg symbol: “XLE”) |

| Payout Profile at Maturity |

· 3-to-1

upside exposure to increases in the Market Measure, subject to the Capped Value

· 1-to-1

downside exposure to decreases in the Market Measure, with 100% of your principal at risk |

| Capped Value |

[$12.00 to $12.40] per unit, a return of [20.00% to 24.00%] over the principal amount, to be determined on the pricing date |

| Participation Rate |

300% |

| Preliminary Offering Documents |

https://www.sec.gov/Archives/edgar/data/1000275/000095010324016856/

dp221105_424b2-mlzob.htm |

| Exchange Listing |

No |

You should read the relevant Preliminary Offering Documents before

you invest. Click on the Preliminary Offering Documents hyperlink above or call your Financial Advisor for a hard copy.

Risk Factors

Please see the Preliminary Offering Documents for a description of

certain risks related to this investment, including, but not limited to, the following:

| · | Depending on the performance of the Market Measure as measured shortly before

the maturity date, your investment may result in a loss; there is no guaranteed return of principal. |

| · | Your return on the notes may be less than the yield you could earn by owning

a conventional fixed or floating rate debt security of comparable maturity. |

| · | Payments on the notes are subject to our credit risk, and actual or perceived

changes in our creditworthiness are expected to affect the value of the notes. |

| · | Your investment return is limited to the return represented by the Capped

Value and may be less than a comparable investment directly in shares of the Market Measure or the securities held by the Market Measure. |

| · | The initial estimated value of the notes is only an estimate, determined as

of a particular point in time by reference to our and our affiliates’ pricing models. |

| · | The public offering price you pay for the notes will exceed the initial estimated

value. |

| · | The initial estimated value does not represent a minimum or maximum price

at which we, MLPF&S, BofAS or any of our affiliates would be willing to purchase your notes in any secondary market (if any exists)

at any time. |

| · | A trading market is not expected to develop for the notes. |

| · | Our business, hedging and trading activities, and those of MLPF&S, BofAS

and our respective affiliates (including trades in shares of the Market Measure or the securities held by the Market Measure), and any

hedging and trading activities we, MLPF&S, BofAS or our respective affiliates engage in for our clients’ accounts, may affect

the market value and return of the notes and may create conflicts of interest with you. |

| · | There may be potential conflicts of interest involving the calculation agent,

which is BofAS. |

| · | The sponsor and advisor of the Market Measure may adjust the Market Measure

in a way that could adversely affect the value of the notes and the amount payable on the notes, and these entities have no obligation

to consider your interests. |

| · | You will have no rights of a holder of shares of the Market Measure or the

securities held by the Market Measure, and you will not be entitled to receive securities or dividends or other distributions by the issuers

of those securities. |

| · | While we, MLPF&S, BofAS or our respective affiliates may from time to

time own shares of the Market Measure or the securities held by the Market Measure, we, MLPF&S, BofAS and our respective affiliates

do not control the Market Measure or the issuers of those securities, and have not verified any disclosure made by any other company. |

| · | There are liquidity and management risks associated with the Market Measure. |

| · | The performance of the Market Measure may not correlate with the performance

of the securities held by the Market Measure as well as the net asset value per share of the Market Measure, especially during periods

of market volatility when the liquidity and the market price of shares of the Market Measure and/or the securities held by the Market

Measure may be adversely affected, sometimes materially. |

| · | The payments on the notes will not be adjusted for all corporate events that

could affect the Market Measure. |

| · | The U.S. federal income tax consequences of an investment in the notes are

uncertain. |

| · | The securities held by the Market Measure are concentrated in one sector. |

| · | A limited number of stocks held by the Market Measure may affect its price,

and the stocks held by the Market Measure are not necessarily representative of the energy sector. |

| · | Adverse conditions in the energy sector may reduce your return on the notes. |

Final terms will be set on the pricing date within the given range

for the specified Market-Linked Investment. Please see the Preliminary Offering Documents for complete product disclosure, including related

risks and tax disclosure.

The graph above and the table below reflect

the hypothetical return on the notes, based on the terms contained in the table to the left (using the mid-point for any range(s)). The

graph and the table have been prepared for purposes of illustration only and do not take into account any tax consequences from investing

in the notes.

| Hypothetical Percentage Change from the Starting Value to the Ending Value |

Hypothetical Redemption Amount per Unit |

Hypothetical Total Rate of Return on the Notes |

| -100.00% |

$0.00 |

-100.00% |

| -50.00% |

$5.00 |

-50.00% |

| -20.00% |

$8.00 |

-20.00% |

| -10.00% |

$9.00 |

-10.00% |

| -6.00% |

$9.40 |

-6.00% |

| -3.00% |

$9.70 |

-3.00% |

| 0.00% |

$10.00 |

0.00% |

| 2.00% |

$10.60 |

6.00% |

| 3.00% |

$10.90 |

9.00% |

| 5.00% |

$11.50 |

15.00% |

| 7.34% |

$12.20(1) |

22.00% |

| 10.00% |

$12.20 |

22.00% |

| 20.00% |

$12.20 |

22.00% |

| 30.00% |

$12.20 |

22.00% |

| 50.00% |

$12.20 |

22.00% |

| 100.00% |

$12.20 |

22.00% |

| (1) | The Redemption Amount per unit cannot exceed the hypothetical

Capped Value. |

| RBC has filed a registration statement (including a product supplement, a prospectus supplement and a prospectus) with the SEC for the offering to which this document relates. Before you invest, you should read those documents, and the other documents that RBC has filed with the SEC, for more complete information about RBC and this offering. You may get these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, RBC, any agent, or any dealer participating in this offering will arrange to send you these documents if you so request by calling toll-free 1-800-294-1322. |

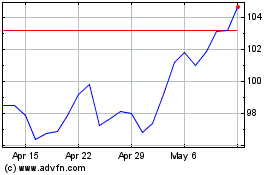

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Oct 2024 to Nov 2024

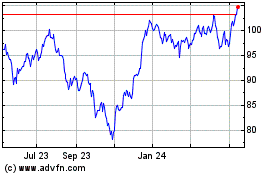

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Nov 2023 to Nov 2024