RYAM Raises $700 million of Debt to Refinance its Capital Structure

October 29 2024 - 7:03AM

Business Wire

Rayonier Advanced Materials Inc. (NYSE: RYAM) (the “Company” or

“RYAM”), the global leader in High Purity Cellulose, announced it

has raised $700 million in aggregate principal amount of secured

term loan financing (the “Term Loan”) from funds managed by Oaktree

Capital Management, L.P., as lead lender, as well as certain

affiliates and managed funds of Silver Point Capital, L.P. and Blue

Torch Capital LLC. Proceeds from the Term Loan, along with cash

from the Company’s balance sheet are expected to be used to

purchase, defease and redeem RYAM’s existing 2026 senior secured

notes, to repay RYAM’s existing 2027 secured term loan financing in

full and to pay related fees and expenses.

“We are pleased to have completed this important financing step

for RYAM, which strengthens our capital structure and preserves the

flexibility to execute our long-term business strategy,” said De

Lyle Bloomquist, RYAM’s President and Chief Executive Officer.

“Importantly, this new debt structure allows us to meet our

obligations while also providing the flexibility to deleverage and

to opportunistically make strategic investments that will fuel the

growth of our biomaterials strategy.”

The Term Loan will initially accrue interest at an annual rate

equal to three-month Term SOFR plus an initial spread of 7 percent,

subject to adjustment based on the Company’s consolidated net

secured debt to covenant EBITDA ratio. The Term Loan will mature in

five years. The Company may, with modest call premiums, voluntarily

prepay the Term Loan, subject to an additional make-whole premium

for the first eighteen months, followed by a 2 percent premium

during the next six months and a 1 percent premium for the twelve

months thereafter. The Company may prepay the Term Loan at par

after 36 months. The Company will be required to maintain an

initial consolidated net secured debt to covenant EBITDA ratio of

no greater than 5.00 times through fiscal 2025, 4.75 times during

fiscal 2026 and 4.50 times during fiscal 2027 and thereafter.

“The Term Loan allows RYAM to benefit from declining interest

rates, as expected in the near-term. The interest rate will further

decline as our net secured leverage moves below 2.50 times covenant

EBITDA. The spread will decrease by half of a percent once this

condition is met. With modest call premiums, we will also have the

flexibility to repay the debt in the medium term as financial

metrics continue to improve and markets recognize the value of

RYAM. This successful financing transaction reinforces our

commitment to creating long-term value for our shareholders and

further establishes RYAM as a leader in the sustainable materials

sector,” concluded Mr. Bloomquist.

Houlihan Lokey served as financial advisor and Wachtell, Lipton,

Rosen & Katz served as legal counsel to RYAM on this

transaction. Sullivan & Cromwell LLP acted as legal counsel to

the lead lender. Additional details of the transaction will be

issued in a Form 8-K filed with the SEC.

About RYAM

RYAM is a global leader of cellulose-based technologies,

including high purity cellulose specialties, a natural polymer

commonly used in the production of filters, food, pharmaceuticals

and other industrial applications. RYAM’s specialized assets,

capable of creating the world’s leading high purity cellulose

products, are also used to produce biofuels, bioelectricity and

other biomaterials such as bioethanol and tall oils. The Company

also manufactures products for paper and packaging markets. With

manufacturing operations in the U.S., Canada and France, RYAM

generated $1.6 billion of revenue in 2023. More information is

available at www.RYAM.com.

Forward-Looking Statements

Certain statements in this document regarding anticipated

financial, business, legal, or other outcomes, including business

and market conditions, outlook, and other similar statements

relating to Rayonier Advanced Materials’ or future or expected

events, developments, or financial or operational performance or

results, are "forward-looking statements" made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995 and other federal securities laws. These forward-looking

statements are identified by the use of words such as "may,"

"will," "should," "expect," "estimate," "believe," "intend,"

"anticipate," and other similar language. However, the absence of

these or similar words or expressions does not mean that a

statement is not forward-looking. While we believe these

forward-looking statements are reasonable when made,

forward-looking statements are not guarantees of future performance

or events, and undue reliance should not be placed on these

statements. Although we believe the expectations reflected in any

forward-looking statements are based on reasonable assumptions, we

can give no assurance that these expectations will be attained. It

is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks and uncertainties.

Other important factors that could cause actual results or

events to differ materially from those expressed in forward-looking

statements that may have been made in this document are described

or will be described in our filings with the U.S. Securities and

Exchange Commission, including our Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. Rayonier Advanced Materials assumes

no obligation to update these statements except as is required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028671151/en/

Media Ryan Houck 904-357-9134

Investors Mickey Walsh 904-357-9162

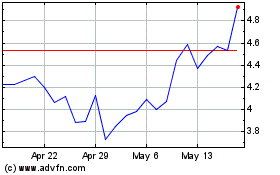

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Oct 2024 to Nov 2024

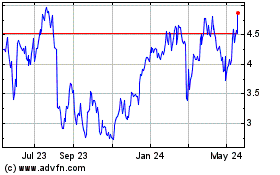

Rayonier Advanced Materi... (NYSE:RYAM)

Historical Stock Chart

From Nov 2023 to Nov 2024